The First of Long Island Corporation (Nasdaq: FLIC), the parent

company of The First National Bank of Long Island, reported

increases in net income and earnings per share for the three and

six months ended June 30, 2022. In the highlights that follow, all

comparisons are of the current three or six-month period to the

same period last year unless otherwise indicated.

SECOND QUARTER HIGHLIGHTS

- Net Income

and EPS were $12.5 million and $.54, respectively, versus $11.4

million and $.48

- ROA and ROE

were 1.18% and 12.94%, respectively, compared to 1.08% and

11.02%

- Net

interest margin was 2.97% versus 2.71%

- Strong loan

originations of $236 million

- Repurchased 286,011 shares at

a cost of $5.3 million

SIX MONTH HIGHLIGHTS

- Net Income

and EPS were $24.6 million and $1.06, respectively, versus $22.7

million and $.95

- ROA and ROE

were 1.18% and 12.43%, respectively, compared to 1.10% and

11.09%

- Net interest margin was 2.93%

versus 2.70%

Analysis of Earnings – Six Months Ended

June 30, 2022

Net income for the first six months of 2022 was

$24.6 million, an increase of $1.9 million, or 8.4%, versus the

same period last year. The increase is primarily due to growth in

net interest income of $4.9 million, or 9.2%, and noninterest

income of $695,000, or 12.1%, excluding 2021 securities gains.

These items were partially offset by increases in the provision for

credit losses of $2.8 million and income tax expense of

$364,000.

The increase in net interest income reflects a

favorable shift in the mix of funding as an increase in average

checking deposits of $157 million, or 12.2%, and a decline in

average interest-bearing liabilities of $127 million, or 5.2%,

resulted in average checking deposits comprising a larger portion

of total funding. Also contributing to the increase was a decline

in interest expense of $1.9 million related to the maturity and

termination of the Bank’s interest rate swap and lower rates on

non-maturity and time deposits. The average cost of

interest-bearing liabilities declined 22 basis points (“bps”) from

.76% for the first six months of 2021 to .54% for the current

six-month period.

The increase in net interest income also

reflects growth of $212 million in average loans outstanding to

$3.2 billion for the first six months of 2022 driven mainly by

commercial mortgage originations. The loan portfolio yield declined

from 3.55% for the 2021 period to 3.49% for the current period as

most originations through June 30, 2022 were committed before the

recent rate increases at yields lower than the overall loan

portfolio and average SBA Paycheck Protection Program (“PPP”) loans

declined $141 million. PPP income declined $2.9 million

to $1.0 million when comparing the six-month periods. The weighted

average yield on the PPP portfolio was 14.6% for the current

six-month period.

During the second quarter of 2022, we originated

$236 million of loans with a weighted average rate of approximately

3.51% which includes $152 million of commercial mortgages at a

weighted average rate of 3.50%. The mortgage loan pipeline was $125

million with a weighted average rate of 4.40% at June 30, 2022.

Net interest margin for the first six months of

2022 was 2.93% versus 2.70% for the 2021 period.

Significant increases in interest rates due to inflation could

present challenges in maintaining or growing net interest income

and margin. The direction of net interest income and margin for the

remainder of 2022 is largely dependent on changes in the yield

curve and competitive and economic conditions.

The provision for credit losses increased $2.8

million when comparing the six-month periods from a credit of $1.6

million in the 2021 period to a charge of $1.2 million in the 2022

period. The provision for the current six-month period was mainly

due to an increase in outstanding mortgage loans partially offset

by qualitative adjustments for current conditions and historical

loss rates.

The increase in noninterest income of $695,000,

excluding $606,000 of gains on sales of securities in 2021, is

primarily attributable to a final transition payment of $477,000

from LPL Financial for the conversion of the Bank’s retail broker

and advisory accounts. The increase also includes higher fees from

debit and credit cards of $339,000 and income from bank-owned life

insurance (“BOLI”) of $320,000. These amounts were partially offset

by a decrease in investment services income of $472,000 as the

shift to an outside service provider resulted in a revenue sharing

agreement and less assets under management.

