Filed

Pursuant to Rule 424(b)(5)

Registration No. 333-259242

PROSPECTUS SUPPLEMENT

(To Prospectus dated September 14, 2021)

750,000

Shares of Common Stock

Warrants

to Purchase 750,000 Shares of Common Stock

We are offering 750,000 shares of our common stock,

par value $0.0001 per share (“Common Stock”) and warrants to purchase 750,000 shares of Common Stock at an exercise price

of $3.75 per share (“Warrants”), pursuant to this prospectus supplement and the accompanying prospectus. The Common Stock

can be purchased in this offering only with the accompanying Warrant. The aggregate public offering price for each share of Common Stock

and accompanying Warrant is $3.75.

Investing

in our securities involves a high degree of risk. Before making an investment decision, please read the information under the heading

“Risk Factors” beginning on page S-8 of this prospectus supplement, page 2 of the accompanying prospectus and in the

documents incorporated by reference herein.

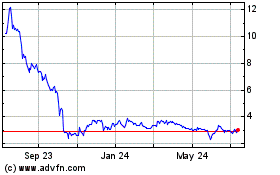

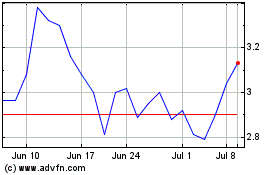

Our Common Stock is traded on The Nasdaq Capital

Market, or Nasdaq, under the symbol “HOFV” and our Series A Warrants are traded on Nasdaq under the symbol “HOFVW”.

On October 10, 2023, the closing price of our Common Stock was $4.50 and the closing price of our Series A Warrants was $0.022.

There

is no established public trading market for the Warrants being offered in this offering and we do not expect an active trading market

to develop. We do not intend to list the Warrants on any securities exchange or other trading market. Without an active trading market,

the liquidity of the Warrants will be limited.

As of October 11, 2023, the aggregate market value

of our outstanding Common Stock held by non-affiliates is approximately $32.4 million based on 5,685,197 shares of outstanding Common

Stock, of which 3,818,042 shares were held by non-affiliates, and a per share price of $8.47 per share, the closing price of our Common

Stock on August 14, 2023, which is the highest closing sale price of our Common Stock on Nasdaq within the prior 60 days. Pursuant to

General Instruction I.B.6 of Form S-3, in no event will we sell securities in a public primary offering with a value exceeding more than

one-third of our public float in any 12-month period so long as our public float remains below $75,000,000. During the previous 12 calendar

months prior to and including the date of this prospectus supplement, we have not offered and sold any of our securities pursuant to General

Instruction I.B.6 of Form S-3.

We

are an “emerging growth company” and a “smaller reporting company” as such terms are defined in the Securities

Act, and as such, are subject to certain reduced public company reporting requirements.

Neither

the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these

securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to

the contrary is a criminal offense.

| | |

Per share of

Common

Stock and

Warrant | | |

Total | |

| Public offering price | |

$ | 3.75 | | |

$ | 2,812,500 | |

| Underwriting discounts and commissions (1) | |

$ | 0.2625 | | |

$ | 196,875 | |

| Proceeds, before expenses, to us | |

$ | 3.4875 | | |

$ | 2,615,625 | |

| (1) | See

“Underwriting” beginning on page S-18 of this prospectus supplement for additional information regarding underwriting compensation. |

We have granted the underwriter an option for

a period of 45 days from the date of this prospectus supplement to purchase up to an additional 112,500 shares of our Common Stock and/or

up to an additional 112,500 Warrants. If the underwriter exercises the option in full, the total underwriting discounts and commissions

payable by us will be $226,406.25, and the total proceeds to us, before expenses will be $3,007,968.

Delivery of securities being offered pursuant

to this prospectus supplement and accompanying prospectus will be made on or about October 13, 2023, subject to the satisfaction of certain

closing conditions.

Sole

Book Runner

Maxim

Group LLC

The

date of this prospectus supplement is October 11, 2023.

Table

of Contents

Prospectus

Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

A registration statement

on Form S-3 (File No. 333-259242) utilizing a shelf registration process relating to the securities described in this prospectus

supplement was initially filed with the SEC on September 1, 2021, and declared effective on September 14, 2021. Under this

shelf registration statement, of which this offering is a part, we may, from time to time, sell up to an aggregate of $50.0 million

of our Common Stock, preferred stock, debt securities, warrants and units. Approximately $20 million remains available for sale as of

the date of this prospectus supplement (excluding the securities offered hereby).

This

document contains two parts. The first part is this prospectus supplement, which describes the terms of this offering of our Common Stock

and Warrants by us, and also adds, updates and changes information contained in the accompanying prospectus and the documents incorporated

herein and therein by reference. The second part is the accompanying prospectus, which gives more general information about us, some

of which may not apply to this offering. To the extent the information contained in this prospectus supplement differs or varies from

the information contained in the accompanying prospectus or any document filed prior to the date of this prospectus supplement and incorporated

herein by reference, the information in this prospectus supplement will supersede and govern. In addition, this prospectus supplement

and the accompanying prospectus do not contain all of the information provided in the registration statement that we filed with the SEC. For

further information about us, you should refer to that registration statement, which you can obtain from the SEC as described elsewhere

in this prospectus supplement under “Where You Can Find More Information” and “Incorporation by Reference.”

This

prospectus supplement does not contain all of the information that is important to you. You should read the accompanying prospectus as

well as the documents incorporated by reference in this prospectus supplement and the accompanying prospectus. See “Incorporation

by Reference” in this prospectus supplement and “Where You Can Find More Information; Incorporation by Reference ”

in the accompanying prospectus.

You

should rely only on the information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus.

We have not, and the underwriter has not, authorized anyone to provide you with information that is different. No dealer, salesperson

or other person is authorized to give any information or to represent anything not contained in this prospectus supplement and the accompanying

prospectus. This prospectus supplement is not an offer to sell or solicitation of an offer to buy these securities in any circumstances

under which the offer or solicitation is unlawful. We are offering to sell, and seeking offers to buy, our Common Stock and Warrants

offered hereby only in jurisdictions where offers and sales are permitted. You should not assume that the information we have included

in this prospectus supplement or the accompanying prospectus is accurate as of any date other than the date of this prospectus supplement

or the accompanying prospectus, respectively, or that any information we have incorporated by reference is accurate as of any date other

than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement or of any of

our securities. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus

supplement incorporates by reference market data and industry statistics and forecasts that are based on independent industry publications

and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness

of this information and we have not independently verified this information. In addition, the market and industry data and forecasts

that may be included or incorporated by reference in this prospectus supplement may involve estimates, assumptions and other risks and

uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors”

contained in this prospectus supplement and the accompanying prospectus and under similar headings in other documents that are incorporated

by reference into this prospectus. Accordingly, investors should not place undue reliance on this information.

