Final Results

DXS INTERNATIONAL PLC

(AQSE: DXSP)

ANNUAL RESULTS

for the year ended 30 April 2024

The Board of DXS International plc (“the

Company” or “DXSP”), the AQSE Growth Market quoted healthcare

information and digital clinical decision support systems provider,

is pleased to announce its audited Final Results for the year ended

30 April 2024.

Financial highlights:

- Revenue decreased

by 2.4% to £3,308,359 (2023: £3,391,219).

- Core recurring

revenue model remains resilient.

- Agreed a 13.09%

price increase on recurring revenue from the NHS effective November

2024.

- Available cash at

the period end was £90,012 plus unutilised debtor drawdowns of

£379,605 (2023 £371,978) .

Change to Amortisation and Impairment creates headline

loss

The loss for the year is £4,738,686 (2023: Profit of £225,191).

The loss is a result of a combination of increased amortisation of

£1,020,916 and impairment of £4,378,114. This loss should be viewed

in the following context.

The Company has invested in, and completed, several innovative

solutions specifically designed for use by the NHS. It is

well-known that the NHS has undergone a decade and more of extreme

austerity that led to a decline in both new investment and health

service delivery. NHS budget constraints in health technology

investment coupled with the disruption caused by Covid

significantly slowed the adoption of new innovative technology

solutions. It is against this background that, after discussions

with our auditors, the Directors have decided that commencement of

sales revenue from these products cannot be accurately predicted

and accordingly has written off, as "impairment”, the development

cost of these products.

However, the Directors remain confident that due to the fast

growing awareness in the NHS about the power of digital technology

to unlock productivity and improve patient outcomes, these

solutions will, in future, become revenue producing.

Operational highlights:

Despite not meeting the financial growth targets

we set for the past year the company has made significant progress

in building a firm technology and operations foundation to fully

exploit what the Directors believe to be fast maturing

opportunities in the NHS. All indications are the new government,

together with the NHS’s high-level acknowledgement that digital

health solutions and services are now essential for the system’s

survival, will drive rapid adoption of innovative solutions. During

the past period, we have dedicated significant effort to building

robust state-of-art solutions specifically designed to address

urgent NHS digital health unmet needs. Our operational highlights

include the following:

- The completion of

our cloud-based core Aios platform together with certified

Interface integrations with England’s main primary care clinical

systems and importantly, with NHS England’s electronic referrals

system (ERS).

- Our new SMART

Referral Cloud solution - several years in development - has now

completed user acceptance testing and is being launched to existing

customers. The solution streamlines the referral process between

primary and secondary care and is designed to help resolve the

known patient referral backlog and extend appeal and usability to

attract new customers.

- We also achieved

accreditation on the Crown Procurements G-Cloud 14 Framework, which

provides existing and new customers with a second framework to

procure our SMART Referral solution.

- ExpertCare, our new

hypertension medicine review solution, is 11 months into an

18-month-long Innovate UK-funded evaluation. Initial project

results show that the solution is highly effective in reducing

blood pressure in the evaluation patient cohort, and we expect a

positive clinical and economic evaluation outcome.

Post-Period

- As announced yesterday we have managed

to secure our first commercial Expercare orderto conduct

hypertensionreviews for a Primary Care Network (PCN)consisting of 7

GP practices

- Management share options expired and

will be replaced with a suitable replacement scheme in due

course.

Outlook

The NHS is under significant pressure to

overcome the current healthcare delivery crisis. In the recent

past, DXS has focused its efforts on solutions that meaningfully

address current NHS pressure points like the backlog in hospital

referrals and the enormous human and financial cost of the rising

incidents of cardiovascular disease.

The company’s recently released SMART Referrals

Solution is set to make an impact on speeding up referrals from

primary to secondary care by improving the administrative and

clinical referral workflow. Early real-world evaluations show the

solution slashes referral rejections and reduces patient waiting

times. This offering has recently been made even more compelling

for our customers due to a recently completed integration with the

NHS Electronic Referral System (ERS). This feature now allows

primary care clinicians to select specific services with shorter

waiting times and is a powerful benefit for patients awaiting

urgent treatment.

DXS has also made significant progress in

advancing its ExpertCare Hypertension Medicines review solution

towards full-blown commercialisation. The solution strongly aligns

with the NHS’ stated objective of reducing the incidence of

cardiovascular disease related events such as heart attack and

stroke. Uncontrolled blood pressure is a known driver of

cardiovascular disease and NHS England’s objectives for 2024/25

includes increasing the percentage of patients with hypertension

treated according to NICE guidance to 80% by March 2025. ExpertCare

is well-positioned to help the NHS meet this objective.

