Form 8-K - Current report

November 12 2024 - 7:54AM

Edgar (US Regulatory)

0001730463FALSE00017304632024-11-122024-11-120001730463sic:Z88802024-11-122024-11-120001730463us-gaap:CommonClassAMember2024-11-122024-11-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 12, 2024

Autolus Therapeutics plc

(Exact name of registrant as specified in its Charter)

| | | | | | | | | | | |

England and Wales | 001-38547 | Not applicable |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| |

The Mediaworks |

191 Wood Lane |

| London | W12 7FP |

| United Kingdom |

(Address of principal executive offices)(Zip Code) |

| | | |

| (44) 20 | 3829 6230 |

| (Registrant's telephone number, including area code) |

|

Not Applicable |

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

American Depositary Shares, each representing one ordinary share, nominal value $0.000042 per share | AUTL | The Nasdaq Global Select Market |

| Ordinary shares, nominal value $0.000042 per share* | * | The Nasdaq Stock Market LLC* |

| | | | | | | | |

* | | Not for trading, but only in connection with the listing of the American Depositary Shares on The Nasdaq Global Select Market. The American Depositary Shares represent the right to receive ordinary shares and are being registered under the Securities Act of 1933, as amended, pursuant to a separate Registration Statement on Form F-6. Accordingly, the American Depositary Shares are exempt from the operation of Section 12(a) of the Securities Exchange Act of 1934, as amended, pursuant to Rule 12a-8 thereunder. |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Conditions.

On November 12, 2024, Autolus Therapeutics plc (the “Company”) announced its financial results for the quarter ended September 30, 2024 and provided a corporate update. A copy of the press release is being furnished as Exhibit 99.1 hereto and is incorporated by reference herein.

The information in this Item 2.02, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information contained herein and in the accompanying exhibit is not incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

In connection with its conference call on November 12, 2024 to discuss its results for the quarter ended September 30, 2024, the Company will utilize an updated corporate presentation, a copy of which is furnished as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by reference.

The information in this Item 7.01, including Exhibit 99.2 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section. The information contained herein and in the accompanying exhibit is not incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Date File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | AUTOLUS THERAPEUTICS PLC |

Dated: November 12, 2024 | By: | /s/Christian Itin, Ph.D. |

| | Name: Christian Itin, Ph.D. |

| | Title: Chief Executive Officer |

Autolus Therapeutics Reports Third Quarter 2024 Financial Results and Business Updates November 12, 2024 at 7:00 AM EST AUCATZYL® (obecabtagene autoleucel) approved by US FDA on November 8, ahead of target PDUFA date of November 16; US commercial launch initiated BLA approval triggers $30m milestone payment to Autolus from Blackstone Marketing authorizations for obe-cel under review with both the MHRA EMA Matthias Will M.D. appointed as Chief Development Officer, effective September 30, 2024 Conference call to be held today at 08:30 am EDT/13:30 pm BST: conference call participants should pre-register using the link at the bottom of this press release LONDON, Nov. 12, 2024 (GLOBE NEWSWIRE) -- Autolus Therapeutics plc (Nasdaq: AUTL), an early commercial-stage biopharmaceutical company developing next-generation programmed T cell therapies, today announces its financial results for the third quarter ended September 30, 2024, and provides additional operational and clinical updates. “With the U.S. Food and Drug Administration (FDA) having approved AUCATZYL ® (obe-cel) for the treatment of adult B-cell Acute Lymphoblastic Leukemia (B-ALL) patients, we are all systems go with our commercial efforts in the US across the Company,” said Dr. Christian Itin, Chief Executive Officer of Autolus. “This first FDA approval is just the beginning for Autolus; we have great belief in our pipeline and our manufacturing capabilities and are excited for the future.” Key updates and anticipated milestones: AUCATZYL® was approved by the FDA for the treatment of adult patients with relapsed and refractory B-cell acute lymphoblastic leukemia on November 8, 2024. Obe-cel in r/r adult B-ALL – The FELIX Study and regulatory updates Obe-cel is under regulatory review in both the EU and the UK, with marketing authorization submissions accepted by the European Medicines Agency in April 2024, and the UK Medicines and Healthcare products Regulatory Agency in August 2024. Post period, Autolus submitted obe-cel for appraisal by the U.K. National Institute for Health and Care Excellence (NICE) and Autolus looks forward to working with NICE and NHS England to make obe-cel available to patients in England and Wales, if approved. Autolus presented updated data from the pivotal Phase 1b/2 FELIX study at the Society of Hematologic Oncology (SOHO) meeting in August 2024 which demonstrated the rationale for tumor burden (TB)-guided dosing by analyzing the impact of bone marrow (BM) blast percentage in patients treated with obe-cel. The data demonstrated the importance of administering a split dose and highlighted the differentiation of obe-cel based on its unique biding properties and tumor burden-guided approach. Post period, Autolus presented data at the 2024 Lymphoma, Leukemia & Myeloma Congress on October 16-19. The poster presentation suggested that adult patients with r/r B-ALL achieve comparable outcomes irrespective of the timing of stem cell transplant (SCT) pre or post obe-cel, suggesting no further benefit of consolidative transplant based on this post-hoc analysis. Additionally, obe-cel given as a sole treatment to patients with lower Tumor Burden (TB) at Lymphodepletion (LD) was associated with better outcomes. Obe-cel in B-cell mediated autoimmune diseases The Phase 1 dose confirmation study (CARLYSLE) in refractory systemic lupus erythematosus (SLE) patients is ongoing and Autolus expects to complete enrolment and patient dosing, as well as present initial data in Q1 2025. The Company anticipates that full data with adequate follow-up will be targeted for 2H 2025 at a medical conference. Pipeline programs in collaboration with University College London Clinical programs AUTO8, AUTO6NG and AUTO1/22 are progressing and the Company is planning data updates for all programs in 2025. Operational Updates: The FDA approval for AUCATZYL triggers a $30 million milestone payment to Autolus from Blackstone in accordance with the terms of the collaboration agreement between the parties. In addition, Autolus will make a £10 million regulatory EX-99.1

