Fox Factory Holding Corp. (NASDAQ: FOXF) (“FOX” or the “Company”)

today reported financial results for the first quarter ended April

3, 2020.

First Quarter Fiscal 2020 Highlights

- Sales increased 14.0% to $184.4 million, compared to $161.7

million in the same period last fiscal year

- Gross margin decreased 90 basis points to 30.7%, compared to

31.6% in the same period last fiscal year; Non-GAAP adjusted gross

margin decreased 80 basis points compared to the same period last

fiscal year

- Net income attributable to FOX stockholders was $8.3 million,

or 4.5% of sales and $0.21 of earnings per diluted share, compared

to $18.1 million, or 11.3% of sales and $0.46 of earnings per

diluted share in the same period last fiscal year

- Non-GAAP adjusted net income was $20.5 million, or $0.52 of

adjusted earnings per diluted share, compared to $21.6 million, or

$0.55 of adjusted earnings per diluted share in the same period

last fiscal year

- Adjusted EBITDA was $31.3 million, or 17.0% of sales, compared

to $30.1 million, or 18.6% of sales in the same period last fiscal

year

“In an unprecedented operating environment, our

global team has done a tremendous job to come together and support

the needs of our customers,” commented Mike Dennison, FOX’s Chief

Executive Officer. “The health and safety of our employees remains

our number one priority, and we believe we are well positioned with

our diversified business model to manage through these challenging

times and emerge stronger. The resilience of our people, the power

of the FOX brand and our performance-defining ride dynamics

products combined with the strength of our valued OEM partners will

continue to provide competitive advantages in the market as we move

forward.”

Sales for the first quarter of fiscal 2020 were

$184.4 million, an increase of 14.0% as compared to sales of $161.7

million in the first quarter of fiscal 2019. This increase in sales

reflects a 24.6% increase in Powered Vehicles Group sales and a

1.8% decrease in Specialty Sports Group sales. The increase in

Powered Vehicles Group products is primarily due to the Ridetech

and SCA acquisitions, and the continued success of its broad

product lineup. The decrease in Specialty Sports Group products is

due to a shift in timing of OEM orders.

Gross margin was 30.7% for the first quarter of

fiscal 2020, a 90 basis point decrease from gross margin of 31.6%

in the first quarter of fiscal 2019. Non-GAAP adjusted gross margin

decreased 80 basis points to 30.9% from the same prior fiscal year

period. The decrease in gross margin was primarily due to

approximately $1.8 million of factory costs incurred during

mandated closures in response to COVID-19 that are not added back

to adjusted gross margin. A reconciliation of gross profit to

non-GAAP adjusted gross profit and the resulting non-GAAP adjusted

gross margin is provided at the end of this press release.

Total operating expenses were $45.0 million for

the first quarter of fiscal 2020 compared to $29.2 million in the

first quarter of fiscal 2019. The increase in operating expenses is

primarily due to acquisition-related costs associated with SCA of

$10.9 million, as well as the inclusion of SCA's operating costs

and amortization expense. The Company’s expenses for the first

quarter of fiscal 2020 also include operating costs related to

Ridetech which was acquired in the second quarter of fiscal 2019,

as well as increases in line with business growth. These increases

were partially offset by lower patent litigation related costs.

As a percentage of sales, operating expenses

were 24.4% for the first quarter of fiscal 2020, compared to 18.1%

in the first quarter of fiscal 2019. Non-GAAP operating expenses

were $30.9 million, or 16.7% of sales in the first quarter of

fiscal 2020, compared to $25.5 million, or 15.7% of sales in the

first quarter of the prior fiscal year. Reconciliations of

operating expense to non-GAAP operating expense are provided at the

end of this press release.

The Company’s effective tax rate was 9.5% in the

first quarter of fiscal 2020, compared to an effective tax rate of

12.4% in the first quarter of fiscal 2019.

Net income attributable to FOX stockholders in

the first quarter of fiscal 2020 was $8.3 million, compared to

$18.1 million in the first quarter of the prior fiscal year.

Earnings per diluted share for the first quarter of fiscal 2020 was

$0.21, compared to earnings per diluted share of $0.46 for the

first quarter of fiscal 2019.

Non-GAAP adjusted net income was $20.5 million,

or $0.52 of adjusted earnings per diluted share, compared to

adjusted net income of $21.6 million, or $0.55 of adjusted earnings

per diluted share in the same period of the prior fiscal year.

