CeFi Users Want To Explore DeFi: Uniswap Survey Uncovers New Wave Of Adoption

May 18 2023 - 3:00PM

NEWSBTC

Uniswap Labs, a leading decentralized finance (DeFi) platform, has

recently conducted a survey to understand the motivations and

barriers of US-based retail users towards DeFi. The survey received

1,860 responses, including non-crypto, centralized finance (CeFi),

and DeFi users. The survey revealed that despite the bear market

backdrop, nearly half of CeFi users expressed an interest in

experimenting with DeFi protocols in the next 12 months. This

finding is encouraging as it indicates a growing interest in DeFi

among traditional finance users, who are willing to learn and

explore the possibilities of on-chain activity. Related Reading:

Internet Computer (ICP) Dips, Will Bearish Momentum Persist?

Uniswap Survey Points to A Shift from CeFi To DeFi However,

the survey also highlighted that complexity, lack of understanding,

and costs are the main barriers preventing CeFi users from using

DeFi platforms for all their cryptocurrency trades. This finding

underscores the importance of providing educational material,

improved user experience, and support to overcome the learning

curve associated with DeFi. But how is Uniswap Labs simplifying

DeFi for CeFi users? Seamless User Interface: Uniswap Labs has a

user-friendly interface that allows users to easily navigate the

platform and execute trades with a few clicks. This contrasts

traditional DeFi platforms, which can be overwhelming for new

users. Automated Market Making (AMM): Uniswap Labs uses an AMM

system that eliminates the need for order books and allows users to

easily swap tokens at a fair market price, simplifying the trading

process and eliminating the need for users to understand complex

trading concepts. Self-Custody: Uniswap Labs strongly emphasizes

self-custody, meaning users have complete control over their assets

and do not rely on centralized custodians. While this may seem

daunting initially, Uniswap Labs provides educational resources and

support to help users understand the benefits of self-custody. With

this, Uniswap Labs, which builds products to onboard people

directly to DeFi, aims to bridge the gap between CeFi and DeFi by

focusing on UX and considering the first steps as a gateway into

the broader crypto ecosystem. By doing so, Uniswap Labs seeks to

provide CeFi users with a more transparent, self-custodial, and

publicly verifiable alternative to centralized finance platforms

that often lack accountability and transparency. Transaction Fees

And Costs Identified As Biggest Barriers Transaction fees and costs

were also identified as notable barriers to entry. However, as

Ethereum continues to scale and layer 2 solutions see greater

adoption, DeFi will become more economically accessible for

price-sensitive users, according to Uniswap’s blog post. The survey

also revealed that better educational resources and increased user

support would increase willingness among CeFi users to trade on

DeFi platforms. Products targeting this CeFi segment have already

invested in these educational resources. Uniswap Labs has assembled

one of the few customer support teams in crypto, considered one of

the best in the industry. For this, Uniswap Labs is exploring layer

2 scaling solutions that will significantly reduce transaction fees

and increase the speed of transactions. This will make DeFi more

economically accessible and user-friendly for price-sensitive

users. Related Reading: Ripple CTO Addresses Controversy

Surrounding BitBoy’s BEN Token Sell-Off Overall, Uniswap Labs’

survey sheds light on the motivations and barriers of US-based

retail users towards DeFi. The platform aims to simplify and

abstract the complexities unique to crypto without compromising on

the ideals of self-custody and transparency. As the industry

continues to grow, it is important to prioritize user education and

support to help users build their knowledge base and grow their

confidence. Featured image from iStock, chart from

TradingView.com

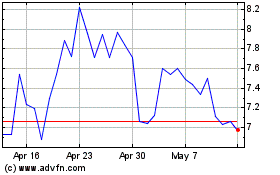

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Apr 2024 to May 2024

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From May 2023 to May 2024