0000708955false00007089552024-01-252024-01-250000708955exch:XNMS2024-01-252024-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 25, 2024

FIRST FINANCIAL BANCORP.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Ohio | | 001-34762 | | 31-1042001 |

(State or other jurisdiction of

incorporation or organization) | | (Commission File Number) | | (I.R.S. employer

identification number) |

| | | | | |

| 255 East Fifth Street, Suite 800 | | Cincinnati, | Ohio | | 45202 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (877) 322-9530

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of exchange on which registered |

| Common stock, No par value | | FFBC | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 25, 2024, First Financial Bancorp. (the "Company") issued its earnings press release that included its results of operations and financial condition for the twelve months and fourth quarter of 2023. A copy of the earnings press release is attached as Exhibit 99.1.

The Company also provided electronic presentation slides that will be used in connection with the earnings conference call. A copy of the electronic presentation slides is included in this Report as Exhibit 99.2 and will be available on the Company's website, www.bankatfirst.com.

The information set forth in this Current Report on Form 8-K (including the information in Exhibits 99.1 and 99.2 attached hereto) is being furnished to the Securities and Exchange Commission and is not deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act") , or otherwise subject to the liabilities under the Exchange Act. Such information shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

The following exhibits shall not be deemed to be "filed" for purposes of the Exchange Act:

Exhibit No. Description

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

FIRST FINANCIAL BANCORP.

| | | | | | | | |

| | By: /s/ James M. Anderson |

| | James M. Anderson |

| | Executive Vice President and Chief Financial Officer |

| | |

| Date: | January 25, 2024 | |

Exhibit 99.1

First Financial Bancorp Announces Fourth Quarter and Full Year 2023

Financial Results and Quarterly Dividend

•Earnings per diluted share of $0.60; $0.62 on an adjusted(1) basis

•Return on average assets of 1.31%; 1.37% on an adjusted(1) basis

•Net interest margin on FTE basis(1) of 4.26%; 7 bp decrease from linked quarter

•Loan growth of $286.4 million; 10.7% on an annualized basis

•Average deposit balances increased 12.9% on an annualized basis

•Credit trends stable to improving in the quarter

•Tangible Book Value increased $1.47, or 13.5% from linked quarter

•Quarterly dividend of $0.23 approved by Board of Directors

Cincinnati, Ohio - January 25, 2024. First Financial Bancorp. (Nasdaq: FFBC) (“First Financial” or the “Company”) announced financial results for the three and twelve months ended December 31, 2023.

For the three months ended December 31, 2023, the Company reported net income of $56.7 million, or $0.60 per diluted common share. These results compare to net income of $63.1 million, or $0.66 per diluted common share, for the third quarter of 2023. For the twelve months ended December 31, 2023, First Financial had earnings per diluted share of $2.69 compared to $2.30 for the same period in 2022.

Return on average assets for the fourth quarter of 2023 was 1.31% while return on average tangible common equity was 21.36%(1). These compare to return on average assets of 1.48% and return on average tangible common equity of 23.60%(1) in the third quarter of 2023.

Fourth quarter 2023 highlights include:

•Net interest margin of 4.21%, or 4.26% on a fully tax-equivalent basis(1)

◦7 bp decrease to 4.26% from 4.33% in the third quarter due to increasing funding costs

◦Higher asset yields and earning asset mix significantly offset 31 bp increase in cost of deposits

◦Average deposit balances increased $415.7 million with growth in money market accounts, interest bearing checking accounts, retail CDs and brokered CD's offsetting declines in noninterest bearing checking and savings accounts

•Noninterest income of $47.0 million, or $47.6 million as adjusted(1)

◦Bannockburn income of $8.7 million included $4.6 million loss on a trade; loss was offset by lower noninterest expenses

◦Strong leasing business income of $12.9 million

◦Higher other noninterest income driven by increase in syndication fees

◦Adjusted(1) $0.6 million for losses on investment securities and other items not expected to recur

•Noninterest expenses of $119.1 million, or $116.8 million as adjusted(1)

◦$2.9 million decrease from linked quarter driven primarily by lower employee costs and marketing expenses

◦Fourth quarter adjustments(1) include $0.9 million FDIC special assessment and other costs not expected to recur such as acquisition, severance and branch consolidation costs

◦Efficiency ratio of 59.3%; 58.0% as adjusted(1)

______________________________________________________________________________

(1) Non-GAAP measure. For details on the calculation of these non-GAAP financial measures and a reconciliation to the GAAP financial measure, see the sections titled “Use of Non-GAAP Financial Measures” in this release and “Appendix: Non-GAAP to GAAP Reconciliation” in the accompanying slide presentation.

•Accelerating loan growth during the quarter

◦Loan balances increased $286.4 million compared to the third quarter

◦Growth of 10.7% on an annualized basis

◦CRE, specialty lending, residential mortgages and finance leases drove quarterly growth

•Robust deposit growth during the quarter

◦Total deposits increased $445.2 million, or 3.4%, from linked quarter

◦Average deposit balances increased $415.7 million with growth in money market accounts, interest bearing checking accounts, retail CDs and brokered CD's offsetting declines in noninterest bearing checking and savings accounts

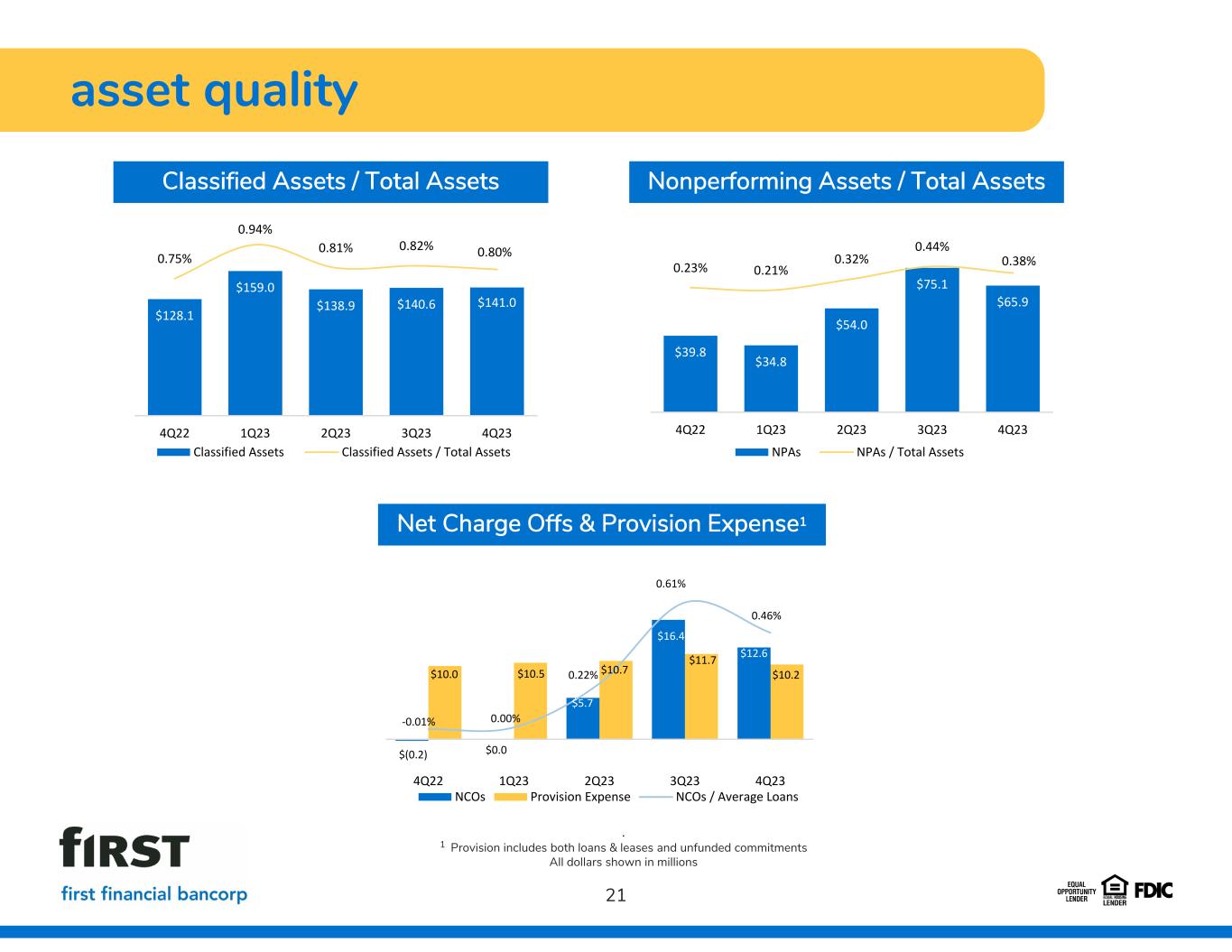

•Total Allowance for Credit Losses of $159.9 million; Total quarterly provision expense of $10.2 million

◦Loans and leases - ACL of $141.4 million; decreased 7 bps to 1.29% of total loans

◦Unfunded Commitments - ACL of $18.4 million; increased $1.4 million from linked quarter

◦Provision expense driven by net charge-offs and loan growth; Classified assets were stable at $141.0 million

◦Annualized net charge-offs were 46 bps of total loans and included $9.2 million related to a single relationship that was previously reserved for

•Capital ratios remain solid

◦Total capital ratio increased 24 bps to 13.75%

◦Tier 1 common equity increased 25 bps to 11.85%

◦Tangible common equity increased 67 bps to 7.17%(1); 9.05%(1) excluding impact from AOCI

◦Tangible book value per share of $12.38(1); 13.5% increase from linked quarter

Additionally, the board of directors approved a quarterly dividend of $0.23 per common share for the next regularly scheduled dividend, payable on March 15, 2024 to shareholders of record as of March 1, 2024.

Archie Brown, President and CEO, commented on the quarter, “I am pleased with our fourth quarter performance. Adjusted(1) earnings per share were $0.62, which resulted in an adjusted(1) return on assets of 1.37% and an adjusted(1) return on tangible common equity ratio of 22.2%. As expected, rising funding costs outpaced our asset yields, however our net interest margin remained very strong at 4.26%. Additionally, balance sheet trends were positive during the quarter, with loans increasing $286 million, or 11% on an annualized basis, and average deposits increasing $416 million, or 13% on an annualized basis."

Mr. Brown continued, “Noninterest income and expenses were both lower than we expected during the quarter. The decline in noninterest income included a $4.6 million loss on a trade at Bannockburn, however excluding this loss, foreign exchange income was within our range of expectations. Leasing income also declined during the period due to lower end of term fees and lease originations shifting to a greater mix of finance leases. While this shift increased interest income and the net interest margin, it resulted in lower noninterest income during the period. Noninterest expenses declined for the quarter primarily due to lower incentive compensation, which is tied directly to noninterest income.”

Mr. Brown commented on asset quality, “Asset quality was stable for the quarter with underlying credit trends improving. Net charge-offs were 46 basis points during the quarter and were driven by a relationship that included borrower fraud. This loan had been on non-accrual for most of the year and was almost fully reserved coming into the fourth quarter. Additionally, nonperforming assets declined by 12% to 0.38% of total assets and classified asset balances were relatively unchanged from the third quarter."

