Washington, D.C. 20549

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of business of the period covered by the annual report.

Indicate by check mark if the Registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Indicate by check mark whether Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of "accelerated filer," "large accelerated filer," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b 2 of the Exchange Act):

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether Registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Not applicable.

This Annual Report on Form 20-F contains statements that constitute forward-looking statements. Forward-looking statements are projections in respect of future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "intend", "expect", "plan", "anticipate", "believe", "estimate", "predict", "potential", or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, including the risks in the section entitled "Risk Factors", uncertainties and other factors, which may cause our company's or our industry's actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward-looking statements.

Forward-looking statements are based on the reasonable assumptions, estimates, analysis and opinions made in light of our experience and our perception of trends, current conditions and expected developments, as well as other factors that we believe to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Management believes that the assumption and expectations reflected in such forward-looking statements are reasonable. Assumptions have been made regarding, among other things: the Company's ability to maintain projected production deliveries within certain timelines; expected expansion of the Company's production capacity; labor costs and material costs remaining consistent with the Company's current expectations; production of electric buses meeting customer expectations and at an expected cost; equipment operating as anticipated; there being no material variations in the current regulatory environment; the Company's ability to produce Buy America compliant vehicles; and the Company's ability to obtain financing as and when required and on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used.

The Company faces risks from the COVID-19 global pandemic which has had, and may continue to have, a material adverse impact on our business and financial condition. While we have recently seen a gradual re-opening of the economy, and a resumption of travel and sales activity, this activity is not at the level it was prior to the pandemic and the future impact of the COVID-19 global pandemic is inherently uncertain, and may negatively impact the financial ability of our customers to purchase vehicles from us, of our suppliers' ability to deliver products used in the manufacture of our all-electric vehicles, in our employees' ability to manufacture our vehicles and to carry out their other duties in order to sustain our business, and in our ability to collect certain receivables owing to us, among other factors. These factors may continue to have a negative impact on our financial results, operations, outlook, goals, growth prospects, cash flows, liquidity and share price, and the potential timing, severity, and ultimate duration of any potential negative impacts is uncertain.

Such risks are discussed in Item 3.D "Risk Factors". In particular, without limiting the generality of the foregoing disclosure, the statements contained in Item 4.B. - "Business Overview", Item 5 - "Operating and Financial Review and Prospects" and Item 11 - "Quantitative and Qualitative Disclosures About Market Risk" are inherently subject to a variety of risks and uncertainties that could cause actual results, performance or achievements to differ significantly. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or performance. Except as required by applicable law, including the securities laws of the United States and Canada, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected financial data

The following information represents selected financial information for our company for the years ended March 31, 2021, March 31, 2020, March 31, 2019, March 31, 2018, and March 31, 2017 from our audited financial statements. The summarized financial information presented below is derived from and should be read in conjunction with our financial statements.

Consolidated

Statements of

Operations and

Comprehensive

Loss Data

|

|

Year Ended

March 31, 2021

|

|

|

Year Ended

March 31, 2020

|

|

|

Year Ended

March 31, 2019

|

|

|

Year Ended

March 31, 2018

|

|

|

Year Ended

March 31, 2017

|

|

|

Revenue

|

$

|

11,884,578

|

|

$

|

13,500,403

|

|

$

|

6,082,561

|

|

$

|

3,516,156

|

|

$

|

-

|

|

|

Cost of Sales

|

$

|

8,304,438

|

|

$

|

9,447,578

|

|

$

|

4,224,419

|

|

$

|

2,267,765

|

|

$

|

-

|

|

|

Gross Profit

|

$

|

3,580,140

|

|

$

|

4,052,825

|

|

$

|

1,858,142

|

|

$

|

1,248,391

|

|

$

|

-

|

|

|

Expenses

|

$

|

9,578,829

|

|

$

|

8,974,872

|

|

$

|

6,324,062

|

|

$

|

4,603,714

|

|

$

|

2,813,217

|

|

|

Loss from Operations

|

$

|

(7,791,075

|

)

|

$

|

(4,922,047

|

)

|

$

|

(4,465,920

|

)

|

$

|

(3,355,323

|

)

|

$

|

(2,813,217

|

)

|

|

Loss for the year

|

$

|

(7,836,754

|

)

|

$

|

(5,145,966

|

)

|

$

|

(4,544,151

|

)

|

$

|

(2,774,140

|

)

|

$

|

(2,813,217

|

)

|

|

Total Comprehensive Loss

|

$

|

(7,815,585

|

)

|

$

|

(5,166,790

|

)

|

$

|

(4,567,842

|

)

|

$

|

(2,752,826

|

)

|

$

|

(2,808,429

|

)

|

|

Loss per Common Share, Basic and Diluted

|

$

|

(0.43

|

)

|

$

|

(0.34

|

)

|

$

|

(0.34

|

)

|

$

|

(0.21

|

)

|

$

|

(0.23

|

)

|

Consolidated

Statements of

Financial

Position Data

|

|

As of

March 31, 2021

|

|

|

As of

March 31, 2020

|

|

|

As of

March 31, 2019

|

|

|

As of

March 31, 2018

|

|

|

As of

March 31, 2017

|

|

|

Cash and Restricted Cash

|

$

|

15,207,948

|

|

$

|

451,605

|

|

$

|

198,920

|

|

$

|

1,007,329

|

|

$

|

56,995

|

|

|

Working Capital (Deficit)

|

$

|

30,808,375

|

|

$

|

743,131

|

|

$

|

(155,176

|

)

|

$

|

2,180,184

|

|

$

|

(111

|

)

|

|

Total Assets

|

$

|

39,619,355

|

|

$

|

13,207,679

|

|

$

|

11,910,299

|

|

$

|

7,490,466

|

|

$

|

4,519,597

|

|

|

Total Liabilities

|

$

|

3,466,907

|

|

$

|

14,382,635

|

|

$

|

11,995,935

|

|

$

|

5,322,721

|

|

$

|

2,342,370

|

|

|

Accumulated Deficit

|

$

|

(31,625,388

|

)

|

$

|

(23,852,634

|

)

|

$

|

(18,706,668

|

)

|

$

|

(14,080,139

|

)

|

$

|

(11,305,999

|

)

|

|

Shareholders' Equity (Deficit)

|

$

|

36,152,448

|

|

$

|

(1,174,956

|

)

|

$

|

(85,636

|

)

|

$

|

2,167,745

|

|

$

|

2,177,227

|

|

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the offer and use of proceeds

Not applicable.

D. Risk Factors

Risk Factors

An investment in our common shares involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in this annual report in evaluating our company and our business before making an investment decision about our company. Our business, operating results and financial condition could be seriously harmed as a result of the occurrence of any of the following risks. You could lose all or part of your investment due to any of these risks.

