Filed Pursuant to Rule 424(b)(2)

Registration No. 333-257697

Amendment #3 dated MARCH

10, 2023

TO PROSPECTUS SUPPLEMENT DATED MAY 16, 2022, AS AMENDED ON JUNE

3, 2022 AND SEPTEMBER 23, 2022

(To Prospectus Dated July 13, 2021)

KULR Technology Group, Inc.

Up to $50,000,000 of Common Stock

This Amendment No. 3 to the

Prospectus Supplement (this “Amendment”), amends and supplements our Prospectus Supplement dated May 16, 2022 (the “Prospectus

Supplement”), as amended by Amendment No. 1 dated June 3, 2022 (“Amendment No. 1”) and Amendment No. 2 dated September

23, 2022 (“Amendment No. 2”). This Amendment should be read in conjunction with the Prospectus Supplement, Amendment No. 1,

Amendment No. 2, and the Prospectus, dated July 13, 2021 (the “Prospectus”), filed as a part of our registration statement

on Form S-3 (File No. 333-257697) (the “Registration Statement”). This Amendment amends only those sections of the Prospectus

Supplement, as amended by Amendment No. 1, and Amendment No. 2, listed in this Amendment; all other sections of the Prospectus Supplement

remain as is.

We filed the Prospectus Supplement

to register the offer and sale up to $50,000,000 of shares of our common stock, par value $0.0001 per share, from time to time pursuant

to the terms of that certain Standby Equity Purchase Agreement dated as of May 13, 2022 (as amended on June 3, 2022, the “SEPA”),

between YA II PN, Ltd. (“Yorkville”) and us.

Pursuant to this Amendment,

the accompanying Prospectus Supplement, Amendment No. 1, Amendment No. 2, and the accompanying base Prospectus, we are offering up to

$50,000,000 of our common stock to Yorkville in connection with our previously announced SEPA, as amended and supplemented in accordance

with the Supplemental Agreement to the SEPA dated September 23, 2022 (the “Supplemental Agreement”), between Yorkville and

us (the SEPA, as amended and supplemented, the “SEPA Offering”). Pursuant to the Supplemental Agreement, Yorkville committed

to advance up to $50,000,000 against future purchases of shares of our common stock under the SEPA (“Pre-Paid Advances”).

Concurrently with the entry into the Supplemental Agreement, Yorkville advanced as an initial Pre-Paid Advance the principal amount of

$15,000,000 for the purchase of our Common Stock from time to time under the SEPA Offering (the “Initial Advance”).

On March 10, 2023, the Company and Yorkville agreed and closed on a second Pre-Paid Advance for $2,000,000 (the “Second Advance”)

for the purchase of our Common Stock from time to time under the SEPA Offering. Interest accrues on the outstanding balance of each of

the Pre-Paid Advances at an annual rate of 10%, subject to an increase to 15% upon events of default described in the Supplemental Agreement.

For additional information

on the methods of sale that may be used by Yorkville, see the section entitled “Plan of Distribution” on page S-5.

Our common stock trades on

the NYSE American Market (“NYSE”) under the symbol “KULR.” On March 9, 2023, the last sale price of our common

stock as reported on NYSE was $1.11 per share.

Investing in our common

stock involves risks. Please read “Risk Factors” beginning on page S-2 of this Amendment and on page S-3 of the Prospectus

Supplement and in the documents incorporated by reference herein.

Neither the Securities

and Exchange Commission (the “SEC”) nor any other regulatory body has approved or disapproved of these securities or passed

upon the accuracy or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal

offense.

This Amendment No. 3 to the Prospectus Supplement

is dated March 10, 2023

TABLE OF CONTENTS

About

This AMENDMENT TO PROSPECTUS SUPPLEMENT

The Prospectus Supplement

is part of a “shelf” registration statement on Form S-3 (File No. 333-257697), which was declared effective on July 13, 2021

and remains in effect on the date hereof. Under this shelf registration process, we may, from time to time, sell any combination of the

securities described in the accompanying prospectus in one or more offerings up to a total dollar amount of $100,000,000.

