Q1false--03-31000117320420250001173204us-gaap:TreasuryStockCommonMember2024-04-012024-06-300001173204cnvs:BaseDistributionMember2024-04-012024-06-300001173204us-gaap:CommonStockMembercnvs:SharesIssuedForEarnoutRelatedLiabilitiesMember2024-04-012024-06-300001173204us-gaap:AdditionalPaidInCapitalMember2024-03-310001173204srt:BoardOfDirectorsChairmanMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2023-04-012023-06-300001173204srt:MinimumMembercnvs:ContentLibraryMember2024-06-300001173204us-gaap:CustomerRelationshipsMember2024-06-300001173204us-gaap:CommonStockMember2024-06-300001173204us-gaap:TrademarksAndTradeNamesMember2024-03-310001173204cnvs:CONtvMember2024-06-300001173204us-gaap:NoncontrollingInterestMember2024-06-300001173204us-gaap:NoncontrollingInterestMember2024-04-012024-06-300001173204cnvs:PodcastAndOtherMember2023-04-012023-06-300001173204srt:MaximumMembercnvs:InternalUseSoftwareMember2024-06-300001173204srt:MaximumMembercnvs:ContentLibraryMember2024-06-300001173204cnvs:CapitalizedContentMember2024-06-300001173204us-gaap:NoncontrollingInterestMember2024-03-310001173204us-gaap:CommonStockMember2022-03-012022-03-150001173204us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001173204us-gaap:SoftwareDevelopmentMember2024-06-300001173204cnvs:AdvertiserRelationshipsAndChannelMembersrt:MaximumMember2024-06-300001173204cnvs:ExerciseOfPreFundedWarrantsMember2023-07-012023-07-310001173204cnvs:PodcastAndOtherMember2024-04-012024-06-300001173204us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001173204cnvs:TotalIntangibleAssetsMember2024-03-310001173204cnvs:TerrifierThreeFinancingMember2024-06-300001173204cnvs:DigitalMediaRightsPaymentDueInMarchTwoThousandAndTwentyFiveMember2024-04-012024-06-300001173204us-gaap:ParentMember2024-06-300001173204us-gaap:FairValueInputsLevel3Member2024-03-310001173204us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2024-06-300001173204cnvs:AdvertiserRelationshipsAndChannelMember2024-06-300001173204cnvs:SupplierAgreementsMember2024-06-300001173204us-gaap:SeriesAPreferredStockMember2024-04-012024-06-300001173204us-gaap:RevolvingCreditFacilityMembercnvs:EastWestBankMember2024-06-300001173204us-gaap:SeriesAPreferredStockMember2024-03-310001173204us-gaap:NoncontrollingInterestMember2023-03-310001173204cnvs:BaseDistributionMember2023-04-012023-06-300001173204cnvs:FoundationTVIncMember2024-04-012024-06-300001173204cnvs:OperatingLeasesLiabilitiesNetOfCurrentPortionMember2024-06-300001173204cnvs:OperatingLeasesLiabilitiesMember2024-03-310001173204us-gaap:RetainedEarningsMember2024-04-012024-06-300001173204srt:MinimumMembercnvs:InternalUseSoftwareMember2024-06-300001173204cnvs:ContentLibraryMember2024-03-310001173204cnvs:TerrifierThreeFinancingMember2024-03-310001173204srt:BoardOfDirectorsChairmanMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2024-04-012024-06-3000011732042023-06-3000011732042022-03-012022-03-150001173204us-gaap:ParentMember2023-06-300001173204cnvs:CapitalizedContentMember2024-03-310001173204us-gaap:CommonStockMembercnvs:SalesAgreementMember2024-05-030001173204us-gaap:PropertySubjectToOperatingLeaseMember2024-03-310001173204cnvs:HoldingsMember2024-04-012024-06-300001173204cnvs:FoundationTvPaymentDueInJuneTwoThousandAndTwentyFiveMember2024-04-012024-06-300001173204us-gaap:AdditionalPaidInCapitalMember2023-03-3100011732042023-06-162023-06-160001173204us-gaap:CommonStockMember2023-06-300001173204cnvs:FoundationTVIncMemberus-gaap:CommonStockMember2024-04-012024-06-300001173204us-gaap:AdditionalPaidInCapitalMember2023-06-300001173204us-gaap:TreasuryStockCommonMember2023-06-300001173204us-gaap:RevolvingCreditFacilityMembercnvs:EastWestBankMemberus-gaap:PrimeRateMember2024-06-300001173204srt:MinimumMember2024-04-012024-06-300001173204us-gaap:CommonStockMembercnvs:AtmSalesAgreementMember2023-04-012024-03-3100011732042023-04-012024-03-310001173204us-gaap:RevolvingCreditFacilityMembercnvs:EastWestBankMemberus-gaap:PrimeRateMember2024-04-012024-06-300001173204us-gaap:FairValueInputsLevel3Member2024-06-300001173204us-gaap:TreasuryStockCommonMember2023-03-310001173204cnvs:TradenamesTrademarksAndPatentsMember2024-06-300001173204cnvs:OTTStreamingandDigitalMember2023-04-012023-06-300001173204cnvs:FoundationTvPaymentDueInDecemberTwoThousandAndTwentyFourMember2024-04-012024-06-300001173204us-gaap:SeriesAPreferredStockMember2024-06-300001173204cnvs:HoldingsMember2024-06-300001173204us-gaap:PreferredStockMember2024-03-3100011732042022-04-012023-03-310001173204us-gaap:CommonStockMembercnvs:DirectOfferingMember2023-04-012023-06-300001173204us-gaap:CommonStockMember2024-04-012024-06-300001173204srt:MinimumMemberus-gaap:ComputerEquipmentMember2024-06-300001173204us-gaap:ParentMember2024-04-012024-06-300001173204us-gaap:ParentMember2023-04-012023-06-3000011732042024-08-070001173204us-gaap:CommonStockMember2023-04-012023-06-300001173204us-gaap:SeriesAPreferredStockMember2023-04-012023-06-300001173204us-gaap:TreasuryStockCommonMember2024-06-3000011732042023-07-012023-07-310001173204cnvs:SalesAgreementMember2024-05-032024-05-030001173204us-gaap:SeriesAPreferredStockMember2022-03-150001173204cnvs:AdvertiserRelationshipsAndChannelMembersrt:MinimumMember2024-06-300001173204us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001173204us-gaap:ParentMember2024-03-310001173204us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-04-012024-06-300001173204us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-04-012023-06-300001173204srt:MaximumMemberus-gaap:ComputerEquipmentMember2024-06-3000011732042023-04-012023-06-300001173204cnvs:TerrifierThreeFinancingMember2024-04-052024-04-050001173204us-gaap:CommonClassAMember2024-03-310001173204country:IN2024-04-012024-06-300001173204us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001173204us-gaap:LineOfCreditMember2024-06-300001173204srt:MaximumMembercnvs:TradenamesTrademarksAndPatentsMember2024-06-300001173204us-gaap:CommonStockMember2023-03-310001173204us-gaap:RevolvingCreditFacilityMembercnvs:EastWestBankMember2023-04-012023-06-300001173204us-gaap:PreferredStockMember2023-03-310001173204us-gaap:NoncontrollingInterestMember2023-06-300001173204cnvs:TotalIntangibleAssetsMember2024-06-300001173204us-gaap:AdditionalPaidInCapitalMember2024-06-300001173204us-gaap:CommonStockMember2024-03-310001173204cnvs:AtmSalesAgreementMember2023-04-012023-06-300001173204us-gaap:LineOfCreditMember2024-03-310001173204cnvs:OTTStreamingandDigitalMember2024-04-012024-06-300001173204cnvs:DistributionAgreementsMembercnvs:TerrifierThreeFinancingMember2024-04-052024-04-050001173204cnvs:SoftwareMember2024-03-3100011732042024-07-102024-07-100001173204us-gaap:ParentMember2023-03-3100011732042024-06-300001173204us-gaap:PreferredStockMember2024-06-3000011732042023-06-160001173204cnvs:OtherNonRecurringMember2023-04-012023-06-300001173204us-gaap:RetainedEarningsMember2024-03-310001173204us-gaap:FairValueInputsLevel1Member2024-06-300001173204cnvs:OtherNonRecurringMember2024-04-012024-06-300001173204srt:MinimumMembercnvs:TradenamesTrademarksAndPatentsMember2024-06-300001173204us-gaap:RestrictedStockUnitsRSUMember2024-04-012024-06-300001173204us-gaap:CommonStockMembercnvs:AtmSalesAgreementMember2023-04-012023-06-300001173204us-gaap:TreasuryStockCommonMember2024-03-310001173204us-gaap:RetainedEarningsMember2023-04-012023-06-300001173204cnvs:EastWestBankMember2024-04-012024-06-300001173204cnvs:ContentLibraryMember2024-06-300001173204us-gaap:RetainedEarningsMember2023-03-310001173204srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2024-06-300001173204us-gaap:RetainedEarningsMember2023-06-300001173204us-gaap:FairValueInputsLevel1Member2024-03-310001173204us-gaap:CommonClassAMember2024-06-3000011732042023-03-310001173204cnvs:OperatingLeasesLiabilitiesNetOfCurrentPortionMember2024-03-3100011732042024-04-012024-06-300001173204us-gaap:RevolvingCreditFacilityMembercnvs:EastWestBankMember2024-04-012024-06-300001173204us-gaap:CustomerRelationshipsMembersrt:MaximumMember2024-06-300001173204us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2024-06-300001173204us-gaap:CommonClassAMember2023-12-082023-12-080001173204cnvs:AdvertiserRelationshipsAndChannelMember2024-03-310001173204srt:MinimumMemberus-gaap:CustomerRelationshipsMember2024-06-300001173204cnvs:TerrifierThreeFinancingMembercnvs:GuarantyAgreementMember2024-04-052024-04-050001173204us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001173204cnvs:HoldingsMember2023-04-012023-06-300001173204cnvs:TerrifierThreeFinancingMember2024-04-050001173204us-gaap:CommonClassAMember2024-04-012024-06-300001173204us-gaap:PropertySubjectToOperatingLeaseMember2024-06-300001173204us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-3100011732042024-03-310001173204us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2024-06-3000011732042024-04-300001173204cnvs:SoftwareMember2024-06-300001173204us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001173204country:IN2024-06-300001173204cnvs:TerrifierThreeFinancingMember2024-06-300001173204us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001173204us-gaap:NoncontrollingInterestMember2023-04-012023-06-300001173204cnvs:LoanGuarantyAndSecurityAgreementMembercnvs:EastWestBankMember2024-06-300001173204us-gaap:PreferredStockMember2023-06-300001173204country:US2024-06-300001173204cnvs:OperatingLeasesLiabilitiesMember2024-06-3000011732042021-04-012021-12-310001173204us-gaap:RevolvingCreditFacilityMembercnvs:EastWestBankMember2023-12-310001173204cnvs:EquityIncentivePlanMember2024-04-012024-06-300001173204cnvs:EastWestBankMember2024-06-300001173204us-gaap:RetainedEarningsMember2024-06-300001173204us-gaap:CustomerRelationshipsMember2024-03-310001173204cnvs:HoldingsMember2024-03-3100011732042024-07-10cnvs:Customersxbrli:purexbrli:sharescnvs:Daysiso4217:USDcnvs:Lease

