As filed with the Securities and Exchange Commission on December 19, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HF FOODS GROUP INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 6325 South Rainbow Boulevard Suite 420 Las Vegas, Nevada, 89118 (888) 905-0988 (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) | 81-2717873 (I.R.S. Employer Identification Number) |

Christine Chang

General Counsel and Chief Compliance Officer

HF Foods Group Inc.

6325 South Rainbow Boulevard, Suite 420

Las Vegas, NV 89118

(888) 905-0988

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Christopher Peterson

Arnold & Porter Kaye Scholer LLP

250 West 55th Street

New York, NY 10019

(212) 836-8861

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (“Securities Act”), other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. ☐

If this Form is a Registration Statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

Large accelerated filer ☐ | Accelerated filer ☒ | Non-accelerated filer ☐ | Smaller reporting company ☐ |

| | | Emerging growth company ☐ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and the selling stockholders are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 19, 2024

PROSPECTUS

HF FOODS GROUP INC.

Up to 5,200,000 Shares of Common Stock

For Resale Offered by the Selling Stockholders

This prospectus relates to the offer and sale from time to time by selling stockholders of up to 5,200,000 shares of our common stock, par value $0.0001 per share, either individually or in units and in one or more transactions. The shares of common stock registered for resale pursuant to this prospectus were issued (i) as consideration in acquisition transactions, (ii) as consideration pursuant to that certain Merger Agreement dated as of June 21, 2019, by and among HF Foods Group Inc. (the “Company”), B&R Merger Sub Inc., a Delaware corporation, B&R Global Holdings, Inc., the stockholders of B&R Global Holdings, Inc., and Xiao Mou Zhang (aka Peter Zhang) as representative of the stockholders, (iii) as consideration pursuant to that certain Merger Agreement, dated as of March 28, 2018, by and among Atlantic Acquisition Corp., HF Group Merger Sub Inc., a Delaware subsidiary formed by Atlantic Acquisition Corp., HF Group Holding Corporation, a North Carolina corporation, the stockholders of HF Group Holding Corporation, and Zhou Min Ni, as representative of the stockholders; (iv) as consideration pursuant to that certain Asset Purchase Agreement, dated December 30, 2021, by and among Great Wall Seafood Supply, Inc., Great Wall Restaurant Supplier, Inc., First Mart Inc., the Company, Great Wall Seafood IL, L.L.C., Great Wall Seafood TX, L.L.C., Bo Chuan Wong and Qiu Xian Li; (v) as consideration pursuant to that certain Asset Purchase Agreement, dated as of April 19, 2022, by and among Sealand Food, Inc., Connie Wang, Jenny Wang and Great Wall Seafood VA, L.L.C. and the Company; and (vi) upon the settlement of certain equity awards granted pursuant to the Company’s equity incentive plans.

We are registering the shares of our common stock on behalf of the selling stockholders, to be offered and sold by them from time to time. We are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of shares by the selling stockholders.

This prospectus provides a general description of the common stock the selling stockholders may offer. The selling stockholders may sell the shares of our common stock described in this prospectus in a number of different ways and at varying prices. See the section titled “Plan of Distribution” on page 16 of this prospectus for more information about how the selling stockholders may sell the shares of common stock being registered pursuant to this prospectus. We are paying certain expenses incurred in registering the shares of common stock, including certain legal, accounting fees and registration fees. The selling stockholders will bear all underwriting discounts, selling commissions and similar fees and arrangements and stock transfer taxes allocable to their respective sales of the shares of our common stock and certain additional legal and advisor fees.

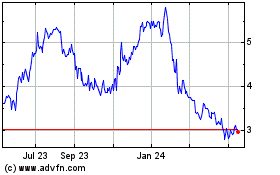

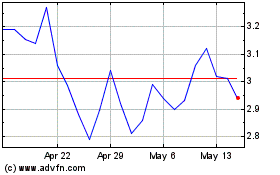

Our common stock is listed on the NASDAQ Capital Market (the “NASDAQ”) under the symbol “HFFG.” The applicable prospectus supplement will contain information, where applicable, as to any other listing, if any, on the NASDAQ or any securities market or other exchange of the securities covered by the applicable prospectus supplement. On December 18, 2024, the last reported sale price of our common stock on NASDAQ was $3.43 per share.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 6 of this prospectus and contained in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus. We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is _________, 2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a Registration Statement that we filed with the Securities and Exchange Commission (“SEC”) using a “shelf” registration process. Under this shelf registration process, the selling stockholders, which as used herein include donees, pledgees, transferees, distributees or other successors-in-interest selling shares of our common stock or interests in our common stock received after the date of this prospectus from the selling stockholders as a gift, pledge, partnership distribution or other transfer identified in this prospectus, may offer and sell up to up to 5,200,000 shares of our common stock. This prospectus provides a general description of the shares of our common stock the selling stockholders may offer. We are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of shares by the selling stockholders. For general information about the distribution of shares of common stock offered by the selling stockholders, see the section in this prospectus titled “Plan of Distribution.”

A prospectus supplement or post-effective amendment may also add, update or change information included in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement or post-effective amendment modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You should rely only on the information contained or incorporated by reference in this prospectus, any applicable prospectus supplement, post-effective amendment or any related free writing prospectus. See “Where You Can Find More Information” and “Information Incorporated by Reference.”

You should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. Neither we nor the selling stockholders have authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement, as well as information we have previously filed with the SEC and incorporated by reference, is accurate as of the date of those documents only. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information and all of such summaries are qualified in their entirety by the actual documents they purport to summarize. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information” and “Information Incorporated by Reference.”