milestone payment to UCL Business Ltd. in accordance with the license agreement between the parties. In September 2024, Autolus announced the appointment of Matthias Will M.D. as Chief Development Officer, effective September 30, 2024. Dr. Will joins Autolus from Dren Bio, Inc., a privately held biotech company, where he served as Chief Medical Officer. During his tenure, Matthias led the expansion of the clinical team and oversaw the submission of two INDs for candidates to potentially treat hematologic cancers. Prior to that he served as Vice President of Clinical Development for CRISPR Therapeutics where he led the development of the company’s allogeneic CAR T programs targeting CD70 in T-cell lymphomas and renal cell carcinoma and the early stage CD70-NK cell program in collaboration with NKarta Inc. 2024/2025 Expected News Flow: Obe-cel FELIX data at American Society of Hematology (ASH) meeting December 2024 Obe-cel in autoimmune disease – initial data from SLE Phase 1 study Q1 2025 Initial data from PY01 trial of obe-cel in pediatric ALL H2 2025 SLE Phase 1 trial presentation at medical conference H2 2025 Financial Results (Unaudited) for the Quarter Ended September 30, 2024 Cash and cash equivalents at September 30, 2024 totaled $657.1 million, as compared to $239.6 million at December 31, 2023. Total operating expenses, net for the three months ended September 30, 2024 were $67.9 million, as compared to $42.9 million for the same period in 2023. Research and development expenses increased from $32.3 million to $40.3 million for the three months ended September 30, 2024, compared to the same period in 2023. This change was primarily due to increases in employee salaries and related costs, and clinical trial and manufacturing costs related to obe-cel, partially offset by a decrease in professional fees and an increase in our U.K. R&D tax credits that reduce R&D expense. General and administrative expenses increased from $10.6 million to $27.3 million for the three months ended September 30, 2024, compared to the same period in 2023. This increase was primarily due to salaries and other employment-related costs driven by increased headcount supporting pre-commercialization activities. Net loss was $82.1 million for the three months ended September 30, 2024, compared to $45.8 million for the same period in 2023. Basic and diluted net loss per ordinary share for the three months ended September 30, 2024, totaled $(0.31), compared to basic and diluted net loss per ordinary share of $(0.26) for the same period in 2023. Autolus estimates that, with its current cash and cash equivalents, it is well capitalized to drive the full launch and commercialization of obe-cel in r/r adult B-ALL as well as to advance its pipeline development plans, which includes providing runway to data in the first pivotal study of obe-cel in autoimmune disease. Financial Results for the Quarter Ended September 30, 2024 Selected Unaudited Condensed Consolidated Balance Sheet Data (In thousands) September 30, 2024 December 31, 2023 Assets Cash and cash equivalents $ 657,067 $ 239,566 Total current assets $ 718,114 $ 275,302 Total assets $ 827,490 $ 375,381 Liabilities and shareholders’ equity Total current liabilities $ 52,474 $ 44,737 Total liabilities $ 350,525 $ 263,907 Total shareholders’ equity $ 476,965 $ 111,474 Selected Unaudited Condensed Consolidated Statements of Operations and Comprehensive Loss Data (In thousands, except share and per share amounts) Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 License revenue $ — $ 406 $ 10,091 $ 1,698 Operating expenses: Research and development (40,323) (32,318) (107,606) (92,938) General and administrative (27,330) (10,611) (67,410) (31,017) Loss on disposal of property and equipment (223) — (223) (3,791)