David Immelman, Chief Executive of DXS, commented:

“Both management and staff at DXS are facing our

market with increased confidence. The company has spent several

years primarily inwardly focused on developing, testing and

certifying its SMART digital platform and products. Concurrently,

it has progressed with developing a body of evidence to support the

effectiveness of its solutions. The evidence gathering (in the form

of real-world evaluations overseen by reputable NHS-funded Health

Innovation Networks) is designed to underpin its soon-to-be

ramped-up marketing and sales initiatives.

We are hopeful that the new government’s

emerging strategy around strengthening primary care with a renewed

focus on increased digitisation and disease prevention will come to

fruition. Our solutions are now well-positioned to benefit from

this direction of travel.

We recognise that to unlock true company value

we need to dramatically increase our sales revenue and

profitability. I wish to assure our shareholders that we remain

singularly focused on this objective and to return value to

stakeholders and our shareholders.”

The Directors of DXS International plc accept

responsibility for this announcement. This announcement contains

information which, prior to its disclosure, was inside information

as stipulated under Regulation 11 of the Market Abuse (Amendment)

(EU Exit) Regulations 2019/310 (as amended).

Contacts :

David

Immelman

DXS International plc

www.dxs-systems.com

|

01252 719800 |

AQSE Corporate

Broker and Corporate Advisor

Hybridan LLP

Claire Louise Noyce |

020 3764 2341 |

Notes to Editors

About DXS:

DXS International presents up to date treatment

guidelines and recommendations, from Clinical Commissioning Groups

and other trusted NHS sources, to doctors, nurses and pharmacists

in their workflow and during the patient consultation. This

effective clinical decision support ultimately translates to

improved healthcare outcomes delivered more cost effectively and

which should significantly contribute towards the NHS achieving its

projected efficiency savings.

The following information is extracted from the

DXS International plc audited accounts for the year ended 30 April

2024.

CHAIRMAN’S REPORT

The Board announces its results for the year

ending 30 April 2024.

For the year ending 30 April 2024, the turnover

decreased by 2.4% to £3,308,359 (2023: £3,391,219).

The loss for the year is £4,738,686 (2023:

Profit of £225,191). The loss is a result of a combination of

increased amortisation of £1,020,916 and impairment of £4,378,114.

This Loss should be viewed in the following context.

The Company has invested in, and completed,

several innovative solutions specifically designed for use by the

NHS. It is well-known that the NHS has undergone a decade and more

of extreme austerity that has led to a decline in both new

investment and health service delivery. NHS budget constraints in

health technology investment coupled with the disruption caused by

Covid significantly slowed the adoption of new innovative

technology solutions. It is against this background that the

Directors have decided that commencement of sales revenue from

these products cannot be accurately predicted and accordingly has

written off, as impairment, the development cost of these products.

However, the Directors remain positive that due to the growing

awareness in the NHS about the power of digital technology to

unlock productivity and improve patient outcomes, these solutions

will ultimately become revenue producing in the near future.

There is huge pressure on the NHS to overcome

the current crisis in health care delivery. In the recent past, DXS

has focused its efforts on solutions that meaningfully address

current NHS pressure points like the backlog in hospital referrals

and the enormous human and financial cost of the rising incidents

of cardiovascular disease.

The company’s recently released Smart Referrals

Solution is set to make an impact on speeding up referrals from

primary to secondary care by improving the administrative and

clinical referral workflow. Early real world evaluations show the

solution slashes referral rejections and reduces patient waiting

times. This offering has become even more compelling for our

customers due to our recently completed integration with the NHS

Electronic Referral System (ERS). This feature now allows primary

care clinicians to select specific services with shorter waiting

times and is a powerful benefit for patients awaiting urgent

treatment.

Our SMART Referral Solution is built on a modern

cloud-based technology stack that is currently being rolled-out as

a replacement for our legacy Point-of-Care solution. This next

generation solution will form the basis for our expansion into a

wider NHS customer base and places us in a strong position to meet

the requirements of the soon to be finalised NHS Digital Services

for Integrated Care Framework (DSIC). The forthcoming Framework is

like the now expired GPIT Futures Framework that enabled our

primary care end-user customers to acquire our solution through

central NHS funding.