Mr. Brown discussed full year results, “2023 was a record year for First Financial. Adjusted(1) earnings per share increased 17% from the prior year to $2.77, while adjusted(1) return on assets was 1.55%, adjusted (1) return on tangible common equity was 25.4% and our adjusted(1) efficiency ratio was 56%. Total revenue of $840.2 million was the highest in the Company's history, increasing 18.5% over the prior year. Our balance sheet responded favorably to the interest rate environment, resulting in a 21% increase in net interest income. Additionally, record years from wealth management and Summit drove a 12% increase in noninterest income.”

Mr. Brown continued, “We are extremely pleased with the performance of our balance sheet during 2023, especially given the turmoil in the banking industry in the first half of the year. Loan production was solid, exceeding 6% in balance growth, while average deposit balances increased 2.4% compared to the prior year. We are also very happy with the 122 basis point expansion in the tangible common equity ratio and 24% increase in tangible book value per share for the year.”

Mr. Brown commented on full year asset quality, “Asset quality trends were elevated during the year. Net charge-offs increased to 33 basis points for 2023, after we achieved a record low of 6 basis points in 2022. This increase was driven by two large relationships, as well as the loss on the sale of a small portfolio of ICRE loans. Non-performing assets to total assets ended the year at 38 basis points. We believe we are well positioned to manage the coming year and we are cautiously optimistic regarding asset quality in 2024.”

Mr. Brown concluded, “Finally, I'd like to commend our associates for their exemplary performance in 2023. They were client focused and executed at a very high level despite the industry uncertainty earlier in the year. During the year we

have strengthened our team with the addition of talent in Wealth Management and in expansion markets, including Chicago, IL, Evansville, IN and Cleveland, OH. I'm extremely proud of the work our team accomplished in 2023 and believe we are positioned to have sustained success in 2024 and beyond.”

Full detail of the Company’s fourth quarter 2023 performance is provided in the accompanying financial statements and slide presentation.

Teleconference / Webcast Information

First Financial’s executive management will host a conference call to discuss the Company’s financial and operating results on Friday, January 26, 2024 at 8:30 a.m. Eastern Time. Members of the public who would like to listen to the conference call should dial (888) 550-5723 (U.S. toll free) or (646) 960-0471 (U.S. local), access code 5048068. The number should be dialed five to ten minutes prior to the start of the conference call. A replay of the conference call will be available beginning one hour after the completion of the live call at (800) 770-2030 (U.S. toll free), (647) 362-9199 (U.S. local), access code 5048068. The recording will be available until February 9, 2024. The conference call will also be accessible as an audio webcast via the Investor Relations section of the Company’s website at www.bankatfirst.com. The webcast will be archived on the Investor Relations section of the Company’s website for 12 months.

Press Release and Additional Information on Website

This press release as well as supplemental information are available to the public through the Investor Relations section of First Financial's website at www.bankatfirst.com.

Use of Non-GAAP Financial Measures

This earnings release contains GAAP financial measures and Non-GAAP financial measures where management believes it to be helpful in understanding the Company’s results of operations or financial position. Where Non-GAAP financial measures are used, the comparable GAAP financial measures, as well as a reconciliation to the comparable GAAP financial measure, can be found in the section titled “Appendix: Non-GAAP to GAAP Reconciliation” in the accompanying slide presentation.

Forward-Looking Statements

Certain statements contained in this report which are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as ‘‘believes,’’ ‘‘anticipates,’’ “likely,” “expected,” “estimated,” ‘‘intends’’ and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Examples of forward-looking statements include, but are not limited to, statements we make about (i) our future operating or financial performance, including revenues, income or loss and earnings or loss per share, (ii) future common stock dividends, (iii) our capital structure, including future capital levels, (iv) our plans, objectives and strategies, and (v) the assumptions that underlie our forward-looking statements.

As with any forecast or projection, forward-looking statements are subject to inherent uncertainties, risks and changes in circumstances that may cause actual results to differ materially from those set forth in the forward-looking statements. Forward-looking statements are not historical facts but instead express only management’s beliefs regarding future results or events, many of which, by their nature, are inherently uncertain and outside of management’s control. It is possible that actual results and outcomes may differ, possibly materially, from the anticipated results or outcomes indicated in these forward-looking statements. Important factors that could cause actual results to differ materially from those in our forward-looking statements include the following, without limitation:

•economic, market, liquidity, credit, interest rate, operational and technological risks associated with the Company’s business;

•future credit quality and performance, including our expectations regarding future loan losses and our allowance for credit losses

•the effect of and changes in policies and laws or regulatory agencies, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and other legislation and regulation relating to the banking industry;

•Management’s ability to effectively execute its business plans;

•mergers and acquisitions, including costs or difficulties related to the integration of acquired companies;

•the possibility that any of the anticipated benefits of the Company’s acquisitions will not be realized or will not be realized within the expected time period;

•the effect of changes in accounting policies and practices;

•changes in consumer spending, borrowing and saving and changes in unemployment;

•changes in customers’ performance and creditworthiness;

•the costs and effects of litigation and of unexpected or adverse outcomes in such litigation;

•current and future economic and market conditions, including the effects of changes in housing prices, fluctuations in unemployment rates, U.S. fiscal debt, budget and tax matters, geopolitical matters, and any slowdown in global economic growth;

•the adverse impact on the U.S. economy, including the markets in which we operate, of the novel coronavirus, which causes the Coronavirus disease 2019 (“COVID-19”), global pandemic, and the impact on the performance of our loan and lease portfolio, the market value of our investment securities, the availability of sources of funding and the demand for our products;

•our capital and liquidity requirements (including under regulatory capital standards, such as the Basel III capital standards) and our ability to generate capital internally or raise capital on favorable terms;

•financial services reform and other current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses, including the Dodd-Frank Act and other legislation and regulation relating to bank products and services;

•the effect of the current interest rate environment or changes in interest rates or in the level or composition of our assets or liabilities on our net interest income, net interest margin and our mortgage originations, mortgage servicing rights and mortgage loans held for sale;

•the effect of a fall in stock market prices on our brokerage, asset and wealth management businesses;

•a failure in or breach of our operational or security systems or infrastructure, or those of our third-party vendors or other service providers, including as a result of cyber attacks;

•the effect of changes in the level of checking or savings account deposits on our funding costs and net interest margin; and

•our ability to develop and execute effective business plans and strategies.

Additional factors that may cause our actual results to differ materially from those described in our forward-looking statements can be found in our Form 10-K for the year ended December 31, 2022, as well as our other filings with the SEC, which are available on the SEC website at www.sec.gov.

All forward-looking statements included in this filing are made as of the date hereof and are based on information available at the time of the filing. Except as required by law, the Company does not assume any obligation to update any forward-looking statement.

About First Financial Bancorp.

First Financial Bancorp. is a Cincinnati, Ohio based bank holding company. As of December 31, 2023, the Company had $17.5 billion in assets, $10.9 billion in loans, $13.4 billion in deposits and $2.3 billion in shareholders’ equity. The Company’s subsidiary, First Financial Bank, founded in 1863, provides banking and financial services products through its six lines of business: Commercial, Retail Banking, Investment Commercial Real Estate, Mortgage Banking, Commercial Finance and Wealth Management. These business units provide traditional banking services to business and retail clients. Wealth Management provides wealth planning, portfolio management, trust and estate, brokerage and retirement plan services and had approximately $3.5 billion in assets under management as of December 31, 2023. The Company operated 130 full service banking centers as of December 31, 2023, located in Ohio, Indiana, Kentucky and Illinois, while the Commercial Finance business lends into targeted industry verticals on a nationwide basis. Additional information about the Company, including its products, services and banking locations, is available at www.bankatfirst.com.

Contact Information

Investors/Analysts Media

Jamie Anderson Tim Condron

Chief Financial Officer Marketing Communications Manager

(513) 887-5400 (513) 979-5796

InvestorRelations@bankatfirst.com media@bankatfirst.com

Selected Financial Information

December 31, 2023

(unaudited)

| | | | | |

| Contents | Page |

| Consolidated Financial Highlights | 2 |

| Consolidated Quarterly Statements of Income | 3 |

| Consolidated Quarterly Statements of Income | 4-5 |

| Consolidated Statements of Condition | 6 |

| Average Consolidated Statements of Condition | 7 |

| Net Interest Margin Rate / Volume Analysis | 8-9 |

| Credit Quality | 10 |

| Capital Adequacy | 11 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FIRST FINANCIAL BANCORP. | |

| CONSOLIDATED FINANCIAL HIGHLIGHTS | |

| (Dollars in thousands, except per share data) | |

| (Unaudited) | |

| | | | | | | | | | | | | | |

| Three Months Ended, | | Twelve months ended, | |

| Dec. 31, | | Sep. 30, | | June 30, | | Mar. 31, | | Dec. 31, | | Dec. 31, | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 | |

| RESULTS OF OPERATIONS | | | | | | | | | | | | | | |

| Net income | $ | 56,732 | | | $ | 63,061 | | | $ | 65,667 | | | $ | 70,403 | | | $ | 69,086 | | | $ | 255,863 | | | $ | 217,612 | | |

| Net earnings per share - basic | $ | 0.60 | | | $ | 0.67 | | | $ | 0.70 | | | $ | 0.75 | | | $ | 0.74 | | | $ | 2.72 | | | $ | 2.33 | | |

| Net earnings per share - diluted | $ | 0.60 | | | $ | 0.66 | | | $ | 0.69 | | | $ | 0.74 | | | $ | 0.73 | | | $ | 2.69 | | | $ | 2.30 | | |

| Dividends declared per share | $ | 0.23 | | | $ | 0.23 | | | $ | 0.23 | | | $ | 0.23 | | | $ | 0.23 | | | $ | 0.92 | | | $ | 0.92 | | |

| | | | | | | | | | | | | | |

| KEY FINANCIAL RATIOS | | | | | | | | | | | | | | |

| Return on average assets | 1.31 | % | | 1.48 | % | | 1.55 | % | | 1.69 | % | | 1.63 | % | | 1.51 | % | | 1.33 | % | |

| Return on average shareholders' equity | 10.50 | % | | 11.62 | % | | 12.32 | % | | 13.71 | % | | 13.64 | % | | 12.01 | % | | 10.34 | % | |

Return on average tangible shareholders' equity (1) | 21.36 | % | | 23.60 | % | | 25.27 | % | | 29.02 | % | | 29.93 | % | | 24.72 | % | | 21.62 | % | |

| | | | | | | | | | | | | | |

| Net interest margin | 4.21 | % | | 4.28 | % | | 4.43 | % | | 4.51 | % | | 4.43 | % | | 4.36 | % | | 3.73 | % | |

Net interest margin (fully tax equivalent) (1)(2) | 4.26 | % | | 4.33 | % | | 4.48 | % | | 4.55 | % | | 4.47 | % | | 4.40 | % | | 3.77 | % | |

| | | | | | | | | | | | | | |

| Ending shareholders' equity as a percent of ending assets | 12.94 | % | | 12.49 | % | | 12.54 | % | | 12.53 | % | | 12.01 | % | | 12.94 | % | | 12.01 | % | |

| Ending tangible shareholders' equity as a percent of: | | | | | | | | | | | | | | |

