0000806279

false

0000806279

2023-07-27

2023-07-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The Securities Exchange Act of 1934

July 27, 2023

Date of Report (Date of earliest event reported)

CODORUS

VALLEY BANCORP, INC.

(Exact

name of registrant as specified in its charter)

| |

Pennsylvania |

|

001-15536 |

|

23-2428543 |

|

| |

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number) |

|

(IRS

Employer Ident. No.) |

|

| |

|

|

|

|

| |

105

Leader Heights Road, York,

Pennsylvania |

|

17403 |

|

| |

(Address

of principal executive offices) |

|

(Zip

Code) |

|

(717) 747-1519

Registrant’s

telephone number, including area code

Not Applicable

(Former

name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation

of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b)under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $2.50 par value |

|

CVLY |

|

NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging

growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. | Results of Operations and Financial Condition |

On July 27, 2023, Codorus Valley Bancorp, Inc. (the “Corporation”)

issued a press release (the “Press Release”) announcing the Corporation’s results of operations for the quarter and

year ended June 30, 2023. A copy of the Press Release and supplementary financial information which accompanied the Press Release are

attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

The information

included in Exhibit 99.1 shall be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended, and therefore

may be incorporated by reference in the Corporation’s filings under the Securities Act of 1933, as amended.

| Item 9.01. |

Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

CODORUS VALLEY BANCORP, INC. |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Date: |

July 27, 2023 |

|

By: |

/s/ Larry D. Pickett |

|

| |

|

|

|

Larry D. Pickett |

|

| |

|

|

|

Executive Vice President, and Chief Financial Officer

(Principal Financial and Accounting Officer) |

|

Exhibit 99.1

FOR

IMMEDIATE RELEASE

July

27, 2023

Codorus

Valley Bancorp, Inc.

Reports

Second Quarter 2023 Earnings

|  | Second

quarter net income of $6.6 million compared to net income of $2.0 million in the quarter

ended June 30, 2022, and $7.0 million in the quarter ended March 31, 2023; |

|  | 63

basis point increase in net interest margin from the quarter ended June 30, 2022,

and 19 basis point decrease from the quarter ended March 31, 2023, to 3.81 percent; |

|  | Second

quarter efficiency ratio of 64.19 percent; return on average assets of 1.22 percent;

and return on equity of 14.17 percent; |

|  | Steady

performance in credit metrics with nonperforming assets to total loans at 0.70 percent

at June 30, 2023; |

|  | Cash

dividend of $0.17 per common share payable on August 8, 2023, to holders of record on

July 25, 2023. |

YORK,

Pa. – Codorus Valley Bancorp, Inc. (“Codorus Valley”, or the “Corporation”) (NASDAQ: CVLY), parent

company of PeoplesBank, A Codorus Valley Company (“PeoplesBank”, or the “Bank”), today reported net income

of $6.6 million or $0.69 per diluted common share, for the quarter ended June 30, 2023. This compares to net income of $2.0 million

or $0.20 per diluted common share, for the quarter ended June 30, 2022, representing an increase of $4.6 million or 238 percent,

and compares to net income of $7.0 million or $0.73 per diluted common share for the first quarter of 2023, representing a decrease

of $400,000 or 5.5 percent. For the first six months of 2023, net income was $13.6 million or $1.42 per diluted share, compared

to $5.0 million or $0.52 per diluted share, for the first six months of 2022, representing an increase of $8.6 million or 172

percent.

“In

the second quarter, the PeoplesBank team continued to concentrate on actions that will position the Corporation for long-term

financial well-being,” stated Craig L. Kauffman, President and CEO. “During the quarter we made efforts to increase

our liquidity, improve credit quality, fortify the balance sheet, and position the Corporation to support its stakeholders. As

a result, we were pleased that the Board increased the cash dividend to $0.17 per share, an increase of $0.01 over the first quarter

of 2023.”

REVIEW

OF RESULTS

Balance

Sheet

Loans

Loans

increased $49.1 million from December 31, 2022 to June 30, 2023, an annualized growth rate of 6.0 percent. Nonperforming assets

increased $600,000, or 6.3 percent to $9.7 million from December 31, 2022 to June 30, 2023, primarily due to a single loan in

the amount of $1.7 million that was more than 90 days past due but still accruing at quarter-end.

Investment

Securities

Investment

Securities decreased $2.8 million to $342.7 million at June 30, 2023 compared to $345.5 million at December 31, 2022. The Bank

sold $4.7 million of investment securities, realizing a net loss of $388,000 during the first quarter of 2023, improving the security

portfolio yield by three basis points. The tax-equivalent yield on securities for the three months ended June 30, 2023 was 2.72

percent, compared to 2.12 percent for the three months ended June 30, 2022 and 2.68 percent for the three months ended March 31,

2023. The unrealized loss on the securities portfolio was $46.6 million at June 30, 2023, compared to $30.7 million at June 30,

2022 and $40.4 million at March 31, 2023.

Borrowings

FHLB

advances and other short-term borrowings increased $71.7 million to $83.3 million at June 30, 2023 compared to $11.6 million at

December 31, 2022, as the Bank added liquidity to the balance sheet during the recent industry turmoil to provide an added measure

of liquidity in the event the Bank were to experience outsized deposit withdrawals.

Deposits

Total

Deposits decreased $60.5 million, or 3.1 percent from December 31, 2022 to June 30, 2023, ending the period at $1.88 billion.

From year-end 2022 to June 30, 2023, noninterest-bearing demand accounts decreased $55.6 million or 12.0 percent, and interest-bearing

demand accounts decreased $18.0 million or 6.2 percent. During that same period, within other interest-bearing deposit categories,

money market accounts decreased by $18.4 million or 2.8 percent and savings accounts decreased $13.2 million or 8.2 percent. Offsetting

the decreases, certificates of deposit increased by $44.6 million or 11.7 percent. As a result of the change in deposit mix, the

average cost of interest-bearing deposits increased to 1.94 percent for the quarter ended June 30, 2023, compared to 0.26 percent

for the quarter ended June 30, 2022 and 1.43 percent for the quarter ended March 31, 2023. For the six months ended June 30, 2023,

the average cost of interest-bearing deposits increased to 1.69 percent, compared to 0.26 percent for the six months ended June

30, 2022. During the three months ended June 30, 2023 overall deposit activity stabilized with a decline of $6.7 million or 0.36

percent from the quarter ended March 31, 2023. We anticipate downward pressure on net interest margin to continue in the second

half of 2023.

