Renault Group: Renaulution, now Revolution

|

Press ReleaseNovember 8,

2022#Renaulution |

| |

| |

Renault Group CMD PR_Renaulution Now Revolution

Renaulution,

now Revolution

Live conference at 9 :00 Paris time available

on www.renaultgroup.com

Towards

a Next Gen automotive

company:

-

Significantly ahead of its initial targets, Renault Group opens the

third chapter of its Renaulution plan:

Revolution

-

Renault Group revolutionizes itself focusing resources on the value

chains arising from the transformation of the automotive and

mobility industry: electric vehicles (EV), software, new mobility

services, circular economy, in addition to ICE & hybrid

vehicles

-

Renault Group aims at becoming a Next Gen automotive

company built on 5 focused businesses addressing all the

new value chains:

-

Ampere: the first EV & Software pure player

born from an OEM disruption

-

Alpine: a high-end zero-emission global brand with

a racing pedigree. A unique asset-light model combined with

proprietary technologies

-

Mobilize: built around a leading financial

services company to enter the market of new mobility, energy and

data-based services

-

The Future Is NEUTRAL: the first 360° circular

economy company in the automotive industry from closed loop in

materials to battery recycling

-

Power: the traditional core

business of Renault Group will continue to develop innovative low

emissions ICE & hybrid vehicles under the Renault, Dacia and

Renault LCV brands, each with their dedicated organization and

governance. To reinforce and project this part of the business into

the future, we announce the creation of a leading worldwide Tier 1

supplier of ICE & hybrid powertrain technologies (Horse

project)

Building

an open

partnerships

ecosystem

to enable future

growth:

-

By creating such leading powertrain technology company, Renault

Group and Geely are combining their technological, manufacturing

and R&D assets. Renault Group will own 50% of this company

representing revenues of €15 billion globally from Day 1

-

Ampere: envisaged IPO on Euronext Paris earliest

H2 2023 (subject to market conditions) with Renault Group keeping

strong majority and the support of potential strategic cornerstone

investors (including Qualcomm Technologies, Inc.)

-

Renault Group has built deep partnerships with 2 major tech

players, Google and Qualcomm

Technologies, to create game-changing technologies

that will enable the development of

Software-Defined

Vehicle (SDV) including

Centralized Electronic Architecture and Car OS

-

Alpine is set to expand globally with half of its

future growth outside of Europe leveraging commercial partnerships

and investors support. Alpine is open to capitalize on the

financial valuation of its F1 Team assets

-

Light Commercial Vehicles (LCV) to launch, in partnership with an

OEM, a game changing EV & software-defined family of vans:

FlexEVan. It allows real-time, end-to-end

operations monitoring and data-driven fleet management. FlexEVan’s

disruptive concept and technology will ensure -30% total cost of

usage for mobility operators

Solid financial

outlook entering

in a new era:

-

Financial outlook 2025-2030:

-

Operating margin: above

8% in 2025 and above 10%

by 2030

-

Free cash-flow: above €2

billion per year on average over 2023-2025 and

above €3 billion per year on average

over 2026-2030

-

Dividend policy: Renault Group

plans to restore dividend payment from 2023 (for 2022 FY – pending

Shareholders’ General Meeting approval). This dividend policy, a

first for Renault Group, will gradually grow, in a disciplined

manner, up to 35% payout ratio of Group

consolidated net income – parent share, in the mid-term. To do so,

the Group must achieve its first priority: return to an

investment grade rating

-

Ambition to grow

employees’

shareholding to 10% by 2030

“Today’s

announcements are a new

sign of Renault

Group

team’s

determination

to prepare

the company

for the future

challenges and

opportunities generated

by the

transformation

of our industry.

After having

executed

one of the

fastest and

unexpected

recovery

plans, after

having prepared

the company for

growth by

securing the

development

of the best

product

line-up

in

decades,

we intend to

position

ourselves faster

and stronger

than

competition

on the new

automotive value

chains:

EV,

software,

new

mobility and

circular

economy.

We focus

full-fledged

teams on each of

the automotive and mobility value

chains. We design an

agile and innovative

organization to

manage the

volatility and

fast technological

evolution of our

times.

Speed,

accountability,

transparency, and

specialization

for excellence are the key

words.

Renault

Group

is one

team of

teams,

benefiting from

simplified

governance and

digital management

platforms boosting

collaboration

and breaking

silos

typical

of traditional

organizations.