Risks Related to Our Business

The COVID-19 global pandemic has had and may continue to have, a material adverse impact on our business and financial condition

The Company faces risks from the COVID-19 global pandemic which has had, and may continue to have, a material adverse impact on our business and financial condition. While we have recently seen a gradual re-opening of the economy, and a resumption of travel and sales activity, this activity is not at the level it was prior to the pandemic and the future impact of the COVID-19 global pandemic is inherently uncertain, and may negatively impact the financial ability of our customers to purchase vehicles from us, of our suppliers' ability to deliver products used in the manufacture of our all-electric vehicles, in our employees' ability to manufacture our vehicles and to carry out their other duties in order to sustain our business, and in our ability to collect certain receivables owing to us, among other factors. These factors may continue to have a negative impact on our financial results, operations, outlook, goals, growth prospects, cash flows, liquidity and share price, and the potential timing, severity, and ultimate duration of any potential negative impacts is uncertain.

We have not reached profitability and currently have negative operating cash flows

For the fiscal year ended March 31, 2021, we generated a loss of $(7,836,754), bringing our accumulated deficit to $(31,625,388). We have minimal revenues and expect significant increases in costs and expenses as we invest in expanding our production and operations. Even if we are successful in increasing revenues from sales of our products, we may be unable to achieve positive cash flow or profitability for a number of reasons, including but not limited to, an inability to control production costs, increases in our selling general and administrative expenses, and a reduction in our product sales price due to competitive or other factors. An inability to generate positive cash flow and profitability until we reach a sufficient level of sales with positive gross margins that cover operating expenses, or an inability to raise additional capital on reasonable terms, will adversely affect our viability as an operating business.

We operate in a capital-intensive industry and will require a significant amount of capital to continue operations

If the revenue from the sale of our electric buses, if any, are not sufficient to cover our cash requirements, we will need to raise additional funds through the sale of equity or other securities, or the issuance of additional debt. Financing may not be available at terms that are acceptable to us, if at all.

Our ability to obtain the necessary financing for our business is subject to a number of factors, including general market conditions and investor acceptance of our business plan. These factors may make the timing, amount, terms and conditions of such financing unattractive or unavailable to us. If we are unable to raise sufficient funds we will have to significantly reduce our spending, delay or cancel our planned activities, or substantially change our current operations and plans in order to reduce our cost structure. Our competitors, many of which have raised or who have access to significant capital, may be able to compete more effectively in our markets given their access to capital, if our access to capital does not improve or is further limited. We might not be able to obtain any funding, and we might not have sufficient resources to conduct our business as projected, both of which could mean that we would be forced to curtail or discontinue our operations.

Developments in alternative technologies or improvements in the internal combustion engine may materially adversely affect the demand for our electric vehicles

Significant developments in alternative technologies, such as advanced diesel, ethanol, fuel cells or compressed natural gas, or improvements in the fuel economy of the internal combustion engine, may materially and adversely affect our business and prospects in ways we do not currently anticipate. For example, fuel which is abundant and relatively inexpensive in North America, such as compressed natural gas, may emerge as consumers' preferred alternative to petroleum-based propulsion. Any failure by us to develop new or enhanced technologies or processes, or to react to changes in existing technologies, could materially delay our development and introduction of new and enhanced electric vehicles, which could result in the loss of competitiveness of our vehicles, decreased revenue and a loss of market share to competitors.

If we are unable to keep up with advances in electric vehicle technology, we may suffer a decline in our competitive position

We may be unable to keep up with changes in electric vehicle technology and, as a result, may suffer a decline in our competitive position. Any failure to keep up with advances in electric vehicle technology would result in a decline in our competitive position which would materially and adversely affect our business, prospects, operating results and financial condition. Our research and development efforts may not be sufficient to adapt to changes in electric vehicle technology. As technologies change we plan to upgrade or adapt our vehicles and introduce new models to continue to provide vehicles with the latest technology. However, our vehicles may not compete effectively with alternative vehicles if we are not able to source and integrate the latest technology into our vehicles at a competitive price. For example, we do not manufacture battery cells or drive motors which makes us dependent upon suppliers of these products for our vehicles.

The majority of our manufacturing is currently contracted out to third party manufacturers and we are dependent on these manufacturers to operate competitively

We currently contract out the majority of the manufacturing of our vehicles to third party manufacturers in Asia, with final assembly performed by our employees in North America. As a result, we are dependent on third party manufacturers to manufacture our vehicles according to our specifications and quality, at a competitive cost and within agreed upon timeframes. If our chosen manufacturing vendors are unable or unwilling to perform these functions then our financial results and reputation may suffer, which may prevent us from being able to continue as a going concern. In addition, we are subject to inherent risks involved in shipping our vehicles from these primary manufacturers to our facilities in North America. During the shipping process our vehicles are subject to theft, loss or damage due to a number of factors, some of which we may be unable to insure cost-effectively, if at all.

We may need to defend ourselves against intellectual property infringement claims, which may be time-consuming and could cause us to incur substantial costs.

Others, including our competitors, may hold or obtain patents, copyrights, trademarks or other proprietary rights that could prevent, limit or interfere with our ability to make, use, develop, sell or market our products and services, which could make it more difficult for us to operate our business. From time to time, the holders of such intellectual property rights may assert their rights and urge us to take licenses, and/or may bring suits alleging infringement or misappropriation of such rights. We may consider the entering into licensing agreements with respect to such rights, although no assurance can be given that such licenses can be obtained on acceptable terms or that litigation will not occur, and such licenses could significantly increase our operating expenses. In addition, if we are determined to have infringed upon a third party's intellectual property rights, we may be required to cease making, selling or incorporating certain components or intellectual property into the goods and services we offer, to pay substantial damages and/or license royalties, to redesign our products and services, and/or to establish and maintain alternative branding for our products and services. In the event that we were required to take one or more such actions, our business, prospects, operating results and financial condition could be materially adversely affected. In addition, any litigation or claims, whether or not valid, could result in substantial costs, negative publicity and diversion of resources and management attention.

We depend on certain key personnel, and our success will depend on our continued ability to retain and attract such qualified personnel

Our success depends on the efforts, abilities and continued service of our executive officers and management. A number of these key employees have significant experience in the electric vehicle industry, and valuable relationships with our suppliers, customers, and other industry participants. A loss of service from any one of these individuals may adversely affect our operations, and we may have difficulty or may be unable to locate and hire a suitable replacement. We have not obtained any "key person" insurance on any of our executives or managers.

We may in be involved in litigation or legal proceedings that are deemed to be material and may require recognition as a provision or a contingent liability on our financial statements.