When

we refer to “we,” “our,” “us” and the “Company” in this prospectus, we mean Hall of Fame

Resort & Entertainment Company and its consolidated subsidiaries, unless otherwise specified.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement contains certain “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Such forward-looking statements relate to, among other things, (i) our ability to recognize the anticipated benefits

of the business combination; (ii) our ability to maintain the listing of our shares on Nasdaq; (iii) our ability to manage growth; (iv)

our ability to execute our business plan and meet our projections, including refinancing our existing term loan and obtaining financing

to construct planned facilities; (v) potential litigation involving the Company; (vi) changes in applicable laws or regulations; (vii)

general economic and market conditions impacting demand for our products and services, and in particular economic and market conditions

in the resort and entertainment industry; and (viii) the potential adverse effects of the ongoing global coronavirus (COVID-19) pandemic

on capital markets, general economic conditions, unemployment and our liquidity, operations and personnel. Forward-looking statements

are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,”

“potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,”

“estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,”

“forecast,” “predict,” “continue” or other similar words or expressions. Forward-looking statements

are based on certain assumptions, discuss future expectations, describe future plans and strategies, contain projections of results of

operations or of financial condition or state other forward-looking information. Our ability to predict results or the actual outcome

of future plans or strategies is inherently uncertain. Although we believe that the expectations reflected in such forward-looking statements

are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking

statements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future

periods to differ materially from forecasted results. Factors which could have a material adverse effect on our operations and future

prospects include, but are not limited to:

| ● | We

are an early-stage company with a minimal track record and limited historical financial information available. |

| ● | We

are relying on various forms of public financing and public debt to finance the Company. |

| ● | The

success of our business is dependent upon the continued success of the National Football Museum, Inc., doing business as the Pro Football

Hall of Fame (“PFHOF”), brand museum experience and our ability to continue to secure favorable contracts with and maintain

a good working relationship with PFHOF and its management team. |

| ● | Incidents

or adverse publicity concerning the Company, PFHOF, or the National Football League (“NFL”) could harm our reputation as

well as negatively impact our revenues and profitability. |

| ● | We

rely partially on sponsorship contracts to generate revenues. |

| ● | We

could be adversely affected by declines in discretionary consumer spending, consumer confidence and general and regional economic conditions. |

| ● | Our

business may be adversely affected by tenant defaults or bankruptcy. |

| ● | Our

planned sports betting, fantasy sports and eSports operations and the growth prospects and marketability of such operations are subject

to a variety of U.S. and foreign laws, and which could subject us to claims or otherwise harm our business. |

| ● | Changes

in consumer tastes and preferences for sports and entertainment products, including fantasy sports, sports betting, Esports and NFTs,

or declines in discretionary consumer spending, consumer confidence and general and regional economic conditions could reduce demand

for our offerings and products and adversely affect the profitability of our business. |

| ● | We

are dependent on our management team, and the loss of one or more key employees could harm our business and prevent us from implementing

our business plan in a timely manner. |

| ● | The

high fixed cost structure of our operations may result in significantly lower margins if revenues decline. |

| ● | The

COVID-19 pandemic could continue to have a material adverse effect on our business. |

| ● | Cyber

security risks and the failure to maintain the integrity of internal or guest data could result in damages to our reputation, the disruption

of operations and/or subject us to costs, fines or lawsuits. |

| ● | The

suspension or termination of, or the failure to obtain, any business or other licenses may have a negative impact on our business. |

| ● | Our

business plan requires additional liquidity and capital resources that might not be available on terms that are favorable to us, or at

all. |

| ● | We

have substantial indebtedness. If we do not receive sufficient capital to substantially repay our indebtedness, our indebtedness may

have a material adverse effect on our business, our financial condition and results of operations. |

| ● | We

will have to increase leverage to develop the Company, which could further exacerbate the risks associated with our substantial indebtedness,

and we may not be able to generate sufficient cash flow from operations to service all of our indebtedness and may be forced to take

other actions to satisfy our obligations under our indebtedness, which may not be successful. |

| ● | We

currently do not intend to pay dividends on our Common Stock. Consequently, your ability to achieve a return on your investment will

depend on appreciation in the price of our Common Stock. |

| ● | Our

Series A Warrants and Series B Warrants are accounted for as liabilities and the changes in value of such warrants could have a material

effect on our financial statements. |

| ● | Our

Certificate of Incorporation allows for our board of directors to create new series of preferred stock without further approval by our

stockholders, which could adversely affect the rights of the holders of our Common Stock. |

| ● | We

currently have outstanding, and we may in the future issue, instruments which are exercisable for or convertible into shares of Common

Stock, which will result in dilution of our Common Stock. |

| ● | Antidilution

provisions in certain of our convertible debt instruments may result in a reduction of the conversion price, which would result in additional

dilution of our Common Stock. |

| ● | The

trading price of our securities has been, and likely will continue to be, volatile and you could lose all or part of your investment. |

| ● | We

may be required to take write-downs or write-offs, restructuring and impairment or other charges that could have a significant negative

effect on our financial condition, results of operations and our stock price, which could cause you to lose some or all of your investment. |

Although

we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels

of activity, performance or achievements. The factors noted above could cause our actual results to differ significantly from those contained

in any forward-looking statement.

We

encourage you to read this prospectus supplement, as well as the information that is incorporated by reference in this prospectus supplement,

in its entirety. In evaluating forward-looking statements, you should consider the risks and uncertainties contained in our reports filed

with the Commission. Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our

management’s views only as of the date of this prospectus supplement. We are under no duty to update any of the forward-looking

statements after the date of this prospectus supplement to conform these statements to actual results.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following summary highlights information contained elsewhere or incorporated by reference into this prospectus supplement and the accompanying

prospectus. It is not complete and does not contain all of the information that you should consider before making an investment decision.

You should read this entire prospectus supplement and the accompanying prospectus, including the “Risk Factors” section on

page S-8 of this prospectus supplement and page 2 of the accompanying prospectus and the disclosures to which those sections refer

you, the financial statements and related notes and the other more detailed information appearing elsewhere or incorporated by reference

into this prospectus supplement before making an investment decision.

The

Company

Overview

We

are a resort and entertainment company leveraging the power and popularity of professional football and its legendary players in partnership

with the National Football Museum, Inc., doing business as the Pro Football Hall of Fame (“PFHOF”). Headquartered in Canton,

Ohio, we own the Hall of Fame Village, a multi-use sports and entertainment destination centered around the PFHOF’s campus. We

expect to create a diversified set of revenue streams through developing themed attractions, premier entertainment programming and sponsorships.

We are pursuing a differentiation strategy across three pillars, including destination-based assets, the Media Company, and gaming.

The

strategic plan has been developed in three phases of growth: Phase I, Phase II, and Phase III. Phase I of the Hall of Fame Village is

operational, consisting of the Tom Benson Hall of Fame Stadium, the ForeverLawn Sports Complex, and HOF Village Media Group, LLC (“Hall

of Fame Village Media” or the “Media Company”). The Tom Benson Hall of Fame Stadium hosts multiple sports and entertainment

events, including the NFL Hall of Fame Game, Enshrinement and Concert for Legends during the annual Pro Football Hall of Fame Enshrinement

Week. The ForeverLawn Sports Complex hosts camps and tournaments for football players, as well as athletes from across the country in

other sports such as lacrosse, rugby and soccer. Hall of Fame Village Media leverages the sport of professional football to produce exclusive

programming. For example, licensing the extensive content controlled by the PFHOF as well as new programming assets developed from live

events such as youth tournaments, camps and sporting events held at the ForeverLawn Sports Complex and the Tom Benson Hall of Fame Stadium.

We

are developing new hospitality, attraction and corporate assets as part of our Phase II development plan. Phase II plans for future components

of the Hall of Fame Village include two hotels (one on campus and one in downtown Canton that opened in November 2020), the Hall of Fame

Indoor Waterpark, the Constellation Center for Excellence (an office building including retail and meeting space, that opened in October

2021), the Center for Performance (a convention center/field house, that opened in October of 2022), the Play-Action Plaza (completed

in December of 2022), and the Fan Engagement Zone (Retail Promenade), core and shell for Retail I was completed in September of 2022

and the core and shell of Retail II was completed in November of 2022) with tenants beginning to open in late 2022. Phase III expansion

plans may include a potential mix of residential space, additional attractions, entertainment, dining, merchandise and more.

