Filed

Pursuant to Rule 424(b)(5)

Registration No. 333-258756

The

information in this preliminary prospectus supplement is not complete and may be changed. A registration statement relating to these

securities has been filed with the Securities and Exchange Commission and is effective. This preliminary prospectus supplement and the

accompanying prospectus are not an offer to sell these securities and they are not soliciting an offer to buy these securities in any

jurisdiction where the offer or sale thereof is not permitted.

Subject to Completion,

dated June 28, 2023

Preliminary

Prospectus Supplement

(To prospectus dated August 20, 2021)

CorMedix

Inc.

Shares

of Common Stock and

Pre-Funded Warrants to

Purchase Up to

Shares of Common Stock

Shares of Common Stock Underlying the Pre-Funded Warrants

We are offering

shares of our common stock and, in lieu of common stock to certain investors, pre-funded warrants to purchase up to an aggregate of

shares

of common stock (the “pre-funded warrants”). The purchase price of each pre-funded warrant will equal the price per share

at which shares of our common stock are being sold to the public in this offering, minus $0.0001, which is the exercise price of each

pre-funded warrant. This prospectus supplement also relates to the offering of the shares of common stock issuable upon exercise of the

pre-funded warrants.

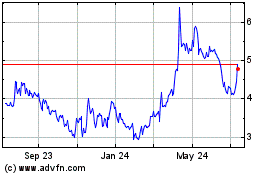

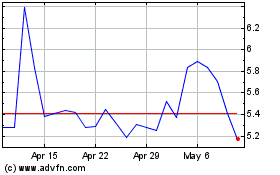

Our common stock is listed on the Nasdaq Global

Market under the symbol “CRMD.” On June 27, 2023, the last reported sale price of our common stock on the Nasdaq Global Market

was $4.97 per share. We do not intend to list the pre-funded warrants on the Nasdaq Global Market, any other national securities exchange

or any other nationally recognized trading system.

Investing in our common stock or pre-funded

warrants involves risks. See “Risk Factors” beginning on page S-3 of this prospectus supplement and the risks discussed under

similar headings in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus, and any free

writing prospectus that we have authorized for use in connection with this offering.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the accuracy or adequacy of this prospectus supplement or accompanying prospectus. Any representation to the contrary is a criminal

offense.

| | |

Per

Share | | |

Per Pre-Funded Warrant | | |

Total | |

| Public Offering Price | |

$ | | | |

$ | | | |

$ | | |

| Underwriting Discounts and Commissions(1) | |

$ | | | |

$ | | | |

$ | | |

| Proceeds, before expenses, to us | |

$ | | | |

$ | | | |

$ | | |

| (1) | We have agreed to reimburse the underwriters for certain expenses.

We refer you to “Underwriting” beginning on page S-9 for additional information regarding total underwriting compensation. |

We have granted the underwriters an option for a period of 30 days

to purchase additional shares of our common

stock. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $ , and

the total proceeds to us, before expenses, will be $ .

Delivery of the shares of common stock and pre-funded

warrants is expected to be made on or about , 2023.

| |

Book-Running Managers |

|

| |

|

|

| RBC

Capital Markets |

Truist

Securities |

JMP Securities

A CITIZENS

COMPANY |

The

date of this prospectus supplement is , 2023.

TABLE OF CONTENTS

Prospectus

Supplement

Prospectus

Neither

we nor the underwriters have authorized anyone to provide you with any information other than the information contained in this prospectus

supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, and any free writing

prospectus we have authorized for use in connection with this offering. We take no responsibility for, and can provide no assurances

as to the reliability of, any other information that others may give you. You should not assume that the information contained in this

prospectus supplement, the accompanying prospectus, the documents incorporated by reference herein or therein, and in any free writing

prospectus that we have authorized for use in connection with this offering is accurate as of any date other than the date of those respective

documents. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates. You

should read this prospectus supplement, the accompanying prospectus, the documents incorporated by reference herein and therein, and

any free writing prospectus that we have authorized for use in connection with this offering in their entirety before making an investment

decision. You should also read and consider the information in the documents to which we have referred you in the sections of this prospectus

supplement titled “Where You Can Find More Information” and “Incorporation of Documents by Reference.”

For

investors outside of the United States: We are not, and the underwriters are not, making offers to sell these securities in any jurisdiction

in which an offer or solicitation is not authorized or permitted or in which the person making such offer or solicitation is not qualified

to do so or to any person to whom it is unlawful to make such an offer or solicitation.

ABOUT

THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is part of the registration

statement that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process

pursuant to which we may, from time to time, sell common stock, pre-funded warrants or other securities, of which this offering is a part.

This document consists of two parts. The first part is this prospectus supplement, including the documents incorporated by reference,

which describes the specific terms of this offering and also adds to and updates the information contained in the accompanying prospectus

and the documents incorporated by reference therein. The second part, the accompanying prospectus, including the documents incorporated

by reference, gives more general information, some of which may not apply to this offering. Generally, when we refer to the “prospectus,”

we are referring to both parts combined. This prospectus supplement and any free writing prospectus we authorize for use in connection

with this offering may add to, update or change information in the accompanying prospectus and the documents incorporated by reference

into this prospectus supplement or the accompanying prospectus.

If information in this prospectus supplement is

inconsistent with information contained in the accompanying prospectus or in any document incorporated by reference herein or therein

that was filed with the SEC before the date of this prospectus supplement, the information in this prospectus supplement will be deemed

to modify or supersede the information contained in the accompanying prospectus and such documents incorporated by reference herein or

therein. This prospectus supplement, the accompanying prospectus, the documents incorporated by reference into each and any free writing

prospectus we authorize for use in connection with this offering include important information about us, the shares of our common stock

and pre-funded warrants and other information you should consider before purchasing the shares of our common stock or pre-funded warrants.

See “Where You Can Find More Information” and “Incorporation of Documents by Reference” in this prospectus supplement

for additional information.

This prospectus supplement and accompanying prospectus

do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities described in this prospectus

supplement and accompanying prospectus or an offer to sell or the solicitation of an offer to buy such securities in any circumstances

in which such offer or solicitation is unlawful. Persons outside the United States who come into possession of this prospectus supplement

and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock

and the pre-funded warrants and the distribution of this prospectus supplement and accompanying prospectus outside the United States.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or

covenant to you. Moreover, such representations, warranties and covenants were accurate only as of the date when made. Accordingly, such

representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

When

we refer to “CorMedix,” “Company,” “we,” “our” and “us” in this prospectus

supplement and accompanying prospectus, we mean CorMedix Inc. and its consolidated subsidiaries, unless otherwise specified.

Neutrolin®

is our registered trademark. DefenCath™ and CorMedix Inc. are our filed trademarks. All other trade names, trademarks and service

marks appearing in this prospectus supplement are the property of their respective owners. We have assumed that the reader understands

that all such terms are source-indicating. Accordingly, such terms, when first mentioned in this prospectus supplement, appear with the

trade name, trademark or service mark notice and then throughout the remainder of this prospectus supplement without trade name, trademark

or service mark notices for convenience only and should not be construed as being used in a descriptive or generic sense.