Noninterest expense remained flat at $32.2

million when comparing the six-month periods. Salaries and benefits

expense decreased $179,000 due to a net reduction in branch

locations partially offset by the hiring of seasoned banking

professionals. Occupancy and equipment expense was stable at $6.3

million as lower rent, depreciation and maintenance and repair

costs from the 2021 branch closures were largely offset by the cost

of new branch locations on the east-end of Long Island and the

relocation to new corporate office space in Melville,

N.Y.

Income tax expense increased $364,000 and the

effective tax rate decreased from 20.6% to 20.2% when comparing the

six-month periods. The decrease in the effective tax rate is mainly

due to the purchase of $20 million of BOLI in December 2021 and

being in a capital tax position for New York State and New York

City purposes. The increase in income tax expense is

due to higher pre-tax earnings in the current six-month period as

compared to the 2021 period partially offset by the lower effective

tax rate.

Analysis of Earnings – Second Quarter

2022 Versus Second Quarter 2021

Net income for the second quarter of 2022 of

$12.5 million increased $1.1 million, or 9.6%, from $11.4 million

earned in the same quarter of last year. The increase is mainly due

to growth in net interest income of $2.8 million, or 10.3%, for

substantially the same reasons discussed above with respect to the

six-month periods. Partially offsetting this was a higher provision

for credit losses of $1.3 million mainly due to strong loan

originations in the current quarter. Also offsetting the increase

in net interest income was an increase of $600,000 in noninterest

expense due to the hiring of seasoned banking professionals, the

cost of new branch locations on the east-end of Long Island and the

relocation of our corporate offices.

Analysis of Earnings – Second Quarter

Versus First Quarter 2022

Net income for the second quarter of 2022

increased $398,000 from $12.1 million earned in the first quarter.

The increase was due to growth in net interest income of $1.7

million mainly related to higher average outstanding loan balances

and higher loan yields. This increase was partially offset by

higher salary and benefit costs due to filling open positions,

higher incentive and stock-based compensation, and additional

occupancy costs mainly related to the relocation of our corporate

offices.

Asset Quality

The Bank’s allowance for credit losses to total

loans (reserve coverage ratio) was .93% on June 30, 2022 as

compared to .96% at December 31, 2021. The decrease in

the reserve coverage ratio was mainly due to qualitative

adjustments for current conditions and historical loss

rates. Nonaccrual and modified loans and loans past due

30 through 89 days are at very low levels.

Capital

The Corporation’s balance sheet remains strong

with a Leverage Ratio of approximately 9.85% on June 30, 2022. We

repurchased 488,897 shares of common stock during the first half of

2022 at a cost of $9.8 million. We expect to continue common stock

repurchases during 2022.

The Corporation’s ROE was 12.94% and 12.43% for

the three-month and six-month periods ended June 30, 2022,

respectively, an increase when compared to 11.02% and 11.09%,

respectively, for the same periods in 2021. The increases in ROE

were due to higher net income for both periods as well as an

increase in accumulated other comprehensive losses due to a

significant increase in the net unrealized loss in the

available-for-sale securities portfolio from higher interest rates.

The losses in the available-for-sale securities portfolio, which

reduced the average balance of stockholders’ equity, accounted for

121 bps and 77 bps of the improvement in the ROE ratio when

compared to the prior year periods. The unrealized loss also

accounted for a $1.89 reduction in the Corporation’s book value per

share of $16.48 at June 30, 2022.

Key Initiatives

We continue focusing on strategic initiatives

supporting the growth of our balance sheet and a profitable

relationship banking business. Such initiatives include improving

the quality of technology through continuing digital enhancements,

optimizing our branch network across a larger geography, using new

branding and “CommunityFirst” focus to improve name recognition,

enhancing our website and social media presence including the

promotion of FirstInvestments, and recruitment of experienced

banking professionals to support our growth and technology

initiatives. We also continue to focus on the areas of

cybersecurity, environmental, social and governance practices. The

consolidation of our back-office staff into a single location at

275 Broadhollow Road in Melville, N.Y. took place in April

2022.