DXS has also made significant progress in

advancing its ExpertCare Hypertension Medicines optimisation

solution towards full-blown commercialisation. The solution

strongly aligns with the NHS’ stated objective of reducing the

incidence of cardiovascular disease related events such as heart

attack and stroke. Uncontrolled blood pressure is a known driver of

cardiovascular disease and NHS England’s objectives for 2024/25

includes increasing the percentage of patients with hypertension

treated according to NICE guidance to 80% by March 2025. Our

innovative rules based AI hypertension digital solution is

currently close to completing a 12-month Innovate UK funded

real-world evaluation. The evaluations’ interim results are highly

encouraging and show strong evidence that ExpertCare could be

highly effective in helping the NHS meet its blood pressure control

targets. As a direct result of this evidence we have secured our

first commercial order with additional prospects in our sales

pipeline.

We are positive that the NHS austerity tide is

beginning to turn and that soon new funding – especially in the

realm of technology and AI - will become more readily available.

Our view is reinforced by a recent statement by Amanda Pritchard

the Chief Executive Officer (CEO) of NHS England who in a recent

statement said: “Despite the challenges we face, there are real

reasons for optimism. We are already putting in place the building

blocks for a better future. The £3.4 billon investment of capital

in data and technology – from 2025/26 onwards – announced in the

Spring Budget will allow us to rollout technology and digital

services to improve access, waiting times and outcomes”.

As we have previously stated, we are of the

conviction, supported by evidence and enthusiastic clinician

support, that our revenue will grow as adoption of our solutions

gain momentum.

We remain committed to growing the revenue and profitability for

our shareholders and thank you for your continued support.

Yours

sincerely,

Bob Sutcliffe

Chairman

REPORT OF THE DIRECTORS

The directors present their annual report and

the audited financial statements for the year ended 30 April 2024.

The Chairman’s statement which is included in this report includes

a review of the achievements of the Company, the trading

performance, financial position, and trading prospects.

DIRECTORS

The directors for the year were:

- Bob Sutcliffe –

Chairman

- David Immelman –

CEO

- Steven Bauer –

COO

PRINCIPAL ACTIVITIES

The group's principal activities during the

period were the development and distribution of clinical decision

support to General Practitioners, Nurses, and Retail Pharmacies in

the United Kingdom. The commercial side included the licensing of

DXS to various ICBs (Integrated Care Boards) and the sale of

e-detailing opportunities to the Pharmaceutical Industry.

The group continues to invest in research and development both

locally and internationally and during this financial year has

invested £992,828 into R&D for the introduction, continuation,

and completion of new DXS solutions. These are targeted at

providing clinicians with solutions to improve referring and the

therapeutic management of long-term conditions. These products are

aligned with the NHS strategy of Digital First and Empowering the

Wider Workforce.

During the period we have repaid £457,451 on bank and

third-party loans.

FINANCIAL INSTRUMENTS

The Directors believe that there is no material

risk arising in respect of interest rates on loans, credit, and

liquidity.

DIVIDEND

The Directors do not recommend a dividend.

DIRECTORS’ RESPONSIBILITIES

The directors are responsible for preparing the

annual report and financial statements for each financial year. The

directors have elected to prepare the financial statements in

accordance with United Kingdom Generally Accepted Accounting

Practice (United Kingdom Accounting Standards and applicable law).

Under company law the directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Group and Company and of the

profit or loss of the Group for that period. In preparing these

financial statements, the directors are required to:

- Select suitable

accounting policies and apply them consistently.

- Make judgments and

accounting estimates that are reasonable and prudent.

- State whether UK

accounting principles have been followed subject to any material

departures disclosed and explained in the financial statements

and,

- Prepare the

financial statements on the going concern basis unless it is

inappropriate to presume that the Group and Company will continue

in the business.

The directors are responsible for keeping

adequate accounting records that are sufficient to show and explain

the Company's transactions and disclose with reasonable accuracy at

any time the financial position of the Company and enable them to

ensure that the financial statements comply with the Companies Act

2006. They are also responsible for safeguarding the assets of the

Company and hence for taking reasonable steps for the prevention

and detection of fraud and other irregularities.

DIRECTORS’ RESPONSIBILITIES TO

AUDITORS

The directors have taken all the necessary steps

that they ought to have taken as directors in order to make

themselves aware of all relevant audit information and to establish

that the Company's auditors are aware of that information.

As far as the directors are aware, there is no

relevant audit information of which the Company’s auditor is

unaware.

Approved by the board and signed on its behalf

by:

D A Immelman

Director

29 October 2024

STRATEGIC REPORT

SECTION 172 REPORT

Section 172 of the Companies Act requires that a

director of the Company is managing in the best interests of all

stakeholders – Customers, Employees and Shareholders.

