|

|

Free Writing Prospectus

|

|

|

VanEck Merk Gold Trust

|

|

|

2020-07-08 Frank Mottek Interview

|

|

|

0001546652

|

|

|

Pursuant to 433/164

|

|

|

333-238022

|

Frank Mottek:

With me now Axel Merk, the President

and Chief Investment Officer of Merk Investments, manager of the Merk Funds which includes the VanEck Merk Gold Trust, OUNZ, as

well as the Merk Hard Currency Fund. Axel, thank you very much for coming to the line, and give us your reaction to the price of

gold, popping above 1,800 here and now hovering at near its all-time high.

Axel Merk:

Crossing the psychologically important level on, of

1,800, and as we reach these milestones, more and more people focus their attention on, on the price of gold. And as we’ve

seen with COVID-19, we’ve got a lot of day traders coming on board to opening their brokerage accounts, and so quote unquote

the party only begins. I’m not suggesting that it will necessarily go through the roof, but the, the price action itself

gets more people to focus on it, and also because gold is in some ways just a brick and doesn’t have so much a fundamental

analysis that, that you can do, it attracts these technical traders, and so these, these breakouts do matter and dynamics may,

might take on a life on their own.

Frank Mottek:

Well, it’s certainly significant that it’s

nearing its all-time high, and, and it’s interesting to look back. Uh, by the way, prior to the last financial crisis back

in 2008, we saw gold move up significantly at a time when inflation was officially non-existent, right? It had gone up to $1,000,

was significantly below that before the crisis hit, and, and now once again, it’s approaching a record high.

Axel Merk:

And, and what’s of course different is that you

may recall after 2009, sure, we had a government stimulus program, but it was not a particularly effective one, and even the, the

tax cuts we had in the current administration, sure, that may boost economy, but not necessarily inflation in a direct way. When

you give people cash, as we’ve done now, that is potentially more inflationary. Also there’s been talk about an infrastructure

spending program, and of course, we don’t know whether that’s going to get done with whoever the next administration

is going to be after November, but there is signs that it’s been okay to spend a great deal of money, and not just in the

U.S., but globally, and the sort of things that are under consideration tend to be more inflationary.

Axel Merk:

People have been hoarding cash and maybe it’s

all going to go in the S&P 500, but maybe people are going to start consuming more and push prices higher, and so people buy

gold as a hedge so to speak against certain risks, and it’s always people are glad they held gold with hindsight and never

quite know why they hold it going forward. But I believe a lot of people are buying gold because of the diversification benefits

that it, it may hold because they have no clue what the S&P is going to do. Nobody really has, and they think they want to

do something, and this is, this appears to be one of the ways that people are attempting to diversify.

Frank Mottek:

Tell us what’s happening with currencies. How’s

the dollar looking these days, and, and as you mentioned, of course central banks around the world are, are taking extraordinary

measures these days, including the European Central Bank. Give us an update on what’s happening in the currency markets.

Axel Merk:

Well, sure. I mean, as we are speaking, the dollar is

down, the dollar index is down about half a percent and dollar is weaker is across all the, the major currencies, and, and today,

the so-called commodity currencies are higher, beta currencies are, are up more. That’s the Swedish krona is, is up quite

a bit. The Canadian dollar is up. The Norwegian krone is up. The weakest currency is up, the yen that’s up less than the

other ones, still up versus the dollar, and so as we are reflating the global economy, the dollar tends to weaken, and maybe, just

maybe the multi-year dollar bull market is, is, is finally over. I sometimes have, have somewhat joked that we have the better

printing press than other countries do.

Axel Merk:

In times of crises sometimes, the reason why the dollar

has continued to benefit is because a lot of borrowing around the world is taking place in dollars, and when there’s a crisis,

you need to de-lever, that means they have to reduce the debt, and that process involves then buying the dollar, and but because

we are foaming the world with easy money, that trend is in a reverse again, and, and the dollar has weakened and, and may well

continue to weaken.

