- Net sales (as reported) of $813 million, decreased 10% from

prior year and increased 5% sequentially

- Adjusted net sales (excluding the impact of divestitures)

increased 6% from prior year and 10% sequentially

- GAAP diluted EPS of $0.45

- Non-GAAP diluted EPS of $0.71

Entegris, Inc. (NASDAQ: ENTG), today reported its financial

results for the Company’s second quarter ended June 29, 2024.

Bertrand Loy, Entegris’ president and chief executive officer,

said: “The Entegris team delivered another quarter of strong

performance and execution. Sales (excluding divestitures) increased

10 percent sequentially and were up in all three divisions and in

most product lines.”

Mr. Loy added: "2024 continues to be a transition year for the

semiconductor industry. We feel good about the improving

fundamentals of the semi market and expect it will gradually

recover in the second half of this year, albeit at a more moderate

pace than previously expected. In the second half of 2024, we will

continue to position the company for strong growth acceleration

into 2025.”

“The compounding process complexity of our customers’ roadmaps

is making Entegris expertise in materials science and materials

purity increasingly valuable,” he said. “This is expected to

translate into higher Entegris content per wafer, expanding served

market, and fuel our market outperformance.”

Quarterly Financial Results Summary

(in thousands, except percentages and per share data)

GAAP Results

Jun 29,

2024

Jul 1,

2023

Mar 30,

2024

Net sales

$812,652

$901,000

$771,025

Gross margin - as a % of net sales

46.2%

42.6%

45.6%

Operating margin - as a % of net sales

16.0%

29.7%

15.3%

Net income

$67,696

$197,646

$45,266

Diluted earnings per common share

$0.45

$1.31

$0.30

Non-GAAP Results

Jun 29,

2024

Jul 1,

2023

Mar 30,

2024

Adjusted gross margin - as a % of net

sales

46.2%

42.6%

45.6%

Adjusted operating margin - as a % of net

sales

22.0%

22.3%

23.1%

Adjusted EBITDA - as a % of net sales

27.8%

27.2%

29.0%

Diluted non-GAAP earnings per common

share

$0.71

$0.66

$0.68

Third Quarter Outlook

For the Company’s guidance for the third quarter ending

September 28, 2024, the Company expects sales of $820 million to

$840 million. The midpoint of this guidance range represents a 10%

year-on-year increase, excluding the impact of divestitures. GAAP

net income of $78 million to $85 million and diluted earnings per

common share is expected to be between $0.51 and $0.56. On a

non-GAAP basis, the Company expects diluted earnings per common

share to range from $0.75 to $0.80, reflecting net income on a

non-GAAP basis in the range of $114 million to $121 million. The

Company also expects adjusted EBITDA of approximately 28.5% to

29.5% of sales.

Segment Results

The Company operates in three segments:

Materials Solutions (MS): MS provides

materials-based solutions, such as chemical mechanical

planarization slurries and pads, deposition materials, process

chemistries and gases, formulated cleans, etchants and other

specialty materials that enable our customers to achieve better

device performance and faster time to yield, while providing for

lower total cost of ownership.

Microcontamination Control (MC): MC

offers advanced filtration solutions that improve customers’ yield,

device reliability and cost by filtering and purifying critical

liquid chemistries and gases used in semiconductor manufacturing

processes and other high-technology industries.

Advanced Materials Handling (AMH): AMH

develops solutions that improve customers’ yields by protecting

critical materials during manufacturing, transportation, and

storage including products that monitor, protect, transport and

deliver critical liquid chemistries, wafers, and other substrates

for a broad set of applications in the semiconductor, life sciences

and other high-technology industries.

Second-Quarter Results

Entegris will hold a conference call to discuss its results for

the second quarter on Wednesday, July 31, 2024, at 9:00 a.m.

Eastern Time. Participants should dial 800-225-9448 or +1

203-518-9708, referencing confirmation ID: ENTGQ224. Participants

are asked to dial in 10 minutes prior to the start of the call. For

the live webcast and replay of the call, please Click Here.

