UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2021

Commission File Number 000-50113

Golar

LNG Limited

(Exact name of Registrant as specified in its Charter)

2nd

Floor, S.E. Pearman Building

9 Par-la-Ville Road

Hamilton, HM 11, Bermuda

(Address of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F

x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101 (b)(1): ¨

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide

an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101 (b)(7): ¨

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report

or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in

which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under

the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other

document is not a press release, is not required to be and has not been distributed to the registrant’s security holders,

and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

INFORMATION CONTAINED IN THIS FORM 6-K

REPORT

GMLP Merger Transactions

On January 13, 2021, Golar LNG Partners

LP, a Marshall Islands limited partnership (“GMLP”), entered into an Agreement and Plan of Merger (the “GMLP

Merger Agreement”) with New Fortress Energy Inc., a Delaware corporation (“NFE”), Golar GP LLC, a Marshall Islands

limited liability company and the general partner of GMLP (the “General Partner”), Lobos Acquisition LLC, a Marshall

Islands limited liability company and an indirect subsidiary of NFE (“GMLP Merger Sub”), and NFE International Holdings

Limited, a private limited company incorporated under the laws of England and Wales and an indirect subsidiary of NFE (“GP

Buyer”), pursuant to which GMLP Merger Sub will merge with and into GMLP, with GMLP surviving the merger as an indirect subsidiary

of NFE (the “GMLP Merger”). Golar LNG Limited, a Bermuda exempted company (“Golar”), owns the General Partner

and approximately 30.8% of the outstanding common units representing limited partner interests in GLMP (the “Common Units”).

At the effective time of the GMLP Merger

(the “GMLP Effective Time”), pursuant to the GMLP Merger Agreement, each Common Unit that is issued and outstanding

as of immediately prior to the GMLP Effective Time will automatically be converted into the right to receive $3.55 in cash (the

“Common Unit Consideration”). At the GMLP Effective Time, each of the incentive distribution rights of GMLP will be

cancelled and cease to exist, and no consideration shall be delivered in respect thereof. Each 8.75% Series A Cumulative Redeemable

Preferred Unit of GMLP issued and outstanding immediately prior to the GMLP Effective Time will be unaffected by the GMLP Merger

and will remain outstanding, and no consideration shall be delivered in respect thereof. Each outstanding unit representing a general

partner interest in the Partnership that is issued and outstanding immediately prior to the GMLP Effective Time will remain issued

and outstanding immediately following the GMLP Effective Time.

At the GMLP Effective Time, each outstanding

option to purchase Common Units granted pursuant to GMLP’s long-term incentive plan (each, a “Partnership Option”),

whether or not vested, will automatically be vested, cancelled and converted into the right to receive an amount in cash equal

to the product of (i) the excess, if any, of the Common Unit Consideration over the applicable exercise price per Common Unit

of such Partnership Option and (ii) the number of Common Units subject to such Partnership Option. Any Partnership Option

which has a per Common Unit exercise price that is greater than or equal to the Common Unit Consideration will be cancelled at

the GMLP Effective Time for no consideration or payment.

At the GMLP Effective Time, each Partnership

Phantom Unit granted pursuant to GMLP’s long-term incentive plan, whether or not vested, will automatically be vested, cancelled

and converted into the right to receive an amount in cash equal to the product of (i) the Common Unit Consideration and (ii) the

number of Common Units subject to such Partnership Phantom Unit.

Concurrently with the consummation of the

GMLP Merger, GP Buyer will purchase from Golar, and Golar will transfer to GP Buyer (the “GP Transfer” and, collectively

with the GMLP Merger and the other transactions contemplated by the GMLP Merger Agreement, the “GMLP Transactions”),

all of the outstanding membership interests in the General Partner pursuant to a Transfer Agreement dated as of January 13,

2021 (the “Transfer Agreement”) for a purchase price of $5,099,188, which is equivalent to $3.55 per general partner unit of GMLP. The Transfer Agreement also provides for the parties

to enter into, among other things, an Omnibus Agreement, a form of which is attached as Exhibit B to the Transfer Agreement,

relating to the provision of certain management services related to the vessels GMLP owns. The obligation of the parties to the

Transfer Agreement to consummate the GP Transfer is subject to certain closing conditions, including: (1) the accuracy of

the other party's representations and warranties, subject to certain materiality qualifiers; (2) performance in all material

respects by the other party; (3) the delivery of certain deliverables under the Transfer Agreement by both parties; and (4) the

conditions to GMLP’s or NFE’s (as applicable) obligations to close the GMLP Merger pursuant to the terms of the GMLP

Merger Agreement must have been waived or satisfied.

