TIDMCIC

RNS Number : 0493U

Conygar Investment Company PLC(The)

21 November 2023

21 November 2023

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014 as amended by the Market

Abuse (Amendment) (EU Exit) Regulations 2019. Upon the publication

of this announcement via the Regulatory Information Service, this

inside information is now considered to be in the public

domain.

THE CONYGAR INVESTMENT COMPANY PLC

PRELIMINARY RESULTS FOR THE YEARED 30 SEPTEMBER 2023

SUMMARY

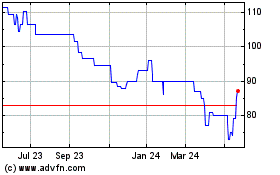

-- Net asset value ("NAV") decreased in the year by GBP29.5

million to GBP95.1 million (159.4p per share; 2022: 208.9p per

share) primarily as a result of a net GBP21.5 million write down in

the carrying value of the Group's investment properties in addition

to a GBP5.2 million write down in the carrying value of the Group's

development site in Holyhead, Anglesey.

-- Total cash deposits of GBP2.7 million (4.5p per share) at the

year end and GBP9.0 million as at 17 November 2023.

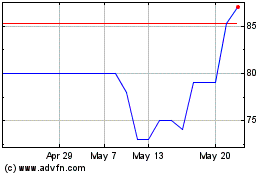

-- Cash deposits boosted after the year end by the placing in

October 2023 of 5 million zero dividend preference shares of GBP1

each (the "ZDP shares") and completion in November 2023 of a GBP12

million loan facility from A.S.K. Partners Limited.

-- Construction progressing well and on budget for the 693 bed

student accommodation development at The Island Quarter, Nottingham

planned for completion in May 2024.

-- GBP47.5 million facility agreement entered into with Barclays

Bank PLC ("Barclays") in December 2022, for a maximum term of 3

years, to enable the completion and subsequent letting of the

student accommodation development at The Island Quarter, with

GBP18.0 million drawn by 30 September 2023.

-- Detailed planning consent granted in May 2023 for a 249,000

square foot bioscience building at The Island Quarter.

-- Revised masterplan agreed with Nottingham City Council which,

subject to investor and occupier appetite, increases the size of

The Island Quarter development up to a maximum of 3.5 million

square feet.

-- Disposal of the development site at Haverfordwest,

Pembrokeshire, for gross proceeds of GBP9.65 million to realise a

profit of GBP0.1 million.

-- Anglesey Freeport confirmed as one of the two newly

established freeports in Wales with our 203 acre brownfield site at

Rhosgoch, Anglesey assigned as a special area within that

freeport.

-- Conditional contract exchanged, at a cost of GBP450,000, for

the purchase of a 14.7 acre plot at Bristol Fruitmarket site in the

St Phillip's Marsh area of Bristol.

Group net asset summary

2023 2022

Per share Per share

GBP'm p GBP'm p

Properties 113.2 189.8 110.1 184.7

Cash 2.7 4.5 17.4 29.1

Borrowings (17.2) (28.8) - -

Provisions - - (3.1) (5.2)

Other net (liabilities) / assets (3.6) (6.1) 0.2 0.3

------- ---------- ------- ------------

Net assets 95.1 159.4 124.6 208.9

======= ========== ======= ============

Robert Ware, Chief executive commented:

"We are acutely aware of the impact that continuing economic and

political uncertainty is having on the real estate sector and

intend to maintain a disciplined approach to both our cash

commitments and financial leverage to ensure our balance sheet

remains robust.

Our results for the year are reflective of the currently subdued

market. However, fundamentals for the private built student

accommodation, build to rent and life science sectors, remain

strong, with supply shortages likely to support improved future

pricing. The value from our development projects will be created

over the medium-term. Given the progress made, in particular at The

Island Quarter, since its acquisition, we remain optimistic about

the Group's future prospects."

Enquiries:

The Conygar Investment Company PLC

Robert Ware: 0207 258 8670

David Baldwin: 0207 258 8670

Liberum Capital Limited (nominated adviser and broker)

Richard Lindley: 0203 100 2222

Jamie Richards: 0203 100 2222

Temple Bar Advisory (public relations)

Alex Child-Villiers: 07795 425580

Will Barker: 07827 960151

Chairman's and chief executive's statement

Overview and results summary

The past year has been one of continual macroeconomic and

geo-political uncertainty. The impact of this on the valuation of

UK real estate, in particular from the sharp uplift in interest

rates and increasing investor caution as higher inflation became

embedded, has been significant. Property v aluations in the UK fell

across all sectors, as yields increased to reflect the higher

interest rate environment.

The value of our investment property portfolio, after allowing

for capital expenditure in the year, has declined by GBP21.5

million (16.3%). In addition, the value of our development site at

Holyhead, Anglesey has been written down by GBP5.2 million. More

recently the outlook for the UK economy has improved, with interest

rates now at or near their peak and inflationary indicators

suggesting further reductions.

The reduced valuations at 30 September 2023 relate primarily to

the undeveloped and unconsented plots at both The Island Quarter,

Nottingham and Holyhead. These have been partly offset by a

valuation surplus from the ongoing student accommodation

development to reflect the considerable progress made on site

during the year for that asset. While these land price falls are

unwelcome, such valuations tend to be volatile and highly sensitive

to small changes in the underlying assumptions of key parameters,

such as rental levels, net initial yields, construction costs,

finance costs and void periods. As the economic situation improves

and inflation eases, we expect to see a rebound in land values

given the unprecedented recent rental growth in particular across

the private built student accommodation ("PBSA") and build to rent

("BTR") sectors.

The Group has incurred net operational and administrative

losses, excluding depreciation, of GBP4.2 million in the year as we

seek to continue the transition of our initially consented

development plots at The Island Quarter to income-producing assets.

This cost increase, required to support both the implementation of

our development programme and operations team comes at a point in

the cycle when rental income receipts for the Group have

reduced.

However, with the restaurant and events venue at 1 The Island

Quarter ("1 TIQ") now established and fully operational and the

ongoing student accommodation development in Nottingham planned for

completion in May 2024, we anticipate a material uplift in revenues

in the medium-term.

The combined valuation and operational losses have been partly

offset by the reversal of a GBP1.7 million deferred tax provision

resulting in a total loss for the year of GBP29.5 million.

Cash deposits and debt financing

Our ambition at the start of the year was to raise significant

additional funds to progress, at a pace, the construction of the

consented student accommodation development at The Island Quarter

and submit further planning applications to better enable investor

participation in our development projects.

To that end, the Group entered into a new facilities agreement

with Barclays Bank PLC in December 2022 comprising a development

facility and an investment facility (together the "facilities") up

to GBP47.5 million in aggregate. The facilities will enable

completion of the construction and subsequent letting of the 693

bed student accommodation development.

The cash deposits of the Group were GBP2.7 million at 30

September 2023.

However, the liquidity of the Group has materially increased

since the balance sheet date by way of the placing in October 2023

of 5 million ZDP shares of GBP1 each in addition to the signing in

November 2023 of a GBP12 million debt facility with A.S.K. Partners

Limited ("ASK"), of which GBP5 million has been drawn at the date

of signing these financial statements. In addition to the 5 million

of placed ZDP shares, the Company subscribed for a further 10

million ZDP shares which it will look to place, subject to investor

sentiment, during the 5-year term of the ZDP to further boost its

cash deposits as required.

Bristol and other property assets

On 6 April 2023, the Group, by way of Conygar Bristol Limited,

in which it holds an 80% interest, entered into a conditional

contract with Wholesale Fruit Centre (Bristol) Limited to acquire

the 14.7 acre site at St Philips Marsh where the Bristol Fruit

Market is currently located, paying an initial deposit of

GBP450,000.