Ending tangible assets (1) | 7.17 | % | | 6.50 | % | | 6.56 | % | | 6.47 | % | | 5.95 | % | | 7.17 | % | | 5.95 | % | |

Risk-weighted assets (1) | 8.90 | % | | 7.88 | % | | 8.03 | % | | 7.87 | % | | 7.32 | % | | 8.90 | % | | 7.32 | % | |

| | | | | | | | | | | | | | |

| Average shareholders' equity as a percent of average assets | 12.52 | % | | 12.70 | % | | 12.60 | % | | 12.29 | % | | 11.98 | % | | 12.53 | % | | 12.85 | % | |

| Average tangible shareholders' equity as a percent of | | | | | | | | | | | | | | |

average tangible assets (1) | 6.57 | % | | 6.69 | % | | 6.57 | % | | 6.21 | % | | 5.84 | % | | 6.51 | % | | 6.59 | % | |

| | | | | | | | | | | | | | |

| Book value per share | $ | 23.84 | | | $ | 22.39 | | | $ | 22.52 | | | $ | 22.29 | | | $ | 21.51 | | | $ | 23.84 | | | $ | 21.51 | | |

Tangible book value per share (1) | $ | 12.38 | | | $ | 10.91 | | | $ | 11.02 | | | $ | 10.76 | | | $ | 9.97 | | | $ | 12.38 | | | $ | 9.97 | | |

| | | | | | | | | | | | | | |

Common equity tier 1 ratio (3) | 11.85 | % | | 11.60 | % | | 11.34 | % | | 11.00 | % | | 10.83 | % | | 11.85 | % | | 10.83 | % | |

Tier 1 ratio (3) | 12.19 | % | | 11.94 | % | | 11.68 | % | | 11.34 | % | | 11.17 | % | | 12.19 | % | | 11.17 | % | |

Total capital ratio (3) | 13.75 | % | | 13.51 | % | | 13.44 | % | | 13.11 | % | | 13.09 | % | | 13.75 | % | | 13.09 | % | |

Leverage ratio (3) | 9.70 | % | | 9.59 | % | | 9.33 | % | | 9.03 | % | | 8.89 | % | | 9.70 | % | | 8.89 | % | |

| | | | | | | | | | | | | | |

| AVERAGE BALANCE SHEET ITEMS | | | | | | | | | | | | | | |

Loans (4) | $ | 10,751,028 | | | $ | 10,623,734 | | | $ | 10,513,505 | | | $ | 10,373,302 | | | $ | 10,059,119 | | | $ | 10,566,587 | | | $ | 9,574,965 | | |

| | | | | | | | | | | | | | |

| Investment securities | 3,184,408 | | | 3,394,237 | | | 3,560,453 | | | 3,635,317 | | | 3,705,304 | | | 3,442,233 | | | 4,032,046 | | |

| Interest-bearing deposits with other banks | 548,153 | | | 386,173 | | | 329,584 | | | 318,026 | | | 372,054 | | | 396,089 | | | 314,552 | | |

| Total earning assets | $ | 14,483,589 | | | $ | 14,404,144 | | | $ | 14,403,542 | | | $ | 14,326,645 | | | $ | 14,136,477 | | | $ | 14,404,909 | | | $ | 13,921,563 | | |

| Total assets | $ | 17,124,955 | | | $ | 16,951,389 | | | $ | 16,968,055 | | | $ | 16,942,999 | | | $ | 16,767,598 | | | $ | 16,997,223 | | | $ | 16,382,730 | | |

| Noninterest-bearing deposits | $ | 3,368,024 | | | $ | 3,493,305 | | | $ | 3,663,419 | | | $ | 3,954,915 | | | $ | 4,225,192 | | | $ | 3,617,961 | | | $ | 4,196,735 | | |

| Interest-bearing deposits | 9,834,819 | | | 9,293,860 | | | 9,050,464 | | | 8,857,226 | | | 8,407,114 | | | 9,261,866 | | | 8,383,529 | | |

| Total deposits | $ | 13,202,843 | | | $ | 12,787,165 | | | $ | 12,713,883 | | | $ | 12,812,141 | | | $ | 12,632,306 | | | $ | 12,879,827 | | | $ | 12,580,264 | | |

| Borrowings | $ | 1,083,954 | | | $ | 1,403,071 | | | $ | 1,523,699 | | | $ | 1,434,338 | | | $ | 1,489,088 | | | $ | 1,360,420 | | | $ | 1,177,013 | | |

| Shareholders' equity | $ | 2,144,482 | | | $ | 2,153,601 | | | $ | 2,137,765 | | | $ | 2,082,210 | | | $ | 2,009,564 | | | $ | 2,129,751 | | | $ | 2,105,339 | | |

| | | | | | | | | | | | | | |

| CREDIT QUALITY RATIOS | | | | | | | | | | | | | |

| Allowance to ending loans | 1.29 | % | | 1.36 | % | | 1.41 | % | | 1.36 | % | | 1.29 | % | | 1.29 | % | | 1.29 | % | |

| Allowance to nonaccrual loans | 215.10 | % | | 193.75 | % | | 276.70 | % | | 409.46 | % | | 464.58 | % | | 215.10 | % | | 464.58 | % | |

| Allowance to nonperforming loans | 215.10 | % | | 193.75 | % | | 276.70 | % | | 409.46 | % | | 335.94 | % | | 215.10 | % | | 335.94 | % | |

| Nonperforming loans to total loans | 0.60 | % | | 0.70 | % | | 0.51 | % | | 0.33 | % | | 0.38 | % | | 0.60 | % | | 0.38 | % | |

| Nonaccrual loans to total loans | 0.60 | % | | 0.70 | % | | 0.51 | % | | 0.33 | % | | 0.28 | % | | 0.60 | % | | 0.28 | % | |

| Nonperforming assets to ending loans, plus OREO | 0.60 | % | | 0.71 | % | | 0.51 | % | | 0.33 | % | | 0.39 | % | | 0.60 | % | | 0.39 | % | |

| Nonperforming assets to total assets | 0.38 | % | | 0.44 | % | | 0.32 | % | | 0.21 | % | | 0.23 | % | | 0.38 | % | | 0.23 | % | |

| Classified assets to total assets | 0.80 | % | | 0.82 | % | | 0.81 | % | | 0.94 | % | | 0.75 | % | | 0.80 | % | | 0.75 | % | |

| Net charge-offs to average loans (annualized) | 0.46 | % | | 0.61 | % | | 0.22 | % | | 0.00 | % | | (0.01) | % | | 0.33 | % | | 0.06 | % | |

(1) Non-GAAP measure. For details on the calculation of these non-GAAP financial measures and a reconciliation to the GAAP financial measure, see the sections titled “Use of Non-GAAP Financial Measures” in this release and “Appendix: Non-GAAP to GAAP Reconciliation” in the accompanying slide presentation.

(2) The tax equivalent adjustment to net interest income recognizes the income tax savings when comparing taxable and tax-exempt assets and assumes a 21% tax rate. Management believes that it is a standard practice in the banking industry to present net interest margin and net interest income on a fully tax equivalent basis. Therefore, management believes these measures provide useful information to investors by allowing them to make peer comparisons. Management also uses these measures to make peer comparisons.

(3) December 31, 2023 regulatory capital ratios are preliminary.

(4) Includes loans held for sale.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FIRST FINANCIAL BANCORP. |

| CONSOLIDATED STATEMENTS OF INCOME |

| (Dollars in thousands, except per share data) |

| (Unaudited) |

| | | |

| Three months ended, | | Twelve months ended, |

| Dec. 31, | | Dec. 31, |

| 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Interest income | | | | | | | | | | | |

| Loans and leases, including fees | $ | 197,416 | | | $ | 152,299 | | | 29.6 | % | | $ | 743,770 | | | $ | 458,742 | | | 62.1 | % |

| Investment securities | | | | | | | | | | | |

| Taxable | 30,294 | | | 30,248 | | | 0.2 | % | | 125,520 | | | 102,314 | | | 22.7 | % |

| Tax-exempt | 3,402 | | | 4,105 | | | (17.1) | % | | 13,901 | | | 18,466 | | | (24.7) | % |

| Total investment securities interest | 33,696 | | | 34,353 | | | (1.9) | % | | 139,421 | | | 120,780 | | | 15.4 | % |

| Other earning assets | 7,325 | | | 3,262 | | | 124.6 | % | | 19,813 | | | 5,484 | | | 261.3 | % |

| Total interest income | 238,437 | | | 189,914 | | | 25.5 | % | | 903,004 | | | 585,006 | | | 54.4 | % |

| | | | | | | | | | | |

| Interest expense | | | | | | | | | | | |

| Deposits | 69,193 | | | 16,168 | | | 328.0 | % | | 202,010 | | | 28,140 | | | 617.9 | % |

| Short-term borrowings | 10,277 | | | 11,091 | | | (7.3) | % | | 53,378 | | | 19,132 | | | 179.0 | % |

| Long-term borrowings | 5,202 | | | 4,759 | | | 9.3 | % | | 19,846 | | | 18,591 | | | 6.8 | % |

| Total interest expense | 84,672 | | | 32,018 | | | 164.5 | % | | 275,234 | | | 65,863 | | | 317.9 | % |

| Net interest income | 153,765 | | | 157,896 | | | (2.6) | % | | 627,770 | | | 519,143 | | | 20.9 | % |

| Provision for credit losses-loans and leases | 8,804 | | | 8,689 | | | 1.3 | % | | 43,074 | | | 6,731 | | | 539.9 | % |

| Provision for credit losses-unfunded commitments | 1,426 | | | 1,341 | | | 6.3 | % | | 33 | | | 4,982 | | | (99.3) | % |

| Net interest income after provision for credit losses | 143,535 | | | 147,866 | | | (2.9) | % | | 584,663 | | | 507,430 | | | 15.2 | % |

| | | | | | | | | | | |

| Noninterest income | | | | | | | | | | | |

| Service charges on deposit accounts | 6,846 | | | 6,406 | | | 6.9 | % | | 27,289 | | | 28,062 | | | (2.8) | % |

| Wealth management fees | 6,091 | | | 5,648 | | | 7.8 | % | | 26,081 | | | 23,506 | | | 11.0 | % |

| Bankcard income | 3,349 | | | 3,736 | | | (10.4) | % | | 14,039 | | | 14,380 | | | (2.4) | % |

| Client derivative fees | 711 | | | 1,822 | | | (61.0) | % | | 5,155 | | | 5,441 | | | (5.3) | % |

| Foreign exchange income | 8,730 | | | 19,592 | | | (55.4) | % | | 54,051 | | | 54,965 | | | (1.7) | % |

| Leasing business income | 12,856 | | | 11,124 | | | 15.6 | % | | 51,322 | | | 31,574 | | | 62.5 | % |

| Net gains from sales of loans | 2,957 | | | 2,206 | | | 34.0 | % | | 13,217 | | | 15,048 | | | (12.2) | % |