Income

Statement

The

Corporation’s net interest income for the three months ended June 30, 2023 was $19.9 million, an increase of 12.2 percent

when compared to $17.7 million for the three months ended June 30, 2022 and a decrease of 3.2 percent when compared to $20.6 million

for the three months ended March 31, 2023. The Corporation’s tax-equivalent net interest margin (“NIM”) was

3.81 percent for the three months ended June 30, 2023, compared to 3.18 percent for the same period in 2022 and 4.00 percent for

the quarter ended March 31, 2023. Net interest income for the six months ended June 30, 2023 was $40.5 million, an increase of

21.0 percent when compared to $33.4 million for the six months ended June 30, 2022. The Corporation’s tax-equivalent NIM

was 3.90 percent for the six months ended June 30, 2023, compared to 2.98 percent for the six months ended June 30, 2022.

The

Corporation’s provision for credit losses, which includes provision for credit losses on unfunded commitments, for the three

months ended June 30, 2023 was a reversal of $77,000 compared to a provision for loan losses of $3.0 million for the three months

ended June 30, 2022 and a provision for credit losses of $738,000 for the quarter ended March 31, 2023. The Corporation’s

nonperforming assets ratio was 0.58 percent at June 30, 2023, a 17.1 percent decrease from the nonperforming assets ratio of 0.70

percent at December 31, 2022. On January 1, 2023, the Corporation adopted ASU 2016-13, Financial Instruments – Credit Losses

(Topic 326) and now measures and records impairment on financial instruments at the time of origination using the current expected

credit loss (“CECL”) methodology. At adoption of the CECL methodology, the allowance for credit losses increased $2.8

million. The net impact to retained earnings was $2.1 million.

Noninterest

income for the three months ended June 30, 2023 was $4.1 million, an increase of $140,000 or 3.6 percent, compared to noninterest

income of $3.9 million for the three months ended June 30, 2022 and an increase of $71,000 or 1.8 percent compared to the three

months ended March 31, 2023. The increase in the current quarter from the three months ended June 30, 2022, was primarily due

to higher service charges on deposit accounts, offset by a decrease in gain on sale of loans. The increase in the current quarter

from the first quarter of 2023 was due to higher service charges on deposit accounts and no loss on sales of securities in the

current period, offset by a decrease in other income associated with interest rate swap fees and a decrease in gains on assets

held for sale. Noninterest income for the six months ended June 30, 2023 was $8.0 million, an increase of $258,000, as compared

to noninterest income of $7.8 million for the six months ended June 30, 2022. Higher trust and investment service fees, service

charges on deposits, other income related to interest rate swap fees and gains on sale of assets held for sale in the current

period were partially offset by a decrease in gains on sale of loans and a loss on sale of securities compared to the six months

ended June 30, 2022.

Noninterest

expense was $15.5 million for the second quarter 2023, a decrease of $700,000 or 4.6 percent, as compared to noninterest expense

of $16.2 million for the second quarter 2022 and an increase of $700,000 compared to noninterest expense of $14.8 million for

the first quarter of 2023. Year over year the decrease was attributed to lower professional and legal fees, lower impaired loan

carrying costs and lower other expense, offset by higher variable compensation accruals. The increase as compared to the first

quarter of 2023 was primarily the result of higher variable compensation accruals, higher charitable donations, partially offset

by lower other expense. Noninterest expense was $30.3 million for the six months ended June 30, 2023, a decrease of $600,000 or

2.0 percent, as compared to noninterest expense of $30.9 million for the six months ended June 30, 2022. The decrease was attributed

to lower professional and legal fees, lower impaired loan carrying costs and lower other expense, offset by higher variable compensation

accruals. Professional and legal fees and other expense were higher in the prior year as a result of costs associated with corporate

matters. Previously expensed impaired loan carrying costs were recovered in the current year, contributing to the decrease year

over year.

Income

tax expense for the quarter ended June 30, 2023 was $1.9 million compared to $500,000 for the same period in 2022 and $2.0 million

in the quarter ended March 31, 2023. The effective tax rate for the three month periods ended June 30, 2023, June 30, 2022 and

March 31, 2023 was 22.7 percent, 20.4 and 22.2 percent, respectively. Income tax expense for the six months ended June 30, 2023

was $3.9 million compared to $1.3 million for the six months ended June 30, 2022. The effective tax rate for the six months ended

June 30, 2023 and June 30, 2022 was 22.4 and 20.7, respectively.

Capital

Shareholders’

equity totaled $185.9 million at June 30, 2023, an increase of $8.6 million from $177.3 million at December 31, 2022. The increase

was primarily attributable to net income of $13.6 million, partially offset by dividends paid of $3.1 million for the six months

ended June 30, 2023 and the adoption of CECL of $2.1 million. Other changes related to accumulated other comprehensive loss and

issuance of treasury stock.

Book

value per share was $19.34 and $18.51 at June 30, 2023 and December 31, 2022, respectively. Tangible book value per share and

tangible book value per share without accumulated other comprehensive loss (1) increased to $19.10 per share and $22.81

per share, respectively, at June 30, 2023 from $18.27 per share and $21.90 per share, respectively, at December 31, 2022, primarily

the result of changes in shareholders’ equity discussed above. The Corporation’s common equity tier 1 capital ratio

was 12.20 percent at June 30, 2023, an increase from 12.04 percent at December 31, 2022. At June 30, 2023, all capital ratios

applicable to the Bank were above regulatory minimum levels and the Bank met the “well-capitalized” criteria under

current bank regulatory guidelines. (Note that the regulatory “well-capitalized” definition is not applicable to small

bank holding companies such as the Corporation).

(1)

Tangible book value per share and tangible book value per share without accumulated other comprehensive loss are non-GAAP financial

measures. Please see Financial Highlights for disclosure and reconciliation of non-GAAP financial measures.

Liquidity

Risk Management

The

Bank maintains a well-diversified deposit base and has a comparatively low level of uninsured deposits. At June 30, 2023, 84%

of the Bank’s deposits were estimated to be FDIC-insured, and an additional 7% of deposits were fully collateralized. The

average account size of the Bank’s consumer deposit base is less than $18,000, and the average account size of the Bank’s

business deposit base is less than $90,000.

The

overall deposit and liquidity position of the Bank and the Corporation remain positive, with overall deposits exceeding the level

at December 31, 2019, the start of the pandemic, by $292 million or 18.4 percent.

Although

the Bank had not utilized the Federal Reserve’s Bank Term Funding Facility as of June 30, 2023, the program has attractive

features, such as being able to borrow based on the par values (rather than market values) of a bank’s investment securities

that are pledged as collateral. For this reason, the program would be considered among the Bank’s other wholesale borrowing

options if additional liquidity was needed.

The

Bank is a member of the IntraFi Network, which provides reciprocal deposit alternatives allowing our clients to have the benefit

of additional FDIC insurance coverage, and assisting the Bank in the management of its liquidity needs.

Dividend

Declared

On

July 11, 2023, the Board of Directors of the Corporation declared a regular quarterly cash dividend of $0.17 per share, payable

on August 8, 2023 to common shareholders of record at the close of business on July 25, 2023. The payment of this $0.17 per share

cash dividend is $0.01 or 6 percent higher than the prior quarterly dividend.

