TIDMEEE

RNS Number : 0159A

Empire Metals Limited

28 January 2022

To view the announcement with the illustrative images please use

the following link:

http://www.rns-pdf.londonstockexchange.com/rns/0159A_1-2022-1-28.pdf

Empire Metals Limited / AIM: EEE / Sector: Natural Resources

28 January 2022

Empire Metals Limited

('Empire' or the 'Company')

Update on Central Menzies Gold Project

Empire Metals Limited, the AIM-quoted resource exploration and

development company, is pleased to provide an update on the second

phase of reverse circulation ('RC') drilling at the Central Menzies

Gold Project in Western Australia ('Central Menzies' or the

'Project'), over which Empire holds an option to acquire a 75%

interest.

Highlights:

-- 1,422m of RC drilling completed, focusing mainly on the

mineralised trend known as Nugget Patch which was prioritised based

on previous exploration results showing a coherent supergene

gold-enriched zone.

-- At Teglio, additional holes were drilled to confirm historic

high-grade gold intersections closely associated with the main

workings, plus an additional traverse to test under a strong

gold-in-soil anomaly recently defined by Empire some 300m northwest

of the previous drilling

-- Significant intercepts reported :

Ø 1m @ 1.35 g/t Au from 81m downhole at Nugget Patch

Ø 2m @ 1.41 g/t Au from 90m downhole at Nugget Patch

Ø 3m @ 3.1 g/t Au from 13m downhole at Teglio (drilled 300m NW

of old workings)

Ø 4m @ 1.12 g/t Au from 36m downhole at Teglio (drilled near old

workings)

Shaun Bunn, Managing Director, said: "The results from the

December drilling programme indicate the existence of gold

mineralised zones along the projected Menzies Shear Zone corridor.

The drilling has intercepted quartz veins and alteration which

occur along the contact between basalts and sediments however only

a few of these intercepts have identified significant gold

mineralisation extending into fresh rock. We will continue to

evaluate the technical merits of the overall licence area with a

plan to complete our evaluation of the Central Menzies Project in

the period leading up to the Option expiry date, due late February

2022. We look forward to updating the market on the outcome of this

review once available."

Background on the Central Menzies Gold Project

In May 2021 Empire entered into an option agreement to acquire a

75% interest in the Central Menzies Gold Project, located in the

Menzies Shire, approximately 115km north of the city of

Kalgoorlie-Boulder and 10km south of the township of Menzies.

Central Menzies consists of four prospecting tenements (P26/2361,

2362, 2363 and 2364) covering a total area of 618 hectares.

Empire can exercise the Option at any time up to the 9-month

option expiration date by payment of AUD$1,750,000 in cash and

AUD$1,250,000 to be settled via the issue of new ordinary shares of

no-par value at a price calculated by reference to a 10% discount

to the 30-day VWAP.

Since entering into the Option Agreement in May Empire Metals

has undertaken several exploration campaigns in order to

technically evaluate the potential for a significant gold resource

within the licence area. The exploration activities undertaken

include:

Geophysical mapping: Empire Metals purchased close-spaced (25

metres) airborne magnetic and radiometric data over the four

exploration licences from Kingwest Resources Ltd which had

commissioned an airborne geophysical survey across the adjacent

tenements in Q4 2019.

Geochemical Mapping: A soil programme comprising 688 sites was

completed in July 2021. The sampling sites were situated on each of

the four licences, although largely focused on P29/2361 and

P29/2363. The sampling grid was 160m x 40m and samples were

collected from 10-30cm below surface using standard industry

practices.

RC Drilling Programme: An initial RC drilling programme of 27 RC

holes for a total of 2,379 metres was completed in September 2021,

targeting the two priority prospects initially identified from the

historical exploration dataset (refer Figure 1.). 14 RC holes for

1,189 metres were drilled at Teglio, testing a strike length of 520

metres. A total of seven sections of drill holes spans this length.

At Nugget Patch a further 13 holes were drilled for 1,190 metres.

These targets were chosen based on elevated gold concentration

within the licence area and the potential to generate significant

strike and lateral extension from old workings. Table 1 summarises

the significant gold intercepts from the Phase 1 drilling

programme.

Hole Number From Depth To Depth Interval Grade (g/t) Target

(m)

----------- --------- --------- ------------ -------------

CMRC21-001 34 41 7 0.5 Teglio North

------------- ----------- --------- --------- ------------ -------------

CMRC21-002 46 49 3 0.36 Teglio North

------------- ----------- --------- --------- ------------ -------------

CMRC21-005 45 48 3 0.86 Teglio

------------- ----------- --------- --------- ------------ -------------

CMRC21-013 44 47 3 0.47 Teglio South

------------- ----------- --------- --------- ------------ -------------

CMRC21-015 48 49 1 4.44 Nugget Patch

------------- ----------- --------- --------- ------------ -------------

CMRC21-016 61 63 2 0.81 Nugget Patch

------------- ----------- --------- --------- ------------ -------------

CMRC21-020 7 10 3 0.53 Nugget Patch

------------- ----------- --------- --------- ------------ -------------

49 51 2 1.51 Nugget Patch

------------- ----------- --------- --------- ------------ -------------

CMRC21-023 50 52 2 1.18 Nugget Patch

------------- ----------- --------- --------- ------------ -------------

CMRC21-026 43 45 2 0.9 Nugget Patch

------------- ----------- --------- --------- ------------ -------------

Table 1. Significant Intercepts from Phase 1 drilling with an

Incremental cut-off grade >0.3g/t Au and >1g Au*m

intervals.

