TIDMWIL

RNS Number : 4979P

Wilmington PLC

18 February 2021

18 February 2021

Wilmington plc

('Wilmington', 'the Group' or 'the Company')

Financial results for the six months ended 31 December 2020

Wilmington plc, the provider of data, information, education and

networking services in Risk & Compliance, Healthcare and

Professional knowledge areas, today announces its half year results

for the six months ended 31 December 2020.

Financial Highlights

* Revenue for the period GBP55.1m (2019: GBP59.5m),

despite no face-to-face events or training, only a

small organic decline of 5% compared to the prior

period, which was not impacted by Covid-19

o Excluding events, revenue increased 1%

* Adjusted profit before tax [1] GBP7.0m (2019:

GBP6.9m) up 1%

o Cost savings from the move to virtual were greater than the fall in

revenue

* Statutory profit before tax GBP5.5m (2019: GBP4.1m),

increase due to one off gain on sale of subsidiary

* Dividend reinstated under new dividend policy at 2.1p

(2019: nil) based on FY21 profits, FY21 furlough to

be repaid

* Adjusted basic earnings per share 2 6.44p (2019:

6.36p) up 1%

* Statutory basic earnings per share of 5.05p (2019:

3.59p)

* Strong cash conversion 3 of 118% (2019: 83%) driven

by favourable working capital movements

* Group net debt at 31 December 2020 of GBP23.2m (31

December 2019: GBP41.3m; 30 June 2020 GBP27.7m)

Operational Highlights

* Data and information businesses, representing 54% of

group revenue, remained resilient and underpinned a

positive underlying revenue performance

* Risk & Compliance division organic revenue growth of

5% against a strong prior period comparator

o Conversion to virtual highly successful, strong growth in ICA Singapore

* Healthcare division revenue declined 10% on an

organic basis, but excluding events revenue increased

6%

* Professional division declined 13% on an organic

basis

o Operating profit increased 3%

o Closure and sale of CLT England and CLT Scotland completed

* Strong demand for digital products demonstrates

continued need for our offering

* Value of investments realised to deliver operational

excellence in four key pillars of growth: sales and

marketing, product management, people, and technology

* New non-executive director, William Macpherson,

joined the Board in February 2021, bringing a wealth

of experience and expertise in the executive

education sector.

Mark Milner, Chief Executive Officer, commented:

"As we continue to navigate the challenges posed by the Covid-19

pandemic, the last six months represent Wilmington's first period

delivering the entire product portfolio on a digital basis.

Excluding events, we have delivered organic growth as a group, with

our face-to-face training activities transitioning very

successfully to digital formats. The resilient performance

demonstrates our ability to successfully drive progress against our

strategic objectives whilst operating as a digital-first

enterprise.

We expect H2 trading to be almost entirely virtual and like most

businesses we are currently unable to predict when normal business

will resume. As a fully digital business, demand for our products

remains strong and we have an acute focus on remaining relevant to

our customers. As we enter the second half, our resilient

performance, along with the opportunity we see ahead, has given the

Board confidence to return to paying a dividend and to repay the UK

furlough support we have received in FY21."

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement this inside information is now considered to be in the

public domain.

For further information, please contact:

Wilmington plc

Mark Milner, Chief Executive Officer

Guy Millward, Chief Financial Officer 020 7490 0049

FTI Consulting

Charles Palmer / Dwight Burden / Emma Hall

/ Debbie Oluwaseyi Sonaike 020 3727 1000

1 Adjusted profit before tax - see note 4

2 Adjusted earnings per share - see note 6

3 Cash conversion - see note 8

Notes to Editors

Wilmington plc is the recognised knowledge leader and partner of

choice for data, information, education and networking in Risk

& Compliance, Healthcare and Professional areas. Wilmington

employs close to 1,000 people and sells to around 120 countries.

Wilmington is listed on the main market of the London Stock

Exchange.

Operational and Strategic Review

Introduction

We are pleased to report on another period of progress for

Wilmington which has reinforced the value of our diversified

portfolio, driven by our agile teams and resilient business model.

Despite ongoing challenges posed by the Covid-19 pandemic, demand

for our products remains strong as our customers continue to rely

on us to help them operate successfully. Adjusted profit before tax

was above the prior year and we achieved good cash generation which

gives the Board the confidence to return to paying a dividend to

shareholders.

The Risk & Compliance division delivered an impressive

performance over the period, achieving 5% organic revenue growth.

This growth was driven by the Compliance business ICA, which

continued to see high demand for regulatory compliance training and

qualifications.

Revenue in the Healthcare division declined 10% on an absolute

basis, a result that was anticipated due to the division making up

the majority of our events revenue in the prior year comparative.

Encouragingly, the data and information services in this division

performed well over the period, with the core business excluding

events increasing revenue by 6%.

Revenue for the Professional division was down 13% on an organic

basis, reflecting the conversion of all training to virtual

alternatives, albeit at a higher gross margin. There was good

take-up of digital formats in the Law for Non-Lawyers and

Investment Banking sectors, offset by weakness in take-up in the

Accountancy sector. However, this transition facilitated cost

savings and therefore operating profit in the period increased.

Results and dividend

Revenue of GBP55.1m was down GBP4.4m or 7.4%. When adjusted for

the closure and disposal of Central Law Training England and

Scotland respectively, and taking into account the minor impact of

currency movements, the organic decline in revenue was 5.4% which

was wholly attributable to face-to-face events not being held

during the period.

Adjusted profit before tax of GBP7.0m (2019: GBP6.9m) was up on

last year, due to the impact of reduced revenue being offset by

significant cost savings. Aside from direct cost savings arising

from events not being run, this result reflects higher margins

achieved through digital product delivery.

Cash generation in the period was strong, with significant

headroom on our facility retained throughout the period. Net debt

at 31 December of GBP23.2m was down from GBP27.7m at 30 June 2020

and GBP41.3m at 31 December 2019.