The board of directors of GMLP (the “GMLP

Board”), acting based upon the recommendation of its Conflicts Committee (the “Conflicts Committee”), (i) determined

that the GMLP Merger Agreement and the GMLP Transactions were in the best interests of GMLP, including the holders of Common Units

(the “Common Unitholders”), (ii) approved the GMLP Merger Agreement and the GMLP Transactions and (iii) resolved

to recommend to the Common Unitholders the approval of the GMLP Merger Agreement. The board of directors of NFE approved the GMLP

Merger Agreement and the GMLP Transactions. Golar, in its individual capacity and as sole member of the General Partner, as applicable,

approved the GMLP Merger Agreement and the GMLP Transactions.

The GMLP Merger Agreement contains customary

representations and warranties by the parties. NFE, GMLP Merger Sub, GMLP and the General Partner have also agreed to various customary

covenants and agreements, including, among others, to conduct, subject to certain exceptions, their business in the ordinary course

consistent with past practice during the period between the execution of the GMLP Merger Agreement and the GMLP Effective Time.

The closing of the GMLP Merger is subject

to satisfaction or waiver (if applicable) of certain conditions, including: (i) the approval of the GMLP Merger Agreement

by the required majority of the Common Unitholders, (ii) the receipt of certain regulatory approvals; (iii) the receipt

of certain specified material third-party consents; (iv) the absence of any legal restraint issued by any court or governmental

entity of competent jurisdiction preventing consummation of the GMLP Merger; (v) the absence of a material adverse effect

on either party; (vi) the accuracy of each party’s representations and warranties, subject in most cases to materiality

or material adverse effect qualifications; (vii) material compliance with each party’s covenants; and (viii) all

conditions to Golar’s or NFE’s (as applicable) obligation to close the GP Transfer under the Transfer Agreement having

been satisfied or waived.

The GMLP Merger Agreement may be terminated

by NFE or GMLP (which, in the case of GMLP, must be approved by the Conflicts Committee) under certain circumstances, including,

among others, by either NFE or GMLP if the closing of the GMLP Merger has not occurred on or before July 13, 2021, and further

provides that, upon termination of the GMLP Merger Agreement under certain circumstances, GMLP may be required to pay NFE a termination

fee equal to $9,424,849. GMLP may also be required to pay NFE for certain expenses incurred by NFE in an amount not to exceed $2,513,293

if the GMLP special meeting concludes and the required majority of the Common Unitholders do not approve the GMLP Merger Agreement.

Contemporaneously with the execution of

the GMLP Merger Agreement, NFE, GMLP, Golar and the General Partner entered into a support agreement (the “Support Agreement”),

which provides for, among other things, Golar’s and the General Partner’s agreement to vote all of the Common Units

held by them as of such date (i) in favor of the adoption of the GMLP Merger Agreement, (ii) against any alternative

proposal, and (iii) against any amendment of GMLP’s certificate of limited partnership or limited partnership agreement

or other proposal that would delay, impede, frustrate, prevent or nullify the GMLP Merger or GMLP Merger Agreement or change in

any manner the voting rights of any outstanding Common Units. In the event of an Adverse Recommendation Change (as defined in the

GMLP Merger Agreement), the obligation of Golar and the General Partner to vote with respect to the foregoing matters will be modified

so that Golar and the General Partner will vote (i) a number of Common Units equal to 20% of the outstanding Common Units

as of the Partnership Meeting Date (as defined in the GMLP Merger Agreement) in respect of such matters and (ii) all remaining

Common Units owned by them in a manner that is proportionate to the manner in which all outstanding Common Units (other than Common

Units held by Golar and the General Partner) are voted in respect of such matters.

The GMLP Merger Agreement, the Transfer

Agreement and the Support Agreement are attached hereto as Exhibits 4.1, 4.2 and 4.3, respectively, and are incorporated herein

by reference. The foregoing summary has been included to provide investors and security holders with information regarding the

terms of the GMLP Merger Agreement, the Transfer Agreement and the Support Agreement and is qualified in its entirety by the terms

and conditions of the GMLP Merger Agreement, the Transfer Agreement and the Support Agreement. It is not intended to provide any

other factual information about the parties or their respective subsidiaries and affiliates. The GMLP Merger Agreement and the

Transfer Agreement contain representations and warranties by each of the parties to the GMLP Merger Agreement, the Transfer Agreement

and the Support Agreement, which were made only for purposes of the GMLP Merger Agreement, the Transfer Agreement and the Support

Agreement and as of specified dates. The representations, warranties and covenants in the GMLP Merger Agreement, the Transfer Agreement

and the Support Agreement were made solely for the benefit of the parties to the GMLP Merger Agreement and the Transfer Agreement;

may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made

for the purposes of allocating contractual risk between the parties to the GMLP Merger Agreement, the Transfer Agreement and the

Support Agreement instead of establishing these matters as facts; and may be subject to standards of materiality applicable to

the contracting parties that differ from those applicable to investors. Investors should not rely on the representations, warranties

and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the parties or any

of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations, warranties

and covenants may change after the date of the GMLP Merger Agreement, the Transfer Agreement and the Support Agreement, which subsequent

information may or may not be fully reflected in NFE’s, GMLP’s or Golar’s public disclosures.

