Guerbet: Revenue at 30 June 2019

July 25 2019 - 11:45AM

Guerbet: Revenue at 30 June 2019

Revenue of €400.6 million for the

1st half of the year, in line with annual

targets:

- +2.8% at current exchange rates

- +1.8% at constant exchange rates

Villepinte, 25 July

2019 – Guerbet (FR0000032526 GBT), a

global specialist in contrast agents and solutions for medical

imaging, today reported €400.6 million in revenue for the

first half of 2019 at 30 June, up 2.8% compared with the first half

of 2018, including a favourable forex impact of €4.1 million.

Taken at constant exchange rates, sales were €396.5 million,

up 1.8%.

After a good Q1 2019, the Group anticipated

a slower second quarter (-1.5% at current exchange rates compared

with Q2 2018). This decrease was related to the planned

reduction of a subcontracting agreement inherited from the CMDS

businesses (third-party business representing 2.8% of Group revenue

in the first half of the year). This non-strategic agreement

contributes very little to the Group’s operating profitability.

Excluding the impact of the decrease in the subcontracting

business, revenue growth at constant exchange rates was 3.1% for

the first half of the year and stable in Q2 compared with the same

periods last year.

The growth in the first half of 2019 was

consistent with the annual objective of moderate sales growth.

Consolidated Group revenue

(IFRS)

| In

millions of euros,at 30 June |

Change

(%) |

2019at current exchange

rates |

Change

(%) |

2019at constant exchange

rates* |

Published 2018 |

|

Sales in Europe |

+1.6% |

176.1 |

+2.9% |

178.3 |

173.3 |

|

Sales in Other Markets |

+3.8% |

224.5 |

+0.9% |

218.2 |

216.3 |

|

Total 1st half revenue |

+2.8% |

400.6 |

+1.8% |

396.5 |

389.6 |

In Europe, first-half revenue at constant

exchange rates increased +2.9%.

Our sales continued their upward trajectory in

the United States, as no Dotarem® generic was launched in that

market. Sales are increasing in Asia as a result of the switch to

direct distribution in Japan as well as good sales in South

Korea.

Diagnostic Imaging revenue grew

2.2% to €351.9 million at constant exchange rates. At current

exchange rates, revenue totalled €354.6 million at 30

June.

These figures show:

- 1.8% growth for the MRI division** to

€135.9 million at constant exchange rates and like-for-like

period and scope (€136.4 million at current exchange rates).

The first-half activity reflects the growth of Dotarem®, still

driven by the United States and partially offset by a lasting

adverse effect associated with the gradual withdrawal of Optimark

from the market.

- The CT/Cath Lab** division’s 3% sales growth

to €211 million at constant exchange rates thanks to the good level

of sales of Optiray® and despite the decline in Xenetix® sales. At

current exchange rates, revenue totalled €212.9 million for

the first half of the year.

Interventional Imaging, the

Group’s growth driver, generated €33.8 million in revenue at

constant exchange rates, up 15.9%. At current exchange rates, sales

were €34.9 million.

Targets unchanged

The change in activity in the first half of 2019

was in line with the annual targets. The Group expects sales to

grow at a moderate pace. Sales of Dotarem® are expected to continue

to grow despite the extension of generics to new countries.

Optiray® sales should continue to grow, especially in Japan. The

sales of DraKon™ and SeQure® microcatheters will act as a growth

driver for the Group’s Interventional Imaging business when sales

come on stream in the United States and then in Europe with a CE

marking obtained in April 2019.

* At constant exchange rates:

amounts and rates of growth are calculated by cancelling out the

exchange rate effect, which is defined as the difference between

the indicator’s value for period N, converted at the exchange rate

for period N-1, and the indicator’s value for

period N-1.** As a reminder, the MRI and

CT/Cath Lab divisions now include sales of injection systems and

related services.

Upcoming events:

Publication of 2019 half-year earnings25

September 2019 after trading

About Guerbet

Guerbet is a pioneer in the contrast-agent

field, with more than 90 years’ experience, and is a leader in

medical imaging worldwide. It offers a comprehensive range of

pharmaceutical products, medical devices, and services for

diagnostic and interventional imaging to improve the diagnosis and

treatment of patients. With 8% of revenue dedicated to R&D and

more than 200 employees distributed across its four centres in

France, Israel, and the United States, Guerbet is a substantial

investor in research and innovation. Guerbet (GBT) is listed on

Euronext Paris (segment B – mid caps) and generated

€790 million in revenue in 2018. For more information about

Guerbet, please visit www.guerbet.com.

Forward-looking statements

Certain information contained in this press

release does not reflect historical data but constitutes

forward-looking statements. These forward-looking statements are

based on estimates, forecasts, and assumptions, including but not

limited to assumptions about the current and future strategy of the

Group and the economic environment in which the Group operates.

They involve known and unknown risks, uncertainties, and other

factors that may result in a significant difference between the

Group’s actual performance and results and those presented

explicitly or implicitly by these forward-looking statements.

These forward-looking statements are valid only

as of the date of this press release, and the Group expressly

disclaims any obligation or commitment to publish an update or

revision of the forward-looking statements contained in this press

release to reflect changes in their underlying assumptions, events,

conditions, or circumstances. The forward-looking statements

contained in this press release are for illustrative purposes only.

Forward-looking statements and information are not guarantees of

future performance and are subject to risks and uncertainties that

are difficult to predict and are generally beyond the Group’s

control. These risks and uncertainties include but are not limited

to the uncertainties inherent in research and development, future

clinical data and analyses (including after a marketing

authorisation is granted), decisions by regulatory authorities

(such as the US Food and Drug Administration or the European

Medicines Agency) regarding whether and when to approve any

application for a drug, process, or biological product filed for

any such product candidates, as well as their decisions regarding

labelling and other factors that may affect the availability or

commercial potential of such product candidates. A detailed

description of the risks and uncertainties related to the Group’s

businesses can be found in Chapter 4.4 “Risk Factors” of the

Group’s Registration Document filed with the French Financial

Markets Authority (AMF) under number D-18-0387 on 25 April

2018, available on the Group’s website (www.guerbet.com).

For more information about Guerbet, please visit

www.guerbet.com

Contacts

| Jerome

EstampesChief Financial

Officer+33 (0)1 45 91 50 00 |

Financial

CommunicationsBenjamin

Lehari+33 (0)1 56 88 11 25blehari@actifin.fr PressJennifer

Jullia+33 (0)1 56 88 11 19jjullia@actifin.fr |

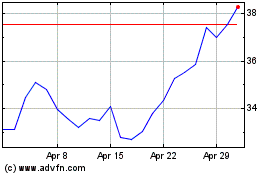

Guerbet (EU:GBT)

Historical Stock Chart

From Jun 2024 to Jul 2024

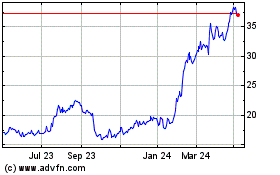

Guerbet (EU:GBT)

Historical Stock Chart

From Jul 2023 to Jul 2024