We may in the future be involved in litigation or legal proceedings that are material and may require recognition as a provision or contingent liability on our financial statements. We have filed a civil claim against the prior CEO and Director of the Company in the Province of British Columbia, and the prior CEO and Director of the Company has filed a response with a counterclaim for wrongful dismissal in the Province of British Columbia. In addition, a company owned and controlled by a former employee who provided services to a subsidiary company of GreenPower until August 2013 filed a claim for breach of confidence against GreenPower in July 2020. We do not expect the outcome of either our claim, or the claims filed against it, to be material, and as of the date of this report the resolution of these claims, including the potential timing or financial impact of these claims is inherently uncertain. However, we may in the future determine that these claims becomes material or we may be subject to other claims that alone or in addition to other claims are considered to be material, and require recognition as a provision or contingent liability on our financial statements.

We are subject to numerous environmental and health and safety laws and any breach of such laws may have a material adverse effect on our business and operating results

We are subject to numerous environmental and health and safety laws, including statutes, regulations, bylaws and other legal requirements. These laws relate to the generation, use, handling, storage, transportation and disposal of regulated substances, including hazardous substances (such as batteries), dangerous goods and waste, emissions or discharges into soil, water and air, including noise and odors (which could result in remediation obligations), and occupational health and safety matters, including indoor air quality. These legal requirements vary by location and can arise under federal, provincial, state or municipal laws. Any breach of such laws, regulations or requirements would have a material adverse effect on our company and its operating results.

Our vehicles are subject to motor vehicle standards and the failure to satisfy such mandated safety standards would have a material adverse effect on our business and operating results.

All vehicles sold must comply with federal, state and provincial motor vehicle safety standards. In both Canada and the United States vehicles that meet or exceed all federally mandated safety standards are certified under the federal regulations. In this regard, Canadian and U.S. motor vehicle safety standards are substantially the same. Rigorous testing and the use of approved materials and equipment are among the requirements for achieving federal certification. Failure by us to have our current or future electric vehicles satisfy motor vehicle standards would have a material adverse effect on our business and operating results.

If our vehicles fail to perform as expected, our ability to continue to develop, market and sell our electric vehicles could be harmed

Our vehicles may contain defects in design and manufacture that may cause them not to perform as expected or that may require repair. For example, our vehicles use technologically complex battery management software to operate. Given the inherent complexity of this software, it may contain defects and errors which would adversely impact the operation of our vehicles. While we have performed extensive testing of our vehicles, we currently have a limited frame of reference to evaluate the performance of our vehicles in the hands of our customers under a range of operating conditions.

We may not succeed in establishing, maintaining and strengthening the GreenPower brand, which would materially and adversely affect customer acceptance of our vehicles and components and our business, revenues and prospects.

Our business and prospects heavily depend on our ability to develop, maintain and strengthen the GreenPower brand. Any failure to develop, maintain and strengthen our brand may materially and adversely affect our ability to sell our planned electric vehicles. If we are not able to establish, maintain and strengthen our brand, we may lose the opportunity to expand our customer base. Promoting and positioning our brand will depend significantly on our ability to provide high quality electric vehicles and maintenance and repair services, and we have limited experience in these areas. In addition, we expect that our ability to develop, maintain and strengthen the GreenPower brand will also depend heavily on the success of our marketing efforts. To date we have limited experience with marketing activities as we have relied primarily on the internet, word of mouth and attendance at industry trade shows to promote our brand. To further promote our brand, we may be required to change our marketing practices, which could result in substantially increased advertising expenses. We operate in a competitive industry, and we may not be successful in building, maintaining and strengthening our brand. Many of our current and potential competitors, particularly automobile manufacturers headquartered in the United States, Japan and the European Union have greater name recognition, broader customer relationships and substantially greater marketing resources than we do. If we do not develop and maintain a strong brand, our business, prospects, financial condition and operating results will be materially and adversely impacted.

We are dependent on our suppliers, many of which are single-source suppliers, and the inability of these suppliers to deliver necessary components of our products according to our schedule and at prices, quality levels and volumes acceptable to us, or our inability to efficiently manage these components, could have a material adverse effect on our financial condition and operating results.

Our products contain numerous purchased parts which we source globally directly from suppliers, many of which are single-source suppliers, although we attempt to qualify and obtain components from multiple sources whenever feasible. Any significant increases in our production may require us to procure additional components in a short amount of time, and in the past we have also replaced certain suppliers because of their failure to provide components that met our quality control standards or our timing requirements. Many of our suppliers have either temporarily suspended their operations or scaled back their operations in order to comply with government and regulatory orders and to protect the health of their employees due to the COVID-19 global pandemic. With the ongoing vaccination efforts economies are gradually re-opening and activity is beginning to recover, though not at the same level as prior to the pandemic. If any of our single source suppliers is unable to deliver components to us there is no assurance that we will be able to secure additional or alternate sources of supply for our components or develop our own replacements in a timely manner, if at all. If we encounter unexpected difficulties with key suppliers, and if we are unable to fill these needs from other suppliers, we could experience production delays and potential loss of access to important technology and parts for producing, servicing and supporting our products.

This limited, and in many cases single source, supply chain exposes us to multiple potential sources of delivery failure or component shortages for production of our products. Furthermore, unexpected changes in business conditions, materials pricing, labor issues, wars, governmental changes, and natural disasters could also affect our suppliers' ability to deliver components to us on a timely basis. The loss of any single or limited source supplier or the disruption in the supply of components from these suppliers could lead to product design changes and delays in product deliveries to our customers, which could hurt our relationships with our customers and result in negative publicity, damage to our brand and a material and adverse effect on our business, prospects, financial condition and operating results.

Changes in our supply chain may lead to an increased cost for our products. We have also experienced cost increases from certain of our suppliers in order to meet our quality targets and timelines as well as due to our design changes, and we may experience similar cost increases in the future. Certain suppliers have sought to renegotiate the terms of supply arrangements. Additionally, we are negotiating with existing suppliers for cost reductions and are seeking new and less expensive suppliers for certain parts. If we are unsuccessful in our efforts to control and reduce supplier costs, our operating results will suffer.

There is no assurance that our suppliers will be able to sustainably and timely meet our cost, quality and volume needs. Furthermore, if the scale of our vehicle production increases, we will need to accurately forecast, purchase, warehouse and transport to our manufacturing facilities components at much higher volumes. If we are unable to accurately match the timing and quantities of component purchases to our actual needs, or successfully manage our inventory to accommodate the increased complexity in our supply chain, we may incur unexpected production disruption, storage, transportation and write-off costs, which could have a material adverse effect on our financial condition and operating results.

The reduction or elimination of government and economic incentives, funding approval or the delay in the timing of advancing funding that has been approved, in particular in the state of California, could have a material adverse effect on our business, financial condition, operating results and prospects.

Any reduction, elimination or discriminatory application of government subsidies and economic incentives because of policy changes, the reduced need for such subsidies and incentives for electric vehicles may result in the diminished competitiveness of the alternative fuel vehicle industry generally or our electric vehicles in particular. This could materially and adversely affect the growth of the alternative fuel automobile markets and our business, prospects, financial condition and operating results.

