UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

–––––––––––––––––––––––––––––––––––––

FORM 8-K

–––––––––––––––––––––––––––––––––––––

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report: March 9, 2016

(Date of earliest event reported)

–––––––––––––––––––––––––––––––––––––

Papa Murphy’s Holdings, Inc.

(Exact name of registrant as specified in its charter)

–––––––––––––––––––––––––––––––––––––

|

| | | | |

Delaware (State or Other Jurisdiction of Incorporation or Organization) | | 001-36432 (Commission File Number) | | 27-2349094 (IRS Employer Identification No.) |

|

| | |

8000 NE Parkway Drive, Suite 350

Vancouver, WA (Address of principal executive offices) | | 98662 (Zip Code) |

(360) 260-7272

(Registrant's telephone number, including area code)

–––––––––––––––––––––––––––––––––––––

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On March 9, 2016, Papa Murphy’s Holdings, Inc. issued a press release announcing its financial results for the quarter ended December 28, 2015. A copy of the press release is furnished as Exhibit 99.1 to this current report and is incorporated by reference herein.

The information furnished on this Form 8-K, including the exhibit attached, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed with this report:

|

| | | |

EXHIBIT NUMBER | | DESCRIPTION OF EXHIBITS | |

99.1 | | Press Release dated March 9, 2016. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

PAPA MURPHY’S HOLDINGS, INC. |

| | |

By: | | /s/ Mark Hutchens |

| | Name: | Mark Hutchens |

| | Title: | Chief Financial Officer |

Date: March 9, 2016

EXHIBIT INDEX

|

| | | |

EXHIBIT NUMBER | | DESCRIPTION OF EXHIBITS | |

99.1 | | Press Release dated March 9, 2016. | |

FOR IMMEDIATE RELEASE

Papa Murphy’s Holdings, Inc. Reports Fourth Quarter and Full Year 2015 Results and 2016 Outlook

- 4Q Revenue Growth of +19.5% -

- 46 New Store Openings in the Quarter -

Vancouver, WA, March 9, 2016 (Globe Newswire) - Papa Murphy’s Holdings, Inc. (NASDAQ: FRSH) today announced financial results for its fourth quarter and full fiscal year ended December 28, 2015.

Key financial highlights for the fourth quarter of 2015 include:

| |

• | Revenue of $33.8 million, an increase of 19.5% compared to the fourth quarter of 2014. |

| |

• | Domestic system comparable store sales decreased by 3.1%, including a 3.2% decrease at domestic franchisee-owned stores and a 2.7% decrease at company-owned stores. |

| |

• | Net income was $2.6 million, or $0.16 per diluted share, compared to $2.8 million, or $0.17 per diluted share, in the fourth quarter of 2014. |

| |

• | Net income in the fourth quarter of 2015 included a benefit of $0.7 million, or $0.04 per diluted share, from a favorable revaluation of deferred taxes and a gain from refranchising two company-owned stores. |

| |

• | Adjusted EBITDA (1) was $7.5 million, compared to $8.8 million in the fourth quarter of 2014. |

| |

• | Papa Murphy’s opened 46 new stores in the quarter across the system, including 40 in the U.S., compared to 37 new store openings in the U.S. in the fourth quarter of 2014. |

Key financial highlights for the full year 2015 include:

| |

• | Revenue of $120.2 million, an increase of 23.4% compared to fiscal year 2014. |

| |

• | Domestic system comparable store sales increased 1.9%, including increases of 1.8% at company-owned stores and 1.9% for domestic franchisee-owned stores. |

| |

• | Reported net income was $4.9 million, compared to $1.2 million in fiscal year 2014. |

| |

• | Pro forma net income(1) was $8.0 million, or $0.47 per diluted share, compared to pro forma net income of $7.2 million, or $0.43 per diluted share in 2014. |

| |

• | Fiscal 2015 pro forma net income(1) included a benefit of $0.7 million, or $0.04 per diluted share, from a favorable revaluation of deferred taxes and a gain from refranchising two company-owned stores. |

| |

• | Adjusted EBITDA (1) was $28.1 million, compared to $27.7 million in 2014. |

| |

• | Papa Murphy’s opened 111 new stores in the year, including 99 in the U.S., compared to 87 new store openings in the U.S. in 2014. |

