Current Report Filing (8-k)

November 02 2021 - 4:07PM

Edgar (US Regulatory)

0001279704

false

0001279704

2021-11-01

2021-11-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 1, 2021

CELLECTAR

BIOSCIENCES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

1-36598

|

|

04-3321804

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

100

Campus Drive, Florham Park, New Jersey 07932

(Address of principal executive offices, and zip code)

(608)

441-8120

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock, par value $0.00001

|

|

CLRB

|

|

NASDAQ Capital Market

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On November 1, 2021, the

Company received a letter from the Listing Qualifications Staff of The Nasdaq Stock Market LLC (“Nasdaq”) indicating that,

based upon the closing bid price of the Company’s common stock (“Common Stock”) for the last 30 consecutive business

days beginning on September 20, 2021, and ending on October 29, 2021, the Company no longer meets the requirement to maintain a minimum

bid price of $1 per share, as set forth in Nasdaq Listing Rule 5550(a)(2).

In accordance with Nasdaq

Listing Rule 5810(c)(3)(A), the Company has been provided a period of 180 calendar days, or until May 2, 2022, in which to regain compliance.

In order to regain compliance with the minimum bid price requirement, the closing bid price of the Company’s Common Stock must be

at least $1 per share for a minimum of ten consecutive business days during this 180-day period. In the event that the Company does not

regain compliance within this 180-day period, the Company may be eligible to seek an additional compliance period of 180 calendar days

if it meets the continued listing requirement for market value of publicly held shares and all other initial listing standards for the

Nasdaq Capital Market, with the exception of the bid price requirement, and provides written notice to Nasdaq of its intent to cure the

deficiency during this second compliance period, by effecting a reverse stock split, if necessary. However, if it appears to the Nasdaq

staff that the Company will not be able to cure the deficiency, or if the Company is otherwise not eligible, Nasdaq will provide notice

to the Company that its Common Stock will be subject to delisting.

The letter does not result

in the immediate delisting of the Company’s Common Stock from the Nasdaq Capital Market. The Company intends to monitor the closing

bid price of its Common Stock and consider its available options in the event that the closing bid price of the Company’s Common

Stock remains below $1 per share.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 2, 2021, the Company appointed Dr.

Laurence Reilly as Interim Chief Medical Officer of the Company. Dr. Reilly succeeds John Friend, MD, who is stepping down but will stay

on through mid-November to finalize the ongoing transition.

Dr. Reilly, age 39, has consulted for the Company

since early this year. Prior to joining Cellectar, he provided strategic consulting and due-diligence services to biotech companies, life

science venture capital and private equity clients, alongside serving as chief strategy & development officer to a European-based

medical device company. Prior to founding his consulting practice, Dr. Reilly served as chief scientific officer and vice president at

Avillion, a drug development company focused on the co-development and financing of pharmaceutical candidates, where he was responsible

for clinical and strategic oversight of co-development programs and partnering with both large pharma and biotech, including Pfizer and

AstraZeneca. Dr. Reilly previously served as a clinician at Pfizer and began his industry career at Lundbeck where he served as medical

and scientific advisor overseeing investigator-initiated research, opinion leader interaction and new compound presentation. Dr. Reilly

earned his medical degree from the University of Liverpool Medical School, U.K., and a Masters Degree in Law from De Montfort University,

U.K.

Dr. Reilly has no family relationships with any

of the Company’s directors or executive officers, and he has no direct or indirect material interest in any transaction required

to be disclosed pursuant to Item 404(a) of Regulation S-K.

On April 8, 2021, the Company entered into a consulting

agreement with Dr. Reilly (the “Consulting Agreement”), pursuant to which the Company engaged Dr. Reilly to serve as an independent

consultant for the purpose of providing the Company with certain services. On November 2, 2021, the Company appointed Dr. Reilly to the

position of Interim Chief Medical Officer and as such, that Dr. Reilly would continue to serve as an independent consultant pursuant to

the Consulting Agreement for the purpose of providing the Company with certain services, including the services to be provided by Dr.

Reilly as the Company’s Interim Chief Medical Officer.

The Company’s

press release announcing the appointment of Dr. Reilly is filed as Exhibit 99.1 hereto and incorporated by reference herein.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: November 2, 2021

|

CELLECTAR BIOSCIENCES, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Dov Elefant

|

|

|

|

Name:

|

Dov Elefant

|

|

|

|

Title:

|

Chief Financial Officer

|

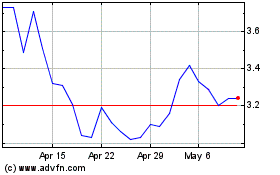

Cellectar Biosciences (NASDAQ:CLRB)

Historical Stock Chart

From Jun 2024 to Jul 2024

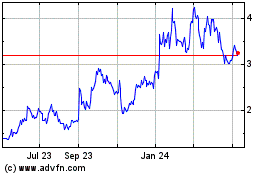

Cellectar Biosciences (NASDAQ:CLRB)

Historical Stock Chart

From Jul 2023 to Jul 2024