In this prospectus, unless otherwise indicated, “the Company,” “HF Foods Group,” “we,” “us” or “our” refer to HF Foods Group Inc., a Delaware corporation, and its consolidated subsidiaries.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

This prospectus and the information incorporated by reference herein contains some of our trademarks, service marks and trade names, including, among others, the HF black and white/color logos, Rong, Rong GREEN LEAF, Great Wall logos, <333>, SEA333, SEA888, “Han Feng,” “Rong Cheng” and “Great Wall.” Each one of these trademarks, service marks or trade names is either (1) our registered trademark, (2) a trademark for which we have a pending application, or (3) a trade name or service mark for which we claim common law rights. All other trademarks, service marks or trade names of any other company appearing in this prospectus or the information incorporated by reference herein belong to their respective owners. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus are presented without the TM, SM and symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent permissible under applicable law, our respective rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

INDUSTRY AND MARKET DATA

The market data and certain other statistical information used throughout this prospectus and the information incorporated by reference herein are based on independent industry publications, government publications and other published independent sources. Although we believe these third-party sources are reliable as of their respective dates, we have not independently verified the accuracy or completeness of this information. Some data is also based on our good faith estimates. While we are not aware of any misstatements regarding our industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in these publications.

PROSPECTUS SUMMARY

This prospectus summary highlights certain information about our company and other information contained elsewhere in this prospectus or in documents incorporated by reference. This summary does not contain all of the information that you should consider before making an investment decision. You should carefully read the entire prospectus, any prospectus supplement, including the section entitled “Risk Factors” and the documents incorporated by reference into this prospectus, before making an investment decision.

The Offering

This prospectus is part of a Registration Statement that we filed with the SEC utilizing a shelf registration process. Under this shelf registration process, the selling stockholders to be identified in a prospectus supplement may offer up to 5,200,000 shares of our common stock, from time to time in one or more offerings under this prospectus, at prices and on terms to be determined by market conditions at the time of any offering. This prospectus provides you with a general description of the common stock the selling stockholders may offer.

The selling stockholders may sell shares of our common stock directly to investors or to or through agents, underwriters or dealers. The selling stockholders and their agents or underwriters reserve the right to accept or reject all or part of any proposed purchase of shares our common stock. If the selling stockholders do offer shares of our common stock to or through agents or underwriters, a prospectus supplement, if required, will be distributed, which will include, among other things:

•the names of those agents or underwriters; and

•applicable fees, discounts and commissions to be paid; and details regarding options to purchase additional shares, if any.

We may suspend the sale of our shares of common stock by the selling stockholders pursuant to this prospectus for certain periods of time for certain reasons, including if the prospectus is required to be supplemented or amended to include additional material information.

The holders of our common stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders. Subject to preferences that may be applicable to any then-outstanding shares of preferred stock, the holders of common stock are entitled to receive ratably such dividends as may be declared by our board of directors out of legally available funds. Upon our liquidation, dissolution or winding up, the holders of our common stock are entitled to share ratably in all assets remaining after payment of liabilities and the liquidation preferences of any then-outstanding shares of preferred stock. Holders of our common stock have no preemptive rights and no right to convert their common stock into any other securities.

There are no redemption or sinking fund provisions applicable to our common stock. The rights, preferences and privileges of the holders of our common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of preferred stock that we may designate in the future. In this prospectus, we have summarized certain general features of our common stock under the section titled “Description of Capital Stock — Common Stock.” You should read both this prospectus and any prospectus supplement together with the additional information described under the heading “Where You Can Find More Information.”

Our Company

HF Foods Group Inc., operating through our subsidiaries, is a leading foodservice distributor to Asian restaurants, primarily Chinese restaurants located throughout the United States. HF Foods was formed through a merger between two complementary market leaders, HF Foods and B&R Global Holdings, Inc., on November 4, 2019. In 2022, HF Foods acquired two frozen seafood suppliers, expanding its distribution network in Illinois, Texas and along the eastern seaboard, from Massachusetts to Florida, as well as Pennsylvania, West Virginia, Ohio, Kentucky, and Tennessee.

With 19 distribution centers and cross-docks and a fleet of over 400 refrigerated vehicles, our distribution network now spans 46 states covering approximately 95% of the contiguous United States. Capitalizing on our deep

understanding of the Chinese culture, with over 1,000 employees and subcontractors, and supported by two outsourced call centers in China, we have become a trusted partner serving approximately 15,000 Asian restaurants providing sales and service support to customers who mainly converse in Mandarin or Chinese dialects.

We are committed to providing excellent customer service by delivering a distinctive product portfolio built from an indelible partnership with both foreign and domestic suppliers. These relationships ensure that we deliver an outstanding array of products at competitive prices. Our relationships with suppliers and knowledge of the market are the cornerstones of our negotiating power with suppliers and enable us to better manage potential supply chain disruptions and stockouts, gain price concessions and increase delivery schedules.

Our business features nineteen strategically positioned distribution centers and cross-docks with over one million square feet of warehouse space and a fleet of over 400 vehicles to provide a wide variety of products with a strong focus on Asian specialty food ingredients essential for Asian cooking. Supported by an extensive supplier network, we aim to provide a one-stop service with on-time delivery and high fulfillment rates, at competitive pricing.

We offer over 2,000 different products to our customers, which include virtually all items needed to operate their restaurant business. Product offerings range from meat and poultry, perishable fresh produce, frozen seafood, general commodities and takeout food packaging materials to meet our customers’ demands. The majority of our procurement currently consists of goods purchased domestically, such as meat, poultry, produce and certain key commodities. We also purchase a significant amount of goods through the import channel, such as frozen seafood, Asian Specialty, packaging and other commodities.