| Net gain (loss) on sale of investment securities | (851) | | | (393) | | | 116.5 | % | | (1,258) | | | (569) | | | 121.1 | % |

| Net gain (loss) on equity securities | 202 | | | 1,315 | | | (84.6) | % | | 206 | | | (639) | | | (132.2) | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Other | 6,102 | | | 4,579 | | | 33.3 | % | | 22,320 | | | 17,873 | | | 24.9 | % |

| Total noninterest income | 46,993 | | | 56,035 | | | (16.1) | % | | 212,422 | | | 189,641 | | | 12.0 | % |

| | | | | | | | | | | |

| Noninterest expenses | | | | | | | | | | | |

| Salaries and employee benefits | 70,637 | | | 73,621 | | | (4.1) | % | | 292,731 | | | 269,368 | | | 8.7 | % |

| | | | | | | | | | | |

| Net occupancy | 5,890 | | | 5,434 | | | 8.4 | % | | 22,990 | | | 22,208 | | | 3.5 | % |

| Furniture and equipment | 3,523 | | | 3,234 | | | 8.9 | % | | 13,543 | | | 13,224 | | | 2.4 | % |

| Data processing | 8,488 | | | 8,567 | | | (0.9) | % | | 35,852 | | | 33,662 | | | 6.5 | % |

| Marketing | 2,087 | | | 2,198 | | | (5.1) | % | | 9,647 | | | 8,744 | | | 10.3 | % |

| Communication | 707 | | | 690 | | | 2.5 | % | | 2,729 | | | 2,683 | | | 1.7 | % |

| Professional services | 3,148 | | | 3,015 | | | 4.4 | % | | 9,926 | | | 9,734 | | | 2.0 | % |

| | | | | | | | | | | |

| State intangible tax | 984 | | | 974 | | | 1.0 | % | | 3,914 | | | 4,285 | | | (8.7) | % |

| FDIC assessments | 3,651 | | | 2,173 | | | 68.0 | % | | 11,948 | | | 7,194 | | | 66.1 | % |

| Intangible amortization | 2,601 | | | 2,573 | | | 1.1 | % | | 10,402 | | | 11,185 | | | (7.0) | % |

| Leasing business expense | 8,955 | | | 6,061 | | | 47.7 | % | | 32,500 | | | 20,363 | | | 59.6 | % |

| Other | 8,466 | | | 15,902 | | | (46.8) | % | | 32,307 | | | 52,699 | | | (38.7) | % |

| Total noninterest expenses | 119,137 | | | 124,442 | | | (4.3) | % | | 478,489 | | | 455,349 | | | 5.1 | % |

| Income before income taxes | 71,391 | | | 79,459 | | | (10.2) | % | | 318,596 | | | 241,722 | | | 31.8 | % |

| Income tax expense (benefit) | 14,659 | | | 10,373 | | | 41.3 | % | | 62,733 | | | 24,110 | | | 160.2 | % |

| Net income | $ | 56,732 | | | $ | 69,086 | | | (17.9) | % | | $ | 255,863 | | | $ | 217,612 | | | 17.6 | % |

| | | | | | | | | | | |

| ADDITIONAL DATA | | | | | | | | | | | |

| Net earnings per share - basic | $ | 0.60 | | | $ | 0.74 | | | | | $ | 2.72 | | | $ | 2.33 | | | |

| Net earnings per share - diluted | $ | 0.60 | | | $ | 0.73 | | | | | $ | 2.69 | | | $ | 2.30 | | | |

| Dividends declared per share | $ | 0.23 | | | $ | 0.23 | | | | | $ | 0.92 | | | $ | 0.92 | | | |

| | | | | | | | | | | |

| Return on average assets | 1.31 | % | | 1.63 | % | | | | 1.51 | % | | 1.33 | % | | |

| Return on average shareholders' equity | 10.50 | % | | 13.64 | % | | | | 12.01 | % | | 10.34 | % | | |

| | | | | | | | | | | |

| Interest income | $ | 238,437 | | | $ | 189,914 | | | 25.5 | % | | $ | 903,004 | | | $ | 585,006 | | | 54.4 | % |

| Tax equivalent adjustment | 1,672 | | | 1,553 | | | 7.7 | % | | 6,356 | | | 6,357 | | | 0.0 | % |

| Interest income - tax equivalent | 240,109 | | | 191,467 | | | 25.4 | % | | 909,360 | | | 591,363 | | | 53.8 | % |

| Interest expense | 84,672 | | | 32,018 | | | 164.5 | % | | 275,234 | | | 65,863 | | | 317.9 | % |

| Net interest income - tax equivalent | $ | 155,437 | | | $ | 159,449 | | | (2.5) | % | | $ | 634,126 | | | $ | 525,500 | | | 20.7 | % |

| | | | | | | | | | | |

| Net interest margin | 4.21 | % | | 4.43 | % | | | | 4.36 | % | | 3.73 | % | | |

Net interest margin (fully tax equivalent) (1) | 4.26 | % | | 4.47 | % | | | | 4.40 | % | | 3.77 | % | | |

| | | | | | | | | | | |

| Full-time equivalent employees | 2,129 | | | 2,070 | | | | | | | | | |

| | | | | | | | | | | |

(1) The tax equivalent adjustment to net interest income recognizes the income tax savings when comparing taxable and tax-exempt assets and assumes a 21% tax rate. Management believes that it is a standard practice in the banking industry to present net interest income on a fully tax equivalent basis. Therefore, management believes these measures provide useful information to investors by allowing them to make peer comparisons. Management also uses these measures to make peer comparisons. |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FIRST FINANCIAL BANCORP. |

| CONSOLIDATED QUARTERLY STATEMENTS OF INCOME |

| (Dollars in thousands, except per share data) |

| (Unaudited) |

| | | | | | | | | | | |

| 2023 |

| Fourth | | Third | | Second | | First | | Year to | | % Change |

| Quarter | | Quarter | | Quarter | | Quarter | | Date | | Linked Qtr. |

| Interest income | | | | | | | | | | | |

| Loans and leases, including fees | $ | 197,416 | | | $ | 192,261 | | | $ | 184,387 | | | $ | 169,706 | | | $ | 743,770 | | | 2.7 | % |

| Investment securities | | | | | | | | | | | |

| Taxable | 30,294 | | | 31,297 | | | 32,062 | | | 31,867 | | | 125,520 | | | (3.2) | % |

| Tax-exempt | 3,402 | | | 3,522 | | | 3,513 | | | 3,464 | | | 13,901 | | | (3.4) | % |

| Total investment securities interest | 33,696 | | | 34,819 | | | 35,575 | | | 35,331 | | | 139,421 | | | (3.2) | % |

| Other earning assets | 7,325 | | | 5,011 | | | 3,933 | | | 3,544 | | | 19,813 | | | 46.2 | % |

| Total interest income | 238,437 | | | 232,091 | | | 223,895 | | | 208,581 | | | 903,004 | | | 2.7 | % |

| | | | | | | | | | | |

| Interest expense | | | | | | | | | | | |

| Deposits | 69,193 | | | 57,069 | | | 44,292 | | | 31,456 | | | 202,010 | | | 21.2 | % |

| Short-term borrowings | 10,277 | | | 14,615 | | | 15,536 | | | 12,950 | | | 53,378 | | | (29.7) | % |

| Long-term borrowings | 5,202 | | | 4,952 | | | 4,835 | | | 4,857 | | | 19,846 | | | 5.0 | % |

| Total interest expense | 84,672 | | | 76,636 | | | 64,663 | | | 49,263 | | | 275,234 | | | 10.5 | % |

| Net interest income | 153,765 | | | 155,455 | | | 159,232 | | | 159,318 | | | 627,770 | | | (1.1) | % |

| Provision for credit losses-loans and leases | 8,804 | | | 12,907 | | | 12,719 | | | 8,644 | | | 43,074 | | | (31.8) | % |

| Provision for credit losses-unfunded commitments | 1,426 | | | (1,234) | | | (1,994) | | | 1,835 | | | 33 | | | (215.6) | % |

| Net interest income after provision for credit losses | 143,535 | | | 143,782 | | | 148,507 | | | 148,839 | | | 584,663 | | | (0.2) | % |

| | | | | | | | | | | |

| Noninterest income | | | | | | | | | | | |

| Service charges on deposit accounts | 6,846 | | | 6,957 | | | 6,972 | | | 6,514 | | | 27,289 | | | (1.6) | % |

| Wealth management fees | 6,091 | | | 6,943 | | | 6,713 | | | 6,334 | | | 26,081 | | | (12.3) | % |

| Bankcard income | 3,349 | | | 3,406 | | | 3,692 | | | 3,592 | | | 14,039 | | | (1.7) | % |

| Client derivative fees | 711 | | | 1,612 | | | 1,827 | | | 1,005 | | | 5,155 | | | (55.9) | % |

| Foreign exchange income | 8,730 | | | 13,384 | | | 15,039 | | | 16,898 | | | 54,051 | | | (34.8) | % |

| Leasing business income | 12,856 | | | 14,537 | | | 10,265 | | | 13,664 | | | 51,322 | | | (11.6) | % |

| Net gains from sales of loans | 2,957 | | | 4,086 | | | 3,839 | | | 2,335 | | | 13,217 | | | (27.6) | % |

| Net gain (loss) on sale of investment securities | (851) | | | (4) | | | (384) | | | (19) | | | (1,258) | | | N/M |

| Net gain (loss) on equity securities | 202 | | | (54) | | | (82) | | | 140 | | | 206 | | | 474.1 | % |

| Other | 6,102 | | | 5,761 | | | 5,377 | | | 5,080 | | | 22,320 | | | 5.9 | % |

| Total noninterest income | 46,993 | | | 56,628 | | | 53,258 | | | 55,543 | | | 212,422 | | | (17.0) | % |

| | | | | | | | | | | |

| Noninterest expenses | | | | | | | | | | | |

| Salaries and employee benefits | 70,637 | | | 75,641 | | | 74,199 | | | 72,254 | | | 292,731 | | | (6.6) | % |

| Net occupancy | 5,890 | | | 5,809 | | | 5,606 | | | 5,685 | | | 22,990 | | | 1.4 | % |

| Furniture and equipment | 3,523 | | | 3,341 | | | 3,362 | | | 3,317 | | | 13,543 | | | 5.4 | % |

| Data processing | 8,488 | | | 8,473 | | | 9,871 | | | 9,020 | | | 35,852 | | | 0.2 | % |

| Marketing | 2,087 | | | 2,598 | | | 2,802 | | | 2,160 | | | 9,647 | | | (19.7) | % |

| Communication | 707 | | | 744 | | | 644 | | | 634 | | | 2,729 | | | (5.0) | % |

| Professional services | 3,148 | | | 2,524 | | | 2,308 | | | 1,946 | | | 9,926 | | | 24.7 | % |

| State intangible tax | 984 | | | 981 | | | 964 | | | 985 | | | 3,914 | | | 0.3 | % |

| FDIC assessments | 3,651 | | | 2,665 | | | 2,806 | | | 2,826 | | | 11,948 | | | 37.0 | % |