Our vehicles are eligible for vouchers from specific government programs, including the Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project ("HVIP") from the California Air Resources Board ("CARB") in partnership with Calstart, and the Specialty-Use Vehicle Incentive Program funded by the Province of British Columbia, Canada. The ability for potential purchasers to receive funding from these programs is subject to the risk of the programs being funded by governments, and the risk of the delay in the timing of advancing funds to the specific programs. To the extent that program funding is not approved, or if the funding is approved but timing of advancing of funds is delayed, subject to cancellation, or otherwise uncertain, this could have a material adverse effect on our business, financial condition, operating results and prospects.

To date the vast majority of our electric vehicle sales have been in the state of California, in part due to subsidies and grants for electric vehicles and electric charging infrastructure available from the California state government. In some cases these grants or subsidies have covered the entire vehicle cost, and in many cases the grants or subsidies have reduced the net cost to our customers to a point that the vehicle is less expensive than purchasing a comparable diesel powered vehicle. The recent announcement from CARB that it is no longer accepting new applications to the HVIP program until new funding for the program is identified has negatively impacted new sales prospects for GreenPower buses in the state of California and any further reduction or elimination of the grants or incentives in the state of California would have a material negative impact on our business, financial condition, operating results and prospects.

If we fail to manage future growth effectively, we may not be able to market and sell our vehicles successfully.

Any failure to manage our growth effectively could materially and adversely affect our business, prospects, operating results and financial condition. We are expecting significant growth in sales, and are currently expanding our employees, facilities and infrastructure in order to accommodate this growth. Our future operating results depend to a large extent on our ability to manage this expansion and growth successfully. Risks that we face in undertaking this expansion include:

• training new personnel;

• forecasting production and revenue;

• controlling expenses and investments in anticipation of expanded operations;

• establishing or expanding manufacturing, sales and service facilities;

• implementing and enhancing administrative infrastructure, systems and processes;

• addressing new markets; and

• establishing international operations.

We intend to continue to hire a number of additional personnel, including manufacturing personnel and service technicians for our electric vehicles. There is significant competition for individuals with experience manufacturing and servicing electric vehicles, and we may not be able to attract, assimilate, train or retain additional highly qualified personnel in the future. The failure to attract, integrate, train, motivate and retain these additional employees could seriously harm our business and prospects.

Our business may be adversely affected by labor and union activities.

Although none of our employees are currently represented by a labor union, it is common throughout the automobile industry for employees to belong to a union. Having a unionized workforce may result in higher employee costs and increased risk of work stoppages. Additionally, we are in the process of expanding our in-house manufacturing capabilities and increasing the number of employees in this area. If our employees engaged in manufacturing were to unionize, this may increase our future production costs and negatively impact our gross margins and financial results.

We also directly and indirectly depend upon other companies with unionized work forces, such as parts suppliers and trucking and freight companies, and work stoppages or strikes organized by such unions could have a material adverse impact on our business, financial condition or operating results. If a work stoppage occurs within our business, or in one of our key suppliers, it could delay the manufacture and sale of our electric vehicles and have a material adverse effect on our business, prospects, operating results and financial condition.

We may become subject to product liability or warranty claims, which could harm our financial condition and liquidity if we are not able to successfully defend or insure against such claims.

We may become subject to product liability or warranty claims, which could harm our business, prospects, operating results and financial condition. The automobile industry experiences significant product liability claims and we face inherent risk of exposure to claims in the event our vehicles do not perform as expected or malfunction resulting in personal injury or death. Our risks in this area are particularly pronounced given our vehicles have only been operating for a short period of time. A successful product liability claim against us could require us to pay a substantial monetary award. Moreover, a product liability claim could generate substantial negative publicity about our vehicles and business which would have a material adverse effect on our brand, business, prospects and operating results.

Global economic conditions could materially adversely impact demand for our products and services.

Our operations and performance depend significantly on economic conditions. The COVID-19 global pandemic and resulting government health regulations have resulted in significant reductions in global economic output and have negatively impacted global economic conditions. The ultimate impact and duration of current negative global economic conditions are highly uncertain. Uncertainty about global economic conditions could result in customers postponing purchases of our products and services in response to tighter credit, unemployment, negative financial news and/or declines in income or asset values and other macroeconomic factors, which could have a material negative effect on demand for our products and services and, accordingly, on our business, results of operations or financial condition.

The trade agreement with China includes tariffs on goods imported to the US from China, and these tariffs negatively impact our financial performance, financial position, and financial results

The United States and China signed a trade agreement in January 2020 after a trade war between the two countries that led to the implementation of tariffs on approximately $360 billion of Chinese imports to the United States. The trade agreement includes terms providing protection for intellectual property and includes a commitment from China to purchase goods and services from the United States, however the majority of the current tariffs on goods imported to the United States from China will remain in place under the trade agreement. GreenPower's buses include parts and components imported from China, and tariffs are applied to imports of these products to the United States. These tariffs have increased the cost of GreenPower's buses imported to the United States and have had and will continue to have a negative impact on our gross margins, profitability, financial performance and financial position. Any escalation of the tariffs on imported goods from China to the United States will cause further negative impacts to our gross margin, profitability, financial performance and financial position.

We rely on global shipping for our vehicles that are produced at contract manufacturers, and for certain parts and components sourced from our global network of suppliers. Over the past year the cost of shipping goods has increased and shipping availability has declined, and if these trends continue this may negatively impact our ability to deliver our vehicles to our customers on a timely basis, and increase our costs, which may negatively impact our financial results and ability to grow our business

Shipping costs have grown significantly since the fall of 2020 due to a number of factors, including imbalances in global trade and countries locking down and opening up at different times. As well, while global demand for shipping has increased strongly over the past year, shipping supply has not, and is not expected to increase until 2023 when newbuild ships are expected to deliver. Furthermore, shipping has been delayed due to port congestion, port closures, and vessel delays.

We rely on global shipping for vehicles that we produce at contract manufacturers, and for certain parts and components sourced from our global network of suppliers. We have experienced an increase in shipping costs and have experienced delays of deliveries of parts and components from our global suppliers, and on vehicles arriving from our contract manufacturers. While these delays and cost increases are not currently at a level that they have caused a material disruption or negative impact to our profitability, these delays and costs may increase to a point that they may negatively impact our financial results and ability to grow our business.

Our line of credit contains covenant restrictions that may limit our ability to operate our business.

The terms of our line of credit contains, and future debt agreements we enter into may contain, covenant restrictions that limit our ability to operate our business, including restrictions on our ability to, among other things, incur additional debt or issue guarantees, create liens, and make certain dispositions of property or assets. As a result of these covenants, our ability to respond to changes in business and economic conditions and engage in beneficial transactions, including to obtain additional financing as needed, may be restricted. Furthermore, our failure to comply with our debt covenants could result in a default under our line of credit, which would permit the lender to demand repayment. If a demand is made for us to repay our line of credit, we may not have sufficient funds available to repay it.