Completion of the acquisition is conditional on the satisfaction

or, where relevant, waiver of the grant of planning permission for

a number of development options by 6 June 2025, subject to

extension provisions. In addition, all tenants are required to have

surrendered their existing leases by 6 April 2024 and the market

licence in respect of the site terminated. The contract is capable

of termination if the vacant possession condition has not been

satisfied or waived by 6 April 2024 or if the vacant possession and

planning permission conditions have not both been satisfied by 6

April 2028.

We intend to utilise part of the net proceeds from the ZDP share

placing and ASK loan to further progress both the Bristol and

Nottingham planning applications and hope to make announcements in

that regard over the next financial year.

However, in order to progress thereafter our pipeline of

development projects, in particular at The Island Quarter, we will

need to raise substantial amounts either as debt, through asset

sales, or from joint ventures and we are in discussions on a number

of fronts in that regard.

Further details of the progress made during the year at The

Island Quarter and our other projects are set out in the strategic

report.

Dividend

The Board recommends that no dividend is declared in respect of

the year ended 30 September 2023. More information on the Group's

dividend policy can be found within the strategic report.

Share buy-back authority

The Board will seek to renew the buy-back authority of 14.99% of

the issued share capital of the Company at the forthcoming AGM as

we consider the buy-back authority to be a useful capital

management tool and will continue to use it, as our cash flows

allow, when we believe the stock market value differs too widely

from our view of the intrinsic value of the Company.

Outlook

We are acutely aware of the impact that continuing economic and

political uncertainty is having on the real estate sector and

intend to maintain a disciplined approach to both our cash

commitments and financial leverage to ensure our balance sheet

remains robust.

Our results for the year are reflective of the currently subdued

market. However, fundamentals for the PBSA, BTR and life science

sectors, remain strong, with supply shortages likely to support

improved future pricing. The value from our development projects

will be created over the medium-term. Given the progress made, in

particular at The Island Quarter, since its acquisition, we remain

optimistic about the Group's future prospects.

N J Hamway R T E Ware

Chairman Chief executive

Strategic report

The Group's strategic report provides a review of the business

for the financial year, discusses the Group's financial position at

the year end and explains the principal risks and uncertainties

facing the business and how we manage those risks. We also outline

the Group's strategy and business model.

Strategy and business model

The Conygar Investment Company PLC ("Conygar") is an AIM quoted

property investment and development group dealing in UK property.

Our aim is to invest in property assets and companies where we can

add significant value using our property management, development

and transaction structuring skills.

The business operates two major strands, being property

investment and property development where we are prepared to use

modest levels of gearing to enhance returns. Assets are recycled to

release capital as opportunities present themselves and we will

continue to buy-back shares where appropriate. The Group is content

to hold cash and adopt a patient strategy unless there is a

compelling reason to invest.

Position of the Group at the year end

The Group net assets as at 30 September 2023 may be summarised

as follows:

2023 2022

Per share Per share

GBP'm p GBP'm p

Properties 113.2 189.8 110.1 184.7

Cash 2.7 4.5 17.4 29.1

Borrowings (17.2) (28.8) - -

Provisions - - (3.1) (5.2)

Other net (liabilities) / assets (3.6) (6.1) 0.2 0.3

------- ---------- ------- ----------

Net assets 95.1 159.4 124.6 208.9

======= ========== ======= ==========

The Group's balance sheet remains both liquid and robust with

property assets and cash deposits totalling GBP115.9 million as at

30 September 2023 and only GBP17.2 million of net bank borrowings

secured against the student accommodation development at The Island

Quarter.

The GBP47.5 million Barclays debt facility will enable the Group

to complete the student accommodation development without the need

for any further equity input. Furthermore, as set out in the

chairman's and chief executive's statement, the net proceeds after

the year end from the placing of 5 million ZDP shares in addition

to the GBP12 million loan facility from ASK will facilitate the

submission of further detailed planning applications at both The

Island Quarter and Bristol sites.

Key performance indicators

The key measures considered when monitoring progress towards the

Board's objective of providing attractive shareholder returns

include the headway made during the year on its development and

investment property portfolio, the movements in net asset value per

share, levels of uncommitted cash and its monitoring of and

performance against its ESG targets.

The chairman's and chief executive's statement provides a

summary on the financial performance and progress made during the

year on the Group's property assets, further details of which are

set out in this strategic report. Matters considered by the audit

committee and remuneration committee are set out in the corporate

governance section of the annual report. The Board's approach and

responsibilities in connection with environmental, social and

governance matters are set out in the ESG section of the annual

report. The other key performance measures are considered

below.

1 TIQ and investment properties under construction

The Group's restaurant and events venue and investment

properties under construction at The Island Quarter, Nottingham

were valued by Knight Frank LLP, in their capacity as external

valuers, as set out below:

2023 Per share 2022 Per share

GBP'm p GBP'm P

Phase 1 - 1 TIQ 14.0 23.5 14.1 23.7

Phase 2 - student accommodation 65.6 110.0 13.6 22.8

Undeveloped plots 29.5 49.5 64.0 107.3

Virgin Active Gym (freehold

interest) 1.2 2.0 1.3 2.2

------ ---------- ------ ----------

Total 110.3 185.0 93.0 156.0

====== ========== ====== ==========

As set out in the chairman's and chief executive's statement, t

he impact of a sharp uplift in interest rates and increasing

investor caution has resulted in a reduction in property v alues

across all sectors, with yields increased to reflect the higher

interest rate environment.

1 TIQ, which has now been operational for just over a year, has

been very well received by the local community. For a brand-new

venue, it has achieved solid revenues in the year to 30 September

2023 of GBP4.3 million. However, the delayed completion of the

development, due to various material and contracting issues,

resulted in the events operation being unable to take advantage of

the late summer and Christmas trade in 2022. This delay, when

compounded by the phased opening, intentional overstaffing as

operations were fully tested and margins being squeezed as a result

of continuing inflationary pressures limited the gross profit in

the year to GBP0.3 million and a pre-tax loss of GBP1.2

million.

Construction of the student accommodation development is now

fully funded. The development is progressing on-time and on-budget,

with completion planned for May 2024 to enable its letting to the

September 2024 Nottingham university intake. The marketing

programme for the accommodation has also commenced with net rental

income, after operational and administrative costs, expected to be

in excess of GBP5.5 million per annum.

In May 2023, detailed consent was granted for our 249,000 square

foot bioscience application to include both laboratory and office

space as well as conference facilities. The consented plot is

located to the north of the site directly adjacent to an existing

bioscience hub. We are progressing discussions with a potential

local tenant seeking significant expansion space as well as an

investor to forward fund the development. However, should they not

proceed, the demand for bioscience space is such that we feel

confident that we would be able to find alternative tenants and

investors.

Nottingham City Council have also agreed, in principle, the

parameters for a sitewide masterplan that will guide and support

the future planning applications at The Island Quarter. This has

resulted in a scheme which, subject to the granting of detailed

consent and local demand, will enable the overall size of the

development to increase up to approximately 3.5 million square

feet. Following on from this, we are progressing the detailed

application for a second phase of student accommodation comprising

approximately 400 beds which is expected to be submitted in the

coming months.