CAUTIONARY

NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying

prospectus, including the documents that we incorporate by reference, contain “forward-looking statements” that involve risks

and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially

from those expressed or implied by such forward-looking statements. The statements contained in this prospectus supplement that are not

purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements

are often identified by the use of words such as, but not limited to, “anticipate,” “believe,” “can,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “will,”

“plan,” “project,” “seek,” “should,” “target,” “will,” “would,”

and similar expressions or variations intended to identify forward-looking statements, which may include, but are not limited to, statements

concerning the following:

| ● | We

have a history of operating losses, may incur additional operating losses in the future and

may not achieve profitability when expected or we may never be profitable. |

| ● | Our

expectation regarding the sufficiency of the proceeds from this offering together with our

existing cash, cash equivalents, short-term investments and available resources to fund the

anticipated launch of DefenCath through anticipated profitability. |

| ● | Our

ability to generate revenue from anticipated future product sales, and our ability to achieve

and maintain profitability. |

| ● | Our

cost of operations could increase significantly more than what we expect depending on the

costs to complete our development program for DefenCath/Neutrolin. |

| ● | We

may need to finance our future cash needs through public or private equity offerings, debt

financings or corporate collaboration and licensing arrangements. Any additional funds that

we obtain may not be on terms favorable to us or our stockholders and may require us to relinquish

valuable rights. |

| ● | DefenCath,

our lead product candidate, has received Fast Track designation and Qualified Infectious

Disease Product designation from the FDA, but we cannot provide assurances that these designations

will not be rescinded. |

| ● | If

the FDA requires a second clinical trial for DefenCath, the development of DefenCath will

take longer and cost more to complete, and we will likely need significant additional funds

to undertake a second trial, if required. |

| ● | Final

approval by regulatory authorities of DefenCath or our other product candidates for commercial

use may be delayed, limited or prevented, any of which would adversely affect our ability

to generate operating revenues. |

| ● | Successful

development and commercialization of our other products is uncertain. |

| ● | If

we or our collaborators are unable to manufacture our products in sufficient quantities or

are unable to obtain regulatory approvals for a manufacturing facility, we may be unable

to meet demand for our products and we may lose potential revenues. |

| ● | The

successful commercialization of DefenCath will depend on obtaining coverage and reimbursement

from third-party payors, and physicians and patients may not accept and use our products. |

| ● | If

we fail to comply with environmental, health and safety laws and regulations, we could become

subject to fines or penalties or incur costs that could harm our business. |

| ● | Clinical

trials required for our product candidates may be expensive and time-consuming, and their

outcome is uncertain. |

| ● | If

we fail to comply with international regulatory requirements, we could be subject to regulatory

delays, fines or other penalties. |

| ● | Even

if approved, our products will be subject to extensive post-approval regulation. |

| ● | Competition

and technological change may make our product candidates and technologies less attractive

or obsolete. |

| ● | Healthcare

policy changes, including reimbursement policies for drugs and medical devices, may have

an adverse effect on our business, financial condition and results of operations. |

| ● | If

we lose key management or scientific personnel, cannot recruit qualified employees, directors,

officers, or other personnel or experience increases in compensation costs, our business

may materially suffer. |

| ● | We

may not successfully manage our growth. |

| ● | We

face the risk of product liability claims and the amount of insurance coverage we hold now

or in the future may not be adequate to cover all liabilities we might incur, and we may

be exposed to liability claims associated with the use of hazardous materials and chemicals. |

| ● | Negative

U.S. and global economic conditions may pose challenges to our business strategy, which relies

on funding from the financial markets or collaborators. |

| ● | If

we materially breach or default under any of our license agreements, the licensor party to

such agreement will have the right to terminate the license agreement, which termination

may materially harm our business. |

| ● | If

we and our licensors do not obtain protection for and successfully defend our respective

intellectual property rights, competitors may be able to take advantage of our research and

development efforts to develop competing products. |

| ● | Ongoing

and future intellectual property disputes could require us to spend time and money to address

such disputes and could limit our intellectual property rights. |

| ● | The

decisions by the European and German patent offices may affect patent rights in other jurisdictions. |

| ● | If

we infringe the rights of third parties we could be prevented from selling products and forced

to pay damages and defend against litigation. |

| ● | We

may seek a sales partner in the U.S. if DefenCath receives FDA approval or we may undertake

marketing and sales of DefenCath in the U.S. on our own. If we are unable to enter into or

maintain agreements with third parties to market and sell DefenCath or any other product

after approval or are unable to find a sales partner or establish our own marketing and sales

capabilities, we may not be able to generate significant or any product revenues. |

| ● | Corporate

and academic collaborators may take actions that delay, prevent, or undermine the success

of our products. |

| ● | Data

provided by collaborators and others upon which we rely that has not been independently verified

could turn out to be false, misleading or incomplete. |

| ● | We

rely on third parties to conduct our clinical trials and pre-clinical studies. If those parties

do not successfully carry out their contractual duties or meet expected deadlines, our product

candidates may not advance in a timely manner or at all. |

| ● | We

will depend on third party suppliers and contract manufacturers for the manufacturing of

our product candidates and have no direct control over the cost of manufacturing our product

candidates. Increases in the cost of manufacturing our product candidates would increase

our costs of conducting clinical trials and could adversely affect our future profitability. |

| ● | We

may need additional financing to fund our activities in the future, which may dilute our

stockholders. |

| ● | Our

executive officers and directors may sell shares of their stock, and these sales could adversely

affect our stock price. |

| ● | Our

common stock price has fluctuated considerably and is likely to remain volatile, in part

due to the limited market for our common stock and you could lose all or a part of your investment. |

| ● | A

significant number of additional shares of our common stock may be issued at a later date,

and their sale could depress the market price of our common stock. |

| ● | Provisions

in our corporate charter documents and under Delaware law could make an acquisition of us,

which may be beneficial to our stockholders, more difficult. |

| ● | If

we fail to comply with the continued listing standards of the Nasdaq Global Market, it may

result in a delisting of our common stock from the exchange. |

| ● | Laws,

rules and regulations relating to public companies may be costly and impact our ability to attract and retain directors and executive

officers. |

| ● | Our

internal control over financial reporting and our disclosure controls and procedures may not prevent all possible errors that could occur. |

| ● | Security

breaches and other disruptions could compromise our information and expose us to liability, which would cause our business and reputation

to suffer. |

| ● | We

do not intend to pay dividends on our common stock so any returns on our common stock will be limited to the value of our common stock. |