In the spirit of above, the Directors of DXS

International plc, strive to maintain a reputation for high but

fair standards in the best interest of its stakeholders.

Our primary focus is on our customers and here

we regard our relationships and channels of communications of

paramount importance. We operate in a sensitive environment,

healthcare, and as such ensure that we meet all the standards

required by our customers, such as Information Governance and

Clinical Safety. In addition, we comply with ISO standards which

assures an overarching good governance approach to all

operations.

The Board is focused on delivering value for

Shareholders underpinned by motivated Employees delivering above

average delivery of solutions and service to Customers. In

achieving the foregoing, the Company focuses on continued

innovation via a policy of research and development funded through

organic investment plus capital raises, as agreed at shareholder

meetings, noting it raised external equity financing in the year to

April 2024, as set out in Note 18 in the Financial Statements.

In our communication to Shareholders the Board

is clear in terms of its short, medium, and long-term strategy and

maintains an open-door approach to Shareholders seeking additional

clarity on any issue. The Board releases notices on a regular basis

informing Shareholders of developments in areas of business

progress, non-confidential strategic decisions, and any change to

company policy. Risks and opportunities are set out in this

strategic review.

The Group is small and while clear management

structures are in place all employees, if required, have direct

access to the Executive Directors on a daily basis and, if

necessary, to the Chairman. The group retains HR services to ensure

the fair and equitable treatment of employees. The Company promotes

a policy of promoting from within supported by training and

mentorship. We encourage diverse thinking and recognise strengths

and contribution to the business.

REVIEW OF THE GROUPS

BUSINESS

The Group loss for the year is £4,738,686 (2023:

Profit of £225,191). The loss is a result of a combination of

increased amortisation of £1,020,916 and impairment of £4,378,114.

Refer to the Chairman’s statement for an explanation of why the

directors took the decision for this impairment.

As an accredited NHS solutions provider, DXS has

well-established business continuity and disaster recovery

protocols in place.

We have continued the development of our new

Aios cloud-based system and are in the process of piloting this new

version. In addition, we completed our IM1 integration for EMIS

which has now been NHS accredited and an Innovate UK grant funded

trial for our ExpertCare hypertension solution is underway.

Although the NHS remains notoriously slow in

adopting new technology, our sustained efforts are seeing gained

awareness of our new SMART referral and Hypertension solution which

we believe will begin generating revenue in the new financial

year.

Our strategy remains aligned with both the new

NHS Long Term Plan and opportunities abroad.

PRINCIPAL RISKS AND

UNCERTAINTIES

The principal risk to the Company in the UK is

that the NHS dramatically changes its plans or cuts its budgets.

This seems unlikely, particularly with the current NHS’ stated

objective for clinicians to operate using digital technologies with

which our new Aios and ExpertCare solutions are aligned.

Failure to achieve predicted quantities of DXS

contracts, and slower development of additional revenue streams may

result in revenues growing more slowly than anticipated. These may

be mitigated due to the launch of market ready new products as the

current situation normalises plus the first ExpertCare commercial

sale.

Our plans for expansion outside of the UK

mitigate this risk. Here we continue with our research and

development plans to take our new Expert Hypertension solution into

international markets where improved management of Hypertension and

other long-term conditions are a top priority.

ANALYSIS OF BUSINESS DURING YEAR ENDING

APRIL 2024

Revenue was marginally down with market

expectations, decreasing by 2.4%. The group showed a loss of

(£4,738,686). The loss is a result of a combination of increased

amortisation of £1,020,916 and impairment of £4,378,114. Refer to

the Chairman’s statement for an explanation of why the directors

took the decision for this impairment.

FINANCIAL METRICS

- Group Revenue of

£3,308,359 (2023: £3,391,219) has decreased by 2.4%. Definition:

Total Group sales including distribution of clinical decision

support to General Practitioners and the licensing of DXS to CCGs

and healthcare publishers. Group Revenue includes the sale of

medicine education slots to the pharmaceutical industry.

- Underlying Group

loss after Tax was (£4,738,686). This was as a result of a

combination of increased amortisation of £1,020,916 and impairment

of £4,378,114. The rationale is explained under Analysis

above.

- Depreciation and

amortisation of deferred Research and Development expenditure and

Goodwill in 2024 was £1,020,916 and in 2023 was £704,091.

- Earnings Per Share

2024 (0.7p), 2023 0.5p. Definition: Earnings per share is the

underlying profit divided by the weighted average number of

ordinary shares in issue.