Development and trading properties

2023 Per share 2022 Per share

GBP'm p GBP'm p

Rhosgoch 2.50 4.2 2.50 4.2

Parc Cybi 0.38 0.6 0.38 0.6

Holyhead Waterfront - - 5.00 8.4

Haverfordwest - - 9.26 15.5

Total 2.88 4.8 17.14 28.7

====== ========== ====== ==========

We announced, in March 2023, the confirmation of the Anglesey

Freeport as one of the two newly established freeports in Wales.

Included within this location, as a special area, is our 203 acre

brownfield site at Rhosgoch. Our further site at Parc Cybi is also

part of the freeport.

These freeports will form special zones with the benefit of

simplified customs procedures, relief on customs duties, tax

benefits and development flexibility designed to attract major

domestic and international investment. The Welsh freeports will

also prioritise environmental sustainability and the climate

emergency.

In addition, the Company owns a further site in Anglesey at

Holyhead Waterfront where we continue to await the determination of

our detailed application for 259 townhouses and apartments, a 250

berth marina and associated marine commercial and retail units. We

have fully written down the value of Holyhead Waterfront at 30

September 2023 as a result of the combined impact from planning

delays, increased finance costs and construction cost price

inflation particularly associated with the marine infrastructure

works. These factors have detrimentally affected the residual value

of the proposed development as has occurred during recent years

across many sites in the UK.

In March 2023, we completed the sale of our site at

Haverfordwest, Pembrokeshire to The Welsh Minister and POBL Homes

and Communities Limited for gross proceeds of GBP9.65 million to

realise a profit in the period of GBP0.1 million.

Financial review

Net asset value

The net asset value decreased in the year by GBP29.5 million to

GBP95.1 million at 30 September 2023 which equates to 159.4p per

share (2022: 208.9p per share). The primary movements were a net

GBP21.5 million write down in the carrying value of The Island

Quarter's investment properties, a GBP5.2 million write down in the

carrying value of Holyhead Waterfront and increased operational and

administrative costs of GBP4.8 million, including depreciation

charges of GBP0.6 million. These were partly offset by the reversal

of a GBP1.7 million provision for deferred tax and a GBP0.1 million

profit from the sale of Haverfordwest.

Cash flow and financing

At 30 September 2023, the Group had cash deposits of GBP2.7

million and had drawn GBP18.0 million of the GBP47.5 million

development loan facility from Barclays (2022: cash of GBP17.4

million and no debt).

During the year, the Group generated GBP5.0 million of cash from

its operating activities, which includes the net proceeds from the

sale of Haverfordwest (2022: generated GBP3.9 million). The other

primary cash inflows for the year were net bank borrowings, after

debt arrangement and debt servicing costs, of GBP16.4 million and

GBP0.2 million of interest on cash deposits.

The primary cash outflows in the period were GBP35.7 million

incurred on the Group's development and investment properties,

including GBP31.7 million of construction costs and professional

fees to progress The Island Quarter's student accommodation

development, GBP1.0 million of fees in connection with the

consented bioscience planning application and GBP1.6 million of

costs to complete the energisation of the electricity substation

and project manage the ongoing operations at The Island Quarter.

Further costs were incurred to complete the fitting out of 1 TIQ

resulting in a net cash outflow in the period of GBP14.7

million.

Net income from property activities

This has been, and continues to be, a transitional period for

the Group where, having sold, over a number of years, the vast

majority of our rent-producing investment properties, to lock in,

for the benefit of our shareholders, the significant returns

generated from those assets, we are now utilising those funds to

progress the planning applications for, and construction of, both

our owned and targeted development projects. As such, the rental

income for the Group during the current and previous years has

reduced from that historically achieved. However, with 1 TIQ now

more established and fully operational, in addition to the student

accommodation development expected to become rent-producing in the

late summer of 2024, we would anticipate a material uplift in

rental and other income in the medium-term.

2023 2022

GBP'm GBP'm

Rental income 0.1 (0.4)

Restaurant and events income 4.3 0.1

Direct costs of rental income (0.5) (0.4)

Direct costs of restaurant and events

income (3.9) (0.6)

--------- ---------

- (1.3)

Proceeds from property sale 9.6 25.7

Cost of property sale (9.5) (21.7)

---------

Total net income arising from property

activities 0.1 2.7

========= =========

Rental income for the year ended 30 September 2022 includes the

reversal of a GBP1.4 million accrued rent debtor following the

sales of Cross Hands and Selly Oak. This debtor arose from the even

spreading of rental income, derived from operating leases, over

each tenant's respective minimum lease term after allowing for

rent-free periods.

Administrative expenses

The administrative expenses for the year were GBP4.8 million

(2022: GBP2.9 million). As set out in the chairman's and chief

executive's statement, managing the substantially increased

development and operations teams, in particular at 1 TIQ, has

required an increase in the Group's overheads.

Taxation

There is no current tax in the year as the Group is loss-making.

However, the results for the year include the reversal of a GBP1.7m

deferred tax provision following the net write down, at 30

September 2023, in the carrying value of The Island Quarter.

Deferred tax is calculated at a rate of 25%, being the rate that

has been enacted or substantively enacted by the balance sheet date

and which is expected to apply when tax liabilities, resulting from

unrealised chargeable gains arising on revaluation of the Group's

investment properties, are projected to be settled.

Capital management

Capital risk management

The Board's primary objective when managing capital is to

preserve the Group's ability to continue as a going concern, in

order to safeguard its equity and provide returns for shareholders

and benefits for other stakeholders, whilst maintaining an optimal

capital structure to reduce the cost of capital.

While the Group does not have a formally approved gearing ratio,

the objective above is actively managed through the direct linkage

of borrowings to specific property. The Group seeks to ensure that

secured borrowing stays within agreed covenants with external

lenders.

Treasury policies

The objective of the Group's treasury policies is to manage the

Group's financial risk, secure cost-effective funding for the

Group's operations and to minimise the adverse effects of

fluctuations in the financial markets on the value of the Group's

financial assets and liabilities, reported profitability and cash

flows.

The Group finances its activities with a combination of bank

loans, cash and short-term deposits. Other financial assets and

liabilities, such as trade receivables and trade payables, arise

directly from the Group's operations. The Group may also enter into

derivative transactions to manage the interest rate risk arising

from the Group's operations and its sources of finance. The main

risks associated with the Group's financial assets and liabilities

are set out below, together with the policies currently applied by

the Board for their management.

The management of cash is monitored weekly with summary cash

statements produced on a monthly basis and discussed regularly in

management and board meetings. The approach is to provide

sufficient liquidity to meet the requirements of the business in

terms of funding developments and potential acquisitions. Surplus

funds are invested with a broad range of institutions. At any point

in time, at least half of the Group's cash is held on instant

access or short-term deposit of less than 30 days.

Dividend policy

The Board recommends that no dividend is paid in respect of the

year ended 30 September 2023 (2022: GBPnil).

Our dividend policy is consistent with the overall strategy of

the business: namely to invest in property assets and companies

where we can add significant value using our property management,

development and transaction structuring skills.

In previous years we have used the surplus cash flow from the

then much larger investment property portfolio to enhance these

properties by refurbishment, re-letting and extending tenancies,

fund the operations of the business, create a medium-term pipeline

of development opportunities, pay a modest dividend and buy-back

shares where appropriate.

The Board will continue to review the dividend policy each year.

Our focus is, and will primarily continue to be, growth in net

asset value per share.

Principal risks and uncertainties

Managing risk is an integral element of the Group's management

activities and a considerable amount of time is spent assessing and

managing risks to the business. Responsibility for risk management

rests with the Board, with external advisers used where

necessary.