The demand for commercial zero-emission electric vehicles depends, in part, on the continuation of current trends resulting from historical dependence on fossil fuels. Extended periods of low diesel or other petroleum-based fuel prices could adversely affect demand for electric vehicles, which could adversely affect our business, prospects, financial condition and operating results.

We believe that much of the present and projected demand for commercial zero-emission electric vehicles results from concerns about volatility in the cost of petroleum-based fuel, the dependency of the United States on oil from unstable or hostile countries, government regulations and economic incentives promoting fuel efficiency and alternative forms of energy, as well as the belief that poor air quality and climate change results in part from the burning of fossil fuels. If the cost of petroleum-based fuel decreased significantly, or the long-term supply of oil in the United States improved, the government may eliminate or modify its regulations or economic incentives related to fuel efficiency and alternative forms of energy. If there is a change in the perception that the burning of fossil fuels does not negatively impact the environment, the demand for commercial zero-emission electric vehicles could be reduced, and our business and revenue may be harmed. Diesel and other petroleum-based fuel prices have been extremely volatile, and we believe this continuing volatility will persist. Lower diesel or other petroleum-based fuel prices over extended periods of time may lower the current perception in government and the private sector that cheaper, more readily available energy alternatives should be developed and produced. If diesel or other petroleum-based fuel prices remain at deflated levels for extended periods of time, the demand for commercial electric vehicles may decrease, which could have an adverse effect on our business, prospects, financial condition and operating results.

We may be compelled to undertake product recalls.

Any product recall in the future may result in adverse publicity, damage to our brand and may adversely affect our business, prospects, operating results and financial condition. We may at various times, voluntarily or involuntarily, initiate a recall if any of our electric vehicle components prove to be defective. Such recalls, voluntary or involuntary, involve significant expense and diversion of management attention and other resources, which would adversely affect our brand image in our target markets and could adversely affect our business, prospects, financial condition and results of operations.

Security breaches and other disruptions to our information technology networks and systems could substantially interfere with our operations and could compromise the confidentiality of our proprietary information, notwithstanding the fact that no such breaches or disruptions have materially impacted us to date.

We rely upon information technology systems and networks, some of which are managed by third-parties, to process, transmit and store electronic information, and to manage or support a variety of business processes and activities, including supply chain management, manufacturing, invoicing and collection of payments from our customers. Additionally, we collect and store sensitive data, including intellectual property, proprietary business information, the proprietary business information of our suppliers, as well as personally identifiable information of our employees, in data centers and on information technology systems. The secure operation of these information technology systems, and the processing and maintenance of this information, is critical to our business operations and strategy. Despite security measures and business continuity plans, our information technology systems and networks may be vulnerable to damage, disruptions or shutdowns due to attacks by hackers or breaches due to errors or malfeasance by employees, contractors and others who have access to our networks and systems, or other disruptions during the process of upgrading or replacing computer software or hardware, hardware failures, software errors, third-party service provider outages, power outages, computer viruses, telecommunication or utility failures or natural disasters or other catastrophic events. The occurrence of any of these events could compromise our systems and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure or other loss of information could result in legal claims or proceedings, liability or regulatory penalties under laws protecting the privacy of personal information, disrupt operations and reduce the competitive advantage we hope to derive from our investment in technology. Our insurance coverage may not be available or adequate to cover all the costs related to significant security attacks or disruptions resulting from such attacks.

Our electric vehicles make use of lithium-ion battery cells, which, if not appropriately managed and controlled, have occasionally been observed to catch fire or vent smoke and flames. If such events occur in our electric vehicles, we could face liability associated with our warranty, for damage or injury, adverse publicity and a potential safety recall, any of which would adversely affect our business, prospects, financial condition and operating results.

The battery packs in our electric vehicles use lithium-ion cells, which have been used for years in laptop computers and cell phones. Highly publicized incidents of laptop computers and cell phones bursting into flames have focused consumer attention on the safety of these cells. These events also have raised questions about the suitability of these lithium-ion cells for automotive applications. There can be no assurance that a field failure of our battery packs will not occur, which would damage the vehicle or lead to personal injury or death and may subject us to lawsuits. Furthermore, there is some risk of electrocution if individuals who attempt to repair battery packs on our vehicles do not follow applicable maintenance and repair protocols. Any such damage or injury would likely lead to adverse publicity and potentially a safety recall. Any such adverse publicity could adversely affect our business, prospects, financial condition and operating results.

Risks Related to Our Company

It may be difficult for non-Canadian investors to obtain and enforce judgments against us because of our Canadian incorporation and presence.

We are a corporation existing under the laws of British Columbia, Canada. Some of our directors and officers, and the experts named in this prospectus, are residents of Canada, and all or a substantial portion of their assets, and a substantial portion of our assets, are located outside the United States. Consequently, although we have appointed an agent for service of process in the United States, it may be difficult for holders of our common shares who reside in the United States to effect service within the United States upon our directors and officers and experts who are not residents of the United States. It may also be difficult for holders of our common shares who reside in the United States to realize in the United States upon judgments of courts of the United States predicated upon our civil liability and the civil liability of our directors, officers and experts under the United States federal securities laws. Investors should not assume that Canadian courts (i) would enforce judgments of United States courts obtained in actions against us or our directors, officers or experts predicated upon the civil liability provisions of the United States federal securities laws or the securities or "blue sky" laws of any state within the United States or (ii) would enforce, in original actions, liabilities against us or our directors, officers or experts predicated upon the United States federal securities laws or any such state securities or "blue sky" laws.

We are an "emerging growth company," and we cannot be certain if the reduced reporting requirements applicable to emerging growth companies will make our common shares less attractive to investors.

We are an "emerging growth company," as defined in the Jumpstart Our Business Startups Act of 2012, or the "JOBS Act". For as long as we continue to be an emerging growth company, we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

We will cease to be an emerging growth company upon the earliest of:

• the last day of the fiscal year during which we have total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every five years by the Securities and Exchange Commission or more);

• the last day of our fiscal year following the fifth anniversary of the completion of our first sale of common equity securities pursuant to an effective registration statement under the Securities Act of 1933;

• the date on which we have, during the previous three-year period, issued more than $1,000,000,000 in non- convertible debt; or

• the date on which we are deemed to be a "large accelerated filer", as defined in Rule 12b-2 of the Securities Exchange Act of 1934.

We cannot predict if investors will find our common shares less attractive because we may rely on these exemptions. If some investors find our common shares less attractive as a result, there may be a less active trading market for our common shares and our share price may be more volatile.

As a foreign private issuer, we are not subject to certain United States securities law disclosure requirements that apply to a domestic United States issuer, which may limit the information that would be publicly available to our shareholders.

