false

0000726601

0000726601

2024-02-02

2024-02-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

____________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): February

2, 2024

Capital

CIty Bank Group, Inc.

(Exact name of registrant as specified in its

charter)

|

Florida |

|

0-13358 |

|

59-2273542 |

| (State of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

217 North

Monroe Street, Tallahassee, Florida |

|

32301 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area

code: (850) 671-0300

___________________________________________________

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, Par value $0.01 |

CCBG |

Nasdaq Stock Market, LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

CAPITAL CITY BANK GROUP, INC.

FORM 8-K

CURRENT REPORT

On February 2, 2024, Capital City Bank Group,

Inc. (the “Company”) issued a press release announcing that its Board of Directors approved a new stock repurchase

program on January 25, 2024 that authorizes the Company to repurchase up to 750,000 shares of its common stock, effective as of

February 1, 2024. The new stock repurchase program will terminate automatically on the fifth anniversary of the program, which is

February 1, 2029. Under the program, shares may be repurchased by the Company from time to time in the open market or through

private transactions, as market conditions warrant. The program does not obligate the Company to repurchase any specified number of

shares of its common stock. The Board also terminated the Company’s existing stock repurchase program, which was set to expire

this month. A copy of the press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits. |

| |

(d) |

|

Exhibits. |

| |

|

|

|

| |

Item No. |

|

Description of Exhibit |

| |

|

|

|

| |

99.1 |

|

Press release, dated February 2, 2024. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

CAPITAL CITY BANK GROUP, INC. |

| |

|

|

|

|

| Date: |

February 2, 2024 |

By: |

/s/ Jeptha E. Larkin |

|

| |

|

|

Jeptha E. Larkin, |

|

| |

|

|

Executive Vice President |

|

| |

|

|

and Chief Financial Officer |

|

EXHIBIT INDEX

Exhibit

Number Description

99.1 Press Release dated February 2, 2024

Exhibit 99.1

Capital City Bank Group, Inc.

Announces Replacement Stock Repurchase Program

TALLAHASSEE, Fla. (February 2, 2024) – Capital City Bank Group, Inc.

(NASDAQ: CCBG) announced today that its Board of Directors approved a new stock repurchase program on January 25, 2024. Under the newly

approved stock repurchase program, the company is authorized to repurchase up to 750,000 shares of its common stock over the next five

years, from time to time, in the open market or through private transactions, as market conditions warrant. However, the new stock repurchase

program does not obligate the company to repurchase any specified number of shares of its common stock. Currently, the company has approximately

16,990,240 shares of common stock issued and outstanding and the number of shares authorized for repurchase under the new repurchase program

currently represents approximately 4.4% of the company’s issued and outstanding shares of common stock. In connection with the approval

of the new stock repurchase program, the Board of Directors terminated the company’s existing stock repurchase program.

About Capital City Bank Group, Inc.

Capital City Bank Group, Inc. (NASDAQ: CCBG) is one of the largest publicly

traded financial holding companies headquartered in Florida and has approximately $4.3 billion in assets. We provide a full range of banking

services, including traditional deposit and credit services, mortgage banking, asset management, trust, merchant services, bankcards,

securities brokerage services and financial advisory services, including the sale of life insurance, risk management and asset protection

services. Our bank subsidiary, Capital City Bank, was founded in 1895 and now has 63 banking offices and 103 ATMs/ITMs in Florida, Georgia

and Alabama. For more information about Capital City Bank Group, Inc., visit www.ccbg.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements

(within the meaning of the Private Securities Litigation Reform Act of 1995 and other legal authority) that are based on current plans

and expectations that are subject to uncertainties and risks, which could cause our future results to differ materially. The words “may,”

“could,” “should,” “would,” “believe,” “anticipate,” “estimate,”

