TIDMPET

RNS Number : 6896A

Petrel Resources PLC

27 September 2022

27 September 2022

Petrel Resources plc

("Petrel" or "the Company")

Unaudited Interim Statement for the six months ended 30 June

2022

Petrel Resources plc (AIM: PET) today announces unaudited

financial results for the six months ended 30(th) June 2022.

Petrel is a hydrocarbon explorer with interests in Iraq, and

Ghana.

Highlights

-- Petrel's Iraqi business is being re-built although as

explained below our Iraqi Director, Riadh Ani has had to resign -

but requires formation of a Government for the Company to progress

new funding.

-- An updated Merjan oil field development proposal has been

submitted to the Ministry.

-- Iraqi oil output recovered to 4.65 million barrels daily in

August 2022.

-- Ratification discussions on Tano 2A block underway with

Ghanaian authorities - though acreage adjustments likely.

-- Board considers there are new expansion opportunities

presented by oil price and demand recovery.

Prior to the recent elections, the Iraqi authorities had

suggested that Petrel initially target "exploration of blocks in

the western desert of Iraq, and present past studies done on the

Merjan-Kifl-West Kifl discoveries, and Petrel's work on the

Mesozoic and Paleozoic plays in the Western Desert". Our updated

development proposal requires an operating Iraqi Government in

order to proceed.

Following the C-19 pandemic, Petrel Resources plc restored

contacts with the Ghanaian authorities to update the acreage to be

explored, and resuscitate the ratification of our signed Petroleum

Agreement on Tano 2A Block. Slowness in ratification of signed

contracts had constrained the development of Ghana's oil and gas

industry. The current Ghanaian government has indicated its

determination to recover momentum. Ghanaian fiscal terms are

competitive, while West African infrastructure steadily

improves.

Financial markets and farm-out interest in petroleum had been

depressed since the oil price war starting in 2014, and continuing

periodically until 2022. This had constrained our options for early

seismic or wells in Ghana. But recent oil & price surges show

that major new investment is required to service global demand.

Petrel Resources hopes to participate in the coming boom.

Despite challenges, Iraq offers the best petroleum commercial

opportunity. Iraqi geology is unsurpassed. Oil demand reaches new

records - despite high prices constraining demand - especially in

gas. But barriers to rapid expansion are above-the-ground issues of

logistics and contractual weaknesses, rather than lack of

geological potential. The solution is to align interests, so that

capital, technology contracts must be updated for effective

exploration and development.

Many Iraqi decision-makers have reached similar conclusions:

they want to increase output to rival Saudi capacity of circa

13mmbod. Unfortunately, the success of patriotic candidates in the

2021 elections has not yet led to an effective Government - without

which there cannot be democratically-supported policy reforms.

But Iraqi oil output has recovered to pre C-19 pandemic levels.

The Baghdad authorities are restoring control over the regions,

vindicating Petrel's longstanding stance of respecting the

sovereignty of the elected Government. Recovering oil & gas

demand and prices have opened room to update fiscal terms and

development plans. Some western majors, ignorant of prevailing

circumstances, had bid over-optimistically on service contracts

from 2009, and then found it hard to operate effectively. Many of

these have departed during the recent oil price war and

pandemic.

TotalEnergies has withdrawn from Kurdistan, but continues

elsewhere in Iraq. Chinese NOCs continue to expand. Iraq is not for

the faint of heart, but there is considerable upside to be realised

provided the elected government implements necessary reforms.

For several years after the 2003 Iraqi invasion, there was a

perception that contractors close to western governments, and later

super-majors, would dominate Iraqi oil exploration and development.

Iraqis had other ideas, however: they want partners, rather than

bosses.

Iraq is sovereign, but so is finance. The investment dollar is

an orphan. It seeks out return, and works to minimise risk - though

resolute investors will carry risk if fairly compensated.

Any investment can be considered to be worth the discounted

Present Value of all cash flows (in and out). Calculations are

sensitive to timing and the discount rate. Foreigners always see

higher risks than locals do.

The more uncertainty (political, tax, operational) the higher

the discount rate, & the lower the Present Value.

For capitalism to work, it must reward all the key players,

whose interests should be aligned - rather than in conflict.

The biggest challenge facing Petrel in this new era is not

operating conditions, access to technology or community relations.

The biggest challenge facing agile industry players is outdated

contracts and fiscal terms. The strong resurgence in demand and

price will smoothen necessary reforms.