Forward Looking Information

This earnings release contains various

“forward-looking statements” within the meaning of that term as set

forth in Rule 175 of the Securities Act of 1933 and Rule 3b-6 of

the Securities Exchange Act of 1934. Such statements are generally

contained in sentences including the words “may” or “expect” or

“could” or “should” or “would” or “believe” or “anticipate”. The

Corporation cautions that these forward-looking statements are

subject to numerous assumptions, risks and uncertainties that could

cause actual results to differ materially from those contemplated

by the forward-looking statements. Factors that could cause future

results to vary from current management expectations include, but

are not limited to, changing economic conditions; legislative and

regulatory changes; monetary and fiscal policies of the federal

government; changes in interest rates; deposit flows and the cost

of funds; demand for loan products; competition; changes in

management’s business strategies; changes in accounting principles,

policies or guidelines; changes in real estate values; and other

factors discussed in the “risk factors” section of the

Corporation’s filings with the Securities and Exchange Commission

(“SEC”). In addition, the pandemic continues to present financial

and operating challenges for the Corporation, its customers and the

communities it serves. These challenges may adversely affect the

Corporation’s business, results of operations and financial

condition for an indefinite period. The forward-looking statements

are made as of the date of this press release, and the Corporation

assumes no obligation to update the forward-looking statements or

to update the reasons why actual results could differ from those

projected in the forward-looking statements.

For more detailed financial information please

see the Corporation’s quarterly report on Form 10-Q for the quarter

ended June 30, 2022. The Form 10-Q will be available through the

Bank’s website at www.fnbli.com on or about August 4, 2022, when it

is electronically filed with the SEC. Our SEC filings are also

available on the SEC’s website at www.sec.gov.

CONSOLIDATED BALANCE

SHEETS(Unaudited)