Strategic risks

Strategic risks are risks arising from an inappropriate strategy

or through flawed execution of a strategy that could threaten the

future performance, solvency or liquidity of the Group. By

definition, strategic risks tend to be longer term than most other

risks and, as has been amply demonstrated in the last few years,

the economic and wider environment can alter quickly and

significantly. Strategic risks identified include global or

national events, regulatory and legal changes, market or sector

changes and key staff retention.

The Board continually monitors and discusses the potential

impact that changes to the environment in which we operate can have

upon the Group. We are confident we have sufficiently high-calibre

directors and managers to manage strategic risks.

We are content that the Group has the right approach toward

strategy and our strong balance sheet is good evidence of that.

Operational risks

Operational risks are essentially those risks that might arise

from inadequate internal systems, processes, resources or incorrect

decision making. Clearly, it is not possible to eliminate

operational risk. However, by ensuring we have the right calibre of

staff and external support in place, we look to minimise such

risks, as most operational risks arise from people-related issues.

Our executive directors are very closely involved in the day-to-day

running of the business to ensure sound management judgement is

applied.

Market risks

Market risks primarily arise from the possibility that the Group

is exposed to fluctuations in the values of, or income from, its

cash deposits and other financial instruments along with its

investment properties and development projects. This is a key risk

to the principal activities of the Group and the exposures are

continuously monitored through timely financial and management

reporting and analysis of available market intelligence.

Where necessary, management takes appropriate action to mitigate

any adverse impact arising from identified risks and market risks

continue to be monitored closely.

The Group is not currently party to any derivative transactions

to fix the interest rate payable in connection with its loan from

Barclays Bank PLC. This is due to the short-term nature of this

development loan in addition to the high entry fees which have been

payable in connection with such products over the last financial

year.

The Group remains compliant with all of its debt covenants.

Estimation and judgement risks

To be able to prepare accounts according to generally accepted

accounting principles, management must make estimates and

assumptions that affect the asset and liability items and revenue

and expense amounts recorded in the accounts. These estimates are

based on historical experience and various other assumptions that

management and the Board believe are reasonable under the

circumstances. The results of these considerations form the basis

for making judgements about the carrying value of assets and

liabilities that are not readily available from other sources.

The key sources of estimation uncertainty that have a

significant risk of causing material adjustment to the carrying

amounts of assets and liabilities within the next financial year

are the following:

Investment properties

The fair values of investment properties are based upon open

market value and calculated using a third-party valuation provided

by an external valuer.

Development properties

The net realisable value of properties held for development

requires an assessment of the value for the underlying assets using

property appraisal techniques and other valuation methods. Such

estimates are inherently subjective and actual values can only be

determined in a sales transaction.

Financial assets and liabilities

The interest rate profile of the Group's cash deposits at the

balance sheet date was as follows:

30 Sep 23 30 Sep 22

GBP'000 GBP'000

Unsecured deposits 2,321 17,109

Performance bonds and other secured

deposits 355 252

---------- ----------

2,676 17,361

========== ==========

The Group's floating rate financial assets comprise cash and

short-term performance bond deposits held with banks whose credit

ratings are acceptable to the Board.

The interest rate profile of the Group's bank borrowings is set

out in note 20.

Credit risk

Credit risk is the risk of financial loss to the Group if a

counterparty fails to meet its contractual obligations. The Group's

principal financial assets include its financial interest in

property assets, cash deposits and trade and other receivables. The

carrying amount of financial assets recorded in the financial

statements represents the Group's maximum exposure to credit risk

without taking account of the value of any collateral obtained.

In the event of default by an occupational tenant, the Group

will suffer a rental shortfall and incur additional costs. The

Directors continually monitor tenant arrears in order to

anticipate, and minimise the impact of, defaults by occupational

tenants and if necessary, where circumstances allow, will apply

rigorous credit control procedures to facilitate the recovery of

trade receivables.

Under IFRS 9, the Group is required to provide for any expected

credit losses arising from trade receivables. For all assured

shorthold tenancies, credit checks are performed prior to

acceptance of the tenant. Regulated tenants are incentivised

through the benefit of their tenancy agreement to avoid default on

their rent and rent deposits are held where applicable.

The Directors have provided for rental and other arrears due

from various tenants which amounts to GBP273,000 at 30 September

2023 (2022: GBP200,000) and which remain outstanding at the date of

signing these financial statements. The impaired receivables are

based on a review of expected credit losses. Impaired receivables

and receivables not considered to be impaired are not material to

the financial statements and, therefore, no further analysis is

provided.

The credit risk on cash deposits is managed through the

Company's policies of monitoring counterparty exposure and the use

of counterparties of good financial standing. At 30 September 2023,

the credit exposure from cash held with banks was GBP2.7 million

which represents 2.8% of the Group's net assets. All cash deposits

at the balance sheet date are placed with banks, whose credit

ratings are acceptable to the Board, on instant access accounts.

Should the credit quality or the financial position of the banks

currently utilised significantly deteriorate, cash deposits would

be moved to alternative banks.

Liquidity risk

Liquidity risk is the risk that the Group will not be able to

meet its financial obligations as they fall due. The Group seeks to

manage its liquidity risk by ensuring that sufficient cash is

available to meet its foreseeable needs. The Group had cash

deposits at the balance sheet date of GBP2.7 million. However, as

set out in the chairman's and chief executive's statement, the cash

deposits of the Group have been increased since the balance sheet

date by the placing in October 2023 of 5 million ZDP shares of GBP1

each and the signing in November 2023 of a GBP12 million debt

facility with ASK, of which GBP5 million has been drawn at the date

of signing these financial statements.

Section 172 statement

Directors' duty to promote the success of the Company under

Section 172 Companies Act 2006

The strategic report is required to include a statement that

describes how the directors have had regard to the matters set out

in section 172(1) (a) to (f) of the Companies Act 2006 when

performing their duty under section 172. Some of the matters

identified in Section 172(1) are already covered by similar

provisions in the QCA Code and have thus been previously reported

by the Company in the corporate governance statement, the corporate

governance report and the QCA statement of compliance on our

website. In order to avoid unnecessary duplication, the relevant

parts of those documents are identified below and are to be treated

as expressly incorporated by reference into this strategic report.

Under section 172 (1) of the Companies Act 2006, each individual

director must act in the way he considers, in good faith, would be

the most likely to promote the success of the Company for the

benefit of its members as a whole, and in doing so have regard

(amongst other matters) to six matters detailed in the section. In

discharging their duties, the directors seek to promote the success

of Conygar for the benefit of members as a whole and have regard to

all the matters set out in Section 172(1), where applicable and

relevant to the business, taking account of its size and structure

and the nature and scale of its activities in the commercial

property market. The following paragraphs address each of the six

matters in Section 172(1) (a) to (f).

(a) The likely consequences of any decision in the long term:

The commercial property market is cyclical by nature. Investing in

commercial property is a long-term business. The decisions taken

must have regard to long-term consequences in terms of success or

failure and managing risks and uncertainties. The directors cannot

expect that every decision they take will prove, with the benefit

of hindsight, to be the best one - external factors may affect the

market and thus change conditions in the future, after a decision

has been taken. However, the Group's investment decisions are

undertaken by a Board with a wide range of experience, over many

years, in both the property and finance sectors.

(b) The interests of the Company's and Group's employees: The

Company has five full-time employees, including the chief

executive, two property directors and the finance director. These

executive directors sit on the Board with the non-executive

directors. The Group also has a growing workforce to support its

operations at The Island Quarter, all of which are employed by a

wholly-owned group company. The commitment of the Board to its

employees is set out in the ESG section of the annual report.