- ROE 2024 (103%)

2023 5%. Definition: Return on Equity (ROE) is the ratio of net

profit of a company to its shareholders funds. It measures the

profitability of a company by expressing its net profit as a

percentage of its shareholders funds which include share capital,

share premium, provision for costs of share option awards and

retained earnings. This drop in the ratio is mainly due to the

one-off impairment charge, which rationale is explained in the

Chairman’s report.

CORPORATE GOVERNANCE

We are committed to establish, maintain, and

continually improve an Integrated Management System (IMS) that

conforms to relevant ISO requirements.

To achieve this objective, we commit to:

- continual

improvement in our performance and services to our

stakeholders.

- Identify, assess,

reduce, and eliminate hazards and risks pertaining to our

business.

- Set risk-based

objectives and targets to meet applicable statutory, business,

information security and service level obligations.

- Comply with

mutually agreed quality and service level requirements of our

customers.

- Develop our people

and provide sufficient resources to meet our objectives and

targets.

We communicate the IMS Policy to all personnel

working for or on behalf of DXS to ensure that they are made aware

of their individual IMS obligations.

Approved by the board and signed on its behalf

by:

D Immelman

Director

29 October 2024

FINANCIAL STATEMENTS

INCOME STATEMENT

Year ended 30 April 2024

| |

|

2024

Continuing Operations |

|

2023

Continuing Operations |

| |

|

|

|

|

| |

|

£ |

|

£ |

| Turnover |

|

3,308,359 |

|

3,391,219 |

| Cost of

Sales |

|

(428,212) |

|

(466,722)) |

| |

|

_________ |

|

_________ |

| Gross Profit |

|

2,880,147 |

|

2,924,497 |

| |

|

|

|

|

| Grant income |

|

136,570 |

|

- |

| Administration

Costs |

|

92,494,510) |

|

(2,261,897) |

| |

|

|

|

|

| Depreciation and

Amortisation and impairment |

|

(1,020,916) |

|

(705,253) |

|

Depreciation and amortisation |

|

(1,020,916) |

|

(705,253) |

|

Impairment |

|

(4,378,114) |

|

- |

| |

|

_________ |

|

_________ |

| |

|

5,399,030 |

|

(705,253) |

| |

|

_________ |

|

_________ |

| |

|

|

|

|

| Operating

Loss |

|

(4,876,823) |

|

(42,653) |

| Sundry

income |

|

15 |

|

5 |

| |

|

_________ |

|

_________ |

| |

|

(4,876,808) |

|

(42,648) |

| Interest

payable and similar expenses |

|

(74,842) |

|

(55,058) |

| |

|

_________ |

|

_________ |

| Loss on ordinary

activities before taxation |

|

(4,951,650) |

|

(97,706)) |

| Tax on loss on

ordinary activities |

|

222,964 |

|

322,897 |

| |

|

_________ |

|

_________ |

| (Loss) /

Profit for the year |

|

(4,738,686 |

|

225,191 |

| |

|

========= |

|

========= |

| Earnings

per share |

|

|

|

|

|

|

|

(7.4p) |

|

0.5p |

|

|

|

(7.4p) |

|

0.5p |

| |

|

========= |

|

========= |

Statement of Other Comprehensive Income

Year ended 30 April 2024

| |

|

2024

£ |

|

2023

£ |

| |

|

|

|

|

| (Loss) / Profit

for the year |

|

(4,738,686) |

|

225,191 |

| Other

comprehensive income |

|

- |

|

- |

| Tax

on components of other comprehensive income |

- |

|

- |

| |

|

_________ |

|

_________ |

|

Total comprehensive income for the year |

(4,738,686) |

|

225,191 |

| |

|

========= |

|

========= |

Statement of Financial Position

Year ended 30 April 2024

| |

Group 2024 |

Group 2023 |

Company 2024 |

Company 2023 |

| |

£ |

£ |

£ |

£ |

| Fixed

Assets |

|

|

|

|

| Intangible

