Results for fiscal year 2020/2021

December 07 2021 - 11:41AM

Results for fiscal year 2020/2021

Group posts best ever

earnings

Recurring EBITDA : €388.2

million

Net profit : €174.0

million

The Board meeting of December 7, 2021, chaired

by Mr. Daniel Derichebourg, approved the parent company and

consolidated financial statements for the year ended September 30,

2021. During the meeting, the Chairman and CEO expressed his

satisfaction with the results of the Group’s various business

lines, and more particularly those of the Environmental Services

division, which benefited from a booming market driven by global

economic recovery and from the successful integration of the

Spanish businesses acquired in late 2019.

Revenue: €3.6 billion

Revenue for the fiscal year 2020/2021 was €3.6 billion, up 46.8%

year on year. Environmental Services revenue grew by 68.6% and

Multiservices revenue by 4.2%.

|

(in thousand tons) |

09/30/2021 |

09/30/2020 |

Change |

|

|

|

|

|

|

Ferrous metals |

3,964.1 |

3,159.2 |

25.5% |

|

Non-ferrous metals |

626.6 |

552.3 |

13.4% |

|

Total volumes |

4,590.7 |

3,711.5 |

23.7% |

|

|

|

|

|

|

(in millions of euros) |

09/30/2021 |

09/30/2020 |

Change |

|

|

|

|

|

|

Ferrous metals |

1,339.3 |

681.9 |

96.4% |

|

Non-ferrous metals |

1,122.8 |

692.7 |

62.1% |

|

Services |

282.3 |

252.8 |

11.7% |

|

Environmental Services revenue |

2,744.4 |

1 627.4 |

68.6% |

|

Multiservices revenue |

871.5 |

836.2 |

4.2% |

|

Holding company revenue |

0.4 |

0.4 |

0.7% |

|

Total Revenue, Derichebourg Group |

3,616.3 |

2,464.1 |

46.8% |

Environmental Services

The volume of ferrous scrap metals sold

increased by 25.5% (up 23% at constant scope).

Several factors underlay this sharp growth:

- a favorable comparison base, deliveries having been low in the

first quarter of fiscal 2019/2020 and April/May 2020 when France

went into its first lockdown,

- sustained demand for ferrous metals, including from blast

furnaces, as they help reduce their CO2 emissions,

- robust year-round demand from Turkish steel mills, keeping

volumes and selling prices up,

- the late resumption of activity at some of the blast furnaces

shut down during the first wave of the health crisis last year,

which created shortages of certain products, and, for those where

this is possible, prompted a shift in demand toward steel from

electrical mills. This development drove up ferrous metal selling

prices from January 2021 and prices stayed high thereafter.

The volume of non-ferrous metals sold increased

by 13.4% (up 11% at constant scope).

The prices of ferrous and non-ferrous metals

sold were much higher than last year, resulting in a 68.6% increase

in Environmental Services revenue.

Multiservices

The jump in Cleaning business revenue (up 12% in

France, 22% in Spain and 7% in Portugal) more than offset a drop in

revenue from the aeronautics business, particularly temporary work,

mostly during the first half-year. Revenue rose 4.2% to €871.5

million.

Recurring EBITDA1

EBITDA grew in all business lines, powering a

€207.3 million (114.6%) increase in Group EBITDA to €388.2

million.Unit margins rose on the back of rising prices and this,

combined with a tight grip on operating costs despite rising sales

and an additional contribution from local authority service

contracts, boosted recurring EBITDA in the Environmental Services

business by 138% to €338.5 million or 12.3% of revenue, the

best ever margin in this business line.Recurring EBITDA in the

Multiservices business rose 17% to €51.4 million giving an EBITDA

margin of 5.9%, again the best ever for the division.

Recurring operating profit

(loss)2

After allowing for €125.0 million of

depreciation and amortization, recurring operating profit was

€263.2 million, up 322%.

