Current Report Filing (8-k)

June 04 2020 - 6:02AM

Edgar (US Regulatory)

0001704711FALSE00017047112020-06-032020-06-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

June 3, 2020

Date of Report (Date of earliest event reported)

FUNKO, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-38274

|

|

35-2593276

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

2802 Wetmore Avenue

Everett, Washington 98201

(Address of Principal Executive Offices) (Zip Code)

(425) 783-3616

(Registrant’s telephone number, including area code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Class A Common Stock,

$0.0001 par value per share

|

FNKO

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 8.01. Other Events.

On June 3, 2020, Funko, Inc. ("Funko,” or the “Company”), announced that in connection with its efforts to reduce costs and preserve liquidity in response to the uncertainty of the COVID-19 pandemic, it expects to reduce its global workforce by approximately 25%. The Company anticipates that a majority of the workforce reduction will occur by the end of the second quarter of 2020 and the remainder by the end of the third quarter of 2020.

Additionally, as a result of these actions, Funko expects to incur approximately $1 million of charges related to certain termination benefits. The Company intends to exclude the charges related to the workforce reduction from its non-GAAP financial metrics, including Adjusted EBITDA, Adjusted Net Income (Loss) and Adjusted Earnings (Loss) per Diluted Share.

Forward Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this Current Report on Form 8-K that do not relate to matters of historical fact should be considered forward-looking statements, including statements regarding our planned workforce reduction and related costs and the anticipated impact of COVID-19 on our business, financial results and financial condition. These forward-looking statements are based on management’s current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: our ability to execute our business strategy and implement our planned workforce reduction; risks related to the impact of COVID-19 on our business, financial results and financial condition; and our ability to attract and retain qualified employees and maintain our corporate culture. These and other important factors discussed under the caption “Risk Factors” in our quarterly report on Form 10-Q for the quarter ended March 31, 2020 and our other filings with the Securities and Exchange Commission could cause actual results to differ materially from those indicated by the forward-looking statements made in this Current Report on Form 8-K. Any such forward-looking statements represent management’s estimates as of the date of this Current Report on Form 8-K. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this Current Report on Form 8-K.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Date: June 3, 2020

|

FUNKO, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Tracy D. Daw

|

|

|

|

Tracy D. Daw

|

|

|

|

Sr. Vice President, General Counsel and Secretary

|

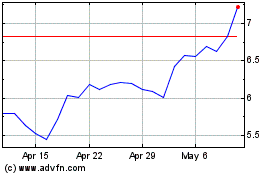

Funko (NASDAQ:FNKO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Funko (NASDAQ:FNKO)

Historical Stock Chart

From Apr 2023 to Apr 2024