You

should not rely upon forward-looking statements as predictions of future events. Such statements are based on management’s expectations

as of the date of this prospectus supplement and involve many risks and uncertainties that could cause our actual results, events or

circumstances to differ materially from those expressed or implied in our forward-looking statements. Such risks and uncertainties include

those described throughout this prospectus supplement and particularly in the section titled “Risk Factors” and elsewhere

in this prospectus supplement and the documents incorporated by reference herein, including in our Annual Report on Form 10-K for the

fiscal year ended December 31, 2022 and other filings made from time to time with the SEC. Given these risks and uncertainties, readers

are cautioned not to place undue reliance on such forward-looking statements. Readers are urged to carefully review and consider all

of the information in this prospectus supplement, including the documented incorporated by reference herein, the accompanying prospectus,

including the documents incorporated by reference therein, and any free writing prospectus that we have authorized for use in connection

with this offering. We undertake no obligation to update any forward-looking statements made in this prospectus supplement to reflect

events or circumstances after the date of this filing or to reflect new information or the occurrence of unanticipated events, except

as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements. Our

forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments

we may make.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights certain information about us, this offering and selected information contained elsewhere in or incorporated by reference

into this prospectus supplement or the accompanying prospectus. This summary is not complete and does not contain all of the information

that you should consider before deciding whether to invest in our common stock. For a more complete understanding of our Company and

this offering, we encourage you to read and consider carefully the more detailed information in this prospectus supplement and the accompanying

prospectus, including the information incorporated by reference in this prospectus supplement and the accompanying prospectus, and the

information included in any free writing prospectus that we have authorized for use in connection with this offering, including the information

under the heading “Risk Factors” in this prospectus supplement on page S-3, the financial statements and related notes, and

the other information that we incorporate by reference into this prospectus supplement, including the section “Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31, 2022.

Overview

We

are a biopharmaceutical company focused on developing and commercializing therapeutic products for the prevention and treatment of life-threatening

diseases and conditions. Our primary focus is on the development of our lead product candidate, DefenCath™, for potential commercialization

in the United States, or U.S., and other key markets. We have in-licensed the rights to develop and commercialize DefenCath and Neutrolin®.

DefenCath is a novel anti-infective solution (a formulation of taurolidine 13.5 mg/mL, and heparin 1000 USP Units/mL) intended for the

reduction and prevention of catheter-related infections and thrombosis in patients requiring central venous catheters, or CVCs, in clinical

settings such as hemodialysis, total parenteral nutrition and oncology. Infections and thrombosis represent key complications among hemodialysis,

total parenteral nutrition and cancer patients with CVCs. These complications can lead to treatment delays and increased costs to the

healthcare system when they occur due to hospitalizations, need for IV antibiotic treatment, long-term anticoagulation therapy, removal/replacement

of the CVC, related treatment costs, as well as increased mortality. We believe DefenCath, if approved, will address a significant unmet

medical need and a potential large market opportunity. The name DefenCath is the U.S. proprietary name conditionally approved by the

U.S. Food and Drug Administration, or FDA, while the name Neutrolin was used in the European Union, or EU, and other territories where

we received CE-Mark approval for the commercial distribution of Neutrolin as a catheter lock solution, or CLS, regulated as a medical

device.

Recent

Developments

On

June 21, 2023, we issued a press release announcing that the resubmission of the New Drug Application for DefenCath for the reduction

of catheter-related bloodstream infections in patients with kidney failure receiving chronic hemodialysis through a CVC has been accepted

for filing by the FDA. We further announced that the FDA considers the resubmission as a complete Class 2 response with a six-month review

and has assigned a Prescription Drug User Fee Act target action date of November 15, 2023.

Corporate

Information

Our

principal executive offices are located at 300 Connell Drive, Suite 4200, Berkeley Heights, New Jersey 07922. Our telephone number is

(908) 517-9500, and our website address is www.cormedix.com. The website and the information contained therein or connected thereto are

not incorporated into this prospectus supplement. Our common stock is listed on the Nasdaq Global Market under the symbol “CRMD.”

This

prospectus supplement and all of our filings under the Exchange Act, including copies of Annual Reports on Form 10-K, Quarterly Reports

on Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports, are available free of charge through our website on the

date we file those materials with, or furnish them to, the SEC. Such filings are also available to the public on the SEC’s website

at www.sec.gov.

THE

OFFERING

| Common stock offered

by us |

shares of our common stock and pre-funded warrants to purchase shares of our common stock. |

| |

|

| Pre-funded warrants offered by us |

We are also offering, in lieu of common stock to certain

investors, pre-funded warrants to purchase shares of our common stock. The purchase price of each pre-funded warrant equals the

price per share at which the shares of our common stock are being sold to the public in this offering, minus $0.0001, which is the

exercise price of each pre-funded warrant per share. Each pre-funded warrant will be exercisable at any time after the date of

issuance of such pre-funded warrant, subject to an ownership limitation. See “Description of Pre-funded Warrants.” This

prospectus supplement also relates to the offering of the shares of our common stock issuable upon exercise of the pre-funded

warrants. |

| |

|

| Underwriters’

option to purchase additional shares of common stock |

The underwriters have an option to purchase a maximum of additional

shares of common stock from us. The underwriters can exercise this option at any time within 30 days from the date of this prospectus

supplement. |

| |

|

| Common stock

to be outstanding immediately after the offering |

shares (or shares

if the underwriters exercise in full their option to purchase additional shares of common stock). |

| |

|

| Use of proceeds |

We intend to use the net proceeds from this offering for

general corporate purposes, commercialization efforts, research and development, and working capital and general expenditures. See

“Use of Proceeds” on page S-5 for additional information. |

| |

|

| Risk factors |

See “Risk Factors” beginning on page S-3 of this prospectus

supplement and the other information included in, or incorporated by reference into, this prospectus supplement for a discussion of certain

factors you should carefully consider before deciding to invest in shares of our common stock or pre-funded warrants. |

| |

|

| Nasdaq Global

Market symbol |

“CRMD”. There is no established trading market for the

pre-funded warrants, and we do not expect a trading market to develop. We do not intend to list the pre-funded warrants on any securities

exchange or other trading market. Without a trading market, the liquidity of the pre-funded warrants will be extremely limited. |

Except

as otherwise indicated, all information in this prospectus supplement is based upon 44,499,788 shares of our common stock outstanding

as of March 31, 2023, and excludes:

| ● | 6,126,080

shares of our common stock issuable upon exercise of stock options outstanding as of March

31, 2023 having a weighted-average exercise price of $5.70 per share; |

| ● | 207,469

shares of our common stock issuable upon the settlement of outstanding restricted stock units

as of March 31, 2023; |

| ● | 48,909

shares of our common stock issuable for payment of deferred board compensation as of March

31, 2023; |

| ● | 4,000

shares of Series C non-voting convertible preferred stock issued and outstanding as of March 31, 2023; |

| ● | 391,953

shares of Series E voting convertible preferred stock issued and outstanding as of March 31, 2023;

and |

| ● | 5,004,069

shares of Series G voting convertible preferred stock issued and outstanding as of March 31, 2023. |

Except as otherwise indicated, all information

in this prospectus supplement assumes no exercise or settlement of outstanding options or restricted stock units after March 31, 2023,

no exercise of the underwriters’ option to purchase additional shares of common stock, and no exercise of pre-funded warrants

in this offering.