“expect,” “intend,” “plan,” “target,” “vision,” “goal,” and similar

expressions are intended to identify forward-looking statements. We may not actually achieve the plans, carry out the intentions or meet

the expectations disclosed in the forward-looking statements, and you should not rely on these forward-looking statements due to many

factors, including: our ability to successfully manage credit risk, interest rate risk, liquidity risk, and other risks inherent to our

industry; legislative or regulatory changes; adverse developments in the financial services industry generally, such as bank failures

and any related impact on depositor behavior; the effects of changes in the level of checking or savings account deposits and the competition

for deposits on our funding costs, net interest margin and ability to replace maturing deposits and advances, as necessary; inflation,

interest rate, market and monetary fluctuations; uncertainty in the pricing of residential mortgage loans that we sell, as well as competition

for the mortgage servicing rights related to these loans and related interest rate risk or price risk resulting from retaining mortgage

servicing rights and the potential effects of higher interest rates on our loan origination volumes; the effects of actions taken by

governmental agencies to stabilize the recent volatility in the financial system and the effectiveness of such actions; changes in monetary

and fiscal policies of the U.S. Government; the effects of security breaches and computer viruses that may affect our computer systems

or fraud related to debit card products; the accuracy of our financial statement estimates and assumptions, including the estimates used

for our allowance for credit losses, deferred tax asset valuation and pension plan; changes in our liquidity position; changes in accounting

principles, policies, practices or guidelines; the frequency and magnitude of foreclosure of our loans; the effects of our lack of a

diversified loan portfolio, including the risks of loan segments, geographic and industry concentrations; the strength of the United

States economy in general and the strength of the local economies in which we conduct operations; our ability to declare and pay dividends,

the payment of which is subject to our capital requirements; changes in the securities and real estate markets; structural changes in

the markets for origination, sale and servicing of residential mortgages; risks related to changes in key personnel and any changes in

our ability to retain key personnel; the effect of corporate restructuring, acquisitions or dispositions, including the actual restructuring

and other related charges and the failure to achieve the expected gains, revenue growth or expense savings from such corporate restructuring,

acquisitions or dispositions; the effects of natural disasters, harsh weather conditions (including hurricanes), widespread health emergencies

(including pandemics, such as the COVID-19 pandemic), military conflict, acts of war, terrorism, civil unrest or other geopolitical events;

our ability to comply with the extensive laws and regulations to which we are subject, including the laws for each jurisdiction where

we operate; the impact of the restatement of our previously issued financial statements as of and for the year ended December 31, 2022,

the three months ended March 31, 2022 and 2023, the three and six months ended June 30, 2022 and 2023, and the three and nine months

ended September 30, 2022; any inability to implement and maintain effective internal control over financial reporting or inability to

remediate our existing material weaknesses in our internal controls deemed ineffective; the inherent limitations in internal control

over financial reporting and disclosure controls and procedures; the willingness of clients to accept third-party products and services

rather than our products and services and vice versa; increased competition and its effect on pricing; technological changes; the outcomes

of litigation or regulatory proceedings; negative publicity and the impact on our reputation; changes in consumer spending and saving

habits; growth and profitability of our noninterest income; the limited trading activity of our common stock; the concentration of ownership

of our common stock; anti-takeover provisions under federal and state law as well as our Articles of Incorporation and our Bylaws; other

risks described from time to time in our filings with the Securities and Exchange Commission; and our ability to manage the risks involved

in the foregoing. Additional factors can be found in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as amended,

and our other filings with the SEC, which are available at the SEC’s internet site (http://www.sec.gov). Forward-looking statements

in this press release speak only as of the date of this press release, and we assume no obligation to update forward-looking statements

or the reasons why actual results could differ, except as may be required by law.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

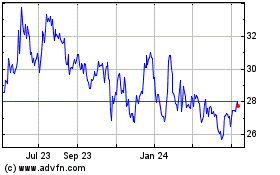

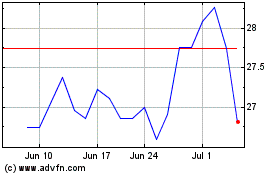

Capital City Bank (NASDAQ:CCBG)

Historical Stock Chart

From Apr 2024 to May 2024

Capital City Bank (NASDAQ:CCBG)

Historical Stock Chart

From May 2023 to May 2024