Background

The

Hall of Fame Resort & Entertainment Company (formerly known as GPAQ Acquisition Holdings, Inc.) was incorporated in Delaware on August

29, 2019, as a subsidiary of Gordon Pointe Acquisition Corp. (“GPAQ”), a special purpose acquisition company formed for the

purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase or other similar business combination with one

or more businesses or assets.

On

July 1, 2020, we consummated the previously announced business combination with HOF Village, LLC, a Delaware limited liability company

(“HOF Village”), pursuant to an Agreement and Plan of Merger dated September 16, 2019 (as amended on November 6, 2019, March

10, 2020 and May 22, 2020, the “Merger Agreement”), by and among the Company, GPAQ Acquiror Merger Sub, Inc., a Delaware

corporation (“Acquiror Merger Sub”), GPAQ Company Merger Sub, LLC, a Delaware limited liability company (“Company Merger

Sub”), HOF Village and HOF Village Newco, LLC, a Delaware limited liability company (“HOFV Newco”). The transactions

contemplated by the Merger Agreement are referred to in this Annual Report on Form 10-K as the “Business Combination.”

On

September 29, 2022, our stockholders approved an amendment to our Certificate of Incorporation to effect a reverse stock split of our

shares of Common Stock, and our Board subsequently approved a final reverse stock split ratio of 1-for-22 (the “Reverse Stock Split”).

The Reverse Stock Split became effective at 12:01am Eastern Time on December 27, 2022 (the “Effective Time”). At the Effective

Time, every 22 shares of issued and outstanding Common Stock were combined and converted into one issued and outstanding share of Common

Stock. Fractional shares were cancelled and stockholders received cash in lieu thereof. All outstanding restricted stock unit awards,

warrants and other securities settled in, exercisable for or convertible into shares of Common Stock were adjusted as a result of the

reverse split, as required by their respective terms. A proportionate adjustment was also made to the maximum number of shares of Common

Stock issuable under the Hall of Fame Resort & Entertainment Company Amended 2020 Omnibus Incentive Plan (the “2020 Omnibus

Incentive Plan”). The number of authorized shares of Common Stock and the par value per share of Common Stock remains unchanged

at $0.0001 per share.

The

Reverse Stock Split primarily was intended to bring the Company into compliance with the minimum bid price requirement for maintaining

its listing on the Nasdaq. The Reverse Stock Split affected all stockholders uniformly and did not alter any stockholder’s percentage

interest in the Company’s equity (other than as a result of the payment of cash in lieu of fractional shares).

Our

principal executive offices are located at 2014 Champions Gateway, Canton, OH 44708, and our telephone number is (330) 754-3427.

Our corporate website address is www.hofreco.com. We do not incorporate the information contained on, or accessible through, our

website into this prospectus, and you should not consider it part of this prospectus.

Emerging

Growth Company and Smaller Reporting Company

We

are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart

Our Business Startups Act of 2012 (the “JOBS Act”), and we may take advantage of certain exemptions from various

reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited

to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure

obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding

a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

Further,

Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial

accounting standards until private companies (that is, those that have not had a registration statement under the Securities Act declared

effective or do not have a class of securities registered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”))

are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt

out of the extended transition period and comply with the requirements that apply to non-emerging growth companies, but any such an election

to opt out is irrevocable. We have elected not to opt out of such extended transition period, which means that when a standard is issued

or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new

or revised standard at the time private companies adopt the new or revised standard. This may make comparison of our financial statements

with another public company, which is neither an emerging growth company nor an emerging growth company that has opted out of using the

extended transition period, difficult or impossible because of the potential differences in accounting standards used.

We

will remain an emerging growth company until the earlier of: (1) the last day of the fiscal year (a) following the fifth

anniversary of the closing of the Company’s initial public offering on January 30, 2018, (b) in which we have total annual

revenue of at least $1.07 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value

of our common equity that is held by non-affiliates exceeds $700 million as of the end of the prior fiscal year’s second fiscal

quarter; and (2) the date on which we have issued more than $1.00 billion in non-convertible debt securities during the prior

three-year period. References herein to “emerging growth company” have the meaning associated with it in the JOBS Act.

Additionally,

we are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting

companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years

of audited financial statements. We will remain a smaller reporting company until the last day of any fiscal year for so long as

either (1) the market value of our shares of Common Stock held by non-affiliates did not equal or exceed $250 million as of

the prior June 30, or (2) our annual revenues did not equal or exceed $100 million during such completed fiscal year and

the market value of our shares of Common Stock held by non-affiliates did not equal or exceed $700 million as of the prior June 30.

Recent

Developments

Suspension

of Sales Under At The Market Program

On

October 10, 2023, the Company reduced the amount of shares of its Common Stock that could be issued and sold pursuant to its

“at-the-market” program (“ATM”) with Wedbush Securities Inc. and Maxim Group LLC, as agents (the

“Agents”), to an amount equal to $39,016,766. The reduction in the amount of shares that can be issued and sold under

the ATM was effected pursuant to the Amendment No. 1 to Equity Distribution Agreement, which amended the Company’s Equity

Distribution Agreement with the Agents, dated September 30, 2021 (the “Equity Distribution Agreement”), to reduce the

aggregate offering price under the Equity Distribution Agreement from $50.0 million to $39,016,766.

The underwriting agreement that we entered into

with Maxim Group LLC in this offering requires that we not issue any shares of our Common Stock from the date of this prospectus supplement

for 90 days thereafter, subject to certain exceptions, and as a result, we have suspended sales pursuant to our ATM under our Equity Distribution

Agreement during such period.

Limited

Waiver of Anti-Dilution Adjustment Rights

On

October 6, 2023, the Company entered into a Limited Waiver Agreement with CH Capital Lending, LLC (“CHCL”), IRG, LLC (“IRG”)

and Midwest Lender Fund, LLC (“MLF” and together with CHCL and IRG, the “IRG Investors”), which are affiliates

of our director Stuart Lichter, pursuant to which the IRG Investors waive any anti-dilution adjustment right with respect to (i) the

exercise price of our Series C Warrants, Series D Warrants, Series E Warrants and Series G Warrants, (ii) the conversion price of Series

C Preferred Stock held by CHCL, and (iii) the conversion price of approximately $28.7 million in our indebtedness held by the IRG Investors,

in each case solely with respect to offerings under a September 2023 engagement letter with Maxim Group LLC (the “Engagement Agreement”).

Also on October 6, 2023, the Company entered into a Limited Waiver Agreement with JKP Financial, LLC (“JKP”), pursuant to

which JKP waives any anti-dilution adjustment right with respect to (i) the exercise price of our Series F Warrants and (ii) the conversion

price of approximately $13.9 million in our indebtedness held by JKP, in each case solely with respect to offerings under the Engagement

Agreement.

Assignment,

Joinder and Amendment of $10,000,000 Loan Agreement

As

previously disclosed, HOF Village Retail I, LLC and HOF Village Retail II, LLC (collectively, “Retail”), which are wholly-owned

subsidiaries of the Company, and The Huntington National Bank (“HNB”) entered into the Loan Agreement dated September 27,

2022 (the “Loan Agreement”), pursuant to which HNB agreed to loan up to Ten Million Dollars ($10,000,000) to Retail for the

purpose of financing improvements to two leasehold parcels of real property in Hall of Fame Village.