RISK

FACTORS

Investing

in our common stock or pre-funded warrants involves risk. Before deciding whether to invest in our common stock or pre-funded warrants,

you should consider carefully the risks and uncertainties described below. You should also consider the risks, uncertainties and assumptions

discussed under the heading “Risk Factors” included in our most recent Annual Report on Form 10-K, which are on file with

the SEC and incorporated herein by reference, and which may be amended, supplemented or superseded from time to time by other reports

we file with the SEC in the future. There may be other unknown or unpredictable economic, business, competitive, regulatory or other

factors that could have material adverse effects on our future results. If any of these risks actually occurs, our business, business

prospects, financial condition or results of operations could be seriously harmed. This could cause the trading price of our common stock

and the value of our pre-funded warrants to decline, resulting in a loss of all or part of your investment. Please also read carefully

the section above titled “Cautionary Statement Regarding Forward-Looking Statements.”

Risks

Related to Our Common Stock and This Offering

Our share price may be volatile, and you may

be unable to sell your shares of common stock at or above the offering price.

The

market price of our common stock is likely to be volatile and could be subject to wide fluctuations in response to many risk factors

listed in this section or incorporated by reference herein, and others beyond our control.

Furthermore,

the stock markets have experienced price and volume fluctuations that have affected and continue to affect the market prices of equity

securities of many companies. These fluctuations often have been unrelated or disproportionate to the operating performance of those

companies. These broad market and industry fluctuations, as well as general economic, political and market conditions such as recessions,

interest rate changes or international currency fluctuations, may negatively impact the market price of our common stock. If the market

price of our common stock after this offering does not exceed the public offering price, you may not realize any return on your investment

in us and may lose some or all of your investment. In the past, companies that have experienced volatility in the market price of their

stock have been subject to securities class action litigation. We may be the target of this type of litigation in the future. Securities

litigation against us could result in substantial costs and divert our management’s attention from other business concerns, which

could seriously harm our business.

Purchasers

of shares of our common stock in this offering will experience immediate and substantial dilution in the book value of their investment.

If you purchase shares of our common stock

in this offering, you will incur immediate and substantial dilution in the as adjusted net tangible book value of your stock of $

per share, based on the public offering price of $ per share, because offering

price per share in this offering may exceed the net tangible book value per share of our common stock outstanding prior to this

offering, assuming no exercise of the pre-funded warrants. To the extent we raise additional capital by issuing equity securities,

our stockholders will experience substantial additional dilution. The exercise of outstanding stock options and warrants may result

in further dilution of your investment. Additionally, because the sales of shares of our common stock offered hereby will be made

directly into the market, the prices at which we sell such securities will vary and these variations may be significant. As a

result, you may suffer dilution if you purchase shares in this offering at a higher price than other shares offered hereby are sold.

See the section entitled “Dilution” below for a more detailed illustration of the dilution you would incur if you

participate in this offering.

We

have broad discretion in the use of the net proceeds from this offering and our existing cash and may not use them effectively.

Our

management will have broad discretion in the application of the net proceeds from this offering, including for any of the purposes described

in the section titled “Use of Proceeds,” as well as our existing cash and cash equivalents, and you will be relying on the

judgment of our management regarding such application. You will not have the opportunity, as part of your investment decision, to assess

whether the net proceeds are being used appropriately. This expected use of the net proceeds from this offering represents our intentions

based upon our current plans and business conditions. The amounts and timing of our actual expenditures may vary significantly depending

on numerous factors, including the progress of our development efforts, the status of and results from clinical trials, as well as any

collaborations that we may enter into with third parties for our product candidates, and any unforeseen cash needs. Because of the number

and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially

from their currently intended use. Our management might not apply the net proceeds or our existing cash in ways that ultimately increase

the value of your investment. If we do not invest or apply the net proceeds from this offering or our existing cash and cash equivalents

in ways that enhance stockholder value, we may fail to achieve expected business and financial results, which could cause our stock price

to decline. Pending their use, we may invest the net proceeds from this offering in short-term, investment-grade, interest-bearing securities.

These investments may not yield a favorable return to our stockholders.

Future

sales of our common stock in the public market, or the perception that such sales could occur, could cause our stock price to fall.

The

sale of a substantial number of shares of our common stock or other equity-related securities in the public markets, or the perception

that such sales could occur, could depress the market price of our common stock and impair our ability to raise capital through the sale

of additional equity securities. We may sell large quantities of our common stock at any time pursuant to this prospectus supplement

or in one or more separate offerings. We cannot predict the effect that future sales of common stock or other equity-related securities

would have on the market price of our common stock.

There is no public market for the pre-funded

warrants being offered in this offering.

There is no established trading market for the

pre-funded warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to

list the pre-funded warrants on any securities exchange or nationally recognized trading system, including the Nasdaq Global Market. Without

an active market, the liquidity of the pre-funded warrants will be limited.

Holders of pre-funded warrants purchased in

this offering will have no rights as holders of our common stock with respect to the shares of common stock underlying such pre-funded

warrants until such holders exercise their pre-funded warrants and acquire our common stock, except as provided in the pre-funded warrants.

Until holders of the pre-funded warrants being

offered in this offering acquire shares of our common stock upon exercise of such pre-funded warrants, the holders will have no rights

with respect to the shares of our common stock underlying such pre-funded warrants. Upon exercise of the pre-funded warrants, the holders

will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise.

We may not receive any additional funds upon

the exercise of the pre-funded warrants.

Each pre-funded warrant may be exercised by way

of a cashless exercise, meaning that the holder may not pay a cash purchase price upon exercise, but instead would receive upon such exercise

the net number of shares of our common stock determined according to the formula set forth in the pre-funded warrant. Accordingly, we

may not receive any additional funds upon the exercise of the pre-funded warrants.

Significant holders or beneficial holders of

our common stock may not be permitted to exercise pre-funded warrants that they hold.

A holder of a pre-funded warrant will not be entitled

to exercise any portion of any pre-funded warrant which, upon giving effect to such exercise, would cause the aggregate number of shares

of our common stock beneficially owned by the holder (together with its affiliates) to exceed 4.99% of the number of shares of our common

stock outstanding immediately after giving effect to the exercise. Such percentage may be increased by the holder of the pre-funded warrant

to any other percentage not in excess of 4.99% upon at least 61 days’ prior notice from the holder to us. As a result, you may not

be able to exercise your pre-funded warrants for shares of our common stock at a time when it would be financially beneficial for you

to do so. In such circumstance you could seek to sell your pre-funded warrants to realize value, but you may be unable to do so in the

absence of an established trading market for the pre-funded warrants.