(c) The need to foster the Company's business relationships with

suppliers, customers and others: The directors have regularly

reported in the Company's annual reports on the constructive

relationships that Conygar seeks to build with its tenants and the

mutual benefits that this brings to both parties; and this

reporting has been extended over the past two years following

Principle 3 of the QCA Code to include suppliers and others. This

is therefore addressed under Principle 3 in the QCA compliance

statement. In recent years, it has been vital to foster our

business relationships with tenants given external factors, such as

political and economic uncertainty.

(d) The impact of the Company's operations on the community and

the environment: This is also addressed under Principle 3 of the

QCA Code in the QCA compliance statement. Due to its size and

structure and the nature and scale of its activities, the Board

considers that the impact of Conygar's operations as a landlord on

the community and the environment is low. With the exception of 1

TIQ, Conygar's assets are used by its tenants for their own

operations rather than by Conygar itself. In the past year, the

Company has not been made aware of any tenant operations that have

had a significant impact on the community or the environment. In

relation to 1 TIQ, as well as ongoing and future planned

developments, Conygar seeks to ensure that designs and construction

comply with all relevant environmental standards and with local

planning requirements and building regulations so as not to

adversely affect the community or the environment. Further details

of this are set out in the ESG section of the annual report.

(e) The desirability of the Company maintaining a reputation for

high standards of business conduct: This is addressed under

Principle 8 of the QCA Code in the corporate governance statement

and in the QCA compliance statement. The Board considers that

maintaining Conygar's reputation for high standards of business

conduct is not just desirable - it is a valuable asset in the

competitive commercial property market.

(f) The need to act fairly as between members of the Company:

The Company has only one class of shares, thus all shareholders

have equal rights and, regardless of the size of their holding,

every shareholder is, and always has been, treated equally and

fairly. Relations with shareholders are further addressed under

Principles 2, 3 and 10 of the QCA Code in the corporate governance

report and the QCA compliance statement. We have been reviewing how

we communicate with shareholders and are encouraging shareholders

to adopt electronic communications and proxy voting in place of

paper documents where this suits them, as well as to raise

questions in writing if they are unable to attend AGMs.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 30 September 2023

Note Year ended Year ended

30 Sep 23 30 Sep 22

GBP'000 GBP'000

Rental income 12/13 141 (404)

Restaurant and events income 4,257 73

Proceeds on sale of development and

trading properties 9,650 7,390

Revenue 14,048 7,059

------------- -------------

Direct costs of rental income 513 395

Direct cost of restaurant and events

income 3,928 572

Costs on sale of development and trading

properties 9,524 3,749

Development costs written off 15 5,164 289

Direct costs 19,129 5,005

------------- -------------

Gross (loss) / profit (5,081) 2,054

Fair value adjustment of property 11 (30) -

Fair value adjustment of investment

properties

under construction 13 (21,546) 320

Profit on sale of investment property - 380

Administrative expenses (4,775) (2,851)

------------- -------------

Operating loss 3 (31,432) (97)

Finance costs 6 - -

Finance income 6 186 73

Loss before taxation (31,246) (24)

Taxation 8 1,714 (29)

------------- -------------

Loss and total comprehensive

charge for the year (29,532) (53)

------------- -------------

Basic and diluted loss per share 10 (49.52p) (0.09)p

All amounts are attributable to equity

shareholders of the Company.

All of the activities of the Group are classed as

continuing.

CONSOLIDATED Statement of Changes in Equity

for the year ended 30 September 2023

Attributable to the equity holders of the Company

Share Capital

Share premium redemption Retained Total

capital account reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Changes in equity

for the year ended

30 September 2022

At 1 October 2021 2,625 - 3,928 107,588 114,141

Loss for the year - - - (53) (53)

Total comprehensive

charge for the year - - - (53) (53)

Gross proceeds from

placing of own shares 357 10,352 - - 10,709

Fees paid on placing

of own shares - (193) - - (193)

Cancellation of share

premium account - (10,159) - 10,159 -

At 30 September 2022 2,982 - 3,928 117,694 124,604

============ ============== ============== ============= ============

Changes in equity

for the year ended

30 September 2023

At 1 October 2022 2,982 - 3,928 117,694 124,604

Loss for the year - - - (29,532) (29,532)

------------ -------------- -------------- ------------- ------------

Total comprehensive

charge for the year - - - (29,532) (29,532)

At 30 September 2023 2,982 - 3,928 88,162 95,072

============ ============== ============== ============= ============

CONSOLIDATED BALANCE SHEET

at 30 September 2023

Note 30 Sep 30 Sep 2022

2023 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 11 15,116 991

Investment properties 12 - -

Investment properties under construction 13 96,350 93,000

Right of use asset 7 - -

Deferred tax asset 8 - 2,986

111,466 96,977

-------------- ------------

Current assets

Development and trading properties 15 2,880 17,137

Inventories 16 110 32

Trade and other receivables 17 2,203 770

Tax asset 28 28

Cash and cash equivalents 2,676 17,361

-------------- ------------

7,897 35,328

-------------- ------------

Total assets 119,363 132,305

Current liabilities

Trade and other payables 18 7,091 1,605

Lease liability for right of use 7 - -

asset

7,091 1,605

Non-current liabilities

Deferred tax liability 8 - 4,700

Provision for liabilities and charge 19 - 1,396

Bank borrowings 20 17,200 -

17,200 6,096

Total liabilities 24,291 7,701

-------------- ------------

Net assets 95,072 124,604

============== ============

Equity

Called up share capital 21 2,982 2,982

Capital redemption reserve 3,928 3,928

Retained earnings 88,162 117,694

-------------- ------------

Total equity 95,072 124,604

============== ============

CONSOLIDATED CASH FLOW STATEMENT

for the year ended 30 September 2023

Year ended Year ended

30 Sep 23 30 Sep

GBP'000 22

GBP'000

Cash flows from operating activities

Operating loss (31,432) (97)

Deficit / (surplus) on revaluation of properties 21,576 (320)

Development costs written off 5,164 289

Profit on sale of development and trading properties (126) (3,641)

Profit on sale of investment property - (380)

Depreciation of property, plant and equipment 595 -

Depreciation of right of use assets - 53

----------- -----------

Cash flows from operations before changes in

working capital (4,223) (4,096)

Increase in inventories (78) (32)

(Increase) / decrease in trade and other receivables (1,125) 1,892

Additions to development and trading properties (294) (1,115)

Net proceeds from sale of development and trading

properties 9,490 7,337

Increase / (decrease) in trade and other payables 1,207 (94)

----------- -----------

Net cash flows generated from operations 4,977 3,892

Cash flows from investing activities

Additions to investment properties (35,731) (28,085)

Net proceeds from sale of an investment property - 18,278

Additions to plant, machinery and office equipment (479) (970)

Finance income 186 73

----------- -----------

Cash flows used in investing activities (36,024) (10,704)

----------- -----------

Cash flows from financing activities

Bank loan drawn 18,033 -

Bank loan arrangement fees (924) -

Prepaid ZDP and debt arrangement fees (113) -

Interest paid (634) -

Net proceeds from placing of own shares - 10,516

Cash flows generated from financing activities 16,362 10,516

----------- -----------

Net (decrease) / increase in cash and cash equivalents (14,685) 3,704

Cash and cash equivalents at 1 October 17,361 13,657

----------- -----------

Cash and cash equivalents at 30 September 2,676 17,361

=========== ===========

NOTES TO THE ACCOUNTS

for the year ended 30 September 2023

1. The financial information set out in this announcement is

abridged and does not constitute statutory accounts for the year

ended 30 September 2023 but is derived from the financial

statements. The auditors have reported on the statutory accounts

for the year ended 30 September 2023, their report was unqualified

and did not contain statements under sections 498(2) or (3) of the

Companies Act 2006, and these will be delivered to the registrar of

companies following the Company's annual general meeting. The

financial information has been prepared using the recognition and

measurement principle of IFRS.