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal period ended: June 30, 2024

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File Number: 001-31810

Cineverse Corp.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

|

22-3720962 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

224 W. 35th St., Suite 500 #947, New York, NY 10001 |

|

10001 |

(Address of principal executive offices) |

|

(Zip Code) |

(212) 206-8600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange on

which registered |

CLASS A COMMON STOCK, PAR VALUE $0.001 PER SHARE |

|

CNVS |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer ☐ |

|

Accelerated filer ☐ |

|

Non-accelerated filer ☒ |

|

Smaller reporting company ☒ |

|

Emerging Growth Company ☐ |

☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of August 7, 2024, 15,706,341 shares of Class A Common Stock, $0.001 par value, were outstanding.

Cineverse Corp.

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (UNAUDITED)

Cineverse Corp.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

June 30,

2024 |

|

|

March 31,

2024 |

|

|

|

(Unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

3,955 |

|

|

$ |

5,167 |

|

Accounts receivable, net of allowance for credit losses of $114 and $269, respectively |

|

|

9,262 |

|

|

|

8,667 |

|

Unbilled revenue |

|

|

4,596 |

|

|

|

6,439 |

|

Employee retention tax credit |

|

|

79 |

|

|

|

1,671 |

|

Content advances |

|

|

12,226 |

|

|

|

9,345 |

|

Other current assets |

|

|

1,413 |

|

|

|

1,432 |

|

Total current assets |

|

|

31,531 |

|

|

|

32,721 |

|

Property and equipment, net |

|

|

2,722 |

|

|

|

2,276 |

|

Intangible assets, net |

|

|

18,238 |

|

|

|

18,328 |

|

Goodwill |

|

|

6,799 |

|

|

|

6,799 |

|

Content advances, net of current portion |

|

|

1,655 |

|

|

|

2,551 |

|

Other long-term assets |

|

|

1,397 |

|

|

|

1,703 |

|

Total Assets |

|

$ |

62,342 |

|

|

$ |

64,378 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

20,247 |

|

|

$ |

20,817 |

|

Line of credit, including unamortized debt issuance costs of $127 and $81, respectively |

|

|

4,690 |

|

|

|

6,301 |

|

Current portion of deferred consideration on purchase of business |

|

|

3,539 |

|

|

|

3,114 |

|

Term Loan, including unamortized debt issuance costs of $131 and $0, respectively |