Our internal control over financial reporting

and our disclosure controls and procedures may not prevent all possible errors that could occur.

Our management is responsible for establishing and

maintaining adequate internal control over financial reporting to provide reasonable assurance regarding the reliability of our financial

reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted

in the United States of America (“U.S. GAAP”). Ensuring that we have adequate internal financial and accounting controls and

procedures in place to produce accurate financial statements on a timely basis is a costly and time-consuming effort that needs to be

re-evaluated frequently. Failure on our part to have effective internal financial and accounting controls would cause our financial reporting

to be unreliable, could have a material adverse effect on our business, operating results, and financial condition, and could cause the

trading price of our common stock to fall dramatically. In June 2023, our registered public accounting firm agreed to a settlement with

the SEC with respect to certain matters relating to systemic quality control failures and violations of audit standards in connection

with audit work for hundreds of special purpose acquisition company (SPAC) clients beginning at the latest in 2020 and continuing through

2022. We are actively monitoring the situation but do not currently believe this settlement will affect CorMedix or our financial statements.

A control system, no matter how well designed and operated, can provide

only reasonable, not absolute, assurance that the control system’s objectives will be satisfied. Internal control over financial

reporting and disclosure controls and procedures are designed to give a reasonable assurance that they are effective to achieve their

objectives. We cannot provide absolute assurance that all of our possible future control issues will be detected. These inherent limitations

include the possibility that judgments in our decision making can be faulty, and that isolated breakdowns can occur because of simple

human error or mistake. The design of our system of controls is based in part upon assumptions about the likelihood of future events,

and there can be no assurance that any design will succeed absolutely in achieving our stated goals under all potential future or unforeseeable

conditions. Because of the inherent limitations in a cost-effective control system, misstatements due to error could occur and not be

detected. This and any future failures could cause investors to lose confidence in our reported financial information, which could have

a negative impact on our financial condition and stock price.

In future periods, if the process required by Section 404 of the Sarbanes-Oxley

Act reveals any material weaknesses or significant deficiencies, the correction of any such material weaknesses or significant deficiencies

could require remedial measures which could be costly and time-consuming. In addition, in such a case, we may be unable to produce accurate

financial statements on a timely basis. Any associated accounting restatement could create a significant strain on our internal resources

and cause delays in our release of quarterly or annual financial results and the filing of related reports, increase our costs and cause

management distraction. Any of the foregoing could cause investors to lose confidence in the reliability of our financial statements,

which could cause the market price of our common stock to decline and make it more difficult for us to finance our operations and growth.

USE

OF PROCEEDS

We estimate that the net proceeds from the sale

of the shares of common stock and pre-funded warrants that we are selling in this offering, after deducting the underwriting discounts

and commissions and estimated offering expenses payable by us, will be approximately $ million, or approximately $ million if the underwriters

exercise in full their option to purchase up to

additional shares of common stock. We will receive nominal proceeds, if any, upon exercise of the pre-funded warrants.

We

intend to use the net proceeds from this offering for general corporate purposes, commercialization efforts, research and development,

and working capital and general expenditures.

We believe that the net proceeds from this offering,

together with our existing cash, cash equivalents, short-term investments and available resources, will enable us to fund the launch of

DefenCath through to anticipated profitability, which could occur as early as the end of 2024. These estimates are based upon the assumption

of an approval of the DefenCath NDA in November 2023, commercial launch in the first quarter of 2024, and other base case assumptions

for market penetration, average selling price, R&D expense and commercial infrastructure cost. This expected use of the net proceeds

from this offering represents our intentions based upon our current plans and business conditions, which could change in the future as

our plans and business conditions evolve. As of the date of this prospectus supplement, we cannot predict with certainty all of the particular

uses for the proceeds to be received upon the completion of this offering, the actual amounts that we will spend on the uses set forth

above, nor can we guarantee that the Company will achieve profitability as early as the end of 2024 or at all. As a result, our management

will retain broad discretion over the allocation of the net proceeds from this offering.

Pending

the application of the net proceeds as set forth above, we intend to invest the net proceeds in short-term, interest-bearing, investment-grade

securities.

DIVIDEND

POLICY

We

have never declared dividends on our equity securities, and currently do not plan to declare dividends on shares of our common stock

in the foreseeable future. We expect to retain our future earnings, if any, for use in the operation and expansion of our business. Further,

pursuant to the terms of our Series C-3 Non-Voting Convertible Preferred Stock, Series E and G Voting Convertible Preferred Stock, we

may not declare or pay any dividends or make any distributions on any of our shares or other equity securities as long as any of those

preferred shares remain outstanding. Subject to the foregoing, the payment of cash dividends in the future, if any, will be at the discretion

of our board of directors and will depend upon such factors as earnings levels, capital requirements, our overall financial condition

and any other factors deemed relevant by our board of directors.

DILUTION

If you invest in our common stock and pre-funded

warrants in this offering, your ownership interest will be diluted to the extent of the difference between the public offering price per

share of our common stock or issuable upon the exercise of the pre-funded warrants and the as-adjusted net tangible book value per share

of our common stock immediately after this offering. We calculate net tangible book value per share by dividing the net tangible book

value (our tangible assets less our total liabilities) by the number of outstanding shares of our common stock.

The historical net tangible book value of our

common stock as of March 31, 2023 was $53.9 million, or $1.21 per share, based on 44,499,788 shares of common stock outstanding as of

March 31, 2023.

After giving effect to the sale of

shares of our common stock in this offering at the public offering price of $ per share and

pre-funded warrants to purchase shares of our common stock at the public offering price of $ per pre-funded warrant (which equals

the public offering price per share of our common stock less the $0.0001 per share exercise price of each such pre-funded warrants

or any resulting accounting associated with the pre-funded warrants), and after deducting estimated underwriting discounts and

commissions and offering expenses, our as-adjusted net tangible book value as of March 31, 2023 would have been $ million, or $ per

share. This represents an immediate increase in the as-adjusted net tangible book value of $ per share to existing stockholders and

an immediate dilution in the as-adjusted net tangible book value of $ per share to new investors purchasing shares of our common

stock in this offering.

The following table illustrates the dilution,

assuming the underwriters do not exercise their option to purchase additional shares of common stock and the holders of the pre-funded

warrants offered hereby do not exercise the pre-funded warrants:

| Public offering price per share | |

| | | |

$ | | |

| Historical net tangible book value per share as of March 31, 2023 | |

$ | 1.21 | | |

| | |

| Increase in net tangible book value per share attributable to new investors | |

$ | | | |

| | |

| As adjusted net tangible book value per share after giving effect to this offering | |

| | | |

$ | | |

| Dilution per share to new investors participating in this offering | |

| | | |

$ | | |

If the underwriters exercise their option to

purchase additional shares of our common stock in full at the public offering price

of per share (and excluding shares of our common stock

issued and any proceeds received upon exercise of the pre-funded warrants or any resulting accounting associated with the pre-funded

warrants), and after deducting estimated underwriting discounts and commissions and offering expenses payable by us, the as-adjusted

net tangible book value would be approximately $ per share, representing an immediate increase in the as-adjusted net tangible book

value of approximately $ per share to existing stockholders and an immediate dilution in the as-adjusted net tangible book value of

per share to new investors purchasing shares of our common stock in this offering.