We have honoured our commitment to reinstate the dividend based

on the expected full year performance, albeit at a rebased level

due to the ongoing challenges of Covid-19. The dividend

reinstatement reflects the robust position of the business in the

current year and will be a payment based on FY21 profits, and

therefore the Board consider it appropriate to simultaneously repay

the UK government assistance received in FY21 of GBP0.2m. The

interim dividend will be 2.1p (2019: nil) and will be paid on 8

April 2021 to shareholders on the share register as at 26 February

2021, with an associated ex-dividend date of 25 February 2021.

Strategic progress

Following our rapid transition to becoming a digital first

enterprise, we continue to focus on organic growth by investing in

our business and actively managing our portfolio. The progress made

against our strategic objectives during the period demonstrates the

benefit of recent investment in the four core areas of operational

excellence identified in our business model as the key pillars of

sustainable growth. Our teams continue to demonstrate exceptional

levels of creativity and motivation, and it is their commitment to

quality that differentiates our offering and ensures it remains

crucial to the future success of our customers.

The innovation that drives our growth is facilitated by

excellence in technology and data. At its core Wilmington is

increasingly a data-led business supported by strong digital

capabilities, and it was these capabilities that enabled the rapid

acceleration of our digitisation strategy last year. As we move

forward, we are relentlessly focussed on maintaining excellence in

this area to ensure we maximise the return on recent investment in

our IT infrastructure, CRM, learning management systems and data.

We will continue to focus on our data science and advanced

analytics activities through our centralised data function. As our

customers adapt and establish new ways of working in a

post-Covid-19 economy, our ambition is to create value as a fully

digital enterprise whilst retaining the flexibility to deliver our

products in face-to-face or hybrid formats as our customers

demand.

The execution of dynamic sales and marketing strategies are

essential to ensuring we realise the full potential of our product

portfolio. Work to enhance our sales capabilities is ongoing and

has created a much more proactive sales culture, encouraging our

teams to identify new opportunities and customers whilst

simultaneously nurturing existing client relationships. In the

period we delivered training to all UK sales leaders through the

Wilmington Sales Academy, with the second phase of the programme

already underway. We have also made significant progress in respect

of our plans to harness the potential of enhanced sales KPI data.

The processes we implemented in the prior year to develop more

detailed and robust sales data are now yielding high quality,

business specific information to inform our sales strategy. This

data provides detailed insights into sales trends, which we use to

substantiate targets and drive improvements in performance.

As we continue to enhance our product portfolio, we have

established a robust product management framework to achieve best

practice. Our comprehensive new product development process has

created a strong ethos around product creation and enhancement in

which customers are at the heart of the conversation, informing our

priorities as we expand our offering. Many of the exciting

opportunities approved by our Investment Committee over the past

year have now reached their launch phase, and we are already seeing

the benefit of these initiatives being rolled out across the

group.

During the period we successfully launched the first of a series

of iterative releases of our new learning Digital Hub. The Hub

provides customers with a dynamic user interface where they can

browse, purchase, and receive our training products in one place,

as well as receiving personalised content, access to a community

platform, and specific insights aligned to their individual

learning requirements. The Digital Hub development programme also

aligns to our ambition to achieve greater cross-group

collaboration; the solution will be used in several Wilmington

businesses allowing us to gain benefits from new product solutions

being shared across the portfolio. As part of our commitment to

deliver innovative and engaging digital learning solutions, we have

installed our first dynamic virtual classroom into our Fort Dunlop,

Birmingham, UK office, and we are progressing well with plans to

replicate the facility in other locations later in the year. The

facility is in testing and will go live in March.

The creativity, adaptability and dedication of our people is

critical to our success. Strong employee engagement is central to

this, and during the period we continued to respond to issues

raised by our last employee engagement survey, and subsequently

launched a follow up survey to ensure we are effectively capturing

the issues that matter most to our people. Participation was 87%

and there has been an encouraging overall increase in engagement

from 6.7 to 7.6 out of 10.

Our top priority in the period has been to support wellbeing as

we continue to adapt to remote working and the ever-changing needs

of the business, whilst also managing the personal impacts of the

Covid-19 pandemic. We provide a wide range of resources, including

our Global Employee Assistance Programme, UK access to a Digital GP

service, and a frequently updated library of webinars, workshops

and information dedicated to wellbeing issues. During the period,

29 of our employees qualified as Mental Health First Aiders; every

part of the group is now supported by a Mental Health First Aider

and, alongside a series of workshops and talks delivered by leading

experts, we are confident that this programme will help us to

promote the importance of mental health awareness within our

organisation, and to foster a culture of openness around the

issue.

Following the launch of our Global Diversity and Inclusion

Working Group early in the year, all members participated in a

dedicated training programme before using our summer employee

engagement survey to gain insights into the perspectives and

priorities of the workforce and to draw on these insights in order

to develop a targeted action plan. The work of the group, which has

executive sponsorship, is ongoing and we are committed to

supporting their progress to ensure that we remain relentlessly

focussed on promoting a culture that exhibits freedom from

discrimination in any form. Diversity and Inclusion is a key

element of our sustainability strategy, and the activities of the

working group will contribute to the ongoing development of this

strategy as we look to progress it by performing an ESG materiality

assessment in the second half.

On 11 February 2021 we welcomed to the Board a new non-executive

director, William Macpherson. William brings a wealth of experience

to Wilmington following a successful executive career as CEO of a

number of professional education and skills development

organisations. He was CEO of QA between 2008 and 2019 during which

time the company achieved very significant growth. Prior to that he

was CEO of Kaplan International, The Financial Training Company and

Wolters Kluwer Professional Training. He is a non-executive

director and chairman of Learning Curve Group Limited, Chair of

Hatcham College Academy and a non-executive director of the London

Film School. W e are keenly looking forward to benefiting from his

experience and expertise in areas highly relevant to the next phase

of our growth and development plans .