Allocating

up to 10%

of the capital to

our

employees,

will contribute to foster a

new common

culture oriented to

value

creation.

We believe also

in cooperation

when it comes to

invest,

create and

scale new

businesses and

technologies.

This is the core of our horizontal

approach, and

the network of

leading partners

that are

participating in

our different

projects,

is the

proof of

the quality of

our

initiatives.

All this is

one of

the most

progressive

re-engineering

projects of the recent

years in our

industry,

a Revolution in

its

kind." said

Luca de Meo,

Chief Executive

Officer of Renault Group.

“What the Group has

achieved in terms of financial turnaround in just 2 years is

outstanding and we will not stop here. We are bringing our

non-negotiable fundamentals – value over volume, competitiveness,

and capital efficiency – to the next level. This new corporate

architecture will allow us to improve our financial performance,

targeting benchmark profitability, free cash-flow generation and

return on capital employed. By

addressing structurally more profitable

value chains, it will

transform our business

mix and create value. Powered by

the focus on growing and cash generating businesses, our plan is

ambitious but also realistic in the light of the current

macroeconomic context. The Renaulution

plan foundation is self-financed but will be accelerated by

external fundings and partnerships enabling the access to key value

chains, to boost growth and innovation while reducing capital

requirements. All in all, the Revolution is also financial and aims

at creating value for all our stakeholders as illustrated by our

dividend policy and our target to reinforce employee

shareholding.” said

Thierry Piéton,

Chief Financial

Officer of Renault Group.

Boulogne-Billancourt, November 8, 2022

Following approval by the Board of Directors

held on November 7, 2022 under the chairmanship

of Jean-Dominique Senard, Luca de Meo, CEO of Renault Group

and Thierry Piéton, CFO of Renault Group, present today, during its

Capital Market Day, the third chapter of its Renaulution

strategy.

Until now, carmakers were evolving in an

environment of mature ICE technology and stable customer

expectations. The ongoing transformations, reshaping the automotive

industry, are driving the emergence of additional value chains:

electric vehicles (EV), software, new mobility services, and

circular economy.

Today, after Resurrection and Renovation, the

first two phases of the Renaulution strategic plan presented in

January 2021, Renault Group opens the third chapter: it launches

its Revolution with the ambition to become a

Next Gen

automotive company.

This new set-up will allow Renault Group to

capture value across all the new profit pools (estimated by

external institutions at ~€220 billion in 2030 vs €110 billion

today). To seize opportunities in these markets and to adapt to

today’s environment, Renault Group creates full-fledged and focused

organizations. It will transform its business mix by harnessing

structurally more profitable value chains. Renault Group leverages

a horizontal and ecosystemic approach to co-create, co-finance and

scale strategic initiatives with leading partners.

Now, Revolution

The guiding principles of this value driven and

ecosystemic approach are:

-

Strategic focus

-

Effectiveness

-

Smart capital allocation

-

Best partners selection

-

Asset-light by design

Renault Group is operating its own Revolution by

creating 5 focused businesses with specialized teams, each built on

a homogeneous set of technologies, with their own

governance and P&L.

These businesses are:

-

Ampere: the first EV & Software pure player

born from an OEM disruption

-

Alpine: a high-end zero-emission global brand with

a racing pedigree. A unique asset-light model combined with

proprietary technologies

-

Mobilize: built around a leading financial

services company to enter the market of new mobility, energy and

data-based services

-

The Future Is NEUTRAL: the first 360° circular

economy company in the automotive industry from closed loop in

materials to battery recycling

-

Power: the traditional core business of Renault

Group will continue to develop innovative low emissions ICE &

hybrid vehicles under the Renault, Dacia and Renault LCV brands,

each with their dedicated organization and governance

Power: innovative low

emissions ICE & hybrid vehicles

ICE & hybrid vehicles will still represent

up to 50% of passenger cars sales worldwide even by 2040.

Developing efficient technologies in that field remains key for the

future of any global OEM. Therefore, Renault Group is ensuring the

further development of its core business, with the launch of a

totally new range of Renault ICE & Hybrid (passenger cars),

Dacia and LCV – and with the creation of a worldwide supplier,

leader in ICE & hybrid powertrain technologies.