Management’s slide presentation concerning the results for the

second quarter will be posted on the Investor Relations section of

www.entegris.com.

About Entegris

Entegris is a leading supplier of advanced materials and process

solutions for the semiconductor and other high-tech industries.

Entegris has approximately 8,000 employees throughout its global

operations and is ISO 9001 certified. It has manufacturing,

customer service and/or research facilities in the United States,

Canada, China, Germany, Israel, Japan, Malaysia, Singapore, South

Korea, and Taiwan. Additional information can be found at

www.entegris.com.

Non-GAAP Information

The Company’s condensed consolidated financial statements are

prepared in conformity with accounting principles generally

accepted in the United States (GAAP). Adjusted Net Sales, Adjusted

EBITDA, Adjusted Gross Profit, Adjusted Segment Profit, Adjusted

Operating Income, non-GAAP Net Income, non-GAAP Adjusted Operating

Margin and diluted non-GAAP Earnings Per Common Share, together

with related measures thereof, are considered “non-GAAP financial

measures” under the rules and regulations of the Securities and

Exchange Commission. The presentation of this financial information

is not intended to be considered in isolation or as a substitute

for, or superior to, the financial information prepared and

presented in accordance with GAAP. The Company provides

supplemental non-GAAP financial measures to better understand and

manage its business and believes these measures provide investors

and analysts additional and meaningful information for the

assessment of the Company’s ongoing results. Management also uses

these non-GAAP measures to assist in the evaluation of the

performance of its business segments and to make operating

decisions. Management believes that the Company’s non-GAAP measures

help indicate the Company’s baseline performance before certain

gains, losses or other charges that may not be indicative of the

Company’s business or future outlook, and that non-GAAP measures

offer a more consistent view of business performance. The Company

believes the non-GAAP measures aid investors’ overall understanding

of the Company’s results by providing a higher degree of

transparency for such items and providing a level of disclosure

that will help investors generally understand how management plans,

measures and evaluates the Company’s business performance.

Management believes that the inclusion of non-GAAP measures

provides greater consistency in its financial reporting and

facilitates investors’ understanding of the Company’s historical

operating trends by providing an additional basis for comparisons

to prior periods. The reconciliations of GAAP net sales to Adjusted

Net Sales (excluding divestitures), GAAP gross profit to Adjusted

Gross Profit, GAAP segment profit to Adjusted Operating Income,

GAAP net income to Adjusted Operating Income and Adjusted EBITDA,

GAAP net income and diluted earnings per common share to non-GAAP

Net Income and diluted non-GAAP Earnings Per Common Share and GAAP

outlook to non-GAAP outlook are included elsewhere in this

release.

Cautionary Note on Forward-Looking Statements

This news release contains “forward-looking statements.” The

words “believe,” “expect,” “anticipate,” “intend,” “estimate,”

“forecast,” “project,” “should,” “may,” “will,” “would” or the

negative thereof and similar expressions are intended to identify

such forward-looking statements. These forward-looking statements

may include statements about fluctuations in demand for

semiconductors; global economic uncertainty and the risks inherent

in operating a global business; supply chain matters; inflationary

pressures; future period guidance or projections; the Company’s

performance relative to its markets, including the drivers of such

performance; market and technology trends, including the duration

and drivers of any growth trends; the development of new products

and the success of their introductions; the focus of the Company’s

engineering, research and development projects; the Company’s

ability to obtain, protect and enforce intellectual property

rights; information technology risks; the Company’s ability to

execute on our business strategies, including the Company’s

expansion of its manufacturing presence in Taiwan and in Colorado

Springs; the Company’s capital allocation strategy, which may be

modified at any time for any reason, including with respect to

share repurchases, dividends, debt repayments and potential

acquisitions; the impact of the acquisitions and divestitures the

Company has made and commercial partnerships the Company has

established, including the acquisition of CMC Materials, Inc. (now

known as CMC Materials LLC) (“CMC Materials”); the amount of

goodwill we carry on our balance sheets; key employee retention;

