By Stu Woo and Maarten van Tartwijk

VELDHOVEN, the Netherlands -- ASML Holding NV, a little-known

company based next to corn fields here, may hold the answer to a

question hanging over the global semiconductor industry: how to

make chips do more while keeping them the same, compact size.

The industry's past prowess has been codified into what's been

called Moore's Law, named after an observation Intel Corp.

co-founder Gordon Moore first made in 1965. He postulated that chip

makers could double the number of transistors in -- and boost the

performance of -- a typical microprocessor every two years.

Last year, though, Intel Chief Executive Brian Krzanich warned

that after decades of incredible leaps, that timeline was slipping

closer to every 2.5 years. Some in the industry feared the eventual

death of Moore's Law, a rule of thumb underpinning modern

computing.

ASML believes its breakthrough technology can postpone the

demise. "I'm not concerned yet about the next 10-plus years," said

Hans Meiling, who oversees ASML's effort trying to solve this

problem.

Many in the industry, including big backers like Intel itself

and Samsung Electronics Co., are hoping ASML can quicken the pace

of innovation once again. With around 15,000 employees and EUR6.3

billion ($7.05 billion) in revenue last year, the company

manufactures equipment that makes chips -- specializing in a field

called photolithography. Specifically, ASML uses light rays to

essentially lay out billions of transistors -- the brain cells of a

chip -- in a microprocessor.

Optical experts such as Canon Inc. and Nikon Corp. are also

active in this market, but ASML dominates it. For the past decade,

ASML has been focused on making more sophisticated light rays,

which it uses to create smaller transistors that can be packed more

tightly onto silicon wafers.

"It is hugely important for the [semiconductor industry's]

ability to continue Moore's Law," said Greg McIntyre of Imec, a

Belgium-based chip-research institute. ASML's latest chip-making

machines could be a big commercial leap forward in this pursuit, he

said.

To get an idea of the scale of the challenge: A strand of human

hair is about 75,000 nanometers in width. The current

industry-standard chip-making machine produces a light ray that

draws 38-nanometer-wide lines. ASML's technology, called extreme

ultraviolet lithography, or EUV, draws lines that have a width of

16 nanometers.

Here's how the process works: Manufacturers first melt silicon,

an abundant material found in beach sand and prized for its

semi-conductive properties, allowing for a controlled flow of

electricity. The melted silicon is cooled into a sausage-like

structure, which is then sliced into thin wafers that look like an

LP record and given a photosensitive coating. Then chip makers,

using thin light rays, draw a grid of lines.

Imagine those grids of lines as streets in a city. Chemicals

etch away the "streets," and the remaining "buildings" essentially

become transistors. Compared with conventional machines, ASML's EUV

tools make those streets narrower, and thus the buildings smaller.

That means more transistors, and more computing power.

By packing more transistors on chips, manufacturers could

increase their computing speed or memory-storage capacity, among

other things. ASML's new technology may keep Moore's Law in

play.

Four years ago, ASML's EUV technology was considered so

promising that Intel, Samsung and Taiwanese Semiconductor

Manufacturing Co. pledged to invest a combined $6 billion in ASML.

Samsung in September sold half of its ASML shares to raise cash,

but said its EUV partnership with the company wouldn't change.

ASML started in the early 1980s as a joint venture co-founded by

electronics giant Royal Philips NV. In the 1990s, it spun off from

Philips and made rudimentary versions of the chip-making equipment

it sells today. Now, all major chip makers use its machines.

ASML, Canon and Nikon all produce conventional machines, which

sell for between about $55 million and $60 million apiece. They can

make the smaller grids as the EUV machines do, but only after a

number of time-consuming workarounds.

The newest machines from ASML, which cost about EUR95 million

each, aren't yet perfect. The company has sold 12 and is currently

working with those buyers to optimize the machines at the chip

makers' sites. ASML said it expects companies to start using the

machines for high-volume production by 2018 or 2019.

"It's a combination of physics, chemistry and mechanics that is

pretty complex," said Mr. Meiling, who has a doctorate in physics

and oversees ASML's EUV program. "It has taken us a long time to

get where we are."

No rival has the research-and-development budget to attempt to

compete with ASML's EUV business, but the Dutch company still faces

a challenge in getting new orders, said Bernstein Research analyst

Pierre Ferragu. Chip makers "will all hesitate until the last

minute about the best approach to introduce EUV in their production

lines," said Mr. Ferragu, especially given the "uncertainties" with

the "extremely complex technology."

Intel isn't yet convinced. The company has been testing ASML's

EUV systems and published positive results, but is also prepared to

continue using the time-consuming trick.

One of ASML's many challenges is keeping the machine running 24

hours a day -- the sort of efficiency chip-making customers prize.

The machines use specks of liquid tin, which when properly

stimulated emits the EUV light. Sometimes, though, that tin

contaminates the mirrors used to project the light rays, requiring

maintenance.

ASML acknowledges it still has some way to go. It says its EUV

machines can make about 1,500 wafers a day and can be relied on to

be operational more than 80% of the time. Its conventional machines

produce more than 5,000 wafers a day -- but with thicker lines, at

least before the tedious workarounds -- and are available 95% of

the time. Customers demand that the EUV machines run at least 90%

of the time.

"We're not there yet," said ASML's Mr. Meiling.

Write to Stu Woo at Stu.Woo@wsj.com and Maarten van Tartwijk at

maarten.vantartwijk@wsj.com

(END) Dow Jones Newswires

October 02, 2016 15:30 ET (19:30 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

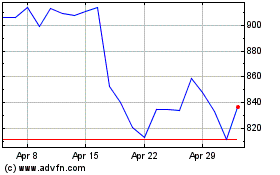

ASML Holding NV (EU:ASML)

Historical Stock Chart

From Jul 2024 to Aug 2024

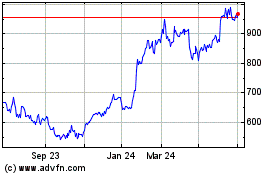

ASML Holding NV (EU:ASML)

Historical Stock Chart

From Aug 2023 to Aug 2024