Assets |

1,455,000 |

5,860,210 |

- |

- |

| Tangible Assets |

1,038 |

1,122 |

- |

- |

| Investments |

|

- |

507,954 |

3,486,478 |

| |

_________ |

_________ |

_________ |

_________ |

| |

1,456,038 |

5,861,332 |

507,954 |

3,486,478 |

| |

_________ |

_________ |

_________ |

_________ |

| Current

assets |

|

|

|

|

| Debtors: amounts

falling due within one year |

1,115,272 |

791,321 |

196,024 |

18,393 |

| Cash at bank and in

hand |

90,012 |

371,977 |

4,094 |

200,929 |

| |

_________ |

_________ |

_________ |

_________ |

| |

1,205,284 |

1,163,299 |

200,118 |

219,322 |

| Creditors: amounts

falling due within one year |

(811,205) |

(865,475) |

(161,124) |

(239,518) |

| |

_________ |

_________ |

_________ |

_________ |

| Net current

assets |

394,079 |

297,823 |

38,994 |

(20,196) |

| |

_________ |

_________ |

_________ |

_________ |

| |

|

|

|

|

| Total assets less

current liabilities |

1,850,117 |

6,159,155 |

546,948 |

3,466,282 |

| |

|

|

|

|

| Creditors: |

|

|

|

|

| Amounts falling due

after more than one year |

(345,455) |

(720,446) |

(99,562) |

(470,042) |

| Deferred

income |

(1,057,276) |

(848,876) |

- |

- |

| |

_________ |

_________ |

_________ |

_________ |

| |

447,385 |

4,589,833 |

447,386 |

2,996,240 |

| |

========= |

========= |

========= |

========= |

| Capital and

reserves |

|

|

|

|

| Called up share

capital |

211,273 |

159,246 |

211,273 |

159,246 |

| Share Premium |

3,213,395 |

2,671,321 |

3,213,395 |

2,671,321 |

| Share option

reserve |

11,589 |

21,382 |

11,589 |

21,382 |

| Retained

earnings |

(2,988,871) |

1,737,884 |

(2,988,871) |

144,291 |

| |

_________ |

_________ |

_________ |

_________ |

| Shareholders’

funds |

447,386 |

4,589,833 |

447,386 |

2,996,240 |

| |

========= |

========= |

========= |

========= |

| |

|

|

|

|

As permitted by Section 408 of the Companies Act 2006, the

Income Statement of the parent company is not presented as part of

these financial statements. The Company made a profit of £2,325

(2022 - £2,395) for the year.

The financial statements were approved and

authorized for issue by the Board on 29 October 2024.

Signed on behalf of the Board of directors

D Immelman

Director |

R Sutcliffe

Director |

Company Registration number

: 06311313

STATEMENT OF CASH FLOWS

Year ended 30 April 2024

| |

|

Group

2024 |

|

Group

2023

|

| |

|

£ |

|

£ |

| Cash flow from

operating activities |

|

323,384 |

|

549,803 |

| Interest

paid |

|

(74,842) |

|

(55,058) |

| Sundry

Income |

|

15 |

|

5 |

| R&D tax

credit received |

|

326,564 |

|

323,897 |

| |

|

_________ |

|

_________ |

| Net cash flow

from operating activities |

|

575,121 |

|

818,647 |

| |

|

_________ |

|

_________ |

| |

|

|

|

|

| Cash flow from

investing activities |

|

- |

|

- |

| Payments to

acquire intangible fixed assets |

|

(992,828) |

|

(1,380,617) |

| Receipts /

(Payments) to acquire tangible fixed assets |

|

(908) |

|

361 |

| |

|

_________ |

|

_________ |

| |

|

(993,736)

_________ |

|

(1,380,256)

_________ |

| Financing

Activities |

|

- |

|

|

| Share issue

proceeds |

|

630,628 |

|

- |

| Share Issue

costs |

|

(36,527) |

|

|

| Repayment of

long term loans |

|

(457,451) |

|

(268,792) |

| Advance of

long term loans |

|

- |

|

750,000 |

| |

|

_________ |

|

_________ |

| |

|

136,650 |

|

481,208 |

| |

|

_________ |

|

_________ |

| |

|

|

|

|

| Net (decrease)