|

|

3,103 |

|

|

|

— |

|

Earnout consideration on purchase of business |

|

|

180 |

|

|

|

180 |

|

Current portion of operating lease liabilities |

|

|

338 |

|

|

|

401 |

|

Deferred revenue |

|

|

332 |

|

|

|

436 |

|

Total current liabilities |

|

|

32,429 |

|

|

|

31,249 |

|

Deferred consideration on purchase of business, net of current portion |

|

|

— |

|

|

|

457 |

|

Operating lease liabilities, net of current portion |

|

|

418 |

|

|

|

462 |

|

Other long-term liabilities |

|

|

58 |

|

|

|

59 |

|

Total Liabilities |

|

|

32,905 |

|

|

|

32,227 |

|

Commitments and contingencies (see Note 6) |

|

|

|

|

|

|

Stockholders’ Equity |

|

|

|

|

|

|

Preferred stock, 15,000,000 shares authorized; Series A 10% - $0.001 par value per share; 20 shares authorized; 7 shares issued and 7 shares outstanding at June 30, 2024 and March 31, 2024 |

|

|

3,559 |

|

|

|

3,559 |

|

Common Stock, $0.001 par value; Class A Stock: 275,000,000 shares authorized as of June 30, 2024, and March 31, 2024; 16,081,458 and 15,985,620 shares issued, with 15,608,410 and 15,699,135 shares outstanding as of June 30, 2024 and March 31, 2024, respectively |

|

|

194 |

|

|

|

194 |

|

Additional paid-in capital |

|

|

546,554 |

|

|

|

545,996 |

|

Treasury stock, at cost; 473,049 and 288,554 shares at June 30, 2024 and March 31, 2024, respectively |

|

|

(12,166 |

) |

|

|

(11,978 |

) |

Accumulated deficit |

|

|

(507,315 |

) |

|

|

(504,153 |

) |

Accumulated other comprehensive loss |

|

|

(290 |

) |

|

|

(345 |

) |

Total stockholders’ equity of Cineverse Corp. |

|

|

30,536 |

|

|

|

33,273 |

|

Deficit attributable to noncontrolling interest |

|

|

(1,099 |

) |

|

|

(1,122 |

) |

Total equity |

|

|

29,437 |

|

|

|

32,151 |

|

Total Liabilities and Equity |

|

$ |

62,342 |

|

|

$ |

64,378 |

|

See accompanying Notes to Condensed Consolidated Financial Statements

Cineverse Corp.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

2024 |

|

|

2023 |

|

Revenues |

$ |

9,127 |

|

|

$ |

12,980 |

|

Costs and expenses |

|

|

|

|

|

Direct operating |

|

4,479 |

|

|

|

6,987 |

|

Selling, general and administrative |

|

6,563 |

|

|

|

7,888 |

|

Depreciation and amortization |

|

863 |

|

|

|

822 |

|

Total operating expenses |

|

11,905 |

|

|

|

15,697 |

|

Operating loss |

|

(2,778 |

) |

|

|

(2,717 |

) |

Interest expense |

|

(431 |

) |

|

|

(295 |

) |

Gain from equity investment in Metaverse, a related party |

|

3 |

|

|

|

— |

|

Other income (expense), net |

|

163 |

|

|

|

(504 |

) |

Net loss before income taxes |

|

(3,043 |

) |

|

|

(3,516 |

) |

Income tax expense |

|

(7 |

) |

|

|

(20 |

) |

Net loss |

|

(3,050 |

) |

|

|

(3,536 |

) |

Net income attributable to noncontrolling interest |

|

(23 |

) |

|

|

(14 |

) |

Net loss attributable to controlling interests |

|

(3,073 |

) |

|

|

(3,550 |

) |

Preferred stock dividends |

|

(89 |

) |

|

|

(88 |

) |

Net loss attributable to common stockholders |

$ |

(3,162 |

) |

|

$ |

(3,638 |

) |

Net loss per share attributable to common stockholders: |

|

|

|

|

|

Basic |

$ |

(0.20 |

) |

|

$ |

(0.37 |

) |

Diluted |

$ |

(0.20 |

) |

|

$ |

(0.37 |

) |

Weighted average shares of Common Stock outstanding: |

|

|

|

|

|

Basic |

|

15,702 |

|

|

|

9,879 |

|

Diluted |

|

15,702 |

|

|

|

9,879 |

|

See accompanying Notes to Condensed Consolidated Financial Statements

Cineverse Corp.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

Net loss |

|

$ |

(3,050 |

) |

|

$ |

(3,536 |

) |

Other comprehensive (loss) income: |

|

|

|

|

|

|

Foreign exchange translation |

|

|

55 |

|

|

|

(78 |

) |

Net income attributable to noncontrolling interest |

|

|

(23 |

) |

|

|

(14 |

) |

Comprehensive loss |

|

$ |

(3,018 |

) |

|

$ |

(3,628 |

) |

See accompanying Notes to Condensed Consolidated Financial Statements

Cineverse Corp.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(3,050 |

) |

|

$ |

(3,536 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

863 |

|

|

|

822 |

|

Provision for credit losses |

|

|

(155 |

) |

|

|

— |

|

Amortization of debt issuance costs |

|

|

97 |

|

|

|

44 |

|

Stock-based compensation |

|

|

470 |

|

|

|

409 |

|

Interest expense for deferred consideration and earnouts |

|

|

62 |

|

|

|

181 |

|

Interest expense for term loan |

|

|

144 |

|

|

|

— |

|

Barter-related non-cash expenses |

|

|

85 |

|

|

|

85 |

|

Other |

|

|

35 |

|

|

|

374 |

|

Changes in operating assets and liabilities, net of acquisitions: |

|

|

|

|

|

|

Accounts receivable |

|

|

(440 |

) |

|

|

5,656 |

|

Other current and long-term assets |

|

|

14 |

|

|

|

(2,333 |

) |

Content advances |

|

|

(1,985 |

) |

|

|

(182 |

) |

Employee retention tax credit |

|

|

1,592 |

|

|

|

312 |

|

Accounts payable, accrued expenses, and other liabilities |

|

|

(513 |

) |

|

|

(4,680 |

) |

Capitalized content |

|

|

(674 |

) |

|

|

(196 |

) |

Unbilled Revenue |

|

|

1,844 |

|

|

|

(211 |

) |

Deferred revenue |

|

|

(104 |

) |

|

|

(5 |

) |

Net cash used in operating activities |

|

$ |

(1,714 |

) |

|

$ |

(3,260 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Expenditures for long-lived assets |

|

|

(624 |

) |

|

|

(272 |

) |

Sale of equity investment securities |

|

|

201 |

|

|

|

— |

|

Net cash used in investing activities |

|

$ |

(423 |

) |

|

$ |

(272 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from line of credit, net of debt issuance costs |

