Swiss Franc Falls On SNB's 25 Bps Rate Cut

June 20 2024 - 4:04AM

RTTF2

The Swiss franc weakened against other major currencies in the

European session on Thursday, after the Swiss National Bank lowered

its key policy rate by 25 basis points for the second consecutive

meeting, citing easing underlying inflationary pressures.

The SNB policy board, headed by Thomas Jordan, decided to cut

the policy rate to 1.25 percent from 1.50 percent. The new rate

will take effect on June 21.

The SNB had unexpectedly reduced its rate by a quarter point at

the March meeting and became the first major central bank to ease

the policy in the current cycle.

Banks' sight deposits held at the central bank will be

remunerated at the SNB policy rate up to a certain threshold, and

at 0.75 percent above this threshold, the bank said today.

In the European trading now, the Swiss franc fell to two-day

lows of 0.9554 against the euro and 177.78 against the yen, from

early highs of 0.9482 and 179.07, respectively. If the Swiss franc

extends its downtrend, it is likely to find support around 0.97

against the euro and 173.00 against the yen.

Against the pound, the franc slid to a 3-day low of 1.1320 from

an early two-day high of 1.1221. The GBP/CHF pair may test support

near the 1.15 region. The Bank of England left its key interest

rate unchanged at 5.25 percent, as expected, on Thursday.

The franc dropped to a three-day low of 0.8911 against the U.S.

dollar, from an early high of 0.8831. On the downside, 0.90 is seen

as the next support level for the CHF/JPY pair.

Looking ahead, Canada new housing price index for May, U.S.

building permits for May, housing starts for May, weekly jobless

claims, U.S. Philadelphia Fed manufacturing index for June and U.S.

EIA crude oil data are slated for release in the New York

session.

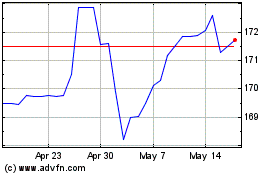

CHF vs Yen (FX:CHFJPY)

Forex Chart

From May 2024 to Jun 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Jun 2023 to Jun 2024