| Intangible amortization | 2,601 | | | 2,600 | | | 2,601 | | | 2,600 | | | 10,402 | | | 0.0 | % |

| Leasing business expense | 8,955 | | | 8,877 | | | 6,730 | | | 7,938 | | | 32,500 | | | 0.9 | % |

| Other | 8,466 | | | 7,791 | | | 8,722 | | | 7,328 | | | 32,307 | | | 8.7 | % |

| Total noninterest expenses | 119,137 | | | 122,044 | | | 120,615 | | | 116,693 | | | 478,489 | | | (2.4) | % |

| Income before income taxes | 71,391 | | | 78,366 | | | 81,150 | | | 87,689 | | | 318,596 | | | (8.9) | % |

| Income tax expense (benefit) | 14,659 | | | 15,305 | | | 15,483 | | | 17,286 | | | 62,733 | | | (4.2) | % |

| Net income | $ | 56,732 | | | $ | 63,061 | | | $ | 65,667 | | | $ | 70,403 | | | $ | 255,863 | | | (10.0) | % |

| | | | | | | | | | | |

| ADDITIONAL DATA | | | | | | | | | | | |

| Net earnings per share - basic | $ | 0.60 | | | $ | 0.67 | | | $ | 0.70 | | | $ | 0.75 | | | $ | 2.72 | | | |

| Net earnings per share - diluted | $ | 0.60 | | | $ | 0.66 | | | $ | 0.69 | | | $ | 0.74 | | | $ | 2.69 | | | |

| Dividends declared per share | $ | 0.23 | | | $ | 0.23 | | | $ | 0.23 | | | $ | 0.23 | | | $ | 0.92 | | | |

| | | | | | | | | | | |

| Return on average assets | 1.31 | % | | 1.48 | % | | 1.55 | % | | 1.69 | % | | 1.51 | % | | |

| Return on average shareholders' equity | 10.50 | % | | 11.62 | % | | 12.32 | % | | 13.71 | % | | 12.01 | % | | |

| | | | | | | | | | | |

| Interest income | $ | 238,437 | | | $ | 232,091 | | | $ | 223,895 | | | $ | 208,581 | | | $ | 903,004 | | | 2.7 | % |

| Tax equivalent adjustment | 1,672 | | | 1,659 | | | 1,601 | | | 1,424 | | | 6,356 | | | 0.8 | % |

| Interest income - tax equivalent | 240,109 | | | 233,750 | | | 225,496 | | | 210,005 | | | 909,360 | | | 2.7 | % |

| Interest expense | 84,672 | | | 76,636 | | | 64,663 | | | 49,263 | | | 275,234 | | | 10.5 | % |

| Net interest income - tax equivalent | $ | 155,437 | | | $ | 157,114 | | | $ | 160,833 | | | $ | 160,742 | | | $ | 634,126 | | | (1.1) | % |

| | | | | | | | | | | |

| Net interest margin | 4.21 | % | | 4.28 | % | | 4.43 | % | | 4.51 | % | | 4.36 | % | | |

Net interest margin (fully tax equivalent) (1) | 4.26 | % | | 4.33 | % | | 4.48 | % | | 4.55 | % | | 4.40 | % | | |

| | | | | | | | | | | |

| Full-time equivalent employees | 2,129 | | | 2,121 | | | 2,193 | | | 2,066 | | | | | |

| | | | | | | | | | | |

| (1) The tax equivalent adjustment to net interest income recognizes the income tax savings when comparing taxable and tax-exempt assets and assumes a 21% tax rate. Management believes that it is a standard practice in the banking industry to present net interest income on a fully tax equivalent basis. Therefore, management believes these measures provide useful information to investors by allowing them to make peer comparisons. Management also uses these measures to make peer comparisons. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FIRST FINANCIAL BANCORP. |

| CONSOLIDATED QUARTERLY STATEMENTS OF INCOME |

| (Dollars in thousands, except per share data) |

| (Unaudited) |

| | | | | | | | | | | |

| | | 2022 |

| | | Fourth | | Third | | Second | | First | | Full |

| | | Quarter | | Quarter | | Quarter | | Quarter | | Year |

| Interest income | | | | | | | | | | | |

| Loans and leases, including fees | | | $ | 152,299 | | | $ | 122,170 | | | $ | 97,091 | | | $ | 87,182 | | | $ | 458,742 | |

| Investment securities | | | | | | | | | | | |

| Taxable | | | 30,248 | | | 26,331 | | | 23,639 | | | 22,096 | | | 102,314 | |

| Tax-exempt | | | 4,105 | | | 5,014 | | | 4,916 | | | 4,431 | | | 18,466 | |

| Total investment securities interest | | | 34,353 | | | 31,345 | | | 28,555 | | | 26,527 | | | 120,780 | |

| Other earning assets | | | 3,262 | | | 1,597 | | | 505 | | | 120 | | | 5,484 | |

| Total interest income | | | 189,914 | | | 155,112 | | | 126,151 | | | 113,829 | | | 585,006 | |

| | | | | | | | | | | |

| Interest expense | | | | | | | | | | | |

| Deposits | | | 16,168 | | | 6,386 | | | 2,963 | | | 2,623 | | | 28,140 | |

| Short-term borrowings | | | 11,091 | | | 6,158 | | | 1,566 | | | 317 | | | 19,132 | |

| Long-term borrowings | | | 4,759 | | | 4,676 | | | 4,612 | | | 4,544 | | | 18,591 | |

| Total interest expense | | | 32,018 | | | 17,220 | | | 9,141 | | | 7,484 | | | 65,863 | |

| Net interest income | | | 157,896 | | | 137,892 | | | 117,010 | | | 106,345 | | | 519,143 | |

| Provision for credit losses-loans and leases | | | 8,689 | | | 7,898 | | | (4,267) | | | (5,589) | | | 6,731 | |

| Provision for credit losses-unfunded commitments | | | 1,341 | | | 386 | | | 3,481 | | | (226) | | | 4,982 | |

| Net interest income after provision for credit losses | | | 147,866 | | | 129,608 | | | 117,796 | | | 112,160 | | | 507,430 | |

| | | | | | | | | | | |

| Noninterest income | | | | | | | | | | | |

| Service charges on deposit accounts | | | 6,406 | | | 6,279 | | | 7,648 | | | 7,729 | | | 28,062 | |

| Wealth management fees | | | 5,648 | | | 5,487 | | | 6,311 | | | 6,060 | | | 23,506 | |

| Bankcard income | | | 3,736 | | | 3,484 | | | 3,823 | | | 3,337 | | | 14,380 | |

| Client derivative fees | | | 1,822 | | | 1,447 | | | 1,369 | | | 803 | | | 5,441 | |

| Foreign exchange income | | | 19,592 | | | 11,752 | | | 13,470 | | | 10,151 | | | 54,965 | |

| Leasing business income | | | 11,124 | | | 7,127 | | | 7,247 | | | 6,076 | | | 31,574 | |

| Net gains from sales of loans | | | 2,206 | | | 3,729 | | | 5,241 | | | 3,872 | | | 15,048 | |

| Net gain (loss) on sale of investment securities | | | (393) | | | (179) | | | 0 | | | 3 | | | (569) | |

| Net gain (loss) on equity securities | | | 1,315 | | | (701) | | | (1,054) | | | (199) | | | (639) | |

| Other | | | 4,579 | | | 4,109 | | | 5,723 | | | 3,462 | | | 17,873 | |

| Total noninterest income | | | 56,035 | | | 42,534 | | | 49,778 | | | 41,294 | | | 189,641 | |

| | | | | | | | | | | |

| Noninterest expenses | | | | | | | | | | | |

| Salaries and employee benefits | | | 73,621 | | | 66,808 | | | 64,992 | | | 63,947 | | | 269,368 | |

| Net occupancy | | | 5,434 | | | 5,669 | | | 5,359 | | | 5,746 | | | 22,208 | |

| Furniture and equipment | | | 3,234 | | | 3,222 | | | 3,201 | | | 3,567 | | | 13,224 | |

| Data processing | | | 8,567 | | | 8,497 | | | 8,334 | | | 8,264 | | | 33,662 | |

| Marketing | | | 2,198 | | | 2,523 | | | 2,323 | | | 1,700 | | | 8,744 | |

| Communication | | | 690 | | | 657 | | | 670 | | | 666 | | | 2,683 | |

| Professional services | | | 3,015 | | | 2,346 | | | 2,214 | | | 2,159 | | | 9,734 | |

| State intangible tax | | | 974 | | | 1,090 | | | 1,090 | | | 1,131 | | | 4,285 | |

| FDIC assessments | | | 2,173 | | | 1,885 | | | 1,677 | | | 1,459 | | | 7,194 | |

| Intangible amortization | | | 2,573 | | | 2,783 | | | 2,915 | | | 2,914 | | | 11,185 | |

| Leasing business expense | | | 6,061 | | | 5,746 | | | 4,687 | | | 3,869 | | | 20,363 | |

| Other | | | 15,902 | | | 23,842 | | | 5,572 | | | 7,383 | | | 52,699 | |

| Total noninterest expenses | | | 124,442 | | | 125,068 | | | 103,034 | | | 102,805 | | | 455,349 | |

| Income before income taxes | | | 79,459 | | | 47,074 | | | 64,540 | | | 50,649 | | | 241,722 | |

| Income tax expense (benefit) | | | 10,373 | | | (8,631) | | | 13,020 | | | 9,348 | | | 24,110 | |

| Net income | | | $ | 69,086 | | | $ | 55,705 | | | $ | 51,520 | | | $ | 41,301 | | | $ | 217,612 | |

| | | | | | | | | | | |

| ADDITIONAL DATA | | | | | | | | | | | |

| Net earnings per share - basic | | | $ | 0.74 | | | $ | 0.60 | | | $ | 0.55 | | | $ | 0.44 | | | $ | 2.33 | |

| Net earnings per share - diluted | | | $ | 0.73 | | | $ | 0.59 | | | $ | 0.55 | | | $ | 0.44 | | | $ | 2.30 | |

| Dividends declared per share | | | $ | 0.23 | | | $ | 0.23 | | | $ | 0.23 | | | $ | 0.23 | | | $ | 0.92 | |

| | | | | | | | | | | |

| Return on average assets | | | 1.63 | % | | 1.35 | % | | 1.28 | % | | 1.03 | % | | 1.33 | % |

| Return on average shareholders' equity | | | 13.64 | % | | 10.58 | % | | 9.84 | % | | 7.53 | % | | 10.34 | % |

| | | | | | | | | | | |

| Interest income | | | $ | 189,914 | | | $ | 155,112 | | | $ | 126,151 | | | $ | 113,829 | | | $ | 585,006 | |

| Tax equivalent adjustment | | | 1,553 | | | 1,712 | | | 1,625 | | | 1,467 | | | 6,357 | |

| Interest income - tax equivalent | | | 191,467 | | | 156,824 | | | 127,776 | | | 115,296 | | | 591,363 | |

| Interest expense | | | 32,018 | | | 17,220 | | | 9,141 | | | 7,484 | | | 65,863 | |

| Net interest income - tax equivalent | | | $ | 159,449 | | | $ | 139,604 | | | $ | 118,635 | | | $ | 107,812 | | | $ | 525,500 | |

| | | | | | | | | | | |

| Net interest margin | | | 4.43 | % | | 3.93 | % | | 3.41 | % | | 3.11 | % | | 3.73 | % |