|

|

16,278 |

|

|

|

8,761 |

|

Payments on line of credit |

|

|

(17,947 |

) |

|

|

(8,761 |

) |

Payment of deferred consideration |

|

|

(95 |

) |

|

|

— |

|

At-the-market issuance fees |

|

|

(41 |

) |

|

|

— |

|

Cost to acquire treasury shares |

|

|

(188 |

) |

|

|

— |

|

Proceeds from the issuance of a term loan, net of debt issuance costs |

|

|

2,918 |

|

|

|

— |

|

Issuance of Class A common stock, net of issuance costs |

|

|

— |

|

|

|

8,509 |

|

Net cash provided by financing activities |

|

$ |

925 |

|

|

$ |

8,509 |

|

Net change in cash and cash equivalents |

|

|

(1,212 |

) |

|

|

4,977 |

|

Cash and cash equivalents at beginning of period |

|

|

5,167 |

|

|

|

7,152 |

|

Cash and cash equivalents at end of period |

|

$ |

3,955 |

|

|

$ |

12,129 |

|

See accompanying Notes to Condensed Consolidated Financial Statements

Cineverse Corp.

SUPPLEMENTAL CASH FLOW INFORMATION AND DISCLOSURE OF NON-CASH INVESTING AND FINANCING ACTIVITY

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

Cash interest paid |

|

$ |

235 |

|

|

$ |

121 |

|

Lease liability related payments |

|

$ |

115 |

|

|

$ |

109 |

|

Income taxes paid |

|

$ |

46 |

|

|

$ |

12 |

|

Noncash investing and financing activities: |

|

|

|

|

|

|

Bonus liability settled in stock |

|

$ |

40 |

|

|

$ |

— |

|

Accrued dividends on preferred stock |

|

$ |

89 |

|

|

$ |

88 |

|

Issuance of Class A common stock for payment of accrued preferred stock dividends |

|

$ |

89 |

|

|

$ |

88 |

|

See accompanying Notes to Condensed Consolidated Financial Statements

CINEVERSE CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Cineverse Corp.

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock |

|

|

Common Stock |

|

|

Treasury |

|

|

Additional

Paid-In |

|

|

Accumulated |

|

|

Accumulated

Other

Comprehensive |

|

|

Total

Stockholders' |

|

|

Non

Controlling |

|

|

|

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Loss |

|

|

Equity |

|

|

Interest |

|

|

Total |

|

Balances as of March 31, 2024 |

|

1 |

|

|

$ |

3,559 |

|

|

|

15,699 |

|

|

$ |

194 |

|

|

|

289 |

|

|

$ |

(11,978 |

) |

|

$ |

545,996 |

|

|

$ |

(504,153 |

) |

|

$ |

(345 |

) |

|

$ |

33,273 |

|

|

$ |

(1,122 |

) |

|

$ |

32,151 |

|

Foreign exchange translation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

55 |

|

|

|

55 |

|

|

|

— |

|

|

|

55 |

|

Stock-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

470 |

|

|

|

— |

|

|

|

— |

|

|

|

470 |

|

|

|

— |

|

|

|

470 |

|

Treasury stock acquired |

|

— |

|

|

|

— |

|

|

|

(184 |

) |

|

|

— |

|

|

|

184 |

|

|

|

(188 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(188 |

) |

|

|

— |

|

|

|

(188 |

) |

Fees incurred in connection with ATM offering |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(42 |

) |

|

|

— |

|

|

|

— |

|

|

|

(42 |

) |

|

|

— |

|

|

|

(42 |

) |

Issuance of common stock for acquiree consideration |

|

— |

|

|

|

— |

|

|

|

29 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

41 |

|

|

|

— |

|

|

|

— |

|

|

|

41 |

|

|

|

— |

|

|

|

41 |

|

Preferred stock dividends paid in stock |

|

— |

|

|

|

— |

|

|

|

64 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

89 |

|

|

|

— |

|

|

|

— |

|

|

|

89 |

|

|

|

— |

|

|

|

89 |

|

Preferred stock dividends accrued |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(89 |

) |

|

|

— |

|

|

|

(89 |

) |

|

|

— |

|

|

|

(89 |

) |

Net loss |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,073 |

) |

|

|

— |

|

|

|

(3,073 |

) |

|

|

23 |

|

|

|

(3,050 |

) |

Balances as of June 30, 2024 |

|

1 |

|

|

$ |

3,559 |

|

|

|

15,608 |

|

|

$ |

194 |

|

|

|

473 |

|

|

$ |

(12,166 |

) |

|

$ |

546,554 |

|

|

$ |

(507,315 |

) |

|

$ |

(290 |

) |

|

$ |

30,536 |

|

|

$ |

(1,099 |

) |

|

$ |

29,437 |

|

See accompanying Notes to Condensed Consolidated Financial Statements

CINEVERSE CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Cineverse Corp.

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock |

|

|

Common Stock |

|

|

Treasury |

|

|

Additional

Paid-In |

|

|

Accumulated |

|

|

Accumulated

Other

Comprehensive |

|

|

Total

Stockholders' |

|

|

Non

Controlling |

|

|

|

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Loss |

|

|

Equity |

|

|

Interest |

|

|

Total |

|

Balances as of March 31, 2023 |

|

1 |

|

|

$ |

3,559 |

|

|

|

9,348 |

|

|

$ |

185 |

|

|

|

66 |

|

|

$ |

(11,608 |

) |

|

$ |

530,998 |

|

|

$ |

(482,395 |

) |

|

$ |

(402 |

) |

|

$ |

40,337 |

|

|

$ |

(1,264 |

) |

|

$ |

39,073 |

|

Foreign exchange translation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(78 |

) |

|

|

(78 |

) |

|

|

— |

|

|

|

(78 |

) |

Stock-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

409 |

|

|

|

— |

|

|

|

— |

|

|

|

409 |

|

|

|

— |

|

|

|

409 |

|

Issuance of Class A common stock in connection with ATM raises, net |

|

— |

|

|

|

— |

|

|

|

177 |

|

|

|

4 |

|

|

|

— |

|

|

|

— |

|

|

|

1,065 |

|

|

|

— |

|

|

|

— |

|

|

|

1,069 |

|

|

|

— |

|

|

|

1,069 |

|

Issuance of Class A common stock in connection with direct equity offering |

|

— |

|

|

|

— |

|

|

|

2,150 |

|

|

|

2 |

|

|

|

— |

|

|

|

— |

|

|

|

7,437 |

|

|

|

— |

|

|

|

— |

|

|

|

7,439 |

|

|

|

— |

|

|

|

7,439 |

|

Preferred stock dividends paid in stock |

|

— |

|

|

|

— |

|

|

|

10 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

88 |

|

|

|

— |

|

|

|

— |

|

|

|

88 |

|

|

|

— |

|

|

|

88 |

|

Preferred stock dividends accrued |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(88 |