______________________

| |

(1) | Pro forma net income and Adjusted EBITDA are non-GAAP measures. For reconciliations of Adjusted EBITDA and pro forma net income to GAAP net income and discussions of why we consider Adjusted EBITDA and pro forma net income to be useful measures, see the financial tables accompanying this release and the paragraph below entitled “Non-GAAP Financial Measures.” |

Ken Calwell, President and Chief Executive Officer of Papa Murphy’s Holdings, Inc., stated, “Our consistent run of 19 consecutive quarters of positive comparable store sales growth ended as we lapped the highly successful national launch of Gourmet Delites, which drove overall comparable store sales growth of 8.4% in the prior year quarter. However, we continue to be encouraged by the performance of some of our less developed markets where comparable store sales growth outperformed the system average by over five-hundred basis points in the quarter. Our strategy of raising brand awareness in these underpenetrated markets by investing in advertising and building stores is resonating with the customer and that gives us and our franchisee partners even greater confidence as we accelerate new unit growth in those markets.”

Calwell continued, “We continue to build our online ordering and digital marketing capability, including an accelerated launch of our new eCommerce platform, which went live across the country last week, three months ahead of schedule. We now have online ordering capability and a mobile app available in over 80% of our domestic stores and have started phase one of Precision Marketing.”

“We opened 46 stores across the system in the quarter, including 40 in the U.S., bringing our system-wide new store count for the year to 111 units and the domestic new store count for the year to 99 units. We had 11 domestic store openings planned for late 2015 that slipped into early 2016, all of which have now opened. Since the end of the quarter, we have opened a total of 18 domestic stores and expect total first-quarter domestic openings of at least 25 stores,” Calwell concluded.

Key Operating Metrics

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 28,

2015 | | December 29,

2014 | | December 28,

2015 | | December 29,

2014 |

Domestic comparable store sales growth | | | | | | | |

Franchised stores | -3.2 | % | | 8.2 | % | | 1.9 | % | | 4.3 | % |

Company-owned stores | -2.7 | % | | 10.5 | % | | 1.8 | % | | 8.1 | % |

System-wide | -3.1 | % | | 8.4 | % | | 1.9 | % | | 4.5 | % |

| | | | | | | |

System-wide sales ($’s in 000s) | $ | 238,787 |

| | $ | 238,948 |

| | $ | 892,249 |

| | $ | 849,682 |

|

| | | | | | | |

Adjusted EBITDA ($’s in 000s) | $ | 7,527 |

| | $ | 8,824 |

| | $ | 28,118 |

| | $ | 27,678 |

|

| | | | | | | |

Store Count | | | | | | | |

Franchised | 1,369 |

| | 1,342 |

| | 1,369 |

| | 1,342 |

|

Company-owned | 127 |

| | 91 |

| | 127 |

| | 91 |

|

International | 40 |

| | 28 |

| | 40 |

| | 28 |

|

System-wide | 1,536 |

| | 1,461 |

| | 1,536 |

| | 1,461 |

|

We use a variety of operating and performance metrics to evaluate the performance of its business. Below is a description of our key operating metrics:

Comparable Store Sales represents the change in year-over-year sales for domestic comparable stores. A comparable store is a store that has been open for at least 52 full weeks from the comparable date (the Tuesday following the opening date). As of the end of the fourth quarter of 2015 and 2014, we had 1,389 and 1,335 domestic comparable stores, respectively.

System-wide Sales include net sales by all of our company-owned and franchisee-owned stores.

Adjusted EBITDA is defined as net income (loss) before interest expense, provision for (benefit from) income taxes and depreciation and amortization, with further adjustments to reflect the additions and eliminations of various income statement items including non-cash charges, income and expenses that we consider not indicative of ongoing operations and various other adjustments. For a reconciliation of Adjusted EBITDA to net income, the most directly comparable GAAP measure, see the financial tables accompanying this release.