Our principal executive offices are located at 6325 South Rainbow Boulevard, Suite 420, Las Vegas, NV. Our website is located at www.hffoodsgroup.com, and our telephone number is (888) 905-0988. Information found on, or accessible through, our website is not a part of, and is not incorporated into, this prospectus, and you should not consider it part of this prospectus or part of any prospectus supplement. Our website address is included in this document as an inactive textual reference only.

RISK FACTORS

Investing in our securities involves risk. The prospectus supplement applicable to a particular offering of securities will contain a discussion of the risks applicable to an investment in HF Foods Group and to the particular types of securities that we are offering under that prospectus supplement. Before making an investment decision, you should carefully consider the risks described under “Risk Factors” in the applicable prospectus supplement and the risks described under Item 1A of Part I in our most recent Annual Report on Form 10-K for the year ended December 31, 2023, which is incorporated herein by reference, or any updates in our Quarterly Reports on Form 10-Q, together with all of the other information appearing in or incorporated by reference into this prospectus and any applicable prospectus supplement, in light of your particular investment objectives and financial circumstances. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. Forward-looking statements include statements about our expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are not historical facts. Words or phrases such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “will” or similar words or phrases, or the negatives of those words or phrases, may identify forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based on many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, include without limitation:

•Low margins in the foodservice distribution industry and periods of significant or prolonged inflation or deflation;

•Qualified labor shortages;

•Unfavorable macroeconomic conditions in the United States;

•Competition in the foodservice distribution industry particularly the entry of new competitors into the Chinese/Asian restaurant supply market niche;

•Increases in fuel costs;

•Disruption of relationships with vendors and increases in product prices;

•Dependency on the timely delivery of products from vendors, particularly the prolonged diminution of global supply chains;

•The effects of the COVID-19 pandemic or other pandemics;

•The steps taken by the governments where our suppliers are located, including the People’s Republic of China, to address the COVID-19 pandemic or other pandemics;

•Disruption of relationships with or loss of customers;

•Changes in consumer eating and dining out habits;

•Related party transactions and possible conflicts of interests;

•Related parties and variable interest entities consolidation;

•Failure to protect our intellectual property rights;

•Our ability to renew or replace our current warehouse leases on favorable terms, or terminations prior to expiration of stated terms;

•Failure to retain our senior management and other key personnel, particularly our CEO, President and COO, CFO and General Counsel and CCO;

•Our ability to attract, train and retain employees;

•Changes in and enforcement of immigration laws;

•Failure to comply with various federal, state and local rules and regulations regarding food safety, sanitation, transportation, minimum wage, overtime and other health and safety laws;

•Product recalls, voluntary recalls or withdrawals if any of the products we distribute are alleged to have caused illness, been mislabeled, misbranded or adulterated or to otherwise have violated applicable government regulations;

•Costs to comply with environmental laws and regulations;

•Litigation, regulatory investigations and potential enforcement actions;

•Increases in commodity prices;

•U.S. government tariffs on products imported into the United States, particularly from China;

•Severe weather, natural disasters and adverse climate change;

•Unfavorable geopolitical conditions;

•Any cyber security incident, other technology disruption or delay in implementing our information technology systems;

•Current indebtedness affecting our liquidity and ability of future financing;

•Failure to acquire other distributors or wholesalers and enlarge our customer base;

•Scarcity of and competition for acquisition opportunities;

•Our ability to obtain acquisition financing;

•The impact of non-cash charges relating to the amortization of intangible assets related to material acquisitions;

•Our ability to identify acquisition candidates;

•Increases in debt in order to successfully implement our acquisition strategy;

•Difficulties in integrating operations, personnel, and assets of acquired businesses that may disrupt our business, dilute stockholder value, and adversely affect our operating results;

•The impact on the price and demand for our common stock resulting from the relative illiquidity of the market for our common stock;

•Significant stockholders’ ability to significantly influence the Company;

•The impact of state anti-takeover laws and related provisions in our governance documents; and

•Other factors set forth in “Risk Factors”.

All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements as well as other cautionary statements that are made from time to time in our other filings with the SEC and public communications. We caution you that the important factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our operations in the way we expect. The forward-looking statements included in this prospectus are made only as of the date hereof. Except as otherwise required by law, we undertake no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise.

DIVIDEND POLICY

We have never declared or paid dividends on our common stock. Payment of cash dividends, if any, in the future will be at the discretion of our board of directors and will depend on applicable law and then-existing conditions, including our financial condition, operating results, contractual restrictions, capital requirements, business prospects and other factors our board of directors may deem relevant. We currently intend to retain all available funds and any future earnings to fund the development and growth of our business.

USE OF PROCEEDS

We are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of shares of our common stock by the selling stockholders.

The selling stockholders will pay any underwriting discounts and commissions and expenses incurred by the selling stockholders for brokerage, accounting, tax or legal services or any other expenses incurred by the selling stockholders in disposing of the securities. We will bear the costs, fees and expenses incurred in effecting the registration of the securities covered by this prospectus, including all registration and filing fees, Nasdaq listing fees and fees and expenses of our counsel and our independent registered public accounting firm.

DESCRIPTION OF OUR CAPITAL STOCK

The descriptions of the securities contained in this prospectus, together with any applicable prospectus supplement, summarize all the material terms and provisions of the common stock that the selling stockholders may offer. If necessary, we will describe in the applicable prospectus supplement relating to a particular offering the specific terms of the common stock offered by that prospectus supplement. We will indicate in the applicable prospectus supplement if the terms of the common stock differs from the terms we have summarized below. We will also include in the prospectus supplement information, where applicable, material United States federal income tax considerations relating to the common stock.