2. The comparative financial information for the year ended 30

September 2022 was derived from information extracted from the

annual report and accounts for that period, which was prepared

under IFRS and which has been filed with the UK registrar of

companies. The auditors have reported on those accounts, their

report was unqualified and did not contain statements under section

498 (2) or (3) of the Companies Act 2006.

3. Operating LOSS

Operating loss is stated after charging: 30 Sep 23 30 Sep 22

GBP'000 GBP'000

Audit of the Company's consolidated and individual

financial statements 50 47

Audit of subsidiaries, pursuant to legislation 60 56

Corporate finance advisory fees from the auditor

* 60 -

Depreciation of property, plant and equipment 595 -

Depreciation of right of use asset - 53

* Cost in relation to the ZDP share issue included within trade

and other receivables at 30 September 2023.

4. PARTICULARS OF EMPLOYEES

The aggregate payroll costs were: Year ended Year ended

30 Sep 23 30 Sep 22

GBP'000 GBP'000

Wages and salaries 3,815 1,674

Social security costs 347 203

Other pension costs 36 8

----------- -----------

4,198 1,885

=========== ===========

The weighted average monthly number of persons, including

executive directors, employed by the Group during the year was 111

(2022: 22). The increase in the year is a result of the employees

that have been recruited to operate and manage the restaurant and

events venue at 1 TIQ.

5. DIRECTORS' EMOLUMENTS

Year ended Year ended

30 Sep 30 Sep 22

23 GBP'000

GBP'000

Basic salary and total emoluments 1,110 1,035

=========== ===========

Emoluments of the highest paid director 400 400

=========== ===========

The Board, being the key management personnel, comprises the

only persons having authority and responsibility for planning,

directing and controlling the activities of the Group.

6. FINANCE COSTS AND FINANCE INCOME

Year ended Year ended

Finance costs 30 Sep 23 30 Sep 22

GBP'000 GBP'000

Bank loan interest 347 -

Bank loan commitment fees 421 -

Bank loan management and monitoring fees 23 -

Amortisation of loan arrangement fees 56 -

----------- -----------

Total finance costs 847 -

Capitalisation of finance costs (note 13) (847) -

----------- -----------

Net finance costs - -

=========== ===========

Finance costs that are directly attributable to the construction

of the student accommodation at The Island Quarter, comprising the

bank loan interest, commitment fees, management fees, monitoring

fees and amortised loan arrangement fees, are capitalised as

incurred into investment properties under construction.

Year ended Year ended

Finance income 30 Sep 23 30 Sep 22

GBP'000 GBP'000

Bank interest receivable 186 73

7. LEASES

Group as lessor:

The Group receives income from investment properties and

existing tenants located at several development sites. At 30

September 2023, the minimum lease payments receivable under

non-cancellable operating leases were as follows:

30 Sep 30 Sep 22

23

GBP'000 GBP'000

Less than one year 144 134

Between one and five years 615 607

Over five years 1,169 1,320

-------- ----------

1,928 2,061

======== ==========

The amounts above represent total rental income up to the next

tenant only break date for each lease.

Group as lessee:

IFRS 16 requires lessees to record all leases on the balance

sheet as liabilities, along with an asset reflecting the right of

use of the asset over the lease term, so long as they are not for a

low value or less than 12 months whereby the lease could be

recognised as an expense on a straight-line basis over the lease

term.

The Group was party to a three-year lease for office premises

which terminated on 28 April 2022. On 11 March 2022, the Group

entered into a subsequent one-year lease, for the same premises,

which terminated on 28 April 2023. On 28 February 2023, a further

lease was entered into for a 3-year term expiring on 28 April 2026

which incorporates a break option on 28 April each year throughout

the term. All of the leases are for an amount of GBP99,100 per

annum.

The original 3-year lease was recorded on the balance sheet.

However, the subsequent one-year lease along with the further

3-year lease, with its annual break optionality, are considered to

be of such a short term that the rent has been recognised as an

expense in the statement of comprehensive income on a straight-line

basis.

Year ended Year ended

30 Sep 30 Sep 22

23

Right of use asset GBP'000 GBP'000

At the start of the year - 53

Depreciation - (53)

------------ -----------

At the end of the year - -

============ ===========

Lease liability GBP'000 GBP'000

At the start of the year - 34

Lease payments - (34)

At the end of the year - -

============ ===========

8. TAX

Year ended Year ended

30 Sep 30 Sep

23 22

GBP'000 GBP'000

Current tax charge - -

Deferred tax (credit) / charge (1,714) 29

----------- -----------

Total tax (credit) / charge (1,714) 29

=========== ===========

The tax assessed on the loss for the year differs from the standard

rate of tax in the UK of 19% (2022: 19%). The differences are

explained below:

Year ended Year ended

30 Sep 30 Sep

23 22

GBP'000 GBP'000

Loss before tax (31,246) (24)

=========== ================

Loss before tax multiplied by the standard

rate of UK tax (5,937) (5)

Effects of:

Investment property revaluation not taxable 4,099 (61)

Capital loss not taxable - (72)

Utilisation of tax losses brought forward (23) (96)

Movement in tax losses carried forward 2,085 224

Expenses not deductible for tax purposes 27 15

Capital allowances utilised (251) (5)

Deferred tax (credit) / charge (1,714) 29

----------- ----------------

Total tax (credit) / charge for the year (1,714) 29

=========== ================

Deferred tax asset

Year ended Year ended

30 Sep 30 Sep

23 22

GBP'000 GBP'000

Deferred tax asset at the start of the year 2,986 2,935

Deferred tax (charge) / credit for the year (2,986) 51

----------- -----------

Deferred tax asset at the end of the year - 2,986

=========== ===========

The Group will recognise a deferred tax asset for tax losses,

held by group undertakings, where the directors believe it is

probable that this asset will be recovered.

As at 30 September 2023, the Group has further unused losses of

GBP48.1 million (2022: GBP22.1 million) for which no deferred

tax asset has been recognised in the consolidated balance sheet.

Deferred tax liability - in respect of

chargeable gains on investment properties Year ended Year ended

30 Sep 30 Sep

23 22

GBP'000 GBP'000

Deferred tax liability at the start of the

year 4,700 4,620

Deferred tax (credit) / charge for the year (4,700) 80

----------- -----------

Deferred tax liability at the end of the year - 4,700

=========== ===========

The directors have assessed the potential deferred tax liability

of the Group as at 30 September 2023 in respect of chargeable

gains that would be payable if the investment properties were

sold at their financial year end valuations. Based on the unrealised

chargeable gains of GBPnil (2022: GBP18,798,000) a deferred tax

liability of GBPnil (2022: GBP4,700,000) has been recognised.

Prior year deferred tax assets and liabilities were calculated

at a corporation tax rate of 25% being the rate that had been

enacted or substantively enacted by that balance sheet date and

which was projected to apply when the liability is settled and

the asset realised.

9. DIVIDS

No dividend will be paid in respect of the year ended 30

September 2023 (2022: nil).

10. LOSS PER SHARE

Loss per share is calculated as the loss attributable to

ordinary shareholders of the Company for the year of GBP29,532,000

(2022: loss of GBP53,000) divided by the weighted average number of

shares in issue throughout the year of 59,638,588 (2022:

58,015,099). There are no diluting amounts in either the current or

prior years.