) |

|

|

— |

|

|

|

(88 |

) |

|

|

— |

|

|

|

(88 |

) |

Net loss |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,550 |

) |

|

|

— |

|

|

|

(3,550 |

) |

|

|

14 |

|

|

|

(3,536 |

) |

Balances as of June 30, 2023 |

|

1 |

|

|

$ |

3,559 |

|

|

|

11,685 |

|

|

$ |

191 |

|

|

|

66 |

|

|

$ |

(11,608 |

) |

|

$ |

539,997 |

|

|

$ |

(486,033 |

) |

|

$ |

(480 |

) |

|

$ |

45,626 |

|

|

$ |

(1,250 |

) |

|

$ |

44,376 |

|

See accompanying Notes to Condensed Consolidated Financial Statements

CINEVERSE CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. NATURE OF OPERATIONS AND LIQUIDITY

Cineverse Corp. (“Cineverse”, “us”, “our”, "we", and “Company” refers to Cineverse Corp. and its subsidiaries unless the context otherwise requires) was incorporated in Delaware on March 31, 2000. Since our inception, we have played a significant role in the digital distribution revolution that continues to transform the media and entertainment landscape.

Cineverse is a premier streaming technology and entertainment company with its core business operating as (i) a portfolio of owned and operated streaming channels with enthusiast fan bases; (ii) a large-scale global aggregator and full-service distributor of feature films and television programs; and (iii) a proprietary technology software-as-a-service platform for over-the-top (“OTT”) app development and content distribution through subscription video on demand ("SVOD"), dedicated ad-supported ("AVOD"), ad-supported streaming linear ("FAST") channels, social video streaming services, and audio podcasts. Our streaming channels reach audiences in several distinct ways: direct-to-consumer, through these major application platforms, and through third party distributors of content on platforms.

The Company’s streaming technology platform, known as MatchpointTM, is a software-based streaming operating platform which provides clients with AVOD, SVOD, transactional video on demand ("TVOD") and linear capabilities, automates the distribution of content, and features a robust data analytics platform.

We distribute products for major brands such as Hallmark, ITV, Nelvana, ZDF, Konami, NFL and Highlander, as well as leading international and domestic content creators, movie producers, television producers and other short-form digital content producers. We collaborate with producers, major brands and other content owners to market, source, curate and distribute quality content to targeted audiences through (i) existing and emerging digital home entertainment platforms, including but not limited to Apple iTunes, Amazon Prime, Netflix, Hulu, Xbox, Pluto, and Tubi, as well as (ii) physical goods, including DVD and Blu-ray Discs.

Our Class A common stock, par value $0.001 per share (the "Common Stock") is listed on The Nasdaq Capital Market (“Nasdaq”) under the symbol “CNVS.”

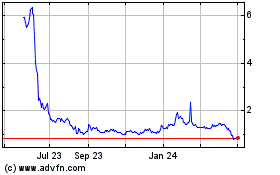

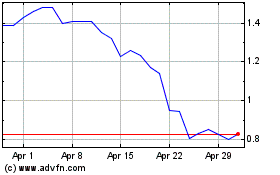

On July 10, 2024, the Company received a letter from the Nasdaq Listing Qualifications staff indicating that, based upon the closing bid price of the Common Stock for the last 30 consecutive business days, the Company no longer meets the requirement to maintain a minimum bid price of $1 per share, as set forth in Nasdaq Listing Rule 5550(a)(2).

In accordance with Nasdaq Listing Rules 5810(c)(3)(A), the Company has been provided a period of 180 calendar days, or until January 6, 2025, in which to regain compliance with the deficiency. In order to regain compliance with the minimum bid price requirement, the closing bid price of the Common Stock must be at least $1 per share for a minimum of ten consecutive business days during this 180-day period. If the Company does not regain compliance with this requirement by January 6, 2025, the Company may be eligible for an additional 180 calendar day compliance period provided that it meets certain continued listing standards, and provides the Staff with written notice of its intention to cure the deficiency.

CINEVERSE CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Financial Condition and Liquidity

We have a history of net losses, and for the three months ended June 30, 2024, we had a net loss attributable to Common Stockholders in the amount of $3.2 million. We may continue to generate net losses for the foreseeable future. As of June 30, 2024, the Company has an accumulated deficit of $507.3 million and negative working capital of $0.9 million. Net cash used in operating activities for the three months ended June 30, 2024 was $1.7 million which included $2.0 million of incremental investment in our content portfolio via advances or minimum guarantee payouts.

The Company is party to a Loan, Guaranty, and Security Agreement, as amended to date, with East West Bank (“EWB”) providing for a revolving line of credit (the “Line of Credit Facility”) of $7.5 million, guaranteed by substantially all of our material subsidiaries and secured by substantially all of our and such subsidiaries’ assets. The Line of Credit Facility bears interest at a rate equal to 1.5% above the prime rate, equal to 10.00% as of June 30, 2024. The term of the Line of Credit Facility has been extended to September 15, 2025. As of June 30, 2024, $4.8 million was outstanding on the Line of Credit Facility, net of unamortized issuance costs of $127 thousand.

On April 5, 2024, Cineverse Terrifier LLC (“T3 Borrower”), a wholly-owned subsidiary of the Company entered into a Loan and Security Agreement with BondIt LLC (“T3 Lender”) and the Company, as a guarantor (the “T3 Loan Agreement”). The T3 Loan Agreement provides for a term loan with a principal amount not to exceed $3,666,000 (the “T3 Loan”), and a maturity date of April 1, 2025, unless extended for 120 days under certain conditions. The T3 Loan bears no interest until the maturity date other than an interest advance equal to $576,000 paid at the closing of the T3 Loan on April 5, 2024. After the principal of the T3 Loan is paid in full, T3 Lender will be entitled to receive 15% of all royalties earned by the Company on the film titled Terrifier 3 (the "Film") under its distribution agreements for the Film until T3 Lender has received 1.75 times the full commitment amount of $3,666,000, consisting of the principal amount plus interest and fees advanced to T3 Borrower, plus any extension interest. See Note 5 - Debt, for further information.

In July 2020, we entered into an At-the-Market sales agreement (the “ATM Sales Agreement”) with A.G.P./Alliance Global Partners (“A.G.P.”) and B. Riley FBR, Inc. (“B. Riley” and, together with A.G.P., the “Sales Agents”), pursuant to which the Company was able to offer and sell, from time to time, through the Sales Agents, shares of Common Stock at the market prices prevailing on Nasdaq at the time of the sale of such shares. For the twelve months ended March 31, 2024, the Company sold 177 thousand shares for $1.1 million in net proceeds, respectively, after deduction of commissions and fees. The ATM Sales Agreement expired in fiscal year 2024 in accordance with its terms.