in cash and cash equivalents |

|

(281,965) |

|

(80,401) |

| Cash and Cash

equivalents at 1 May 2021 |

|

371,977 |

|

452,378 |

| |

|

_________ |

|

_________ |

| Cash and Cash

equivalents at 30 April 2022 |

|

90,012 |

|

371,977 |

| |

|

========= |

|

========= |

| Cash and Cash

equivalents consists of: |

|

|

|

|

| Cash at bank

and in hand |

|

90,012 |

|

371,977 |

| |

|

========= |

|

========= |

| |

|

|

|

|

| |

|

|

|

|

| Net Debt

Reconciliation |

Current Debt |

Non Current Debt |

Cash |

Total |

| |

£ |

£ |

£ |

£ |

| At 30 April

2022 |

(293,132) |

(331,330) |

452,379 |

(172,083) |

| Cash Flow |

(20,354) |

- |

(80,401) |

(100,755) |

| Non cash flow |

- |

(389,116) |

- |

(389,116) |

| |

________ |

________ |

________ |

________ |

| At 30 April

2023 |

(313,486) |

(720,446) |

371,978 |

(661,954) |

| Non – cash

flow |

- |

374,991 |

- |

374,991 |

| Cash Flow |

26,857 |

- |

(281,966) |

(255,109) |

| |

_________ |

_________ |

________ |

_________ |

| At 30 April

2024 |

(286,629) |

(345,455) |

90,012 |

(542,072) |

| |

========= |

========= |

========= |

========= |

NOTES TO THE FINANCIAL STATEMENTS

(CONTINUED)

Year ended 30 April 2023

1 Summary

of significant accounting policies

(a) General information and basis

of preparation.

DXS International PLC is a public company

limited by shares incorporated in England and Wales. The address of

the registered office is given in the company information on Page 4

of these financial statements.

The group's principal activities during the year

were the development and distribution of clinical decision support

to General Practitioners, Nurses and Retail Pharmacies in the

United Kingdom and South Africa. The commercial side includes the

licensing of DXS products to various ICBs, the sale of e-detailing

opportunities to the pharmaceutical industry, the UK Primary Care

sector and the licencing of DXS technology to healthcare

publishers.

The financial statements have been prepared in

accordance with applicable accounting standards including Financial

Reporting Standard 102, the Financial Reporting Standard applicable

in the UK and Republic of Ireland (FRS 102) and the Companies Act

2006. The financial statements have been prepared on a going

concern basis under the historical cost convention. The financial

statements are prepared in sterling which is the functional

currency of the company.

In the opinion of the Directors the group has

sufficient funding to continue as a going concern for at least

twelve months from the date of approval of the financial

statements. Details supporting opinion are set out in Note 1(m)

below.

The significant accounting policies applied in

the preparation of these financial statements are set out below.

These policies have been consistently applied to all years

presented unless otherwise stated.

(b) Intangible

assets

Intangible assets acquired separately from a

business are capitalised at cost.

Research and development expenditure, other than

specific identifiable development expenditure, is written off

against profits in the year in which it is incurred.

Identifiable development expenditure is

capitalised to the extent that the technical, commercial and

financial feasibility can be demonstrated. Developed products are

for use within the NHS and other medical institutions within both

the UK and internationally. The Group is already a supplier of

services to the NHS.

Goodwill arising on business combinations is

capitalised, classed as an asset on the balance sheet and amortised

over its useful life. The period originally chosen for writing off

the current goodwill was 20 years because the directors believed

that this was the period of time for the benefit to be received.

The Directors reviewed the anticipated future life of the goodwill

during 2020. It was considered that the anticipated future life of

the goodwill would not exceed 3 years from 1 May 2020. Accordingly

the Net Book Value of the goodwill at 30 April 2020 was amortised

over 3 years.

Intangible assets are amortised over a straight

line basis over their useful lives. The useful lives of intangible

assets are as follows:

|

Intangible type |

Useful life |

Reasons |

|

Development expenditure |

5 years from the date that the specific product is completed and

available for distribution. |

Period of time for benefit to be received. |

Provision is made for any impairment if the

recoverable amount of the asset is less than its carrying amount,

based on Directors judgement of the future revenue to be derived

from each product.

The company has completed a number of projects

specifically for use by the NHS. Due to NHS Budget restraints, the

often unavailability of senior NHS staff numbers with the authority

to make decisions, the continuing changing structure of the NHS,

the directors have decided that commencement of sales revenue from

these products cannot be accurately predicted and accordingly have

written off as impairment the net book value of these products.

However, with the potential restructuring of the NHS, the Directors

believe that these products will be revenue producing in the

future.

(c) Tangible fixed assets

The company capitalises items purchased as

Tangible Fixed Assets which have a cost in excess of £550.

Tangible fixed assets are stated at cost less

accumulated depreciation.

Depreciation is provided on all tangible fixed

assets at rates calculated to write off the cost , less estimated

residual value, of each asset on a systematic basis over its

expected useful life as follows:

Plant and

equipment 3-4 years

straight line

(d) Debtors and

creditors receivable/ payable within one year

Debtors and creditors with no stated interest

rate and receivable or payable within one year are recorded at

transaction price. Any losses arising from impairment are

recognised in the profit and loss account in other administration

expenses.

