Adnams PLC Trading Statement (1989A)

September 22 2022 - 2:01AM

UK Regulatory

TIDMADB

RNS Number : 1989A

Adnams PLC

22 September 2022

Adnams plc - Interim Trading Statement

For the half year ended 30 June 2022, Adnams experienced a

trading period marked by stabilisation and consolidation following

the prior two years of disrupted trading. This resulted in revenues

of GBP30m, up GBP9m on 2021, delivering a much reduced operating

loss of (GBP0.7 million) compared to (GBP3.1m) in the previous

year, a result in line with expectations.

Cashflow remains strong and the company has repaid all

outstanding monies owed to HMRC and is no longer in receipt of any

Government support schemes. The business refinanced in January and

maintained its facility with Barclays at GBP20m. This comprises a

GBP10m term loan, GBP7m revolving credit facility and a GBP3m

overdraft. The business also retains the facility to draw down a

further GBP3m.

The trading mix between the on-trade and off-trade mirror that

of the wider market, with the on-trade recovering some of its lost

ground during the pandemic at the expense of the off-trade. The

cask beer market remains subdued with pub and bar customers

developing a preference for keg beer as a lower risk alternative to

cask whilst footfall remains uncertain. Adnams long-term

investments over many years means the company is well placed to

respond to this development. The company's Hotel, Managed and Tied

estate has delivered a solid half year with the attractiveness of

East Anglian tourist locations, staycations, and the company's

minimal exposure to town and city centre locations benefiting the

business. The retail business is ahead of last year, with shops

becoming more of a hub for both online deliveries and business

customers - an integration aided by our investment in a new website

and e-commerce platform in early 2022.

From a product perspective Ghost Ship 4.5%, Ghost Ship 0.5% and

the Copper House Gin range remain the company's product focus.

Investments this year have focused upon automation and process

efficiency with the aim of increasing raw material yield and

reducing energy usage. The company has also continued to invest in

the fabric of pubs and shops and all investments have been

consistent with the company's approach to the natural, social and

built environment.

An interim dividend was paid in February this year of 156p per

'B' share and 39p per 'A' share in recognition of:

I) the continued support of members during the pandemic

II) the company paying no final dividend for the year ended 31

December 2019

III) strong trading throughout the Spring, Summer and Autumn of

2021.

Released: 22/09/2022

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXGZGZLKMDGZZM

(END) Dow Jones Newswires

September 22, 2022 02:01 ET (06:01 GMT)

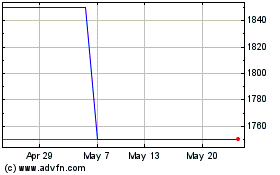

Adnams (AQSE:ADB)

Historical Stock Chart

From Jan 2025 to Feb 2025

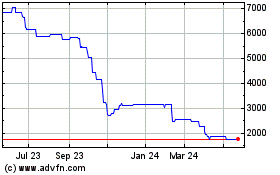

Adnams (AQSE:ADB)

Historical Stock Chart

From Feb 2024 to Feb 2025