Renault Group will combine its ICE

& hybrid powertrain technologies

(Horse project) together with Geely

to create a worldwide leading

supplier

Renault Group and Geely will combine their ICE

in a 50-50 entity. This dedicated business will design, develop,

produce, and sell all ICE & hybrid powertrain components and

systems with state-of-the-art technologies. Day 1, the entity will

have a turnover of over €15 billion and a volume of 5 million units

per year, already serving 8 customers who will benefit of increased

synergies and productivity.

This entity will be full-fledged and global,

with:

-

17 plants supplying 130 countries

-

5 R&D centers in Europe (Spain, Romania and Sweden), China, and

South America for a total of 3,000 engineers

-

A total of 19,000 employees, across 3 continents

It will offer a complete portfolio of

technologies on all components: engine, gearbox, xHEV systems and

batteries at best level. Thanks to this project, Renault Group will

double both its scale and market coverage from 40% to 80%

worldwide. This growth will be fueled by geographical expansion,

with access to North America and China, and by products

complementarity to come up with complete low emissions systems and

solutions for OEMs. To do that, it will develop its technology

portfolio in the field of alternative fuels seeking for cooperation

with a potential partner from the energy industry.

Renault brand ICE

&

Hybrid:

globally uplifted

Even with the sharp rise of the EV offer, the

combustion engine vehicles will still continue to grow especially

outside of Europe. Thus, Renault brand will remain present on ICE

& hybrid markets, especially in Latin America, India, South

Korea and North Africa. Renault ICE & Hybrid passenger cars

sales will keep growing 2% per year on average over 2022-2030.

To uplift the brand in all geographies, Renault

will continue its C-segment offensive and will grow by 20% its net

revenue, while expanding its contribution margin by 30% between

2022 and 2030.

Dacia: growing

from >10% operating margin

to 15% by 2030

Dacia’s model is unique, built upon the

combination of three main components:

-

An engineering focus on design-to-cost already providing a solid

double-digit cost advantage

-

A unique industrial and sourcing footprint with a benchmark cost

competitiveness

-

An asset-light distribution model ensuring costs comparable to

agency model

-

85% retail channel mix

As a consequence, Dacia already generates an

operating margin above 10%, and aims to reach 15% by 2030.

To achieve this ambition, Dacia, currently a

B-segment champion will boldly enter the C-segment. After Jogger

this year, Dacia Bigster will embody this move and 2 other vehicles

will follow, allowing Dacia to double its profit pool coverage. In

parallel, Dacia will also keep lowering costs and will benefit from

the doubling of the volume of the global CMF-B platform across

brands which will reach 2 million units by 2030.

Dacia will contribute to reinvent the ICE value

chain through the cooperation with Horse project by developing

breakthrough powertrains adaptation for alternative & synthetic

fuels. Dacia will smoothly transition to EV in Europe by pioneering

affordable EV solutions.

LCV: propelled into the future by two

game changers

Renault Group’s LCV business relies on solid

foundations with over 5 million vehicles in European car park, an

ecosystem of over 600 dedicated Pro+ dealers, 4 plants and the most

up-to-date line-up by 2026.

Renault LCV will develop two game changing

projects to address a dynamic and changing market:

-

Hyvia: the Group’s joint-venture with Plug for

carbon-free hydrogen mobility offers a complete ecosystem, from

fuel cells vehicles, to electrolyzers, to hydrogen refueling. It

combines Plug’s H2 expertise with Renault Group’s industrial and

engineering assets. Hyvia aims for 30% of the hydrogen-powered LCV

market by 2030, in Europe and a cumulated order intake of €1

billion by 2026.

-

FlexEVan: a game changing EV & software

defined family of vans to be deployed on the market from 2026.

FlexEVan will be compact for urban use thanks to a specially

designed EV platform. FlexEVan will benefit from the SDV developed

within Ampere. The vehicle will thus become a fully connected

warehouse extension, integrated into the customer's digital

ecosystem. It will be the first vehicle to benefit from the

application of the software-defined vehicle technology at Renault

Group, allowing notably for real-time, end-to-end operations

monitoring and data-driven fleet management. FlexEVan will reduce

the total lifecycle cost of usage for the clients by at least 30%,

i.e. more than the price of the van. To support the development of

FlexEVan, Renault Group intends to create Flexis,

a partnership with a relevant partner having experience in the

sector and a complementary activity. Thanks to this partnership,

developments will be shared, meaning a significant decrease in

costs and a maximization of customers coverage.