| |

|

6/30/22 |

|

12/31/21 |

| |

|

|

| |

|

(dollars in thousands) |

| Assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

64,073 |

|

|

$ |

43,675 |

|

|

Investment securities available-for-sale, at fair value |

|

|

689,269 |

|

|

|

734,318 |

|

|

|

|

|

|

|

|

|

|

Loans: |

|

|

|

|

|

|

|

Commercial and industrial |

|

|

108,049 |

|

|

|

90,386 |

|

|

SBA Paycheck Protection Program |

|

|

4,427 |

|

|

|

30,534 |

|

|

Secured by real estate: |

|

|

|

|

|

|

|

Commercial mortgages |

|

|

1,948,321 |

|

|

|

1,736,612 |

|

|

Residential mortgages |

|

|

1,228,607 |

|

|

|

1,202,374 |

|

|

Home equity lines |

|

|

44,929 |

|

|

|

44,139 |

|

|

Consumer and other |

|

|

1,214 |

|

|

|

991 |

|

| |

|

|

3,335,547 |

|

|

|

3,105,036 |

|

|

Allowance for credit losses |

|

|

(30,865 |

) |

|

|

(29,831 |

) |

| |

|

|

3,304,682 |

|

|

|

3,075,205 |

|

| |

|

|

|

|

|

|

|

Restricted stock, at cost |

|

|

20,905 |

|

|

|

21,524 |

|

|

Bank premises and equipment, net |

|

|

38,081 |

|

|

|

37,523 |

|

|

Right of use asset - operating leases |

|

|

24,095 |

|

|

|

8,438 |

|

|

Bank-owned life insurance |

|

|

109,320 |

|

|

|

107,831 |

|

|

Pension plan assets, net |

|

|

19,161 |

|

|

|

19,097 |

|

|

Deferred income tax benefit |

|

|

22,433 |

|

|

|

3,987 |

|

|

Other assets |

|

|

18,565 |

|

|

|

17,191 |

|

| |

|

$ |

4,310,584 |

|

|

$ |

4,068,789 |

|

|

Liabilities: |

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

Checking |

|

$ |

1,469,969 |

|

|

$ |

1,400,998 |

|

|

Savings, NOW and money market |

|

|

1,750,367 |

|

|

|

1,685,410 |

|

|

Time |

|

|

385,039 |

|

|

|

228,837 |

|

| |

|

|

3,605,375 |

|

|

|

3,315,245 |

|

| |

|

|

|

|

|

|

|

Short-term borrowings |

|

|

10,000 |

|

|

|

125,000 |

|

|

Long-term debt |

|

|

279,435 |

|

|

|

186,322 |

|

|

Operating lease liability |

|

|

25,668 |

|

|

|

11,259 |

|

|

Accrued expenses and other liabilities |

|

|

13,650 |

|

|

|

17,151 |

|

| |

|

|

3,934,128 |

|

|

|

3,654,977 |

|

| Stockholders'

Equity: |

|

|

|

|

|

|

|

Common stock, par value $.10 per share: |

|

|

|

|

|

|

|

Authorized, 80,000,000 shares; |

|

|

|

|

|

|

|

Issued and outstanding, 22,840,516 and 23,240,596 shares |

|

|

2,284 |

|

|

|

2,324 |

|

|

Surplus |

|

|

84,703 |

|

|

|

93,480 |

|

|

Retained earnings |

|

|

335,697 |

|

|

|

320,321 |

|

| |

|

|

422,684 |

|

|

|

416,125 |

|

|

Accumulated other comprehensive loss, net of tax |

|

|

(46,228 |

) |

|

|

(2,313 |

) |

| |

|

|

376,456 |

|

|

|

413,812 |

|

| |

|

$ |

4,310,584 |

|

|

$ |

4,068,789 |

|

| |

|

|

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF

INCOME(Unaudited)

| |

|

Six Months Ended |

|

Three Months Ended |

|

| |

|

6/30/22 |

|

6/30/21 |

|

6/30/22 |

|

6/30/21 |

|

| |

|

|

|

| |

|

(dollars in thousands) |

|

| Interest and dividend

income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

|

$ |

56,149 |

|

$ |

53,456 |

|

|

$ |

28,763 |

|

$ |

26,750 |

|

|

|

Investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

3,805 |

|

|

4,078 |

|

|

|

2,137 |

|

|

2,245 |

|

|

|

Nontaxable |

|

|

3,962 |

|

|

4,462 |

|

|

|

1,994 |

|

|

2,214 |

|

|

| |

|

|

63,916 |

|

|

61,996 |

|

|

|

32,894 |

|

|

31,209 |

|

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings, NOW and money market deposits |

|

|

1,564 |

|

|

2,260 |

|

|

|

801 |

|

|

1,194 |

|

|

|

Time deposits |

|

|

2,100 |

|

|

3,897 |

|

|

|

1,155 |

|

|

1,593 |

|

|

|

Short-term borrowings |

|

|

684 |

|

|

700 |

|

|

|

243 |

|

|

350 |

|

|

|

Long-term debt |

|

|

1,868 |

|

|

2,311 |

|

|

|

1,000 |

|

|

1,146 |

|

|

| |

|

|

6,216 |

|

|

9,168 |

|

|

|

3,199 |

|

|

4,283 |

|

|

|

Net interest income |

|

|

57,700 |

|

|

52,828 |

|

|

|

29,695 |

|

|

26,926 |

|

|

| Provision (credit) for credit

losses |

|

|

1,159 |

|

|

(1,609 |

) |

|

|

726 |

|

|

(623 |

) |

|

|

Net interest income after provision (credit) for credit losses |

|

|

56,541 |

|

|

54,437 |

|

|

|

28,969 |

|

|

27,549 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank-owned life insurance |

