Sichenzia Ross Ference Carmel LLP Closes Over 100 Capital Markets Transactions Valued At Over $700 Million in 2023

February 08 2024 - 9:00AM

Today, Sichenzia Ross Ference Carmel LLP (“SRFC”), a full-service

law firm internationally recognized for its securities and

litigation practices, announced that it has closed over 100

transactions, ranging from $1.1 million to $70 million. In 2023,

with the total value of these transactions surpassing $700 million.

The transactions on behalf of both issuers and underwriters

included initial public offerings, secondary public offerings,

registered direct offerings and private placements.

SRFC provides world-class, personalized and cost-effective

solutions, representing broker-dealers, businesses and individuals

in all types of commercial litigation and arbitration. In October

of 2023, Sichenzia Ross Ference LLP combined forces with Carmel,

Milazzo & Feil to form SRFC and currently consists of

approximately 70 experienced attorneys in offices including New

York City, California and Florida.

Notable transaction highlights from 2023 include:

- Represented E-Home Household Service Holdings Limited, (NASDAQ:

“EJH”) a household service company based in Fuzhou, China, in a $70

million shelf-takedown

- Represented Zynex, Inc., (NASDAQ: “ZYXI”) an innovative medical

technology company specializing in manufacturing and selling

non-invasive medical devices for pain management, stroke

rehabilitation, cardiac monitoring and neurological diagnostics, in

a Rule 144A private offering

- Represented EF Hutton in $57.5 Million initial public offering

(IPO) of Cetus Capital Acquisition Corp

- Represented A.G.P. / Alliance Global Partners in the $57.5

Million initial public offering of Bukit Jalil Global Acquisition 1

Ltd.

- Represented Spartan Capital Securities, LLC in an $18.1 million

initial public offering of ordinary shares of Multi Ways

Holdings Limited (NYSE American: MWG)

“Sichenzia Ross Ference Carmel is proud to be one of the most

prolific securities law firms in the country, representing some of

the most dynamic companies entering the market today,” said Greg

Sichenzia, Founding Partner at SRFC. “Expectations are high for

2024, especially for the return of a strong IPO market and

participation from global issuers and underwriters. We look forward

to growth on behalf of the firm, its people and our clients In our

first full year as SRFC.”

A full list of transactions can be found here.

About Sichenzia Ross Ference Carmel LLPSRFC is

a full-service law firm with a nationally recognized corporate,

securities, and litigation practice that provides experienced

representation in all matters involving the securities industry. In

addition to handling routine to complex commercial matters, SRFC’s

renowned litigation and regulatory department specializes in

defending broker-dealers, registered persons, public and private

corporations, and individuals in investigations and enforcement

proceedings before the SEC, FINRA, and other regulatory bodies, as

well as litigations and arbitrations across all forums in the

securities industry, including class action lawsuits, shareholder

derivative actions, and matters involving allegations of fraud,

misrepresentation or other securities violations.

Finally, SRFC has a burgeoning expungement practice, where it

represents registered persons seeking to have false and harmful

customer complaints removed from their industry records. In

addition to SRFC’s well-known securities practice, we have

expertise in multiple disciplines including complex commercial

litigation in an array of matters from shareholder derivative

actions, partnership disputes, breach of contract, etc. SRFC

practice groups include tax and trust and estates, notably

providing sophisticated estate planning for its high-net-worth

clients.

Follow SRFC on LinkedIn and X (formerly Twitter)

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/00599898-1bda-4776-a4ee-b2efe853f81b

Media contact:

FischTank PR

srfc@fischtankpr.com

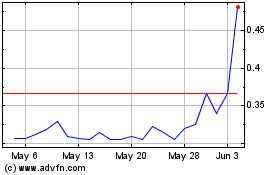

Multi Ways (AMEX:MWG)

Historical Stock Chart

From Oct 2024 to Nov 2024

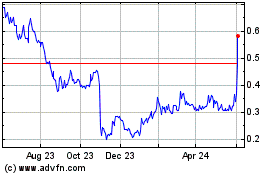

Multi Ways (AMEX:MWG)

Historical Stock Chart

From Nov 2023 to Nov 2024