Ampere: the

1st EV and

software pure player

born from an OEM

disruption

With Ampere, Renault Group is creating a

standalone company that will be the 1st EV and software pure player

born from an OEM disruption. Ampere will develop, manufacture, and

sell full EV passenger cars, with cutting-edge software-defined

vehicle (SDV) technology, under the Renault brand. Ampere will

bring the best of both worlds: know-how and assets from Renault

Group with the focus and agility of an EV pure player.

Based in France, Ampere will be a full-fledged

OEM with around 10,000 employees. As a tech company, Ampere will

drive innovation with around 3,500 engineers, half of them

specialized in software.

Before 2030, Ampere’s line-up of 6 electric cars

will be ideally positioned on the fastest-growing segments in

Europe covering 80% of the EV mainstream profit pool: the B segment

with the new Renault 5 Electric and Renault 4 Electric, and the C

segment with Megane E-tech Electric, Scénic Electric and 2 other

vehicles to be revealed. A large portion of the investments of the

first 4 vehicles has already been spent.

Ampere targets to produce around 1 million EVs

for the Renault brand in 2031. Ampere is a growth story, with above

30% of compound annual growth rate (CAGR) in the 10 years to

come.

Ampere relies on 3 tech backbones making it

unique in the EV and software ecosystem:

-

A high-tech and

top-competitive

manufacturing footprint: ElectriCity, already one

of the major and most competitive EV production poles in Europe: in

2025, a vehicle will be produced in less than 10 hours. 400k units

production capacity from day 1, scalable to 1 million leveraging

other Renault Group facilities, ElectriCity also offers a unique

local ecosystem with 80% of the suppliers within 300km

-

A European EV

value chain: Ampere is partnering with the most

relevant players to access to know-how, to secure sustainable

supply and to gain visibility and control on costs and performance.

Thanks to its European-based supply chain, Ampere will secure the

supply for more than 80 GWh required for its cars by 2030. From 10%

coverage of the EV value chain in 2020, it is now above 30% and

will reach 80% by 2030

-

A breakthrough

Software-Defined

Vehicle (SDV)

technology: SDV is the future of the automotive

industry, allowing the car to be constantly upgradable throughout

its lifecycle, learning from its users, and keeping the vehicle

linked from cradle to grave to the OEM. To launch its first open

and horizontal SDV in 2026, Renault Group has built deep

partnerships with 2 major tech players:

-

Qualcomm Technologies to co-develop high-performance computing

platforms based on Snapdragon Digital® Chassis™ solutions for the

Centralized Electronic Architecture. This includes System on Chip

and low layers software in addition to features, in-car services

and applications. Qualcomm Technologies, or one of its

affiliates, intends to invest in the Renault Group's dedicated

electric and software company Ampere

-

Google with whom the collaboration includes an Android-based

platform for Software-Defined Vehicle and cloud software to enable

a SDV digital twin

Building the SDV in a horizontal way is unique

in the entire industry. It reduces development time and cost.

Partnering with Google to create this open platform based on

Android allows Ampere to leverage one of the world’s largest global

ecosystem of third-party apps developers. They will come up with a

variety of services that will enrich the user experience while

accelerating the development of features through the lifetime of

the vehicle.

These partnerships will enable Renault Group to

reduce costs, improve efficiency, flexibility and speed of vehicle

developments, and increase value for end-users thanks to continuous

software innovation and updates.

Alpine: a high-end zero-emission global brand with a

racing pedigree

Over the past two years, Alpine has had a

rebirth, capitalizing on its iconic A110 sports coupé and on its

entry into Formula 1, where it aims to become a championship

contender. Today, Alpine is a true high-end brand, a full-fledged

OEM, asset-light, tech focused, a team of 2,000 people, of which

50% are engineers. Being part of the Group ensures Alpine access to

Ampere EV and Software technological assets. Looking forward,

Alpine will leverage commercial partnerships and investors support

to accelerate its growth and international expansion.

Alpine is developing a brand-new line-up that

will fuel its growth and international ambitions. It will be

full-electric from 2026. By then, Alpine will also reveal the next

A110, and 2 new models: a B-hatchback and a C+ crossover.

Alpine then plans to launch two D and E segments cutting-edge cars

to support its international expansion. As a result, we expect half

of Alpine’s growth to come from new markets beyond Europe including

potentially North America and China.

