Immuneering Reports First Quarter 2022 Financial Results and Recent Business Highlights

May 10 2022 - 6:30AM

Immuneering Corporation (NASDAQ: IMRX), a biopharmaceutical company

using translational bioinformatics to advance a pipeline of product

candidates designed to benefit large populations of patients with

cancer and other diseases, today reported financial results for the

first quarter ended March 31, 2022 and provided recent business

highlights.

“We believe IMM-1-104 has great potential to benefit the many

cancer patients with tumors driven by RAS mutations. We are

thrilled to be gearing up to file our IND for IMM-1-104, which

remains on track to be filed in the third quarter of 2022, and we

expect to enroll our first patient in the Phase 1 trial in the

fourth quarter of 2022. To date, we have generated compelling

preclinical results across a broad range of animal tumor models

including KRAS-G12C, KRAS-G12D, KRAS-G12S, NRAS-Q61R, and

BRAF-V600E mutations. In totality, this compelling preclinical

data package demonstrates IMM-1-104’s potential to have broad

activity that is independent of the specific mutation activating

the MAPK pathway.” said Ben Zeskind, Ph.D., MBA, chief executive

officer of Immuneering Corporation.

Corporate Highlights

- IMM-1-104 Observed Greater Tumor Growth Inhibition

Compared to Binimetinib in a NRAS Mutant Melanoma Model:

In January 2022, Immuneering presented preclinical data in a

presentation titled “Head-to-Head Comparison of the Dual-MEK

Inhibitor IMM-1-104 Versus Binimetinib in NRAS Mutant Melanoma

Models,” by Peter King, PhD, Vice President and Head of Discovery.

In the SK-MEL-2 melanoma xenograft mouse model exhibiting the

NRAS-Q61R mutation, IMM-1-104 demonstrated superior tumor growth

inhibition relative to binimetinib (binimetinib was tested versus

dacarbazine in the Phase 3 NEMO trial). Immuneering also hosted a

key expert event with Dr. Anna Pavlick, a leading melanoma expert,

to discuss the NRAS mutant melanoma treatment landscape. A replay

of the key expert event can be accessed at:

https://ir.immuneering.com/news-events/events-presentations.

- Diana F. Hausman, M.D. Joins

Immuneering’s Board of Directors: Immuneering appointed

Diana F. Hausman, M.D. to its board of directors in January 2022.

Dr. Hausman is currently the Chief Medical Officer of Link

Immunotherapeutics and was the former Chief Medical Officer of

Lengo Therapeutics. As a board member of Immuneering, Dr. Hausman

will leverage her more than two decades of clinical drug

development experience to help advance Immuneering’s

pipeline.

- Immuneering Published Its First Environmental, Social,

and Governance (ESG) Report on March 31, 2022: The company

published its first annual ESG report which highlights the

company’s commitment to corporate social responsibility. The 2021

ESG report was guided by standards established by the

Sustainability Accounting Standards Board (SASB). The report is

available at:

https://ir.immuneering.com/environment-social-and-governance-esg.

Key Development Highlights

- IMM-1-104 IND submission expected in Q3 2022:

Immuneering expects to file the IND for IMM-1-104 in the third

quarter of 2022 and expects to enroll the first patient in its

Phase 1 trial evaluating IMM-1-104 in the fourth quarter of

2022.

- Second IND, IMM-6-415, submission expected in

2023: IMM-6-415, the company’s MEK-io program, is

currently in IND-enabling studies. Immuneering expects to file an

IND application for IMM-6-415 in 2023. IMM-6-415 is a dual-MEK

inhibitor that has drug-like properties optimized for immune

modulation and may enhance and/or expand clinical responses to

checkpoint inhibitors.

First Quarter 2022 Financial

Highlights

- Cash Position: Cash and cash equivalents and marketable

securities as of March 31, 2022 were $137.8 million, compared with

$150.2 million as of December 31, 2021.

- Research and Development (R&D) Expenses: R&D expenses

for the first quarter of 2022 were $9.1 million, compared with $5.4

million for the same period in 2021. The increase in R&D

expenses was primarily attributable to higher preclinical costs

related to the company’s lead programs and increased personnel to

support ongoing research and development activities.

- General and Administrative (G&A) Expenses: G&A expenses

for the first quarter of 2022 were $4.0 million, compared with $1.2

million for the same period of 2021. The increase in G&A

expenses was primarily attributable to an increase in headcount in

our general and administrative functions to support the company’s

business and to costs related to operating as a public

company.

- Net Loss: Net loss attributable to common stockholders was

$12.9 million, or $0.49 per share, for the quarter ended March 31,

2022, compared to $6.2 million, or $1.26 per share, for the quarter

ended March 31, 2021.