Before investing in shares

of our common stock, we urge you to carefully read this Amendment, the Prospectus Supplement and the accompanying Prospectus, together

with the information incorporated in the Prospectus Supplement and the accompanying Prospectus before making an investment decision. You

should also read and consider the information in the documents referred to in the sections of the Prospectus Supplement entitled “Where

You Can Find More Information” and “Incorporation by Reference” of this Amendment. These documents contain important

information about us and our common stock, and other information you should know before investing.

The Prospectus Supplement,

as amended by this Amendment, describes the terms of the SEPA Offering and also adds to and updates information contained in the documents

incorporated by reference into the Prospectus Supplement and the accompanying Prospectus. To the extent there is a conflict between the

information contained in this Amendment, Amendment No. 1, Amendment No. 2, or the Prospectus Supplement, on the one hand, and the information

contained in any document incorporated by reference into the Prospectus Supplement and the accompanying Prospectus that was filed with

the SEC before the date of this Amendment, Amendment No. 1, Amendment No. 2, or the Prospectus Supplement, on the other hand, you should

rely on the information in this Amendment, Amendment No. 1, Amendment No. 2, or the Prospectus Supplement, as applicable.

You should rely only on the

information contained in or incorporated by reference into the Prospectus Supplement, as amended by Amendment No. 1, Amendment No. 2,

and this Amendment, or contained in or incorporated by reference into the accompanying Prospectus to which we have referred you. We have

not authorized anyone to provide you with information that is different. If anyone provides you with different or inconsistent information,

you should not rely on it. The information contained in, or incorporated by reference into, this Amendment and the Prospectus Supplement

and contained in, or incorporated by reference into, the accompanying Prospectus is accurate only as of the respective dates thereof,

regardless of the time of delivery of this Prospectus Supplement, as amended by Amendment No. 1 and this Amendment, and the accompanying

Prospectus or of any sale of securities offered hereby.

We are offering to sell,

and are seeking offers to buy, the shares of common stock only in jurisdictions where such offers and sales are permitted. The distribution

of this Amendment, Amendment No. 1, Amendment No. 2, the Prospectus Supplement and the accompanying Prospectus and the offering of the

shares of common stock in certain states or jurisdictions or to certain persons within such states and jurisdictions may be restricted

by law. Persons outside the United States who come into possession of this Amendment, Amendment No. 1, Amendment No. 2, the Prospectus

Supplement and the accompanying Prospectus must inform themselves about and observe any restrictions relating to the offering of the shares

of common stock and the distribution of this Amendment, Amendment No. 1, Amendment No. 2, the Prospectus Supplement and the accompanying

Prospectus outside the United States. The Prospectus Supplement, as amended by Amendment No. 1, Amendment No. 2, and this Amendment, and

the accompanying Prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer

to buy, any securities offered by the Prospectus Supplement, as amended by Amendment No. 1, Amendment No. 2, and this Amendment, and the

accompanying Prospectus by any person in any state or jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

Incorporation

by Reference

We are “incorporating

by reference” into the Prospectus Supplement the information in documents we file with the SEC, which means that we are disclosing

important information to you by referring you to those documents. The information incorporated by reference is an important part of the

Prospectus Supplement, and information that we file later with the SEC will automatically update and supersede this information to the

extent that the later filed information modifies or replaces such earlier information. We incorporate by reference in the Prospectus Supplement

the following documents, which we have filed or will file with the SEC:

| |

● |

our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2022, filed with the SEC on May 16, 2022 |

| |

|

|

| |

● |

our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2022, filed with the SEC on August 15, 2022 |

| |

|

|

| |

● |

our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2022, filed with the SEC on November 14,

2022 |

| |

|

|

| |

● |

our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the SEC on

March 28, 2022 |

| |

|

|

| |

● |

our definitive proxy statement on Schedule 14A filed with the SEC on October 7, 2022 |

| |

● |

all documents and reports subsequently filed by us with the SEC (other than, in each case, any information or documents furnished, rather than filed, with the SEC pursuant to certain items of Form 8-K) after the date hereof and prior to the closing of this offering. |

You may obtain any of the

documents incorporated by reference in the Prospectus Supplement from the SEC at the SEC’s website at http://www.sec.gov.