Business

Lines

In

the second quarter of 2023, Consumer Banking marketing efforts continued to focus on deposit accounts by incentivizing new openings

of Momentum Checking and Savings accounts. Efforts included traditional and digital marketing, using mass marketing and targeted

marketing approaches. This led to a 141 percent increase in online traffic to the Bank’s Momentum Check and Savings webpage

over the first quarter of 2023 and a 25 percent increase in online loan applications and related loan bookings. In addition,

the Bank promoted its mortgage and HELOC offerings, and digital marketing campaigns were deployed in certain branch markets, resulting

in a 13.5 percent increase in web visitors related to that campaign over the first quarter of 2023.

Business

Banking marketing efforts continued to focus on helping clients through the Bank’s Preferred SBA Lender program in the first

month of the second quarter of 2023, transitioning to an offer for Treasury Management services in the last two months of the

quarter. Interest for the Bank’s Treasury Management offer was high, resulting in the offer landing page ranking as the

highest-viewed Business Banking-related webpage on the Bank’s website in the second quarter of 2023. Additionally, during

the second quarter of 2023, the Bank hired two seasoned revenue leaders, a York-based Business Banking Leader and a Maryland-based

CRE Team Leader.

PeoplesBank

Wealth Management continued to offer the expertise of its team to clients through a variety of events and personal outreach. In

addition, the Bank welcomed a new Wealth Advisor to the team to further deepen the Bank’s presence in the markets it serves.

Overall,

marketing efforts led to a 5 percent increase in website visitors over the first quarter of 2023. Desktop users increased 2.8

percent and mobile device users increased 7.7 percent over the first quarter of 2023.

About

Codorus Valley Bancorp, Inc.

Codorus

Valley Bancorp, Inc. is the largest independent financial services holding company headquartered in York, Pennsylvania. Codorus

Valley primarily operates through its financial services subsidiary, PeoplesBank, A Codorus Valley Company. PeoplesBank offers

a full range of consumer, business, wealth management, and mortgage services at financial centers located in communities throughout

South Central Pennsylvania and Central Maryland. Codorus Valley Bancorp, Inc.’s Common Stock is listed on the NASDAQ Global

Market under the symbol “CVLY”.

Cautionary

Note Regarding Forward-looking Statements

This

Press Release may contain forward-looking statements by Codorus Valley Bancorp, Inc. (the “Corporation”). Forward-looking

statements may include information concerning the financial condition, results of operations and business of the Corporation and

its subsidiaries and include, but are not limited to, statements regarding expectations or predictions of future financial or

business performance or conditions relating to the Corporation and its operations. These forward-looking statements include statements

with respect to the Corporation’s beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions,

that are subject to significant risks and uncertainties, and are subject to change based on various factors (some of which are

beyond the Corporation’s control). Forward-looking statements may also include, but are not limited to, discussions of strategy,

financial projections and estimates and their underlying assumptions, statements regarding plans, objectives, goals, expectations

or consequences, and statements about future performance, expenses, operations, or products and services of the Corporation and

its subsidiaries. Forward-looking statements can be identified by the use of words such as “may,” “should,”

“will,” “could,” “believes,” “plans,” “expects,” “estimates,”

“intends,” “anticipates,” “strives to,” “seeks,” ”intends,” “anticipates”

or similar words or expressions.

Forward-looking

statements are not historical facts, nor should they be relied upon as providing assurance of future performance. Forward-looking

statements are based on current beliefs, expectations and assumptions regarding the future of the Corporation’s business,

future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking

statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult

to predict and many of which are outside of the Corporation’s control. Actual results could differ materially from those

indicated in forward-looking statements due to, among others, the following factors: changes in market interest rates and the

persistence of the current inflationary environment in the U.S. and our market areas and the potential for an economic downturn

or recession; the effects of financial challenges at other banking institutions that could lead to depositor concerns that spread

within the banking industry causing disruptive deposit outflows and other destabilizing results; legislative and regulatory changes

and the uncertain impact of new laws and regulations; monetary and fiscal policies of the federal government; the effects of changes

in accounting policies and practices; ineffectiveness of the Corporation’s business strategy due to changes in the current

or future market conditions; changes in deposit flows, the cost of funds, demand for loan products and the demand for financial

services; the effects of the COVID-19 pandemic, including on the Corporation’s credit quality and operations as well as

its impact on general economic conditions; competition; market volatility, market downturns, changes in consumer behavior and

business closures; adverse changes in the quality or composition of the Corporation’s loan, investment and mortgage-backed

securities portfolios, including from the effects of the current inflationary environment; geographic concentration of the Corporation’s

business; deterioration of commercial real estate values; the adequacy of loan loss reserves and the Corporation’s transition

to the Current Expected Credit Loss (CECL) method of reserving for losses in its loan portfolio; deterioration in the credit quality

of borrowers; the Company’s ability to attract and retain key personnel; the impact of operational risks, including the

risk of human error, failure or disruption of internal processes and systems, including of the Corporation’s information

and other technology systems; uncertainty surrounding the transition from LIBOR to an alternate reference rate: failure or circumvention

of our internal controls; the Corporation’s ability to keep pace with technological changes; breaches of security or failures

of the Corporation to identify and adequately address cybersecurity and data breaches; changes in government regulation and supervision

and the potential for negative consequences resulting from regulatory examinations, investigations and violations; the effects

of adverse outcomes from claims and litigation; occurrence of natural or man-made disasters or calamities, including health emergencies,

the spread of infectious diseases, epidemics or pandemics, an outbreak or escalation of hostilities or other geopolitical instabilities,

the effects of climate change or extraordinary events beyond the Corporation’s control, and the Corporation’s ability to

deal effectively with disruptions caused by the foregoing; and other economic, competitive, governmental and technological factors

affecting the Corporation’s operations, markets, products, services and fees.

For

a discussion of certain risks and uncertainties that could affect the Corporation, please refer to the “Risk Factors”

section of the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2022, and in its current and periodic

reports that are, or will be, filed with the Securities and Exchange Commission (the “SEC”) and available on the SEC’s

website at www.sec.gov or in the Investor Relations section of the Corporation’s website at www.peoplesbanknet.com.

The Corporation undertakes no obligation, other than as required by law, to update or revise any forward-looking statements to

reflect new information, events occurring after the date of this press release or other circumstances.

Certain

Accounting Matters

Accounting

standards require the consideration of subsequent events occurring after the balance sheet date for matters that require adjustment

to, or disclosure in, the consolidated financial statements. The review period for subsequent events extends up to and includes

the filing date of a public company’s financial statements when filed with the SEC. Accordingly, the consolidated financial

information in this announcement is subject to change.

The

Corporation uses certain non-GAAP (Generally Accepted Accounting Principles) financial measures in this Press Release. The Corporation’s

management believes that the supplemental non-GAAP information provided in this press release is utilized by market analysts and

others to evaluate the Corporation’s financial condition and results of operations and, therefore, such information is useful

to investors. These measures have limitations as analytical tools and should not be considered a substitute for analysis of results

under GAAP. These non-GAAP financial measures are reconciled to the most comparable measures following the “Financial Highlights”

section of this press release.