Reconciliations of net income attributable to FOX stockholders as

compared to non-GAAP adjusted net income and the calculation of

non-GAAP adjusted earnings per diluted share are provided at the

end of this press release.

Adjusted EBITDA in the first quarter of fiscal

2020 was $31.3 million, compared to $30.1 million in the first

quarter of fiscal 2019. Adjusted EBITDA margin in the first quarter

of fiscal 2020 was 17.0%, compared to 18.6% in the first quarter of

fiscal 2019. Reconciliations of net income to adjusted EBITDA and

the calculation of adjusted EBITDA margin are provided at the end

of this press release.

Balance Sheet Highlights

As of April 3, 2020, the Company had cash

and cash equivalents of $76.2 million compared to $43.7 million as

of January 3, 2020. Inventory was $156.6 million as of

April 3, 2020, compared to $128.5 million as of

January 3, 2020. As of April 3, 2020, accounts receivable

and accounts payable were $85.7 million and $88.6 million,

respectively, compared to $91.6 million and $55.1 million,

respectively, as of January 3, 2020. The changes in accounts

receivable, inventory and accounts payable reflect the SCA

acquisition and the impacts of the COVID-19 pandemic on the

Company's shipment, collection and payment cycles. Prepaids and

other current assets increased to $75.8 million as of April 3,

2020, compared to $17.9 million as of January 3, 2020,

primarily due to SCA-related items including vehicle chassis

deposits and contingent retention incentives held in escrow.

Property, plant and equipment, net was $127.6

million as of April 3, 2020, compared to $108.4 million as of

January 3, 2020 reflecting capital expenditures of $12.8

million as well as the acquisition of SCA.

Total debt was $479.2 million, compared to $68.0

million as of January 3, 2020. The increase is primarily due

to the acquisition of SCA in the quarter, as well as additional

draws on the Company's line of credit to increase cash on hand.

Fiscal 2020 Guidance

The Company previously issued its fiscal year

2020 guidance on March 3, 2020. However, due to the rapidly

evolving market conditions domestically and internationally in

response to the continued spread of COVID-19, full fiscal year 2020

guidance remains suspended as previously reported on April 9, 2020

and the Company does not intend to provide quarterly guidance until

further notice. The Company continues to expect to maintain

compliance with its amended and restated credit facility.

Conference Call &

Webcast

The Company will hold an investor conference

call today at 1:30 p.m. Pacific time (4:30 p.m. Eastern Time). The

conference call dial-in number for North America listeners is (877)

425-9470, and international listeners may dial (201) 389-0878; the

conference ID is 13702378. Live audio of the conference call will

be simultaneously webcast in the investor relations section of the

Company's website at http://www.ridefox.com. The webcast of the

teleconference will be archived and available on the Company’s

website.

About Fox Factory Holding Corp. (NASDAQ:

FOXF)

Fox Factory Holding Corp. designs and

manufactures performance-defining ride dynamics products primarily

for bicycles, on-road and off-road vehicles and trucks,

side-by-side vehicles, all-terrain vehicles, snowmobiles, specialty

vehicles and applications, motorcycles, and commercial trucks. The

Company is a direct supplier to leading powered vehicle original

equipment manufacturers ("OEMs"). Additionally, the Company

supplies top bicycle OEMs and their contract manufacturers, and

provides aftermarket products to retailers and distributors.

FOX is a registered trademark of Fox Factory,

Inc. NASDAQ Global Select Market is a registered trademark of The

NASDAQ OMX Group, Inc. All rights reserved.

Non-GAAP Financial Measures

In addition to reporting financial measures in

accordance with generally accepted accounting principles (“GAAP”),

FOX is including in this press release “non-GAAP adjusted gross

margin,” “non-GAAP operating expense,” “non-GAAP adjusted net

income,” “non-GAAP adjusted earnings per diluted share,” “adjusted

EBITDA,” and “adjusted EBITDA margin,” all of which are non-GAAP

financial measures. FOX defines non-GAAP adjusted gross margin as

gross profit margin adjusted for certain strategic transformation

costs and the amortization of acquired inventory valuation markup.