As a foreign private issuer, we will be exempt from certain rules under the Securities Exchange Act of 1934 that impose disclosure requirements as well as procedural requirements for proxy solicitations under Section 14 of the Securities Exchange Act of 1934 if our common shares are registered pursuant to Section 12 of the Securities Exchange Act of 1934. In addition, our officers, directors and principal shareholders will be exempt from the reporting and "short-swing" profit recovery provisions of Section 16 of the Securities Exchange Act of 1934 if our common shares are registered pursuant to Section 12 of the Securities Exchange Act of 1934. Moreover, we are not required to file periodic reports and financial statements with the Securities and Exchange Commission as frequently or as promptly as a company that files as a U.S. domestic issuer whose securities are registered under the Securities Exchange Act of 1934, nor are we generally required to comply with the Securities and Exchange Commission's Regulation FD, which restricts the selective disclosure of material non-public information. For as long as we are a "foreign private issuer" we intend to file our annual financial statements on Form 20-F and furnish our quarterly updates on Form 6-K to the Securities and Exchange Commission for so long as we are subject to the reporting requirements of Section 13(g) or 15(d) of the Securities Exchange Act of 1934. However, the information we file or furnish is not the same as the information that is required in annual and quarterly reports on Form 10-K or Form 10-Q for U.S. domestic issuers. Accordingly, there may be less information publicly available concerning us than there is for a company that files as a U.S. domestic issuer.

Our shareholders approved a shareholder rights plan which may be implemented by management and may impede a change in control

Our shareholders approved a shareholder rights plan which has not been implemented by management, but which, if implemented, may impede a change in control. The shareholder rights plan provides for the issuance of one right for each common share of the company outstanding, and the rights become separable and exercisable upon the receipt of a take-over bid or similar proposal other than those meeting certain conditions or those that are exempted by our board of directors. The potential for the rights becoming separable and exercisable may have the effect of impeding a change of control of the company.

Risks Related to Our Common Shares

Because we can issue additional common shares or preferred shares, our shareholders may experience dilution in the future.

We are authorized to issue an unlimited number of common shares without par value and an unlimited number of preferred shares without par value. Our board of directors has the authority to cause us to issue additional common shares or preferred shares and to determine the special rights and restrictions of the shares of one or more series of our preferred shares, without consent of our shareholders. The issuance of any such securities may result in a reduction of the book value or market price of our common shares. Given the fact that we have not achieved profitability or generated positive cash flow historically, and we operate in a capital intensive industry with significant working capital requirements, we may be required to issue additional common equity or securities that are dilutive to existing common shares in the future in order to continue its operations. Our efforts to fund our intended business plan may result in dilution to existing shareholders. Further, any such issuances could result in a change of control or a reduction in the market price for our common shares.

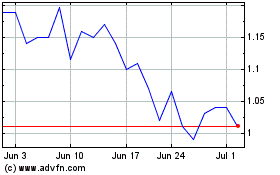

The market price of our common shares may be volatile and may fluctuate in a way that is disproportionate to our operating performance.

Our common shares are quoted on Nasdaq and listed on the TSXV. Trading of shares on Nasdaq or TSXV is often characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects.

The price of our common shares has fluctuated significantly. This volatility could depress the market price of our common shares for reasons unrelated to operating performance. The market price of our common shares could decline due to the impact of any of the following factors upon the market price of our common shares:

-

sales or potential sales of substantial amounts of our common shares;

-

announcements about us or about our competitors;

-

litigation and other developments relating to our company or those of our suppliers or our competitors;

-

conditions in the automobile industry;

-

governmental regulation and legislation;

-

variations in our anticipated or actual operating results;

-

change in securities analysts' estimates of our performance, or our failure to meet analysts' expectations;

-

change in general economic conditions or trends;

-

changes in capital market conditions or in the level of interest rates; and

-

investor perception of our industry or our prospects.

Many of these factors are beyond our control. The stock markets in general, and the market price of common shares of vehicle companies in particular, have historically experienced extreme price and volume fluctuations. These fluctuations often have been unrelated or disproportionate to the operating performance of these companies. These broad market and industry factors could reduce the market price of our common shares, regardless of our actual operating performance.

A prolonged and substantial decline in the price of our common shares could affect our ability to raise further working capital, thereby adversely impacting our ability to continue operations.

A prolonged and substantial decline in the price of our common shares could result in a reduction in the liquidity of our common shares and a reduction in our ability to raise capital. Because we plan to acquire a significant portion of the funds we need in order to conduct our planned operations through the sale of equity securities, a decline in the price of our common shares could be detrimental to our liquidity and our operations because the decline may cause investors not to choose to invest in our shares. If we are unable to raise the funds we require for all our planned operations and to meet our existing and future financial obligations, we may be forced to reallocate funds from other planned uses and may suffer a significant negative effect on our business plan and operations, including our ability to develop new products and continue our current operations. As a result, our business may suffer, and we may go out of business.

Because we do not intend to pay any cash dividends on our common shares in the near future, our shareholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common shares in the near future. The declaration, payment and amount of any future dividends will be made at the discretion of our board of directors, and will depend upon, among other things, the results of operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and if dividends are paid, there is no assurance with respect to the amount of any such dividend. Unless we pay dividends, our shareholders will not be able to receive a return on their shares unless they sell them.

We may be classified as a "passive foreign investment company," which may have adverse U.S. federal income tax consequences for U.S. shareholders.

Generally, for any taxable year in which 75% or more of our gross income is passive income, or at least 50% of the average quarterly value of our assets (which may be determined in part by the market value of our common shares, which is subject to change) are held for the production of, or produce, passive income, we would be characterized as a passive foreign investment company ("PFIC") for U.S. federal income tax purposes. Our status as a PFIC is a fact-intensive determination made on an annual basis, and we cannot provide any assurance regarding our PFIC status for the taxable year ending March 31, 2021 or for future taxable years.

If we are a PFIC for any year during a non-corporate U.S. shareholder's holding period of our common shares, then such non-corporate U.S. shareholder generally will be required to treat any gain realized upon a disposition of our common shares, or any so-called "excess distribution" received on our common shares, as ordinary income, rather than as capital gain, and the preferential tax rate applicable to dividends received on our common shares would not be available. Interest charges would also be added to the taxes on gains and distributions realized by all U.S. holders.

A U.S. shareholder may avoid these adverse tax consequences by making a timely and effective "qualified electing fund" election ("QEF election"). A U.S. shareholder who makes a QEF election generally must report, on a current basis, its share of our ordinary earnings and net capital gains, whether or not we distribute any amounts to our shareholders. The QEF election is available only if our company characterized as a PFIC provides a U.S. shareholder with certain information regarding its earnings and capital gains as required under applicable U.S. Treasury regulations. In the event we become a PFIC, U.S. Holders should be aware that we might not satisfy the recordkeeping requirements that apply to a QEF or supply U.S. Holders with information such U.S. Holders require to report under the QEF rules in the event that our company is a PFIC for any tax year.

