Wilmington PLC Wilmington plc Pre-close Trading Update (7299D)

June 28 2019 - 2:00AM

UK Regulatory

TIDMWIL

RNS Number : 7299D

Wilmington PLC

28 June 2019

28 June 2019

Wilmington plc

('Wilmington', 'the Group' or 'the Company')

Pre-close Trading Update

Wilmington plc, the provider of information, education and

networking services in Risk & Compliance, Healthcare and

Professional knowledge areas, today announces a pre-close trading

update for the year to 30 June 2019.

Trading Update

The Board is pleased to announce that underlying trading is

broadly in line with the full year expectations set out at the

start of the financial year. After a strong Q3, with organic

revenue growth levels that were in excess of those expected, Q4 is

likely to be approximately flat year on year, such that full year

organic revenue growth will be positive, albeit towards the lower

end of the previously anticipated low single digit range.

Underlying costs are similarly at the lower end of expectations and

hence on a comparable basis adjusted profit before tax is expected

to be in line with previous guidance.

These results will be impacted by the adoption in the year of

the IFRS 15 revenue recognition standard. As previously disclosed

at the time of the interim results announcement in February,

adoption of IFRS 15 for the year to 30 June 2018 had a GBP0.5m

negative impact on previously reported full year revenue and

adjusted EBITA. It is anticipated that the corresponding impact of

adoption of IFRS 15 for the year to 30 June 2019 will be slightly

higher than for the prior year due mainly to growth in revenue from

on-line training programmes.

Cashflow generation in the second half of the year has been

strong and expectations for year end net debt remain unchanged.

Adoption of IFRS 15 has no impact on cash or cash generation.

The preliminary announcement of the Group's full year results to

30 June 2019 is expected to be published on 19 September 2019.

Divisional Commentary

Organic revenue growth for the full year in the Risk &

Compliance division is expected to be in line with our mid-single

digit growth aspiration. Good growth momentum has continued in the

main Compliance business during H2 with strong demand for both

on-line courses and in-house programmes.

In the Healthcare division, revenue performance has continued to

improve, with an expectation that full year organic revenue growth

will be around 1% with a stronger second half after the 5% organic

decline in H1. The improvement comes partly from new business sales

performance in the UK Healthcare business, which is expected to

grow by mid-single digit percentage year on year. The second half

in Healthcare has also seen a strong performance in US Healthcare

due in part to a record attendance at the flagship RISE Nashville

event that was held in March.

Market conditions for the Professional businesses have proved

challenging in Q4 with the Brexit delay and uncertainties over the

current political climate in the UK resulting in lower demand for

training from legal and accountancy clients. This is expected to

result in a low single digit organic decline in revenues for the

Professional division for the full year after a flat first half.

Recent investments in new products and internal systems means the

division is well placed to benefit when market demand improves once

the political situation is resolved and there is clarity on ongoing

laws and regulations.

Board Update

As announced on 16 May 2019, the Board is pleased to welcome

Mark Milner who will be joining the Group as Chief Executive

Officer on 1 July 2019. At the same time, Martin Morgan, currently

Interim Executive Chairman will revert to his previous position as

Non-executive Chairman.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement this inside information is now considered to be in the

public domain.

For further information, please contact:

Wilmington plc 020 7490 0049

Martin Morgan, Interim Executive Chairman

Richard Amos, Chief Financial Officer

FTI Consulting 020 3727 1000

Charles Palmer / Dwight Burden / Leah Dudley

Notes to Editors

Wilmington plc is the recognised knowledge leader and partner of

choice for information, education and networking in Risk &

Compliance, Healthcare and Professional areas. Wilmington employs

close to 1,000 people and has customers in 120 countries.

Wilmington plc is a premium listed company on the main market of

the London Stock Exchange.

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTSEMFMWFUSEDM

(END) Dow Jones Newswires

June 28, 2019 02:00 ET (06:00 GMT)

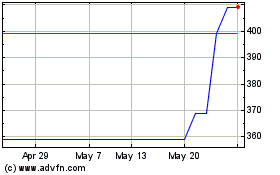

Wilmington (AQSE:WIL.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Wilmington (AQSE:WIL.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024