Questions

or comments concerning this Press Release should be directed to:

Codorus

Valley Bancorp, Inc.

| Craig L. Kauffman |

Larry D. Pickett |

| President and CEO |

Chief Financial Officer |

| 717-747-1501 |

717-747-1502 |

| ckauffman@peoplesbanknet.com

|

lpickett@peoplesbanknet.com |

CODORUS VALLEY BANCORP, INC.

Consolidated Balance Sheets (Unaudited)

| (Dollars in thousands, except share and per share data) | |

June 30,

2023 | | |

December 31,

2022 | | |

June 30,

2022 | |

| | |

| | |

| | |

| |

| Assets | |

| | | |

| | | |

| | |

| Interest bearing deposits with banks | |

$ | 68,946 | | |

$ | 99,777 | | |

$ | 262,122 | |

| Cash and due from banks | |

| 20,670 | | |

| 20,662 | | |

| 21,847 | |

| Total cash and cash equivalents | |

| 89,616 | | |

| 120,439 | | |

| 283,969 | |

| Securities, available-for-sale, at fair value (amortized cost $389,292, net of allowance for credit losses of $0) | |

| 342,691 | | |

| 345,457 | | |

| 329,032 | |

| Restricted investment in bank stocks, at cost | |

| 3,917 | | |

| 955 | | |

| 955 | |

| Loans held for sale | |

| 428 | | |

| 154 | | |

| 1,154 | |

| Loans (net of deferred fees of $3,883 - 2023 and $3,813 - 2022) | |

| 1,681,688 | | |

| 1,632,857 | | |

| 1,584,532 | |

| Less-allowance for credit losses (1) | |

| (20,681 | ) | |

| (20,736 | ) | |

| (22,865 | ) |

| Net loans | |

| 1,661,007 | | |

| 1,612,121 | | |

| 1,561,667 | |

| Premises and equipment, net | |

| 19,672 | | |

| 21,136 | | |

| 21,534 | |

| Operating leases right-of-use assets | |

| 2,772 | | |

| 3,072 | | |

| 3,412 | |

| Goodwill | |

| 2,301 | | |

| 2,301 | | |

| 2,301 | |

| Other assets | |

| 93,313 | | |

| 89,417 | | |

| 84,699 | |

| Total assets | |

$ | 2,215,717 | | |

$ | 2,195,052 | | |

$ | 2,288,723 | |

| Liabilities | |

| | | |

| | | |

| | |

| Deposits | |

| | | |

| | | |

| | |

| Noninterest bearing | |

$ | 408,290 | | |

$ | 463,853 | | |

$ | 497,396 | |

| Interest bearing | |

| 1,474,383 | | |

| 1,479,366 | | |

| 1,542,179 | |

| Total deposits | |

| 1,882,673 | | |

| 1,943,219 | | |

| 2,039,575 | |

| Short-term borrowings | |

| 83,320 | | |

| 11,605 | | |

| 14,249 | |

| Long-term debt | |

| 11,535 | | |

| 11,550 | | |

| 11,565 | |

| Subordinate debentures - face amount $31,000 (less discount and debt issuance cost of $196 at June 30, 2023 and $236 at December 31, 2022) | |

| 30,804 | | |

| 30,764 | | |

| 30,723 | |

| Operating leases liabilities | |

| 2,892 | | |

| 3,204 | | |

| 3,559 | |

| Allowance for credit losses on off-balance sheet credit exposures | |

| 2,089 | | |

| 0 | | |

| 0 | |

| Other liabilities | |

| 16,535 | | |

| 17,410 | | |

| 13,770 | |

| Total liabilities | |

| 2,029,848 | | |

| 2,017,752 | | |

| 2,113,441 | |

| Shareholders’ equity | |

| | | |

| | | |

| | |

| Preferred stock, par value $2.50 per share; 1,000,000 shares authorized; no shares issued or outstanding | |

| 0 | | |

| 0 | | |

| 0 | |

| Common stock, par value $2.50 per share; 30,000,000 shares

authorized; shares issued: 9,883,660 at June 30, 2023 and December 31, 2022; and shares outstanding: 9,611,110 at June

30, 2023 and 9,581,230 at December 31, 2022 | |

| 24,709 | | |

| 24,709 | | |

| 24,708 | |

| Additional paid-in capital | |

| 142,272 | | |

| 141,896 | | |

| 141,678 | |

| Retained earnings | |

| 60,532 | | |

| 52,146 | | |

| 39,926 | |

| Accumulated other comprehensive loss | |

| (35,650 | ) | |

| (34,764 | ) | |

| (23,462 | ) |

| Treasury stock shares outstanding, at cost: 272,550 shares at June 30, 2023 and 302,430 at December 31, 2022 | |

| (5,994 | ) | |

| (6,687 | ) | |

| (7,568 | ) |

| Total shareholders’ equity | |

| 185,869 | | |

| 177,300 | | |

| 175,282 | |

| Total liabilities and shareholders’ equity | |

$ | 2,215,717 | | |

$ | 2,195,052 | | |

$ | 2,288,723 | |

(1)

Beginning January 1, 2023, calculation is based on current expected loss methodology. Prior to January 1, 2023, calculation was

based on incurred loss methodology.

CODORUS VALLEY BANCORP, INC.

Consolidated Statements of Income (Unaudited)

| | |

Three months ended | | |

Six months ended | |

| | |

June 30, | | |

March 31, | | |

June 30, | | |

June 30, | |

| (dollars in thousands, except per share data) | |

2023 | | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Interest income | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans, including fees | |

$ | 24,803 | | |

$ | 23,034 | | |

$ | 16,788 | | |

$ | 47,837 | | |

$ | 32,469 | |

| Investment securities: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Taxable | |