FOX defines non-GAAP operating expense as operating expense

adjusted for amortization of purchased intangibles, patent

litigation-related expenses, acquisition and integration-related

expenses, strategic transformation costs and costs related to tax

restructuring initiatives. FOX defines non-GAAP adjusted net income

as net income attributable to FOX Stockholders adjusted for

amortization of purchased intangibles, patent litigation-related

expenses, acquisition and integration-related expenses, strategic

transformation costs, and costs related to tax restructuring

initiatives, all net of applicable tax. These adjustments are more

fully described in the tables included at the end of this press

release. Non-GAAP adjusted earnings per diluted share is defined as

non-GAAP adjusted net income divided by the weighted average number

of diluted shares of common stock outstanding during the period.

FOX defines adjusted EBITDA as net income adjusted for interest

expense, net other expense, income taxes, amortization of purchased

intangibles, depreciation, stock-based compensation, patent

litigation-related expenses, acquisition and integration-related

expenses, strategic transformation costs, and costs related to tax

restructuring initiatives that are more fully described in the

tables included at the end of this press release. Adjusted EBITDA

margin is defined as adjusted EBITDA divided by sales.

FOX includes these non-GAAP financial measures

because it believes they allow investors to understand and evaluate

the Company’s core operating performance and trends. In particular,

the exclusion of certain items in calculating non-GAAP operating

expense, non-GAAP adjusted net income and adjusted EBITDA (and

accordingly, non-GAAP adjusted earnings per diluted share and

adjusted EBITDA margin) can provide a useful measure for

period-to-period comparisons of the Company’s core business. These

non-GAAP financial measures have limitations as analytical tools,

including the fact that such non-GAAP financial measures may not be

comparable to similarly titled measures presented by other

companies because other companies may calculate non-GAAP operating

expense, non-GAAP adjusted net income, non-GAAP adjusted earnings

per diluted share, adjusted EBITDA and adjusted EBITDA margin

differently than FOX does. For more information regarding these

non-GAAP financial measures, see the tables included at the end of

this press release.