On May 3, 2024, the Company entered into a sales agreement (the “2024 Sales Agreement”) with A.G.P./Alliance Global Partners and The Benchmark Company, LLC (collectively, the “Sales Agents”), pursuant to which the Company may offer and sell, from time to time, through the Sales Agents, shares of Common Stock. Shares of Common Stock may be offered and sold for an aggregate offering price of up to $15 million. The Sales Agents’ obligations to sell shares under the 2024 Sales Agreement are subject to satisfaction of certain conditions, including the continuing effectiveness of the Registration Statement on Form S-3 (Registration No. 333-273098) (the “Registration Statement”) filed by the Company with the U.S. Securities and Exchange Commission (the “SEC”) on June 30, 2023 and declared effective by the SEC on January 25, 2024, and other customary closing conditions. The Company will pay the Sales Agents a commission of 3.0% of the aggregate gross proceeds from each sale of shares and has agreed to provide the Sales Agents with customary indemnification and contribution rights. The Company has also agreed to reimburse the Sales Agents for certain specified expenses. The Company is not obligated to sell any shares under the 2024 Sales Agreement and has not sold any shares through the date of this report.

On June 16, 2023, the Company closed on the sale of 2,150 thousand shares of Common Stock, 517 thousand pre-funded warrants, and warrants to purchase up to 2,667 thousand shares of Common Stock at a combined public offering price of $3.00 per share and accompanying warrant for aggregate gross proceeds of approximately $7.4 million, after deducting placement agent fees and other offering expenses in the amount of $0.6 million. The warrants had an exercise price of $3.00 per share, were exercisable immediately and will expire five years from the issuance. The Company received $2.999 per share for the pre-funded warrants, with the remaining $0.001 due at the time of exercise. All 517 thousand pre-funded warrants were subsequently exercised in July 2023 for total proceeds of $0.5 thousand.

CINEVERSE CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The Company will continue to invest in content development and acquisition, from which it believes it will obtain an appropriate return on its investment. As of June 30, 2024 and March 31, 2024, short term content advances were $12.2 million and $9.3 million, respectively, and content advances, net of current portion were, $1.7 million and $2.6 million, respectively.

Our capital requirements will depend on many factors, and we may need to use existing capital resources and/or undertake equity or debt offerings, if necessary and opportunistically available, for further capital needs. We believe our cash and cash equivalent balances as of June 30, 2024 will be sufficient to support our operations for at least twelve months from the filing of this report.

2. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Consolidation

The accompanying interim Condensed Consolidated Financial Statements of Cineverse Corp. have been prepared in conformity with accounting principles generally accepted in the United States (“GAAP”) and are consistent in all material respects with those applied in the Company’s Annual Report on Form 10-K for the year ended March 31, 2024 filed with the Securities and Exchange Commission (the “SEC”) on July 1, 2024. These Condensed Consolidated Financial Statements are unaudited and have been prepared by the Company following the rules and regulations of the SEC.

Certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted as permitted by such rules and regulations; however, the Company believes the disclosures are adequate to make the information presented not misleading. Certain columns and rows may not foot due to the use of rounded numbers.

The interim financial information is unaudited, but reflects all normal recurring adjustments that are, in the opinion of management, necessary to fairly present the information set forth herein. The interim Condensed Consolidated Financial Statements should be read in conjunction with the audited Consolidated Financial Statements and related notes included in the Company’s Annual Report on Form 10-K for the year ended March 31, 2024. Interim results are not necessarily indicative of the results for a full year.

The preparation of the Condensed Consolidated Financial Statements in conformity with GAAP requires management to make estimates and judgments that affect the amounts reported in the Consolidated Financial Statements and accompanying notes. Significant items subject to such estimates and assumptions include revenue recognition, allowance for credit losses, returns and recovery reserves, goodwill and intangible asset impairments, share-based compensation expense, valuation allowance for deferred income taxes and amortization of intangible assets. The Company bases its estimates on historical experience and on various other assumptions that the Company believes to be reasonable under the circumstances. On a regular basis, the Company evaluates the assumptions, judgments and estimates. Actual results may differ from these estimates.

We own an 85% interest in CON TV, LLC ("CONtv"), a worldwide digital network that creates original content, and sells and distributes on-demand digital content on the internet and other consumer digital distribution platforms, such as gaming consoles, set-top boxes, handsets, and tablets. We evaluated the investment under the voting interest entity model and determined that the entity should be consolidated as we have a controlling financial interest in the entity through our ownership of outstanding voting shares, and that other equity holders do not have substantive voting, participating or liquidation rights.

Accounting Policies

There have been no material changes in the Company’s significant accounting policies as compared to the significant accounting policies described in the Company’s Annual Report on Form 10-K for the year ended March 31, 2024.

CINEVERSE CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Segment Reporting

The Company manages its operations and its business in one reporting segment.

Reclassifications

Certain amounts have been reclassified to conform to the current presentation.

Cash and Cash Equivalents

We consider all highly liquid investments with an original maturity of three months or less to be “cash equivalents.” We maintain bank accounts with major banks, which from time to time may exceed the Federal Deposit Insurance Corporation’s insured limits. We periodically assess the financial condition of the institutions and believe that the risk of any loss is minimal.

Employee Retention Tax Credit

The Coronavirus Aid, Relief, and Economic Security Act (the "CARES Act") provided an employee retention tax credit ("ERTC") which was a refundable tax credit against certain employment taxes. The Consolidated Appropriations Act (the "Appropriations Act") extended and expanded the availability of the employee retention credit through December 31, 2021. The Appropriations Act amended the employee retention credit to be equal to 70% of qualified wages paid to employees during the 2021 fiscal year.

The Company qualified for the employee retention credit beginning in June 2020 for qualified wages through September 2021 and filed a cash refund claim during the fiscal year ended March 31, 2023 in the amount of $2.5 million. As of June 30, 2024 and March 31, 2024, the tax credit receivable of $0.1 and $1.7 million, respectively, has been included in the Employee retention tax credit line on the Company's Condensed Consolidated Balance Sheet. The Company received notification during the second quarter of fiscal year 2024 that its ERTC claim was under examination with the Internal Revenue Service ("IRS"). In April 2024, the Company received a letter from the IRS indicating that its claim had been accepted and $1.7 million was received in June 2024, inclusive of interest.

Property and Equipment, Net

Property and equipment, net are stated at cost, less accumulated depreciation and amortization. Depreciation expense is recorded using the straight-line method over the estimated useful lives of the respective assets as follows:

|

|

|

Computer equipment and software |

|

3 - 5 years |

Internal use software |

|

3 - 5 years |

Machinery and equipment |

|

3 - 10 years |

Furniture and fixtures |

|

2 - 7 years |

We capitalize costs associated with software developed or obtained for internal use when the preliminary project stage is completed, and it is determined that the software will provide significantly enhanced capabilities and modifications. These capitalized costs are included in property and equipment, net and include external direct cost of services procured in developing or obtaining internal-use software and personnel and related expenses for employees who are directly associated with, and who devote time to internal-use software projects. Capitalization of these costs ceases once the project is substantially complete and the software is ready for its intended use. Once the software is ready for its intended use, the costs are amortized over the useful life of the software. Post-configuration training and maintenance costs are expensed as incurred. We amortize internal-use software over its estimated useful life on a straight-line basis.