2022 Financial Guidance

- Immuneering reiterates full year GAAP operating expenses to be

between $55.0 million and $60.0 million including estimated

non-cash stock-based compensation. Based on cash, cash equivalents

and marketable securities as of March 31, 2022, the company expects

its cash runway to extend into the third quarter of

2024.

About Immuneering

Corporation Immuneering aims to improve patient

outcomes by advancing a unique pipeline of oncology and

neuroscience product candidates developed using its translational

bioinformatics platform. Immuneering has more than a decade of

experience applying translational bioinformatics to generate

insights into drug mechanism of action and patient treatment

response. Building on this experience, Immuneering’s

disease-agnostic discovery platform enables the company to create

product candidates based on 1) biological insights that are both

counterintuitive and deeply rooted in data, and 2) novel chemistry.

Immuneering’s lead product candidate IMM-1-104 is designed to be a

highly selective dual-MEK inhibitor that further disrupts KSR to

modulate the signaling dynamics of the MAPK pathway. Specifically,

it is designed to drive deep cyclic inhibition that deprives tumor

cells of the sustained proliferative signaling required for rapid

growth, while providing a cadenced, moderate level of signaling

sufficient to spare healthy cells. IMM-1-104 is being developed to

treat advanced solid tumors in patients harboring RAS mutations,

and is translationally guided by Immuneering’s proprietary,

human-aligned 3D tumor modeling platform combined with

patient-aligned bioinformatics. In addition to IMM-1-104,

Immuneering is evaluating its MEK-io product candidate, IMM-6-415,

in IND-enabling studies, and has five other oncology programs in

the discovery stage that are designed to target components of the

MAPK or mTOR pathway, as well as two discovery stage neuroscience

programs.

Forward-Looking

Statements This press release includes certain

disclosures that contain "forward-looking statements," including,

without limitation, statements regarding Immuneering’s expectations

regarding the sufficiency of Immuneering’s cash, cash equivalents

and marketable securities, its full year GAAP operating expenses

for 2022, Immuneering’s commitment to corporate social

responsibility, the treatment potential of IMM-1-104 and IMM-6-415,

the timing of submission of the IND and commencement of clinical

trials for IMM-1-104 and IMM-6-415, and Immuneering’s ability to

advance its pipeline and further diversify its portfolio and make

progress towards its longstanding goal of creating better medicines

for cancer patients. Forward-looking statements are based on

Immuneering’s current expectations and are subject to inherent

uncertainties, risks and assumptions that are difficult to predict.

Factors that could cause actual results to differ include, but are

not limited to, the risks inherent in oncology and neuroscience

drug development, including target discovery, target validation,

lead compound identification, lead compound optimization,

preclinical studies and clinical trials. These and other risks and

uncertainties are described more fully in the section titled "Risk

Factors" in Immuneering’s most recent Form 10-Q filed with the U.S.

Securities and Exchange Commission. Forward-looking statements

contained in this announcement are made as of this date, and

Immuneering undertakes no duty to update such information except as

required under applicable law.

Corporate Contact: Rebecca Kusko,

Ph.D. Immuneering

Corporation 617-500-8080 rkusko@immuneering.com

Investor Contact: Susan A. NoonanS.A.

Noonan Communicationssusan@sanoonan.com 917-513-5303

IMMUNEERING

CORPORATIONCONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited)