11. PROPERTY, PLANT AND EQUIPMENT

Property

30 Sep 30 Sep

23 22

GBP'000 GBP'000

At the start of the year - -

Reclassification from investment properties

under construction (note 13) 14,100 -

Additions 192 -

Depreciation (262) -

Fair value adjustment (30)

--------- ---------

At the end of the year 14,000 -

========= =========

As at 1 October 2022, the Group's then operational restaurant,

beverage and events venue at 1 TIQ was reclassified, at fair value,

from an investment property under construction to property, plant

and equipment. The fair value on reclassification was derived from

the 30 September 2022 valuation, as provided by Knight Frank

LLP.

Land and buildings, are stated at the revalued amounts less any

depreciation or impairment losses subsequently accumulated. Land is

not depreciated. Depreciation on revalued buildings is recognised

using the straight-line basis and results in the carrying amount,

less the residual value, being expensed in profit or loss over the

estimated useful lives of 50 years.

As at 30 September 2023, 1 TIQ was valued by Knight Frank LLP in

their capacity as external valuer. The valuation was prepared on a

fixed fee basis, independent of the property value and undertaken

in accordance with RICS Valuation - Global Standards on the basis

of fair value, supported by reference to market evidence of

transaction prices for similar properties. It assumed a willing

buyer and a willing seller in an arm's length transaction and

reflected usual deductions in respect of purchaser's costs and SDLT

as applicable at the valuation date. The independent valuer made

various assumptions including future rental income, anticipated

void costs and the appropriate discount rate or yield.

Plant and equipment

30 Sep 30 Sep

23 22

GBP'000 GBP'000

At the start of the year 991 -

Additions 458 991

Depreciation (333) -

--------- ---------

At the end of the year 1,116 991

========= =========

During the current and prior year, the Group acquired plant,

machinery and office equipment required to operate the restaurant,

beverage and events venue at 1 TIQ.

Depreciation is recognised so as to write off the cost of these

assets, over their estimated useful economic lives, using the

straight-line method at 25% per annum. As the venue at 1 TIQ was

only partly operational from 14 September 2022 no depreciation was

recognised in the period to 30 September 2022.

12. INVESTMENT PROPERTIES

Freehold investment properties

30 Sep 30 Sep

23 22

GBP'000 GBP'000

At the start of the year - 17,750

Additions - 148

Disposals - (17,898)

At the end of the year - -

========== =========

The Group's retail park in Cross Hands, Carmarthenshire was sold

in the prior year for net proceeds of GBP18.3 million. As at 30

September 2021, Cross Hands was valued by Knight Frank LLP in their

capacity as external valuer.

For the year ended 30 September 2022, Group revenue included

GBP433,000 derived from investment properties leased out under

operating leases. Group revenue for the prior year also includes

the reversal of a GBP1,194,000 rent spreading debtor following the

sale of Cross Hands.

13. INVESTMENT PROPERTIES UNDER CONSTRUCTION

Freehold land and buildings

30 Sep 30 Sep

23 22

GBP'000 GBP'000

At the start of the year 93,000 70,500

Reclassification to property,

plant and equipment (note 11) (14,100) -

Additions 39,545 23,591

Capitalisation of finance costs (note 6) 847 -

Fair value adjustments (21,546) 320

Movement in introductory fee provision (1,396) (1,411)

At the end of the year 96,350 93,000

========== =========

Investment properties under construction comprise freehold land

and buildings at The Island Quarter, Nottingham which are held for

current or future development as investment properties and reported

in the balance sheet at fair value.

Valuations of the Group's investment properties under

construction are inherently subjective as they are based on

assumptions which may not prove to be accurate and which, as a

result, are subject to material uncertainty. This is particularly

true for The Island Quarter given its scale, lack of comparable

evidence and the early-stage position of this substantial

development. As such, relatively small changes to the underlying

assumptions of key parameters, such as rental levels, net initial

yields, construction costs, finance costs and void periods can have

a significant impact both positively and negatively on the

resulting valuation, as has been evidenced in the current year.

In preparing their valuation, Knight Frank have utilised market

and site-specific data, their own extensive knowledge of the real

estate sector, professional judgement and other market observations

as well as information provided by the Company's executive

directors. The resulting models and assumptions therein have also

been reviewed for overall reasonableness by the Conygar Board.

Inevitably in a complex model like this, and as noted above,

variations in assumptions can lead to widely differing values.

The valuation was prepared on a fixed fee basis, independent of

the property value and undertaken in accordance with RICS Valuation

- Global Standards on the basis of fair value, supported by

reference to market evidence of transaction prices for similar

properties. It assumes a willing buyer and a willing seller in an

arm's length transaction and reflects usual deductions in respect

of purchaser's costs and SDLT as applicable at the valuation date.

The independent valuer makes various assumptions including future

rental income, anticipated void costs and the appropriate discount

rate or yield.

The fair value of Nottingham has been determined using an income

capitalisation technique whereby contracted rent and market rental

values are capitalised with a market capitalisation rate. This

technique is consistent with the principles in IFRS 13 and uses

significant unobservable inputs, such that the fair value has been

classified in all periods as Level 3 in the fair value hierarchy as

defined in IFRS 13. For Nottingham, the key unobservable inputs are

the net initial yields, construction costs, rental income rates,

construction financing costs and expiry void periods. Net initial

yields have been estimated for the individual units at between 4.5%

and 7.0%. and debt financing rates, including arrangement fees,

estimated to average 8.0% over the construction period. Principal

sensitivities of measurement to variations in the significant

unobservable outputs are that decreases in net initial yields,

construction costs, financing costs and void periods will increase

the fair value whereas reductions to rental income rates would

decrease the fair value.

As at 1 October 2022, the Group's then operational restaurant,

beverage and events venue at 1 TIQ was reclassified, at fair value,

from an investment property under construction to property, plant

and equipment. The fair value on reclassification was derived from

the 30 September 2022 valuation, as provided by Knight Frank

LLP.

The historical cost of the Group's investment properties under

construction as at 30 September 2023 was GBP89,198,000 (2022:

GBP62,566,000). The Group's revenue for the year includes GBP33,000

derived from properties leased out under operating leases (2022:

GBP271,000).

14. INVESTMENT IN SUBSIDIARY UNDERTAKINGS

Listed below are the subsidiary undertakings of the Group at 30

September 2023.

Country

of % of

equity

Company name Principal activity Registration held

Conygar Holdings Ltd** Holding company England 100%

Conygar ZDP PLC** Issuer of ZDP shares England 100%

Property trading and

Conygar Bristol Ltd** development England 80%****

Conygar Haverfordwest Property trading and

Ltd** development England 100%*

Property trading and

Conygar Holyhead Ltd** development England 100%*

Conygar Nottingham

Ltd** Property investment England 100%*

Nohu Limited** Property investment England 100%*

Parc Cybi Management

Company Limited** Management company England 100%

Conygar Developments

Ltd** Dormant England 100%*

Conygar Wales PLC** Dormant England 100%*

The Island Quarter

Student

Property Company Ltd** Property investment England 100%*

The Island Quarter

Student

Operating Company

Ltd** Property operations England 100%*

The Island Quarter

Canal

Turn

Operating Company Restaurant and events

Ltd** operations England 100%*

The Island Quarter

Management Company

Ltd** Dormant England 100%*

The Island Quarter

Careers Recruitment and human

Ltd** resources England 100%*

The Island Quarter

Propco

2 Ltd** Dormant England 100%*

The Island Quarter

Propco

3 Ltd** Dormant England 100%*

The Island Quarter

Propco

4 Ltd** Dormant England 100%*

Lamont Property

Holdings

Ltd*** Holding company Jersey 100%*

Conygar Ashby Ltd*** Property investment Jersey 100%*

Conygar Cross Hands

Ltd*** Property investment Jersey 100%*

* Indirectly owned.