future capital and other expenditures, including estimates thereof;

the Company’s expected tax rate; the impact, financial or

otherwise, of any organizational changes or changes in the legal

and regulatory environment in which we operate; the impact of

accounting pronouncements; quantitative and qualitative disclosures

about market risk; climate change and our environmental, social and

governance commitments; and other matters. These forward-looking

statements are based on current management expectations and

assumptions only as of the date of this news release, are not

guarantees of future performance and involve substantial risks and

uncertainties that are difficult to predict and that could cause

actual results to differ materially from the results expressed in,

or implied by, these forward-looking statements. These risks and

uncertainties include, but are not limited to, weakening of global

and/or regional economic conditions, generally or specifically in

the semiconductor industry, which could decrease the demand for the

Company’s products and solutions; the level of, and obligations

associated with, the Company’s indebtedness, including the debts

incurred in connection with the acquisition of CMC Materials; risks

related to the acquisition and integration of CMC Materials,

including the ability to achieve the anticipated value-creation

contemplated by the acquisition of CMC Materials; raw material

shortages, supply and labor constraints, price increases,

inflationary pressures and rising interest rates; operational,

political and legal risks of the Company’s international

operations; the Company’s dependence on sole source and limited

source suppliers; the Company’s ability to meet rapid demand

shifts; the Company’s ability to continue technological innovation

and introduce new products to meet customers’ rapidly changing

requirements; substantial competition; the Company’s concentrated

customer base; the Company’s ability to identify, complete and

integrate acquisitions, joint ventures, divestitures or other

similar transactions; the Company’s ability to effectively

implement any organizational changes; the Company’s ability to

protect and enforce intellectual property rights; the impact of

regional and global instabilities, hostilities and geopolitical

uncertainty, including, but not limited to, the ongoing conflicts

between Ukraine and Russia, between Israel and Hamas and other

tensions in the Middle East, as well as the global responses

thereto; the increasing complexity of certain manufacturing

processes; changes in government regulations of the countries in

which the Company operates, including the imposition of tariffs,

export controls and other trade laws, restrictions and changes to

national security and international trade policy, especially as

they relate to China; fluctuation of currency exchange rates;

fluctuations in the market price of the Company’s stock; and other

risk factors and additional information described in the Company’s

filings with the U.S. Securities and Exchange Commission (the

“SEC”), including under the heading “Risk Factors” in Item 1A of

the Company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, filed on February 15, 2024, and in the Company’s

other SEC filings. Except as required under the federal securities

laws and the rules and regulations of the SEC, the Company

undertakes no obligation to update publicly any forward-looking

statements or information contained herein, which speak as of their

respective dates.

Entegris, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Operations

(In thousands, except per share

data)

(Unaudited)

Three months ended

Jun 29, 2024

Jul 1, 2023

Mar 30, 2024

Net sales

$812,652

$901,000

$771,025

Cost of sales

436,833

516,834

419,205

Gross profit

375,819

384,166

351,820

Selling, general and administrative

expenses

116,315

145,596

112,193

Engineering, research and development

expenses

81,885

71,030

71,876

Amortization of intangible assets

47,513

54,680

50,159

Gain on termination of alliance

agreement

—

(154,754)

—

Operating income

130,106

267,614

117,592

Interest expense, net

52,527

78,605

54,379

Other expense, net

2,977

7,724

14,285

Income before income tax expense

(benefit)

74,602

181,285

48,928

Income tax expense (benefit)

6,689

(16,491)

3,456

Equity in net loss of affiliates

217

130

206

Net income

$67,696

$197,646

$45,266

Basic earnings per common share:

$0.45

$1.32

$0.30

Diluted earnings per common share:

$0.45

$1.31

$0.30

Weighted average shares outstanding:

Basic

150,801

149,825

150,549

Diluted

151,819

150,837

151,718

Entegris, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Operations

(In thousands, except per share

data)

(Unaudited)