Frank Mottek:

What do you see ahead for the price of gold here?

Axel Merk:

Well, it’s going to become more volatile I would

think, because as more people get attention and, and, and so forth. Now that said, the price of gold can move quite a bit in, in,

in both directions. We currently, if you look at the, the Commitment of Traders report that the CFTC is publishing, there’s

a lot of dollar bulls out there right now, and so that makes it vulnerable in a short term. That said, because we have broken through

these 1,800 levels, I, I would be very reluctant to call for a correction right now, quite the opposite seems to be taking place.

But in any case, if somebody were to buy gold now, I would encourage anybody to take a longer term view while I am very positive

on the price of gold, I have no idea what the price of gold is going to do tomorrow, or indeed in the next five minutes.

Frank Mottek:

What about (laughs) the price of silver and some of

the other metals? Looks like silver is al- along for the ride here at the moment.

Axel Merk:

Yes. The, the, the silver bulls are finally getting rewarded

after many years of suffering. The difference between gold and, and other precious metals is that they have greater industrial

use, and so the dynamics are more complicated and gold is, I guess, complicated enough for me, and so I tend (laughs) not to comment

too much on, on silver, but, but obviously when you have a global economy that’s, that’s slowed down, silver has suffered,

but in, in recent weeks, not just precious metals, but also copper for example has, has gone up quite a bit, and, and so that’s

all I think part of the reflationary trade, and, and also of the, of the dollar weakness, but again, the dynamics are more complex.

Gold is, the price of gold in, in dollars is volatile. Silver is much more volatile, and so that’s why some people like it,

but it had been a frustrating ride, of course, for, for silver investors for many years, and finally they are, they’re getting

some reward here.

Frank Mottek:

And we’ve had these conversations for many, many

years, Axel, and of course, you had the Merk Hard Currency Fund and the OUNZ Fund, the gold fund which you created some years ago.

Can you tell us about that and, and what investors should know about that?

Axel Merk:

Well, yes. We, we do have some investment vehicles in

that space. In the physical gold space, we do have an investment product where investors can buy gold on the exchange, and then

if and when they want to, they can request delivery. It’s, it’s more the optionality that if they want to take delivery,

that is available, and so many investors appreciate that. That is one of the, the, sometimes there has been accusation on some

of the gold ETFs, is the gold really there? Well, in, in our gold ETF, investors if they want to, they can take it home, and importantly,

the taking delivery is not in itself a taxable event, and what I mean with that is when they buy the ETF, they own the underlying

gold, and so when they take delivery, they’re just requesting to get what they already own. And so many people like it, and

it trades like the other gold ETFs do, except we happen to think that it, it has some features that, that investors appreciate,

and, and the market, we watch that to some extent at least because it’s been, been growing, but obviously together with the

other gold ETFs that have had significant inflows as well.

Frank Mottek:

Well, thank you for that, and, and also as far as the,

the currency markets are concerned where are you placing your bets at this point?

Axel Merk:

Well, you mentioned the, the mutual fund. The mutual

fund has been, was launched in 2005 as a, as a play against a weakening dollar. Now that has continued to do what it needs to do.

In recent years when we had a dollar bull market, it, performance wasn’t great, but it did what it’s supposed to be

doing. Now what, it, it’s positioned more assertively than it had in the past, and, and significant extent because we have

taken down the euro weight quite a bit, especially after Lagarde was nominated to be the head of the ECB. We think she’s

not going to be all that beneficial to the euro. Now that said, the euro’s kind of an anchor point outside of the dollar,

and, and other currencies around it tend to be more volatile, and so as the dollar is weakening, there, there might be some additional

volatility there. Obviously when that’s in, in the favor of the fund, then investors appreciate it, and so for the time being,

that’s, that’s playing out. But yes, that fund has been focused more on the kind of the, the commodity and higher beta

currencies, focusing on the, on the major currencies now, on the G10 currencies.