This prospectus may not be used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

Capital Stock

General

The following description of common stock and preferred stock, together with the additional information we include in any applicable prospectus supplement, summarizes the material terms and provisions of the common stock that the selling stockholders may offer under this prospectus but is not complete. For the complete terms of our common stock and preferred stock, please refer to our Second Amended and Restated Certificate of Incorporation, as may be amended from time to time (our “Charter”), any certificates of designation for our preferred stock, that may be authorized from time to time, and our Amended and Restated Bylaws, as amended from time to time (our “Bylaws”). The Delaware General Corporation Law (the “DGCL”) may also affect the terms of these securities. While the terms we have summarized below will apply generally to any future common stock or preferred stock that the selling stockholders may offer, we will describe the specific terms of any series of these securities in more detail in the applicable prospectus supplement. If we so indicate in a prospectus supplement, the terms of any common stock the selling stockholders offer under that prospectus supplement may differ from the terms we describe below.

As of November 7, 2024, our authorized capital stock consists of 100,000,000 shares of common stock, par value $0.0001 per share, of which 52,730,183 shares were issued and outstanding, and 1,000,000 shares of preferred stock, par value $0.001 per share, none of which were issued and outstanding. The authorized and unissued shares of common stock and preferred stock are available for issuance without further action by our stockholders, unless such action is required by applicable law or the rules of any stock exchange on which our securities may be listed. Unless approval of our stockholders is so required, our board of directors will not seek stockholder approval for the issuance and sale of our common stock.

Common Stock

Holders of our common stock are entitled to one vote for each share held on all matters to be voted on by stockholders. The members of our board of directors will generally serve for a term of one year. Holders of our common stock are entitled to one vote per share on all matters voted on by the stockholders, including in connection with the election of directors, as provided by law. Holders of our common stock do not have cumulative voting rights. Except as otherwise required by the DGCL or our Charter and Bylaws, action requiring stockholder approval

may be taken by a vote of the holders of a majority of the voting power of the shares of stock of the Company present in person or by proxy and entitled to vote on the relevant matter at a meeting at which a quorum is present.

After satisfaction of any dividend rights of holders of preferred stock and subject to applicable law, if any, holders of common stock are entitled to receive dividends, if any, as may be declared from time to time by our board of directors in its discretion.

Holders of our common stock have no preemptive, subscription, redemption, conversion or exchange rights and no sinking fund provisions.

All outstanding shares of our common stock are duly authorized, validly issued, fully paid and non-assessable. Additional shares of common stock may be issued, as authorized by our board of directors from time to time, without stockholder approval, except for any stockholder approval required by the NASDAQ.

The rights, preferences and privileges of holders of common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of preferred stock that we may designate and issue in the future.

Our common stock is listed on the NASDAQ under the symbol “HFFG.” The transfer agent and registrar for our common stock is Equiniti Trust Company, LLC, New York, New York.

Preferred Stock

Our board of directors may determine or alter for each class of preferred stock the voting powers, designations, preferences, and special rights, qualifications, limitations, or restrictions as permitted by law. Our board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of the common stock. Having the ability to issue preferred stock provides flexibility in connection with possible acquisitions and other corporate purposes, but could also, among other things, have the effect of delaying, deferring or preventing a change in control of our company and may adversely affect the market price of our common stock and the voting and other rights of the holders of common stock.

Our board of directors will fix the rights, preferences, privileges, qualifications and restrictions of the preferred stock of each series that we issue in the certificate of designation relating to that series. We will incorporate by reference into the registration statement of which this prospectus is a part the form of any certificate of designation that describes the terms of the series of preferred stock to be offered under this prospectus. This description of the preferred stock in the certificate of designation and any applicable prospectus supplement will include:

•the title and stated value;

•the number of shares being offered;

•the liquidation preference per share;

•the purchase price per share;

•the currency for which the shares may be purchased;

•the dividend rate per share, dividend period and payment dates and method of calculation for dividends;

•whether dividends will be cumulative or non-cumulative and, if cumulative, the date from which dividends will accumulate;

•our right, if any, to defer payment of dividends and the maximum length of any such deferral period;

•the procedures for any auction and remarketing, if any;

•the provisions for a sinking fund, if any;

•the provisions for redemption or repurchase, if applicable, and any restrictions on our ability to exercise those redemption and repurchase rights;

•any listing of the preferred stock on any securities exchange or market;

•whether the preferred stock will be convertible into our common stock or other securities of ours, and, if applicable, the conversion period, the conversion price, or how it will be calculated, and under what circumstances it may be adjusted;

•voting rights, if any, of the preferred stock;

•preemption rights, if any;

•restrictions on transfer, sale or other assignment, if any;

•a discussion of any material or special United States federal income tax considerations applicable to the preferred stock;

•the relative ranking and preferences of the preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs;

•any limitations on issuances of any class or series of preferred stock ranking senior to or on a parity with the series of preferred stock being issued as to dividend rights and rights if we liquidate, dissolve or wind up our affairs; and

•any other specific terms, rights, preferences, privileges, qualifications or restrictions of the preferred stock.

When we issue shares of preferred stock, the shares will be fully paid and non-assessable.

Certain Anti-Takeover Effects of Delaware Law and Provisions of Our Charter and Bylaws

Some provisions of Delaware law, our Charter and our Bylaws could delay or discourage some transactions involving an actual or potential change in control of us or our management and may limit the ability of our stockholders to remove current management or approve transactions that our stockholders may deem to be in their best interests. These provisions:

•allow our board of directors to issue any authorized but unissued shares of common stock without approval of stockholders;

•authorize our board of directors to establish one or more series of preferred stock, the terms of which can be determined by our board of directors at the time of issuance;

•provide an advanced written notice procedure with respect to stockholder proposals and the nomination of candidates for election as directors, other than nominations made by or at the direction of our board of directors, subject to the rights of stockholders to request inclusion of proposals in our proxy statement pursuant to Rule 14a-8 under the Exchange Act (or any successor provision of law);

•state that special meetings of our stockholders may be called only by the Chairman of our board of directors, our President, or at the request of a majority of our board of directors;

•allow our directors, and not our stockholders, to fill vacancies on our board of directors, including vacancies resulting from removal or enlargement of our board of directors, unless such vacancies are created by the removal of a director by the stockholders; and

•grant our board of directors the authority to alter any provision of the Bylaws without a stockholder assent or vote; provided, however, that such authority of our board of directors is subject to the power of the stockholders to alter, amend, change, add to, repeal, rescind or make new Bylaws by the affirmative vote of the holders of at least a majority of the voting power of the outstanding shares entitled to vote thereon.