The

foregoing calculations exclude the following shares as of March 31, 2023:

| ● | 6,126,080

shares of our common stock issuable upon exercise of stock options outstanding as of March

31, 2023 having a weighted-average exercise price of $5.70 per share; |

| ● | 207,469

shares of our common stock issuable upon the settlement of outstanding restricted stock units

as of March 31, 2023; |

| ● | 48,909

shares of our common stock issuable for payment of deferred board compensation as of March

31, 2023; |

| ● | 4,000 shares of Series C non-voting convertible preferred stock issued

and outstanding as of March 31, 2023; |

| ● | 391,953 shares of Series E voting convertible preferred stock issued

and outstanding as of March 31, 2023; and |

| ● | 5,004,069

shares of Series G voting convertible preferred stock issued and outstanding as of March 31, 2023. |

To the extent that any options are exercised,

new options are issued or we otherwise issue additional shares of common stock in the future at a price less than the public offering

price, there may be further dilution to purchasers of our common stock in this offering. The number of shares of our common stock to be

outstanding after this offering does not take into account the shares of our common stock issuable upon the exercise of the pre-funded

warrants.

DESCRIPTION OF PRE-FUNDED WARRANTS

The following is a brief summary of certain terms and conditions of

the pre-funded warrants being offered by us, which is subject in all respects to the provisions contained in the pre-funded warrants.

Form and Term

The pre-funded warrants will be issued as individual warrant agreements to each individual purchaser of a pre-funded warrant. The form

of pre-funded warrant will be filed as an exhibit to a Current Report on Form 8-K that we will file with the SEC.

The pre-funded warrants do not expire.

Exercisability

The pre-funded warrants are exercisable at any

time after their original issuance. The pre-funded warrants will be exercisable, at the option of each holder, in whole or in part, by

delivering to us a duly executed exercise notice and by payment in full of the exercise price in immediately available funds for the number

of shares of our common stock purchased upon such exercise. As an alternative to payment of the exercise price in immediately available

funds, the holder may elect to exercise the pre-funded warrant through a cashless exercise, in which case the holder would receive upon

such exercise the net number of shares of our common stock determined according to the formula set forth in the pre-funded warrant. No

fractional shares of our common stock will be issued in connection with the exercise of a pre-funded warrant. In lieu of fractional shares,

we will pay the holder an amount in cash equal to the fractional amount multiplied by the last closing trading price of our common stock

on the exercise date.

Exercise limitations

Under the pre-funded warrants, we may not effect

the exercise of any portion of any pre-funded warrant, and a holder will not have the right to exercise any portion of any pre-funded

warrant, which, upon giving effect to such exercise, would cause the aggregate number of shares of our common stock beneficially owned

by the holder (together with its affiliates) to exceed 4.99% of the number of shares of our common stock outstanding immediately after

giving effect to the exercise. However, any holder may increase or decrease such percentage to any other percentage not in excess of 4.99%

upon at least 61 days’ prior notice from the holder to us.

Exercise price

The exercise price per whole share of our common

stock purchasable upon the exercise of the pre-funded warrants is $0.0001 per share of our common stock. The exercise price of the pre-funded

warrants and the number of shares of our common stock issuable upon exercise of the pre-funded warrants are subject to appropriate adjustment

in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting

our common stock and also upon any distributions of assets, including cash, stock or other property to our stockholders. The exercise

price will not be adjusted below the par value of our common stock.

Charges, Taxes and Expenses

Issuance and delivery

of shares of our common stock upon exercise of a pre-funded warrant will be made without charge to the holder thereof for any

issue or transfer tax, transfer agent fee or other incidental tax or expense (excluding any applicable stamp duties) in respect of the

issuance thereof, all of which taxes and expenses shall be paid by us. However, we are not required to pay any tax that may be payable

in respect of any transfer involved in the registration of any warrant shares or pre-funded warrants in a name other than that

of the holder or an affiliate thereof. The holder shall be responsible for all other tax liability that may arise as a result of holding

or transferring its pre-funded warrants or receiving shares upon exercise thereof.

Transferability

Subject to applicable laws, the pre-funded warrants

may be offered for sale, sold, transferred or assigned without our consent. The pre-funded warrants will be held in definitive form by

the warrant agent. The ownership of the pre-funded warrants and any transfers of the pre-funded warrants will be registered in a warrant

register maintained by the warrant agent. We will initially act as warrant agent.

Exchange listing

We do not plan to apply to list the pre-funded

warrants on the Nasdaq Global Market, any other national securities exchange or any other nationally recognized trading system.

Fundamental transactions

In the event of a fundamental transaction, as

described in the pre-funded warrants and generally including any reorganization, recapitalization or reclassification of our common stock,

the sale, transfer or other disposition of all or substantially all of our properties or assets, our consolidation or merger with or into

another person, the acquisition of more than 50% of our outstanding common stock, or any person or group becoming the beneficial owner

of 50% of the voting power represented by our outstanding common stock, upon consummation of such a fundamental transaction, the holders

of the pre-funded warrants will be entitled to receive upon exercise of the pre-funded warrants the kind and amount of securities, cash

or other property that the holders would have received had they exercised the pre-funded warrants immediately prior to such fundamental

transaction without regard to any limitations on exercise contained in the pre-funded warrants.

No rights as a stockholder

Except by virtue of such holder’s ownership

of shares of our common stock, the holder of a pre-funded warrant does not have the rights or privileges of a holder of our common stock,

including any voting rights or the rights to receive dividends, until the holder exercises the pre-funded warrant. In the event of certain

distributions, including cash dividends, if any, to all holders of our common stock for no consideration, the holder of a pre-funded warrant

shall be entitled to participate in such distributions to the same extent as if such holder held the number of shares of our common stock

acquirable upon complete exercise of its pre-funded warrant (without regard to any limitations on exercise). If such distribution would

result in such holder and the other attribution parties exceeding the exercise limitations described above, a portion of such distribution

shall be held in abeyance for the benefit of such holder until such time as the ownership limitations would not be exceeded.

