Current Report Filing (8-k)

October 14 2020 - 2:13PM

Edgar (US Regulatory)

0001675644

false

0001675644

2020-10-13

2020-10-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 13, 2020

FVCBankcorp, Inc.

(Exact name of registrant as specified in

its charter)

|

Virginia

|

001-38647

|

47-5020283

|

|

(State or other jurisdiction

|

(Commission file number)

|

(IRS Employer

|

|

of incorporation)

|

|

Number)

|

11325 Random Hills Road

Fairfax, Virginia 22030

(Address of Principal Executive Offices)

(Zip Code)

(703) 436-3800

Registrant’s telephone number, including

area code:

Check the appropriate

box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (See General Instruction A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant to

Section 12(b) of the Act:

|

Title of Each

Class:

|

|

Trading

Symbol(s)

|

|

Name

of Each Exchange on Which Registered:

|

|

Common Stock, $0.01 par value

|

|

FVCB

|

|

The Nasdaq Stock Market, LLC

|

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On October 13,

2020, FVCBankcorp, Inc. (the “Company”) entered into Subordinated Note Purchase Agreements (collectively, the “Purchase

Agreement”) with certain qualified institutional buyers and institutional accredited investors pursuant to which the Company

sold and issued an aggregate of $20,000,000 in aggregate principal amount of 4.875% fixed-to-floating rate subordinated notes due

2030 (the “Notes”).

The Notes will initially bear interest at

4.875% per annum, beginning October 13, 2020 to but excluding October 15, 2025, payable semi-annually in arrears. From and including

October 15, 2025 through October 14, 2030, or up to an early redemption date, the interest rate shall reset quarterly to an interest

rate per annum equal to the then current three-month SOFR plus 471 basis points, payable quarterly in arrears. Beginning on October

15, 2025 through maturity, the Notes may be redeemed, at the Company’s option, on any scheduled interest payment date. The

Notes will mature on October 15, 2030. The Purchase Agreement contains certain customary representations, warranties and covenants

made by the Company, on the one hand, and the Purchasers, severally and not jointly, on the other hand.

If certain events

of default occur, such as the bankruptcy of the Company, the holder of a Note may declare the principal amount of the Note to be

due and immediately payable. The Notes will be unsecured, subordinated obligations of the Company and will rank junior in right

of payment to the Company’s existing and future senior indebtedness. The Notes are not convertible into common stock or preferred

stock, and are not callable by the holders.

The Notes have been structured to qualify

as Tier 2 capital under bank regulatory guidelines, and the proceeds from the sale of the Notes will be utilized for general corporate

purposes, including supporting regulatory capital ratios of the Company’s subsidiary bank and the potential repayment of

the Company’s existing subordinated debt (which debt becomes callable in June 30, 2021).

The Notes were

offered and sold in reliance on the exemptions from registration provided by Section 4(a)(2) of the Securities Act of 1933,

as amended (the “Securities Act”), and Rule 506(b) of Regulation D thereunder.

The foregoing descriptions

of the Purchase Agreement and the Notes do not purport to be complete and are qualified in their entirety by reference to the forms

of the Purchase Agreement and the Note which are attached hereto as Exhibits 10.1 and 4.1, respectively, and are incorporated herein

by reference.

|

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information

set forth under Item 1.01 above is incorporated by reference into this Item 2.03.

|

|

Item 7.01

|

Regulation FD Disclosure.

|

In connection with the offering of the Notes,

the Company made presentations to potential investors. The information presented to such potential investors is attached as Exhibit

99.1 to this Current Report on Form 8-K, and is incorporated herein by reference.

The information

contained in this Item 7.01, including the information incorporated by reference herein from Exhibit 99.1, shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth

by specific reference in such a filing.

On October 13,

2020, the Company issued a press release regarding the offering of Notes. A copy of the press release is attached hereto as Exhibit

99.2 and is incorporated herein by reference.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

FVCBANKCORP, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jennifer L. Deacon

|

|

|

|

Jennifer L. Deacon, Executive

Vice President and Chief Financial Officer

|

Dated: October 14, 2020

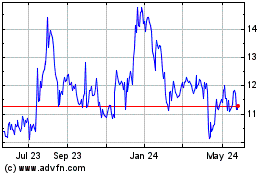

FVCBankcorp (NASDAQ:FVCB)

Historical Stock Chart

From Jun 2024 to Jul 2024

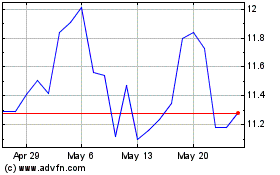

FVCBankcorp (NASDAQ:FVCB)

Historical Stock Chart

From Jul 2023 to Jul 2024