Mobilize:

built around a leading financial services

company to enter

the market of new mobility, energy and data-based

services

Mobilize is built around a core asset, Mobilize

Financial Services (MFS), one of the best financial services

providers on the market with 4 million of customers. MFS will

expand its traditional business while developing new businesses

such as subscription, insurance, and operational leasing.

Mobilize is set to become a leading and

profitable Vehicle-as-a-Service (VaaS) dedicated provider,

combining financial, mobility, energy and data-based services

supported by purpose-designed vehicles. These services, aggregated

in a one-stop-shop solution, will serve the needs of retail

customers, fleets and mobility operators while generating recurring

revenue. What makes Mobilize different from any other automotive

brand is that it comes from the services to the product and not the

other way around. Thanks to the VaaS model, Mobilize will generate

3 times more revenue during the whole vehicle lifecycle, compared

to classic sales.

The Future Is NEUTRAL: the first 360°

circular economy company in the automotive industry from

closed-loop in materials

to battery recycling

To materialize its commitment to circular

economy and to move towards resources neutrality, Renault Group

announced on October 13th the creation of a new company: The Future

Is NEUTRAL. Bringing together all the existing expertise of the

Group and its partners in this activity, this new entity offers

closed-loop recycling solutions at each stage of a vehicle's life:

supply of parts and raw materials, production, usage and end of

life. From around 50% of value chain coverage today, The Future Is

NEUTRAL aims to reach above 90% by 2030. It is set to become the

European leader at industrial scale in the closed-loop automotive

circular economy. It will service Renault Group as well as the

entire industry. In order to accelerate its development and

strengthen its leadership, The Future Is NEUTRAL is opening up

a minority of its capital to outside investors with the objective

of to co-finance investments of around €500 million until 2030.

ESG: a performance lever for Renault Group

The Group’s Revolution will see an acceleration

of its ESG trajectory representing a key driver for the operating

and financial performance of the Group.

The business re-engineering of Renault Group

will enable it to become a front-runner in the quest for carbon

neutrality and inclusive future.

On the climate front, the Group aims for

carbon neutrality in Europe in 2040 and

worldwide by 2050, adopting a

cradle to grave approach. The Group has set

intermediate carbon footprint reduction targets to lead the way,

with specific action plans for each of its businesses.

Each business has its own ESG objectives, all of

them benefitting to the Group ESG targets:

|

Power |

Ampere |

Alpine |

Mobilize |

The Future Is

NEUTRAL |

- Affordable mobility

- Up to -70%CO2 emissions per vehicle by

2030

|

- 100% EV line-up

- Carbon neutrality in production in

2025

- Local value chain

- Upskilling & reskilling

|

- 100% EV line-up by 2026

- Carbon neutrality in production by

2030

|

- 100% electric line-up

- Renewable energy

- Battery second life

|

- Car-to-car parts & materials

closed loops

- Battery recycling

- >90% coverage of the circular

economy value chain by 2030

|

In regards with the Renault Group’s tradition of

social responsibility, it will accompany the transition, upskilling

& reskilling of thousands of people towards the new value

chains of the automotive revolution. As an example, with ReKnow

University, open to the entire industry, 15,000 Renault Group’s

employees and 4,500 students and suppliers will be trained by 2025

to future auto industry skills in electric mobility, circular

economy, software and cybersecurity & data.

Cash talks

The Group’s re-engineering along 5 businesses

will be directly reflected in its financial reporting to improve

simplicity, accountability and transparency, both internally and

externally. The performances of these 5 businesses will continue to

build on the financial discipline implemented during the

Resurrection phase. The Group’s levers – value over volume,

competitiveness and capital efficiency – will be further

accelerated respectively by its new products offensive, a strong

focus on variable costs, sustainable supplier network development

and digitization. And furthermore, a unique ecosystemic partnership

approach will extend the coverage of key value chains with a low

capital intensity bias.

To face current industry unprecedented

transformation challenge, Renault Group developed an approach based

on two principles:

-

A self-financed plan, secured by strong free cash-flow generation

from its businesses

-

Partnerships or external funding to accelerate growth, innovation

or competitiveness and reduce capital requirements

Ampere: low cash-burn & external

funding

Renault Group wishes to accelerate Ampere’s

future development and propel Renault brand into its electric

future without drawing heavily on the Group’s financial resources.