UNDERWRITING

We entered into an underwriting agreement with

the underwriters named below on , 2023. RBC

Capital Markets, LLC and Truist Securities, Inc. are acting as the representatives of the underwriters. Subject to the terms and conditions

stated in the underwriting agreement dated the date of this prospectus supplement, each underwriter named below has severally and not

jointly agreed to purchase, and we have agreed to sell to that underwriter, the number of shares of our common stock and pre-funded warrants

set forth opposite the underwriter’s name.

| Underwriter | |

Number of Shares | | |

Number of pre-funded warrants | |

| RBC Capital Markets, LLC | |

| | | |

| | |

| Truist Securities, Inc. | |

| | | |

| | |

| JMP Securities LLC | |

| | | |

| | |

| Total | |

| | | |

| | |

The underwriting agreement provides that the obligations

of the underwriters to purchase the shares of our common stock or pre-funded warrants included in this offering are subject to approval

of legal matters by counsel and to other conditions. The underwriters are obligated to purchase all the shares of our common stock or

pre-funded warrants (other than those covered by the underwriters’ option to purchase additional shares of our common stock option

described below) if they purchase any of the shares of our common stock or pre-funded warrants.

Shares of our common stock and pre-funded warrants

sold by the underwriters to the public will initially be offered at the initial public offering price set forth on the cover of this prospectus

supplement. Any shares of our common stock and pre-funded warrants sold by the underwriters to securities dealers may be sold at a discount

from the initial public offering price not to exceed $ per share. If all the shares of common stock or pre-funded warrants are not sold

at the initial offering price, the underwriters may change the offering price and the other selling terms.

Underwriting

discounts and commissions

The following table shows the underwriting discounts

and commissions that we are to pay to the underwriters in connection with this offering. These amounts are shown assuming both no exercise

and full exercise of the underwriters’ option to purchase additional shares.

| | |

Paid by the

Company | |

| | |

No Exercise | | |

Full Exercise | |

| Per share of common stock | |

$ | | | |

$ | | |

| Per pre-funded warrant | |

$ | | | |

$ | | |

| Total | |

$ | | | |

$ | | |

Indemnification

We have agreed to indemnify the underwriters against

certain liabilities, including liabilities under the Securities Act, or to contribute to payments the underwriters may be required to

make because of any of those liabilities.

Option to

Purchase Additional Shares

We have granted to the underwriters an option,

exercisable for 30 days from the date of this prospectus supplement, to purchase up to additional

shares at the public offering price less the underwriting discounts and commissions. To the extent the option is exercised, each underwriter

must purchase a number of additional shares approximately proportionate to that underwriter’s initial purchase commitment. Any shares

of our common stock issued or sold under the option will be issued and sold on the same terms and conditions as the other shares that

are the subject of this offering.

Lock-Ups

We and our officers and directors have agreed

that, for a period of 90 days from the date of this prospectus supplement, we and they will not, without the prior written consent of

the Representatives, dispose of or hedge any shares or any securities convertible into or exchangeable for our common stock, subject to

certain customary exceptions, the Representatives in their sole discretion, may release any of the securities subject to these lock-up

agreements at any time without notice.

NASDAQ Global

Market Listing

The shares are listed on the Nasdaq Global Market

under the symbol “CRMD.” We do not intend to list the pre-funded warrants on the Nasdaq Global Market, any other national

securities exchange or any other nationally recognized trading system.

Expenses and

Reimbursements

We estimate that our portion of the total expenses

of this offering will be $ , which includes the fees and expenses for which we have agreed to reimburse the underwriters.

Price Stabilization,

Short Positions and Penalty Bids

In connection with the offering, the underwriters

may purchase and sell shares of our common stock and pre-funded warrants in the open market. Purchases and sales in the open market may

include short sales, purchases to cover short positions, which may include purchases pursuant to the underwriters’ option to purchase

additional shares of our common stock, and stabilizing purchases.

| ● | Short sales involve secondary market sales by the underwriters

of a greater number of shares than they are required to purchase in the offering. |

| ● | “Covered” short sales are sales of shares in

an amount up to the number of shares represented by the underwriters’ option to purchase additional shares. |

| ● | “Naked” short sales are sales of shares in an

amount in excess of the number of shares represented by the underwriters’ option to purchase additional shares. |

| ● | Covering transactions involve purchases of shares either

pursuant to the underwriters’ option to purchase additional shares or in the open market in order to cover short positions. |

| ● | To close a naked short position, the underwriters must purchase

shares in the open market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward

pressure on the price of the shares in the open market after pricing that could adversely affect investors who purchase in the offering. |

| ● | To close a covered short position, the underwriters must

purchase shares in the open market or must exercise the underwriters’ option to purchase additional shares. In determining the source

of shares to close the covered short position, the underwriters will consider, among other things, the price of shares available for

purchase in the open market as compared to the price at which they may purchase shares through the underwriters’ option to purchase additional

shares. |

| ● | Stabilizing transactions involve bids to purchase shares

so long as the stabilizing bids do not exceed a specified maximum. |

Purchases to cover short positions and stabilizing

purchases, as well as other purchases by the underwriters for their own accounts, may have the effect of preventing or retarding a decline

in the market price of the shares. They may also cause the price of the shares to be higher than the price that would otherwise exist

in the open market in the absence of these transactions. The underwriters may conduct these transactions on the Nasdaq Global Market,

in the over-the-counter market or otherwise. If the underwriters commence any of these transactions, they may discontinue them at any

time.

In addition, in connection with this offering,

some of the underwriters (and selling group members, if any) may engage in passive market making transactions in the shares on the Nasdaq

Global Market, prior to the pricing and completion of the offering. Passive market making consists of displaying bids on the Nasdaq Global

Market no higher than the bid prices of independent market makers and making purchases at prices no higher than those independent bids

and effected in response to order flow. Net purchases by a passive market maker on each day are limited to a specified percentage of the

passive market maker’s average daily trading volume in the shares during a specified period and must be discontinued when that limit

is reached. Passive market making may cause the price of the shares to be higher than the price that otherwise would exist in the open

market in the absence of those transactions. If the underwriters commence passive market making transactions, they may discontinue them

at any time.

Electronic

Distribution

In connection with the offering, certain of the

underwriters or securities dealers may distribute prospectuses by electronic means, such as e-mail.

Other Relationships

The underwriters are full service financial institutions

engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment

management, principal investment, hedging, financing and brokerage activities. The underwriters and their respective affiliates have in

the past performed commercial banking, investment banking and advisory services for us from time to time for which they have received

customary fees and reimbursement of expenses and may, from time to time, engage in transactions with and perform services for us in the

ordinary course of their business for which they may receive customary fees and reimbursement of expenses. In the ordinary course of their

various business activities, the underwriters and their respective affiliates may make or hold a broad array of investments and actively

trade debt and equity securities (or related derivative securities) and financial instruments (which may include bank loans and/or credit

default swaps) for their own account and for the accounts of their customers and may at any time hold long and short positions in such

securities and instruments. Such investments and securities activities may involve securities and/or instruments of ours or our affiliates.