| 2,492 | | |

| 2,457 | | |

| 1,732 | | |

| 4,949 | | |

| 3,012 | |

| Tax-exempt | |

| 99 | | |

| 101 | | |

| 105 | | |

| 200 | | |

| 204 | |

| Dividends | |

| 51 | | |

| 17 | | |

| 10 | | |

| 68 | | |

| 19 | |

| Other | |

| 545 | | |

| 684 | | |

| 648 | | |

| 1,229 | | |

| 876 | |

| Total interest income | |

| 27,990 | | |

| 26,293 | | |

| 19,283 | | |

| 54,283 | | |

| 36,580 | |

| Interest expense | |

| | | |

| | | |

| | | |

| | | |

| | |

| Deposits | |

| 7,077 | | |

| 5,137 | | |

| 1,010 | | |

| 12,214 | | |

| 2,072 | |

| Federal funds purchased and other short-term borrowings | |

| 437 | | |

| 38 | | |

| 12 | | |

| 475 | | |

| 22 | |

| Long-term debt | |

| 30 | | |

| 28 | | |

| 83 | | |

| 58 | | |

| 188 | |

| Subordinated debentures | |

| 547 | | |

| 535 | | |

| 439 | | |

| 1,082 | | |

| 858 | |

| Total interest expense | |

| 8,091 | | |

| 5,738 | | |

| 1,544 | | |

| 13,829 | | |

| 3,140 | |

| Net interest income | |

| 19,899 | | |

| 20,555 | | |

| 17,739 | | |

| 40,454 | | |

| 33,440 | |

| (Recovery of) provision for credit losses - loans (1) | |

| (31 | ) | |

| 492 | | |

| 2,974 | | |

| 461 | | |

| 4,001 | |

| (Recovery of) provision for credit losses - unfunded commitments (1) | |

| (46 | ) | |

| 246 | | |

| 0 | | |

| 200 | | |

| 0 | |

| Net interest income after provision for credit losses | |

| 19,976 | | |

| 19,817 | | |

| 14,765 | | |

| 39,793 | | |

| 29,439 | |

| Noninterest income | |

| | | |

| | | |

| | | |

| | | |

| | |

| Trust and investment services fees | |

| 1,275 | | |

| 1,202 | | |

| 1,137 | | |

| 2,477 | | |

| 2,299 | |

| Income from mutual fund, annuity and insurance sales | |

| 323 | | |

| 369 | | |

| 345 | | |

| 692 | | |

| 675 | |

| Service charges on deposit accounts | |

| 1,541 | | |

| 1,485 | | |

| 1,368 | | |

| 3,026 | | |

| 2,650 | |

| Income from bank owned life insurance | |

| 329 | | |

| 322 | | |

| 308 | | |

| 651 | | |

| 619 | |

| Other income | |

| 587 | | |

| 862 | | |

| 532 | | |

| 1,449 | | |

| 951 | |

| (Loss) gain on sale of loans held for sale | |

| (4 | ) | |

| 10 | | |

| 221 | | |

| 6 | | |

| 579 | |

| Gain on sale of assets held for sale | |

| 0 | | |

| 118 | | |

| 0 | | |

| 118 | | |

| 0 | |

| Loss on sales of securities | |

| 0 | | |

| (388 | ) | |

| 0 | | |

| (388 | ) | |

| 0 | |

| Total noninterest income | |

| 4,051 | | |

| 3,980 | | |

| 3,911 | | |

| 8,031 | | |

| 7,773 | |

| Noninterest expense | |

| | | |

| | | |

| | | |

| | | |

| | |

| Personnel | |

| 9,489 | | |

| 9,042 | | |

| 8,491 | | |

| 18,531 | | |

| 16,881 | |

| Occupancy of premises, net | |

| 880 | | |

| 978 | | |

| 922 | | |

| 1,858 | | |

| 1,901 | |

| Furniture and equipment | |

| 878 | | |

| 838 | | |

| 812 | | |

| 1,716 | | |

| 1,699 | |

| Professional and legal | |

| 379 | | |

| 467 | | |

| 1,055 | | |

| 846 | | |

| 1,914 | |

| Marketing | |

| 387 | | |

| 276 | | |

| 433 | | |

| 663 | | |

| 833 | |

| FDIC insurance | |

| 244 | | |

| 250 | | |

| 188 | | |

| 494 | | |

| 427 | |

| Debit card processing | |

| 432 | | |

| 478 | | |

| 385 | | |

| 910 | | |

| 767 | |

| Charitable donations | |

| 899 | | |

| 32 | | |

| 885 | | |

| 931 | | |

| 915 | |

| External data processing | |

| 1,043 | | |

| 1,010 | | |

| 1,018 | | |

| 2,053 | | |

| 1,839 | |

| Committee & Director Fees | |

| 88 | | |

| 358 | | |

| 85 | | |

| 456 | | |

| 280 | |

| PA shares (benefit) tax | |

| (423 | ) | |

| 343 | | |

| (397 | ) | |

| (80 | ) | |

| (41 | ) |

| (Recovery of) impaired loan carrying costs | |

| (238 | ) | |

| (98 | ) | |

| 157 | | |

| (336 | ) | |

| 295 | |

| Other | |

| 1,418 | | |

| 837 | | |

| 2,189 | | |

| 2,245 | | |

| 3,189 | |

| Total noninterest expense | |

| 15,476 | | |

| 14,811 | | |

| 16,223 | | |

| 30,287 | | |

| 30,899 | |

| Income before income taxes | |

| 8,551 | | |

| 8,986 | | |

| 2,453 | | |

| 17,537 | | |

| 6,313 | |

| Provision for income taxes | |

| 1,940 | | |

| 1,994 | | |

| 500 | | |

| 3,934 | | |

| 1,307 | |

| Net income | |

$ | 6,611 | | |

$ | 6,992 | | |

$ | 1,953 | | |

$ | 13,603 | | |

$ | 5,006 | |

| Net income available to common shareholders | |

| 6,611 | | |

| 6,992 | | |

| 1,953 | | |

| 13,603 | | |

| 5,006 | |

| Net income per share, basic | |

| 0.69 | | |

| 0.73 | | |

| 0.20 | | |

| 1.42 | | |

| 0.53 | |

| Net income per share, diluted | |

| 0.69 | | |

| 0.73 | | |

| 0.20 | | |

| 1.42 | | |

| 0.52 | |

(1)

Beginning January 1, 2023, calculation is based on current expected loss methodology. Prior to January 1, 2023, calculation was

based on incurred loss methodology.

Codorus Valley Bancorp, Inc.

Financial Highlights

Selected Financial Data (Unaudited)

| | |

Quarterly | | |

Year-to-Date | |

| | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2022 | | |

June 30, | |

| | |

2nd Qtr | | |

1st Qtr | | |

4th Qtr | | |

3rd Qtr | | |

2nd Qtr | | |

2023 | | |

2022 | |

| Earnings and Per Share Data (1) | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| (in thousands, except per share data) | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Net income | |