** Subsidiaries with the same registered office as the Company.

*** Subsidiaries incorporated in Jersey with a registered office at 3(rd) Floor, 44 Esplanade,

St Helier, Jersey JE4 9WG.

**** 20% of the issued share capital in Conygar Bristol Limited is owned by Urban & City

Limited.

15. DEVELOPMENT AND TRADING PROPERTIES

30 Sep 30 Sep

23 22

GBP'000 GBP'000

At the start of the year 17,137 20,192

Additions 276 924

Disposals (1) (9,369) (3,690)

Development costs written off (2) (5,164) (289)

--------- ---------

At the end of the year 2,880 17,137

========= =========

1. The Group's development site at Haverfordwest, Pembrokeshire

was sold in March 2023 for gross proceeds of GBP9.65 million

realising a profit in the year of GBP0.13 million.

2. As set out in the strategic report, the value of Holyhead

Waterfront has been fully written down at 30 September 2023.

Development and trading properties are reported in the balance

sheet at the lower of cost and net realisable value. The net

realisable value of properties held for development requires an

assessment of the underlying assets using property appraisal

techniques and other valuation methods. Such estimates are

inherently subjective as they are made on assumptions which may not

prove to be accurate and which can only be determined in a sales

transaction.

16. INVENTORIES

30 Sep 30 Sep

23 22

GBP'000 GBP'000

Food and drink 110 32

======== ========

Inventories recognised as an expense in the year total

GBP1,411,000 (2022: GBP82,000).

17. TRADE AND OTHER RECEIVABLES

30 Sep 30 Sep

23 22

GBP'000 GBP'000

Trade receivables 139 70

Other receivables 1,432 423

Prepayments and accrued income 632 277

-------- ----------

2,203 770

======== ==========

Trade and other receivables are measured on initial recognition

at fair value, and are subsequently measured at amortised cost

using the effective interest rate method, less any impairment.

Impairment is calculated using an expected credit loss model.

Other receivables, as at 30 September 2023, includes GBP1.2

million paid to date in connection with the proposed acquisition of

the 14.7 acre site in Bristol comprising a conditionally refundable

GBP0.5 million exchange deposit, an introductory fee of GBP0.4

million plus legal and advisory fees in connection with the

contract and initial planning related works.

Prepayments, as at 30 September 2023, include GBP0.3 million of

provisional arrangement fees in connection with the placing of the

ZDP shares which completed in October 2023.

18. TRADE AND OTHER PAYABLES

30 Sep 30 Sep

23 22

GBP'000 GBP'000

Social security and payroll taxes 156 56

Trade payables 5,996 938

Accruals and deferred income 939 611

-------- --------

7,091 1,605

======== ========

Trade and other payables are recognised initially at fair value,

and are subsequently measured at amortised cost using the effective

interest rate method.

Trade payables, as at 30 September 2023, primarily comprise

costs payable to the contractor and other professionals in

connection with the student accommodation development at The Island

Quarter. These costs were incurred by 30 September 2023 but not

paid until October 2023 with the student accommodation development

costs funded by way of a further drawdown from the Barclays loan

facility.

19. PROVISION FOR LIABILITIES AND CHARGES

30 Sep 30 Sep 22

23

GBP'000 GBP,000

At the start of the year 1,396 5,614

Paid in the year - (2,807)

Movement in provision in the year (1,396) (1,411)

------------- --------------

At the end of the year - 1,396

============= ==============

As at 30 September 2021, the Group was party to a services

agreement and introduction fee agreement in connection with its

investment property at Nottingham. The fee payable was to be

calculated on the earlier of the date of sale of the property or 22

December 2021 with settlement to follow, subject to agreement

between each party, 31 business days after the fee calculation has

been finalised. In January 2022, the introductory fee, calculated

at GBP2.807 million, was paid and the longstop date for the

services agreement calculation extended until 22 December 2023.The

provisions at 30 September 2023 and 30 September 2022 have been

calculated by reference to the value of the property at each

balance sheet date after allowing for a priority return and

applicable costs. The reduction in the Group's investment property

values in the year has resulted in a full reversal of the other

services provision at 30 September 2023.

20. BORROWINGS - non current

Year ended 30 September 2023

Drawn Undrawn Total

GBP'000 GBP'000 GBP'000

At the start of the year - - -

Drawdown of new facility 18,033 29,467 47,500

-------- -------- --------

At the end of the year 18,033 29,467 47,500

Less unamortised loan arrangement

fees (833) - (833)

-------- -------- --------

17,200 29,467 46,667

======== ======== ========

On 23 December 2022, the Group entered into a new facilities

agreement with Barclays Bank PLC comprising a development facility

and an investment facility (together the "facilities") up to

GBP47.5 million in aggregate. The facilities will enable completion

of the construction, targeted by the summer of 2024, and subsequent

letting of the 693-bed student accommodation development at The

Island Quarter site in Nottingham. Security is provided by way of

the student accommodation plot as well as the guarantees from the

Company noted below.

The maximum term of the combined facilities is 3 years. This

includes the development facility for up to 27 months, which

subject to the satisfaction of certain conditions prior to the

expiry of the development facility, switches into the investment

facility for the remainder of the 3-year term. Interest on the

development facility is payable on a Sonia-linked floating rate

basis for each interest period plus a margin of 3.25%, and interest

is payable on the investment facility at the same Sonia rate plus a

margin of 1.90%.

The Company has provided cost overrun and interest shortfall

guarantees of up to GBP5 million in connection with the development

facility. A capital guarantee is also in place which could increase

the Company's guarantee by GBP2.5 million if certain covenants are

not met in advance of drawing the investment facility or the

development facility is not repaid when due.

The Group remained compliant with all covenants throughout the

period up to the date of this report.

Reconciliation of liabilities to cash flows from financing

activities

30 Sep 30 Sep

23 22

GBP'000 GBP'000

Bank borrowings at the start of the year - -

Cash flows from financing activities:

Bank borrowings drawn 18,033 -

Loan arrangement fees paid (1) (889) -

Non-cash movements:

Amortisation of loan arrangement fees 56 -

Bank borrowings at the end of the year 17,200 -

======== ========

1. In addition to the arrangement fees paid in connection with

the Barclays loan the Company has also paid a further GBP149,000 in

the year in connection with provisional arrangement fees for both

the ASK loan and ZDP share placing. The funds from these were not

received until after the year end.

21. SHARE CAPITAL

Authorised share capital: 30 Sep 30 Sep 22

23

GBP GBP

140,000,000 (2022: 140,000,000) Ordinary shares

of 5p each 7,000,000 7,000,000

========= ===========

Allotted and called up:

No GBP'000

As at 30 September 2022 and 30 September 2023 59,638,588 2,982

================ =================

22. CAPITAL COMMITMENTS

As at 30 September 2023, the Group had contracted capital

commitments, not provided for in the financial statements, of

GBP19,795,000 (2022: GBP32,060,000) in connection with the

construction, development or enhancement of the Group's investment

and trading properties which are expected to be incurred in the

next financial year. GBP19,627,000 relates to the remaining

construction costs anticipated to enable completion of the student

accommodation development at The Island Quarter which are to be

funded entirely by way of further drawdowns from the Barclays loan

facility.

On 6 April 2023, the Group, by way of its 80% interest in the

shares of Conygar Bristol Limited, entered into a conditional