2016 Financial Outlook

Based on current information, Papa Murphy’s Holdings, Inc. is providing the following full-year guidance for fiscal year 2016, which ends on January 2, 2017:

| |

• | Domestic system-wide comparable store sales growth of approximately 2.0% to 3.0%; |

| |

• | Domestic new store openings of between 115 and 120 units, including 20 to 25 company-owned; |

| |

• | Revenue to include transaction fees from franchisees for use of the new on-line ordering platform of approximately $1.7 million and zero-margin POS License revenue of approximately $2.1 million; |

| |

• | Selling, general and administrative expenses of approximately $34 million to $36 million, inclusive of operating costs of approximately $3.1 million associated with the new on-line ordering platform and approximately $2.1 million associated with POS Licenses resold to franchisees at cost; |

| |

• | Pre-Opening costs associated with new Company stores of approximately $0.9 million; |

| |

• | Capital expenditures, including acquisitions, of approximately $13 million to $15 million; |

| |

• | Full-Year Effective Tax rate of approximately 38.5%; and |

| |

• | Diluted share-count of approximately 17 million. |

Conference Call

Papa Murphy’s Holdings, Inc. will host a conference call to discuss the third quarter financial results on Wednesday, March 9, 2016 at 5:00 p.m. Eastern Time.

The conference call can be accessed live over the phone by dialing 877-407-3982 or for international callers by dialing 201-493-6780. A replay will be available after the call and can be accessed by dialing 877-870-5176 or for international callers by dialing 858-384-5517; the passcode is 13630727. The replay will be available until Wednesday, March 16, 2016. The conference call will also be webcast live from the Company’s corporate website at investors.papamurphys.com, under

the “Events & Presentations” page. An archive of the webcast will be available at this location shortly after the call has concluded.

About Papa Murphy’s

Papa Murphy’s Holdings, Inc. (Nasdaq: FRSH) is a franchisor and operator of the largest Take ‘N’ Bake pizza chain in the United States, selling fresh, hand-crafted pizzas ready for customers to bake at home. The company was founded in 1981 and currently operates over 1,500 franchised and corporate-owned fresh pizza stores in 38 States, Canada and United Arab Emirates. Papa Murphy’s core purpose is to bring all families together through food people love with a goal to create fun, convenient and fulfilling family dinners. In addition to scratch-made pizzas, the company offers a growing menu of grab ‘n’ go items, including salads, sides and desserts. For more information, visit www.papamurphys.com.

Forward-looking Statements

This news release, as well as other information provided from time to time by Papa Murphy's Holdings, Inc. or its employees, may contain forward looking statements that involve risks and uncertainties that could cause actual results to differ materially from those anticipated in the forward looking statements. Forward-looking statements give the Company's current expectations and projections relating to the Company's financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "guidance," "anticipate," "estimate," "expect," "forecast," "project," "plan," "intend," "believe," "confident," "may," "should," "can have," "likely," "future" and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events.

Forward-looking statements in this press release include statements relating to the Company’s projected sales growth, projected system-wide sales, projected new store openings, projected selling, general, and administrative expenses, projected revenue from transaction fees, projected pre-opening costs, projected capital expenditures, projected effective tax rate, projected diluted share count, strategic, operational, and technological initiatives, including the roll-out of its e-commerce platform, future financial or operational results, and speed of consumer acceptance.

Any such forward-looking statements are not guarantees of performance or results, and involve risks, uncertainties (some of which are beyond the Company's control) and assumptions. Although the Company believes any forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results and cause them to differ materially from those anticipated in any forward-looking statements. Please refer to the risk factors discussed in the Company’s annual report on Form 10-K for the fiscal year ended December 28, 2015 (which was filed today and can be found at the SEC’s website www.sec.gov); each such risk factor is specifically incorporated into this press release. Should one or more of these risks or uncertainties materialize, the Company's actual results may vary in material respects from those projected in any forward-looking statements.

Any forward-looking statement made by the Company in this press release speaks only as of the date on which it is made. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future developments or otherwise.

