Form 8-K - Current report

July 19 2023 - 7:00AM

Edgar (US Regulatory)

0000061398

false

0000061398

2023-07-18

2023-07-18

0000061398

us-gaap:CommonStockMember

2023-07-18

2023-07-18

0000061398

tell:SeniorNotes8.25PercentDue2028Member

2023-07-18

2023-07-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): |

July 18, 2023 |

|

Tellurian

Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-5507 |

|

06-0842255 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 1201

Louisiana Street, Suite

3100, Houston,

TX |

|

77002 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

| Registrant’s telephone number, including

area code: |

(832)

962-4000 |

|

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common

stock, par value $0.01 per share |

|

TELL |

|

NYSE

American LLC |

| |

|

|

|

|

| 8.25%

Senior Notes due 2028 |

|

TELZ |

|

NYSE

American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

On July 18, 2023, Tellurian

Inc. (the “Company”) entered into a binding commitment letter (the “Commitment Letter”) with a fund

of Blue Owl Real Estate Capital LLC (the “Investor”) regarding the sale and leaseback of approximately 800 acres of

land (the “Property”) owned and/or leased by Driftwood LNG LLC, a wholly owned subsidiary of the Company or an affiliate

(“Driftwood LNG”), to be used for the proposed Driftwood liquefied natural gas terminal facility (the “Driftwood

terminal”) in Lake Charles, Louisiana. The Commitment Letter effectively replaced the previously announced letter of intent,

dated as of April 4, 2023, between the Company and the Investor (the “LOI”).

Pursuant to the Commitment

Letter, the transaction (the “Transaction”) will consist of (i) the sale by Driftwood LNG, and purchase by a special

purpose entity to be formed by the Investor (the “Purchaser”), of Driftwood LNG’s interests in the Property for

$1.0 billion (the “Purchase Price”) pursuant to a purchase and sale agreement (the “Purchase Agreement”)

and (ii) upon (and as a condition to) the closing of the transactions contemplated by the Purchase Agreement, a 40-year lease of

the Property from the Purchaser to Driftwood LNG pursuant to a master lease (the “Master Lease”). Terms of the Master

Lease will include, among others, (i) a capitalization rate of 8.75%, (ii) annual rent escalators of 3.00%, (iii) a requirement

that Driftwood LNG post a letter of credit equal to 12 months of rent, and (iv) a requirement that joint and several contingent guarantors

of the Master Lease (the “Contingent Guarantors”) hold an investment grade rating of BBB or higher or attain an equivalent

shadow credit rating, and be otherwise acceptable to the Purchaser.

Pursuant to the Commitment

Letter, during the one-year period ending on or around July 18, 2024, the Company and its affiliates must negotiate exclusively with

the Purchaser with respect to the Transaction and must not solicit, accept, or negotiate any other offer for the sale and leaseback of,

or any substantially similar transaction with respect to, the Property (the “Exclusivity Period”). If during the Exclusivity

Period, the Company breaches the foregoing exclusivity provision or enters into a sale–leaseback transaction or any equity or debt

investment or financing or similar transaction with respect to, or otherwise in connection with or related to a final investment decision

(or similar final decision to move forward with the construction) of, the Driftwood project (whether or not secured directly or indirectly

by the Property or the direct or indirect owners of the Property or any interest therein) with a party other than the Purchaser, and does

not enter into the Transaction with the Purchaser, then the Company will be obligated to pay the Purchaser a fee equal to 3% of the Purchase

Price (the “Break Fee”). The Commitment Letter also provides that the Purchaser will be required to pay the Company

the Break Fee if all conditions precedent to the Purchaser’s obligations to consummate the Transaction during the Commitment Period

(as defined below) are satisfied or waived by the Purchaser and the Purchaser fails to fund the Purchase Price in accordance with the

terms of the Purchase Agreement.

Pursuant to the Commitment

Letter, the period in which the Purchaser may be obligated to consummate the Transaction will commence on July 18, 2023, and terminate

upon the earliest to occur of (i) January 14, 2024, (ii) the termination of the Commitment Letter in accordance with its

terms, and (iii) the termination of the Purchase Agreement (such period, the “Commitment Period”). The closing

of the Transaction will occur upon the satisfaction of the closing conditions in the Purchase Agreement, including the Company or its

affiliates securing equity and debt commitments in a sufficient amount with respect to the development of the Driftwood project on terms

satisfactory to the Purchaser. The Purchaser’s obligation to complete the Transaction is also subject to the parties’ entry

into definitive agreements, including the Purchase Agreement.

| Item 1.02 | Termination of a Material Definitive Agreement. |

The information set forth

in Item 1.01 is incorporated herein by reference to this Item 1.02.

On July 18, 2023, the

LOI was terminated. The terms and conditions of the LOI were substantially similar to those of the Commitment Letter, except with respect

to the terms of the Exclusivity Period, Commitment Period, or similar period, and the Break Fee.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| | TELLURIAN INC. |

| | | |

| Date: July 19, 2023 | | By: |

/s/ Daniel A. Belhumeur |

| | | Name:

|

Daniel A. Belhumeur |

| | | Title: |

Executive Vice President and General Counsel |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tell_SeniorNotes8.25PercentDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

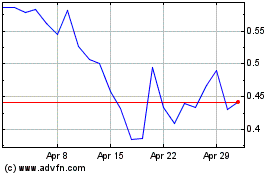

Tellurian (AMEX:TELL)

Historical Stock Chart

From Apr 2024 to May 2024

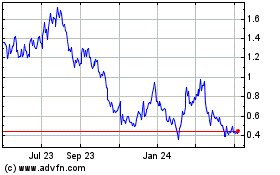

Tellurian (AMEX:TELL)

Historical Stock Chart

From May 2023 to May 2024