Grayscale Victory Sends Bitcoin Open Interest Surging After Hitting One-Year Lows

August 30 2023 - 7:00PM

NEWSBTC

Over the last couple of weeks, the Bitcoin open interest had been

on a downtrend that sent it toward one-year lows. However, with the

Grayscale victory against the SEC coming on Tuesday, August 29, and

sending a positive wave across the entire region, open interest in

the digital asset has begun to surge once more. Bitcoin Open

Interest Pulls A Quick Reversal On-chain data tracking platform

Kaiko reported on Tuesday, August 29, that the Bitcoin open

interest had been on the decline for a while. In the chart shared

by the tracker, it is obvious that this BTC metric had previously

fallen significantly since 2022. Related Reading: Is Vitalik

Buterin Selling His ETH Stash? Let’s Take A Look At His

Transactions 🤔📈#BTC open interest continued declining last week

after the Aug 17 sell-off, hitting its lowest level since the

collapse of Terra in May 2022.🗓️ pic.twitter.com/M5L07ReabY — Kaiko

(@KaikoData) August 29, 2023 As August drew to a close, the open

interest in the digital asset eventually declined to levels not

seen since the Terra network collapse back in May 2022. This

suggested that it could be a good chance to get into Bitcoin and it

would be proven true not too long after. On the same day, news

broke that Grayscale had triumphed over the United States

Securities and Exchange Commission (SEC) in court over its bid for

its Spot Bitcoin ETF filing to be reconsidered. This triggered a

rapid uptrend in the price of the digital asset and the open

interest followed suit. According to data from Coinglass, the

Bitcoin open interest is seeing double-digit growth on some

exchanges already. The open interest on the dYdX exchange is up

over 35%, and the cumulative open interest across all exchanges is

now in the green, rising 9.55% in the last 24 hours. Open interest

recovers following Grayscale win | Source: Coinglass Does This Mean

BTC Will Continue The Uptrend? For now, the price of Bitcoin is

still purely driven by the hype from the Grayscale victory. This

means that there is no telling how long the uptrend will last and

when it will start correcting downward. However, as long as

investors remain optimistic about the victory, BTC will continue to

enjoy green days. Related Reading: XRP Price Faces Immense Sell

Pressure That Could Trigger 20% Decline As for open interest, a

recovery isn’t always a good thing as it opens up an avenue for

shorters to enter the market. For example, a look at Keiko’s chart

shows open interest was high leading up to the FTX collapse in

2022. Then in early 2023 when the price of Bitcoin was rallying,

open interest fell before picking up steam once more. For now, BTC

is still enjoying the spike in attention. The price of the

cryptocurrency is up 5.35% in the last 24 hours to trade at

$27,349. BTC retraces after touching $28,000 | Source: BTCUSD on

Tradingview.com Follow Best Owie on Twitter for market insights,

updates, and the occasional funny tweet… Featured image from

Unsplash, chart from TradingView.com

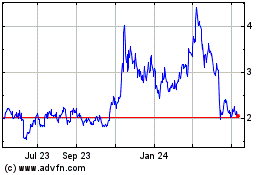

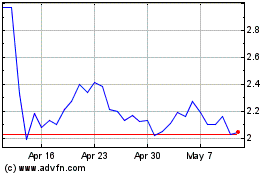

dYdX (COIN:DYDXUSD)

Historical Stock Chart

From Apr 2024 to May 2024

dYdX (COIN:DYDXUSD)

Historical Stock Chart

From May 2023 to May 2024