Non-GAAP Financial Measures

To supplement its financial information presented in accordance with generally accepted accounting principles (GAAP), the Company is also providing with this press release the non-GAAP financial measures of EBITDA, Adjusted EBITDA and pro forma net income. EBITDA, Adjusted EBITDA and pro forma net income are not derived in accordance with GAAP and should not be considered by the reader as an alternative to net income (the most comparable GAAP financial measure to each of EBITDA, Adjusted EBITDA and pro forma net income). The Company’s management believes that EBITDA and Adjusted EBITDA are helpful as indicators of the current financial performance of the Company because EBITDA and Adjusted EBITDA reflect the additions and eliminations of various income statement items that management does not consider indicative of ongoing operating results. Management believes that pro forma net income is also helpful as an indicator of the financial performance of the Company during fiscal year 2015 and prior periods because it adjusts net income to reflect the Company’s performance as if the Company’s initial public offering and secondary offering, repayment of a portion of its long-term debt, write-down of its interest in Project Pie, LLC, and partial expensing of market vesting stock compensation had occurred at the beginning of the applicable periods and removes specific costs that are not indicative of ongoing operations. We have provided reconciliations of EBITDA, Adjusted EBITDA and pro forma net income to GAAP net income in the financial tables accompanying this release.

PAPA MURPHY’S HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statements of Operations

(In thousands of dollars, except share and per share data)