Portfolio management

We continue to derive benefits from our diversified portfolio,

notably the resilience that this diversity has brought in the past

year. However, we remain focussed on actively managing the

portfolio by assessing the potential of each business to exhibit

the six common Wilmington characteristics that we recognise as key

drivers of organic growth. As we announced in the 2020 annual

report, we concluded that CLT, our business in the Law for Lawyers

market, did not align with our aspirations for future growth.

Following a strategic review of the two component parts of this

business, we made the difficult decision to close the CLT England

business from 31 August 2020, and we engaged in a sale process for

the CLT Scotland business. This process was successfully completed

in December 2020 when the business was sold to the University of

Law.

Current trading and outlook

We expect trading in H2 FY21 to be almost entirely virtual and,

like most businesses, are not currently able to predict when

business will return to normal allowing us to resume face-to-face

activities where our clients wish us to. The business has proved

resilient through this difficult period and from what we see today,

notwithstanding external factors outside of our control, our

short-term performance should continue in the vein of our H1

performance.

Financial Review

Adjusting items, measures and adjusted results

Reference is made in this financial review to adjusted results

as well as the equivalent statutory measures. Adjusted results in

the opinion of the Directors can provide additional relevant

information on future or past performance where equivalent

information cannot be presented using financial measures under

IFRS. Adjusted results exclude adjusting items, gains on sales of

subsidiaries and amortisation of intangible assets (excluding

computer software).

Variances described below as 'organic' are after adjusting for

acquisitions, disposals and business closures and are at constant

currency exchange rates.

Overview

H1 2020 H2 2019 Absolute variance Organic variance

GBP'm GBP'm GBP'm % %

Revenue 55.1 59.5 (4.4) (7%) (5%)

Adjusted EBITA 7.8 7.9 (0.1) (2%) (3%)

Adjusted Profit Before

Tax 7.0 6.9 0.1 1% 1%

Adjusted EBITA margin 14.1% 13.3%

Despite a six-month period, which was fully impacted by the

Covid-19 pandemic with a comparator period which was not impacted,

the overall revenue performance has been strong. Adjusting for the

closure and disposal of CLT England and CLT Scotland respectively,

revenue has fallen 5% or GBP3.2m. This fall is fully attributable

to the events businesses which now make up just 4% of total revenue

(2019: 8%; full year 2020: 10%). Excluding events revenue which

fell 65% on H1 FY20, revenue has increased 1% on an organic basis.

Revenue from training remained flat despite the need to convert all

training to virtual equivalents, and data and information revenue,

which now represents 54% of our revenues (full year 2020: 51%),

increased by 2%.

The cost savings generated by the transition from face-to-face

to virtual delivery of training and events in the period have fully

mitigated the fall in revenue, resulting in Adjusted profit before

tax increasing by 1% from the same period last year.

Risk & Compliance

H1 2020 H1 2019 Absolute Organic

Variance Variance

Revenue GBP'm GBP'm

Compliance 15.1 14.1 7% 8%

Risk 6.4 6.5 (0%) (1%)

Total 21.5 20.6 5% 5%

Operating

profit 6.4 6.1 5% 5%

Margin 29.7% 29.6%

Overall revenue for the Risk & Compliance division was up 5%

on both an absolute and organic basis at GBP21.5m (2019: GBP20.6m).

This was a strong performance in the period with no face-to-face

training or events able to take place. Within this, revenue in the

Compliance businesses combined grew 7% on an absolute basis and 8%

on an organic basis once the impacts of currency were adjusted for.

This reflected a strong performance in Singapore in the main

Compliance business, ICA, offset by a decline in the other

Compliance businesses which were impacted by the lack of

face-to-face events in the period and by the timings of course

launches. The Risk businesses reported a small decline in the

period due to H1 face-to-face events which were not able to take

place, excluding events Risk revenue was up year on year.

Divisional operating profit was up 5% on an absolute and organic

basis to GBP6.4m (2019: GBP6.1m) reflecting the increase in

revenue. Operating margin remained stable at 29.7% (2019:

29.6%).

Healthcare

H1 2020 H1 2019 Absolute Organic

Variance Variance

Revenue GBP'm GBP'm

European Healthcare 14.2 14.5 (2%) (3%)

US Healthcare 1.5 3.1 (51%) (50%)

Other Information Businesses 3.2 3.5 (7%) (7%)

Total 18.9 21.1 (10%) (10%)

Operating profit 1.1 1.3 (14%) (21%)

Margin 5.7% 5.9%

Overall revenue for the Healthcare division declined 10% on an

organic basis and 10% on an absolute basis to GBP18.9m (2019:

GBP21.1m). Healthcare is the division which encompasses the

majority of our events revenue and the decline is wholly

attributable to the lack of face-to-face events. The data and

information services which make up the remainder of the division's

revenue have encouragingly held up well, with events excluded,

revenue in the Healthcare division increased by 6%. The Other

Information businesses saw a continued slow decline in their legacy

portfolio. This reduction was compounded by the impact of Covid-19

on events and some customer groups being severely impacted.

The fall in revenue was partially mitigated by cost savings

resulting in a fall in operating profit of 14% or 21% on an organic

basis and operating profit margins reducing slightly to 5.7% (2019:

5.9%).

Professional

H1 2020 H1 2019 Absolute Organic

Variance Variance

GBP'm GBP'm

Revenue

Ongoing businesses 14.0 16.1 (13%) (13%)

CLT 0.6 1.7 (68%) (68%)

Total 14.6 17.8 (18%) (13%)

Operating profit 2.8 2.7 3% 5%

Margin 19.3% 15.3%

Overall revenue for the Professional division was down 18% at

GBP14.6m (2019: GBP17.8m). On an organic basis, adjusting for CLT

England and CLT Scotland which were closed down and disposed of

respectively in the period, the revenue reduction was 13%. This

organic decline was driven by the conversion of all training in the

Professional division from primarily face-to-face to entirely

virtual which although resulted in a drop in revenue also reduced

costs associated with training and resulted in operating profit

increasing in the period.