|

|

1,490 |

|

|

1,170 |

|

|

|

748 |

|

|

591 |

|

|

|

Service charges on deposit accounts |

|

|

1,506 |

|

|

1,418 |

|

|

|

780 |

|

|

735 |

|

|

|

Net gains on sales of securities |

|

|

— |

|

|

606 |

|

|

|

— |

|

|

— |

|

|

|

Other |

|

|

3,452 |

|

|

3,165 |

|

|

|

1,496 |

|

|

1,501 |

|

|

| |

|

|

6,448 |

|

|

6,359 |

|

|

|

3,024 |

|

|

2,827 |

|

|

| Noninterest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

19,736 |

|

|

19,915 |

|

|

|

9,981 |

|

|

9,845 |

|

|

|

Occupancy and equipment |

|

|

6,307 |

|

|

6,344 |

|

|

|

3,356 |

|

|

3,067 |

|

|

|

Other |

|

|

6,155 |

|

|

6,019 |

|

|

|

3,092 |

|

|

2,917 |

|

|

| |

|

|

32,198 |

|

|

32,278 |

|

|

|

16,429 |

|

|

15,829 |

|

|

|

Income before income taxes |

|

|

30,791 |

|

|

28,518 |

|

|

|

15,564 |

|

|

14,547 |

|

|

| Income tax expense |

|

|

6,227 |

|

|

5,863 |

|

|

|

3,083 |

|

|

3,159 |

|

|

|

Net income |

|

$ |

24,564 |

|

$ |

22,655 |

|

|

$ |

12,481 |

|

$ |

11,388 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share and Per Share Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares |

|

|

23,088,542 |

|

|

23,758,398 |

|

|

|

22,999,598 |

|

|

23,735,723 |

|

|

|

Dilutive restricted stock units |

|

|

85,043 |

|

|

89,776 |

|

|

|

71,028 |

|

|

96,060 |

|

|

|

|

|

|

23,173,585 |

|

|

23,848,174 |

|

|

|

23,070,626 |

|

|

23,831,783 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic EPS |

|

|

$1.06 |

|

|

$.95 |

|

|

|

$.54 |

|

|

$.48 |

|

|

|

Diluted EPS |

|

|

$1.06 |

|

|

$.95 |

|

|

|

$.54 |

|

|

$.48 |

|

|

|

Cash Dividends Declared per share |

|

|

$.40 |

|

|

$.38 |

|

|

|

$.20 |

|

|

$.19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCIAL RATIOS |

|

(Unaudited) |

| ROA |

|

|

1.18 |

% |

|

1.10 |

% |

|

|

1.18 |

% |

|

1.08 |

% |

|

| ROE |

|

|

12.43 |

% |

|

11.09 |

% |

|

|

12.94 |

% |

|

11.02 |

% |

|

| Net Interest Margin |

|

|

2.93 |

% |

|

2.70 |

% |

|

|

2.97 |

% |

|

2.71 |

% |

|

| Dividend Payout Ratio |

|

|

37.74 |

% |

|

40.00 |

% |

|

|

37.04 |

% |

|

39.58 |

% |

|

|

|

PROBLEM AND POTENTIAL PROBLEM LOANS AND

ASSETS(Unaudited)