Risk

Factors

Investing in our common

stock involves risk. Before you invest in our common stock, you should carefully consider all of the risk factors incorporated by reference

in the Prospectus Supplement, including the risk factors set forth in our most recent Annual Report on Form 10-K, any subsequent Quarterly

Reports on Form 10-Q or Current Reports on Form 8-K. You should also carefully consider all of the other information included or incorporated

by reference in the Prospectus Supplement. The occurrence of any of these risks could materially and adversely affect our business, financial

condition, liquidity, cash flows, results of operations, prospects, and our ability to implement our investment strategy and to make

or sustain distributions to our stockholders, which could result in a partial or complete loss of your investment in our common stock.

Some statements in the Prospectus Supplement constitute forward-looking statements. See the section entitled “Special Note Regarding

Forward-Looking Statements” of the Prospectus Supplement.

Additional Risks Related to this Offering and Our Common Stock

Substantial blocks of our Common Stock may

be sold into the market as a result of the Supplemental Agreement.

The price of our Common Stock

could decline if there are substantial sales of shares of our Common Stock, if there is a large number of shares of our Common Stock available

for sale, or if there is the perception that these sales could occur.

On September 23, 2022, we entered

into the Supplemental Agreement with Yorkville. Pursuant to the Supplemental Agreement, we requested a Pre-Paid Advance of $15,000,000

from Yorkville, with a right to request further Pre-Paid Advances with an aggregate limitation on all Pre-Paid Advances of $50,000,000.

On March 10, 2023, Yorkville accepted our request for an additional Pre-Paid Advance for $2,000,000. Each Pre-Paid Advance will be offset

upon the issuance of our Common Stock to Yorkville at an Investor Purchase Price equal to the lower of (a) 135% of the of the daily volume

weighted average price, or the VWAP, of our common stock on NYSE, as of the trading day immediately prior to the date of the Pre-Paid

Advance, or the Fixed Price, or (b) 95% of the lowest VWAP of our common stock on NYSE during the three consecutive trading days immediately

preceding the date on which Yorkville provides the purchase notice to us, or the Market Price, and the lower of the Fixed Price and the

Variable Price shall be referred to as the Purchase Price; however, in no event shall the Purchase Price be less than the $0.75 per share,

or the Floor Price.

Any issuances of shares of

our Common Stock pursuant to the Supplemental Agreement to offset each Pre-Paid Advance will dilute the percentage ownership of stockholders

and may dilute the per share projected earnings (if any) or book value of our Common Stock. Sales of a substantial number of shares of

our Common Stock in the public market or other issuances of shares of our Common Stock, or the perception that these sales or issuances

could occur, could cause the market price of our Common Stock to decline and may make it more difficult for you to sell your shares at

a time and price that you deem appropriate.

Once we receive a Pre-Paid Advance, we do

not have the right to control the timing and amount of the issuance of our shares of Common Stock to Yorkville under the Supplemental

Agreement and, accordingly, it is not possible to predict the actual number of shares we will issue pursuant to the Supplemental Agreement

at any one time or in total.

With the exception of the Initial

Advance, we have the right to control the timing and amount, subject to limitations under the Supplemental Agreement, of the Pre-Paid

Advances. However, once we receive a Pre-Paid Advance, including the Initial Advance and the Second Advance, we do not have the right

to control the timing and amount of any issuances of our shares of Common Stock to Yorkville under the Supplemental Agreement. Sales of

our Common Stock, if any, to Yorkville under the Supplemental Agreement will depend upon market conditions and other factors, and the

discretion of Yorkville.

We may ultimately decide to

sell to Yorkville all, some or none of the shares of our Common Stock that may be available for us to sell to Yorkville pursuant to the

Supplemental Agreement.

Because the purchase price

per share to be paid by Yorkville for the shares of Common Stock that we may sell to Yorkville under the SEPA Offering, if any, will fluctuate

based on the market prices of our Common Stock, if any, it is not possible for us to predict, as of the date of the Prospectus Supplement

and prior to any such sales, the number of shares of Common Stock that we will sell to Yorkville under the SEPA Offering, the purchase

price per share that Yorkville will pay for shares purchased from us under the SEPA Offering, or the aggregate gross proceeds that we

will receive from those purchases by Yorkville under the SEPA Offering, if any.