Our Iraqi Director, Riadh Ani has helped maintain strong

relationships with Ministry of Oil officials, even during the

darkest hours of sanctions, invasion, conflict, and Covid-19. He

has now regretfully decided to resign with immediate effect as a

Non-Executive Director in order to enter public service. Our loss

will be society's gain, and we wish him the very best success in

this next challenge. Riadh's insights and introductions will help

Petrel in Iraq for years to come.

Petrel Resources plc Interests (as of May 2022):

Ghana

Tano 2A Petroleum Agreement: 30% Petrel Working Interest.

Awaiting ratification, then exploration periods of 3 years initial

term + 2 extension periods of 3.5 years.

Iraq

Western Desert Block 6: 100% Petrel Interest. Awaiting

ratification since 2002. 30 year term, or until early pay-out.

Prior Technical Cooperation Agreement (TCA studies, with 50%

Itochu interest) on the Merjan oil-field.

What should Iraq's oil policy be now?

Unfortunately, the combination of suspicion of foreign oil

companies, sanctions, and wars (including internal sectarian

conflict and resistance since 2003) have held back Iraq's

development, including the building of necessary oil and other

infrastructure. Iraq's government earnings and economy remains

dependent on oil.

Have Service Contracts achieved their objectives for companies

and Iraq? No: even at its pre-C-19 peak of c.4.7 million barrels of

oil daily (mmbod) output, Iraq fell short of its 6 to 9 mmbod 1989

plan, and the high hopes of rivalling Saudi Arabia. There is

insufficient incentive for contractors to boost production, and

recoveries - while the Ministry of Oil has been hollowed out by

sanctions and wars, and now unable to fill the gap.

Should the Federal Ministry of Oil negotiate Production Sharing

Agreements?

Yes: this would better align the interests of the parties, and

create more wealth, value-added in downstream industries like

refined products and petrochemicals, infrastructure and employment

for Iraq.

The success of Qatar in LNG - or even the Emirates and Oman show

what can be done with more pragmatism.

Future

Petrel is confident that necessary funding will be available for

medium term ongoing activities.

David Horgan

Chairman

26 September 2022

For further information please visit http://www.petrelresources.com/ or contact:

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this announcement.

In addition, market soundings (as defined in MAR) were taken in

respect of the matters contained in this announcement, with the

result that certain persons became aware of inside information (as

defined in MAR), as permitted by MAR. This inside information is

set out in this announcement. Therefore, those persons that

received inside information in a market sounding are no longer in

possession of such inside information relating to the company and

its securities.

S

For further information please visit http://www.petrelresources.com/ or contact:

Petrel Resources

David Horgan, Chairman +353 (0) 1 833 2833

John Teeling, Director

Nominated Adviser and Broker

Beaumont Cornish - Nominated Adviser

Roland Cornish

Felicity Geidt +44 (0) 020 7628 3396

Novum Securities Limited - Broker

Colin Rowbury +44 (0) 20 399 9400

BlytheRay - PR +44 (0) 207 138 3206

Megan Ray +44 (0) 207 138 3553

Madeleine Gordon-Foxwell +44 (0) 207 138 3208

Teneo

Luke Hogg +353 (0) 1 661 4055

Alan Tyrrell +353 (0) 1 661 4055

Petrel Resources plc

Financial Information (Unaudited)

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six Months Ended Year Ended

30 June 22 30 June 21 31 Dec 21

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

Administrative expenses (140) (162) (322)

- - -

------------------------ ------------------------ ------------------------

OPERATING LOSS (140) (162) (322)

LOSS BEFORE TAXATION (140) (162) (322)

Income tax expense - - -

------------------------ ------------------------ ------------------------

LOSS FOR THE PERIOD (140) (162) (322)

Other comprehensive income] - - -

TOTAL COMPREHENSIVE PROFIT FOR THE

PERIOD (140) (162) (322)

======================== ======================== ========================

LOSS PER SHARE - basic and diluted (0.09c) (0.10c) (0.21c)

======================== ======================== ========================

CONDENSED STATEMENT OF FINANCIAL POSITION 30 June 22 30 June 21 31 Dec 21

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

ASSETS:

NON-CURRENT ASSETS

Intangible assets 933 932 933

----------- ----------- ----------

933 932 933

----------- ----------- ----------

CURRENT ASSETS

Trade and other receivables 12 18 25

Cash and cash equivalents 30 255 102

----------- ----------- ----------

42 273 127

TOTAL ASSETS 975 1,205 1,060

----------- ----------- ----------

CURRENT LIABILITIES

Trade and other payables (847) (777) (792)