Following on from the strategic review the decision was made to

close the vast majority of CLT England, and trading ceased in

August 2020. CLT Scotland, which remained profitable, was sold in

the period resulting in a gain on disposal in the income statement

of GBP770,000 which has been classed as other income. See note 7

for details.

Operating profit in the Professional division increased by

GBP0.1m to GBP2.8m (2019: GBP2.7m) due to the savings discussed

above. Operating margins as a result increased to 19.3% (2019:

15.3%).

Adjusted operating profit ('Adjusted EBITA')

The fall in revenue in the period was mitigated by savings

generated by virtual delivery. This resulted in Adjusted EBITA

falling by only GBP0.1m or 2% on an absolute basis and 3% on an

organic basis.

Adjusting items within operating expenses, amortisation

excluding computer software and Other income

Adjusting items within operating expenses were GBP0.6m (2019:

GBP0.5m). They represent those items that in the opinion of the

Directors are one-off in nature and which do not represent the

ongoing trading performance of the business. The amount recognised

in the period reflects costs associated with the closure of CLT

England. Amortisation of intangible assets (excluding computer

software) was GBP1.7m (2019: GBP2.4m), the fall driven by some

historic assets becoming fully amortised. Other income represents

the gain on sale of CLT Scotland. Full details can be found in note

7.

Finance costs

Net finance costs fell GBP0.2m or 20% to GBP0.8m (2019: GBP1.0m)

driven primarily by lower net debt levels when compared to the same

period last year.

Profit before taxation

The above movements have resulted in a Profit before tax of

GBP5.5m (2019: GBP4.1m). This has been impacted by significant

one-off items in the period, adjusting for these, Adjusted profit

before tax is up 1% at GBP7.0m (2019: GBP6.9m).

Taxation

The tax charge is GBP1.1m (2019: GBP0.9m) with an overall

effective tax rate 4 of 20% compared to 23% in the prior period.

The fall in effective tax rate was due to the gain on sale of CLT

Scotland not being subject to corporation tax. The underlying tax

rate 5 which ignores the tax effects of adjusting items remained

essentially flat at 20% (2019: 20%), which is a good guide to the

expected full year underlying tax rate.

Earnings per share

Adjusted basic earnings per share increased by 1% to 6.44p

(2019: 6.36p), owing to the increase in adjusted profit before tax.

Statutory basic earnings per share were 5.05p compared to 3.59p in

2019 with the increase driven by the one-off gain on sale of

CLS in the period.

Trade and other receivables

Trade and other receivables decreased GBP4.6m to GBP23.6m (2019:

GBP28.2m) due primarily to the cancellation of some large events at

the start of H2, which last year were billed in H1 and were

therefore reflected in working capital at December 2019.

Trade and other payables

The overall trade and other payables balance increased GBP4.4m

to GBP54.5m from GBP50.1m at 31 December 2020. Within this,

subscriptions and deferred revenue decreased by GBP3.6m to GBP26.5m

(2019: GBP30.1m), driven by a reduction in events, which are billed

further in advance than many of our other revenue types and the

closure and disposal of CLT England and CLT Scotland.

Excluding subscriptions and deferred revenue, trade and other

payables increased GBP8.0m which was driven by UK VAT and payroll

tax payments being delayed last financial year. A repayment plan is

in place for these and they will be fully settled by the end of

this financial year. Additionally, staff bonus payments in relation

to the previous financial year which would usually have been paid

in September, were delayed and have been paid in January 2021,

albeit at a reduced level.

Net debt and cashflow

Net debt, which includes cash and cash equivalents, bank loans

(excluding capitalised loan arrangement fees) and bank overdrafts,

was GBP23.2m (30 June 2020: GBP27.7m; 31 December 2019: GBP41.3m).

Cash generation of GBP4.5m compared to a cash outflow of GBP7.5m in

the same period last year as a result of no dividend being paid in

H1 this year, plus favourable timings of supplier payments and UK

corporation tax payments returning to normal levels following the

government changing the schedule of payments for large companies

last year, which effectively resulted in a doubling of payments in

H1 of the prior year. Additionally, no deferred consideration was

paid this year compared to GBP1.4m in the prior period.

Cash conversion was 118% (2019: 83%) driven by favourable

working capital movements.

Dividend

On the basis of the strong profit and cash generation, as well

as confidence in the outlook for the group, an interim dividend of

2.1p per share (2019: nil) will be paid on 8 April 2021 to

shareholders on the share register as at 26 February, with an

associated ex-dividend date of 25 February 2021.

As this dividend will be paid in respect of the financial year

ended 30 June 2021 the Board feels it is appropriate to repay all

amounts received from the UK government's furlough scheme in

respect of this financial year. In the prior financial year we

announced that we had agreed a partial relaxation of the covenants

attached to our banking facilities and GBP15.0m of additional

facilities had been put in place through the Government's

Coronavirus Large Business Interruption Scheme ('CLBILS') to

provide us with cover if the economic situation was to further

deteriorate. As these worst-case scenarios have not occurred, in

recognition of our confidence in the business and to allow us to

resume dividend payments, we have reverted to our original covenant

agreements and repaid the CLBILS facility on 17 February 2021.