On

September 21, 2023, CH Capital Lending, LLC (“Lender”), an affiliate of our director Stuart Lichter, succeeded to the rights

and obligations of HNB under the Loan Agreement pursuant to the Assignment of Note, Security Instrument and Other Loan Documents. Also,

on September 21, 2023, the Company, Retail and Lender entered into the Joinder and First Amendment to Loan Agreement (“First Joinder

and Amendment”), pursuant to which (i) the Company becomes a borrower under the Loan Agreement (the Company together with Retail,

“Borrower”); (ii) the Loan Agreement is amended to provide that Borrower will have the right to use up to Two Million Dollars($2,000,000)

of the loan proceeds for the purpose of paying the costs of construction of the Hall of Fame Village Waterpark which will be owned by

the Company or its affiliates or subsidiaries (the “Permitted Purpose”); provided, that in the event Borrower desires to

use more than Two Million Dollars ($2,000,000) for the Permitted Purpose, Borrower must obtain the written consent of Lender; and (iii)

the Loan Agreement is amended to provide that so long as loan proceeds are used solely for the Permitted Purpose, Lender waives conditions

to loan funding up to the amount of $2,000,000, with any future waiver of conditions to additional loan funding subject to the written

consent of Lender.

Dispute with Johnson Controls, Inc.

On July 2, 2020, the Company entered into an Amended and Restated Sponsorship

and Naming Rights Agreement (the “Naming Rights Agreement”) among HOFV Newco, the National Football Museum, Inc., doing business

as the Pro Football Hall of Fame (“PFHOF”), and Johnson Controls, Inc. (“JCI” or “Johnson Controls”),

that amended and restated the Sponsorship and Naming Rights Agreement, dated as of November 17, 2016 (the “Original Sponsorship

Agreement”). Among other things, the Amended Sponsorship Agreement: (i) reduced the total amount of fees payable to Newco during

the term of the Amended Sponsorship Agreement from $135 million to $99 million; (ii) restricted the activation proceeds from rolling over

from year to year with a maximum amount of activation proceeds in one agreement year to be $750,000; and (iii) renamed the “Johnson

Controls Hall of Fame Village” to “Hall of Fame Village”. This is a prospective change, which the Company reflected

beginning in the third quarter of 2020.

JCI has a right to terminate the Naming Rights Agreement

if the Company does not provide evidence to JCI by October 31, 2021 that it has secured sufficient debt and equity financing to complete

Phase II, or if Phase II is not open for business by January 2, 2024, in each case subject to day-for-day extension due to force majeure

and a notice and cure period. In addition, under the Naming Rights Agreement JCI’s obligation to make sponsorship payments to the

Company may be suspended commencing on December 31, 2020, if the Company has not provided evidence reasonably satisfactory to JCI on or

before December 31, 2020, subject to day-for-day extension due to force majeure, that the Company has secured sufficient debt and equity

financing to complete Phase II.

Additionally, on October 9, 2020, Newco, entered

into a Technology as a Service Agreement (the “TAAS Agreement”) with JCI. Pursuant to the TAAS Agreement, JCI will provide

certain services related to the construction and development of the Hall of Fame Village (the “Project”), including, but not

limited to, (i) design assist consulting, equipment sales and turn-key installation services in respect of specified systems to be constructed

as part of Phase 2 and Phase 3 of the Project and (ii) maintenance and lifecycle services in respect of certain systems constructed as

part of Phase 1, and to be constructed as part of Phase 2 and Phase 3, of the Project. Under the terms of the TAAS Agreement, Newco has

agreed to pay JCI up to an aggregate of approximately $217 million for services rendered by JCI over the term of the TAAS Agreement.

The TAAS Agreement provides that in respect of the

Naming Rights Agreement, Johnson Controls and Newco intend, acknowledge and understand that: (i) Newco’s performance under the TAAS

Agreement is essential to, and a condition to Johnson Controls’ performance under, the Naming Rights Agreement; and (ii) Johnson

Controls’ performance under the Naming Rights Agreement is essential to, and a condition to Newco’s performance under, the

TAAS Agreement. In the TAAS Agreement, Johnson Controls and Newco represent, warrant and agree that the transactions agreements and obligations

contemplated under the TAAS Agreement and the Naming Rights Agreement are intended to be, and shall be, interrelated, integrated and indivisible,

together being essential to consummating a single underlying transaction necessary for the Project.

On May 10, 2022, the Company received from JCI a

notice of termination (the “TAAS Notice”) of the TAAS Agreement effective immediately. The TAAS Notice states that termination

of the TAAS Agreement by JCI is due to Newco’s alleged breach of its payment obligations. Additionally, JCI in the TAAS Notice demands

the amount which is the sum of: (i) all past due payments and any other amounts owed by Newco under the TAAS Agreement; (ii) all commercially

reasonable and documented subcontractor breakage and demobilization costs; and (iii) all commercially reasonable and documented direct

losses incurred by JCI directly resulting from the alleged default by the Company and the exercise of JCI’s rights and remedies

in respect thereof, including reasonable attorney fees.

Also on May 10, 2022, the Company received from

JCI a notice of termination (“Naming Rights Notice”) of the Name Rights Agreement, effective immediately. The Naming Rights

Notice states that the termination of the Naming Rights Agreement by JCI is due to JCI’s concurrent termination of the TAAS Agreement.

The Naming Rights Notice further states that the Company must pay JCI, within 30 days following the date of the Naming Rights Notice,

$4,750,000. The Company has not made such payment to date. The Naming Rights Notice states that Newco is also in breach of its covenants

and agreements, which require Newco to provide evidence reasonably satisfactory to JCI on or before October 31, 2021, subject to day-for-day

extension due to force majeure, that Newco has secured sufficient debt and equity financing to complete Phase II.

The Company disputes that it is in default under

either the TAAS Agreement or the Naming Rights Agreement. The Company believes JCI is in breach of the Naming Rights Agreement and the

TAAS Agreement due to their failure to make certain payments in accordance with the Naming Rights Agreement, and, on May 16, 2022, provided

notice to JCI of these breaches.

The Company is pursuing dispute resolution pursuant

to the terms of the Naming Rights Agreement to simultaneously defend against JCI’s allegations and pursue its own claims. The Company

anticipates that resolution of the dispute regarding the Naming Rights Agreement will include the TAAS Agreement. The parties participated

in mediation in November 2022, but were unable to reach a resolution. On January 24, 2023, Newco filed a demand for arbitration, asserting

claims against JCI for breach of contract, breach of the implied duty of good faith and fair dealing, and unjust enrichment. On February

16, 2023, JCI filed its response, generally denying Newco’s allegations and asserting counterclaims for breach of contract, breach

of the implied covenant of good faith and fair dealing, and unjust enrichment. On March 9, 2023, Newco filed its response to JCI’s

counterclaims, generally denying JCI’s allegations. A panel of three arbitrators has been constituted to hear and determine the

dispute.

On October 4, 2023, the Company and JCI commenced

an arbitration hearing in Ohio to determine the outcome of the dispute. The ultimate outcome of this dispute cannot presently be determined.

However, in management’s opinion, the likelihood of a material adverse outcome is remote. Accordingly, adjustments, if any, that

might result from the resolution of this matter have not been reflected in the Company’s condensed consolidated financial statements

that are incorporated by reference in this Prospectus Supplement. During the year ended December 31, 2022, the Company suspended its revenue

recognition until the dispute is resolved and has recorded an allowance against the amounts due as of June 30, 2023 and December 31, 2022

in the amount of $7,187,500 and $4,812,500, respectively. The balances due under the Naming Rights Agreement as of June 30, 2023 and December

31, 2022 amounted to $8,697,917 and $6,635,417 respectively.

Modification

Agreements

On October 6, 2023, the Company and certain of its subsidiaries

entered into a modification agreement with the IRG Investors that defers interest payments until from July 1, 2023 until March 31, 2024

(“Deferral Period”) owed under approximately $30.7 million in loan arrangements with such IRG Investors. Also on October

6, 2023, the Company and certain of its subsidiaries entered into a modification agreement with JKP that defers interest payments during

the Deferral Period owed under approximately $13.9 in loan arrangements with JKP.