Figure 1. Central Menzies Project drill hole location plan with

the recent drilling collar locations in green and the recent soil

sampling in brown. Historic drill intersections with significant

grade*metres are also highlighted.

Phase 2 RC Drilling Programme

A second phase of RC drilling was carried out in December 2021,

focused on testing the 500m long Nugget Patch gold trend where a

coherent zone of supergene gold mineralisation was previously

delineated close to the base of strong weathering during the

initial RC drilling programme in September 2021. At Teglio

additional holes were drilled to confirm historic high grade gold

intersections closely associated with the main workings, plus an

additional traverse to test under a strong gold-in-soil anomaly

recently defined by Empire some 300m northwest of the previous

drilling.

The drilling programme consisted of 13 RC holes for a total of

1,422 metres with nine RC holes drilled at Nugget Patch, for

1,1,112 metres, and a further four holes drilled at Teglio, for 310

metres (refer Figure 2), with the following significant intercepts

reported :

o 1m @ 1.35 g/t Au from 81m downhole at Nugget Patch

o 2m @ 1.41 g/t Au from 90m downhole at Nugget Patch

o 3m @ 3.1 g/t Au from 13m downhole at Teglio

o 4m @ 112 g/t Au from 36m downhole at Teglio

Figure 2. Phase 2 RC drill hole collar locations highlighted in

red, Phase 1 in grey. Historic drill intersections with significant

grade*metres are also highlighted.

Competent Person Statement

The technical information in this report that relates to the

Eclipse Gold Project has been compiled by Mr Andrew Bewsher, a

full-time employee of BM Geological Services. Mr Bewsher is a

Member of the Australian Institute of Geoscientists. Mr Bewsher has

been engaged as a consultant by Empire Metals Limited. Mr Bewsher

has sufficient experience that is relevant to the style of

mineralisation and type of deposit under consideration and to the

activity being undertaken to qualify as a Competent Person as

defined in the 2012 Edition of the 'Australasian Code for Reporting

of Exploration Results, Mineral Resources and Ore Reserves'. Mr

Bewsher consents to the inclusion in this release of the matters

based on his information in the form and context in which it

appears.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014, as incorporated into UK law by the

European Union (Withdrawal) Act 2018, until the release of this

announcement.

**S**

For further information please visit www.empiremetals.co.uk or

contact:

Shaun Bunn Empire Metals Ltd Company Tel: 020 7907

9327

Greg Kuenzel Empire Metals Ltd Company Tel: 020 7907

9327

Ewan Leggat S. P. Angel Corporate Nomad & Broker Tel: 020 3470

Finance LLP 0470

Adam Cowl S. P. Angel Corporate Nomad & Broker Tel: 020 3470

Finance LLP 0470

Damon Heath Shard Capital Partners Joint Broker Tel: 020 7186

LLP 9950

Susie Geliher St Brides Partners Ltd PR Tel: 020 7236

/Ana Ribeiro 1177

Selina Lovell St Brides Partners Ltd PR Tel: 020 7236

1177

About Empire Metals Limited

Empire Metals is an AIM-listed (LON: EEE) exploration and

resource development company with a project portfolio comprising

gold interests in Australia and Austria.

The Company strategy is to develop a pipeline of projects at

different stages in the development curve. Its current focus is on

the high-grade Eclipse Gold Project and the Central Menzies Gold

Project in Western Australia, with the goal to expand through the

addition of further projects in the region to develop a viable and

compelling portfolio of precious metals assets.

Empire also holds a portfolio of three precious metals projects

located in an historically high-grade gold production region

comprising the Rotgulden, Schonberg and Walchen prospects in

central-southern Austria.

The Board continues to evaluate opportunities through which to

realise the value of its wider portfolio and reviews further assets

which meet the Company's investment criteria.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDLVLFLLFLBBBK

(END) Dow Jones Newswires

January 28, 2022 07:13 ET (12:13 GMT)

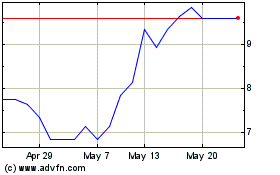

Empire Metals (AQSE:EEE.GB)

Historical Stock Chart

From Jun 2024 to Jul 2024

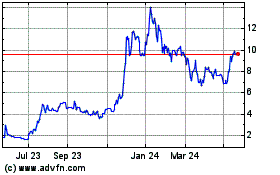

Empire Metals (AQSE:EEE.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024