CINEVERSE CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Intangible Assets, Net

Intangible assets are stated at cost less accumulated amortization. For intangible assets that have finite lives, the assets are amortized using the straight-line method over the estimated useful lives of the related assets. For intangible assets with indefinite lives, the assets are tested annually for impairment or sooner if a triggering event occurs.

Amortization lives of intangible assets are as follows:

|

|

|

Content Library |

|

3 – 20 years |

Tradenames, Trademarks and Patents |

|

2 – 15 years |

Customer Relationships |

|

5 – 13 years |

Advertiser Relationships and Channel |

|

2 – 13 years |

Software |

|

10 years |

Capitalized Content |

|

3 years |

Supplier Agreements |

|

2 years |

The Company’s intangible assets included the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30, 2024 |

|

|

|

Cost Basis |

|

|

Accumulated

Amortization |

|

|

Net |

|

Content Library |

|

$ |

24,154 |

|

|

$ |

(21,547 |

) |

|

$ |

2,607 |

|

Advertiser Relationships and Channel |

|

|

12,604 |

|

|

|

(2,951 |

) |

|

|

9,653 |

|

Customer Relationships |

|

|

8,690 |

|

|

|

(7,940 |

) |

|

|

750 |

|

Software |

|

|

3,200 |

|

|

|

(960 |

) |

|

|

2,240 |

|

Tradenames, Trademarks and Patents |

|

|

3,922 |

|

|

|

(3,088 |

) |

|

|

834 |

|

Capitalized Content |

|

|

2,496 |

|

|

|

(342 |

) |

|

|

2,154 |

|

Total Intangible Assets |

|

$ |

55,066 |

|

|

$ |

(36,828 |

) |

|

$ |

18,238 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31, 2024 |

|

|

|

Cost Basis |

|

|

Accumulated

Amortization |

|

|

Net |

|

Content Library |

|

$ |

24,133 |

|

|

$ |

(21,492 |

) |

|

$ |

2,641 |

|

Advertiser Relationships and Channel |

|

|

12,603 |

|

|

|

(2,541 |

) |

|

|

10,062 |

|

Customer Relationships |

|

|

8,690 |

|

|

|

(7,872 |

) |

|

|

818 |

|

Software |

|

|

3,200 |

|

|

|

(880 |

) |

|

|

2,320 |

|

Trademark and Tradenames |

|

|

3,914 |

|

|

|

(3,059 |

) |

|

|

855 |

|

Capitalized Content |

|

|

1,822 |

|

|

|

(190 |

) |

|

|

1,632 |

|

Total Intangible Assets |

|

$ |

54,362 |

|

|

$ |

(36,035 |

) |

|

$ |

18,328 |

|

During the three months ended June 30, 2024 and June 30, 2023, the Company had amortization expense of $0.7 million and $0.7 million, respectively.

CINEVERSE CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

As of June 30, 2024, amortization expense is expected to be (in thousands):

|

|

|

|

|

|

|

Total |

|

In-process intangible assets |

|

$ |

469 |

|

2025 |

|

|

3,286 |

|

2026 |

|

|

3,149 |

|

2027 |

|

|

2,124 |

|

2028 |

|

|

1,413 |

|

2029 |

|

|

1,356 |

|

Thereafter |

|

|

6,441 |

|

Total |

|

$ |

18,238 |

|

Capitalized Content

The Company capitalizes direct costs incurred in the production of content from which it expects to generate a return over the anticipated useful life and the Company’s predominant monetization strategy informs the method of amortizing these deferred costs. The determination of the predominant monetization strategy is made at commencement of the production or license period and the classification of the monetization strategy as individual or group only changes if there is a significant change to the title’s monetization strategy relative to its initial assessment. The costs are capitalized to the Capitalized Content costs within Intangible Assets and are amortized as a group within Depreciation and Amortization within the Condensed Consolidated Statements of Operations.

Impairment of Long-lived and Finite-lived Intangible Assets

We review the recoverability of our long-lived assets and finite-lived intangible assets, when events or conditions occur that indicate a possible impairment exists. The assessment for recoverability is based primarily on our ability to recover the carrying value of our long-lived and finite-lived assets from expected future undiscounted net cash flows. If the total of expected future undiscounted net cash flows is less than the total carrying value of the asset, the asset is deemed not to be recoverable and possibly impaired. We then estimate the fair value of the asset to determine whether an impairment loss should be recognized. An impairment loss will be recognized if the asset’s fair value is determined to be less than its carrying value. Fair value is determined by computing the expected future discounted cash flows. There were no impairment charges recorded for long-lived and finite-lived intangible assets during the three months ended June 30, 2024 and 2023.

Goodwill

Goodwill is the excess of the purchase price paid over the fair value of the net assets of an acquired business. Goodwill is tested for impairment on an annual basis or more often if warranted by events or changes in circumstances indicating that the carrying value may exceed fair value, also known as impairment indicators.

Inherent in the fair value determination for each reporting unit are certain judgments and estimates relating to future cash flows, including management’s interpretation of current economic indicators and market conditions, and assumptions about our strategic plans with regard to its operations. To the extent additional information arises, market conditions change, or our strategies change, it is possible that the conclusion regarding whether our remaining goodwill is impaired could change and result in future goodwill impairment charges that will have a material effect on our consolidated financial position or results of operations.

The Company has the option to assess goodwill for possible impairment by performing a qualitative analysis to determine if it is more likely than not that the fair value of a reporting unit is less than its carrying amount or to perform the quantitative impairment test. The Company annually assesses goodwill for potential impairment during its fourth fiscal quarter, or sooner if events occur or circumstances would indicate it would be more likely than not that fair value would be reduced below its carrying amount. For the year ended, March 31, 2024, the Company recognized a goodwill impairment charge of $14.0 million. No goodwill impairment charge was recorded in the three months ended June 30, 2024 and 2023.

CINEVERSE CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Fair Value Measurements

The fair value measurement disclosures are grouped into three levels based on valuation factors:

•Level 1 – quoted prices in active markets for identical investments

•Level 2 – other significant observable inputs (including quoted prices for similar investments and market corroborated inputs)

•Level 3 – significant unobservable inputs (including our own assumptions in determining the fair value of investments)

The following tables summarize the levels of fair value measurements of our financial assets and liabilities (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30, 2024 |

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Equity investment in Metaverse, at fair value |

|

$ |

162 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

162 |

|

|

|

$ |

162 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

162 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Current portion of earnout consideration on purchase of a business |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

180 |

|

|

$ |

180 |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

180 |

|

|

$ |

180 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31, 2024 |

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Equity investment in Metaverse, at fair value |

|

$ |

362 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

362 |

|

|

|

$ |

362 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

362 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Current portion of earnout consideration on purchase of a business |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

180 |

|

|

$ |

180 |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

180 |

|

|

$ |

180 |

|

Equity Investment in Metaverse

The Company has an equity investment in A Metaverse Company (“Metaverse”), a publicly traded Chinese entertainment company, formerly Starrise Media Holdings Limited, whose ordinary shares are listed on the Stock Exchange of Hong Kong.