4The effective tax rate is calculated as the total tax charge

divided by profit before tax

5The underlying tax rate is calculated as one minus the adjusted

profit after tax divided by the adjusted profit before tax

Consolidated Income Statement

Year

ended

Six months Six months

ended 31 ended 31

December December 30 June

2020 2019 2020

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 5 55,071 59,475 113,075

Operating expenses before amortisation of

intangibles excluding computer software

and adjusting items (47,282) (51,563) (99,044)

Adjusting items 4 (580) (486) (625)

Amortisation of intangibles excluding computer

software 4 (1,700) (2,381) (4,797)

Operating expenses (49,562) (54,430) (104,466)

Other income - gain on sale of subsidiary 7 770 - -

Operating profit 6,279 5,045 8,609

------------ ------------ ----------

Net finance costs (783) (979) (2,175)

Profit before tax 4 5,496 4,066 6,434

------------ ------------ ----------

Taxation (1,073) (924) (1,760)

------------ ------------ ----------

Profit for the period 4,423 3,142 4,674

------------ ------------ ----------

Attributable to:

Owners of the parent 4,423 3,142 4,674

Non-controlling interests - - -

------------ ------------ ----------

4,423 3,142 4,674

Earnings per share attributable to the owners

of the parent:

Basic (p) 6 5.05 3.59 5.33

Diluted (p) 6 5.03 3.54 5.26

------------ ------------ ----------

Adjusted earnings per share attributable

to the owners of the parent:

Basic (p) 6 6.44 6.36 10.71

Diluted (p) 6 6.42 6.29 10.56

------------ ------------ ----------

The notes on pages 12 to 17 are an integral part of these

consolidated financial statements.

Consolidated Statement of Comprehensive Income

Six months Six months Year

ended ended ended

31 December 31 December 30 June

2020 2019 2020

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Profit for the period 4,423 3,142 4,674

Other comprehensive income/(expense):

Items that may be reclassified subsequently

to the Income Statement

------------- ------------- ----------

Fair value movements on interest rate swap

(net of tax) (113) 56 116

Currency translation differences (1,460) (88) 513

Net investment hedges (net of tax) 683 345 (237)

------------- ------------- ----------

Other comprehensive income for the period,

net of tax (890) 313 392

------------- ------------- ----------

Total comprehensive income for the period 3,533 3,455 5,066

------------- ------------- ----------

Attributable to:

Owners of the parent 3,533 3,455 5,066

Non-controlling interests - - -

3,533 3,455 5,066

------------- ------------- ----------

Items in the statement above are disclosed net of tax. The notes

on pages 12 to 17 are an integral part of these financial

statements.

Consolidated Balance Sheet

31 December 31 December 30 June

2020 2019 2020

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 76,705 77,078 77,876

Intangible assets 17,711 21,736 19,712

Property, plant and equipment 5,374 5,292 5,134

Right of use assets 10,452 10,943 11,760

Deferred consideration receivable 1,750 2,098 2,163

Deferred tax assets 1,244 741 1,189

113,236 117,888 117,834

------------ ------------ ----------

Current assets

Trade and other receivables 23,640 28,178 25,526

Current tax asset 1,072 1,721 1,314

Derivative financial instruments 367 367 -

Deferred consideration receivable 483 193 -

Cash and cash equivalents 7,905 6,031 21,426

------------ ------------ ----------

33,467 36,490 48,266

------------ ------------ ----------

Total assets 146,703 154,378 166,100

------------ ------------ ----------

Current liabilities

Trade and other payables (54,476) (50,124) (58,495)

Lease liabilities (2,571) (2,424) (2,660)

Deferred consideration payable - - (572)

cash settled -

Derivative financial instruments (198) (133) (59)

(57,245) (53,253) (61,214)

Non-current liabilities

Borrowings (30,400) (46,711) (48,495)

Lease liabilities (9,288) (10,087) (10,461)

Deferred tax liabilities (2,346) (2,383) (2,524)

(42,034) (59,181) (61,480)

------------ ------------ ----------

Total liabilities (99,279) (112,434) (122,694)

------------ ------------ ----------

Net assets 47,424 41,944 43,406

------------ ------------ ----------

Equity

Share capital 4,380 4,380 4,380

Share premium 45,225 45,225 45,225

Treasury and ESOT reserves (453) (300) (590)

Share based payments reserve 1,419 915 1,195

Translation reserve 2,341 3,200 3,801

Accumulated losses (5,488) (11,476) (10,605)

------------ ------------ ----------

Total equity 47,424 41,944 43,406

------------ ------------ ----------

The notes on pages 12 to 17 are an integral part of these

consolidated financial statements.

Consolidated Statement of Changes in Equity

Share capital, Share

share premium, based

treasury shares payments Translation Accumulated Total

and ESOT shares reserve reserve losses equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 30 June 2019 (audited) 49,506 839 3,288 (10,765) 42,868

Effect of initial application

of IFRS 16 - - - (180) (180)

Tax relating to initial

application of IFRS 16 - - - 34 34

At 1 July 2019 (audited) 49,506 839 3,288 (10,911) 42,722

Profit for the period - - - 3,142 3,142

Other comprehensive (expense)/income

for the period - - (88) 401 313

----------------- ---------- -------------- -------------- ---------

49,506 839 3,200 (7,368) 46,177

Dividends - - - (4,378) (4,378)

Issue of share capital 3 (242) - 239 -

ESOT share purchases (204) - - - (204)

Share based payments - 318 - - 318

Tax on share based payments - - - 31 31

At 31 December 2019 (unaudited) 49,305 915 3,200 (11,476) 41,944

----------------- ---------- -------------- -------------- ---------

Profit for the period - - - 1,532 1,532

Other comprehensive income/(expense)

for the period - - 601 (522) 79

49,305 915 3,801 (10,466) 43,555

ESOT share purchases (293) - - - (293)

Sale of treasury shares 3 - - - 3

Share based payments - 280 - - 280

Tax on share based payments - - - (139) (139)

At 30 June 2020 (audited) 49,015 1,195 3,801 (10,605) 43,406

Profit for the period - - - 4,423 4,423

Other comprehensive (expense)/income

for the period - - (1,460) 570 (890)

49,015 1,195 2,341 (5,612) 46,939

Performance share plan

awards vesting settled

via ESOT 137 (241) - 104 -

Share based payments - 465 - - 465

Tax on share based payments - - - 20 20

At 31 December 2020 (unaudited) 49,152 1,419 2,341 (5,488) 47,424

----------------- ---------- -------------- -------------- ---------

The notes on pages 12 to 17 are an integral part of these

consolidated financial statements.