THE

OFFERING

| Securities offered by us pursuant to this prospectus supplement |

|

We are offering 750,000 shares of our Common Stock and warrants to purchase 750,000 shares of our Common Stock. The Warrants have an initial exercise price of $3.75 per share and are exercisable from October 13, 2023 (upon issuance) until October 13, 2028 (five years from the date they first became exercisable). The Warrants will be issued in registered form under a warrant agency agreement between Continental Stock Transfer & Trust Company, as warrant agent, and us. This prospectus supplement and the accompanying prospectus also includes the offering of the shares of Common Stock issuable upon exercise of the Warrants. |

| |

|

|

| Over-allotment option |

|

We have granted the underwriter an option for a period of 45 days from the date of this prospectus supplement to purchase up to an additional 112,500 shares of our Common Stock and/or up to an additional 112,500 Warrants. |

| |

|

|

| Offering Price |

|

$3.75 per share of Common Stock and accompanying Warrant. |

| |

|

|

| Common Stock outstanding prior to this offering(1) |

|

5,685,197 shares of Common Stock. |

| |

|

|

| Common Stock to be outstanding after this offering (1) |

|

6,435,197 shares of Common Stock. |

| |

|

|

| Use of Proceeds |

|

We intend to use the net proceeds from this offering for general corporate purposes, including the potential repayment of indebtedness. See “Use of Proceeds.” |

| |

|

|

| Voting Rights |

|

Each holder of our Common Stock is entitled to one vote per share on all matters submitted to a vote of the stockholders. See “Description of Capital Stock.” |

| |

|

|

| Lock-Ups |

|

The Company and each of its officers, directors and holders of 10% or more of our Common Stock as of the date of this prospectus supplement will enter into lock-up agreements pursuant to which such persons and entities shall agree, for a period of ninety (90) days from the date of this prospectus supplement that they shall neither offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any securities of the Company without the underwriter’s prior written consent, including the issuance of shares of Common Stock upon the exercise of currently outstanding options, subject to certain exceptions. |

| |

|

|

| Risk Factors |

|

This investment involves a high degree of risk. See “Risk Factors” beginning on page S-8 of this prospectus supplement, page 2 of the accompanying prospectus and under similar headings in the other documents that are incorporated by reference herein for a discussion of the risks you should carefully consider before deciding to invest in our Common Stock. |

| Ticker

Symbols |

|

Our

Common Stock is traded on The Nasdaq Capital Market, or Nasdaq, under the symbol “HOFV” and our Series A Warrants

are traded on Nasdaq under the symbol “HOFVW”. We do not intend to list the Warrants offered in this offering on any

stock exchange. |

| |

|

|

| Transfer

Agent and Warrant Agent |

|

The

registrar and transfer agent in respect of our Common Stock is Continental Stock Transfer & Trust Company (the “Transfer

Agent”). Continental Stock Transfer & Trust Company will also act as Warrant Agent pursuant to a warrant agency agreement

between it and us. |

| (1) |

The number of shares of our Common Stock outstanding before and after the completion of this offering is based on 5,685,197 shares of our Common Stock outstanding as of October 6, 2023, and excludes the following: |

| ● | 1,123,657

shares of Common Stock issuable upon the exercise of warrants that we issued upon completion of the Business Combination (“Series A

Warrants”), with an exercise price of $253.11 per share; |

| ● | 170,862

shares of Common Stock issuable upon the exercise of warrants that we issued on November 18, 2020 (the “Series B Warrants”)

that are outstanding as of September 22, 2023, with an exercise price of $30.81 per share; |

| ● | 455,867

shares of Common Stock issuable upon the exercise of warrants that we issued on December 29, 2020, as amended and restated on March 1,

2022, (the “Amended and Restated Series C Warrants”), with an exercise price of $12.77 per share; |

| ● | 111,321

shares of Common Stock issuable upon the exercise of warrants that we issued on June 4, 2021, as amended and restated on March 1, 2022,

(the “Series D No. W-1 Warrants”), with an exercise price of $12.77 per share; |

| ● | 1,484

shares of Common Stock issuable upon the exercise of warrants that we issued on June 4, 2021 (the “Series D No. W-2 Warrants”),

with an exercise price of $151.86 per share; |

| ● | 68,128

shares of Common Stock issuable upon the exercise of warrants that we issued on March 1, 2022, as amended and restated on November 7,

2022, (the “Series E Warrants”), with an exercise price of $12.77 per share; |

| ● | 68,128

shares of Common Stock issuable upon the exercise of warrants that we issued on March 1, 2022, as amended and restated on November 7,

2022, (the “Series F Warrants”), with an exercise price of $12.77 per share; |

| ● | 5,677

shares of Common Stock issuable upon the exercise of warrants that we issued on June 8, 2022 (the “Series G Warrants”), with

an exercise price of $12.77 per share; |

| ● | 2,969

shares of Common Stock issuable upon conversion of our 7.00% Series B Convertible Preferred Stock, par value $0.0001 per share, with

a conversion price of $67.35 per share (“Series B Preferred Stock”)(a); |

| ● | 454,407

shares of Common Stock issuable upon conversion of our 7.00% Series C Convertible Preferred Stock, par value $0.0001 per share, with

a conversion price of $33.01 per share (“Series C Preferred Stock”)(a); |

| ● | 259,691

shares of Common Stock reserved for issuance of awards under our 2020 Omnibus Incentive Plan; |

| ● | 46,197

shares of Common Stock reserved for issuance of awards under the Hall of Fame Resort & Entertainment Company 2023 Inducement Plan

(the “2023 Inducement Plan”); |

| ● | 162,490

shares of Common Stock issuable upon vesting of outstanding restricted stock unit awards, including awards granted under the 2020 Omnibus

Incentive Plan and inducement awards granted under the 2023 Inducement Plan; |

| ● | Up

to (A) approximately 220,430 shares of our Common Stock that are issuable upon either (i) conversion of the Company’s 8.00% Convertible

Notes due 2025 (the “PIPE Notes”) that were initially issued in connection with a private placement, or (ii) exercise of

warrants to purchase our Common Stock that are issuable upon redemption of PIPE Notes (the “Note Redemption Warrants”), or

(iii) some combination thereof; The number of shares of Common Stock issuable in respect of the PIPE Notes is calculated based on the

maximum aggregate principal amount of PIPE Notes, assuming all future interest payments will be paid as PIK Interest (as defined below);(b) |

| ● | 839,823

shares of Common Stock issuable upon conversion at a conversion price of $12.77 per share of Common Stock of the $10,724,551 Joinder

and First Amended and Restated Promissory Note, effective as of November 7, 2022, issued by the Company, HOFV Newco, and HOF Village

Youth Fields, LLC (“HOFV Youth Fields”) to CH Capital Lending, LLC(a); |

| ● | 708,547

shares of Common Stock issuable upon conversion at a conversion price of $12.77 per share of Common Stock of the $9,048,146 Term Loan

Agreement dated December 1, 2020, as assigned and amended, among the Company, HOFV Newco, HOFV Youth Fields and HOFV Stadium, as borrowers,

and CH Capital Lending, LLC, as lender(a); |

| ● | 344,612

shares of Common Stock issuable upon conversion at a conversion price of $12.77 per share of Common Stock of the $4,400,702 Joinder and

Second Amended and Restated Secured COGNOVIT Promissory Note, effective as of November 7, 2022, issued by the Company, HOFV Newco and

