Form DFAN14A - Additional definitive proxy soliciting materials filed by non-management and Rule 14(a)(12) material

August 14 2023 - 2:35PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

| DIVERSIFIED HEALTHCARE TRUST |

(Name of Registrant as Specified In Its Charter)

|

| |

Flat footed,

llc

marc andersen

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Flat Footed LLC, a Delaware

limited liability company (“Flat Footed”), together with the other participant named herein, has filed a definitive proxy

statement and accompanying GOLD proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit

votes in connection with its opposition to proposals to be presented at the special meeting of shareholders (the “Special Meeting”)

of Diversified Healthcare Trust, a Maryland corporation (the “Company”).

Item 1: On August 14, 2023,

Flat Footed issued the following press release:

Glass Lewis Joins ISS in Recommending Shareholders

of Diversified Healthcare Trust Vote AGAINST the Proposed Merger with Office Properties Income Trust

Both Leading Independent Proxy Advisory Firms Have

Concluded the Proposed Merger Does Not Represent the Best Path Forward for DHC Shareholders

Glass Lewis Concludes that Flat Footed’s Rebuke

of the Proposed Merger is “Comprehensive, Well Supported and Persuasive”

Report From Glass Lewis Acknowledges the “Lack

of Compelling Structural Fit,” the “Brief, Narrow and Dubiously Independent” Process, and the “Markedly Unfavorable

Terms for DHC Shareholders”

Visit www.SaveDHC.com

to Obtain Information on How to Vote AGAINST the Deal on the GOLD Proxy Card at the August 30th

Special Meeting

WILSON, Wyo.--(BUSINESS WIRE)--Flat Footed LLC (together

with its affiliates, “FFL” or “we”), a top shareholder of Diversified Healthcare Trust (Nasdaq: DHC) (“DHC”

or the “Company”) and the owner of approximately 9.8% of the Company’s outstanding common shares, today commented on

Glass, Lewis & Co. (“Glass Lewis”) and Institutional Shareholder Services Inc.’s (“ISS”) recommendations

that DHC shareholders vote AGAINST the proposed merger with Office Properties Income Trust (Nasdaq: OPI) (“OPI”)

at the Company’s upcoming Special Meeting of Shareholders (the “Special Meeting”) on August 30, 2023.

Marc Andersen, Managing Member of FFL, commented:

“We appreciate that Glass Lewis has joined ISS

in recommending that DHC’s shareholders vote AGAINST the proposed merger with OPI. Over the past several months, we

have run a facts-based and objective campaign to lay out the deal’s flaws and show the array of viable alternatives that exist.

It is encouraging to see that both leading proxy advisory firms and several credible investors have come to similar conclusions.

In light of what is now broad public opposition, we urge the Board of Trustees to abandon the transaction in favor of one of the non-dilutive

alternatives that we have identified. FFL hopes to work with DHC and its leadership to get past this unfortunate detour and pursue long-term

value creation on a standalone basis. We believe DHC has a very bright future as the senior housing market’s fundamentals continually

improve.”

In its report, Glass Lewis noted the following:1

| · | “[…] we see very little cause for [DHC] investors to support the OPI transaction at

this time.” |

| · | “[…] concerns with the current transaction, including a limited and questionably structured

process, a dubious structural rationale and what appear to be markedly unfavorable terms for DHC shareholders.” |

| · | “Disclosure regarding the board’s review of other alternatives capable of adequately

supporting DHC’s financial needs – including the sale of unencumbered assets […] does not credibly establish a wide

variety of specific options were evaluated at length prior to pursuing the OPI agreement […]” |

| · | “[…] we consider RMR and the DHC board are in a uniquely poor position to stoke concern

around prospective value destruction, and would maintain the view that vocal opponents to the current deal, including Flat Footed,

raise persuasive doubt around whether the DHC board effectively assessed a wider array of financial alternatives.” |

| · | “We believe investors should readily question the board’s apparent disinclination to

firmly eliminate prospective conflicts of interest, real or perceived, in connection with a related party transaction involving another

entity managed by RMR […]” |

| · | “[…] the underlying industrial logic appears deeply flawed, with few obvious synergies

between DHC’s senior housing portfolio and OPI’s existing office property exposure. The lack of a compelling structural

fit is demonstrated […]” |

Last week, ISS recommended

DHC shareholders vote AGAINST the deal in a report that noted:2

| · | “As of Aug. 2, 2023, the value of the merger consideration represents a take-under at a meaningful

53.7 percent discount to DHC’s closing price.” |

| · | “[…] the company could potentially pay off all of its outstanding unsecured debt,

with a sizeable amount of assets remaining at a value well above the company's current trading price and the merger consideration […] shareholders

may question why they should support a merger at such a depressed valuation to the company’s stated asset value.” |

| · | “[…] the unsolicited offer, at a time when the recovery in the SHOP segment was

much more nascent, indicates a potential likelihood of third-party interest in DHC, which raises questions as

to why the special committee did not approach any potential third-party acquirers.” |

| · | “DHC has substantial unencumbered assets, and could execute asset sales, as the management team

has previously pointed out […] the company should have multiple options to address this near-term constraint without introducing

the valuation and operational risks from the OPI merger.” |

| · | […] the lack of a competitive sales process or evidence that the company exhausted all

refinancing opportunities, coupled with the inherent conflicts of interest with OPI and RMR, make it difficult for shareholders

to believe that the proposed merger is in fact the best option.” |

***

1 Permission to quote Glass Lewis was neither sought nor obtained. Emphases added.

2 Permission to quote ISS was neither sought nor obtained. Emphases added.

Visit www.SaveDHC.com

to Download FFL’s Investor Presentation and to Obtain Information on How to Vote the

GOLD Proxy Card AGAINST ALL of DHC’s Proposals at the Upcoming Special Meeting.

***

About Flat Footed

Flat Footed LLC is a special situation, value-oriented

investment management firm focused on leveraged, asset-heavy companies with complex capital structures. The Flat Footed LLC team has cumulatively

managed $2.8 billion since founding their first fund together in 1999. For more information, visit www.flatfootedllc.com.

Contacts

Flat Footed LLC

ir@flatfootedllc.com

Okapi Partners LLC

Mark Harnett

(212) 297-0720

mharnett@okapipartners.com

or

Longacre Square Partners

Greg Marose / Charlotte Kiaie, 646-386-0091

FFL@longacresquare.com

Item 2: Also on August

14, 2023, Flat Footed posted the following materials to www.SaveDHC.com:

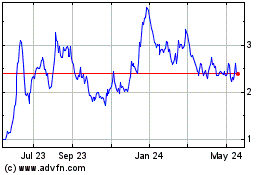

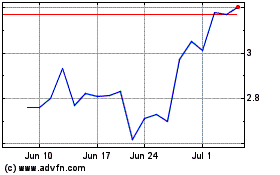

Diversified Healthcare (NASDAQ:DHC)

Historical Stock Chart

From Apr 2024 to May 2024

Diversified Healthcare (NASDAQ:DHC)

Historical Stock Chart

From May 2023 to May 2024