In this context, the Group envisages external partners and

investors to embark on the journey with assumptions as follows:

-

Established EV player with limited cash burn. Free cash-flow above

0 in 2025

-

Open to external investors to accelerate R&D and ecosystem

development

-

Alliance scale (Renault Group, Nissan, Mitsubishi Motors): equity

participation under study

-

Envisaged IPO on Euronext Paris earliest H2 2023 (subject to market

conditions) with Renault Group keeping strong majority and the

support of potential strategic cornerstone investors (including

Qualcomm Technologies)

Horse project:

financially optimizing the ICE

& hybrid powertrain

future

From a financial standpoint, Horse project aims

at providing productivity gains, fixed costs reduction and

significant Group’s balance sheet improvement. Renault Group will

keep 50% of the entity, a level which would lead to the

deconsolidation of this activity from Renault Group’s scope and

financial statements, starting from H2 2023.

The carve-out impacts are estimated as

follows:

-

€2.5 billion fixed assets reduction

-

€1.2 billion fixed costs variabilization, per year on average and

€2.4 billion reduction in R&D and Capex from 2023 to 2030

-

Powertrain cost competitiveness: €2.5 billion from 2023-2030.

Positive impact as early as 2024

-

A dividend stream corresponding to Renault Group retained

ownership

-

A potential future capital gain

Financial outlook per business: profit & cash are

king

|

|

Power |

Ampere |

Alpine |

Mobilize |

The Future Is NEUTRAL |

|

Value proposition |

Cash-flow generation |

Profitable growth & innovation with low execution risk |

Internationallygrowing high-end anchor |

Recurring services revenue with high margins |

Sustainable & profitable growth |

|

Revenue |

- +4% CAGR 2022-2027

- -4% CAGR 2027-2030

|

- >30% CAGR 2022-2030

- ~1 million vehicles in 2031

- 11% R&D Capex (in % of revenue, on average, 2022-2030)

|

- 40% CAGR 2022-2030

- €2 billion revenue in 2026

- >€8 billion revenue in 2030

|

- +8% CAGR 2022-2025

- +14% CAGR 2026-2030

|

- From €0.8 billion revenue in 2022 to >€2.3 billion1 in

2030

|

|

Operating margin |

- ~+3pts auto operating margin 2022-2025

|

- Breakeven in 2025

- ~10% in 2030

|

- Breakeven in 2026

- >10% in 2030

|

- MBA2: breakeven by 2025 and double-digit by 2027

- MFS2: high double-digit operating margin

|

|

1 The Future Is NEUTRAL outlook: Total Scope,

Sum of the Parts – not entirely within Renault Group scope of

consolidation 2 MBA: Mobilize Beyond Automotive; MFS: Mobilize

Financial Services

Renault Group

financial

outlook: new

heights!

Renault Group aims to reach the following

targets:

- Operating

margin: above 8% in 2025 and above 10% by 2030

-

Free cash-flow: above €2 billion per year on average over 2023-2025

and above €3 billion per year on average over 2026-2030

-

Free cash-flow will include Mobilize Financial Services dividend

projected to be above €500m per year on average (subject to

regulatory and MFS board approvals)

-

R&D and Capex: capped at the maximum of 8.0% of revenue over

2022-2030

-

ROCE: above 30% from 2025

Furthermore, Renault Group confirms its 2022 FY

financial outlook with:

- A Group

operating margin above 5%

-

An Automotive operational free cash-flow above €1.5 billion

Reinstating the dividend

Renault Group plans to restore dividend payment

from 2023 (for the 2022 full year – pending Shareholders’ General

Meeting approval). This dividend symbolizes a new era and then will

gradually grow in a disciplined manner up to 35% payout ratio of

Group consolidated net income – parent share, in the mid-term. To

do so, the Group must achieve its first priority which is to turn

back to an investment grade rating.

Capital allocation policy:

implementing a balanced capital

allocation

Renault Group aims at using at least 50% of the

excess cash generated to reinvest in the Group. Looking forward,

Renault Group intends to be more active on financial investments,

in line with its ecosystemic approach, but limiting them to maximum

15% to 20% of its free cash-flow.

For the remaining cash allocation, aside from

dividend, the Group wishes to associate its employees to its

performance to foster a common sense of belonging to the project

and nurture a culture of value. Through dedicated employees’

shareholding programs, it ambitions to see the employee

shareholding portion grow to 10% of the Group capital by 2030.