We are subject to Section 203 of the DGCL, which is an anti-takeover law. In general, Section 203 prevents a publicly-held Delaware corporation from engaging in a “business combination” with any “interested stockholder” for a period of three years following the date that the person became an interested stockholder unless (1) its board of directors approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder, (2) at least two-thirds of the outstanding shares not owned by that interested stockholder approve the business combination, or (3) upon becoming an interested stockholder, that stockholder owned at least 85% of the outstanding shares, excluding those held by officers, directors and some employee stock plans. In general, a “business combination” includes, among other things, a merger or consolidation involving us and the “interested stockholder” and the sale of more than 10% of our assets. In general, an “interested stockholder” is any entity or person beneficially owning 15% or more of our outstanding voting stock and any entity or person affiliated with or controlling or controlled by such entity or person.

A Delaware corporation may “opt out” of these provisions with an express provision in its original certificate of incorporation or an express provision in its certificate of incorporation or bylaws resulting from a stockholders’ amendment approved by at least a majority of the outstanding voting shares. We have not opted out of these provisions.

Because of these provisions, persons considering unsolicited tender offers or other unilateral takeover proposals may be more likely to negotiate with our board of directors rather than pursue non-negotiated takeover attempts. As a result, these provisions may make it more difficult for our stockholders to benefit from transactions that are opposed by an incumbent board of directors.

Preferred Stock Purchase Rights

On April 11, 2023, our board of directors authorized and declared a dividend distribution of one right (each, a “Right”) for each outstanding share of common stock to stockholders of record as of the close of business on April 24, 2023 (the “Record Date”). Each Right entitles the registered holder to purchase from the Company one one-thousandth of a share of Series A Participating Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”), of the Company at an exercise price of $19.50 (the “Exercise Price”), subject to adjustment. On April 11, 2024, the expiration date of each Right was extended to April 11, 2025. The complete terms of the Rights are set forth in a Preferred Stock Rights Agreement (as amended, the “Rights Agreement”), dated as of April 11, 2023, between the Company and American Stock Transfer & Trust Company, LLC (now known as Equiniti Trust Company, LLC), as rights agent.

Our board of directors adopted the Rights Agreement to protect stockholders from coercive or otherwise unfair takeover tactics. The Rights Agreement functions by imposing a significant penalty upon any person or group that acquires fifteen percent (15%) or more of the shares of our common stock without the approval of the board of directors. As a result, the overall effect of the Rights Agreement and the issuance of the Rights may be to render more difficult or discourage a merger, tender or exchange offer or other business combination involving the Company that is not approved by the board of directors.

Rule 144

Pursuant to Rule 144 under the Securities Act (“Rule 144”), a person who has beneficially owned our restricted common stock for at least six months would be entitled to sell their shares of our common stock provided that (i) such person is not deemed to have been our affiliate at the time of, or at any time during the three months preceding, a sale and (ii) we are subject to the Exchange Act periodic reporting requirements for at least three months before the sale and have filed all required reports under Section 13 or 15(d) of the Exchange Act during the 12 months (or such shorter period as required to file such reports) preceding the sale.

Persons who have beneficially owned our restricted common stock for at least six months but who are our affiliates at the time of, or at any time during the three months preceding, a sale would be subject to additional restrictions, by which such person would be entitled to sell within any three-month period only a number of shares of our common stock that does not exceed the greater of:

•1% of the total number of shares of our common stock then outstanding; or

•the average weekly reported trading volume of our common stock during the four calendar weeks preceding the filing of a notice on Form 144 with respect to the sale.

Sales by our affiliates under Rule 144 are also limited by manner of sale provisions and notice requirements and by the availability of current public information about us.

SELLING STOCKHOLDERS

This prospectus also relates to the possible resale by certain of our shareholders, who we refer to in this prospectus as the “selling stockholders,” of up to 5,200,000 shares of our common stock that were issued and outstanding prior to the original date of filing of the registration statement of which this prospectus forms a part. The selling stockholders acquired the shares of our common stock included in this prospectus:

•as consideration in acquisition transactions;

•as consideration pursuant to that certain merger agreement dated as of June 21, 2019, by and among the Company, B&R Merger Sub Inc., a Delaware corporation, B&R Global Holdings, Inc., the stockholders of B&R Global Holdings, Inc., and Xiao Mou Zhang (aka Peter Zhang);

•as consideration pursuant to that certain merger agreement, dated as of March 28, 2018, by and among Atlantic Acquisition Corp., HF Group Merger Sub Inc., a Delaware subsidiary formed by Atlantic Acquisition Corp., HF Group Holding Corporation, a North Carolina corporation, the stockholders of HF Group Holding Corporation, and Zhou Min Ni, as representative of the stockholders;

•as consideration pursuant to that certain Asset Purchase Agreement, dated December 30, 2021, by and among Great Wall Seafood Supply, Inc., Great Wall Restaurant Supplier, Inc., First Mart Inc., the Company, Great Wall Seafood IL, L.L.C., Great Wall Seafood TX, L.L.C., Bo Chuan Wong and Qiu Xian Li;

•as consideration pursuant to that certain Asset Purchase Agreement, dated as of April 19, 2022, by and among Sealand Food, Inc., Connie Wang, Jenny Wang and Great Wall Seafood VA, L.L.C. and the Company; and

•upon the settlement of certain equity awards granted pursuant to the Company’s equity incentive plans.