HOFV Youth Fields to IRG(a); |

| ● | 322,554

shares of Common Stock issuable upon conversion at a conversion price of $12.77 per share of Common Stock of the $4,119,019 Backup Promissory

Note, effective as of November 7, 2022, issued by the Company, HOFV Newco and HOFV Youth Fields to Midwest Lender Fund, LLC(a); |

| ● | 733,585

shares of Common Stock issuable upon conversion at a conversion price of $12.77 per share of Common Stock of the $9,367,890 Backup Joinder

Second Amended and Restated Secured Cognovit Promissory Note, effective as of November 7, 2022, issued by the Company, HOFV Newco and

HOFV Youth Fields to JKP Financial, LLC, as holder(a); |

| ● | 344,612

shares of Common Stock issuable upon conversion at a conversion price of $12.77 per share of Common Stock of the $4,400,702 Joinder and

First Amended and Restated Secured Cognovit Promissory Note, effective as of November 7, 2022, by and among the Company, HOFV Newco,

HOFV Youth Fields, as makers, and JKP Financial, LLC, as holder(a); |

| ● | $25,645,093

aggregate price in shares of our Common Stock that we may offer and sell, from time to time through Wedbush Securities Inc. and Maxim

Group LLC, as agents (the “Agents”), under our Equity Distribution Agreement, by any method permitted by law deemed to be

an “at the market offering” as defined in Rule 415 of the Securities Act, including sales made by means of ordinary brokers’

transactions, including on The Nasdaq Capital Market, at market prices or as otherwise agreed with the Agents(c); and |

| |

● |

750,000 shares of Common Stock issuable upon the exercise of the Warrants offered hereby. |

Unless we specifically state otherwise, all information in this

prospectus supplement assumes no exercise by the underwriters of their option to purchase up to an additional 112,500 shares of our Common

Stock and/or up to an additional 112,500 Warrants.

| (a) | The

conversion price of the instrument is subject to a weighted-average anti-dilution adjustment,

which has been waived by the holder of the instrument for this offering. |

| (b) | The

original aggregate principal amount of PIPE Notes is $20,721,293. Interest on PIPE Notes

is payable quarterly in either cash or an increase in the principal amount of PIPE Notes

(“PIK Interest”). If the Company pays interest as PIK Interest, the interest

rate for such payment is 10%, rather than 8%. The Company has been paying interest on the

PIPE Notes as PIK Interest to conserve cash. The current aggregate principal amount of the

PIPE Notes is $27,868,206. The maximum aggregate principal amount of PIPE Notes, assuming

all future interest payments will be paid as PIK Interest, is $33,475,146. |

| (c) |

The underwriting agreement that we entered into with Maxim Group LLC in this offering requires that we not issue any shares of our Common Stock from the date of this prospectus supplement for 90 days thereafter, subject to certain exceptions, and as a result, we have suspended sales pursuant to our ATM under our Equity Distribution Agreement during such period. |

RISK FACTORS

Investing in our securities involves risks. Before

making an investment decision with respect to our securities, you should carefully consider the following risks, the risks described in

our most recent Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q for the quarters ended June 30, 2023 and March 31,

2023 and in our other periodic reports filed with the SEC and incorporated by reference herein, as well as other information and data

set forth in this prospectus supplement, the accompanying prospectus, and the documents incorporated by reference herein and therein,

and in any free writing prospectus that we have authorized for use in connection with this offering. The occurrence of any of such risks

could materially and adversely affect our business, prospects, financial condition and results of operations, which could cause you to

lose all or a part of your investment in our securities. Some statements in this prospectus supplement, including statements in the following

risk factors, constitute forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.”

Risks Relating to this Offering

The number of shares of Common Stock available for future issuance

or sale could adversely affect the per share trading price of our Common Stock.

We cannot predict whether future issuances or sales

of our Common Stock or the availability of shares for resale in the open market will decrease the per share trading price of our Common

Stock. The issuance of substantial numbers of our Common Stock in the public market or the perception that such issuances might occur

could adversely affect the per share trading price of our Common Stock.

You may experience significant dilution as a result of this offering,

which may adversely affect the trading price of our Common Stock.

The issuance and sale of our Common Stock and Warrants

through the underwriter pursuant to this offering may have a dilutive effect on our earnings per share after giving effect to the issuance

of the shares and the receipt of the net proceeds. The actual amount of dilution from this offering, or from any future offering of our

Common Stock, will be based on numerous factors, particularly the use of proceeds and the return generated by that use, and cannot be

determined at this time. Additionally, we are not restricted from issuing additional Common Stock, including securities that are convertible

into or exchangeable for, or that represent the right to receive, Common Stock or any substantially similar securities in the future.

The trading price of our Common Stock could decline as a result of sales of shares of our Common Stock in the market pursuant to this

offering, or otherwise, or as a result of the perception or expectation that such sales could occur. See “Dilution” below

for a more detailed illustration of the dilution you may incur if you participate in this offering.

We have broad discretion to determine how to use the funds raised

in this offering, and may use them in ways that may not enhance our operating results or the price of our Common Stock.

Because we have not designated the amount of net proceeds

from this offering to be used for any particular purpose, our management will have broad discretion as to the application of the net proceeds

from this offering and could use them for purposes other than those contemplated at the time of the offering. We could spend the proceeds

from this offering in ways our stockholders may not agree with or that do not yield a favorable return, if at all. We intend to use the

net proceeds, if any, from this offering for general corporate purposes, including the potential repayment of indebtedness. However, our

actual use of these proceeds may differ from our current plans. You will be relying on the judgment of our management with regard to the

use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds

are being used in ways with which you would agree. It is possible that the net proceeds will be invested in a way that does not yield

a favorable, or any, return for us. The failure of our management to use such funds effectively could have a material adverse effect on

our business, financial condition, operating results and cash flow. See “Use of Proceeds.”

Our share price may be volatile.

The market price of our Common Stock has fluctuated

in the past. Such volatility resulted in rapid and substantial increases and decreases in our stock price that may or may not be related

to our operating performance or prospects. Consequently, the current market price of our Common Stock may not be indicative of future

market prices, and we may be unable to sustain or increase the value of an investment in our Common Stock.

We do not anticipate paying any dividends.

We do not currently intend to pay any cash dividends

on our Common Stock for the foreseeable future. We currently intend to invest our future earnings, if any, to fund our growth. Therefore,

stockholders are not likely to receive any dividends on their Common Stock for the foreseeable future. Since we do not intend to pay dividends,

stockholders’ ability to receive a return on their investment will depend on any future appreciation in the market value of our

Common Stock. Our Common Stock may not appreciate or even maintain the price at which our holders have purchased it.

Antidilution provisions in certain of our convertible debt instruments

may result in a reduction of the conversion price, which would result in additional dilution of our Common Stock.

Approximately $47,478,146 of our convertible debt

instruments include a weighted-average antidilution conversion price adjustment provision. Under this provision, if the Company issues

additional shares of Common Stock without consideration or for a consideration per share less than the conversion price in effective immediately

prior to such issuance, subject to certain exceptions, the conversion price shall be lowered based on a weighted-average adjustment formula,

which would result in additional dilution of our Common Stock.

There is no public market for the Warrants being offered in this

offering and we do not expect one to develop.

There is no established public trading market for

the Warrants being offered in this offering and we do not expect an active trading market to develop. We do not intend to list the Warrants

on any securities exchange or other trading market. Without an active trading market, the liquidity of the Warrants will be limited.

The Warrants are speculative in nature.

The Warrants offered in this offering do not confer

any rights of Common Stock ownership on their holders, such as voting rights or the right to receive dividends, but rather merely represent

the right to acquire shares of our Common Stock at a fixed price for a limited period of time. There can be no assurance that the market

price of the Common Stock will ever equal or exceed the exercise price of the Warrants, and consequently, whether it will ever be profitable

for holders of the Warrants to exercise the Warrants.

