Form 10-Q - Quarterly report [Sections 13 or 15(d)]

August 03 2023 - 7:11AM

Edgar (US Regulatory)

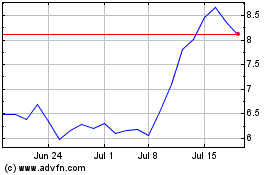

Fulcrum Therapeutics (NASDAQ:FULC)

Historical Stock Chart

From Apr 2024 to May 2024

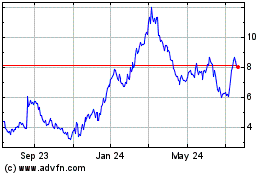

Fulcrum Therapeutics (NASDAQ:FULC)

Historical Stock Chart

From May 2023 to May 2024