Six months ended

Jun 29, 2024

Jul 1, 2023

Net sales

$1,583,677

$1,823,396

Cost of sales

856,038

1,037,545

Gross profit

727,639

785,851

Selling, general and administrative

expenses

228,508

315,463

Engineering, research and development

expenses

153,761

142,936

Amortization of intangible assets

97,672

112,254

Goodwill impairment

—

88,872

Gain on termination of alliance

agreement

—

(154,754)

Operating income

247,698

281,080

Interest expense, net

106,906

163,426

Other expense, net

17,262

3,066

Income before income tax

expense

123,530

114,588

Income tax expense

10,145

4,978

Equity in net loss of affiliates

423

130

Net income

$112,962

$109,480

Basic earnings per common share:

$0.75

$0.73

Diluted earnings per common share:

$0.74

$0.73

Weighted average shares outstanding:

Basic

150,675

149,626

Diluted

151,769

150,609

Entegris, Inc. and

Subsidiaries

Condensed Consolidated Balance

Sheets

(In thousands)

(Unaudited)

Jun 29, 2024

Dec 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$320,008

$456,929

Trade accounts and notes receivable,

net

457,107

457,052

Inventories, net

633,373

607,051

Deferred tax charges and refundable income

taxes

52,690

63,879

Assets held-for-sale

6,195

278,753

Other current assets

107,413

113,663

Total current assets

1,576,786

1,977,327

Property, plant and equipment, net

1,495,098

1,468,043

Right-of-use assets

83,710

80,399

Goodwill

3,943,893

3,945,860

Intangible assets, net

1,184,955

1,281,969

Deferred tax assets and other noncurrent

tax assets

24,059

31,432

Other assets

28,085

27,561

Total assets

$8,336,586

$8,812,591

LIABILITIES AND EQUITY

Current liabilities

Accounts payable

141,579

134,211

Accrued liabilities

235,201

283,158

Liabilities held-for-sale

662

19,223

Income tax payable

62,416

77,403

Total current liabilities

439,858

513,995

Long-term debt

4,122,233

4,577,141

Long-term lease liabilities

71,800

68,986

Other liabilities

200,305

243,875

Shareholders’ equity

3,502,390

3,408,594

Total liabilities and equity

$8,336,586

$8,812,591

Entegris, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Cash Flows

(In thousands)

(Unaudited)

Three months ended

Six months ended

Jun 29, 2024

Jul 1, 2023

Jun 29, 2024

Jul 1, 2023

Operating activities:

Net income

$67,696

$197,646

$112,962

$109,480

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation

47,407

43,719

92,750

90,494

Amortization

47,513

54,680

97,672

112,254

Share-based compensation expense

26,889

11,458

34,797

42,136

Provision for deferred income taxes

(12,723)

(31,988)

(24,088)

(66,814)

Loss on extinguishment of debt

796

4,482

11,385

7,269

Impairment of goodwill

—

—

—

88,872

Gain on termination of alliance

agreement

—

(154,754)

—

(154,754)

Loss (gain) from sale of businesses and

held-for-sale assets, net

537

14,935

(4,311)

28,577

Other

13,784

21,670

48,264

49,526

Changes in operating assets and

liabilities, net of effects of acquisitions:

Trade accounts and notes receivable

(35,125)

9,562

(11,908)

17,941

Inventories

(15,797)

29,843

(50,659)

(5,009)

Accounts payable and accrued

liabilities

(33,728)

(43,638)

(42,634)

(23,595)

Income taxes payable, refundable income

taxes and noncurrent taxes payable

(15,001)

(31,437)

(16,923)

(15,570)

Other

18,964

840

11,091

(1,918)

Net cash provided by operating

activities

111,212

127,018

258,398

278,889

Investing activities:

Acquisition of property and equipment

(59,269)

(116,051)

(125,889)

(250,043)

Proceeds, net from sale of businesses

—

759

249,600

134,286

Proceeds from termination of alliance

agreement

—

169,251

—

169,251

Other

47

258

(1,917)