Net interest margin (fully tax equivalent) (1) | | | 4.47 | % | | 3.98 | % | | 3.45 | % | | 3.16 | % | | 3.77 | % |

| | | | | | | | | | | |

| Full-time equivalent employees | | | 2,070 | | | 2,072 | | | 2,096 | | | 2,050 | | |

| | | | | | | | | | | |

(1) The tax equivalent adjustment to net interest income recognizes the income tax savings when comparing taxable and tax-exempt assets and assumes a 21% tax rate. Management believes that it is a standard practice in the banking industry to present net interest income on a fully tax equivalent basis. Therefore, management believes these measures provide useful information to investors by allowing them to make peer comparisons. Management also uses these measures to make peer comparisons. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FIRST FINANCIAL BANCORP. |

| CONSOLIDATED STATEMENTS OF CONDITION |

| (Dollars in thousands) |

| (Unaudited) |

| | | | | | | | | | | | | |

| Dec. 31, | | Sep. 30, | | June 30, | | Mar. 31, | | Dec. 31, | | % Change | | % Change |

| 2023 | | 2023 | | 2023 | | 2023 | | 2022 | | Linked Qtr. | | Comp Qtr. |

| ASSETS | | | | | | | | | | | | | |

| Cash and due from banks | $ | 213,059 | | | $ | 220,335 | | | $ | 217,385 | | | $ | 199,835 | | | $ | 207,501 | | | (3.3) | % | | 2.7 | % |

| Interest-bearing deposits with other banks | 792,960 | | | 452,867 | | | 485,241 | | | 305,465 | | | 388,182 | | | 75.1 | % | | 104.3 | % |

| Investment securities available-for-sale | 3,021,126 | | | 3,044,361 | | | 3,249,404 | | | 3,384,949 | | | 3,409,648 | | | (0.8) | % | | (11.4) | % |

| Investment securities held-to-maturity | 80,321 | | | 81,236 | | | 82,372 | | | 83,070 | | | 84,021 | | | (1.1) | % | | (4.4) | % |

| Other investments | 129,945 | | | 133,725 | | | 141,892 | | | 143,606 | | | 143,160 | | | (2.8) | % | | (9.2) | % |

| Loans held for sale | 9,213 | | | 12,391 | | | 15,267 | | | 9,280 | | | 7,918 | | | (25.6) | % | | 16.4 | % |

| Loans and leases | | | | | | | | | | | | | |

| Commercial and industrial | 3,501,221 | | | 3,420,873 | | | 3,433,162 | | | 3,449,289 | | | 3,410,272 | | | 2.3 | % | | 2.7 | % |

| Lease financing | 474,817 | | | 399,973 | | | 360,801 | | | 273,898 | | | 236,124 | | | 18.7 | % | | 101.1 | % |

| Construction real estate | 564,832 | | | 578,824 | | | 536,464 | | | 525,906 | | | 512,050 | | | (2.4) | % | | 10.3 | % |

| Commercial real estate | 4,080,939 | | | 3,992,654 | | | 4,048,460 | | | 4,056,627 | | | 4,052,759 | | | 2.2 | % | | 0.7 | % |

| Residential real estate | 1,333,674 | | | 1,293,470 | | | 1,221,484 | | | 1,145,069 | | | 1,092,265 | | | 3.1 | % | | 22.1 | % |

| Home equity | 758,676 | | | 743,991 | | | 728,711 | | | 724,672 | | | 733,791 | | | 2.0 | % | | 3.4 | % |

| Installment | 159,078 | | | 160,648 | | | 165,216 | | | 204,372 | | | 209,895 | | | (1.0) | % | | (24.2) | % |

| Credit card | 59,939 | | | 56,386 | | | 55,911 | | | 53,552 | | | 51,815 | | | 6.3 | % | | 15.7 | % |

| Total loans | 10,933,176 | | | 10,646,819 | | | 10,550,209 | | | 10,433,385 | | | 10,298,971 | | | 2.7 | % | | 6.2 | % |

| Less: | | | | | | | | | | | | | |

| Allowance for credit losses | (141,433) | | | (145,201) | | | (148,646) | | | (141,591) | | | (132,977) | | | (2.6) | % | | 6.4 | % |

| Net loans | 10,791,743 | | | 10,501,618 | | | 10,401,563 | | | 10,291,794 | | | 10,165,994 | | | 2.8 | % | | 6.2 | % |

| Premises and equipment | 194,740 | | | 192,572 | | | 192,077 | | | 188,959 | | | 189,080 | | | 1.1 | % | | 3.0 | % |

| Operating leases | 153,214 | | | 136,883 | | | 132,272 | | | 153,986 | | | 91,738 | | | 11.9 | % | | 67.0 | % |

| Goodwill | 1,005,868 | | | 1,005,868 | | | 1,005,828 | | | 1,005,738 | | | 1,001,507 | | | 0.0 | % | | 0.4 | % |

| Other intangibles | 83,949 | | | 86,378 | | | 88,662 | | | 91,169 | | | 93,919 | | | (2.8) | % | | (10.6) | % |

| | | | | | | | | | | | | |

| Accrued interest and other assets | 1,056,762 | | | 1,186,618 | | | 1,078,186 | | | 1,076,033 | | | 1,220,648 | | | (10.9) | % | | (13.4) | % |

| Total Assets | $ | 17,532,900 | | | $ | 17,054,852 | | | $ | 17,090,149 | | | $ | 16,933,884 | | | $ | 17,003,316 | | | 2.8 | % | | 3.1 | % |

| | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | | |

| Deposits | | | | | | | | | | | | | |

| Interest-bearing demand | $ | 2,993,219 | | | $ | 2,880,617 | | | $ | 2,919,472 | | | $ | 2,761,811 | | | $ | 3,037,153 | | | 3.9 | % | | (1.4) | % |

| Savings | 4,331,228 | | | 4,023,455 | | | 3,785,445 | | | 3,746,403 | | | 3,828,139 | | | 7.6 | % | | 13.1 | % |

| Time | 2,718,390 | | | 2,572,909 | | | 2,484,780 | | | 2,336,368 | | | 1,700,705 | | | 5.7 | % | | 59.8 | % |

| Total interest-bearing deposits | 10,042,837 | | | 9,476,981 | | | 9,189,697 | | | 8,844,582 | | | 8,565,997 | | | 6.0 | % | | 17.2 | % |

| Noninterest-bearing | 3,317,960 | | | 3,438,572 | | | 3,605,181 | | | 3,830,102 | | | 4,135,180 | | | (3.5) | % | | (19.8) | % |

| Total deposits | 13,360,797 | | | 12,915,553 | | | 12,794,878 | | | 12,674,684 | | | 12,701,177 | | | 3.4 | % | | 5.2 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| FHLB short-term borrowings | 800,000 | | | 755,000 | | | 1,050,300 | | | 1,089,400 | | | 1,130,000 | | | 6.0 | % | | (29.2) | % |

| Other | 137,814 | | | 219,188 | | | 165,983 | | | 128,160 | | | 157,156 | | | (37.1) | % | | (12.3) | % |

| Total short-term borrowings | 937,814 | | | 974,188 | | | 1,216,283 | | | 1,217,560 | | | 1,287,156 | | | (3.7) | % | | (27.1) | % |

| Long-term debt | 344,115 | | | 340,902 | | | 339,963 | | | 342,647 | | | 346,672 | | | 0.9 | % | | (0.7) | % |

| Total borrowed funds | 1,281,929 | | | 1,315,090 | | | 1,556,246 | | | 1,560,207 | | | 1,633,828 | | | (2.5) | % | | (21.5) | % |

| Accrued interest and other liabilities | 622,200 | | | 694,700 | | | 595,606 | | | 577,497 | | | 626,938 | | | (10.4) | % | | (0.8) | % |

| Total Liabilities | 15,264,926 | | | 14,925,343 | | | 14,946,730 | | | 14,812,388 | | | 14,961,943 | | | 2.3 | % | | 2.0 | % |

| | | | | | | | | | | | | |

| SHAREHOLDERS' EQUITY | | | | | | | | | | | | | |

| Common stock | 1,638,972 | | | 1,636,054 | | | 1,632,659 | | | 1,629,428 | | | 1,634,605 | | | 0.2 | % | | 0.3 | % |

| Retained earnings | 1,136,718 | | | 1,101,905 | | | 1,060,715 | | | 1,016,893 | | | 968,237 | | | 3.2 | % | | 17.4 | % |

| Accumulated other comprehensive income (loss) | (309,819) | | | (410,005) | | | (353,010) | | | (328,059) | | | (358,663) | | | (24.4) | % | | (13.6) | % |

| Treasury stock, at cost | (197,897) | | | (198,445) | | | (196,945) | | | (196,766) | | | (202,806) | | | (0.3) | % | | (2.4) | % |

| Total Shareholders' Equity | 2,267,974 | | | 2,129,509 | | | 2,143,419 | | | 2,121,496 | | | 2,041,373 | | | 6.5 | % | | 11.1 | % |

| Total Liabilities and Shareholders' Equity | $ | 17,532,900 | | | $ | 17,054,852 | | | $ | 17,090,149 | | | $ | 16,933,884 | | | $ | 17,003,316 | | | 2.8 | % | | 3.1 | % |

|

|

|

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FIRST FINANCIAL BANCORP. |

| AVERAGE CONSOLIDATED STATEMENTS OF CONDITION |

| (Dollars in thousands) |

| (Unaudited) |

| | | | | |

| Quarterly Averages | | Year-to-Date Averages |

| Dec. 31, | | Sep. 30, | | June 30, | | Mar. 31, | | Dec. 31, | | Dec. 31, |

| 2023 | | 2023 | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| ASSETS | | | | | | | | | | | | | |

| Cash and due from banks | $ | 214,678 | | | $ | 211,670 | | | $ | 221,527 | | | $ | 218,724 | | | $ | 218,216 | | | $ | 216,625 | | | $ | 233,925 | |

| | | | | | | | | | | | | |

| Interest-bearing deposits with other banks | 548,153 | | | 386,173 | | | 329,584 | | | 318,026 | | | 372,054 | | | 396,089 | | | 314,552 | |

| Investment securities | 3,184,408 | | | 3,394,237 | | | 3,560,453 | | | 3,635,317 | | | 3,705,304 | | | 3,442,233 | | | 4,032,046 | |

| Loans held for sale | 12,547 | | | 15,420 | | | 11,856 | | | 5,531 | | | 8,639 | | | 11,369 | | | 12,968 | |

| Loans and leases | | | | | | | | | | | | | |

| Commercial and industrial | 3,422,381 | | | 3,443,615 | | | 3,469,683 | | | 3,456,681 | | | 3,249,252 | | | 3,447,984 | | | 2,979,273 | |

| Lease financing | 419,179 | | | 371,598 | | | 323,819 | | | 252,219 | | | 203,790 | | | 342,243 | | | 153,380 | |