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 28,

2015 | | December 29,

2014 | | December 28,

2015 | | December 29,

2014 |

| Unaudited | | Unaudited | | |

REVENUES | | | | | | | |

Franchise royalties | $ | 10,687 |

| | $ | 10,956 |

| | $ | 40,243 |

| | $ | 39,305 |

|

Franchise and development fees | 1,129 |

| | 1,412 |

| | 4,222 |

| | 4,531 |

|

Company-owned store sales | 21,373 |

| | 15,477 |

| | 74,300 |

| | 50,598 |

|

Lease and other | 599 |

| | 422 |

| | 1,444 |

| | 2,965 |

|

Total revenues | 33,788 |

| | 28,267 |

| | 120,209 |

| | 97,399 |

|

| | | | | | | |

COSTS AND EXPENSES | | | | | | | |

Store operating costs: | | | | | | | |

Cost of food and packaging | 7,662 |

| | 5,936 |

| | 26,603 |

| | 19,686 |

|

Compensation and benefits | 5,864 |

| | 3,738 |

| | 19,858 |

| | 12,673 |

|

Advertising | 2,660 |

| | 1,511 |

| | 7,888 |

| | 5,041 |

|

Occupancy | 1,363 |

| | 824 |

| | 4,750 |

| | 2,873 |

|

Other store operating costs | 2,155 |

| | 1,283 |

| | 7,517 |

| | 4,434 |

|

Selling, general, and administrative | 7,125 |

| | 6,325 |

| | 28,207 |

| | 29,263 |

|

Depreciation and amortization | 2,622 |

| | 2,237 |

| | 10,002 |

| | 8,052 |

|

Loss (gain) on disposal of property and equipment | (317 | ) | | 45 |

| | (251 | ) | | 72 |

|

Total costs and expenses | 29,134 |

| | 21,899 |

| | 104,574 |

| | 82,094 |

|

| | | | | | | |

OPERATING INCOME | 4,654 |

| | 6,368 |

| | 15,635 |

| | 15,305 |

|

| | | | | | | |

Interest expense, net | 1,117 |

| | 1,125 |

| | 4,523 |

| | 8,025 |

|

Loss on early retirement of debt | — |

| | — |

| | — |

| | 4,619 |

|

Loss on impairment of investments | — |

| | — |

| | 4,500 |

| | — |

|

Other expense, net | 43 |

| | 60 |

| | 133 |

| | 178 |

|

INCOME BEFORE INCOME TAXES | 3,494 |

| | 5,183 |

| | 6,479 |

| | 2,483 |

|

| | | | | | | |

Provision for income taxes | 862 |

| | 2,359 |

| | 2,068 |

| | 1,235 |

|

NET INCOME | 2,632 |

| | 2,824 |

| | 4,411 |

| | 1,248 |

|

| | | | | | | |

Net loss attributable to noncontrolling interests | — |

| | — |

| | 500 |

| | — |

|

NET INCOME ATTRIBUTABLE TO PAPA MURPHY’S | 2,632 |

| | 2,824 |

| | 3,911 |

| | 1,248 |

|

| | | | | | | |

Earnings (Loss) per share of common stock | | | | | | | |

Basic | $ | 0.16 |

| | $ | 0.17 |

| | $ | 0.29 |

| | $ | (0.07 | ) |

Diluted | $ | 0.16 |

| | $ | 0.17 |

| | $ | 0.29 |

| | $ | (0.07 | ) |

Weighted average common stock outstanding | | | | | | | |

Basic | 16,706,308 |

| | 16,594,464 |

| | 16,653,127 |

| | 12,101,236 |

|

Diluted | 16,805,559 |

| | 16,710,913 |

| | 16,870,693 |

| | 12,101,236 |

|

PAPA MURPHY’S HOLDINGS, INC. AND SUBSIDIARIES

Selected Balance Sheet Data

(In thousands of dollars)

|

| | | | | | | |

| December 28,

2015 | | December 29,

2014 |

Cash and cash equivalents | $ | 6,867 |

| | $ | 5,056 |

|

Total current assets | 18,896 |

| | 14,991 |

|

Total assets | 275,471 |

| | 264,127 |

|

Total current liabilities | 24,149 |

| | 18,558 |

|

Long-term debt, net of current portion | 108,237 |

| | 110,715 |

|

Total Papa Murphy’s Holdings Inc. shareholders’ equity | 97,656 |

| | 91,298 |

|

PAPA MURPHY’S HOLDINGS, INC. AND SUBSIDIARIES

Reconciliation of Net Income to EBITDA and Adjusted EBITDA

(In thousands of dollars)

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 28,

2015 | | December 29,

2014 | | December 28,

2015 | | December 29,

2014 |

Net income as reported | $ | 2,632 |

| | $ | 2,824 |

| | $ | 4,411 |

| | $ | 1,248 |

|

Net loss attributable to noncontrolling interests | — |

| | — |

| | 500 |

| | — |

|

Net Income Attributable to Papa Murphy’s | 2,632 |

| | 2,824 |

| | 4,911 |

| | 1,248 |

|

Depreciation and amortization | 2,622 |

| | 2,237 |

| | 10,002 |

| | 8,052 |

|

Income tax provision | 862 |

| | 2,359 |

| | 2,068 |

| | 1,235 |

|

Interest expense, net | 1,117 |

| | 1,125 |

| | 4,523 |

| | 8,025 |

|

EBITDA | 7,233 |

| | 8,545 |

| | 21,504 |

| | 18,560 |

|

Loss (gain) on disposal of property and equipment (a) | (317 | ) | | 45 |

| | (251 | ) | | 72 |

|

Expenses not indicative of future operations (b) | — |

| | — |

| | 4,670 |

| | 2,300 |

|

Transaction costs (c) | — |

| | 6 |

| | 65 |

| | 78 |

|

New store pre-opening expenses (d) | 232 |

| | 21 |

| | 696 |

| | 32 |

|

Non-cash expenses and non-income based state taxes (e) | 379 |

| | 207 |

| | 1,434 |

| | 2,017 |

|

Loss on early retirement of debt (f) | — |

| | — |

| | — |

| | 4,619 |

|

Adjusted EBITDA | $ | 7,527 |

| | $ | 8,824 |

| | $ | 28,118 |

| | $ | 27,678 |

|

| | | | | | | |

Adjusted EBITDA margin (1) | 22.3 | % | | 31.2 | % | | 23.4 | % | | 28.4 | % |

| |

(1) | Adjusted EBITDA margin is calculated by dividing Adjusted EBITDA by total revenues. |

| |

(a) | Represents non-cash (gains) and losses resulting from disposal of property and equipment, including divested Company-owned stores |