Holders of our Warrants will have no rights as a common stockholder

until they acquire our Common Stock.

Until you acquire shares of our Common Stock upon

exercise of the Warrants, you will have no rights with respect to shares of our Common Stock issuable upon exercise of such Warrants.

Upon exercise of your Warrants, you will be entitled to exercise the rights of a common stockholder only as to matters for which the record

date occurs after the exercise date.

We may not be able to maintain compliance with NASDAQ’s continued

listing requirements.

Our Common Stock is listed on The NASDAQ Capital Market.

There are a number of continued listing requirements that we must satisfy in order to maintain our listing on The NASDAQ Capital Market.

If we fail to maintain compliance with all applicable continued listing requirements for The NASDAQ Capital Market and NASDAQ determines

to delist our Common Stock, the delisting could adversely affect the market liquidity of our Common Stock, our ability to obtain financing

to repay debt and fund our operations.

Risks Related to Our Business

For risks related to our business, please see the

risks described in our most recent Annual Report on Form 10-K and in our other periodic reports filed with the SEC and incorporated by

reference herein, as well as other information and data set forth in this prospectus supplement, the accompanying prospectus, and the

documents incorporated by reference herein and therein, and in any free writing prospectus that we have authorized for use in connection

with this offering. The following is an updated version of a risk factor relating to our business:

Our business plan requires

additional liquidity and capital resources that might not be available on terms that are favorable to us, or at all.

We have

sustained recurring losses through June 30, 2023 and our accumulated deficit was $180,061,757 as of such date. Since inception, our operations

have been funded principally through the issuance of debt and equity. As of June 30, 2023, we had approximately $9.3 million of unrestricted

cash and $7.5 million of restricted cash, and $12.4 million of liquid investments held to maturity consisting of U.S. Treasury securities.

Through August 10, 2024, we have $59.3 million in debt principal payments coming due. For a fee of one percent of the principal, the Company

may extend the maturity of up to $42.1 million principal of debt until March 31, 2025.

While

our strategy assumes that we will receive sufficient capital to have sufficient working capital, we currently do not have available cash

and cash flows from operations to provide us with adequate liquidity for the near-term or foreseeable future. Our current projected liabilities

exceed our current cash projections and we have very limited cash flow from current operations. We therefore will require additional capital

and/or cash flow from future operations to fund the Company, our debt service obligations and our ongoing business. There is no assurance

that we will be able to raise sufficient additional capital or generate sufficient future cash flow from our future operations to fund

the Hall of Fame Village, our debt service obligations or our ongoing business. If the amount of capital we are able to raise, together

with any income from future operations, is not sufficient to satisfy our liquidity and capital needs, including funding our current debt

obligations, we may be required to abandon or alter our plans for the Company. The Company may have to raise additional capital through

the equity market, which could result in substantial dilution to existing stockholders. If management is unable to execute its planned

debt and equity financing initiatives, these conditions raise substantial doubt about our ability to continue to sustain operations for

at least one year from the issuance of our condensed consolidated financial statements for the quarter ended June 30, 2023 included in

this quarterly report on Form 10-Q. The accompanying condensed consolidated financial statements do not include any adjustments that might

result from the outcome of these uncertainties.

Our

ability to obtain necessary financing may be impaired by factors such as the health of and access to capital markets, our limited track

record and the limited historical financial information available, or the substantial doubt about our ability to continue as a going concern.

Any additional capital raised through the sale of additional shares of our capital stock, convertible debt or other equity may dilute

the ownership percentage of our stockholders.

USE OF PROCEEDS

We estimate that the net proceeds of this offering, after deducting

estimated underwriting discounts and commissions, will be approximately $2,615,625 (or approximately $3,007,968.75 if the underwriter

exercises in full the option to purchase up to 112,500 additional shares of Common Stock and/or up to an additional 112,500 Warrants).

If all of the Warrants sold in this offering were to be exercised in cash at an exercise price of $3.75 per share, we would receive additional

net proceeds of approximately $2,812,500. We cannot predict when or if these Warrants will be exercised. It is possible that these Warrants

may expire and may never be exercised.

We intend to use the net proceeds from this offering

for general corporate purposes, including the potential repayment of indebtedness.

CAPITALIZATION

The following table sets forth our unaudited cash

and capitalization as of June 30, 2023:

| |

● |

on an as-adjusted basis to reflect the consummation of this offering, after deducting the underwriting discounts and commissions. |

You should read this table in conjunction with our

consolidated financial statements and related notes and the sections entitled “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” included in our Annual Report on Form 10-K for the year ended December 31, 2022 and our Quarterly

Report on Form 10-Q for the three months ended June 30, 2023, each of which is incorporated by reference in this prospectus supplement.

| | |

As of June 30, 2023 | |

| | |

Actual | | |

As

Adjusted(1) | |

| Cash and cash equivalents | |

| | |

| |

| Cash | |

$ | 9,307,494 | | |

$ | 11,923,119 | |

| Restricted Cash | |

| 7,543,499 | | |

| 7,543,499 | |

| Total cash and cash equivalents | |

$ | 16,850,993 | | |

$ | 19,466,618 | |

| | |

| | | |

| | |

| Notes Payable, net | |

| 195,270,837 | | |

| 195,270,837 | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Undesignated preferred stock, $0.0001 par value; 4,917,000 shares authorized; no shares issued or outstanding at June 30, 2023 | |

| — | | |

| — | |

| Series B convertible preferred stock, $0.0001 par value; 15,200 shares designated; 200 shares issued and outstanding at June 30, 2023; liquidation preference of $222,011 as of June 30, 2023 | |

| — | | |

| — | |

| Series C convertible preferred stock, $0.0001 par value; 15,000 shares designated; 15,000 shares issued and outstanding at June 30, 2023; liquidation preference of $15,707,500 as of June 30, 2023 | |

| 2 | | |

| 2 | |

| Common stock, $0.0001 par value; 300,000,000 shares authorized; 5,667,446 shares issued and outstanding at June 30, 2023 | |

| 566 | | |

| 641 | |

| Additional paid-in capital | |

| 340,814,772 | | |

| 343,430,322 | |

| Accumulated Deficit | |

| (180,061,757 | ) | |

| (180,061,757 | ) |

| Noncontrolling interest | |

| (936,945 | ) | |

| (936,945 | ) |

| Total equity | |

| 159,816,638 | | |

| 162,432,263 | |

| | |

| | | |

| | |

| Total capitalization | |

$ | 371,938,468 | | |

$ | 377,169,718 | |

| (1) | We intend to use the net proceeds from this offering for

general corporate purposes, including the potential repayment of indebtedness. The repayment of debt is not reflected in this table. |