366

Net cash (used in) provided by

investing activities

(59,222)

54,217

121,794

53,860

Financing activities:

Proceeds from debt

30,000

—

254,537

117,170

Payments of debt

(85,000)

(311,501)

(728,311)

(428,671)

Payments for debt issuance costs

—

(3,475)

—

(3,475)

Payments for dividends

(15,099)

(14,980)

(30,355)

(30,150)

Issuance of common stock

1,494

18,374

10,467

36,767

Taxes paid related to net share settlement

of equity awards

(878)

(240)

(15,306)

(9,646)

Other

(526)

(279)

(902)

(578)

Net cash used in financing

activities

(70,009)

(312,101)

(509,870)

(318,583)

Effect of exchange rate changes on

cash, cash equivalents and restricted cash

(2,655)

(11,149)

(7,243)

(10,588)

(Decrease) increase in cash, cash

equivalents and restricted cash

(20,674)

(142,015)

(136,921)

3,578

Cash, cash equivalents and restricted

cash at beginning of period

340,682

709,032

456,929

563,439

Cash, cash equivalents and restricted

cash at end of period

$320,008

$567,017

$320,008

$567,017

Entegris, Inc. and

Subsidiaries

Segment Information

(In thousands)

(Unaudited)

Three months ended

Six months ended

Net sales

Jun 29, 2024

Jul 1, 2023

Mar 30, 2024

Jun 29, 2024

Jul 1, 2023

Materials Solutions

$342,333

$440,634

$350,036

$692,369

$888,964

Microcontamination Control

293,769

283,614

267,864

561,633

552,911

Advanced Materials Handling

188,225

190,356

162,854

351,079

409,209

Inter-segment elimination

(11,675)

(13,604)

(9,729)

(21,404)

(27,688)

Total net sales

$812,652

$901,000

$771,025

$1,583,677

$1,823,396

Three months ended

Six months ended

Segment profit

Jun 29, 2024

Jul 1, 2023

Mar 30, 2024

Jun 29, 2024

Jul 1, 2023

Materials Solutions

$70,268

$215,738

$67,124

$137,392

$186,216

Microcontamination Control

93,709

100,661

86,555

180,264

196,658

Advanced Materials Handling

28,980

35,830

24,606

53,586

83,995

Total segment profit

192,957

352,229

178,285

371,242

466,869

Amortization of intangibles

(47,513)

(54,680)

(50,159)

(97,672)

(112,254)

Unallocated expenses

(15,338)

(29,935)

(10,534)

(25,872)

(73,535)

Total operating income

$130,106

$267,614

$117,592

$247,698

$281,080

Entegris, Inc. and

Subsidiaries

Reconciliation of GAAP Gross

Profit to Adjusted Gross Profit

(In thousands)

Three months ended

Six months ended

Jun 29, 2024

Jul 1, 2023

Mar 30, 2024

Jun 29, 2024

Jul 1, 2023

Net Sales

$812,652

$901,000

$771,025

$1,583,677

$1,823,396

Gross profit-GAAP

$375,819

$384,166

$351,820

$727,639

$785,851

Adjustments to gross profit:

Restructuring costs 1

—

—

—

—

7,377

Adjusted gross profit

$375,819

$384,166

$351,820

$727,639

$793,228

Gross margin - as a % of net sales

46.2 %

42.6 %

45.6 %

45.9 %

43.1 %

Adjusted gross margin - as a % of net

sales

46.2 %

42.6 %

45.6 %

45.9 %

43.5 %

1 Restructuring charges resulting from

cost saving initiatives.