Impairment of operating lease right-of-use assets and related property and equipment — (382) (414) (382) Total operating expenses, net (67,876) (42,905) (165,562) (126,430) Total other expenses, net (14,196) (2,965) (27,428) (4,777) Net loss before income tax (82,072) (45,870) (192,990) (131,207) Income tax (expense) benefit (22) 21 (66) (5) Net loss (82,094) (45,849) (193,056) (131,212) Other comprehensive income (loss): Foreign currency exchange translation adjustment 27,010 (5,837) 28,094 5,104 Total comprehensive loss $ (55,084) $ (51,686) $ (164,962) $ (126,108) Basic and diluted net loss per ordinary share $ (0.31) $ (0.26) $ (0.77) $ (0.75) Weighted-average basic and diluted ordinary shares 266,084,589 173,984,101 251,480,521 173,890,666 Conference Call Management will host a conference call and webcast at 8:30 am EDT/1:30 pm BST to discuss the company’s financial results and provide a general business update. Conference call participants should pre-register using this link to receive the dial-in numbers and a personal PIN, which are required to access the conference call. A simultaneous audio webcast and replay will be accessible on the events section of Autolus’ website. About Autolus Therapeutics plc Autolus is a biopharmaceutical company developing next-generation, programmed T cell therapies for the treatment of cancer and autoimmune disease. Using a broad suite of proprietary and modular T cell programming technologies, Autolus is engineering precisely targeted, controlled and highly active T cell therapies that are designed to recognize target cells, break down their defense mechanisms and eliminate these cells. Autolus has an FDA approved product, AUCATZYL®, and a pipeline of product candidates in development for the treatment of hematological malignancies, solid tumors and autoimmune diseases. For more information, please visit www.autolus.com About Aucatzyl® (obecabtagene autoleucel, AUTO1) AUCATZYL® is a B-lymphocyte antigen CD19 (CD19) chimeric antigen receptor (CAR) T cell therapy approved by the FDA for the treatment of relapsed/refractory (r/r) Adult B-cell Acute Lymphoblastic Leukemia (B-ALL). Please see full Prescribing Information, including BOXED WARNING and Medication Guide. Obe-cel is designed with a fast target binding off-rate to minimize excessive activation of the programmed T cells. In the EU a regulatory submission to the EMA was accepted in April 2024, while in the UK, an MAA was submitted to MHRA in July 2024. In collaboration with Autolus’ academic partner, University College London, obe-cel is currently being evaluated in a Phase 1 clinical trial for B-cell non-Hodgkin lymphoma (B-NHL). About FELIX clinical trial Autolus’ Phase 1b/2 clinical trial of obe-cel enrolled adult patients with r/r B-precursor ALL. The trial had a Phase 1b component prior to proceeding to the single arm, Phase 2 clinical trial. The primary endpoint was overall response rate, and the secondary endpoints included duration of response, MRD negative complete remission rate and safety. The trial enrolled over 100 patients across 30 of the leading academic and non-academic centers in the United States, United Kingdom and Europe. [NCT04404660] About AUTO1/22 AUTO1/22 is a novel dual targeting CAR T cell-based therapy candidate based on obe-cel. It is designed to combine the enhanced safety, robust expansion and persistence seen with the fast off rate CD19 CAR from obe-cel with a high sensitivity CD22 CAR to reduce antigen negative relapses. This product candidate is currently in a Phase 1 clinical trial for patients with r/r pediatric ALL. [NCT02443831] About AUTO6NG AUTO6NG is a next generation programmed T cell product candidate in development for the treatment of both neuroblastoma and other GD2-expressing solid tumors. AUTO6NG builds on preliminary proof of concept data from AUTO6, a CAR targeting GD2-expression cancer cell currently in clinical development for the treatment of neuroblastoma. AUTO6NG incorporates additional cell programming modules to overcome immune suppressive defense mechanisms in the tumor microenvironment, in addition to endowing the CAR T cells with extended persistence capacity. A Phase 1 clinical trial of AUTO6NG in children with relapsed/refractory neuroblastoma was opened for enrollment in the fourth quarter of 2023. About AUTO8 AUTO8 is a next-generation product candidate for multiple myeloma which comprises two independent CARs for the multiple myeloma targets, B-cell maturation antigen (BCMA) and CD19. We have developed an optimized BCMA CAR designed for improved killing of target cells that express BCMA at low levels. This has been combined with fast off rate CD19 CAR from obe-cel, with the aim of inducing deep and durable responses and extending the durability of effect over other BCMA CARs currently in development. This product candidate is currently in a Phase I clinical trial for patients with r/r multiple myeloma. [NCT04795882] Forward-Looking Statements This press release contains forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts, and in some cases can be identified by terms such as "may," "will," "could," "expects," "plans," "anticipates," and "believes." These statements include, but are not limited to, statements regarding the market opportunity for AUCATZYL®, Autolus’ development and commercialization of its product candidates, and the timing of data announcements and regulatory submissions. Any forward-looking statements are based on management's current views and assumptions and involve risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements. These