After a period of time when trading in Metaverse's ordinary shares had been halted, the resumption of active trading status in November 2023 represented renewed availability of quoted, unadjusted prices in active markets for identical assets, upon which the Company can execute a sale and readily access pricing information at the measurement date. Accordingly, the Company has presented the fair value of its Metaverse shares held as of March 31, 2024 within the Level 1 grouping. The fair value of the shares held is presented within Other long term assets and as of June 30, 2024 and March 31, 2024 was $0.2 million and $0.4 million, respectively.

CINEVERSE CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Earnout consideration on purchase of business

Prior to the completion of the earnout period at the end of fiscal year 2024, the Company estimated the fair value of its earnout liability using contractual inputs from the related business combination, which established specific fiscal year revenue growth, profitability and EBITDA targets. As of June 30, 2024, the balance which is classified as short term in nature remains unchanged from the balance March 31, 2024.

Our cash and cash equivalents, accounts receivable, unbilled revenue and accounts payable and accrued expenses are financial instruments and are recorded at cost in the consolidated balance sheets. The estimated fair values of these financial instruments approximate their carrying amounts because of their short-term nature.

Content Advances

Content advances represent amounts prepaid to studios or content producers for which we provide content distribution services. We evaluate advances regularly for recoverability and record a provision for amounts that we expect may not be recoverable. Amounts which are expected to be recovered in more than 12 months are classified as long term and presented within content advances, net of current portion, which were $1.7 million and $2.6 million as of June 30, 2024, and March 31, 2024, respectively. For the three months ended June 30, 2024 and 2023, the Company recognized an increase and reduction in our reserve for the recovery of advances in the amount of $57 thousand and $172 thousand, respectively.

Accounts Payable and Accrued Expenses

Accounts payable and accrued expenses consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

June 30,

2024 |

|

|

March 31,

2024 |

|

Accounts payable |

|

$ |

6,000 |

|

|

$ |

5,804 |

|

Amounts due to producers |

|

|

9,647 |

|

|

|

9,889 |

|

Accrued compensation and benefits |

|

|

961 |

|

|

|

1,119 |

|

Accrued other expenses |

|

|

3,639 |

|

|

|

4,005 |

|

Total Accounts Payable and Accrued Expenses |

|

$ |

20,247 |

|

|

$ |

20,817 |

|

Deferred Consideration

The Company has recognized liabilities related to deferred consideration arrangements related to the acquisition of FoundationTV ("FTV") and Digital Media Rights ("DMR"). These payments are fixed in nature and are due to the sellers of the respective companies. The Company initially recognized the liability at fair value at the time of acquisition and has since recognized interest expense related to accretion in advance of the ultimate settlement of these liabilities. Amounts due within 12 months under the terms of the agreements are classified as current within the Condensed Consolidated Balance Sheets.

The deferred consideration related to the acquisition of DMR is payable in either shares of Common Stock or cash, at the Company's discretion and subject to certain conditions. A payment of $2.4 million is due in March 2025.

The deferred consideration related to the FTV acquisition is payable in the amount of $238 thousand in December 2024, and $464 thousand in June 2025. There is $618 thousand presently due and payable. The Company has the right to pay up to 25% of post-close purchase price in shares of Common Stock.

CINEVERSE CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Revenue Recognition

Payment terms and conditions vary by customer and typically provide net 30-to-90 day terms. We do not adjust the promised amount of consideration for the effects of a significant financing component when we expect, at contract inception, that the period between our transfer of a promised product or service to our customer and payment for that product or service will be one year or less.

The following tables present the Company’s disaggregated revenue by source (in thousands):

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

2024 |

|

|

2023 |

|

Streaming and digital |

$ |

7,703 |

|

|

$ |

10,114 |

|

Podcast and other |

|

1,043 |

|

|

|

429 |

|

Base distribution |

|

351 |

|

|

|

1,158 |

|

Other non-recurring |

|

30 |

|

|

|

1,279 |

|

Total Revenue |

$ |

9,127 |

|

|

$ |

12,980 |

|

The Company's Streaming and digital revenue pertains to its OTT business, including the licensing, service, advertising, and subscription revenue related to the Company's streaming business and partnerships. Base distribution revenue relates to non-streaming revenue, including Theatrical revenue and the sale of DVD's. Podcast and other revenue primarily relate to the Company's Bloody Disgusting Podcast Network. As the Company satisfies its performance obligations from these revenue sources, whether relating to the delivery of digital content, physical goods, or licensing, revenue is generally measured at a point in time.

Other non-recurring revenue relates to the Company's legacy digital cinema operations, whose operations have run-off, still may generate non-recurring revenue from the sale of cinema assets or the recognition of variable consideration as the associated uncertainty associated with the revenue is resolved.

The Company follows the five-step model established by ASC 606, Revenue from contracts with customers ("ASC 606") when preparing its assessment of revenue recognition.

Principal Agent Considerations

Revenue earned from the delivery of digital content and physical goods may be recognized gross or net depending on the terms of the arrangement. We determine whether revenue should be reported on a gross or net basis based on each revenue stream. Key indicators that we use in evaluating gross versus net treatment include, but are not limited to, the following:

•which party is primarily responsible for fulfilling the promise to provide the specified good or service; and

•which party has discretion in establishing the price for the specified good or service.

Shipping and Handling

Shipping and handling costs are incurred to move physical goods (e.g., DVDs and Blu-ray Discs) to customers. We recognize all shipping and handling costs as an expense in direct operating expenses because we are responsible for delivery of the product to our customers prior to transfer of control to the customer.

Credit Losses

We maintain reserves for expected credit losses on accounts receivable primarily on a specific identification basis. We review the composition of accounts receivable and analyze historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves.

CINEVERSE CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

We recognize accounts receivable, net of an estimated allowance for product returns and customer chargebacks, at the time that we recognize revenue from a sale. Reserves for product returns and other allowances are variable consideration as part of the transaction price. If actual future returns and allowances differ from past experience, adjustments to our allowances may be required.

During the three months ended June 30, 2024 and 2023, the Company recognized a reduction in its provision for credit losses of $0.2 million and $0, respectively.

Contract Liabilities

We generally record a receivable related to revenue when we have an unconditional right to invoice and receive payment, and we record deferred revenue (contract liability) when cash payments are received or due in advance of our performance, such as the sale of DVDs with future release dates, even if amounts are refundable. Amounts recorded as contract liabilities are generally not long-term in nature.