$ | 6,611 | | |

$ | 6,992 | | |

$ | 7,932 | | |

$ | 7,154 | | |

$ | 1,953 | | |

$ | 13,603 | | |

$ | 5,006 | |

| Basic earnings per share | |

$ | 0.69 | | |

$ | 0.73 | | |

$ | 0.83 | | |

$ | 0.75 | | |

$ | 0.20 | | |

$ | 1.42 | | |

$ | 0.53 | |

| Diluted earnings per share | |

$ | 0.69 | | |

$ | 0.73 | | |

$ | 0.83 | | |

$ | 0.75 | | |

$ | 0.20 | | |

$ | 1.42 | | |

$ | 0.52 | |

| Cash dividends paid per share | |

$ | 0.16 | | |

$ | 0.16 | | |

$ | 0.15 | | |

$ | 0.15 | | |

$ | 0.15 | | |

$ | 0.32 | | |

$ | 0.30 | |

| Book value per share | |

$ | 19.34 | | |

$ | 19.28 | | |

$ | 18.51 | | |

$ | 17.63 | | |

$ | 18.37 | | |

$ | 19.34 | | |

$ | 18.37 | |

| Tangible book value per share (2) | |

$ | 19.10 | | |

$ | 19.04 | | |

$ | 18.27 | | |

$ | 17.39 | | |

$ | 18.13 | | |

$ | 19.10 | | |

$ | 18.13 | |

| Tangible book value per share without AOCI (8) | |

$ | 22.81 | | |

$ | 22.26 | | |

$ | 21.90 | | |

$ | 21.21 | | |

$ | 20.59 | | |

$ | 22.81 | | |

$ | 20.59 | |

| Average shares outstanding | |

| 9,600 | | |

| 9,585 | | |

| 9,566 | | |

| 9,545 | | |

| 9,532 | | |

| 9,593 | | |

| 9,509 | |

| Average diluted shares outstanding | |

| 9,610 | | |

| 9,612 | | |

| 9,589 | | |

| 9,568 | | |

| 9,565 | | |

| 9,612 | | |

| 9,541 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Performance Ratios (%) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Return on average assets (3) | |

| 1.22 | | |

| 1.29 | | |

| 1.43 | | |

| 1.25 | | |

| 0.34 | | |

| 1.25 | | |

| 0.42 | |

| Return on average equity (3) | |

| 14.17 | | |

| 15.45 | | |

| 18.50 | | |

| 15.93 | | |

| 4.31 | | |

| 14.80 | | |

| 5.35 | |

| Net interest margin (4) | |

| 3.81 | | |

| 4.00 | | |

| 3.98 | | |

| 3.66 | | |

| 3.18 | | |

| 3.90 | | |

| 2.98 | |

| Efficiency ratio (5) | |

| 64.19 | | |

| 59.05 | | |

| 60.87 | | |

| 63.51 | | |

| 74.43 | | |

| 61.57 | | |

| 74.47 | |

| Net overhead ratio (3)(6) | |

| 2.10 | | |

| 1.93 | | |

| 2.13 | | |

| 2.04 | | |

| 2.11 | | |

| 2.02 | | |

| 1.96 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Asset Quality Ratios (%) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loan charge-offs to average loans (3) | |

| 0.20 | | |

| 0.15 | | |

| 0.24 | | |

| 0.02 | | |

| 0.54 | | |

| 0.17 | | |

| 0.51 | |

| Allowance for credit losses to total loans (7) | |

| 1.23 | | |

| 1.31 | | |

| 1.27 | | |

| 1.39 | | |

| 1.44 | | |

| 1.23 | | |

| 1.44 | |

| Nonperforming assets to total loans and foreclosed real estate | |

| 0.70 | | |

| 0.55 | | |

| 0.70 | | |

| 0.99 | | |

| 1.05 | | |

| 0.70 | | |

| 1.05 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Capital Ratios (%) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average equity to average assets | |

| 8.58 | | |

| 8.38 | | |

| 7.75 | | |

| 7.84 | | |

| 7.78 | | |

| 8.48 | | |

| 7.93 | |

| Tier 1 leverage capital ratio | |

| 10.38 | | |

| 10.20 | | |

| 9.77 | | |

| 9.18 | | |

| 8.79 | | |

| 10.38 | | |

| 8.79 | |

| Common equity Tier 1 capital ratio | |

| 12.37 | | |

| 12.19 | | |

| 12.04 | | |

| 11.80 | | |

| 11.63 | | |

| 12.37 | | |

| 11.63 | |

| Tier 1 risk-based capital ratio | |

| 12.94 | | |

| 12.76 | | |

| 12.61 | | |

| 12.38 | | |

| 12.23 | | |

| 12.94 | | |

| 12.23 | |

| Total risk-based capital ratio | |

| 15.85 | | |

| 15.75 | | |

| 15.57 | | |

| 15.42 | | |

| 15.30 | | |

| 15.85 | | |

| 15.30 | |

(1) per share amounts and shares outstanding were adjusted

for stock dividends

(2) non-GAAP measure - book value less goodwill and core deposit

intangibles; see reconciliation below

(3) annualized for the quarterly periods presented

(4) net interest income (tax-equivalent) as a percentage of

average interest earning assets

(5) noninterest expense as a percentage of net interest income

and noninterest income (tax-equivalent)

(6) noninterest expense less noninterest income as a percentage

of average assets

(7) excludes loans held for sale

(8) non-GAAP measure - book value less accumulated other comprehensive

income; see reconciliation below

Reconciliation of Non-GAAP Financial Measures (Tangible Book

Value and Tangible Book Value without AOCI)

| (in thousands, except per share data) | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2022 | |

| | |

2nd Qtr | | |

1st Qtr | | |

4th Qtr | | |

3rd Qtr | | |

2nd Qtr | |

| Total Shareholders’ Equity | |

$ | 185,869 | | |

$ | 184,946 | | |

$ | 177,300 | | |

$ | 168,339 | | |

$ | 175,282 | |

| Less: Goodwill and Other Intangible Assets | |

| (2,302 | ) | |

| (2,303 | ) | |

| (2,303 | ) | |

| (2,303 | ) | |

| (2,304 | ) |

| Tangible Shareholders’ Equity | |

$ | 183,567 | | |

$ | 182,643 | | |

$ | 174,997 | | |

$ | 166,036 | | |

$ | 172,978 | |

| Less: Accumulated Other Comprehensive Income | |

| (35,650 | ) | |

| (30,941 | ) | |

| (34,764 | ) | |

| (36,499 | ) | |

| (23,462 | ) |

| Tangible Shareholders’ Equity without AOCI | |

$ | 219,217 | | |

$ | 213,584 | | |

$ | 209,761 | | |

$ | 202,535 | | |

$ | 196,440 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common Shares Outstanding | |

| 9,611 | | |

| 9,594 | | |

| 9,581 | | |

| 9,548 | | |

| 9,541 | |

| Book Value Per Share | |

$ | 19.34 | | |

$ | 19.28 | | |

$ | 18.51 | | |

$ | 17.63 | | |

$ | 18.37 | |

| Effect of Intangible Assets | |

| (0.24 | ) | |

| (0.24 | ) | |

| (0.24 | ) | |

| (0.24 | ) | |

| (0.24 | ) |

| Tangible Book Value Per Share | |

$ | 19.10 | | |

$ | 19.04 | | |

$ | 18.27 | | |

$ | 17.39 | | |

$ | 18.13 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Book Value Per Share | |

$ | 19.34 | | |

$ | 19.28 | | |

$ | 18.51 | | |

$ | 17.63 | | |

$ | 18.37 | |

| Effect of Intangible Assets and AOCI | |

| 3.47 | | |

| 2.98 | | |

| 3.39 | | |

| 3.58 | | |

| 2.22 | |

| Tangible Book Value Per Share without AOCI | |

$ | 22.81 | | |

$ | 22.26 | | |

$ | 21.90 | | |

$ | 21.21 | | |

$ | 20.59 | |

This report contains certain financial information determined

by methods other than in accordance with GAAP. This non-GAAP disclosure has limitation as an analytical tool and should not be

considered in isolation or as a substitute for the analysis of the Corporation’s results as reported under GAAP, nor is it necessarily

comparable to non-GAAP performance measures that may be presented by other companies. Our management uses this non-GAAP measure

in its analysis of our performance because it believes this measure is material and will be used as a measure of our performance

by inestors.