Hygo Merger Transactions

On January 13, 2021, NFE, Hygo Energy

Transition Ltd., a Bermuda exempted company (“Hygo”), Golar, Stonepeak Infrastructure Fund II Cayman (G) Ltd.

(“Stonepeak”), and Lobos Acquisition Ltd., a Bermuda exempted company and an indirect, wholly-owned Subsidiary of NFE

(“Hygo Merger Sub”), entered into an Agreement and Plan of Merger (the “Hygo Merger Agreement”), pursuant

to which Hygo Merger Sub will merge with and into Hygo (the “Hygo Merger”), with Hygo surviving the Hygo Merger as

a wholly owned subsidiary of NFE (the “Surviving Company”). As of the date of the Hygo Merger Agreement, each of Golar

and Stonepeak (together, the “Hygo Shareholders”) owns 50% of the outstanding common shares, par value $1.00 per share,

of Hygo (each, a “Hygo Share”).

At the effective time of the Hygo Merger

(the “Hygo Effective Time”), pursuant to the Hygo Merger Agreement: (i) Golar will receive 18.6 million shares of Class A Common Stock, par value $0.01 per share, of NFE (“Common Stock”) and

an aggregate of $50 million in cash and (ii) Stonepeak will receive 12.7 million shares of Common Stock and an aggregate of $530 million

in cash.

The respective boards of directors of NFE,

Hygo Merger Sub and Hygo have approved the Hygo Merger Agreement and the transactions contemplated thereby. Concurrently with the

execution of the Hygo Merger Agreement, the Hygo Shareholders executed and delivered to NFE a written consent in their capacity

as the holders of all of the outstanding Hygo Shares, and, solely with respect to Stonepeak, also in its capacity as the holder

of all of the outstanding redeemable preferred share, par value $5.00 per share, of Hygo, approving the Hygo Merger Agreement and the Hygo Merger, thereby providing all

requisite approval of the Hygo Shareholders that is required to consummate the Hygo Merger.

The Hygo Merger Agreement contains customary

representations and warranties by each of NFE, Hygo, and the Hygo Shareholders. NFE and Hygo have also agreed to various customary

covenants and agreements, including, among others, to conduct, subject to certain exceptions, their business in the ordinary course

during the period between the execution of the Hygo Merger Agreement and the Hygo Effective Time.

The closing of the Hygo Merger is subject

to satisfaction or waiver (if applicable) of certain conditions, including: (i) the receipt of all required regulatory approvals;

(ii) the receipt of certain specified material third-party consents; (iii) the absence of any legal restraint issued

by any court or governmental entity of competent jurisdiction preventing consummation of the Hygo Merger; (iv) the approval

for listing on the Nasdaq Global Select Market of the Common Stock to be issued in the Hygo Merger; (v) the absence of a material

adverse effect on either party; (vi) the accuracy of each party’s representations and warranties, subject in most cases

to materiality or material adverse effect qualifications; (vii) material compliance with each party’s covenants; and

(viii) delivery of a transition services agreement and shareholders’ agreement, each substantially in the applicable

form attached as exhibits thereto.

The Hygo Merger Agreement may be terminated

by NFE or Hygo under certain circumstances, including, among others, by either NFE or Hygo if the closing of the Hygo Merger has

not occurred on or before July 12, 2021.

The Hygo Merger Agreement is attached hereto

as Exhibit 4.4 and is incorporated herein by reference. The foregoing summary has been included to provide investors and security

holders with information regarding the terms of the Hygo Merger Agreement and is qualified in its entirety by the terms and conditions

of the Hygo Merger Agreement. It is not intended to provide any other factual information about the parties or their respective

subsidiaries and affiliates. The Hygo Merger Agreement contains representations and warranties by each of the parties to the Hygo

Merger Agreement, which were made only for purposes of the Hygo Merger Agreement and as of specified dates. The representations,

warranties and covenants in the Hygo Merger Agreement were made solely for the benefit of the parties to the Hygo Merger Agreement;

may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made

for the purposes of allocating contractual risk between the parties to the Hygo Merger Agreement instead of establishing these

matters as facts; and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable

to investors. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations

of the actual state of facts or condition of the parties or any of their respective subsidiaries or affiliates. Moreover, information

concerning the subject matter of the representations, warranties and covenants may change after the date of the Hygo Merger Agreement,

which subsequent information may or may not be fully reflected in NFE’s, Hygo’s or Golar’s public disclosures.