|

|

|

FOX FACTORY HOLDING CORP. |

|

Condensed Consolidated Balance Sheets |

|

(in thousands, except per share data) |

|

|

| |

As of |

|

As of |

| |

April 3, |

|

January 3 |

| |

2020 |

|

2020 |

| |

|

|

|

| |

(Unaudited) |

|

|

|

Assets |

|

|

|

| Current

assets: |

|

|

|

|

Cash and cash equivalents |

$ |

76,182 |

|

|

$ |

43,736 |

|

|

Accounts receivable (net of allowances of $1,205 and $810 at

April 3, 2020 and January 3, 2020, respectively) |

85,652 |

|

|

91,632 |

|

|

Inventory |

156,553 |

|

|

128,505 |

|

|

Prepaids and other current assets |

75,799 |

|

|

17,940 |

|

|

Total current assets |

394,186 |

|

|

281,813 |

|

|

Property, plant and equipment, net |

127,633 |

|

|

108,379 |

|

| Lease

right-of-use assets |

20,632 |

|

|

17,472 |

|

| Deferred

tax assets |

15,161 |

|

|

25,725 |

|

|

Goodwill |

285,723 |

|

|

93,527 |

|

|

Intangibles, net |

219,906 |

|

|

81,949 |

|

| Other

assets |

5,458 |

|

|

451 |

|

|

Total assets |

$ |

1,068,699 |

|

|

$ |

609,316 |

|

|

Liabilities and stockholders’ equity |

|

|

|

| Current

liabilities: |

|

|

|

|

Accounts payable |

$ |

88,613 |

|

|

$ |

55,144 |

|

|

Accrued expenses |

40,285 |

|

|

35,744 |

|

|

Reserve for uncertain tax positions |

957 |

|

|

925 |

|

|

Current portion of long-term debt |

8,818 |

|

|

— |

|

|

Total current liabilities |

138,673 |

|

|

91,813 |

|

| Line of

credit |

85,000 |

|

|

68,000 |

|

|

Long-term debt, less current portion |

385,404 |

|

|

— |

|

| Other

liabilities |

13,709 |

|

|

11,584 |

|

|

Total liabilities |

622,786 |

|

|

171,397 |

|

|

Redeemable non-controlling interest |

16,207 |

|

|

15,719 |

|

|

Stockholders’ equity |

|

|

|

|

Preferred stock, $0.001 par value — 10,000 authorized and no shares

issued or outstanding as of April 3, 2020 and January 3,

2020 |

— |

|

|

— |

|

|

Common stock, $0.001 par value — 90,000 authorized; 39,493 shares

issued and 38,603 outstanding as of April 3, 2020; 39,448

shares issued and 38,559 outstanding as of January 3,

2020 |

39 |

|

|

39 |

|

|

Additional paid-in capital |

123,470 |

|

|

123,274 |

|

|

Treasury stock, at cost; 890 common shares as of April 3, 2020

and January 3, 2020 |

(13,754 |

) |

|

(13,754 |

) |

|

Accumulated other comprehensive (loss) income |

(790 |

) |

|

150 |

|

|

Retained earnings |

320,741 |

|

|

312,491 |

|

|

Total stockholders’ equity |

429,706 |

|

|

422,200 |

|

|

Total liabilities, redeemable non-controlling interest and

stockholders’ equity |

$ |

1,068,699 |

|

|

$ |

609,316 |

|

|

|

|

|

|

|

|

|

|

|

|

|

FOX FACTORY HOLDING CORP. |

|

Condensed Consolidated Statements of Income |

|

(In thousands, except per share data) |

|

(Unaudited) |

|

|

| |

For the three months ended |

| |

April 3, |

|

March 29, |

| |

2020 |

|

2019 |

|

Sales |

$ |

184,361 |

|

|

$ |

161,700 |

|

| Cost of

sales |

127,746 |

|

|

110,643 |

|

|

Gross profit |

56,615 |

|

|

51,057 |

|

|

Operating expenses: |

|

|

|

|

Sales and marketing |

12,063 |

|

|

9,262 |

|

|

Research and development |

8,029 |

|

|

7,303 |

|

|

General and administrative |

22,413 |

|

|

11,180 |

|

|

Amortization of purchased intangibles |

2,543 |

|

|

1,493 |

|

| Total

operating expenses |

45,048 |

|

|

29,238 |

|

| Income

from operations |

11,567 |

|

|

21,819 |

|

| Other

expense, net: |

|

|

|

|

Interest expense |

1,847 |

|

|

829 |

|

|

Other expense (income) |

62 |

|

|

(13 |

) |

| Other

expense, net |

1,909 |

|

|

816 |

|

| Income

before income taxes |

9,658 |

|

|

21,003 |

|

|

Provision for income taxes |

920 |

|

|

2,601 |

|

| Net

income |

8,738 |

|

|

18,402 |

|

| Less:

net income attributable to non-controlling interest |

488 |

|

|

299 |

|

| Net

income attributable to FOX stockholders |

$ |

8,250 |

|

|

$ |

18,103 |

|

| Earnings

per share: |

|

|

|

|

Basic |

$ |

0.21 |

|

|

$ |

0.48 |

|

|

Diluted |

$ |

0.21 |

|

|

$ |

0.46 |

|

| Weighted

average shares used to compute earnings per share: |

|

|

|

|

Basic |

38,571 |

|

|

38,041 |

|

|

Diluted |

39,151 |

|

|

39,097 |

|

|

|

|

|

|

|

|

FOX FACTORY HOLDING CORP.

NET INCOME TO NON-GAAP ADJUSTED NET INCOME

RECONCILIATIONAND CALCULATION OF NON-GAAP ADJUSTED

EARNINGS PER SHARE (In thousands, except per

share data) (Unaudited)

The following table provides a reconciliation of

net income attributable to FOX stockholders, the most directly

comparable financial measure calculated and presented in accordance

with GAAP, to non-GAAP adjusted net income (a non-GAAP measure),

and the calculation of non-GAAP adjusted earnings per share (a

non-GAAP measure) for the three months ended April 3, 2020 and

March 29, 2019. These non-GAAP financial measures are provided

in addition to, and not as alternatives for, the Company’s reported

GAAP results.