risks and uncertainties include, but are not limited to, the risks that Autolus’ preclinical or clinical programs do not advance or result in approved products on a timely or cost effective basis or at all; the results of early clinical trials are not always being predictive of future results; the cost, timing and results of clinical trials; that many product candidates do not become approved drugs on a timely or cost effective basis or at all; the ability to enroll patients in clinical trials; and possible safety and efficacy concerns. For a discussion of other risks and uncertainties, and other important factors, any of which could cause Autolus’ actual results to differ from those contained in the forward-looking statements, see the section titled "Risk Factors" in Autolus' Annual Report on Form 10-K filed with the Securities and Exchange Commission, or the SEC, on March 21, 2024 as well as discussions of potential risks, uncertainties, and other important factors in Autolus' subsequent filings with the Securities and Exchange Commission. All information in this press release is as of the date of the release, and Autolus undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. You should, therefore, not rely on these forward-looking statements as representing Autolus’ views as of any date subsequent to the date of this press release. Contact: Amanda Cray +1 617-967-0207 a.cray@autolus.com Olivia Manser +44 (0) 7780 471 568 o.manser@autolus.com Susan A. Noonan S.A. Noonan Communications +1-917-513-5303 susan@sanoonan.com

Q3 2024 Financial Results and Business Updates 12 November 2024 Autolus.com For Investor communication only. Not for use in product promotion. Not for further distribution. EX-99.2

Disclaimer These slides contain forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts, and in some cases can be identified by terms such as “may,” “will,” “could,” “expects,” “plans,” “anticipates,” and “believes.” These statements include, but are not limited to: statements regarding Autolus’ development and commercialization of its product candidates; Autolus' manufacturing, sales and marketing plans for AUCATZYL, including expectations regarding the timing of commercial launch in the United States and the ability to reach patients in a timely manner; the amount and timing of milestone payments under Autolus' collaboration and license agreements; and future development plans of obe-cel, including the timing or likelihood of expansion into additional markets or geographies and related regulatory approvals. Any forward-looking statements are based on management’s current views and assumptions and involve risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation: Autolus' ability to maintain regulatory approval of AUCATZYL; its ability to execute its commercialization strategy for AUCATZYL; its ability to develop, manufacture and commercialize its other product candidates and the timing or likelihood of expansion of AUCATZYL into additional markets or geographies; Autolus' ability to establish and expand a commercial infrastructure and to successfully launch, market and sell AUCATZYL; actions of regulatory agencies, which may affect the initiation, timing and progress of clinical trials or future regulatory approval; the labelling for AUCATZYL/obe-cel in any future indication or patient population, if approved; the potential for payors to delay, limit or deny coverage for AUCATZYL; Autolus' ability to obtain, maintain and enforce intellectual property protection for AUCATZYL or any product candidates it is developing; the results of clinical trials are not always being predictive of future results; the cost, timing and results of clinical trials; that many product candidates do not become approved drugs on a timely or cost effective basis or at all; the ability to enroll patients in clinical trials; and possible safety and efficacy concerns. For a discussion of other risks and uncertainties, and other important factors, any of which could cause Autolus’ actual results to differ from those contained in the forward-looking statements, see the section titled “Risk Factors” in Autolus' Annual Report on Form 10-K filed with the Securities and Exchange Commission, or the SEC, on March 21, 2024, as well as discussions of potential risks, uncertainties, and other important factors in Autolus’ subsequent filings with the Securities and Exchange Commission. All information in this presentation is as of the date of the presentation, and Autolus undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. You should, therefore, not rely on these forward-looking statements as representing the Company’s views as of any date subsequent to the date of this presentation. 2

