Filed pursuant

to Rule 424(b)(3)

File No. 333-230255

UNITED STATES

NATURAL GAS FUND, LP

Supplement dated

December 7, 2020

to

Prospectus dated

April 24, 2020

___________________________________________________

This

supplement contains information that amends, supplements or modifies certain information contained in the prospectus of United

States Natural Gas Fund, LP (“UNG”) dated April 24, 2020 (the “Prospectus”).

You

should carefully read the Prospectus and this supplement before investing. This supplement should be read in conjunction with

the Prospectus. You should also carefully consider the “Risk Factors” beginning on page 4 of the Prospectus before

you decide to invest.

Macquarie Futures USA

LLC to Serve as a Futures Commission Merchant for UNG

Effective

December 3, 2020, UNG has engaged Macquarie Futures USA LLC to serve as an additional futures commission merchant. UNG’s

relationships with RBC Capital Markets, LLC, RCG Division of Marex Spectron, and E D & F Man Capital Markets Inc. will remain in place.

In

light of the foregoing, the section entitled “Futures Commission Merchant” beginning on page 31 of the Prospectus

is revised to add the following text at the end of the section:

Macquarie

Futures USA LLC

Effective

December 3, 2020, UNG has engaged Macquarie Futures USA LLC (“MFUSA”) to serve as an additional futures commission

merchant. The Customer Agreement between UNG and MFUSA requires MFUSA to provide services to UNG in connection with the purchase

and sale of futures contracts in natural gas and Other Natural Gas-Related Investments that may be purchased or sold by or through MFUSA for UNG’s

account. Under this agreement, UNG pays MFUSA commissions for executing and clearing trades on behalf of UNG.

MFUSA’s

primary address is 125 West 55th Street, New York, NY 10019. MFUSA is registered in the United States with the CFTC

as an FCM providing futures execution and clearing services covering futures exchanges globally. MFUSA is a member of various

U.S. futures and securities exchanges.

MFUSA

is a large broker dealer subject to many different complex legal and regulatory requirements. As a result, certain of MFUSA’s

regulators may from time to time conduct investigations, initiate enforcement proceedings and/or enter into settlements with MFUSA

with respect to issues raised in various investigations. MFUSA complies fully with its regulators in all investigations which

may be conducted and in all settlements it may reach. As of the date hereof, MFUSA has no material litigation to disclose as that

term is defined under the U.S. Commodity Exchange Act and the regulations promulgated thereunder.

MFUSA

will act only as clearing broker for UNG and as such will be paid commissions for executing and clearing trades on behalf of UNG.

MFUSA has not passed upon the adequacy or accuracy of this disclosure document. MFUSA will not act in any supervisory capacity

with respect to USCF or participate in the management of USCF or UNG.

MFUSA

is not affiliated with UNG or USCF. Therefore, neither USCF nor UNG believes that there are any conflicts of interest with MFUSA

or its trading principals arising from its acting as UNG’s FCM.

Litigation

and Claims

UNG

filed a supplement, dated August 6, 2020 (the “Prior Prospectus Supplement”) to the Prospectus that, among other things,

disclosed a purported class action initiated by Robert Lucas, individually and on behalf of others similarly situated (the “Lucas

Class Action”). The complaint filed in the Lucas Class Action has been amended to add parties and amend the claims set forth

therein. Accordingly, the following description amends and restates the disclosure included in the Prospectus Supplement regarding

the Lucas Class Action in its entirety:

In re: United States Oil Fund, LP Securities Litigation

On

June 19, 2020, USCF, USO, John P. Love, and Stuart P. Crumbaugh were named as defendants in the Lucas Class Action (the “Initial

Lucas Class Complaint”). The Initial Lucas Class Complaint alleges that, beginning in March 2020, in connection with USO’s

registration and issuance of additional USO shares, USCF, USO, and the other defendants in the Initial Lucas Class Action failed

to disclose to investors in USO certain extraordinary market conditions and the attendant risks that caused the demand for oil

to fall precipitously, including the COVID-19 global pandemic and the Saudi Arabia-Russia oil price war. Plaintiff alleges that

USCF, USO, and the other defendants in the Initial Lucas Class Action possessed inside knowledge about the consequences of these

converging adverse events on USO and did not sufficiently acknowledge them until late April and May 2020, after USO suffered losses

and was allegedly forced to abandon its investment strategy. The Court thereafter consolidated the Initial Lucas Class Action

with two related putative class action complaints and appointed a lead plaintiff. The consolidated class action is pending in

the U.S. District Court for the Southern District of New York under the caption In re:

United States Oil Fund, LP Securities Litigation, Civil Action No. 1:20-cv-04740. The consolidated class action seeks

to certify a class and award the class compensatory damages at an amount to be determined at trial.

On

November 30, 2020, the lead plaintiff filed an amended complaint in In re: United States

Oil Fund, LP Securities Litigation (the “Amended Lucas Class Complaint”). In addition to amending the Initial

Lucas Class Complaint with respect to the underlying facts, including revising the start of the class period to February 2020,

and adding claims under the Securities Act of 1933, the Amended Lucas Class Complaint added as defendants directors of USCF (Nicholas

D. Gerber, Andrew F Ngim, Robert L. Nguyen, Peter M. Robinson, Gordon L. Ellis, and Malcolm R. Fobes III); marketing agent (ALPS

Distributors, Inc.); and Authorized Participants (ABN Amro, BNP Paribas Securities Corporation, Citadel Securities LLC, Citigroup

Global Markets, Inc., Credit Suisse Securities USA LLC, Deutsche Bank Securities Inc., Goldman Sachs & Company, J.P. Morgan

Securities Inc., Merrill Lynch Professional Clearing Corporation, Morgan Stanley & Company Inc., Nomura Securities International

Inc., RBC Capital Markets LLC, SG Americas Securities LLC, UBS Securities LLC, and Virtu Financial BD LLC).

USCF, USO, and

the other defendants in In re: United States Oil Fund, LP Securities Litigation

intend to vigorously contest such claims and move for their dismissal.

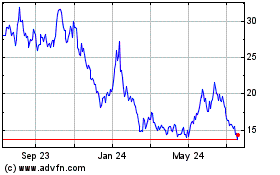

United States Natural Gas (AMEX:UNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

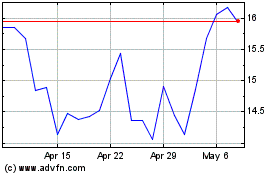

United States Natural Gas (AMEX:UNG)

Historical Stock Chart

From Apr 2023 to Apr 2024