A U.S. shareholder may also mitigate the adverse tax consequences by timely making a mark-to-market election. A U.S. shareholder who makes the mark-to-market election generally must include as ordinary income each year the increase in the fair market value of the common shares and deduct from gross income the decrease in the value of such shares during each of its taxable years. A mark-to-market election may be made and maintained only if our common shares are regularly traded on a qualified exchange, including Nasdaq. Whether our common shares are regularly traded on a qualified exchange is an annual determination based on facts that, in part, are beyond our control. Accordingly, a U.S. shareholder might not be eligible to make a mark-to-market election to mitigate the adverse tax consequences if we are characterized as a PFIC.

Each U.S. shareholder should consult their own tax advisors with respect to the possibility of making these elections and the U.S. federal income tax consequences of the acquisition, ownership and disposition of our common shares. In addition, our PFIC status may deter certain U.S. investors from purchasing our common shares, which could have an adverse impact on the market price of our common shares.

ITEM 4. INFORMATION ON THE COMPANY

Summary

We are a corporation incorporated under the Business Corporations Act (British Columbia) in British Columbia, Canada under the name "GreenPower Motor Company Inc." with an authorized share structure of unlimited number of common shares and preferred shares without par value. Our principal place of business is located at Suite 209 - 240 Carrall Street, Vancouver, British Columbia V6J 2B2, Canada and our telephone number is (604) 563-4144.

Our registered records office is located at Suite 900 - 885 West Georgia Street, Vancouver, BC V6C 3H1, Canada and its telephone number is (604) 687-5700, attention Mr. Virgil Z. Hlus.

Our registered agent in the United States is GKL Corporate/Search, Inc., located at One Capitol Mall, Suite 660, Sacramento, California 95814 and its telephone number is (800) 446-5455.

Additional information related us is available on SEDAR at www.sedar.com and www.greenpowermotor.com. We do not incorporate the contents of our website or of sedar.com into this Annual Report. Information on our website does not constitute part of this Annual Report.

A. History and Development of Our Company

Our company was incorporated under the Business Corporations Act (British Columbia) on March 30, 2010 as "Oakmont Capital Corp." Oakmont Capital Corp.'s authorized capital consisted of an unlimited number of common and preferred shares. On June 17, 2011, Oakmont Capital Corp. completed an initial public offering of 4,000,000 common shares for gross proceeds of CDN$400,000 and the Oakmont Capital Corp. shares began trading on the TSX Venture Exchange on June 21, 2011 under the symbol "OMK.P". Prior to completing its Qualifying Transaction (as defined in the policies of the TSX Venture Exchange), Oakmont Capital Corp. was a capital pool company listed for trading on the TSX Venture Exchange in Canada. A capital pool company is a company with no assets other than cash and no commercial operations. The capital pool company uses its funds to seek out an investment opportunity.

On October 25, 2012, Oakmont Capital Corp. entered into a share exchange agreement with 0939181 B.C. Ltd., pursuant to which Oakmont Capital Corp. agreed to acquire 0939181 B.C. Ltd., which would constitute Oakmont Capital Corp.'s Qualifying Transaction. On July 3, 2013, the TSX Venture Exchange accepted Oakmont Capital Corp.'s Qualifying Transaction. Oakmont Capital Corp. then became a Tier 2 Mining Issuer on the TSX Venture Exchange. On July 3, 2013, Oakmont Capital Corp. also changed its name to "Oakmont Minerals Corp." The common shares of Oakmont Minerals Corp. began trading on the TSX Venture Exchange under the symbol "OMK" on July 8, 2013. Oakmont Minerals Corp. was then a natural resource company engaged in the acquisition and exploration of resource properties, with its focus on the Utah Manganese Properties, which included four separate properties (known as Duma Point, Dubinky Well, Moab Fault and Flat Iron) consisting of 150 mineral claims totaling 1,250 hectares held 100% by Utah Manganese Inc., a wholly-owned subsidiary of 0939181 B.C. Ltd. Oakmont Minerals corp. was engaged in the exploration of the Utah Manganese Properties to determine the presence of geo-chemical characteristics that could support small-to-medium scale extraction of minerals suitable for use in specialty high strength steel production. Oakmont Minerals Corp. remained in the exploration stage and did not generate revenues or income from operations.

On December 23, 2014, 0999314 B.C. Ltd., a British Columbia corporation and a wholly-owned subsidiary of Oakmont Minerals Corp. completed an amalgamation with GreenPower Motor Company Inc., a British Columbia corporation, pursuant to an amalgamation agreement between Oakmont Minerals Corp., 0999314 B.C. Ltd., and GreenPower Motor Company Inc. dated April 14, 2014. The amalgamated company (with the name "0999314 B.C. Ltd.") became a wholly-owned subsidiary of Oakmont Minerals Corp. and Oakmont Minerals Corp. changed its name to "GreenPower Motor Company Inc." and the common shares of GreenPower Motor Company Inc. (formerly Oakmont Minerals Corp.) were consolidated on the basis of two pre-consolidation shares for each post-consolidation share. And our common shares began trading under the symbol "GPV" on the TSX Venture Exchange effective December 30, 2014. For accounting purposes, this amalgamation was considered a reverse take-over whereby GreenPower Motor Company Inc. was considered the acquiring company of Oakmont Minerals Corp. Subsequent to the completion of the amalgamation, the business of GreenPower Motor Company Inc. became the business of the amalgamated company.

Prior to the amalgamation on December 23, 2014, GreenPower Motor Company Inc., the acquiring company of Oakmont Minerals Corp. for accounting purposes, was incorporated on September 18, 2007 as "Blackrock Resources Ltd." under the Business Corporations Act (British Columbia), with an authorized share structure of unlimited number of common shares and preferred shares without par value. Pursuant to share purchase agreements dated September 30, 2013, Blackrock Resources Ltd. completed a reverse takeover transaction with GP GreenPower Industries Inc., whereby it acquired all of the issued and outstanding shares of GP GreenPower Industries Inc. in exchange for the issuance of 47,534,402 common shares of Blackrock Resources Ltd. In connection with the reverse takeover transaction with GP GreenPower Industries Inc., Blackrock Resources Ltd. changed its name from "Blackrock Resources Ltd." to its then name, "GreenPower Motor Company Inc.", on July 22, 2013.

In May 2015, our common shares were approved for trading on the OTCQB in the United States under the trading symbol "GPVRF".

In October 2015, we announced the sale of two school buses to Adomani Inc. and appointed Adomani Inc. as a non-exclusive authorized factory sales representative for school buses in California. In November 2015, we entered into a letter of intent with the Greater Victoria Harbour Authority and CVS Cruise Victoria Ltd. to lease our EV 550 double decker buses. The buses were delivered to CVS Cruise Victoria Ltd. in February 2018. By mid-2016, our company was offering a suite of transit buses ranging in length from 30 feet to 45 feet, a 45-foot coach bus, a 45-foot double decker, and a school bus.