Operating profit (loss)

With few non-recurring items to report over the

fiscal year, operating profit amounted to €262.7 million, up

367.8%. Operating profit is up by 170% compared to 2019 or

2018.

Net profit for the year attributable to

the shareholders of the consolidating entity

The net profit attributable to shareholders was

€174 million, up 716.1% year on year.

Dividends

The Board of Directors will propose to the

General Meeting the payment of a dividend of €0.32 per share,

representing 29.3% of net profit attributable to shareholders and

equivalent to a dividend yield of 3.5% based on the share’s closing

price at November 30, 2021.

Outlook

Trading conditions remained favorable throughout

October and November 2021, with a slight dip in volumes but prices

remaining generally high despite a fall in non-ferrous metals

prices in November. Two months into the new fiscal year, earnings

are ahead of last year.

The long-term fundamentals underlying the

Group’s businesses are favorable:

- Healthy demand for recycled raw materials for manufacturing

metals via a secondary recycling process that avoids CO2

emissions,

- A continuing trend towards outsourcing among Multiservices

customers, with demand for bids that include a CSR and digital

component.

Short term, there are a number of risks, not all

of which will materialize as some are mutually exclusive. This

makes the general environment a little riskier than a few months

ago:

- resurgence of the COVID pandemic and its potential impact on

the global economy,

- high energy prices that could lead some customers to cut back

their output,

- ongoing shortage of semi-conductors, which is working its way

up the production chain and could impact output by Group

customers.

The Group remains confident in its fundamentals,

solid financial structure, reactivity in times of crisis and now

proven ability to integrate new businesses and is trading in a

market where demand for recycled metals is set to remain

strong.

Update on Ecore acquisition

Derichebourg Environnement filed its

notification of concentration on October 26, 2021 and proposals for

structural commitments to the European Commission on November 25,

2021. At the date of this press release, negotiations with the

Commission on these commitments are ongoing. So as not to impact

these negotiations, additional information will be published once

the situation has been precisely determined. Derichebourg expects

to complete the deal by end-December 2021.

