Loss Widens at IRWD on Higher Costs - Analyst Blog

January 16 2013 - 5:40AM

Zacks

Ironwood Pharmaceuticals, Inc.’s (IRWD)

fourth-quarter 2012 loss of 41 cents per share compared unfavorably

with the year-ago loss of 7 cents per share. Results were hurt by

higher selling, general and administrative (SG&A) and

collaboration expense. The Zacks Consensus Estimate hinted at a

loss of 50 cents per share.

Total revenues in the final quarter of 2012 were down 16.1%

year-over-year to $27 million. Revenues were above the Zacks

Consensus Estimate of $18 million.

Full year 2012 loss was 68 cents per share compared to year-ago

loss of 65 cents per share. Loss was narrower than the Zacks

Consensus Estimate of loss of 78 cents per share. Revenues in 2012

jumped 128.1% from the previous year to $150.2 million.

Linzess Launch Quarter Sales

The company and partner Forest Laboratories,

Inc. (FRX) reported Linzess (linaclotide) net product

sales of $19.2 million in the fourth quarter of 2012. Linzess sales

primarily consisted of initial trade stocking.

We remind investors that on Dec 17, 2012, the companies

announced the US launch of their drug Linzess. The launch followed

the approval of the drug by the US Food and Drug Administration

(FDA) in Aug 2012 for the treatment (once-daily) of adults

suffering from irritable bowel syndrome with constipation (IBS-C)

or chronic idiopathic constipation (CIC).

In the EU, approval came in November 2012 under the trade name

Constella. Ironwood Pharma is collaborating with Almirall, S.A. in

EU for the drug. The product is expected to be launched in the EU

in the first half of 2013. Ironwood Pharma is also working with its

Japanese partner, Astellas Pharma Inc. for the development of

linaclotide in Japan and other Asian countries.

To further analyze the effect of Linzess on abdominal symptoms

in patients suffering from CIC, Forest Labs and Ironwood Pharma

have initiated a phase IIIb clinical trial. Results from the trial

are expected in the second half of 2013.

Other Expenses

During the quarter, SG&A expenses surged 139% to $33.3

million. The massive increase was primarily attributable to Linzess

commercialization costs. For 2013, Ironwood Pharma expects total

investment in sales and marketing for Linzess to be in the range of

$250-$300 million.

Research and development (R&D) expenses amounted to $28.3

million, an increase of 16.7%, reflecting investment in its

pipeline, which includes IW-9179 (phase II) for patients with

functional dyspepsia.

We currently have an Outperform recommendation on Ironwood

Pharma. The stock carries a Zacks Rank #2 (Buy) in the short run.

We expect investor focus to remain on the market performance of the

lead product, Linzess.

Pharma stocks, which currently look very attractive, are

Targacept Inc. (TRGT), Aeterna

Zentaris (AEZS) and Valeant

Pharmaceuticals (VRX). These companies carry a Zacks Rank

#1 (Strong Buy).

AETERNA ZENTARS (AEZS): Free Stock Analysis Report

FOREST LABS A (FRX): Free Stock Analysis Report

IRONWOOD PHARMA (IRWD): Free Stock Analysis Report

TARGACEPT INC (TRGT): Free Stock Analysis Report

VALEANT PHARMA (VRX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

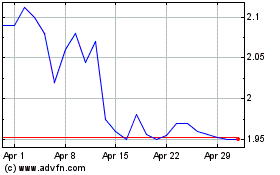

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Jun 2024 to Jul 2024

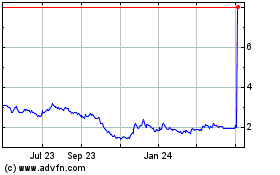

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Jul 2023 to Jul 2024