Consolidated Cash Flow Statement

Six months ended 31 December Six months Year ended 30

2020 ended 31 December 2019 June 2020

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Cash generated from

operations before adjusting

items 8 9,203 6,585 26,512

Cash flows for adjusting

items - operating activities (302) (271) (293)

Cash flows from tax on share

based payments (5) (17) (16)

------------------------------ ------------------------ ----------------

Cash generated from

operations 8,896 6,297 26,203

Interest paid (763) (814) (1,632)

Tax paid (1,169) (3,420) (4,377)

------------------------------ ------------------------ ----------------

Net cash generated from

operating activities 6,964 2,063 20,194

------------------------------ ------------------------ ----------------

Cash flows from investing

activities

Sale of subsidiary net of

cash 400 - -

Deferred consideration paid - (1,385) (1,957)

Deferred consideration

received - - 200

Cash flows for adjusting

items - investing activities (43) - (217)

Purchase of property, plant

and equipment (455) (304) (538)

Proceeds from disposal of

property, plant and

equipment 7 18 27

Purchase of intangible assets (1,422) (1,637) (3,315)

------------------------------ ------------------------ ----------------

Net cash used in investing

activities (1,513) (3,308) (5,800)

------------------------------ ------------------------ ----------------

Cash flows from financing

activities

Dividends paid to owners of

the parent - (4,378) (4,378)

Share issuance costs - (3) (3)

Payment of lease liabilities (1,285) (1,129) (2,392)

Purchase of shares by ESOT - (204) (497)

Cash flows for loan

arrangement fees (215) (708) (741)

Increase in bank loans 1,000 7,000 14,000

Decrease in bank loans (18,181) (1,000) (7,000)

Net cash (used in)/generated

from financing activities (18,681) (422) (1,011)

------------------------------ ------------------------ ----------------

Net (decrease)/increase in

cash and cash equivalents,

net of bank overdrafts (13,230) (1,667) 13,383

Cash and cash equivalents,

net of bank overdrafts, at

beginning of the period 21,426 7,921 7,921

Exchange (losses)/gains on

cash and cash equivalents (291) (223) 122

------------------------------ ------------------------ ----------------

Cash and cash equivalents,

net of bank overdrafts at

end of the period 7,905 6,031 21,426

------------------------------ ------------------------ ----------------

Reconciliation of net debt

------------------------------ ------------------------ --------------

Cash and cash equivalents at

beginning of the period 21,426 7,921 7,921

Cash classified as held for

sale - - -

Bank loans at beginning of

the period (49,082) (41,790) (41,790)

------------------------------ ------------------------ --------------

Net debt at beginning of the

period (27,656) (33,869) (33,869)

Net (decrease)/increase in

cash and cash equivalents

(net of bank overdrafts) (13,521) (1,890) 13,505

Net repayment/(drawdown) in

bank loans 17,181 (6,000) (7,000)

Exchange gain/(loss) on bank

loans 842 423 (292)

------------------------------ ------------------------ --------------

Cash and cash equivalents at

end of the period 7,905 6,031 21,426

Bank loans at end of the

period (31,059) (47,367) (49,082)

------------------------------ ------------------------ --------------

Net debt at end of the period (23,154) (41,336) (27,656)

------------------------------ ------------------------ --------------

The notes on pages 12 to 17 are an integral part of these

consolidated financial statements.

Notes to the Financial Results

General information

The Company is a public limited company incorporated and

domiciled in the UK. The address of the Company's registered office

is 10 Whitechapel High Street, London, E1 8QS.

The Company is listed on the Main Market on the London Stock

Exchange. The Company is a provider of data and information,

education and networking to the professional markets.

This condensed consolidated interim financial information

('Interim Information') was approved for issue by the Board of

Directors on 17 February 2021.

The Interim Information is neither reviewed nor audited and does

not comprise statutory accounts within the meaning of Section 434

of the Companies Act 2006. Statutory accounts for the year ended 30

June 2020 were approved by the Board of Directors on 16 September

2019 and subsequently filed with the Registrar. The report of the

auditors on those accounts was unqualified, did not contain an

emphasis of matter paragraph and did not contain any statement

under Section 498 of the Companies Act 2006.

1. Basis of preparation

This Interim Information for the six months ended 31 December

2020 has been prepared in accordance with the Disclosure and

Transparency Rules of the Financial Conduct Authority and in

accordance with IAS 34 'Interim Financial Reporting' as adopted by

the European Union. The Interim Information should be read in

conjunction with the Annual Financial Statements for the year ended

30 June 2020 which have been prepared in accordance with IFRSs as

adopted by the European Union, and are available on the Group's

website: wilmingtonplc.com.

The Group's forecast and projections, taking account of

reasonably possible changes in trading performance, show that the

Group will be able to operate well within the level of its current

banking facilities. The Directors have therefore adopted a going

concern basis in preparing the Interim Information.

2. Accounting policies

The accounting policies, significant judgements and key sources

of estimation adopted in the preparation of this Interim Report are

consistent with those applied by the Group in its consolidated

financial statements for the year ended 30 June 2020.

The following new standards, amendments and interpretations have

been adopted in the current year:

Effective for

International Financial accounting

Reporting Standards periods starting

(IFRS/IAS) after

----------------------- -------------------------------------- -----------------

Amendments to References to Conceptual

IFRS Standards Framework in IFRS Standards 1 January 2020

Amendments to IAS 1

and IAS 8 Definition of Material 1 January 2020

Amendments to IFRS

9, IAS 39 and IFRS

7 Interest Rate Benchmark Reform 1 January 2020

----------------------- -------------------------------------- -----------------

The following new standards and amendments to new standards have

been issued but are not yet effective for the purpose of the

Interim Report and have not been early adopted.