Information about the selling stockholders, where applicable, including their identities, the number of shares of common stock owned by each selling stockholders prior to the offering, the number of shares of our common stock to be offered by each selling stockholders and the amount of common stock to be owned by each selling stockholders after completion of the offering, will be set forth in an applicable prospectus supplement, documents incorporated by reference or in a free writing prospectus we file with the SEC. The applicable prospectus supplement will also disclose whether any of the selling stockholders has held any position or office with, has been employed by or otherwise has had a material relationship with us during the three years prior to the date of the prospectus supplement.

The selling stockholders may not sell any shares of our common stock pursuant to this prospectus until we have identified such selling stockholder and the shares being offered for resale by such selling stockholders in a subsequent prospectus supplement. However, the selling stockholders may sell or transfer all or a portion of their shares of our common stock pursuant to any available exemption from the registration requirements of the Securities Act.

PLAN OF DISTRIBUTION

We are registering for resale by the selling stockholders up to 5,200,000 shares of common stock. The selling stockholders, which as used herein include donees, pledgees, transferees, distributees or other successors-in-interest selling shares of our common stock or interests in our common stock received after the date of this prospectus from the selling stockholders as a gift, pledge, partnership distribution or other transfer may, from time to time, sell, transfer, distribute or otherwise dispose of certain of their shares of common stock or interests in our common stock on any stock exchange, market or trading facility on which shares of our common stock are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. The applicable prospectus supplement will describe the terms of the offering of the securities, including:

•the name or names of any underwriters, if, and if required, any dealers or agents;

•the purchase price of the securities;

•any underwriting discounts and other items constituting underwriters’ compensation;

•any discounts or concessions allowed or re-allowed or paid to dealers; and

•any securities exchange or market on which the securities may be listed or traded.

The selling stockholders may use any one or more of the following methods when disposing of their shares of common stock or interests therein:

•ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•one or more underwritten offerings;

•block trades in which the broker-dealer will attempt to sell the shares of common stock as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

•purchases by a broker-dealer as principal and resale by the broker-dealer for its accounts;

•an exchange distribution in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•distributions to their members, partners or shareholders;

•short sales effected after the date of the registration statement of which this prospectus is a part is declared effective by the SEC;

•through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•in-market transactions, including transactions on a national securities exchange or quotations service or over-the-counter market;

•directly to one or more purchasers;

•through agents;

•through agreements with broker-dealers, who may agree with the selling stockholders to sell a specified number of such shares of common stock at a stipulated price per share; and

•a combination of any such methods of sale.

The selling stockholders may, from time to time, pledge or grant a security interest in some shares of our common stock owned by them and, if a selling stockholder defaults in the performance of its secured obligations, the pledgees or secured parties may offer and sell such shares of common stock from time to time, under this prospectus, or under an amendment or supplement to this prospectus amending the list of the selling stockholders to include the pledgee, transferee or other successors in interest as the selling stockholders under this prospectus. The selling stockholders also may transfer shares of our common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of shares of our common stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of our common stock in the course of hedging the positions they assume. The selling stockholders may also sell shares of our common stock short and deliver these securities to close out their short positions, or loan or pledge shares of our common stock to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities that require the delivery to such broker-dealer or other financial institution of shares of our common stock offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the selling stockholders from the sale of shares of our common stock offered by them will be the purchase price of such shares of our common stock less discounts or commissions, if any. The selling stockholders reserve the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of shares of our common stock to be made directly or through agents. We will not receive any of the proceeds from any offering by the selling stockholders.

The selling stockholders also may in the future resell a portion of our common stock in open market transactions in reliance upon Rule 144 under the Securities Act, provided that they meet the criteria and conform to the requirements of that rule, or pursuant to other available exemptions from the registration requirements of the Securities Act.

To the extent required, our common stock to be sold, the purchase prices and public offering prices, the names of any agent, dealer or underwriter, and any applicable discounts, commissions, concessions or other compensation with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

The selling stockholders may grant to the underwriters options to purchase additional securities to cover over-allotments, if any, at the public offering price, with additional underwriting commissions or discounts, as may be set forth in a related prospectus supplement. The terms of any over-allotment option will be set forth in the prospectus supplement for those securities.

If the selling stockholders use a dealer in the sale of the securities being offered pursuant to this prospectus or any prospectus supplement, the selling stockholders will sell the securities to the dealer, as principal. The dealer may then resell the securities to the public at varying prices to be determined by the dealer at the time of resale. If required, the names of the dealers and the terms of the transaction will be specified in a prospectus supplement.

The selling stockholders may sell the securities directly or through agents they designated from time to time. If required, we will name any agent involved in the offering and sale of securities and we will describe any commissions paid to the agent in the applicable prospectus supplement.

We or the selling stockholders may authorize agents or underwriters to solicit offers by institutional investors to purchase securities from the selling stockholders at the public offering price set forth in the prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery on a specified date in the future. If required, we will describe the conditions to these contracts and the commissions we must pay for solicitation of these contracts in the prospectus supplement.

In connection with the sale of the securities, underwriters, dealers or agents may receive compensation from us, the selling stockholders or from purchasers of the securities for whom they act as agents, in the form of discounts, concessions or commissions. Underwriters may sell the securities to or through dealers, and those dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters or commissions from the purchasers for whom they may act as agents. Underwriters, dealers and agents that participate in the distribution of the securities, and any institutional investors or others that purchase securities directly for the purpose of resale or distribution, may be deemed to be underwriters, and any discounts or commissions received by them from us or the selling stockholders and any profit on the resale of the common stock by them may be deemed to be underwriting discounts and commissions under the Securities Act. No FINRA member firm may receive compensation in excess of that allowable under FINRA rules, including Rule 5110, in connection with the offering of the securities.