| |

|

06/30/22 |

|

|

12/31/21 |

|

| |

|

|

|

| |

|

|

|

| |

|

(dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

| Loans including modifications

to borrowers experiencing financial difficulty: |

|

|

|

|

|

|

|

|

|

Modified and performing according to their modified terms |

|

$ |

540 |

|

|

$ |

554 |

|

|

Past due 30 through 89 days |

|

|

193 |

|

|

|

460 |

|

|

Past due 90 days or more and still accruing |

|

|

— |

|

|

|

— |

|

|

Nonaccrual |

|

|

260 |

|

|

|

1,235 |

|

| |

|

|

993 |

|

|

|

2,249 |

|

| |

|

|

|

|

|

|

|

|

| Other real estate owned |

|

|

— |

|

|

|

— |

|

| |

|

$ |

993 |

|

|

$ |

2,249 |

|

| |

|

|

|

|

|

|

|

|

| Allowance for credit

losses |

|

$ |

30,865 |

|

|

$ |

29,831 |

|

| Allowance for credit losses as

a percentage of total loans |

|

|

.93 |

% |

|

|

.96 |

% |

| Allowance for credit losses as

a multiple of nonaccrual loans |

|

|

118.7 |

x |

|

|

24.2 |

x |

| |

|

|

|

|

|

|

|

|

AVERAGE BALANCE SHEET, INTEREST RATES AND

INTEREST DIFFERENTIAL(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, |

| |

|

2022 |

|

2021 |

| |

|

Average |

|

Interest/ |

|

Average |

|

Average |

|

Interest/ |

|

Average |

|

(dollars in thousands) |

|

Balance |

|

Dividends |

|

Rate |

|

Balance |

|

Dividends |

|

Rate |

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-earning bank balances |

|

$ |

33,674 |

|

|

$ |

97 |

|

.58 |

% |

|

$ |

184,641 |

|

|

$ |

96 |

|

.10 |

% |

| Investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable (1) |

|

|

432,303 |

|

|

|

3,708 |

|

1.72 |

|

|

|

445,712 |

|

|

|

3,982 |

|

1.79 |

|

|

Nontaxable (1) (2) |

|

|

315,418 |

|

|

|

5,015 |

|

3.18 |

|

|

|

357,924 |

|

|

|

5,648 |

|

3.16 |

|

| Loans (1) (2) |

|

|

3,220,953 |

|

|

|

56,151 |

|

3.49 |

|

|

|

3,008,594 |

|

|

|

53,459 |

|

3.55 |

|

| Total interest-earning

assets |

|

|

4,002,348 |

|

|

|

64,971 |

|

3.25 |

|

|

|

3,996,871 |

|

|

|

63,185 |

|

3.16 |

|

| Allowance for credit

losses |

|

|

(30,059 |

) |

|

|

|

|

|

|

|

|

(32,256 |

) |

|

|

|

|

|

|

| Net interest-earning

assets |

|

|

3,972,289 |

|

|

|

|

|

|

|

|

|

3,964,615 |

|

|

|

|

|

|

|

| Cash and due from banks |

|

|

33,106 |

|

|

|

|

|

|

|

|

|

34,228 |

|

|

|

|

|

|

|

| Premises and equipment,

net |

|

|

37,942 |

|

|

|

|

|

|

|

|

|

38,399 |

|

|

|

|

|

|

|

| Other assets |

|

|

144,329 |

|

|

|

|

|

|

|

|

|

133,715 |

|

|

|

|

|

|

|

| |

|

$ |

4,187,666 |

|

|

|

|

|

|

|

|

$ |

4,170,957 |

|

|

|

|

|

|

|

| Liabilities and

Stockholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Savings, NOW & money