Effective for

International Financial accounting

Reporting Standards periods starting

(IFRS/IAS) after

----------------------- ------------------------------------------- -----------------

Amendments to IFRS

17, IFRS 4 and IFRS Amendments to IFRS 17 and IFRS 4,'Insurance

9 Contracts', deferral of IFRS 9 1 January 2021

Amendments to IFRS

9, IAS 39, IFRS 7, Interest Rate Benchmark Reform - Phase

IFRS 4, and IFRS 16 2 1 January 2021

Management is currently assessing the impact of the above new

standards. In advance of the year starting 1 July 2021, the Group

will put in place necessary processes to capture all of the

adjustments and additional disclosures required for those standards

taking effect before this date.

3. Principal risks and uncertainties

The principal risks and uncertainties that affect the Group

remain unchanged from those stated on pages 37 to 45 of the

strategic report in the Annual Report and Financial Statements for

the year ended 30 June 2020, with the exception of the following

update in relation to liquidity and capital risk.

Bank facility extension

To ensure the Group had sufficient facility headroom to deal

with the most pessimistic trading scenarios initially anticipated

as a result of the impact of the Covid-19 pandemic, the Board

agreed with its lenders to access GBP15m of additional facility

headroom through the Government's Coronavirus Large Business

Interruption Loan Scheme ('CLBILS'). The additional funding was

secured on 7 August 2020. In recognition of the continued strong

cash position of the Group the GBP15m CLBILS facility was repaid in

full on 17 February 2021.

4. Measures of profit

Reconciliation to profit on continuing activities before tax

To provide shareholders with additional understanding of the

trading performance of the Group, adjusted EBITA has been

calculated as profit before tax after adding back:

* amortisation of intangible assets excluding computer

software;

* adjusting items (included in operating expenses);

* other income - gain on sale of subsidiary; and

* net finance costs.

Adjusted profit before tax, adjusted EBITA and adjusted EBITDA

reconcile to profit on continuing activities before tax as

follows:

Six months Six months

ended ended

31 December 31 December Year ended

2020 2019 30 June 2020

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------- -------------- --------------

Profit before tax 5,496 4,066 6,434

Amortisation of intangible assets excluding

computer software 1,700 2,381 4,797

Adjusting items (included in operating

expenses) 580 486 625

Other income - gain on sale of subsidiary (770) - -

Adjusted profit before tax 7,006 6,933 11,856

Net finance costs 783 979 2,175

------------- -------------- --------------

Adjusted operating profit ('adjusted EBITA') 7,789 7,912 14,031

Depreciation of property, plant and equipment

included in operating expenses 597 684 1,105

Depreciation of right of use assets 1,103 1,006 2,094

Amortisation of intangible assets - computer

software 1,064 752 2,080

------------- -------------- --------------

Adjusted EBITA before depreciation ('adjusted

EBITDA') 10,553 10,354 19,310

------------- -------------- --------------

The following adjusting items have been charged to the Income

Statement during the period but are considered to be adjusting so

are shown separately:

Six months ended Six months ended Year ended

31 December 31 December 30 June

2020 2019 2020

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

---------------- ---------------- ----------

Costs relating to strategic activities 580 - 218

Net increase in the liability for deferred consideration - 486 407

Other adjusting items (included in operating expenses) 580 486 625

Amortisation of intangible assets excluding computer software 1,700 2,381 4,797

Total adjusting items (classified in profit before tax) 2,280 2,867 5,422

---------------- ---------------- ----------

5. Segmental information

In accordance with IFRS 8 the Group's operating segments are

based on the operating results reviewed by the Board, which

represents the chief operating decision maker.

The Group's organisational structure reflects the main

communities to which it provides information, education and

networking. The three divisions (Risk & Compliance, Healthcare

and Professional) are the Group's segments and generate all of the

Group's revenue.

The Board considers the business from both a geographic and

product perspective. Geographically, management considers the

performance of the Group between the UK, North America, the rest of

Europe and the rest of the world.

(a) Business segments

Year ended 30

Six months ended 31 December 2019 June 2020

Six months ended 31 December 2020 (unaudited) (unaudited) (audited)

----------------------------------------------- ----------------------------------- ----------------------

Revenue Contribution Revenue Contribution Revenue Contribution

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------- -------------------------------- ----------- ---------------------- -------- ------------

Risk & Compliance 21,543 6,396 20,560 6,091 41,739 12,849

Healthcare 18,948 1,082 21,096 1,255 40,993 3,260

Professional 14,580 2,821 17,819 2,731 30,343 2,901

Group contribution 55,071 10,299 59,475 10,077 113,075 19,010

Unallocated central

overheads - (1,981) - (1,802) - (4,255)

Share based payments - (529) - (363) - (724)

7,789 59,475 7,912 113,075 14,031

Amortisation of

intangible assets

excluding computer

software (1,700) (2,381) (4,797)

Adjusting items

(included in operating

expenses) (580) (486) (625)

Other income - gain on

sale of subsidiary 770 - -

Net finance costs (783) (979) (2,175)

Profit before tax 5,496 4,066 6,434

Taxation (1,073) (924) (1,760)

-------------------------------- ---------------------- ------------

Profit for the

financial period 4,423 3,142 4,674

-------------------------------- ---------------------- ------------

There are no intra-segmental revenues which are material for

disclosure. Unallocated central overheads represent head office

costs that are not specifically allocated to segments. Total assets

and liabilities for each reportable segment are not presented, as

such information is not provided to the Board.