Entegris, Inc. and

Subsidiaries

Reconciliation of GAAP Segment

Profit to Adjusted Operating Income

(In thousands)

(Unaudited)

Three months ended

Six months ended

Adjusted segment profit

Jun 29, 2024

Jul 1, 2023

Mar 30, 2024

Jun 29, 2024

Jul 1, 2023

MS segment profit

$70,268

$215,738

$67,124

$137,392

$186,216

Restructuring costs 1

—

—

—

—

7,108

Loss (gain) on sale of businesses and

held-for-sale assets, net 2

537

14,936

(4,848)

(4,311)

28,578

Goodwill impairment 3

—

—

—

—

88,872

Gain on termination of alliance agreement

4

—

(154,754)

—

—

(154,754)

Impairment on long-lived assets 5

—

—

12,967

12,967

—

MS adjusted segment profit

$70,805

$75,920

$75,243

$146,048

$156,020

MC segment profit

$93,709

$100,661

$86,555

$180,264

$196,658

Restructuring costs 1

—

—

—

—

2,795

MC adjusted segment profit

$93,709

$100,661

$86,555

$180,264

$199,453

AMH segment profit

$28,980

$35,830

$24,606

$53,586

$83,995

Restructuring costs 1

—

—

—

—

1,254

AMH adjusted segment profit

$28,980

$35,830

$24,606

$53,586

$85,249

Unallocated general and administrative

expenses

$15,338

$29,935

$10,534

$25,872

$73,535

Less: unallocated deal and integration

costs

(724)

(18,441)

(2,218)

(2,942)

(38,416)

Less: unallocated restructuring costs

1

—

—

—

—

(86)

Adjusted unallocated general and

administrative expenses

$14,614

$11,494

$8,316

$22,930

$35,033

Total adjusted segment profit

$193,494

$212,411

$186,404

$379,898

$440,722

Less: adjusted unallocated general and

administrative expenses

(14,614)

(11,494)

(8,316)

(22,930)

(35,033)

Total adjusted operating income

$178,880

$200,917

$178,088

$356,968

$405,689

1 Restructuring charges resulting from

cost saving initiatives.

2 Loss (gain) from the sale of certain

businesses and held-for-sale assets, net.

3 Non-cash impairment charges associated

with goodwill.

4 Gain on the termination of the alliance

agreement with MacDermid Enthone.

5 Impairment of long-lived assets.

Entegris, Inc. and

Subsidiaries

Reconciliation of GAAP Net

Income to Adjusted Operating Income and Adjusted EBITDA

(In thousands)

(Unaudited)

Three months ended

Six months ended

Jun 29, 2024

Jul 1, 2023

Mar 30, 2024

Jun 29, 2024

Jul 1, 2023

Net sales

$812,652

$901,000

$771,025

$1,583,677

$1,823,396

Net income

$67,696

$197,646

$45,266

$112,962

$109,480

Net income - as a % of net sales

8.3%

21.9%

5.9%

7.1%

6.0%

Adjustments to net income:

Equity in net loss of affiliates

217

130

206

423

130

Income tax expense (benefit)

6,689

(16,491)

3,456

10,145

4,978

Interest expense, net

52,527

78,605

54,379

106,906

163,426

Other expense, net

2,977

7,724

14,285

17,262

3,066

GAAP - Operating income

130,106

267,614

117,592

247,698

281,080

Operating margin - as a % of net sales

16.0%

29.7%

15.3%

15.6%

15.4%

Goodwill impairment 1

—

—

—

—

88,872

Deal and transaction costs 2

—

—

—

—

3,001

Integration costs:

Professional fees 3

147

13,324

2,140

2,287

25,312

Severance costs 4

577

965

78

655

2,327

Retention costs 5

—

362

—

—

1,642

Other costs 6

—

3,789

—

—

6,134

Restructuring costs 7

—

—

—

—

11,242

Loss (gain) on sale of businesses and

held-for-sale assets, net 8

537

14,937

(4,848)

(4,311)

28,579

Gain on termination of alliance agreement

9

—

(154,754)

—

—

(154,754)

Impairment of long-lived assets 10

—

—

12,967

12,967

—

Amortization of intangible assets 11

47,513

54,680

50,159

97,672

112,254

Adjusted operating income

178,880

200,917

178,088

356,968

405,689

Adjusted operating margin - as a % of net

sales

22.0%

22.3%

23.1%

22.5%

22.2%

Depreciation

47,407

43,719

45,343

92,750

90,494

Adjusted EBITDA

$226,287

$244,636

$223,431

$449,718

$496,183

Adjusted EBITDA - as a % of net sales

27.8%

27.2%

29.0%

28.4%

27.2%

1 Non-cash impairment charges associated

with goodwill.