----------- ----------- ----------

(847) (777) (792)

----------- ----------- ----------

NET CURRENT LIABILITIES (805) (504) (665)

NET ASSETS 128 428 268

=========== =========== ==========

EQUITY

Share capital 1,963 1,963 1,963

Capital conversion reserve fund 8 8 8

Capital redemption reserve 209 209 209

Share premium 21,786 21,786 21,786

Share based payment reserve 27 27 27

Retained deficit (23,865) (23,565) (23,725)

----------- ----------- ----------

TOTAL EQUITY 128 428 268

=========== =========== ==========

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Capital Capital Share based

Share Share Redemption Conversion Payment Retained Total

Capital Premium Reserves Reserves Reserves Losses Equity

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

As at 1 January 2021 1,963 21,786 209 8 27 (23,403) 590

Total comprehensive income - (162) (162)

-------- -------- ----------- ----------- ---------------------- --------- --------

As at 30 June 2021 1,963 21,786 209 8 27 (23,565) 428

Total comprehensive income - (160) (160)

-------- -------- ----------- ----------- ---------------------- --------- --------

As at 31 December 2021 1,963 21,786 209 8 27 (23,725) 268

Total comprehensive income - (140) (140)

----------- ----------- ----------------------

As at 30 June 2022 1,963 21,786 209 8 27 (23,865) 128

======== ======== =========== =========== ====================== ========= ========

CONDENSED CONSOLIDATED CASH FLOW Six Months Ended Year Ended

30 June 22 30 June 21 31 Dec 21

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

CASH FLOW FROM OPERATING ACTIVITIES

Loss for the period (140) (162) (322)

Foreign exchange 2 (8) (10)

----------- ----------- -----------

(138) (170) (332)

Movements in Working Capital 68 83 91

----------- ----------- -----------

CASH USED IN OPERATIONS (70) (87) (241)

NET CASH USED IN OPERATING ACTIVITIES (70) (87) (241)

----------- ----------- -----------

INVESTING ACTIVITIES

Payments for exploration and evaluation assets 0 0 (1)

----------- ----------- -----------

NET CASH USED IN INVESTING ACTIVITIES 0 0 (1)

----------- ----------- -----------

NET DECREASE IN CASH AND CASH EQUIVALENTS (70) (87) (242)

Cash and cash equivalents at beginning of the period 102 334 334

Exchange gains/(losses) changes on cash and cash equivalent (2) 8 10

CASH AND CASH EQUIVALENT AT THE OF THE PERIOD 30 255 102

=========== =========== ===========

Notes:

1. INFORMATION

The financial information for the six months ended 30 June 2022

and the comparative amounts for the six months ended 30 June 2021

are unaudited.

The interim financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the European Union. The interim financial statements have been

prepared applying the accounting policies and methods of

computation used in the preparation of the published consolidated

financial statements for the year ended 31 December 2021.

The interim financial statements do not include all of the

information required for full annual financial statements and

should be read in conjunction with the audited consolidated

financial statements of the Group for the year ended 31 December

2021, which are available on the Company's website

www.petrelresources.com

The interim financial statements have not been audited or

reviewed by the auditors of the Group pursuant to the Auditing

Practices board guidance on Review of Interim Financial

Information.

2. No dividend is proposed in respect of the period.

3. GOING CONCERN

The Group incurred a loss for the period of EUR140,055 (2021:

loss of EUR322,077) and had net current liabilities of EUR804,979

(2021: EUR664,924) at the statement of financial position date.

These conditions as well as those noted below, represent a material

uncertainty that may cast significant doubt on the Group and

Company's ability to continue as a going concern.

Included in current liabilities is an amount of EUR812,531

(2021: EUR767,531) owed to key management personnel in respect of

remuneration due at the statement of financial position date. Key

management have confirmed that they will not seek settlement of

these amounts in cash for a period of at least one year after the

date of approval of the financial statements or until the Group has

generated sufficient funds from its operations after paying its

third party creditors.

The Group and Company had a cash balance of EUR29,806 (2021:

EUR101,843) at the statement of financial position date. The

directors have prepared cashflow projections for a period of at

least twelve months from the date of approval of these financial

statements which indicate that additional finance may be required

to fund working capital requirements and develop existing projects.

As the Group is not revenue or cash generating it relies on raising

capital from the public market.