ANALYSIS OF NET INTEREST INCOME

Average Balances and Interest Rates, Taxable-Equivalent Basis

(Unaudited)

| | |

Three

Months Ended | |

| | |

June

30, 2023 | | |

March

31, 2023 | | |

June

30, 2022 | |

| (Dollars in thousands) | |

Average

Balance | | |

Taxable-Equivalent

Interest | | |

Taxable-Equivalent

Rate | | |

Average

Balance | | |

Taxable-Equivalent

Interest | | |

Taxable-Equivalent

Rate | | |

Average

Balance | | |

Taxable-Equivalent

Interest | | |

Taxable-Equivalent

Rate | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Assets | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest bearing deposits

with banks | |

$ | 43,006 | | |

$ | 545 | | |

| 5.08 | % | |

$ | 60,286 | | |

$ | 684 | | |

| 4.60 | % | |

$ | 331,335 | | |

$ | 648 | | |

| 0.78 | % |

| Investment securities: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Taxable | |

| 370,345 | | |

| 2,543 | | |

| 2.75 | | |

| 369,154 | | |

| 2,474 | | |

| 2.72 | | |

| 317,889 | | |

| 1,742 | | |

| 2.20 | |

| Tax-exempt | |

| 22,581 | | |

| 121 | | |

| 2.15 | | |

| 23,537 | | |

| 125 | | |

| 2.15 | | |

| 25,561 | | |

| 132 | | |

| 2.07 | |

| Total investment securities | |

| 392,926 | | |

| 2,664 | | |

| 2.72 | | |

| 392,691 | | |

| 2,599 | | |

| 2.68 | | |

| 343,450 | | |

| 1,874 | | |

| 2.19 | |

| Loans: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Taxable (1) | |

| 1,644,775 | | |

| 24,630 | | |

| 6.01 | | |

| 1,613,154 | | |

| 22,860 | | |

| 5.75 | | |

| 1,557,857 | | |

| 16,648 | | |

| 4.29 | |

| Tax-exempt | |

| 22,292 | | |

| 214 | | |

| 3.85 | | |

| 22,597 | | |

| 217 | | |

| 3.89 | | |

| 15,837 | | |

| 176 | | |

| 4.46 | |

| Total

loans | |

| 1,667,067 | | |

| 24,844 | | |

| 5.98 | | |

| 1,635,751 | | |

| 23,077 | | |

| 5.72 | | |

| 1,573,694 | | |

| 16,824 | | |

| 4.29 | |

| Total

earning assets | |

| 2,102,999 | | |

| 28,053 | | |

| 5.35 | | |

| 2,088,728 | | |

| 26,360 | | |

| 5.12 | | |

| 2,248,479 | | |

| 19,346 | | |

| 3.45 | |

| Other

assets (2) | |

| 72,796 | | |

| | | |

| | | |

| 71,428 | | |

| | | |

| | | |

| 82,763 | | |

| | | |

| | |

| Total

assets | |

$ | 2,175,795 | | |

| | | |

| | | |

$ | 2,160,156 | | |

| | | |

| | | |

$ | 2,331,242 | | |

| | | |

| | |

| Liabilities

and Shareholders’ Equity | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Deposits: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest bearing demand | |

$ | 899,474 | | |

| 4,612 | | |

| 2.06 | % | |

$ | 902,917 | | |

| 3,461 | | |

| 1.55 | % | |

$ | 981,025 | | |

| 431 | | |

| 0.18 | % |

| Savings | |

| 151,143 | | |

| 12 | | |

| 0.03 | | |

| 160,062 | | |

| 12 | | |

| 0.03 | | |

| 165,245 | | |

| 12 | | |

| 0.03 | |

| Time | |

| 411,309 | | |

| 2,453 | | |

| 2.39 | | |

| 393,732 | | |

| 1,664 | | |

| 1.71 | | |

| 423,298 | | |

| 567 | | |

| 0.54 | |

| Total interest bearing

deposits | |

| 1,461,926 | | |

| 7,077 | | |

| 1.94 | | |

| 1,456,711 | | |

| 5,137 | | |

| 1.43 | | |

| 1,569,568 | | |

| 1,010 | | |

| 0.26 | |

| Short-term borrowings | |

| 44,139 | | |

| 437 | | |

| 3.97 | | |

| 12,894 | | |

| 38 | | |

| 1.20 | | |

| 12,080 | | |

| 12 | | |

| 0.40 | |

| Long-term debt | |

| 14,520 | | |

| 208 | | |

| 5.75 | | |

| 14,690 | | |

| 194 | | |

| 5.37 | | |

| 21,828 | | |

| 153 | | |

| 2.81 | |

| Subordinated

debentures | |

| 30,798 | | |

| 369 | | |

| 4.81 | | |

| 30,777 | | |

| 369 | | |

| 4.86 | | |

| 30,717 | | |

| 369 | | |

| 4.82 | |

| Total

interest bearing liabilities | |

| 1,551,383 | | |

| 8,091 | | |

| 2.09 | | |

| 1,515,072 | | |

| 5,738 | | |

| 1.54 | | |

| 1,634,193 | | |

| 1,544 | | |

| 0.38 | |

| Noninterest bearing

deposits | |

| 418,504 | | |

| | | |

| | | |

| 444,416 | | |

| | | |

| | | |

| 503,211 | | |

| | | |

| | |

| Other liabilities | |

| 19,277 | | |

| | | |

| | | |

| 18,250 | | |

| | | |

| | | |

| 12,531 | | |

| | | |

| | |

| Shareholders’

equity | |

| 186,631 | | |

| | | |

| | | |

| 182,418 | | |

| | | |

| | | |

| 181,307 | | |

| | | |

| | |

| Total

liabilities and shareholders’ equity | |

$ | 2,175,795 | | |

| | | |

| | | |

$ | 2,160,156 | | |

| | | |

| | | |

$ | 2,331,242 | | |

| | | |

| | |

| Net interest income

(tax equivalent basis) | |

| | | |

$ | 19,962 | | |

| | | |

| | | |

$ | 20,622 | | |

| | | |

| | | |

$ | 17,802 | | |

| | |

| Net

interest margin (3) | |

| | | |

| | | |

| 3.81 | % | |

| | | |

| | | |

| 4.00 | % | |

| | | |

| | | |

| 3.18 | % |

| Tax equivalent adjustment | |

| | | |

| (63 | ) | |

| | | |

| | | |

| (67 | ) | |

| | | |

| | | |

| (63 | ) | |

| | |

| Net

interest income | |

| | | |

$ | 19,899 | | |

| | | |

| | | |

$ | 20,555 | | |

| | | |

| | | |

$ | 17,739 | | |

| | |

(1) Average balances include nonaccrual loans.