Existing bonds will remain under Renault SA, the

issuer of the industrial activities of the Group. Each business

could use financing instruments depending on its own needs and

strategy.

Alliance

Renault Group, Nissan and Mitsubishi Motors are

currently engaged in discussions to jointly address the new

challenges and opportunities driving the future of the automotive

industry, which include:

-

An agreement on a set of strategic common initiatives across

markets, products, and technologies

-

Nissan and Mitsubishi Motors consideration to invest in Ampere

which will support Renault Group’s Renaulution strategy and will be

one of the strategic steps towards Nissan Ambition 2030 and

Mitsubishi Motors strategy

-

Structural improvements to ensure sustainable Alliance operations

and governance

*

* *

This plan will be presented to employee

representative bodies in accordance with applicable

regulations.

The presentation is available on

www.renaultgroup.com.

* *

*

About Renault Group

Renault Group is at the forefront of a mobility

that is reinventing itself. Strengthened by its alliance with

Nissan and Mitsubishi Motors, and its unique expertise in

electrification, Renault Group comprises 4 complementary brands -

Renault, Dacia, Alpine and Mobilize - offering sustainable and

innovative mobility solutions to its customers. Established in more

than 130 countries, the Group has sold 2.7 million vehicles in

2021. It employs nearly 111,000 people who embody its Purpose every

day, so that mobility brings people closer. Ready to pursue

challenges both on the road and in competition, Renault Group is

committed to an ambitious transformation that will generate value.

This is centred on the development of new technologies and

services, and a new range of even more competitive, balanced and

electrified vehicles. In line with environmental challenges, the

Group’s ambition is to achieve carbon neutrality in Europe by

2040.https://www.renaultgroup.com/en/

| RENAULT

GROUP

INVESTORRELATIONS |

|

Philippine de

Schonen+33 6 13 45 68 39philippine.de-schonen@renault.com

|

|

|

| RENAULT

GROUP PRESS RELATIONS

PRESSE |

|

Frédéric Texier+33

6 10 78 49 20frederic.texier@renault.com |

Astrid de

Latude+33 6 25 63 22 08astrid.de-latude@renault.com |

|

Disclaimer

This press release contains forward-looking

statements. All statements other than statements of historical fact

included in this press release are forward-looking statements.

Forward-looking statements give the current expectations and

projections of Renault Group relating to its financial condition,

results of operations, plans, objectives, future performance and

business. These statements may include, without limitation, any

statements preceded by, followed by or including words such as

“target,” “believe,” “expect,” “aim,” “intend,” “may,” “estimate,”

“plan,” “project,” “will,” “should,” “would,” “could” and other

words and terms of similar meaning or the negative thereof. Such

forward-looking statements involve known and unknown risks,

uncertainties and other important factors beyond Renault Group’

control that could cause the Renault Group’ actual results,

performance or achievements to be materially different from the

expected results, performance or achievements expressed or implied

by such forward-looking statements. These risks and uncertainties

include those discussed or identified under Chapter 4 of the

Universal Registration Document of Renault Group, filed with the

French Autorité des marchés financiers (AMF) on 24 March 2022 and

available on the Company’s website (www.renaultgroup.com) and the

AMF’s website (www.amf-france.org). Such forward-looking statements

are based on numerous assumptions regarding Renault Group’ present

and future business strategies and the environment in which it will

operate in the future. Accordingly, readers of this press release

are cautioned against relying on these forward-looking statements.

These forward-looking statements are made as of the date of this

press release. In addition, the forward-looking financial

information included in this press release has not been audited by

Renault Group’s statutory auditors.

This press release does not contain or

constitute an offer of securities for sale or an invitation or

inducement to invest in securities in France, the United States or

any other jurisdiction.

- Renault Group CMD PR_Renaulution Now Revolution

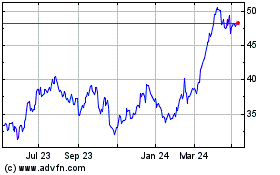

Renault (EU:RNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

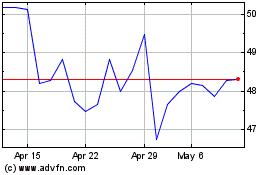

Renault (EU:RNO)

Historical Stock Chart

From Apr 2023 to Apr 2024