In December 2016, we announced that the California Air Resources Board had awarded $9.5 million to the City of Porterville to deploy 10 GreenPower EV 350 40-foot transit buses and to install 11 charging stations on its transit routes. Two EV 350 buses were delivered to the City of Porterville in the year ended March 31, 2018, and another 6 buses were delivered in the year ended March 31, 2019. The 9th bus was delivered during the quarter ended June 30,2019 and the final bus was delivered to the City of Porterville during the quarter ended September 30, 2019.

In June 2018, our company appointed Creative Bus Sales as our exclusive sales agent. Creative Bus Sales is the largest bus dealer in the United States, with 18 physical locations, a 75-person sales team and more than 200 service and support staff.

During the year ended March 31, 2019, we delivered 14 buses to customers, pursuant to vehicle leases and vehicle sales. The customers were all located in the state of California, and include Sacramento Regional Transit, the University of California San Francisco, the Port of Oakland, Airline Coach Services and the City of Porterville. On November 14, 2018, Utah Manganese Inc., the wholly-owned subsidiary of 0939181 B.C. Ltd., the company with which Oakmont Capital Corp. effected its Qualifying Transaction in 2013, changed its name from "Utah Manganese Inc." to "San Joaquin Valley Equipment Leasing Inc." and San Joaquin Valley Equipment Leasing Inc. is now used by GreenPower Motor Company Inc. to enter into lease agreements to lease its buses.

During the year ended March 31, 2020, we completed and delivered a total of 68 buses, including 62 EV Stars, 4 Synapse school buses, and 2 EV 350s. Of this total, the Company provided lease financing for 24 EV Stars, 2 with San Diego Airport Parking, and 22 with Green Commuter. Beginning in March 2020, GreenPower's business and operations began adapting in response to the COVID-19 global pandemic. As an essential business manufacturing on behalf of the transit industry, we maintained production, although at reduced levels compared to prior to the pandemic. Some of our suppliers and contract manufacturers temporarily suspended or reduced their production levels, and our internal staffing levels in production were temporarily reduced in order to comply with government regulations and maintain physical distancing in order to protect the health of our staff, customers and other stakeholders. While we were able to maintain sales and production during this period, we did so at a reduced rate in order to comply with physical distancing requirements and government health regulations.

During the three months ended March 31, 2020 GreenPower entered into agreements with Momentum Dynamics ("Momentum") to integrate wireless charging into the EV Star and with Perrone Robotics ("Perrone") to build a fully autonomous EV Star for the transit market. GreenPower has agreed to collaborate with Momentum and separately with Perrone to integrate their components, software and technology on an EV Star, and to work with these companies on sales of EV Stars that have integrated their respective technologies. Both parties have agreed to provide technical support and training in order to integrate the technology and provide after sales support to potential customers.

During the year ended March 31, 2021, the Company delivered a total of 74 buses, including 35 EV Stars and 5 EV 250s for which the Company provided lease financing, 30 EV Stars that had previously been on lease and whose leases were cancelled and the vehicles were subsequently sold, and the sale of 1 Synapse school bus, 1 EV Star Cargo Plus, 1 EV Star Plus, and 1 EV Star. Included in the 30 EV Stars that had previously been on lease and whose leases were cancelled and the vehicles subsequently sold were 13 EV Stars where the leases were originally entered into during the year ended March 31, 2020.

Towards the end of our prior fiscal year and continuing into the first quarter, GreenPower's operations were temporarily curtailed in response to the COVID-19 pandemic and government stay in place orders. Further, the COVID-19 pandemic impacted the operation of certain of the Company's suppliers and contract manufacturers. While we have recently seen a gradual re-opening of the economy, and a resumption of travel and sales activity, this activity is not at the level it was prior to the pandemic. Management undertook a number of steps during this period to retain financial liquidity and manage the impact of these events. Steps taken by management include: the temporary reduction in salaries of certain employees including a 30% salary reduction by the CEO, the temporary postponement of interest payments on convertible debentures held by insiders, the securing of funds and grants under programs offered in Canada and the US, including the SBA's PPP program, and pro-actively managing the Company's supply chain by securing critical parts and supplies in order to continue manufacturing electric vehicles.

During April 2020 GreenPower received the final report for the EV Star's Federal Transit Bus Test performed for the Federal Transit Administration at the Altoona Bus Testing site at Penn State University. This tests the maintainability, reliability, safety and performance of transit vehicles, and is required by the FTA for transit properties looking to purchase vehicles with federal funds. The EV Star passed the Altoona Test with an overall score of 92.2 which, as of the date of the test, makes the EV Star the highest scoring medium or heavy-duty vehicle that has completed the Altoona test, and the only all-electric Class 4 vehicle to have passed the Altoona test. Management believes the combination of Altoona certification and the ability to manufacture a Buy America compliant vehicle offer significant competitive advantages to GreenPower in successfully deploying vehicles to transit authorities based in the US.

The principal capital expenditures of our company have been investments in a 9.3 acre parcel of land in the City of Porterville with a carrying value of $801,317 as at March 31, 2021, and in electric buses and EV equipment with a carrying value of $1,023,164 as at March 31, 2021. To date, our principal capital expenditures have been funded with capital which has been sourced from our company's sale of common shares, convertible debentures, warrants, proceeds from the exercise of warrants and options for common shares, loans from related parties, and from our company's $8 million operating credit line with the Bank of Montreal.

There have been no indications of any public takeover offers by third parties in respect of our company's shares or by our company in respect of other companies' shares which have occurred during the last and current financial year.

B. Business Overview

GreenPower designs, builds and distributes a full suite of high-floor and low-floor all-electric medium and heavy-duty vehicles, including transit buses, school buses, shuttles, cargo van, and a cab and chassis. GreenPower employs a clean-sheet design to manufacture all-electric vehicles that are purpose built to be battery powered with zero emissions while integrating global suppliers for key components. This OEM platform allows GreenPower to meet the specifications of various operators while providing standard parts for ease of maintenance and accessibility for warranty requirements. GreenPower was founded in Vancouver, Canada with primary operational facilities in southern California. Listed on the Toronto exchange since November 2015, GreenPower completed its U.S. IPO and NASDAQ listing in August 2020.

We are an OEM of Class 4-8 commercial, heavy-duty bus vehicles for products ranging from a 25-foot Min-eBus to a 45-foot double decker bus. We utilize various contract manufacturers in Malaysia, Taiwan, Hong Kong and China for all of the major components with final assembly in Porterville, California.

We believe our battery-electric commercial vehicles offer fleet operators significant benefits, which include:

• low total cost-of-ownership vs. conventional gas or diesel-powered vehicles;

• lower maintenance costs;

• reduced fuel expenses;