(b) Segmental information by geography

The UK is the Group's country of domicile and the Group

generates the majority of its revenue from external customers in

the UK. The geographical analysis of revenue is on the basis of the

country of origin in which the customer is invoiced:

Six months Six months Year

ended 31 ended 31 ended

December December 30 June

2020 2019 2020

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------ ------------ ----------

UK 30,815 32,579 65,793

North America 6,208 10,920 21,037

Europe (excluding the UK) 11,444 10,778 18,042

Rest of the world 6,604 5,198 8,203

------------ ------------ ----------

Total revenue 55,071 59,475 113,075

------------ ------------ ----------

6. Earnings per share

Adjusted earnings per share has been calculated using adjusted

earnings calculated as profit after taxation and non-controlling

interests but before:

* amortisation of intangible assets excluding computer

software;

* adjusting items (included in operating expenses);

* other income - gain on sale of subsidiary; and

* adjusting items (included in finance costs).

The calculation of the basic and diluted earnings per share is

based on the following data:

Six months Six months

ended 31 ended 31 Year ended

December December 30 June

2020 2019 2020

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Earnings from continuing operations for

the purpose of basic earnings per share 4,423 3,142 4,674

Add/(remove):

Amortisation of intangible assets excluding

computer software (net of non-controlling

interests) 1,700 2,381 4,797

Adjusting items (included in operating

expenses) 580 486 625

Other income - gain on sale of subsidiary (770) - -

Tax effect of adjustments above (293) (436) (712)

Adjusted earnings for the purposes of adjusted

earnings per share 5,640 5,573 9,384

------------ ------------ -----------

Number Number Number

Weighted average number of ordinary shares

for the purpose of basic and adjusted earnings

per share 87,603,917 87,577,105 87,590,511

Effect of dilutive potential ordinary shares:

Future exercise of share awards and options 293,090 1,067,312 1,254,878

Weighted average number of ordinary shares

for the purposes of diluted earnings per

share 87,897,007 88,644,417 88,845,389

------------ ------------ -----------

Basic earnings per share 5.05p 3.59p 5.33p

Diluted earnings per share 5.03p 3.54p 5.26p

Adjusted basic earnings per share ('adjusted

earnings per share') 6.44p 6.36p 10.71p

Adjusted diluted earnings per share 6.42p 6.29p 10.56p

------------ ------------ -----------

7. Disposal of subsidiary

On 16 December 2020 the Group disposed of Central Law Training

Scotland. The disposal was executed by way of the sale of 100% of

the equity shares.

The gain on disposal comprises:

GBP'000

Cash and cash equivalents 400

Settlement of intercompany balances 1,190

----------------------------------------- --------

Total consideration received 1,590

----------------------------------------- --------

Directly attributable costs of disposal (100)

Net assets disposed (720)

----------------------------------------- --------

Gain on disposal 770

----------------------------------------- --------

8. Cash generated from operations

Six months Six months

ended 31 ended 31 Year ended

December December 30 June

2020 2019 2020

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Profit from continuing operations before

income tax 5,496 4,066 6,434

Adjusting items 580 486 625

Depreciation of property, plant and equipment 597 684 1,105

Depreciation of right of use assets 1,103 1,006 2,094

Gain on sale of subsidiary (770) - -

Amortisation of intangible assets 2,764 3,133 6,877

Loss/(profit) on disposal of property,

plant and equipment 1 (3) (7)

Share based payments (including social

security costs) 529 363 724

Net finance costs 783 979 2,175

------------ ------------ -----------

Operating cash flows before movements

in working capital 11,083 10,714 20,027

Decrease/(increase) in trade and other

receivables 2,319 664 3,279

(Decrease)/increase in trade and other

payables (4,199) (4,793) 3,206

------------ ------------ -----------

Cash generated from operations before

adjusting items 9,203 6,585 26,512

------------ ------------ -----------

Cash conversion is calculated as a percentage of cash generated

by operations to Adjusted EBITA as follows:

Year ended

30 June

Six months Six months

ended 31 ended 31

December December

2020 2019 2020

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Funds from operations before adjusting

items:

Adjusted EBITA 7,789 7,912 14,031

Share based payments (including social

security costs) 529 363 724

Amortisation of intangible assets - computer

software 1,064 752 2,080

Depreciation of property, plant and equipment

included in operating expenses 597 684 2,094

Depreciation of right of use assets 1,103 1,006 1,105

Loss/(profit) on disposal of property,

plant and equipment 1 (3) (7)

------------- -------------- -----------

Operating cash flows before movements

in working capital 11,083 10,714 20,027

Net working capital movement (1,880) (4,129) 6,485

------------- -------------- -----------

Funds from operations before adjusting

items 9,203 6,585 26,512

------------- -------------- -----------

Cash conversion 118% 83% 189%

------------- -------------- -----------

Free cash flows:

Operating cash flows before movement in

working capital 11,083 10,714 20,027

Proceeds on disposal of property, plant

and equipment 7 18 27

Net working capital movement (1,880) (4,129) 6,485

Interest paid (763) (814) (1,632)

Payment of lease liabilities (1,285) (1,129) (2,392)

Tax paid (1,169) (3,420) (4,377)

Purchase of property, plant and equipment (455) (304) (538)

Purchase of intangible assets (1,422) (1,637) (3,315)

------------- -------------- -----------

Free cash flows 4,116 (701) 14,285

------------- -------------- -----------

9. Related party transactions

The Company and its wholly owned subsidiary undertakings offer

certain Group-wide purchasing facilities to the Company's other

subsidiary undertakings whereby the actual costs are recharged.

Close family members of key management personnel provided

services to the Group during the period for lecturing. The total

invoiced for these services was GBP55,625 (2019: GBP49,883).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BCGDDBUBDGBR

(END) Dow Jones Newswires

February 18, 2021 02:00 ET (07:00 GMT)

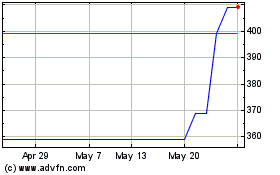

Wilmington (AQSE:WIL.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Wilmington (AQSE:WIL.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024