| |

|

Three Months Ended March 31, |

| |

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

|

Revenue |

|

$ |

183,698 |

|

|

$ |

748,200 |

|

| Cost of

revenue |

|

|

90,846 |

|

|

|

409,163 |

|

| |

|

|

|

|

|

|

| Gross

profit |

|

|

92,852 |

|

|

|

339,037 |

|

| |

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

Research and development |

|

|

9,058,545 |

|

|

|

5,391,020 |

|

|

General and administrative |

|

|

3,951,866 |

|

|

|

1,184,023 |

|

|

Amortization of intangible asset |

|

|

8,103 |

|

|

|

— |

|

|

Total operating expenses |

|

|

13,018,514 |

|

|

|

6,575,043 |

|

|

Loss from operations |

|

|

(12,925,662 |

) |

|

|

(6,236,006 |

) |

| |

|

|

|

|

|

|

| Other income

(expense) |

|

|

|

|

|

|

|

Interest income |

|

|

132,506 |

|

|

|

6,355 |

|

|

Other expense |

|

|

(103,218 |

) |

|

|

— |

|

| Net loss |

|

$ |

(12,896,374 |

) |

|

$ |

(6,229,651 |

) |

|

|

|

|

|

|

|

|

| Net loss per share

attributable to common stockholders, basic and diluted |

|

$ |

(0.49 |

) |

|

$ |

(1.26 |

) |

| Weighted-average common shares

outstanding, basic and diluted |

|

|

26,359,080 |

|

|

|

4,950,129 |

|

|

|

|

|

|

|

|

|

| Other comprehensive loss: |

|

|

|

|

|

|

|

Unrealized losses from marketable securities |

|

|

(118,386 |

) |

|

|

— |

|

| Comprehensive

Loss |

|

$ |

(13,014,760 |

) |

|

$ |

(6,229,651 |

) |

IMMUNEERING

CORPORATIONCONSOLIDATED BALANCE

SHEETS(Unaudited)

| |

|

March 31, 2022 |

|

December 31, 2021 |

| |

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

75,205,060 |

|

|

$ |

74,888,145 |

|

|

Marketable securities, current |

|

|

62,565,953 |

|

|

|

74,311,203 |

|

|

Accounts receivable |

|

|

279,614 |

|

|

|

246,040 |

|

|

Prepaids and other current assets |

|

|

1,479,592 |

|

|

|

2,888,608 |

|

|

Total current assets |

|

|

139,530,219 |

|

|

|

152,333,996 |

|

| |

|

|

|

|

|

|

| Marketable securities,

non-current |

|

|

— |

|

|

|

996,560 |

|

| Property and equipment,

net |

|

|

874,569 |

|

|

|

807,223 |

|

| Goodwill |

|

|

6,690,431 |

|

|

|

6,701,726 |

|

| Intangible asset |

|

|

430,897 |

|

|

|

439,000 |

|

| Right-of-use assets, net |

|

|

4,831,639 |

|

|

|

5,324,198 |

|

| Other assets |

|

|

89,579 |

|

|

|

102,129 |

|

|

Total assets |

|

$ |

152,447,334 |

|

|

$ |

166,704,832 |

|

| |

|

|

|

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,642,364 |

|

|

$ |

1,394,340 |

|

|

Accrued expenses |

|

|

1,718,804 |

|

|

|

3,965,447 |

|

|

Other liabilities, current |

|

|

47,213 |

|

|

|

— |

|

|

Lease liabilities, current |

|

|

265,419 |

|

|

|

274,039 |

|

|

Total current liabilities |

|

|

3,673,800 |

|

|

|

5,633,826 |

|

| |

|

|

|

|

|

|

| Long-term liabilities: |

|

|

|

|

|

|

|

Other liabilities, non-current |

|

|

9,898 |

|

|

|

— |

|

|

Lease liabilities, non-current |

|

|

4,707,526 |

|

|

|

5,090,897 |

|

|

Total liabilities |

|

|

8,391,224 |

|

|

|

10,724,723 |

|

| Commitments and contingencies

(Note 12) |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

| Preferred stock, $0.001 par

value; 10,000,000 shares authorized at March 31, 2022 and December

31, 2021, respectively; 0 shares issued or outstanding at March 31,

2022 and December 31, 2021 |

|

|

— |

|

|

|

— |

|

| Class A common stock, $0.001

par value, 200,000,000 shares authorized at March 31, 2022 and

December 31, 2021; 26,383,299 and 26,320,199 shares issued and

outstanding at March 31, 2022 and

December 31, 2021, respectively |

|

|

26,383 |

|

|

|

26,320 |

|

| Class B common stock, $0.001

par value, 20,000,000 shares authorized at March 31, 2022 and

December 31, 2021; 0 shares issued and outstanding at

March 31, 2022 and December 31, 2021 |

|

|

— |

|

|

|

— |

|

| Additional paid-in

capital |

|

|

216,366,884 |

|

|

|

215,276,186 |

|

| Accumulated other

comprehensive loss |

|

|

(167,395 |

) |

|

|

(49,009 |

) |

| Accumulated deficit |

|

|

(72,169,762 |

) |

|

|

(59,273,388 |

) |

|

Total stockholders' equity |

|

|

144,056,110 |

|

|

|

155,980,109 |

|

|

Total liabilities and stockholders' equity |

|

$ |

152,447,334 |

|

|

$ |

166,704,832 |

|

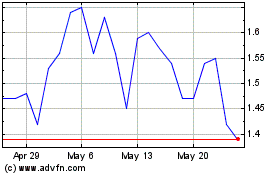

Immuneering (NASDAQ:IMRX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Immuneering (NASDAQ:IMRX)

Historical Stock Chart

From Jul 2023 to Jul 2024