| |

(b) | For 2015 represents $4,000 loss from the impairment and disposal of Project Pie, a cost-method investment, $325 bad debt on related receivables, and $345 in secondary offering costs. For 2014, $1,677 represents the elimination of management and advisory fees and related costs paid to Lee Equity Partners, LLC, $278 in IPO preparation costs, and $345 in non-recurring accrued management transition and restructuring costs related to recruiting a new CFO. |

| |

(c) | Represents transaction costs relating to the acquisition of franchised stores. |

| |

(d) | Represents expenses directly associated with the opening of new stores and incurred primarily in advance of the store opening, including wages, benefits, travel for training of opening teams, grand opening marketing costs and other store operating costs. |

| |

(e) | Represents (i) non-cash expenses related to equity-based compensation; (ii) non-cash expenses related to the difference between GAAP and cash rent expense; and (iii) state revenue taxes levied in lieu of an income tax. |

| |

(f) | Represents losses resulting from refinancing of long-term debt. |

PAPA MURPHY’S HOLDINGS, INC. AND SUBSIDIARIES

Reconciliation of Net Income to Pro Forma Net Income

(In thousands of dollars, except share and per share data)

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 28,

2015 | | December 29,

2014 | | December 28,

2015 | | December 29,

2014 |

Net income as reported | $ | 2,632 |

| | $ | 2,824 |

| | $ | 4,411 |

| | $ | 1,248 |

|

Net loss attributable to noncontrolling interests | — |

| | — |

| | 500 |

| | — |

|

Net Income Attributable to Papa Murphy’s | 2,632 |

| | 2,824 |

| | 4,911 |

| | 1,248 |

|

Management fees and expenses | — |

| | — |

| | — |

| | 1,678 |

|

Loss on early retirement of debt (1) | — |

| | — |

| | — |

| | 4,619 |

|

Reduction in interest expense based on reduced debt balance | — |

| | — |

| | — |

| | 1,839 |

|

Expenses not indicative of future operations: | | | | | | | |

Secondary offering and IPO preparation costs | — |

| | — |

| | 345 |

| | 652 |

|

Loss on Project Pie impairment and disposal | — |

| | — |

| | 4,325 |

| | — |

|

Non-cash compensation expenses | — |

| | — |

| | 287 |

| | 1,464 |

|

Incremental public company costs | — |

| | — |

| | — |

| | (655 | ) |

Income tax expense on adjustments (2) | — |

| | — |

| | (1,908 | ) | | (3,634 | ) |

Pro forma net income | $ | 2,632 |

| | $ | 2,824 |

| | $ | 7,960 |

| | $ | 7,211 |

|

| | | | | | | |

Earnings per share - pro forma: | | | | | | | |

Basic | $ | 0.16 |

| | $ | 0.17 |

| | $ | 0.48 |

| | $ | 0.43 |

|

Diluted | $ | 0.16 |

| | $ | 0.17 |

| | $ | 0.47 |

| | $ | 0.43 |

|

| | | | | | | |

Weighted-average shares outstanding - pro forma: | | | | | | | |

Basic | 16,706,308 |

| | 16,594,464 |

| | 16,653,127 |

| | 16,583,043 |

|

Diluted | 16,805,559 |

| | 16,710,913 |

| | 16,870,693 |

| | 16,741,989 |

|

| |

(1) | Represents losses resulting from refinancing of long-term debt. |

| |

(2) | Reflects the tax expense associated with adjustment 1 above at a normalized tax rate in line with our estimated long-term effective tax rate. |

Investor Contact:

Fitzhugh Taylor, ICR

fitzhugh.taylor@icrinc.com

877-747-7272

Media Contact:

Christine Beggan, ICR

Christine Beggan@icrinc.com

203-682-8329

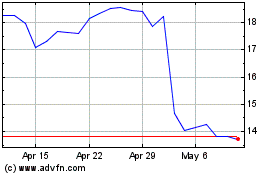

Freshworks (NASDAQ:FRSH)

Historical Stock Chart

From Jul 2024 to Aug 2024

Freshworks (NASDAQ:FRSH)

Historical Stock Chart

From Aug 2023 to Aug 2024