Agenda 3 • Welcome and Introduction: Olivia Manser, Director, Investor Relations • Operational Highlights: Dr. Christian Itin, CEO • Financial Results: Rob Dolski, CFO • Upcoming Milestones and Conclusion: Dr. Christian Itin, CEO • Q&A: Dr. Christian Itin and Rob Dolski

AUCATZYL® now FDA approved 4 ✓ AUCATZYL indicated for the treatment of adults with relapsed or refractory B-cell precursor acute lymphoblastic leukemia (B-ALL) ✓ First chimeric antigen receptor T-cell (CAR T) therapy approved by the FDA with no requirement for a REMS program (Risk Evaluation Mitigation Strategy) ✓ Novel and differentiated mechanism of action: first and currently only approved CD19 CAR T with a fast off-rate ✓ First and currently only approved CAR T therapy with customized, tumor-burden guided dosing Please see full prescribing information Prescribing information including BOXED WARNING Post-period event

Pillars to drive launch success 5 30 key centers primed for activation covering ~ 60% of r/r B-ALL target population with ~30 additional centers to follow by end 2025 Prioritizing activation of centers Post-approval Pricing reflects clinical evidence, differentiated safety profile, economic value $525,000 WAC1 Pricing strategy focused on delivering value to customers and achieving broad coverage Robust and reliable supply Team dedicated to successful commercial efforts Experienced team with multiple CAR T launches Strong scientific communication and physician engagement within medical affairs Dedicated single point-of-contact for every center 1Wholesale acquisition cost, or WAC, before any discounts, rebates or other price concessions The Nucleus: Autolus’ state-of-the-art, dedicated purpose-built facility Target vein-to-release time of ~16 days

Autolus executed to plan in Q3 2024 6 Clinical Operational • Obe-cel progressing according to plan – AUCATZYL approved by FDA ahead of PDUFA target action date – Under review by both the EMA and MHRA and submitted to NICE in the UK – Additional data from the FELIX study – Society of Hematologic Oncology meeting in August 2024 demonstrating the rationale for tumor burden (TB)-guided dosing – Post period – Lymphoma Leukemia & Myeloma Congress in October 2024 which suggested that patients who underwent Stem Cell Transplant had poorer outcomes and reducing tumor burden prior to lymphodepletion is crucial for improved outcomes • Appointed Matthias Will, MD as Chief Development Officer • Continued expansion of commercial team and onboarding of treatment centers

Upcoming data at ASH 7 Clinical • Deep Molecular Remission May Predict Better Outcomes – Abstract 194508 - Oral presentation – Dr. Elias Jabbour - Monday, December 9, 2024; 4:30 PM - 6:00 PM PT • The Impact of Bridging Therapies on CAR T-Cell Expansion and Persistence – Abstract 201514 – Poster presentation – Dr. Jae Park – Sunday, December 8, 2024; 6:00 PM - 8:00 PM PT • Healthcare Resource Utilization and Costs Associated with Managing CRS and ICANS – Abstract 205694 – Poster presentation – Dr. Bijal D Shah – Monday, December 9, 2024; 6:00 PM - 8:00 PM PT • What We Have Learned from the FELIX Trial – Abstract 208028 – Poster presentation – Dr. Claire Roddie - Monday, December 9, 2024; 6:00 PM - 8:00 PM PT

Expanding the obe-cel opportunity Deep value program with potentially broad applicability

The obe-cel product family and franchise opportunity 9 Obe-cel CD19 AUTO1/22 CD19/CD22 AUTO8 CD19/BCMA B-ALL and B-NHL B-cell mediated autoimmune disease B-ALL and B-NHL Multiple Myeloma B-cell and plasma cell mediated autoimmune • Optimized CD19 CAR design • Potential best-in-class efficacy and safety profile • Supported by state-of-the-art manufacturing • Supported by mature FELIX clinical/CMC package • Dual CD19 & CD22 Targeting • Designed to prevent antigen negative escape • Supported by Phase 1 data in pediatric B-ALL • Dual CD19 & BCMA Targeting • Designed to induce deep and durable responses • Initial Phase 1 data presented at ASH 2023