The information presented in the table above is as of June 30,

2023 and excludes:

| ● | 1,123,657

shares of Common Stock issuable upon the exercise of our Series A Warrants, with an

exercise price of $253.11 per share; |

| ● | 170,862

shares of Common Stock issuable upon the exercise of our Series B Warrants that are

outstanding as of June 30, 2023, with an exercise price of $30.81 per share; |

| ● | 455,867

shares of Common Stock issuable upon the exercise of our Amended and Restated Series C Warrants,

with an exercise price of $12.77 per share; |

| ● | 111,321

shares of Common Stock issuable upon the exercise of our Series D No. W-1 Warrants, with

an exercise price of $12.77 per share; |

| ● | 1,484

shares of Common Stock issuable upon the exercise of our Series D No. W-2 Warrants, with

an exercise price of $151.86 per share; |

| ● | 68,128

shares of Common Stock issuable upon the exercise of our Series E Warrants, with an exercise

price of $12.77 per share; |

| ● | 68,128

shares of Common Stock issuable upon the exercise of our Series F Warrants, with an exercise

price of $12.77 per share; |

| ● | 5,677

shares of Common Stock issuable upon the exercise of our Series G Warrants, with an exercise

price of $12.77 per share; |

| ● | 2,969

shares of Common Stock issuable upon conversion of our Series B Preferred Stock, with a conversion

price of $67.35 per share(a); |

| ● | 454,407

shares of Common Stock issuable upon conversion of our Series C Preferred Stock, with a conversion

price of $33.01 per share(a); |

| ● | 272,264

shares of Common Stock reserved for issuance of awards under our 2020 Omnibus Incentive Plan; |

| ● | 46,197

shares of Common Stock reserved for issuance of awards under tour 2023 Inducement Plan; |

| ● | 163,922

shares of Common Stock issuable upon vesting of outstanding restricted stock unit awards,

including awards granted under our 2020 Omnibus Incentive Plan and inducement awards granted

under our 2023 Inducement Plan; |

| ● | Up

to (A) approximately 220,430 shares of our Common Stock that are issuable upon either (i)

conversion of the Company’s 8.00% Convertible Notes due 2025 (the “PIPE Notes”)

that were initially issued in connection with a private placement, or (ii) exercise of warrants

to purchase our Common Stock that are issuable upon redemption of PIPE Notes (the “Note

Redemption Warrants”), or (iii) some combination thereof; The number of shares of Common

Stock issuable in respect of the PIPE Notes is calculated based on the maximum aggregate

principal amount of PIPE Notes, assuming all future interest payments will be paid as PIK

Interest (as defined below);(b) |

| ● | 839,823

shares of Common Stock issuable upon conversion at a conversion price of $12.77 per share

of Common Stock of the $10,724,551 Joinder and First Amended and Restated Promissory Note,

effective as of November 7, 2022, issued by the Company, HOFV Newco, and HOFV Youth Fields

to CH Capital Lending, LLC(a); |

| ● | 708,547

shares of Common Stock issuable upon conversion at a conversion price of $12.77 per share

of Common Stock of the $9,048,146 Term Loan Agreement dated December 1, 2020, as assigned

and amended, among the Company, HOFV Newco, HOFV Youth Fields and HOFV Stadium, as borrowers,

and CH Capital Lending, LLC, as lender(a); |

| ● | 344,612

shares of Common Stock issuable upon conversion at a conversion price of $12.77 per share

of Common Stock of the $4,400,702 Joinder and Second Amended and Restated Secured COGNOVIT

Promissory Note, effective as of November 7, 2022, issued by the Company, HOFV Newco and

HOFV Youth Fields to IRG(a); |

| ● | 322,554

shares of Common Stock issuable upon conversion at a conversion price of $12.77 per share

of Common Stock of the $4,119,019 Backup Promissory Note, effective as of November 7, 2022,

issued by the Company, HOFV Newco and HOFV Youth Fields to Midwest Lender Fund, LLC(a); |

| ● | 733,585

shares of Common Stock issuable upon conversion at a conversion price of $12.77 per share

of Common Stock of the $9,367,890 Backup Joinder Second Amended and Restated Secured Cognovit

Promissory Note, effective as of November 7, 2022, issued by the Company, HOFV Newco and

HOFV Youth Fields to JKP Financial, LLC, as holder(a); |

| ● | 344,612

shares of Common Stock issuable upon conversion at a conversion price of $12.77 per share

of Common Stock of the $4,400,702 Joinder and First Amended and Restated Secured Cognovit

Promissory Note, effective as of November 7, 2022, by and among the Company, HOFV Newco,

HOFV Youth Fields, as makers, and JKP Financial, LLC, as holder(a); |

| |

● |

$25,645,093 aggregate price in shares of our Common Stock that we may offer and sell, from time to time through Wedbush Securities Inc. and Maxim Group LLC, as agents (the “Agents”), under our Equity Distribution Agreement, by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415 of the Securities Act, including sales made by means of ordinary brokers’ transactions, including on The Nasdaq Capital Market, at market prices or as otherwise agreed with the Agents(c); and |

| ● | 750,000

shares of Common Stock issuable upon the exercise of the Warrants offered hereby. |

| (a) | The conversion price of the instrument is subject to a weighted-average

anti-dilution adjustment, which has been waived by the holder of the instrument for this offering. |

| (b) | The original aggregate principal amount of PIPE Notes is

$20,721,293. Interest on PIPE Notes is payable quarterly in either cash or an increase in the principal amount of PIPE Notes (“PIK

Interest”). If the Company pays interest as PIK Interest, the interest rate for such payment is 10%, rather than 8%. The Company

has been paying interest on the PIPE Notes as PIK Interest to conserve cash. The current aggregate principal amount of the PIPE Notes

is $27,868,206. The maximum aggregate principal amount of PIPE Notes, assuming all future interest payments will be paid as PIK Interest,

is $33,475,146. |

| (c) |

The underwriting agreement that we entered into with Maxim Group LLC in this offering requires that we not issue any shares of our Common Stock from the date of this prospectus supplement for 90 days thereafter, subject to certain exceptions, and as a result, we have suspended sales pursuant to our ATM under our Equity Distribution Agreement during such period. |

DILUTION

Our net tangible book value as of June 30, 2023

was approximately $159,816,638, or $28.19 per share based on 5,667,446 shares of Common Stock outstanding at June 30, 2023.

Net tangible book value per share is determined by

dividing our total tangible assets, less total liabilities, by the number of shares of our Common Stock outstanding as of June 30,

2023. Dilution in net tangible book value per share represents the difference between the amount per share paid by purchasers of shares

of Common Stock in this offering and the as adjusted net tangible book value per share of our Common Stock immediately after giving effect

to this offering.

After giving effect to the sale of 750,000 shares of our Common Stock

and 750,000 warrants to purchase Common in this offering at the public offering price of $3.75, and after deducting commissions and estimated

aggregate offering expenses payable by us, our as adjusted net tangible book value as of June 30, 2023 would have been approximately

$162,432,263, or $25.31 per share. This represents an immediate increase in net tangible book value of $21.56 per share to existing stockholders

and an immediate decrease in net tangible book value of $2.88 per share to new investors purchasing our Common Stock in this offering.

The following table illustrates this dilution on a per share basis:

| Public offering price per share |

|

|

|

|

|

$ |

3.75 |

|

| Net tangible book value per share before this offering, as of June 30, 2023 |

|

$ |

28.19 |

|

|

|

|

|

| Increase in net tangible book value per share attributable to investors in this offering |

|

$ |

21.56 |

|

|

|

|

|

| As adjusted net tangible book value per share after this offering |

|

|

|

|

|

$ |

25.31 |

|

| Decrease in net tangible book value to new investors |

|

|

|

|

|

$ |

(2.88 |

) |

We may choose to raise additional capital due to market

conditions or strategic considerations. To the extent that we raise additional capital through the sale of equity or convertible debt

securities, the issuance of these securities could result in further dilution to our stockholders.

The above

discussion and table are based on 5,667,446 shares of our Common Stock outstanding as of June 30, 2023, and excludes the following:

| ● | 1,123,657

shares of Common Stock issuable upon the exercise of our Series A Warrants, with an exercise price of $253.11 per share; |

| | | |

| ● | 170,862

shares of Common Stock issuable upon the exercise of our Series B Warrants that are outstanding as of June 30, 2023, with an exercise

price of $30.81 per share; |

| | | |

| ● | 455,867