Hill & Smith PLC Trading update (5687A)

May 25 2023 - 2:00AM

UK Regulatory

TIDMHILS

RNS Number : 5687A

Hill & Smith PLC

25 May 2023

25 May 2023

Hill & Smith PLC

Trading update

Strong start to the year ahead of expectations

Hill & Smith PLC ("the Group"), the international group

creating sustainable infrastructure and safe transport through

innovation, provides a trading update for four month period ("the

period") to 30 April 2023 ahead of its Annual General Meeting to be

held later today.

Group Performance

The Group has delivered a record trading performance in the

period, with 18% constant currency revenue growth (10% on an

organic constant currency basis) and strong profit growth against a

relatively soft 2022 comparator.

The Engineered Solutions division delivered a standout

performance in the period with record revenue and operating profit.

The strong performance reflects buoyant demand in our US

businesses, particularly for composite solutions. The integration

of Enduro Composites, a US-based designer, manufacturer and

supplier of engineered composite solutions acquired in February

2023, is progressing well and the business has traded ahead of

expectations.

The Galvanizing division also delivered record results in the

period. Our US galvanizing business continues to see strong market

demand and delivered good revenue and profit growth, underpinned by

an increase in production volumes. In the UK, anticipated lower

production volumes have been largely offset through pricing and

efficiency actions.

The Roads & Security division delivered good growth in the

period, including strong trading at National Signal, a US-based

off-grid solar lighting solutions business acquired in October

2022, which continues to perform ahead of expectations. In April

2023, we successfully completed the disposal of the final part of

our loss making Swedish roads business.

Outlook

Based on the strong trading in the period and good momentum

across the Group, we expect full year 2023 operating profit to be

modestly ahead of the top end of analyst expectations(*) . We

remain positive on the medium to longer term outlook, supported by

strong market growth drivers for sustainable infrastructure.

Financial Calendar

The Group's interim results for the six months ending 30 June

2023 are scheduled to be announced on 9 August 2023.

* The current company compiled analyst consensus expectation for

FY23 is for underlying operating profit of GBP107.0m with a range

of GBP105.2m-GBP110.2m

Cautionary Statement

This announcement contains forward looking statements which are

made in good faith based on the information available at the time

of its approval. It is believed that the expectations reflected in

these statements are reasonable but they may be affected by a

number of risks and uncertainties that are inherent in any forward

looking statement which could cause actual results to differ

materially from those currently anticipated. Nothing in this

document should be regarded as a profit forecast nor should it be

taken to mean that earnings per share of Hill & Smith in the

year ending 31 December 2023, or in future years, will necessarily

match or exceed the Group's historical earnings per share.

F or further information, please contact:

Hill & Smith PLC

Alan Giddins, Executive Chair Tel: +44 (0)121 704 7434

Hannah Nichols, Chief Financial Officer

MHP

Reg Hoare/Rachel Farrington/Catherine Chapman Tel: +44 (0)20 3128 8613

Notes to Editors

Hill & Smith PLC creates sustainable infrastructure and safe

transport through innovation. The Group employs c.4,000 people

worldwide with the majority employed by its autonomous, agile,

customer focussed operating businesses based in the UK, USA,

Australia and India. The Group office is in the UK and Hill &

Smith PLC is quoted on the London Stock Exchange (LSE: HILS.L).

The Group's operating businesses are organised into three main

business divisions:

Galvanizing Services: increasing the sustainability and

maintenance free life of steel products including structural steel

work, lighting, bridges and other products for industrial and

infrastructure markets.

Engineered Solutions: supplying engineered steel, and composite

solutions with low embodied energy for a wide range of

infrastructure markets including power generation and distribution,

marine, rail and housing. The division also supplies engineered

pipe supports for the water, power and liquid natural gas markets

and seismic protection solutions.

Roads & Security: supplying products and services to support

road and highway infrastructure including temporary and permanent

road safety barriers, intelligent traffic solutions, street

lighting columns and bridge parapets. In addition, the division

includes two businesses which are market leaders in the provision

of off-grid solar lighting and power solutions. The security

portfolio includes hostile vehicle mitigation solutions, high

security fencing and automated gate solutions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTAIMRTMTMTBLJ

(END) Dow Jones Newswires

May 25, 2023 02:00 ET (06:00 GMT)

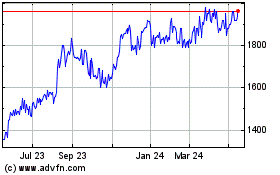

Hill & Smith (AQSE:HILS.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

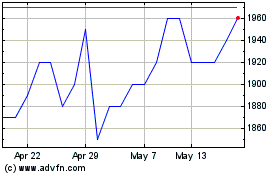

Hill & Smith (AQSE:HILS.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025