Dynamic environment in cell therapy for autoimmune patients 10 EULAR updates and abstracts for ACR2024 continue to support overall proof of concept/biology in autoimmune disease • Available clinical data is largely based on compassionate use experience with more clinical trial data emerging • A Kymriah-like autologous CAR T program showed transformational clinical outcomes in refractory autoimmune patients – To date a single myositis patient relapsed after 18 months (compassionate use cohort) – Response rate expectations for the field were set high ~100% • Some variability in clinical outcomes is beginning to emerge – All CD19 CAR Ts may not be alike; different design and manufacturing process may contribute – Patient populations vary across data sets – All autoimmune indications may not be alike – inflammatory process versus structural damage • Obe-cel has shown profound removal of the B cell compartment, indicated by the long-term outcomes in ALL without subsequent therapy while showing a favorable safety profile in this challenging patient population. • Obe-cel is well positioned for autoimmune disease – Phase 1 CARLYSLE study in advanced SLE ongoing – Enrolment due to complete in Q1 25 and initial data in Q1 25 Autoimmune

Financial Results

Financial summary (unaudited) USD ($’ 000) Q3 2024 Q4 2023 Variance Cash and cash equivalents 657,067 239,566 417,501 USD ($’ 000) Q3 2024 Q3 2023 Variance License revenue - 406 (406) Operating expenses: R&D (40,323) (32,318) (8,005) G&A (27,330) (10,611) (16,719) Loss on disposal of property and equipment (223) - (223) Impairment of operating lease right-of-use assets and related property and equipment - (382) 382 Total operating expense, net (67,876) (42,905) (24,971) Other income, net 54 136 (82) Foreign exchange losses (11,884) (1,733) (10,151) Interest Income 8,320 3,646 4,674 Interest expense (10,686) (5,014) (5,672) Income tax (expense) benefit (22) 21 (43) Net loss (82,094) (45,849) (36,245) 12

Upcoming news flow

Autolus planned news flow 14 Anticipated Milestone or Data Catalysts Anticipated Timing Obe-cel FELIX data update at ASH 2024 December 2024 Initial data from SLE Phase 1 trial Q1 2025 Initial data from PY01 trial in pediatric ALL 2H 2025 SLE Phase 1 trial presentation at medical conference 2H 2025 Oncology Autoimmune

Autolus.com Thank you

v3.24.3

Cover

|

Nov. 12, 2024 |

| Entity Listings [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 12, 2024

|

| Entity Registrant Name |

Autolus Therapeutics plc

|

| Entity Incorporation, State or Country Code |

X0

|

| Entity File Number |

001-38547

|

| Entity Address, Address Line One |

The Mediaworks

|

| Entity Address, Address Line Two |

191 Wood Lane

|

| Entity Address, City or Town |

London

|

| Entity Address, Postal Zip Code |

W12 7FP

|

| Entity Address, Country |

GB

|

| City Area Code |

(44) 20

|

| Local Phone Number |

3829 6230

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Central Index Key |

0001730463

|

| Amendment Flag |

false

|

| Entity Emerging Growth Company |

false

|

| Common Class A |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

Ordinary shares, nominal value $0.000042 per share*

|

| Trading Symbol |

*

|

| Security Exchange Name |

NASDAQ

|

| 8880 American Depositary Receipts |

|

| Entity Listings [Line Items] |

|

| Title of 12(b) Security |

American Depositary Shares, each representing one ordinary share, nominal value $0.000042 per share

|

| Trading Symbol |

AUTL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sic_Z8880 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

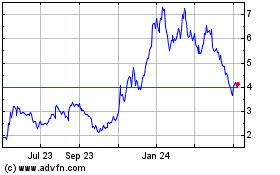

Autolus Therapeutics (NASDAQ:AUTL)

Historical Stock Chart

From Dec 2024 to Jan 2025

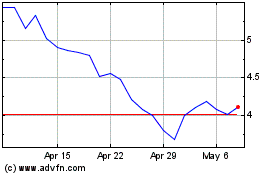

Autolus Therapeutics (NASDAQ:AUTL)

Historical Stock Chart

From Jan 2024 to Jan 2025