Annexe 1 : INCOME STATEMENT

|

(in millions of euros) |

09/30/2021 |

09/30/2020 |

Change |

|

|

|

|

|

|

Revenue |

3,616.3 |

2,464.1 |

46.8% |

|

of which Environmental Services |

2,744.4 |

1,627.4 |

68.6% |

|

of which Multiservices |

871.5 |

836.2 |

4.2% |

|

|

|

|

|

|

Recurring EBITDA |

388.2 |

180.9 |

114.6% |

|

of which Environmental Services |

338.5 |

142.2 |

138.0% |

|

of which Multiservices |

51.4 |

44.0 |

17.0% |

|

|

|

|

|

|

Recurring operating profit (loss) |

263.2 |

62.4 |

322.0% |

|

of which Environmental Services |

242.0 |

52.5 |

361.2% |

|

of which Multiservices |

26.1 |

18.1 |

44.1% |

|

|

|

|

|

|

Net non-current items |

(0.5) |

(6.2) |

|

|

|

|

|

|

|

Operating Profit (loss) |

262.7 |

56.2 |

367.8% |

|

|

|

|

|

|

Net financial expenses |

(16.7) |

(12.3) |

|

|

Other financial items |

0.5 |

(2.3) |

|

|

|

|

|

|

|

Profit before tax |

246.5 |

41.5 |

493.5% |

|

|

|

|

|

|

Income tax |

(71.3) |

(19.5) |

|

|

Income from associates |

0.3 |

0.4 |

|

|

Income from discontinued or held-for-sale activities |

|

|

|

|

Net profit (loss) attributable to non-controlling interests |

(1.5) |

(1.1) |

|

|

|

|

|

|

|

Net profit attributable to shareholders |

174.0 |

21.3 |

716.1% |

Annexe 2 : BALANCE SHEET

|

(in millions of euros) |

09/30/2021 |

09/30/2020 |

Change (%) |

|

Goodwill |

266.2 |

261.1 |

|

|

Intangible assets |

5.6 |

7.5 |

|

|

Property, plant and equipment |

501.1 |

497.7 |

|

|

Voting rights |

216.1 |

190.2 |

|

|

Financial assets |

10.2 |

10.0 |

|

|

Equity interests in associates and joint ventures |

12.5 |

12.6 |

|

|

Deferred taxesOther assets |

28.00.4 |

31.1 |

|

|

Total non-current assets |

1,040.1 |

1,010.1 |

3.0% |

|

Inventories |

136.6 |

105.3 |

|

|

Trade receivables |

396.6 |

309.9 |

|

|

Tax receivables |

6.6 |

4.1 |

|

|

Other assets |

78.5 |

68.3 |

|

|

Financial assets |

19.4 |

15.4 |

|

|

Cash and cash equivalents |

787.5 |

361.9 |

|

|

Financial instruments |

0.1 |

|

|

|

Total current assets |

1,425.2 |

865.0 |

64.8% |

|

Total non-current assets and groups of assets |

|

|

|

|

Total assets |

2,465.3 |

1,875.1 |

31.5% |

| |

|

|

|

| |

|

|

|

|

(in millions of euros) |

09/30/2021 |

09/30/2020 |

Change (%) |

|

Group shareholders’ equity |

699.3 |

521.6 |

|

|

Non-controlling interests |

3.8 |

2.6 |

|

|

Total shareholders’ equity |

703.1 |

524.2 |

34.1% |

|

Loans and financial debts |

826.0 |

572.2 |

|

|

Provisions for pensions and similar benefits |

49.2 |

50.8 |

|

|

Other provisions |

34.9 |

33.4 |

|

|

Deferred taxes |

25.5 |

23.2 |

|

|

Other liabilities |

6.3 |

3.2 |

|

|

Total non-current liabilities |

941.9 |

682.6 |

38.0% |

|

Loans and financial debts |

157.3 |

130.9 |

|

|

Provisions |

2.3 |

4.6 |

|

|

Trade payables |

374.2 |

254.5 |

|

|

Tax payables |

7.1 |

4.7 |

|

|

Other liabilities |

277.1 |

271.2 |

|

|

Financial instruments |

2.2 |

2.3 |

|

|

Total current liabilities |

820.3 |

668.2 |

22.8% |

|

Total liabilities related to a group of assets held for sale |

|

|

|

|

Total liabilities |

2,465.3 |

1,875.1 |

31.5% |

Annexe 3 : Change in net financial debt from September

30, 2020 to September 30, 2021

| Net

financial debt 09/30/2020 |

341.1 |

| Recurring

EBITDA |

(388.2) |

|

Investments |

122.1 |

| Net financial

expenses |

16.7 |

| Corporate

income taxes |

65.8 |

| Change in

working capital requirements |

0.9 |

| Other |

3.1 |

| Subtotal |

161.5 |

| Dividends |

0.0 |

|

Acquisitions |

5.6 |

| New rights of

use from operating leases |

28.6 |

| |

|

| Net

financial debt 09/30/2021 |

195.7 |

1 Recurring EBITDA = Recurring operating profit (loss) + net

depreciation and amortization on tangible and intangible assets,

and right-of-use assets

2 Recurring operating profit (loss) = Operating profit (loss)

+/- non-recurring items

- Results for fiscal year 2020-2021

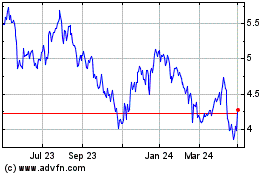

Derichebourg (EU:DBG)

Historical Stock Chart

From Oct 2024 to Nov 2024

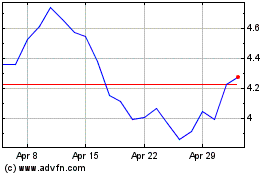

Derichebourg (EU:DBG)

Historical Stock Chart

From Nov 2023 to Nov 2024