Has Bitcoin Price Broken Out Of Downtrend Resistance? BTCUSD Analysis October 6, 2022

October 06 2022 - 5:30PM

NEWSBTC

In this episode of NewsBTC’s daily technical analysis

videos, we examine a possible breakout of Bitcoin price on

linear scale. We also compare the breakout on logarithmic scale to

determine if the signal might be a reliable sign the bottom could

be in. Take a look at the video below: VIDEO: Bitcoin Price

Analysis (BTCUSD): October 6, 2022 Related Reading: Bitcoin Bulls

Snap Back With The Bollinger Bands | BTCUSD Analysis October 5,

2022 Is This The Bitcoin Breakout We’ve Been Waiting For? Bitcoin

price has broken out of an important downtrend line on linear

scale. The downtrend line connects the peak at $68K, the top in

March at $48K, and several recent rejections. On the lowest

timeframes, Bitcoin has pushed outside of this diagonal sloping

trend line. Before bulls begin to celebrate, BTCUSD is best charted

on logarithmic scale. Switching to log scale immediately makes

the trend line seem obsolete. Moving the trend line across the same

turning points in the market, produces a lot less steep of a

downtrend line. Linear scale breakout leaves room leftover in log

scale | Source: BTCUSD on TradingView.com BTCUSD Momentum

Comparison Using The MACD And LMACD The standard MACD tool also

makes sense to use with a linear scale chart. But if you want more

direct comparisons of momentum across larger time scales, you also

need to use a logarithm version of the tool. Using the regular

MACD to compare past price action isn’t practical. The LMACD also

tends to provide more reliable signals. For example here, Bitcoin

has already crossed bullish on the MACD long ago, while the LMACD

is only about to confirm after several more weeks of sideways. The

MACD and linear scale (left) versus the LMACD and log scale (right)

| Source: BTCUSD on TradingView.com Related Reading: Bitcoin Bounce

Coincides With Possible Macro Reversal | BTCUSD Analysis October 4,

2022 Why The Log Scale Shows Several More Weeks Of Crypto Winter A

historical view of linear scale versus log scale shows the

difference between the two types of charts across BTCUSD price

action. On the linear chart, anything prior to 2017 looks like a

flat line, meanwhile there were price swings of thousands of

percent up and 80 to 90% down several times over. But again, there

is that breakout. Comparing the same type of breakout during past

bear markets shows that there is very little significance on linear

scale. In 2018, BTC broke out of several downtrend resistance

lines, only to form new ones. In 2014, BTC made it out of the

downtrend, only to later retest the line as resistance turned

support. Diagonal downtrend lines in log scale are endlessly more

reliable. The log downtrend lines in linear scale show that Bitcoin

has a lot more to go before it breaks free of this crypto winter.

Bitcoin probably has a lot more to go before a viable breakout |

Source: BTCUSD on TradingView.com Learn crypto technical analysis

yourself with the NewsBTC Trading Course. Click here to access the

free educational program. Follow @TonySpilotroBTC on Twitter or

join the TonyTradesBTC Telegram for exclusive daily market

insights and technical analysis education. Please note: Content

is educational and should not be considered investment

advice. Featured image from iStockPhoto, Charts from

TradingView.com

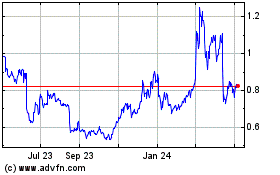

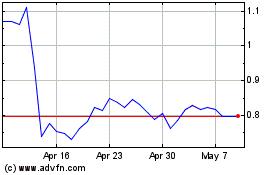

EOS (COIN:EOSUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

EOS (COIN:EOSUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024