2 Deal and transaction costs associated

with the CMC Materials acquisition and completed divestitures.

3 Represents professional and vendor fees

recorded in connection with services provided by consultants,

accountants, lawyers and other third-party service providers to

assist us in integrating CMC Materials into our operations. These

fees arise outside of the ordinary course of our continuing

operations.

4 Represents severance charges related to

the integration of the CMC Materials acquisition.

5 Represents retention charges related

directly to the CMC Materials acquisition and completed

divestitures, and are not part of our normal, recurring cash

operating expenses.

6 Represents other employee related costs

and other costs incurred relating to the CMC Materials acquisition

and the completed divestitures. These costs arise outside of the

ordinary course of our continuing operations.

7 Restructuring charges resulting from

cost saving initiatives.

8 Loss (gain) from the sale of certain

businesses and held-for-sale assets, net.

9 Gain on the termination of the alliance

agreement with MacDermid Enthone.

10 Impairment of long-lived assets.

11 Non-cash amortization expense

associated with intangibles acquired in acquisitions.

Entegris, Inc. and

Subsidiaries

Reconciliation of GAAP Net

Income and Diluted Earnings per Common Share to Non-GAAP Net Income

and Diluted Non-GAAP Earnings per Common Share

(In thousands, except per share

data) (Unaudited)

Three months ended

Six months ended

Jun 29, 2024

Jul 1, 2023

Mar 30, 2024

Jun 29, 2024

Jul 1, 2023

GAAP net income

$67,696

$197,646

$45,266

$112,962

$109,480

Adjustments to net income:

Goodwill impairment 1

—

—

—

—

88,872

Deal and transaction costs 2

—

—

—

—

3,001

Integration costs:

Professional fees 3

147

13,324

2,140

2,287

25,312

Severance costs 4

577

965

78

655

2,327

Retention costs 5

—

362

—

—

1,642

Other costs 6

—

3,789

—

—

6,134

Restructuring costs 7

—

—

—

—

11,242

Loss on extinguishment of debt and

modification 8

796

4,481

11,551

12,347

8,361

Loss (gain) on sale of businesses and

held-for-sale assets, net 9

537

14,937

(4,848)

(4,311)

28,579

Gain on termination of alliance agreement

10

—

(154,754)

—

—

(154,754)

Infineum termination fee, net 11

—

—

—

—

(10,877)

Impairment of long-lived assets 12

—

—

12,967

12,967

—

Amortization of intangible assets 13

47,513

54,680

50,159

97,672

112,254

Tax effect of adjustments to net income

and discrete tax items14

(10,157)

(35,825)

(13,541)

(23,698)

(34,186)

Non-GAAP net income

$107,109

$99,605

$103,772

$210,881

$197,387

Diluted earnings per common share

$0.45

$1.31

$0.30

$0.74

$0.73

Effect of adjustments to net income

$0.26

$(0.65)

$0.39

$0.65

$0.58

Diluted non-GAAP earnings per common

share

$0.71

$0.66

$0.68

$1.39

$1.31

Diluted weighted averages shares

outstanding

151,819

150,837

151,718

151,769

150,609

Diluted non-GAAP weighted average shares

outstanding

151,819

150,837

151,718

151,769

150,609

1 Non-cash impairment charges associated

with goodwill.

2 Deal and transaction costs associated

with the CMC Materials acquisition and completed divestitures.

3 Represents professional and vendor fees

recorded in connection with services provided by consultants,

accountants, lawyers and other third-party service providers to

assist us in integrating CMC Materials into our operations. These

fees arise outside of the ordinary course of our continuing

operations.

4 Represents severance charges related to

the integration of CMC Materials.

