Antin Agrees to Invest in GTL Leasing, the Leading Lessor of Hydrogen Midstream Equipment in North America Acquisition Marks NextGen Fund I’s Sixth Investment

June 20 2024 - 7:30AM

Business Wire

Regulatory News:

Antin Infrastructure Partners (Paris:ANTIN) announces today that

it has agreed to acquire a majority stake in GTL Leasing, the

leading lessor of gaseous hydrogen transportation and storage

equipment in North America. GTL represents the sixth investment for

NextGen Fund I, its second in North America and first in the

rapidly expanding hydrogen industry. GTL adds another next

generation infrastructure theme to the fund which already has

investments in smart grids (SNRG and PearlX), EV charging (Powerdot

and RAW Charging) and recycling (JV with Enviro Systems and

Michelin).

Founded by Michael Koonce in 2013, GTL is a technology-agnostic

equipment lessor which has developed one of the largest fleets of

high-pressure gaseous trailers and cylinders in North America, used

mainly to transport and store hydrogen and other industrial gases.

GTL leases equipment to leading utility, mobility, transportation,

energy and industrial companies. With facilities in both California

and Oklahoma, GTL offers integrated maintenance and re-testing

services of its equipment for clients to comply with rigorous

certification requirements.

GTL benefits from significant tailwinds within the North

American hydrogen market, especially the sharply increasing demand

for low-carbon H2 in the zero-emission logistics and material

handling end markets. Antin’s investment will significantly enlarge

the platform, broaden its product portfolio and allow GTL to pursue

a robust pipeline of opportunities with blue chip customers. GTL’s

management team, led by Michael Koonce, who will remain CEO, will

continue to leverage its significant operational experience and

extensive relationships throughout the hydrogen industry.

Michael Koonce, GTL Leasing’s CEO and founder, stated: “With

Antin as our long-term strategic partner, we are well positioned to

accelerate our market leading position in specialized hydrogen

equipment leasing to include cryogenic hydrogen transport and

storage, compressor/dispenser platforms for fuel cell electric

vehicle growth and fuel cell generators. We will continue to

deliver operational excellence and provide flexibility to our

customers. Antin’s experience in the transport and energy sectors

will bring valuable expertise and collaboration.”

Delisa Leighton, President of GTL Leasing, noted: “This

significant capital investment by Antin will allow us to meet our

customers’ real time infrastructure needs including the many

transit agencies transitioning their fleets to hydrogen-powered

vehicles which are in need of storage, compression and fueling

solutions.”

Nathalie Kosciusko-Morizet and Stephan Feilhauer, NextGen

Partners at Antin, commented: “We are very pleased to have GTL

Leasing join Antin’s growing platform in North America, which now

includes seven investments across our Flagship, Mid Cap and NextGen

strategies. This acquisition aligns perfectly with our vision of

driving sustainable energy solutions and the ‘grey to green’

transition in logistics.”

Armistead Street Capital Partners served as strategic advisor to

GTL Leasing on the transaction, and Moscone Emblidge & Rubens

LLP served as legal counsel. Orrick, Herrington & Sutcliffe LLP

provided legal counsel to Antin.

With no material conditions precedent outstanding, closing of

the transaction is anticipated to occur within the next month.

About GTL Leasing

GTL Leasing was established in 2013 and has grown exponentially

over the last ten years to become the leading lessor of

high-pressure gaseous hydrogen transport and storage equipment.

Though hydrogen transports represent the majority of GTL’s fleet,

GTL also leases trailers that contain other gases such as breathing

air, nitrogen and compressed natural gas. GTL provides customers

with short- and long-term operating leases which typically include

maintenance services provided by its team of highly skilled

in-house technicians. GTL has facilities in Catoosa, Oklahoma and

Livermore, California.

About Antin Infrastructure

Partners

Antin Infrastructure Partners is a leading private equity firm

focused on infrastructure. With over €31 billion in assets under

management across its Flagship, Mid Cap and NextGen investment

strategies, Antin targets investments in the energy and

environment, digital, transport and social infrastructure sectors.

With offices in Paris, London, New York, Singapore, Seoul and

Luxembourg, Antin employs approximately 220 professionals dedicated

to growing, improving and transforming infrastructure businesses

while delivering long-term value to portfolio companies and

investors. Majority owned by its partners, Antin is listed on

Euronext Paris (Ticker: ANTIN – ISIN: FR0014005AL0).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240620917587/en/

Media Contacts Antin

Infrastructure Partners Nicolle Graugnard, Communication

Director Email: media@antin-ip.com

Ludmilla Binet, Head of Shareholder Relations Email:

shareholders@antin-ip.com

Brunswick Email: antinip@brunswickgroup.com Tristan

Roquet Montegon +33 (0) 6 37 00 52 57 Gabriel Jabès +33 (0) 6 40 87

08 14

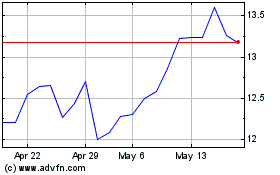

Antin Infrastructure Par... (EU:ANTIN)

Historical Stock Chart

From May 2024 to Jun 2024

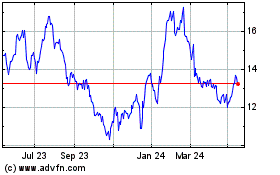

Antin Infrastructure Par... (EU:ANTIN)

Historical Stock Chart

From Jun 2023 to Jun 2024