| Construction real estate | 540,314 | | | 547,884 | | | 518,190 | | | 536,294 | | | 501,787 | | | 535,715 | | | 476,597 | |

| Commercial real estate | 4,060,733 | | | 4,024,798 | | | 4,050,946 | | | 4,017,021 | | | 4,028,944 | | | 4,038,457 | | | 4,040,365 | |

| Residential real estate | 1,320,670 | | | 1,260,249 | | | 1,181,053 | | | 1,115,889 | | | 1,066,859 | | | 1,220,138 | | | 976,775 | |

| Home equity | 750,925 | | | 735,251 | | | 726,333 | | | 728,185 | | | 735,039 | | | 735,236 | | | 721,048 | |

| Installment | 160,242 | | | 164,092 | | | 172,147 | | | 205,934 | | | 208,484 | | | 175,447 | | | 159,807 | |

| Credit card | 64,037 | | | 60,827 | | | 59,478 | | | 55,548 | | | 56,325 | | | 59,998 | | | 54,752 | |

| Total loans | 10,738,481 | | | 10,608,314 | | | 10,501,649 | | | 10,367,771 | | | 10,050,480 | | | 10,555,218 | | | 9,561,997 | |

| Less: | | | | | | | | | | | | | |

| Allowance for credit losses | (149,398) | | | (150,297) | | | (145,578) | | | (136,419) | | | (127,541) | | | (145,472) | | | (125,001) | |

| Net loans | 10,589,083 | | | 10,458,017 | | | 10,356,071 | | | 10,231,352 | | | 9,922,939 | | | 10,409,746 | | | 9,436,996 | |

| Premises and equipment | 194,435 | | | 194,228 | | | 190,583 | | | 190,346 | | | 189,342 | | | 192,414 | | | 191,191 | |

| Operating leases | 139,331 | | | 132,984 | | | 138,725 | | | 107,092 | | | 88,365 | | | 129,631 | | | 76,967 | |

| Goodwill | 1,005,870 | | | 1,005,844 | | | 1,005,791 | | | 1,005,713 | | | 998,575 | | | 1,005,805 | | | 999,611 | |

| Other intangibles | 85,101 | | | 87,427 | | | 89,878 | | | 92,587 | | | 95,256 | | | 88,724 | | | 99,081 | |

| | | | | | | | | | | | | |

| Accrued interest and other assets | 1,151,349 | | | 1,065,389 | | | 1,063,587 | | | 1,138,311 | | | 1,168,908 | | | 1,104,587 | | | 985,393 | |

| Total Assets | $ | 17,124,955 | | | $ | 16,951,389 | | | $ | 16,968,055 | | | $ | 16,942,999 | | | $ | 16,767,598 | | | $ | 16,997,223 | | | $ | 16,382,730 | |

| | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | | |

| Deposits | | | | | | | | | | | | | |

| Interest-bearing demand | $ | 2,988,086 | | | $ | 2,927,416 | | | $ | 2,906,855 | | | $ | 2,906,712 | | | $ | 3,103,091 | | | $ | 2,932,477 | | | $ | 3,158,560 | |

| Savings | 4,235,658 | | | 3,919,590 | | | 3,749,902 | | | 3,818,807 | | | 3,943,342 | | | 3,932,100 | | | 4,049,883 | |

| Time | 2,611,075 | | | 2,446,854 | | | 2,393,707 | | | 2,131,707 | | | 1,360,681 | | | 2,397,289 | | | 1,175,086 | |

| Total interest-bearing deposits | 9,834,819 | | | 9,293,860 | | | 9,050,464 | | | 8,857,226 | | | 8,407,114 | | | 9,261,866 | | | 8,383,529 | |

| Noninterest-bearing | 3,368,024 | | | 3,493,305 | | | 3,663,419 | | | 3,954,915 | | | 4,225,192 | | | 3,617,961 | | | 4,196,735 | |

| Total deposits | 13,202,843 | | | 12,787,165 | | | 12,713,883 | | | 12,812,141 | | | 12,632,306 | | | 12,879,827 | | | 12,580,264 | |

| Federal funds purchased and securities sold | | | | | | | | | | | | | |

| under agreements to repurchase | 3,586 | | | 10,788 | | | 21,881 | | | 26,380 | | | 16,167 | | | 15,583 | | | 29,526 | |

| FHLB short-term borrowings | 554,826 | | | 878,199 | | | 1,028,207 | | | 925,144 | | | 944,320 | | | 845,666 | | | 672,928 | |

| Other | 185,221 | | | 175,682 | | | 132,088 | | | 139,195 | | | 184,439 | | | 158,221 | | | 115,041 | |

| Total short-term borrowings | 743,633 | | | 1,064,669 | | | 1,182,176 | | | 1,090,719 | | | 1,144,926 | | | 1,019,470 | | | 817,495 | |

| Long-term debt | 340,321 | | | 338,402 | | | 341,523 | | | 343,619 | | | 344,162 | | | 340,950 | | | 359,518 | |

| Total borrowed funds | 1,083,954 | | | 1,403,071 | | | 1,523,699 | | | 1,434,338 | | | 1,489,088 | | | 1,360,420 | | | 1,177,013 | |

| Accrued interest and other liabilities | 693,676 | | | 607,552 | | | 592,708 | | | 614,310 | | | 636,640 | | | 627,225 | | | 520,114 | |

| Total Liabilities | 14,980,473 | | | 14,797,788 | | | 14,830,290 | | | 14,860,789 | | | 14,758,034 | | | 14,867,472 | | | 14,277,391 | |

| | | | | | | | | | | | | |

| SHAREHOLDERS' EQUITY | | | | | | | | | | | | | |

| Common stock | 1,637,197 | | | 1,634,102 | | | 1,631,230 | | | 1,633,396 | | | 1,632,941 | | | 1,633,992 | | | 1,634,558 | |

| Retained earnings | 1,111,786 | | | 1,076,515 | | | 1,034,092 | | | 989,777 | | | 941,987 | | | 1,053,441 | | | 887,826 | |

| Accumulated other comprehensive loss | (406,265) | | | (358,769) | | | (330,263) | | | (339,450) | | | (361,284) | | | (358,870) | | | (207,778) | |

| Treasury stock, at cost | (198,236) | | | (198,247) | | | (197,294) | | | (201,513) | | | (204,080) | | | (198,812) | | | (209,267) | |

| Total Shareholders' Equity | 2,144,482 | | | 2,153,601 | | | 2,137,765 | | | 2,082,210 | | | 2,009,564 | | | 2,129,751 | | | 2,105,339 | |

| Total Liabilities and Shareholders' Equity | $ | 17,124,955 | | | $ | 16,951,389 | | | $ | 16,968,055 | | | $ | 16,942,999 | | | $ | 16,767,598 | | | $ | 16,997,223 | | | $ | 16,382,730 | |

| | | | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FIRST FINANCIAL BANCORP. | |

| NET INTEREST MARGIN RATE/VOLUME ANALYSIS | |

| (Dollars in thousands) | |

| (Unaudited) | |

| | | | | | | | | | | | | | | | |

| | Quarterly Averages | | | | | | | | | | | | | Year-to-Date Averages | |

| | December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | | | | December 31, 2023 | | December 31, 2022 | |

| | Balance | | Interest | | Yield | | Balance | | Interest | | Yield | | Balance | | Interest | | Yield | | | | | | | | | | | | | Balance | | Yield | | Balance | | Yield | |

| Earning assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment securities | | $ | 3,184,408 | | | $ | 33,696 | | | 4.20 | % | | $ | 3,394,237 | | | $ | 34,819 | | | 4.07 | % | | $ | 3,705,304 | | | $ | 34,353 | | | 3.68 | % | | | | | | | | | | | | | $ | 3,442,233 | | | 4.05 | % | | $ | 4,032,046 | | | 3.00 | % | |

| Interest-bearing deposits with other banks | | 548,153 | | | 7,325 | | | 5.30 | % | | 386,173 | | | 5,011 | | | 5.15 | % | | 372,054 | | | 3,262 | | | 3.48 | % | | | | | | | | | | | | | 396,089 | | | 5.00 | % | | 314,552 | | | 1.74 | % | |

Gross loans (1) | | 10,751,028 | | | 197,416 | | | 7.29 | % | | 10,623,734 | | | 192,261 | | | 7.18 | % | | 10,059,119 | | | 152,299 | | | 6.01 | % | | | | | | | | | | | | | 10,566,587 | | | 7.04 | % | | 9,574,965 | | | 4.79 | % | |

| Total earning assets | | 14,483,589 | | | 238,437 | | | 6.53 | % | | 14,404,144 | | | 232,091 | | | 6.39 | % | | 14,136,477 | | | 189,914 | | | 5.33 | % | | | | | | | | | | | | | 14,404,909 | | | 6.27 | % | | 13,921,563 | | | 4.20 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nonearning assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Allowance for credit losses | | (149,398) | | | | | | | (150,297) | | | | | | | (127,541) | | | | | | | | | | | | | | | | | | (145,472) | | | | | (125,001) | | | | |

| Cash and due from banks | | 214,678 | | | | | | | 211,670 | | | | | | | 218,216 | | | | | | | | | | | | | | | | | | 216,625 | | | | | 233,925 | | | | |

| Accrued interest and other assets | | 2,576,086 | | | | | | | 2,485,872 | | | | | | | 2,540,446 | | | | | | | | | | | | | | | | | | 2,521,161 | | | | | 2,352,243 | | | | |

| Total assets | | $ | 17,124,955 | | | | | | | $ | 16,951,389 | | | | | | | $ | 16,767,598 | | | | | | | | | | | | | | | | | | $ | 16,997,223 | | | | | $ | 16,382,730 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Deposits: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing demand | | $ | 2,988,086 | | | $ | 14,480 | | | 1.92 | % | | $ | 2,927,416 | | | $ | 12,953 | | | 1.76 | % | | $ | 3,103,091 | | | $ | 5,195 | | | 0.66 | % | | | | | | | | | | | | | $ | 2,932,477 | | | 1.45 | % | | $ | 3,158,560 | | | 0.28 | % | |

| Savings | | 4,235,658 | | | 26,632 | | | 2.49 | % | | 3,919,590 | | | 19,853 | | | 2.01 | % | | 3,943,342 | | | 4,819 | | | 0.48 | % | | | | | | | | | | | | | 3,932,100 | | | 1.73 | % | | 4,049,883 | | | 0.22 | % | |

| Time | | 2,611,075 | | | 28,081 | | | 4.27 | % | | 2,446,854 | | | 24,263 | | | 3.93 | % | | 1,360,681 | | | 6,154 | | | 1.79 | % | | | | | | | | | | | | | 2,397,289 | | | 3.81 | % | | 1,175,086 | | | 0.88 | % | |

| Total interest-bearing deposits | | 9,834,819 | | | 69,193 | | | 2.79 | % | | 9,293,860 | | | 57,069 | | | 2.44 | % | | 8,407,114 | | | 16,168 | | | 0.76 | % | | | | | | | | | | | | | 9,261,866 | | | 2.18 | % | | 8,383,529 | | | 0.34 | % | |