5 Represents retention charges related

directly to the CMC Materials acquisition and completed

divestitures, and are not part of our normal, recurring cash

operating expenses.

6 Represents other employee-related costs

and other costs incurred relating to the CMC Materials acquisition

and completed divestitures. These costs arise outside of the

ordinary course of our continuing operations.

7 Restructuring charges resulting from

cost saving initiatives.

8 Non-recurring loss on extinguishment of

debt and modification of our Credit Agreement.

9 Loss (gain) from the sale of certain

businesses and held-for-sale assets, net.

10 Gain on the termination of the alliance

agreement with MacDermid Enthone.

11 Non-recurring gain from Infineum

termination fee.

12 Impairment of long-lived assets.

13 Non-cash amortization expense

associated with intangibles acquired in acquisitions.

14 The tax effect of pre-tax adjustments

to net income was calculated using the applicable marginal tax rate

for each respective year.

Entegris, Inc. and

Subsidiaries

Reconciliation of Reported Net

Sales to Adjusted Net Sales (excluding divestitures)

Non-GAAP

(In thousands)

(Unaudited)

Three months ended

Six months ended

Jun 29, 2024

Jul 1, 2023

Mar 30, 2024

Jun 29, 2024

Jul 1, 2023

Net sales

$812,652

$901,000

$771,025

$1,583,677

$1,823,396

Less: divestitures 1

—

(135,225)

(33,907)

(33,907)

(279,263)

Adjusted Net sales (excluding

divestitures) Non-GAAP

$812,652

$765,775

$737,118

$1,549,770

$1,544,133

1 Adjusted for the quarterly impact of net

sales from divestitures.

Entegris, Inc. and

Subsidiaries

Reconciliation of GAAP Outlook

to Non-GAAP Outlook *

(In millions, except per share

data)

(Unaudited)

Third Quarter Outlook

Reconciliation GAAP Operating Margin to

non-GAAP Operating Margin and Adjusted EBITDA Margin

September 28, 2024

Net sales

$820 - $840

GAAP - Operating income

$139 - $153

Operating margin - as a % of net sales

17.0% - 18.2%

Deal, transaction and integration

costs

—

Amortization of intangible assets

47

Adjusted operating income

$187 - $201

Adjusted operating margin - as a % of net

sales

22.7% - 23.9%

Depreciation

47

Adjusted EBITDA

$234 - $248

Adjusted EBITDA - as a % of net sales

28.5% - 29.5%

Third Quarter Outlook

Reconciliation GAAP net income to

non-GAAP net income

September 28, 2024

GAAP net income

$78 - $85

Adjustments to net income:

Deal, transaction and integration

costs

—

Amortization of intangible assets

47

Income tax effect

(11)

Non-GAAP net income

$114 - $121

Third Quarter Outlook

Reconciliation GAAP diluted earnings

per share to non-GAAP diluted earnings per share

September 28, 2024

Diluted earnings per common share

$0.51 - $0.56

Adjustments to diluted earnings per common

share:

Deal, transaction and integration

costs

—

Amortization of intangible assets

0.31

Income tax effect

(0.07)

Diluted non-GAAP earnings per common

share

$0.75 - $0.80

*As a result of displaying amounts in

millions, rounding differences may exist in the tables.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731830670/en/

Bill Seymour VP of Investor Relations T + 1 952 556 1844

bill.seymour@entegris.com

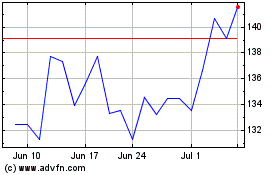

Entegris (NASDAQ:ENTG)

Historical Stock Chart

From Oct 2024 to Nov 2024

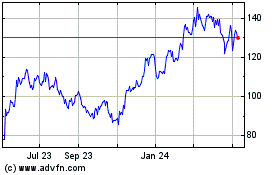

Entegris (NASDAQ:ENTG)

Historical Stock Chart

From Nov 2023 to Nov 2024