(2) Average balances include bank owned life insurance and

foreclosed real estate.

(3) Net interest income (tax-equivalent basis) annualized as

a percentage of average interest earning assets.

ANALYSIS OF NET INTEREST INCOME

Average Balances and Interest Rates, Taxable-Equivalent Basis

(Unaudited)

| | |

Six Months Ended | |

| | |

June 30, 2023 | | |

June 30, 2022 | |

| (Dollars in thousands) | |

Average

Balance | | |

Taxable-Equivalent Interest | | |

Taxable-Equivalent

Rate | | |

Average

Balance | | |

Taxable-Equivalent Interest | | |

Taxable-Equivalent

Rate | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Assets | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest bearing deposits with banks | |

$ | 51,598 | | |

$ | 1,229 | | |

| 4.80 | % | |

$ | 407,024 | | |

$ | 876 | | |

| 0.43 | % |

| Investment securities: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Taxable | |

| 369,754 | | |

| 5,017 | | |

| 2.74 | | |

| 288,164 | | |

| 3,031 | | |

| 2.12 | |

| Tax-exempt | |

| 23,057 | | |

| 246 | | |

| 2.15 | | |

| 25,075 | | |

| 256 | | |

| 2.06 | |

| Total investment securities | |

| 392,811 | | |

| 5,263 | | |

| 2.70 | | |

| 313,239 | | |

| 3,287 | | |

| 2.12 | |

| Loans: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Taxable (1) | |

| 1,629,051 | | |

| 47,490 | | |

| 5.88 | | |

| 1,537,122 | | |

| 32,241 | | |

| 4.23 | |

| Tax-exempt | |

| 22,443 | | |

| 431 | | |

| 3.87 | | |

| 13,378 | | |

| 287 | | |

| 4.33 | |

| Total loans | |

| 1,651,494 | | |

| 47,921 | | |

| 5.85 | | |

| 1,550,500 | | |

| 32,528 | | |

| 4.23 | |

| Total earning assets | |

| 2,095,903 | | |

| 54,413 | | |

| 5.24 | | |

| 2,270,763 | | |

| 36,691 | | |

| 3.26 | |

| Other assets (2) | |

| 72,031 | | |

| | | |

| | | |

| 87,410 | | |

| | | |

| | |

| Total assets | |

$ | 2,167,934 | | |

| | | |

| | | |

$ | 2,358,173 | | |

| | | |

| | |

| Liabilities and Shareholders’ Equity | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Deposits: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest bearing demand | |

$ | 901,186 | | |

| 8,073 | | |

| 1.81 | % | |

$ | 989,158 | | |

$ | 761 | | |

| 0.16 | % |

| Savings | |

| 155,578 | | |

| 24 | | |

| 0.03 | | |

| 160,639 | | |

| 24 | | |

| 0.03 | |

| Time | |

| 402,569 | | |

| 4,117 | | |

| 2.06 | | |

| 437,138 | | |

| 1,287 | | |

| 0.59 | |

| Total interest bearing deposits | |

| 1,459,333 | | |

| 12,214 | | |

| 1.69 | | |

| 1,586,935 | | |

| 2,072 | | |

| 0.26 | |

| Short-term borrowings | |

| 28,603 | | |

| 475 | | |

| 3.35 | | |

| 11,029 | | |

| 22 | | |

| 0.40 | |

| Long-term debt | |

| 14,605 | | |

| 402 | | |

| 5.55 | | |

| 22,591 | | |

| 308 | | |

| 2.75 | |

| Subordinated debentures | |

| 30,787 | | |

| 738 | | |

| 4.83 | | |

| 30,706 | | |

| 738 | | |

| 4.85 | |

| Total interest bearing liabilities | |

| 1,533,328 | | |

| 13,829 | | |

| 1.82 | | |

| 1,651,261 | | |

| 3,140 | | |

| 0.38 | |

| Noninterest bearing deposits | |

| 431,394 | | |

| | | |

| | | |

| 507,162 | | |

| | | |

| | |

| Other liabilities | |

| 19,391 | | |

| | | |

| | | |

| 12,649 | | |

| | | |

| | |

| Shareholders’ equity | |

| 183,821 | | |

| | | |

| | | |

| 187,101 | | |

| | | |

| | |

| Total liabilities and shareholders’ equity | |

$ | 2,167,934 | | |

| | | |

| | | |

$ | 2,358,173 | | |

| | | |

| | |

| Net interest income (tax equivalent basis) | |

| | | |

$ | 40,584 | | |

| | | |

| | | |

$ | 33,551 | | |

| | |

| Net interest margin (3) | |

| | | |

| | | |

| 3.90 | % | |

| | | |

| | | |

| 2.98 | % |

| Tax equivalent adjustment | |

| | | |

| (130 | ) | |

| | | |

| | | |

| (111 | ) | |

| | |

| Net interest income | |

| | | |

$ | 40,454 | | |

| | | |

| | | |

$ | 33,440 | | |

| | |

(1) Average balances include nonaccrual loans.

(2) Average balances include bank owned life insurance and

foreclosed real estate.

(3) Net interest income (tax-equivalent basis) annualized as

a percentage of average interest earning assets.

v3.23.2

Cover

|

Jul. 27, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 27, 2023

|

| Entity File Number |

001-15536

|

| Entity Registrant Name |

CODORUS

VALLEY BANCORP, INC.

|

| Entity Central Index Key |

0000806279

|

| Entity Tax Identification Number |

23-2428543

|

| Entity Incorporation, State or Country Code |

PA

|

| Entity Address, Address Line One |

105

Leader Heights Road

|

| Entity Address, City or Town |

York

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

17403

|

| City Area Code |

(717)

|

| Local Phone Number |

747-1519

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $2.50 par value

|

| Trading Symbol |

CVLY

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

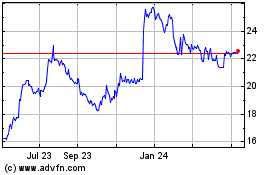

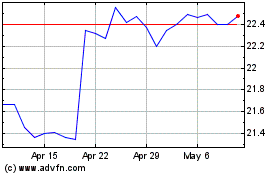

Codorus Valley Bancorp (NASDAQ:CVLY)

Historical Stock Chart

From Apr 2024 to May 2024

Codorus Valley Bancorp (NASDAQ:CVLY)

Historical Stock Chart

From May 2023 to May 2024