| Borrowed funds | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Short-term borrowings | | 743,633 | | | 10,277 | | | 5.48 | % | | 1,064,669 | | | 14,615 | | | 5.45 | % | | 1,144,926 | | | 11,091 | | | 3.84 | % | | | | | | | | | | | | | 1,019,470 | | | 5.24 | % | | 817,495 | | | 2.34 | % | |

| Long-term debt | | 340,321 | | | 5,202 | | | 6.06 | % | | 338,402 | | | 4,952 | | | 5.81 | % | | 344,162 | | | 4,759 | | | 5.49 | % | | | | | | | | | | | | | 340,950 | | | 5.82 | % | | 359,518 | | | 5.17 | % | |

| Total borrowed funds | | 1,083,954 | | | 15,479 | | | 5.67 | % | | 1,403,071 | | | 19,567 | | | 5.53 | % | | 1,489,088 | | | 15,850 | | | 4.22 | % | | | | | | | | | | | | | 1,360,420 | | | 5.38 | % | | 1,177,013 | | | 3.20 | % | |

| Total interest-bearing liabilities | | 10,918,773 | | | 84,672 | | | 3.08 | % | | 10,696,931 | | | 76,636 | | | 2.84 | % | | 9,896,202 | | | 32,018 | | | 1.28 | % | | | | | | | | | | | | | 10,622,286 | | | 2.59 | % | | 9,560,542 | | | 0.69 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest-bearing liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest-bearing demand deposits | | 3,368,024 | | | | | | | 3,493,305 | | | | | | | 4,225,192 | | | | | | | | | | | | | | | | | | 3,617,961 | | | | | 4,196,735 | | | | |

| Other liabilities | | 693,676 | | | | | | | 607,552 | | | | | | | 636,640 | | | | | | | | | | | | | | | | | | 627,225 | | | | | 520,114 | | | | |

| Shareholders' equity | | 2,144,482 | | | | | | | 2,153,601 | | | | | | | 2,009,564 | | | | | | | | | | | | | | | | | | 2,129,751 | | | | | 2,105,339 | | | | |

| Total liabilities & shareholders' equity | | $ | 17,124,955 | | | | | | | $ | 16,951,389 | | | | | | | $ | 16,767,598 | | | | | | | | | | | | | | | | | | $ | 16,997,223 | | | | | $ | 16,382,730 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net interest income | | $ | 153,765 | | | | | | | $ | 155,455 | | | | | | | $ | 157,896 | | | | | | | | | | | | | | | | | | $ | 627,770 | | | | | $ | 519,143 | | | | |

| Net interest spread | | | | | | 3.45 | % | | | | | | 3.55 | % | | | | | | 4.05 | % | | | | | | | | | | | | | | | 3.68 | % | | | | 3.51 | % | |

| Net interest margin | | | | | | 4.21 | % | | | | | | 4.28 | % | | | | | | 4.43 | % | | | | | | | | | | | | | | | 4.36 | % | | | | 3.73 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tax equivalent adjustment | | | | | | 0.05 | % | | | | | | 0.05 | % | | | | | | 0.04 | % | | | | | | | | | | | | | | | 0.04 | % | | | | 0.04 | % | |

| Net interest margin (fully tax equivalent) | | | | | | 4.26 | % | | | | | | 4.33 | % | | | | | | 4.47 | % | | | | | | | | | | | | | | | 4.40 | % | | | | 3.77 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Loans held for sale and nonaccrual loans are included in gross loans. | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FIRST FINANCIAL BANCORP. |

NET INTEREST MARGIN RATE/VOLUME ANALYSIS (1) |

| (Dollars in thousands) |

| (Unaudited) |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | Linked Qtr. Income Variance | | Comparable Qtr. Income Variance | | Year-to-Date Income Variance |

| | Rate | | | Volume | | Total | | Rate | | Volume | | Total | | Rate | | Volume | | Total |

| Earning assets | | | | | | | | | | | | | | | | | | | |

| Investment securities | | $ | 1,097 | | | | $ | (2,220) | | | $ | (1,123) | | | $ | 4,855 | | | $ | (5,512) | | | $ | (657) | | | $ | 42,530 | | | $ | (23,889) | | | $ | 18,641 | |

| Interest-bearing deposits with other banks | | 149 | | | | 2,165 | | | 2,314 | | | 1,710 | | | 2,353 | | | 4,063 | | | 10,250 | | | 4,079 | | | 14,329 | |

Gross loans (2) | | 2,818 | | | | 2,337 | | | 5,155 | | | 32,412 | | | 12,705 | | | 45,117 | | | 215,229 | | | 69,799 | | | 285,028 | |

| Total earning assets | | 4,064 | | | | 2,282 | | | 6,346 | | | 38,977 | | | 9,546 | | | 48,523 | | | 268,009 | | | 49,989 | | | 317,998 | |

| | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities | | | | | | | | | | | | | | | | | | | |

| Total interest-bearing deposits | | $ | 8,318 | | | | $ | 3,806 | | | $ | 12,124 | | | $ | 42,980 | | | $ | 10,045 | | | $ | 53,025 | | | $ | 154,713 | | | $ | 19,157 | | | $ | 173,870 | |

| Borrowed funds | | | | | | | | | | | | | | | | | | | |

| Short-term borrowings | | 99 | | | | (4,437) | | | (4,338) | | | 4,732 | | | (5,546) | | | (814) | | | 23,671 | | | 10,575 | | | 34,246 | |

| Long-term debt | | 221 | | | | 29 | | | 250 | | | 502 | | | (59) | | | 443 | | | 2,336 | | | (1,081) | | | 1,255 | |

| Total borrowed funds | | 320 | | | | (4,408) | | | (4,088) | | | 5,234 | | | (5,605) | | | (371) | | | 26,007 | | | 9,494 | | | 35,501 | |

| Total interest-bearing liabilities | | 8,638 | | | | (602) | | | 8,036 | | | 48,214 | | | 4,440 | | | 52,654 | | | 180,720 | | | 28,651 | | | 209,371 | |

Net interest income (1) | | $ | (4,574) | | | | $ | 2,884 | | | $ | (1,690) | | | $ | (9,237) | | | $ | 5,106 | | | $ | (4,131) | | | $ | 87,289 | | | $ | 21,338 | | | $ | 108,627 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

(1) Not tax equivalent. | | | | | | | | | | | | | | | | | | | |

(2) Loans held for sale and nonaccrual loans are included in gross loans. | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FIRST FINANCIAL BANCORP. | |

| CREDIT QUALITY | |

| (Dollars in thousands) | |

| (Unaudited) | |

| | | | | | | | | | | | |

| Dec. 31, | | Sep. 30, | | June 30, | | Mar. 31, | | Dec. 31, | | Full Year | | Full Year | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 | |

| ALLOWANCE FOR CREDIT LOSS ACTIVITY | | | | | | | | | | | |

| Balance at beginning of period | $ | 145,201 | | | $ | 148,646 | | | $ | 141,591 | | | $ | 132,977 | | | $ | 124,096 | | | $ | 132,977 | | | $ | 131,992 | | |

| | | | | | | | | | | | | | |

| Provision for credit losses | 8,804 | | | 12,907 | | | 12,719 | | | 8,644 | | | 8,689 | | | 43,074 | | | 6,731 | | |

| Gross charge-offs | | | | | | | | | | | | | | |

| Commercial and industrial | 6,866 | | | 9,207 | | | 2,372 | | | 730 | | | 334 | | | 19,175 | | | 5,899 | | |

| Lease financing | 4,244 | | | 76 | | | 90 | | | 13 | | | 0 | | | 4,423 | | | 152 | | |

| Construction real estate | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | |

| Commercial real estate | 1 | | | 6,008 | | | 2,648 | | | 66 | | | 245 | | | 8,723 | | | 3,667 | | |

| Residential real estate | 9 | | | 10 | | | 20 | | | 0 | | | 79 | | | 39 | | | 224 | | |

| Home equity | 174 | | | 54 | | | 21 | | | 91 | | | 72 | | | 340 | | | 160 | | |

| Installment | 2,054 | | | 1,349 | | | 1,515 | | | 1,524 | | | 717 | | | 6,442 | | | 1,549 | | |

| Credit card | 363 | | | 319 | | | 274 | | | 217 | | | 212 | | | 1,173 | | | 907 | | |

| Total gross charge-offs | 13,711 | | | 17,023 | | | 6,940 | | | 2,641 | | | 1,659 | | | 40,315 | | | 12,558 | | |

| Recoveries | | | | | | | | | | | | | | |

| Commercial and industrial | 459 | | | 335 | | | 631 | | | 109 | | | 293 | | | 1,534 | | | 939 | | |

| Lease financing | 52 | | | 1 | | | 1 | | | 1 | | | 0 | | | 55 | | | 49 | | |

| Construction real estate | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | |

| Commercial real estate | 93 | | | 39 | | | 153 | | | 2,238 | | | 1,327 | | | 2,523 | | | 4,304 | | |

| Residential real estate | 24 | | | 44 | | | 113 | | | 66 | | | 15 | | | 247 | | | 174 | | |

| Home equity | 178 | | | 125 | | | 232 | | | 80 | | | 88 | | | 615 | | | 898 | | |

| Installment | 210 | | | 87 | | | 90 | | | 54 | | | 68 | | | 441 | | | 165 | | |

| Credit card | 123 | | | 40 | | | 56 | | | 63 | | | 60 | | | 282 | | | 283 | | |

| Total recoveries | 1,139 | | | 671 | | | 1,276 | | | 2,611 | | | 1,851 | | | 5,697 | | | 6,812 | | |

| Total net charge-offs | 12,572 | | | 16,352 | | | 5,664 | | | 30 | | | (192) | | | 34,618 | | | 5,746 | | |

| Ending allowance for credit losses | $ | 141,433 | | | $ | 145,201 | | | $ | 148,646 | | | $ | 141,591 | | | $ | 132,977 | | | $ | 141,433 | | | $ | 132,977 | | |

| | | | | | | | | | | | | | |

| NET CHARGE-OFFS TO AVERAGE LOANS AND LEASES (ANNUALIZED) | | | | | | | | | | | |

| Commercial and industrial | 0.74 | % | | 1.02 | % | | 0.20 | % | | 0.07 | % | | 0.01 | % | | 0.51 | % | | 0.17 | % | |

| Lease financing | 3.97 | % | | 0.08 | % | | 0.11 | % | | 0.02 | % | | 0.00 | % | | 1.28 | % | | 0.07 | % | |

| Construction real estate | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | | 0.00 | % | |

| Commercial real estate | (0.01) | % | | 0.59 | % | | 0.25 | % | | (0.22) | % | | (0.11) | % | | 0.15 | % | | (0.02) | % | |

| Residential real estate | 0.00 | % | | (0.01) | % | | (0.03) | % | | (0.02) | % | | 0.02 | % | | (0.02) | % | | 0.01 | % | |

| Home equity | 0.00 | % | | (0.04) | % | | (0.12) | % | | 0.01 | % | | (0.01) | % | | (0.04) | % | | (0.10) | % | |