market deposits |

|

$ |

1,713,883 |

|

|

|

1,564 |

|

.18 |

|

|

$ |

1,786,527 |

|

|

|

2,260 |

|

.26 |

|

| Time deposits |

|

|

319,206 |

|

|

|

2,100 |

|

1.33 |

|

|

|

371,919 |

|

|

|

3,897 |

|

2.11 |

|

| Total interest-bearing

deposits |

|

|

2,033,089 |

|

|

|

3,664 |

|

.36 |

|

|

|

2,158,446 |

|

|

|

6,157 |

|

.58 |

|

| Short-term borrowings |

|

|

88,091 |

|

|

|

684 |

|

1.57 |

|

|

|

56,813 |

|

|

|

700 |

|

2.48 |

|

| Long-term debt |

|

|

196,268 |

|

|

|

1,868 |

|

1.92 |

|

|

|

229,593 |

|

|

|

2,311 |

|

2.03 |

|

| Total interest-bearing

liabilities |

|

|

2,317,448 |

|

|

|

6,216 |

|

.54 |

|

|

|

2,444,852 |

|

|

|

9,168 |

|

.76 |

|

| Checking deposits |

|

|

1,442,398 |

|

|

|

|

|

|

|

|

|

1,285,761 |

|

|

|

|

|

|

|

| Other liabilities |

|

|

29,342 |

|

|

|

|

|

|

|

|

|

28,509 |

|

|

|

|

|

|

|

| |

|

|

3,789,188 |

|

|

|

|

|

|

|

|

|

3,759,122 |

|

|

|

|

|

|

|

| Stockholders' equity |

|

|

398,478 |

|

|

|

|

|

|

|

|

|

411,835 |

|

|

|

|

|

|

|

| |

|

$ |

4,187,666 |

|

|

|

|

|

|

|

|

$ |

4,170,957 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income (2) |

|

|

|

|

$ |

58,755 |

|

|

|

|

|

|

|

$ |

54,017 |

|

|

|

| Net interest spread (2) |

|

|

|

|

|

|

|

2.71 |

% |

|

|

|

|

|

|

|

2.40 |

% |

| Net interest margin (2) |

|

|

|

|

|

|

|

2.93 |

% |

|

|

|

|

|

|

|

2.70 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) The average balances of loans include

nonaccrual loans. The average balances of investment securities

include unrealized gains and losses on AFS securities in the 2021

period and exclude such amounts in the 2022 period. Unrealized

gains and losses were immaterial in 2021.

(2) Tax-equivalent basis. Interest income on a

tax-equivalent basis includes the additional amount of interest

income that would have been earned if the Corporation's investment

in tax-exempt loans and investment securities had been made in

loans and investment securities subject to federal income taxes

yielding the same after-tax income. The tax-equivalent amount of

$1.00 of nontaxable income was $1.27 for each period presented

using the statutory federal income tax rate of 21%.

AVERAGE BALANCE SHEET, INTEREST RATES AND

INTEREST DIFFERENTIAL(Unaudited)

| |

|

|

Three Months Ended June 30, |

| |

|

2022 |

|

2021 |

|

(dollars in thousands) |

|

AverageBalance |

|

Interest/Dividends |

|

AverageRate |

|

AverageBalance |

|

Interest/Dividends |

|

AverageRate |

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-earning bank balances |

|

$ |

39,607 |

|

|

$ |

83 |

|

.84 |

% |

|

$ |

213,688 |

|

|

$ |

57 |

|

.11 |

% |

| Investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable (1) |

|

|

431,740 |

|

|

|

2,054 |

|

1.90 |

|

|

|

489,407 |

|

|

|

2,188 |

|

1.79 |

|

|

Nontaxable (1) (2) |

|

|

316,166 |

|

|

|

2,524 |

|

3.19 |

|

|

|

354,175 |

|

|

|

2,802 |

|

3.16 |

|

| Loans (1) (2) |

|

|

3,281,178 |

|

|

|

28,764 |

|

3.51 |

|

|

|

3,004,227 |

|

|

|

26,752 |

|

3.56 |

|

| Total interest-earning

assets |

|

|

4,068,691 |

|

|

|

33,425 |

|

3.29 |

|

|

|

4,061,497 |

|

|

|

31,799 |

|

3.13 |

|

| Allowance for credit

losses |

|

|

(30,266 |

) |

|

|

|

|

|

|

|

|

(31,623 |

) |

|

|

|

|

|

|

| Net

interest-earning assets |

|

|

4,038,425 |

|

|

|

|

|

|

|

|

|

4,029,874 |

|

|

|

|

|

|

|

| Cash and due from banks |

|

|

33,723 |

|

|

|

|

|

|

|

|

|

35,491 |

|

|

|

|

|

|

|

| Premises and equipment,

net |

|

|

38,002 |

|

|

|

|

|

|

|

|

|

38,102 |

|

|

|

|

|

|

|

| Other assets |

|

|

137,582 |

|

|

|

|

|

|

|

|

|

132,671 |

|

|

|

|

|

|

|

| |

|

$ |

4,247,732 |

|

|

|

|

|

|

|

|

$ |

4,236,138 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities

and Stockholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Savings, NOW & money