| |

|

|

|

| |

For the three months ended |

| |

April 3, |

|

March 29, |

| |

2020 |

|

2019 |

|

Net income attributable to FOX stockholders |

$ |

8,250 |

|

|

$ |

18,103 |

|

| Amortization of purchased

intangibles |

2,543 |

|

|

1,493 |

|

| Patent litigation-related

expenses |

436 |

|

|

2,043 |

|

| Other acquisition and

integration-related expenses (1) |

10,952 |

|

|

110 |

|

| Strategic transformation costs

(2) |

601 |

|

|

230 |

|

| Tax reform implementation

costs |

— |

|

|

132 |

|

| Tax impacts of reconciling

items above (3) |

(2,252 |

) |

|

(494 |

) |

| Non-GAAP adjusted net

income |

$ |

20,530 |

|

|

$ |

21,617 |

|

| |

|

|

|

| Non-GAAP adjusted

EPS |

|

|

|

| Basic |

$ |

0.53 |

|

|

$ |

0.57 |

|

| Diluted |

$ |

0.52 |

|

|

$ |

0.55 |

|

| |

|

|

|

| Weighted average

shares used to compute non-GAAP adjusted EPS |

|

|

|

| Basic |

38,571 |

|

|

38,041 |

|

| Diluted |

39,151 |

|

|

39,097 |

|

| |

|

|

|

|

|

(1) Represents various acquisition-related costs

and expenses incurred to integrate acquired entities into the

Company’s operations and the impact of the finished goods inventory

valuation adjustment recorded in connection with the purchase of

acquired assets, per period as follows:

| |

|

|

|

| |

For the three months ended |

| |

April 3, |

|

March 29, |

| |

2020 |

|

2019 |

|

Acquisition related costs and expenses |

$ |

10,892 |

|

|

$ |

110 |

|

| Finished goods inventory

valuation adjustment |

60 |

|

|

— |

|

| Other acquisition and

integration-related expenses |

$ |

10,952 |

|

|

$ |

110 |

|

| |

|

|

|

|

|

|

|

(2) Represents costs associated with various

strategic initiatives including the expansion of the Powered

Vehicles Group’s manufacturing operations. For the three month

period ended April 3, 2020, $314 is classified as operating

expense, and $287 is classified as cost of sales, respectively. For

the three month period ended March 29, 2019, $230 is

classified as cost of sales.

(3) Tax impact calculated based on the

respective year to date effective tax rate, including the full year

impact of non-deductible transaction costs.

FOX FACTORY HOLDING CORP.

NET INCOME TO ADJUSTED EBITDA RECONCILIATION

ANDCALCULATION OF NET INCOME MARGIN AND ADJUSTED

EBITDA MARGIN (In thousands)

(Unaudited)

The following tables provide a reconciliation of

net income, the most directly comparable financial measure

calculated and presented in accordance with GAAP, to adjusted

EBITDA (a non-GAAP measure), and the calculations of net income

margin and adjusted EBITDA margin (a non-GAAP measure) for the

three months ended April 3, 2020 and March 29, 2019.

These non-GAAP financial measures are provided in addition to, and

not as alternatives for, the Company’s reported GAAP results.

| |

|

| |

For the three months ended |

| |

April 3, |

|

March 29, |

| |

2020 |

|

2019 |

|

Net income |

$ |

8,738 |

|

|

$ |

18,402 |

|

| Provision for income

taxes |

920 |

|

|

2,601 |

|

| Depreciation and

amortization |

5,836 |

|

|

4,006 |

|

| Non-cash stock-based

compensation |

1,921 |

|

|

1,729 |

|

| Patent litigation-related

expenses |

436 |

|

|

2,043 |

|

| Other acquisition and

integration-related expenses (1) |

10,899 |

|

|

110 |

|

| Strategic transformation costs

(2) |

601 |

|

|

230 |

|

| Tax reform implementation

costs |

— |

|

|

132 |

|

| Other expense, net |

1,909 |

|

|

816 |

|

| Adjusted

EBITDA |

$ |

31,260 |

|

|

$ |

30,069 |

|

| |

|

|

|

| Net Income

Margin |

4.7 |

% |

|

11.4 |

% |

| |

|

|

|

| Adjusted EBITDA

Margin |

17.0 |

% |

|

18.6 |

% |

| |

|

|

|

|

|

(1) Represents various acquisition-related costs

and expenses incurred to integrate acquired entities into the

Company’s operations, excluding $53 in stock-based compensation,

and the impact of the finished goods inventory valuation adjustment

recorded in connection with the purchase of acquired assets, per

period as follows:

| |

|

|

|

| |

For the three months ended |

| |

April 3, |

|

March 29, |

| |

2020 |

|

2019 |

|

Acquisition related costs and expenses |

$ |

10,839 |

|

|

$ |

110 |

|

| Finished goods inventory

valuation adjustment |

60 |

|

|

— |

|

| Other acquisition and

integration-related expenses |

$ |

10,899 |

|

|

$ |

110 |

|

| |

|

|

|

|

|

|

|

(2) Represents costs associated with various

strategic initiatives including the expansion of the Powered

Vehicles Group’s manufacturing operations. For the three month

period ended April 3, 2020, $314 is classified as operating

expense, and $287 is classified as cost of sales, respectively. For

the three month period ended March 29, 2019, $230 is

classified as cost of sales.