Cautionary Statement Regarding Forward-Looking

Statements

This report contains forward-looking statements

(as defined in Section 21E of the Securities Exchange Act of 1934, as amended). All statements, other than statements of historical

facts, that address activities and events that will, should, could or may occur in the future are forward-looking statements. Words

such as “may,” “could,” “should,” “would,” “expect,” “plan,”

“anticipate,” “intend,” “forecast,” “believe,” “estimate,” “predict,”

“propose,” “potential,” “continue,” or the negative of these terms and similar expressions

are intended to identify such forward-looking statements. Forward-looking statements in this report include statements relating

to the proposed Hygo and GMLP transactions, the expected benefits of the transactions, the timing of the closings thereof the application

of proceeds therefrom and other statements that are not historical facts. These forward-looking statements involve many risks and

uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Specific

factors that could cause actual results to differ from those in the forward-looking statements include, but are not limited to:

(i) changes in federal, state, local and foreign laws or regulations to which NFE, Hygo, Golar or GMLP is subject; (ii) the

risk that the proposed Hygo and GMLP transactions may not be completed in a timely manner or at all; (iii) GMLP’s ability

to receive, on a timely basis or otherwise, the required approval of the proposed GMLP transaction by GMLP’s common unitholders;

(iv) the possibility that competing offers or acquisition proposals for GMLP will be made; (v) the possibility that any

or all of the various conditions to the consummation of the Hygo and GMLP transactions may not be satisfied or waived, including

the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations

or restrictions placed on such approvals); and (vi) other risk factors identified herein or from time to time in Golar’s

periodic filings with the SEC. These factors are not necessarily all of the important factors that could cause actual results to

differ materially from those expressed in any of Golar’s forward-looking statements. Other known or unpredictable factors

could also have material adverse effects on future results. You should not place undue reliance on these forward-looking statements,

which speak only as of the date of this report. Golar undertakes no obligation to update publicly any forward-looking statements

whether as a result of new information, future events or otherwise, unless required by applicable law.

THIS REPORT ON FORM 6-K IS HEREBY

INCORPORATED BY REFERENCE INTO THE REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-237936) OF THE REGISTRANT

EXHIBITS

The following exhibits are filed as part

of this Report:

|

Exhibit

|

|

|

4.1*

|

Agreement and Plan of Merger, by and among Golar LNG Partners LP, Golar GP LLC, New Fortress Energy Inc., Lobos Acquisition LLC and NFE International Holdings Limited, dated as of January 13, 2021

|

|

4.2*

|

Transfer Agreement, dated as of January 13, 2021, by and among Golar LNG Limited, Golar GP LLC and NFE International Holdings Limited

|

|

4.3*

|

Support Agreement, dated as of January 13, 2021, by and among Golar LNG Partners LP, Golar LNG Limited, Golar LNG Partners LP and Golar GP LLC

|

|

4.4*

|

Agreement and Plan of Merger by and among Hygo Energy Transition Ltd., New Fortress Energy Inc., Golar LNG Limited, Stonepeak Infrastructure Fund II Cayman (G) Ltd. and Lobos Acquisition Ltd., dated as of January 13, 2021.

|

|

|

*

|

Certain schedules and similar attachments have been omitted pursuant to Item 601(a)(5) of Regulation S-K and will be provided

to the Commission upon request.

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

|

|

|

|

GOLAR LNG LIMITED

|

|

|

|

|

|

|

|

|

|

|

|

Date: January 19, 2021

|

|

By:

|

/s/ Karl Frederik Staubo

|

|

|

|

|

Karl Fredrik Staubo

|

|

|

|

|

Chief Financial Officer

|

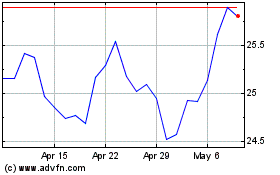

Golar LNG (NASDAQ:GLNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

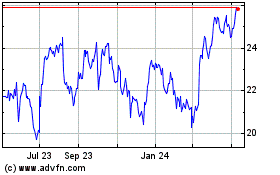

Golar LNG (NASDAQ:GLNG)

Historical Stock Chart

From Apr 2023 to Apr 2024