(e) Loans and

borrowings

Loans and borrowings are initially recognised at

the transaction price including transaction costs. Subsequently

they are measured at amortised cost using an effective interest

rate method. If an arrangement constitutes a finance transaction it

is measured at present value.

(f) Grants

Government Grants, including non - monetary

grants, shall not be recognised until there is reasonable assurance

that :

(a) the entity will comply with the conditions attached to them;

and

(b) the grants will be received.

An entity shall recognise grants either based on the performance

model or the accrual model. In the current year, the Grant has been

accounted for on the accrual basis over the period in which the

Group recognised the related costs for which the grant is intended

to compensate.

(g) Tax

Current tax represents the amount of tax payable

or receivable in respect of the taxable profit for the current or

past reporting periods. It is measured at the amount expected to be

paid or recovered using the tax rates and laws that have been

enacted or substantively enacted by the reporting date.

(h) Turnover and other income

Turnover is measured at the fair value of the

consideration received or receivable net of VAT and trade

discounts. The policy adopted for the recognition of turnover is as

follows:

Sale of services and products

Turnover is from the sale of products and

services to the pharmaceutical industry and the UK Primary Care

sector and is recognised over the term of service contract and is

apportioned on a time basis representing the delivery of the

service.

(i) Foreign currency

Foreign currency transactions are initially

recognised by applying to the foreign currency amount the exchange

rate between the functional currency and the foreign currency at

the date of the transaction.

Monetary assets and liabilities denominated in a

foreign currency at the balance sheet date are translated using the

closing rate.

Foreign exchange gains or losses are recognised

in the Income Statement.

(j) Employee benefits

When employees have rendered service to the

company, short term employee benefits to which the employees are

entitled are recognised at the undiscounted amount expected to be

paid in exchange for that service.

The company operates a defined contribution plan

for the benefit of its employees. Contributions are expensed as

they become payable.

(k) Leases

Rentals payable under operating leases are

charged to the income statement on a straight line basis over the

period of the lease.

(l) Share option policy

The company recognised as an expense, the fair

value of share options granted over their vesting period. The fair

value is calculated by applying an option pricing model.

(m) Key judgements and Key

accounting estimates

The Key judgements or Key Accounting estimates

with a material effect on the carrying value of assets and

liabilities are set out below -.

Going concern

In regards to the going concern of the group,

the directors have considered cash flow forecasts for the period to

April 2026 which included a price increase. To date only a portion

of this increase has been received with the remaining increase

expected in the first quarter of 2025. Should this price increase

be delayed as mitigation there are the new SMART Referral pipeline

sales that are not included in the current cashflow. In addition to

the SMART Referral sales are new potential Expertcare solution

sales which are expected to be revenue generating from late 2024.

The first Expertcare contract with a third party has been signed

and will start generating income during December 2024. Also

included are costs which, if forecasted sales are slower than

anticipated, can be reduced accordingly.

Given the market potential for the new products,

supported by trial results, the directors consider it appropriate

to adopt the going concern basis of accounting and are satisfied

that there is no material uncertainty.

Research and Development Tax credit

The Research and Development tax credit received

from HMRC is not a government grant but a recognition of the costs

incurred in respect of the company's research and development and

is received through an adjustment to the taxable income of the

company.

Impairment

As per the NHS mandate requiring NHS accredited

suppliers to continue a process of innovation, the Group has

invested heavily into developing new innovative solutions to meet

the NHS unmet needs. However, while there is no doubt as to the

potential benefits will realise for the NHS, the slow pace at which

the NHS has been, and continues to operate is frustrating. This

lethargic pace has come about for a number of reasons, such as the

post COVID restructuring, delays in funding renewals and more

recently the GP Collective Actions which are adversely affecting

times to market.

The directors have decided that commencement of

sales revenue from these products cannot be accurately predicted

and accordingly have written off as impairment a large portion of

the cost of these products. The Directors emphatically believe that

these products will be revenue producing in future years and

evidence of this, although slow, exists.

(n) Reduced disclosure

DXS International PLC meets the definition of a

qualifying entity under FRS 102 paragraph 1.12(b) and has therefore

taken advantage of the disclosure exemption in relation to the

parent cash flow statement.

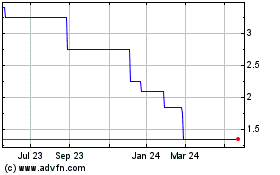

DXS (AQSE:DXSP)

Historical Stock Chart

From Oct 2024 to Nov 2024

DXS (AQSE:DXSP)

Historical Stock Chart

From Nov 2023 to Nov 2024