The underwriters and their affiliates may also make investment recommendations and/or publish or express independent research views in

respect of such securities or financial instruments and may hold, or recommend to clients that they acquire, long and/or short positions

in such securities and instruments. For example, Truist Securities, Inc. and JMP Securities LLC, act as the sales agents under our At-the-Market

Issuance Sales Agreement, pursuant to which we may sell, from time to time, an aggregate of up to $50 million of our common stock.

Sales Outside

the United States

No action has been taken in any jurisdiction (except

in the United States) that would permit a public offering of our common stock or pre-funded warrants, or the possession, circulation or

distribution of this prospectus supplement or any other material relating to us or our common stock or pre-funded warrants in any jurisdiction

where action for that purpose is required. Accordingly, the shares of common stock or pre-funded warrants may not be offered or sold,

directly or indirectly, and neither this prospectus supplement nor any other offering material or advertisements in connection with our

common stock or pre-funded warrants may be distributed or published, in or from any country or jurisdiction, except in compliance with

any applicable rules and regulations of any such country or jurisdiction.

The underwriters may arrange to sell the common

stock or pre-funded warrants offered hereby in certain jurisdictions outside the United States, either directly or through affiliates,

where it is permitted to do so.

European Economic

Area

In relation to each Member State of the European

Economic Area which has implemented the Prospectus Directive (each, a “Relevant Member State”) an offer to the public of shares

of our common stock or pre-funded warrants may not be made in that Relevant Member State, except that an offer to the public in that Relevant

Member State of shares of our common stock or pre-funded warrants may be made at any time under the following exemptions under the Prospectus

Directive:

| (a) | to any legal entity which is a qualified investor as defined

in the Prospectus Directive; |

| (b) | to fewer than 150 natural or legal persons (other than qualified

investors as defined in the Prospectus Directive), subject to obtaining the prior consent of the representative for any such offer; or |

| (c) | in any other circumstances falling within Article 3(2) of

the Prospectus Directive, provided that no such offer of shares of our common stock shall result in a requirement for the publication

by us or any underwriter of a prospectus pursuant to Article 3 of the Prospectus Directive. |

For the purposes of this provision, the expression

an “offer to the public” in relation to shares of our common stock or pre-funded warrants in any Relevant Member State means

the communication in any form and by any means of sufficient information on the terms of the offer and any shares of our common stock

or pre-funded warrants to be offered so as to enable an investor to decide to purchase any shares of our common stock or pre-funded warrants,

as the same may be varied in that Member State by any measure implementing the Prospectus Directive in that Member State, the expression

“Prospectus Directive” means Directive 2003/71/EC (as amended), including by Directive 2010/73/EU, and includes any relevant

implementing measure in the Relevant Member State.

This European Economic Area selling restriction

is in addition to any other selling restrictions set out below.

United Kingdom

In the United Kingdom, this prospectus supplement

is only addressed to and directed as qualified investors who are (i) investment professionals falling within Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (the Order); or (ii) high net worth entities and other persons to whom

it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant

persons”). Any investment or investment activity to which this prospectus supplement relates is available only to relevant persons

and will only be engaged with relevant persons. Any person who is not a relevant person should not act or relay on this prospectus supplement

or any of its contents.

Hong Kong

The shares of our common stock or pre-funded warrants

may not be offered or sold in Hong Kong by means of any document other than (i) in circumstances which do not constitute an offer to the

public within the meaning of the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32 of the Laws of Hong Kong) (“Companies

(Winding Up and Miscellaneous Provisions) Ordinance”) or which do not constitute an invitation to the public within the meaning

of the Securities and Futures Ordinance (Cap. 571 of the Laws of Hong Kong) (“Securities and Futures Ordinance”), or (ii)

to “professional investors” as defined in the Securities and Futures Ordinance and any rules made thereunder, or (iii) in

other circumstances which do not result in the document being a “prospectus” as defined in the Companies (Winding Up and Miscellaneous

Provisions) Ordinance, and no advertisement, invitation or document relating to the shares of our common stock or pre-funded warrants

may be issued or may be in the possession of any person for the purpose of issue (in each case whether in Hong Kong or elsewhere), which

is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under

the securities laws of Hong Kong) other than with respect to shares or pre-funded warrants which are or are intended to be disposed of

only to persons outside Hong Kong or only to “professional investors” in Hong Kong as defined in the Securities and Futures

Ordinance and any rules made thereunder.

Singapore

This prospectus supplement has not been registered

as a prospectus with the Monetary Authority of Singapore. Accordingly, this prospectus supplement and any other document or material in

connection with the offer or sale, or invitation for subscription or purchase, of the shares of our common stock or pre-funded warrants

may not be circulated or distributed, nor may the shares be offered or sold, or be made the subject of an invitation for subscription

or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined under Section

4A of the Securities and Futures Act, Chapter 289 of Singapore (the “SFA”)) under Section 274 of the SFA, (ii) to a relevant

person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1) of the SFA, or any person pursuant to Section 275(1A) of the

SFA, and in accordance with the conditions specified in Section 275 of the SFA or (iii) otherwise pursuant to, and in accordance with

the conditions of, any other applicable provision of the SFA, in each case subject to conditions set forth in the SFA.

Where the shares of our common stock or pre-funded

warrants are subscribed or purchased under Section 275 of the SFA by a relevant person which is a corporation (which is not an accredited

investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which

is owned by one or more individuals, each of whom is an accredited investor, the securities (as defined in Section 239(1) of the SFA)

of that corporation shall not be transferable for 6 months after that corporation has acquired the shares under Section 275 of the SFA

except: (1) to an institutional investor under Section 274 of the SFA or to a relevant person (as defined in Section 275(2) of the SFA),

(2) where such transfer arises from an offer in that corporation’s securities pursuant to Section 275(1A) of the SFA, (3) where

no consideration is or will be given for the transfer, (4) where the transfer is by operation of law, (5) as specified in Section 276(7)

of the SFA, or (6) as specified in Regulation 32 of the Securities and Futures (Offers of Investments) (Shares and Debentures) Regulations

2005 of Singapore (“Regulation 32”).

Where the shares of our common stock or pre-funded

warrants are subscribed or purchased under Section 275 of the SFA by a relevant person which is a trust (where the trustee is not an accredited

investor (as defined in Section 4A of the SFA)) whose sole purpose is to hold investments and each beneficiary of the trust is an accredited

investor, the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferable for 6 months after

that trust has acquired the shares of our common stock or pre-funded warrants under Section 275 of the SFA except: (1) to an institutional

investor under Section 274 of the SFA or to a relevant person (as defined in Section 275(2) of the SFA), (2) where such transfer arises

from an offer that is made on terms that such rights or interest are acquired at a consideration of not less than S$200,000 (or its equivalent

in a foreign currency) for each transaction (whether such amount is to be paid for in cash or by exchange of securities or other assets),

(3) where no consideration is or will be given for the transfer, (4) where the transfer is by operation of law, (5) as specified in Section

276(7) of the SFA, or (6) as specified in Regulation 32.

Japan

The securities have not been and will not be registered