These conditions as well as those noted below, represent a

material uncertainty that may cast significant doubt on the Group

and Company's ability to continue as a going concern.

As in previous years the Directors have given careful

consideration to the appropriateness of the going concern basis in

the preparation of the financial statements and believe the going

concern basis is appropriate for these financial statements. The

financial statements do not include the adjustments that would

result if the Group and Company were unable to continue as a going

concern.

4. LOSS PER SHARE

Basic loss per share is computed by dividing the loss after

taxation for the year attributable to ordinary shareholders by the

weighted average number of ordinary shares in issue and ranking for

dividend during the year. Diluted earnings per share is computed by

dividing the loss after taxation for the year by the weighted

average number of ordinary shares in issue, adjusted for the effect

of all dilutive potential ordinary shares that were outstanding

during the year.

The following table sets out the computation for basic and

diluted earnings per share (EPS):

30 June 22 30 June 21 31 Dec 21

EUR EUR EUR

Loss per share - Basic and Diluted (0.09c) (0.10c) (0.21c)

Basic and diluted loss per share

The earnings and weighted average number of ordinary shares used in the calculation of basic

loss per share are as follows:

EUR'000 EUR'000 EUR'000

Loss for the period attributable to equity holders (140) (162) (322)

Denominator Number Number Number

for basic and diluted EPS 157,038,467 157,038,467 157,038,467

Basic and diluted loss per share are the same as the effect of

the outstanding share options is anti-dilutive.

5. INTANGIBLE ASSETS

30 June 22 30 June 21 31 Dec 21

Exploration and evaluation assets: EUR'000 EUR'000 EUR'000

Opening balance 933 932 932

Additions - - 1

Impairment - - -

________ ________ ________

Closing balance 933 932 933

Exploration and evaluation assets relate to expenditure incurred

in exploration in Ghana. The directors are aware that by its nature

there is an inherent uncertainty in Exploration and evaluation

assets and therefore inherent uncertainty in relation to the

carrying value of capitalized exploration and evaluation

assets.

During 2018 the Group resolved the outstanding issues with the

Ghana National Petroleum Company (GNPC) regarding a contract for

the development of the Tano 2A Block. The Group has signed a

Petroleum Agreement in relation to the block and this agreement

awaits ratification by the Ghanaian government.

Relating to the remaining exploration and evaluation assets at

the financial year end, the directors believe there were no facts

or circumstances indicating that the carrying value of the

intangible assets may exceed their recoverable amount and thus no

impairment review was deemed necessary by the directors. The

realisation of these intangible assets is dependent on the

successful discovery and development of economic reserves and is

subject to a number of significant potential risks, as set out

below:

-- Licence obligations;

-- Exchange rate risks;

-- Uncertainty over development and operational costs;

-- Political and legal risks, including arrangements with

Governments for licences, profit sharing and taxation;

-- Foreign investment risks including increases in taxes,

royalties and renegotiation of contracts;

-- Financial risk management;

-- Going concern and

-- Ability to raise finance.

Regional Analysis 30 Jun 22 30 Jun 21 31 Dec 21

EUR'000 EUR'000 EUR'000

Ghana 933 932 933

6. SHARE CAPITAL

2022 2021

EUR'000 EUR'000

Authorised:

800,000,000 ordinary shares of EUR0.0125 10,000 10,000

Issued and fully paid

2022 2021

Number Share Capital Share Premium Number Share Capital Share Premium

EUR'000 EUR'000 EUR'000 EUR'000

At 1 January 157,038,467 1,963 21,786 157,038,467 1,963 21,786

Share issue - - - - - -

At end of period 157,038,467 1,963 21,786 157,038,467 1,963 21,786

Movements in issued share capital

There was no movement in the issued share capital of the company

in the current or prior year.

7. POST BALANCE SHEET EVENTS

There are no material post balance sheets events affecting the

Group.

8. The Interim Report for the six months to 30(th) June 2022 was

approved by the Directors on 26 September 2022.

9. The Interim Report will be available on the Company's website at www.petrelresources.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUQPBUPPGAQ

(END) Dow Jones Newswires

September 27, 2022 02:00 ET (06:00 GMT)

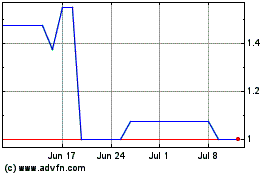

Petrel Resources (AQSE:PET.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Petrel Resources (AQSE:PET.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024