We or the selling stockholders may provide agents, underwriters and other purchasers with indemnification against particular civil liabilities, including liabilities under the Securities Act, or contribution with respect to payments that the agents, underwriters or other purchasers may make with respect to such liabilities. Agents and underwriters may engage in transactions with, or perform services for, us in the ordinary course of business.

To facilitate the public offering of a series of securities, persons participating in the offering may engage in transactions that stabilize, maintain, or otherwise affect the market price of the securities. This may include over-allotments or short sales of the securities, which involves the sale by persons participating in the offering of more securities than have been sold to them by us. In exercising the over-allotment option granted to those persons. In addition, those persons may stabilize or maintain the price of the securities by bidding for or purchasing securities in the open market or by imposing penalty bids, whereby selling concessions allowed to underwriters or dealers participating in any such offering may be reclaimed if securities sold by them are repurchased in connection with stabilization transactions. The effect of these transactions may be to stabilize or maintain the market price of the securities at a level above that which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time. We make no representation or prediction as to the direction or magnitude of any effect that the transactions described above, if implemented, may have on the price of our common stock.

Selling stockholders may use this prospectus in connection with resales of shares of our common stock. This prospectus and any accompanying prospectus supplement will identify the selling stockholders, the terms of our common stock and any material relationships between us and the selling stockholders. Selling stockholders may be deemed to be underwriters under the Securities Act in connection with shares of our common stock they resell and any profits on the sales may be deemed to be underwriting discounts and commissions under the Securities Act. Unless otherwise set forth in a prospectus supplement, the selling stockholders will receive all of the net proceeds from the resale of shares of our common stock.

A selling stockholder that is an entity may elect to make an in-kind distribution of common stock to its members, partners or shareholders pursuant to the registration statement of which this prospectus is a part by delivering a prospectus. To the extent that such members, partners or shareholders are not affiliates of ours, such members, partners or shareholders would thereby receive freely tradable shares of common stock pursuant to the distribution through a registration statement.

Unless otherwise specified in the applicable prospectus supplement, any common stock sold pursuant to a prospectus supplement will be eligible for trading as quoted on the NASDAQ. Any underwriters to whom securities are sold by the selling stockholders for public offering and sale may make a market in the securities, but such underwriters will not be obligated to do so and may discontinue any market making at any time without notice.

In order to comply with the securities laws of some states, if applicable, the securities offered pursuant to this prospectus will be sold in those states only through registered or licensed brokers or dealers. In addition, in some states securities may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and complied with.

LEGAL MATTERS

Unless otherwise indicated in the applicable prospectus supplement, the validity of the securities offered hereby will be passed upon for us by Arnold & Porter Kaye Scholer LLP, New York, New York. If the validity of the securities offered hereby in connection with offerings made pursuant to this prospectus are passed upon by counsel for the underwriters, dealers or agents, if any, such counsel will be named in the prospectus supplement relating to such offering.

EXPERTS

The consolidated financial statements of HF Foods Group Inc. (the Company) as of December 31, 2023 and 2022 and for each of the three years in the period ended December 31, 2023 and management’s assessment of the effectiveness of internal control over financial reporting as of December 31, 2023 incorporated by reference in this Prospectus and in the Registration Statement have been so incorporated in reliance on the reports of BDO USA, P.C., an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting. The report on the effectiveness of internal control over financial reporting expresses an adverse opinion on the effectiveness of the Company’s internal control over financial reporting as of December 31, 2023.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus and any subsequent prospectus supplements do not contain all of the information in the Registration Statement. We have omitted from this prospectus some parts of the Registration Statement as permitted by the rules and regulations of the SEC. Statements in this prospectus concerning any document we have filed as an exhibit to the Registration Statement or that we otherwise filed with the SEC are not intended to be comprehensive and are qualified in their entirety by reference to these filings. In addition, we file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet site that contains reports, proxy and information statements and other information that we file electronically with the SEC. The SEC’s Internet site can be found at https://www.sec.gov. In addition, we make available on or through our Internet site copies of these reports as soon as reasonably practicable after we electronically file or furnished them to the SEC. Our Internet site can be found at https://www.hffoodsgroup.com. Our website is not a part of this prospectus.

INFORMATION INCORPORATED BY REFERENCE

We have elected to incorporate certain information by reference into this prospectus. By incorporating by reference, we can disclose important information to you by referring you to other documents we have filed or will file with the SEC. The information incorporated by reference is deemed to be part of this prospectus, except for information incorporated by reference that is superseded by information contained in this prospectus. This means that you must look at all of the SEC filings that we incorporate by reference to determine if any statements in the prospectus or any document previously incorporated by reference have been modified or superseded. This prospectus incorporates by reference the documents set forth below that we have previously filed with the SEC:

•Our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 26, 2024; •The information specifically incorporated by reference into our Annual Report on Form 10-K from our Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 24, 2024; •Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on May 10, 2024, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, filed with the SEC on August 9, 2024, and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, filed with the SEC on November 12, 2024; •Our Current Reports on Form 8-K filed with the SEC on December 19, 2024, November 26, 2024, November 22, 2024, October 28, 2024 (as amended by our Current Report on Form 8-K/A filed on November 14, 2024), July 5, 2024, June 28, 2024,June 10, 2024, June 10, 2024, June 5, 2024, June 4,

2024,June 3, 2024, May 6, 2024, April 25, 2024, April 12, 2024, and February 9, 2024 (other than any portions thereof deemed furnished and not filed in accordance with SEC rules); and •The description of our common stock set forth in the Registration Statement on Form 8-A12B filed on August 8, 2017, including any amendments or reports filed for the purposes of updating such description, including Exhibit 4.1 to our Annual Report on Form 10-K for the year ended December 31, 2023. All documents subsequently filed by the Registrant with the SEC pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after the date of the initial filing of the registration statement and prior to effectiveness of the registration statement that contains this prospectus and prior to the termination of the offering (except in each case the information contained in such document to the extent “furnished” and not “filed”), shall be deemed to be incorporated by reference herein and to be a part hereof from the date of filing of such documents.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein, or in any other subsequently filed document which also is incorporated or deemed to be incorporated by reference herein, modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

PROSPECTUS

HF FOODS GROUP INC.