Frank Mottek:

And is, is the Swiss franc still connected directly to the euro

which they did some years ago?

Axel Merk:

Well, actually, we haven’t invested in the Swiss

franc in several years in that fund, and, and a significant extent because we don’t like what the Swiss National Bank is

doing. But the, yes, I mean, the, the Swiss National Bank is frustrated often how strong the Swiss franc is, and it really depends

on the day on, on a crisis level on how that’s trading towards the euro. But there’s always the intervention risk with

the Swiss National Bank, and the Swiss National Bank is, is buying equities and all kinds of things in order to try to weaken its

currencies, and so in, at least in that mutual fund, we stay away from it because it’s not consistent with with the, the

objectives that we have in that fund.

Frank Mottek:

And perhaps more significantly and that’s gotten

more attention in recent years, the Asian currencies, what about the, the Chinese currency? What’s happening with that in

relation to the U.S. dollar?

Axel Merk:

Well, that’s been a political hot potato, of course,

with some people claiming the Chinese are currency manipulators. I mean, if anything, they tried to keep their currency a little

bit stronger for a while. There’s also a lot of talk about the Hong Kong dollar with rumblings coming whether the, the peg

should be broken. When we look at underneath the surface, there’s actually very little pressure there that could have caused

change if, if you rattle the cages sufficiently, but in recent months, if anything, there was upward pressure on the Hong Kong

dollar, and so CNH which is kind of the, the onshore Chinese yuan, is trading right around seven, and so it’s been there

for a while, so there’s, it’s really rather quote unquote boring, but it has not stopped the politicians to making

a big fuss about that currency.

Frank Mottek:

And during all of this, Axel, I know you’ve been

doing special programs as, as well for your social media followers. Are you still doing that, and, and how can people access your

best information there?

Axel Merk:

Well, sure. Coming to, to Twitter maybe where I am,

@AxelMerk, is, is probably a good starting point and I’ve been doing more video sessions and market commentaries, and all

kinds of things. If somebody wants to have a live commentary on, on what I say, that’s really (laughs) the easiest place

to, to reach me. We do all kind of other things as well, but Twitter is probably a, a good, good starting point.

Frank Mottek:

All right, and while we have you on the line just, I

know you’re also an economist and where do you see this thing go from here?

Axel Merk:

Well, if you, if you can tell me what the weather’s

like tomorrow, maybe I tell you (laughs) where the market is going to be tomorrow. I can give you a very sensible argument why

this economy is going to recover and I can give you a good argument as to why we going to have a boatload of problems ahead. Ultimately,

people do get used to crises, and the markets are focused on the S&P 500, and so as long as you can push a like button somewhere,

something in the S&P is going to do fine, whereas when a hair salon or many restaurants shut down, they’re not listed

on the NYSE, right? At the same time, we’ll have delinquencies rise and so forth, so if you want to have a glass half-empty,

I can give you a convincing argument as well. We’re just printing a great deal of money to try to push everything higher,

and how that’s going to play out in detail, I don’t know, but I’d encourage anybody to have a longer term plan

and, and stick to it because I, the one thing I’m pretty sure of is that whatever plan you have, you’re going to get

question the coming months with whatever market action we’ll be seeing.

Frank Mottek:

Axel, thank you very much for taking the call on this

big day today. Axel Merk, the President and Chief Investment Officer of Merk Investments, manager of the Merk Funds. Thank you

again very much and we’ll hope to speak with you again very, very soon.

Axel Merk:

My pleasure.

***

The issuer has filed a registration statement

with the SEC for offering to which this communication relates. Before you invest, you should read the prospectus and other documents.

4

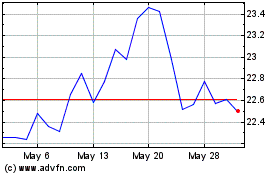

VanEck Merk Gold (AMEX:OUNZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

VanEck Merk Gold (AMEX:OUNZ)

Historical Stock Chart

From Jul 2023 to Jul 2024