FOX FACTORY HOLDING

CORP. GROSS PROFIT TO NON-GAAP ADJUSTED GROSS

PROFIT RECONCILIATION ANDCALCULATION OF GROSS

MARGIN AND NON-GAAP ADJUSTED GROSS MARGIN

(In thousands)

(Unaudited)

The following table provides a reconciliation of

gross profit to non-GAAP adjusted gross profit (a non-GAAP measure)

for the three months ended April 3, 2020

and March 29, 2019, and the calculation of gross margin

and non-GAAP adjusted gross margin (a non-GAAP measure). These

non-GAAP financial measures are provided in addition to, and not as

alternatives for, the Company’s reported GAAP results.

| |

|

|

|

| |

For the three months ended |

| |

April 3, |

|

March 29, |

| |

2020 |

|

2019 |

|

Sales |

$ |

184,361 |

|

|

$ |

161,700 |

|

| |

|

|

|

| Gross

Profit |

$ |

56,615 |

|

|

$ |

51,057 |

|

| Strategic transformation costs

(1) |

287 |

|

|

230 |

|

| Amortization of acquired

inventory valuation markup (2) |

60 |

|

|

— |

|

| Non-GAAP Adjusted Gross

Profit |

$ |

56,962 |

|

|

$ |

51,287 |

|

| |

|

|

|

| Gross

Margin |

30.7 |

% |

|

31.6 |

% |

| |

|

|

|

| Non-GAAP Adjusted Gross

Margin |

30.9 |

% |

|

31.7 |

% |

| |

|

|

|

|

|

(1) Represents costs associated with various

strategic initiatives including the expansion of the Powered

Vehicles Group’s manufacturing operations.

(2) Represents the impact of the finished goods

inventory valuation adjustment recorded in connection with our 2020

acquisition of SCA.

FOX FACTORY HOLDING CORP.

OPERATING EXPENSE TO NON-GAAP OPERATING EXPENSE

RECONCILIATION ANDCALCULATION OF OPERATING EXPENSE

AND NON-GAAP OPERATING EXPENSE AS A PERCENTAGE OF

SALES(In thousands)

(Unaudited)

The following tables provide a reconciliation of

operating expense to non-GAAP operating expense (a non-GAAP

measure) and the calculations of operating expense as a percentage

of sales and non-GAAP operating expense as a percentage of sales (a

non-GAAP measure), for the three months ended April 3, 2020

and March 29, 2019. These non-GAAP financial measures are

provided in addition to, and not as an alternative for, the

Company’s reported GAAP results.

| |

|

|

|

| |

For the three months ended |

| |

April 3, |

|

March 29, |

| |

2020 |

|

2019 |

|

Sales |

$ |

184,361 |

|

|

|

$ |

161,700 |

|

|

| |

|

|

|

| Operating

Expense |

$ |

45,048 |

|

|

|

$ |

29,238 |

|

|

| Amortization of purchased

intangibles |

(2,543 |

) |

|

|

(1,493 |

) |

|

| Patent litigation-related

expenses |

(436 |

) |

|

|

(2,043 |

) |

|

| Other acquisition and

integration-related expenses (1) |

(10,892 |

) |

|

|

(110 |

) |

|

| Strategic transformation costs

(2) |

(314 |

) |

|

|

— |

|

|

| Tax reform implementation

costs |

— |

|

|

|

(132 |

) |

|

| Non-GAAP operating

expense |

$ |

30,863 |

|

|

|

$ |

25,460 |

|

|

| |

|

|

|

| Operating expense as a

percentage of sales |

24.4 |

|

% |

|

18.1 |

|

% |

| |

|

|

|

| Non-GAAP operating

expense as a percentage of sales |

16.7 |

|

% |

|

15.7 |

|

% |

| |

|

|

|

|

|

|

|

(1) Represents various acquisition-related costs

and expenses incurred to integrate acquired entities into the

Company’s operations.

(2) Represents costs associated with various

strategic initiatives including the expansion of the Powered

Vehicles Group’s manufacturing operations.