Up to 5,200,000 Shares of Common Stock

For Resale Offered by the Selling Stockholders

PRELIMINARY PROSPECTUS

, 2024

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth the fees and expenses payable by us in connection with the issuance and distribution of the offered securities being registered hereby, other than underwriting discounts and commissions. All of the amounts shown are estimates except the Commission Registration Fee.

| | | | | |

| AMOUNT |

SEC registration fee | $ | 2,866 | |

Legal fees and expenses | * |

Accounting fees and expenses | * |

Transfer agent fees and expenses | * |

Miscellaneous expenses | * |

Total | * |

__________________

*Estimated expenses not presently known.

Item 15. Indemnification of Directors and Officers.

Section 145(a) of the DGCL provides, in general, that a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative (other than an action by or in the right of the corporation), because he or she is or was a director, officer, employee, or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee, or agent of another corporation, partnership, joint venture, trust, or other enterprise, against expenses (including attorneys’ fees), judgments, fines, and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit, or proceeding, if he or she acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful.

Section 145(b) of the DGCL provides, in general, that a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending, or completed action or suit by or in the right of the corporation to procure a judgment in its favor because the person is or was a director, officer, employee, or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee, or agent of another corporation, partnership, joint venture, trust, or other enterprise, against expenses (including attorneys’ fees) actually and reasonably incurred by the person in connection with the defense or settlement of such action or suit if he or she acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification shall be made with respect to any claim, issue, or matter as to which he or she shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or other adjudicating court determines that, despite the adjudication of liability but in view of all of the circumstances of the case, he or she is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or other adjudicating court shall deem proper.

Section 145(g) of the DGCL provides, in general, that a corporation may purchase and maintain insurance on behalf of any person who is or was a director, officer, employee, or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee, or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against such person and incurred by such person in any such capacity, or arising out of his or her status as such, whether or not the corporation would have the power to indemnify the person against such liability under Section 145 of the DGCL.

Our Bylaws provide that we will indemnify, to the fullest extent permitted by the DGCL, any person who was or is made or is threatened to be made a party or is otherwise involved in any action, suit, or proceeding, whether

civil, criminal, administrative, or investigative, by reason of the fact that he, or a person for whom he is the legal representative, is or was one of our directors or officers or, while serving as one of our directors or officers, is or was serving at our request as a director, officer, employee, or agent of another corporation or of another entity, against all liability and loss suffered and expenses (including attorneys’ fees) actually and reasonably incurred by such person, subject to limited exceptions relating to indemnity in connection with a proceeding (or part thereof) initiated by such person. Our Bylaws that will be in effect upon completion of this offering will further provide for the advancement of expenses to each of our officers and directors.

Our Charter provides that, to the fullest extent permitted by the DGCL, as the same exists or may be amended from time to time, our directors shall not be personally liable to us or our stockholders for monetary damages for breach of fiduciary duty as a director. Under Section 102(b)(7) of the DGCL, the personal liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty can be limited or eliminated except (i) for any breach of the director’s duty of loyalty to the corporation or its stockholders; (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; (iii) under Section 174 of the DGCL (relating to unlawful payment of dividend or unlawful stock purchase or redemption); or (iv) for any transaction from which the director derived an improper personal benefit.

We also maintain directors and officers insurance policies which cover certain liabilities arising out of claims based on acts or omissions of our directors or officers in their capacities as directors or officers, whether or not we would have the power to indemnify such person against such liability under the DGCL or the provisions of our Charter or Bylaws.

We have entered into indemnification agreements with each of our directors and our executive officers. These agreements will provide that we will indemnify each of our directors and such officers to the fullest extent permitted by law and by our Charter and Bylaws.

Item 16. Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 3.1 | | |

| 3.2 | | |

| 3.3 | | |

| 3.4 | | |

| 4.1 | | |

| 4.2 | | |

| 4.3 | | |

| 5.1 | | |

| 23.1 | | |

| 23.2 | | |

| 24.1 | | |

| 107 | | |

__________________

*To the extent applicable, to be filed by a post-effective amendment or as an exhibit to a document filed under the Exchange Act and incorporated by reference herein.

**To be filed pursuant to Section 305(b)(2) of the Trust Indenture Act of 1939, as amended.

Item 17. Undertakings.

a.The undersigned Registrant hereby undertakes:

1.To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

i.To include any prospectus required by Section 10(a)(3) of the Securities Act;

ii.To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement.

iii.To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the registration statement;

Provided however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the Registrant pursuant to section 13 or section 15(d) of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

2.That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

3.To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

4.That, for the purpose of determining liability under the Securities Act to any purchaser:

i.Each prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

ii.Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; provided, however, that no

statement made in a registration statement or prospectus that is part of the Registration Statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the Registration Statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

5.That, for the purpose of determining liability of the Registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

i.Any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

ii.Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

iii.The portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

iv.Any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.