market deposits |

|

$ |

1,739,429 |

|

|

|

801 |

|

.18 |

|

|

$ |

1,864,640 |

|

|

|

1,194 |

|

.26 |

|

| Time deposits |

|

|

360,289 |

|

|

|

1,155 |

|

1.29 |

|

|

|

322,987 |

|

|

|

1,593 |

|

1.98 |

|

| Total

interest-bearing deposits |

|

|

2,099,718 |

|

|

|

1,956 |

|

.37 |

|

|

|

2,187,627 |

|

|

|

2,787 |

|

.51 |

|

| Short-term borrowings |

|

|

52,247 |

|

|

|

243 |

|

1.87 |

|

|

|

54,985 |

|

|

|

350 |

|

2.55 |

|

| Long-term debt |

|

|

206,105 |

|

|

|

1,000 |

|

1.95 |

|

|

|

226,002 |

|

|

|

1,146 |

|

2.03 |

|

| Total

interest-bearing liabilities |

|

|

2,358,070 |

|

|

|

3,199 |

|

.54 |

|

|

|

2,468,614 |

|

|

|

4,283 |

|

.70 |

|

| Checking deposits |

|

|

1,468,285 |

|

|

|

|

|

|

|

|

|

1,327,332 |

|

|

|

|

|

|

|

| Other liabilities |

|

|

34,593 |

|

|

|

|

|

|

|

|

|

25,649 |

|

|

|

|

|

|

|

| |

|

|

3,860,948 |

|

|

|

|

|

|

|

|

|

3,821,595 |

|

|

|

|

|

|

|

| Stockholders' equity |

|

|

386,784 |

|

|

|

|

|

|

|

|

|

414,543 |

|

|

|

|

|

|

|

| |

|

$ |

4,247,732 |

|

|

|

|

|

|

|

|

$ |

4,236,138 |

|

|

|

|

|

|

|

| Net interest income (2) |

|

|

|

|

$ |

30,226 |

|

|

|

|

|

|

|

$ |

27,516 |

|

|

|

| Net interest spread (2) |

|

|

|

|

|

|

|

2.75 |

% |

|

|

|

|

|

|

|

2.43 |

% |

| Net interest margin (2) |

|

|

|

|

|

|

|

2.97 |

% |

|

|

|

|

|

|

|

2.71 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) The average balances of loans include

nonaccrual loans. The average balances of investment securities

include unrealized gains and losses on AFS securities in the 2021

period and exclude such amounts in the 2022 period. Unrealized

gains and losses were immaterial in 2021.

(2) Tax-equivalent basis. Interest income on a

tax-equivalent basis includes the additional amount of interest

income that would have been earned if the Corporation's investment

in tax-exempt loans and investment securities had been made in

loans and investment securities subject to federal income taxes

yielding the same after-tax income. The tax-equivalent amount of

$1.00 of nontaxable income was $1.27 for each period presented

using the statutory federal income tax rate of 21%.

For More Information Contact:Jay McConie, EVP

and CFO (516) 671-4900, Ext. 7404

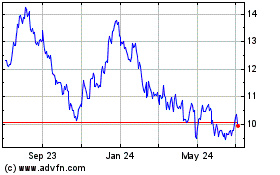

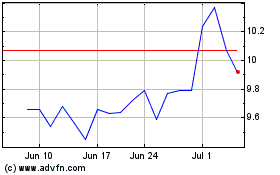

First of Long Island (NASDAQ:FLIC)

Historical Stock Chart

From Jun 2024 to Jul 2024

First of Long Island (NASDAQ:FLIC)

Historical Stock Chart

From Jul 2023 to Jul 2024