Cautionary Note Regarding

Forward-Looking Statements

Certain statements in this press release

including earnings guidance may be deemed to be forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended and Section 21E of the Securities Exchange Act

of 1934, as amended. The Company intends that all such statements

be subject to the “safe-harbor” provisions contained in those

sections. Forward-looking statements generally relate to future

events or the Company’s future financial or operating performance.

In some cases, you can identify forward-looking statements because

they contain words such as “may,” “might,” “will,” “would,”

“should,” “expect,” “plan,” “anticipate,” “could,” “intend,”

“target,” “project,” “contemplate,” “believe,” “estimate,”

“predict,” “likely,” “potential” or “continue” or other similar

terms or expressions and such forward-looking statements include,

but are not limited to, statements about the impact of the global

outbreak of COVID-19 on the Company’s business and operations; the

Company’s continued growing demand for its products; the Company’s

execution on its strategy to improve operating efficiencies; the

Company’s optimism about its operating results and future growth

prospects; the Company’s expected future sales and future non-GAAP

adjusted earnings per diluted share; and any other statements in

this press release that are not of a historical nature. Many

important factors may cause the Company’s actual results, events or

circumstances to differ materially from those discussed in any such

forward-looking statements, including but not limited to: the

Company’s ability to complete any acquisition and/or incorporate

any acquired assets into its business; the Company’s ability to

improve operating and supply chain efficiencies; the Company’s

ability to enforce its intellectual property rights; the Company’s

future financial performance, including its sales, cost of sales,

gross profit or gross margin, operating expenses, ability to

generate positive cash flow and ability to maintain profitability;

the Company’s ability to adapt its business model to mitigate the

impact of certain changes in tax laws including those enacted in

the U.S. in December 2017; changes in the relative proportion of

profit earned in the numerous jurisdictions in which the Company

does business and in tax legislation, case law and other

authoritative guidance in those jurisdictions; factors which impact

the calculation of the weighted average number of diluted shares of

common stock outstanding, including the market price of the

Company’s common stock, grants of equity-based awards and the

vesting schedules of equity-based awards; the Company’s ability to

develop new and innovative products in its current end-markets and

to leverage its technologies and brand to expand into new

categories and end-markets; the Company’s ability to increase its

aftermarket penetration; the Company’s exposure to exchange rate

fluctuations; the loss of key customers; strategic transformation

costs; the outcome of pending litigation; the possibility that the

Company may not be able to accelerate its international growth; the

Company’s ability to maintain its premium brand image and

high-performance products; the Company’s ability to maintain

relationships with the professional athletes and race teams that it

sponsors; the possibility that the Company may not be able to

selectively add additional dealers and distributors in certain

geographic markets; the overall growth of the markets in which the

Company competes; the Company’s expectations regarding consumer

preferences and its ability to respond to changes in consumer

preferences; changes in demand for high-end suspension and ride

dynamics products; the Company’s loss of key personnel, management

and skilled engineers; the Company’s ability to successfully

identify, evaluate and manage potential acquisitions and to benefit

from such acquisitions; product recalls and product liability

claims; future economic or market conditions; and the other risks

and uncertainties described in “Risk Factors” contained in its

Annual Report on Form 10-K or Quarterly Reports on Form 10-Q or

otherwise described in the Company’s other filings with the

Securities and Exchange Commission. New risks and uncertainties

emerge from time to time and it is not possible for the Company to

predict all risks and uncertainties that could have an impact on

the forward-looking statements contained in this press release. In

light of the significant uncertainties inherent in the

forward-looking information included herein, the inclusion of such

information should not be regarded as a representation by the

Company or any other person that the Company’s expectations,

objectives or plans will be achieved in the timeframe anticipated

or at all. Investors are cautioned not to place undue reliance on

the Company’s forward-looking statements and the Company undertakes

no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

CONTACT:

ICRKatie Turner646-277-1228Katie.Turner@icrinc.com

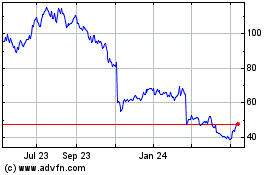

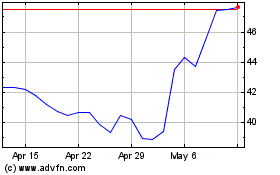

Fox Factory (NASDAQ:FOXF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Fox Factory (NASDAQ:FOXF)

Historical Stock Chart

From Jul 2023 to Jul 2024