In addition, unless we satisfy

the exception set forth in the Supplemental Agreement based on the average price of our sales thereunder or we obtain stockholder approval,

we will not be able to issue shares of our Common Stock in excess of 19.9% of the outstanding shares of Common Stock as of May 13, 2022

(the “Exchange Cap”) under the SEPA Offering (or any other transaction that is integrated with the Supplemental Agreement)

in accordance with applicable NYSE American rules, unless certain minimum price requirements are met under such NYSE American rules.

Depending on the market prices of our Common Stock in the future, this could be a significant limitation on the amount of funds we are

able to raise pursuant to the Supplemental Agreement. Other limitations in the Supplemental Agreement, including the ownership limitation

on Yorkville of 4.99% of the then outstanding voting power or number of shares of outstanding Common Stock (the “Ownership Limitation”),

and our ability to meet the conditions necessary to request a Pre-Paid Advance, could also prevent us from being able to request Pre-Paid

Advances up to the Commitment Amount.

Further, the resale by Yorkville

of a significant amount of shares registered in this offering at any given time, or the perception that these sales may occur, could cause

the market price of our Common Stock to decline and to be highly volatile.

Our current business plans require a significant

amount of capital. If we are unable to obtain sufficient funding or do not have access to capital, we may not be able to execute our business

plans and our prospects, financial condition and results of operations could be materially adversely affected.

The extent to which we rely

on Yorkville as a source of funding will depend on a number of factors, including the prevailing market price of our Common Stock, our

ability to meet the conditions necessary to request for Pre-Paid Advances under the Supplemental Agreement, the impacts of the Exchange

Cap and the Ownership Limitation and the extent to which we are able to secure funding from other sources. In addition to the amount of

funds we ultimately raise under the Supplemental Agreement, if any, we expect to continue to seek other sources of funding, including

by offering additional equity, and/or equity-linked securities, through one or more credit facilities and potentially by offering debt

securities, to finance a portion of our future expenditures.

We have experienced operating

losses, and we expect to continue to incur operating losses. We expect our capital expenditures to continue to be significant in the foreseeable

future as we expand our business. We expect to expend capital with significant outlays. Our capital requirements are uncertain and actual

capital requirements may be different from those we currently anticipate. In addition, new opportunities for growth in future product

lines, services and markets may arise and may require additional capital.

We entered into the Supplemental

Agreement whereby we will have the ability to request Pre-Paid Advances of up to $50.0 million, including the Initial Advance of $15,000,000

and the Second Advance of $2,000,000, requested by us in connection therewith. The Supplemental Agreement is intended to amend and supplement

the previously entered into the SEPA whereby we have the right, but not the obligation, to sell to Yorkville up to $50.0 million of our

shares of common stock. However, our optionality under the SEPA, as amended by the Supplemental Agreement, is subject to certain conditions

that may not be satisfied. Accordingly, we may not be able to utilize these facilities to raise additional capital when, or in the amounts,

we may require. In addition, we agreed with Yorkville that we will not request Advance Notices under the SEPA while there are Pre-Paid

Advances outstanding under the Supplemental Agreement, unless mutually agreed upon by the parties. Any debt we incur from Yorkville or

other parties could make us more vulnerable to a downturn in our operating results or a downturn in economic conditions. If our cash flow

from operations and our then-existing liquidity is insufficient to meet any debt service requirements, we could be required to refinance

our obligations, or dispose of assets in order to meet debt service requirements.

We expect that we will need

to raise additional capital in order to continue to execute our business plans in the future, and we plan to use the SEPA, as amended

by the Supplemental Agreement, if the conditions for its use are satisfied and seek additional equity and/or debt financing, including

by offering additional equity, and/or equity-linked securities, through one or more credit facilities and potentially by offering debt

securities, to finance a portion of our future expenditures.

The sale of additional equity

or equity-linked securities could dilute our stockholders. The incurrence of indebtedness would result in increased debt service obligations

and could result in operating and financing covenants that would restrict our operations or our ability to pay dividends to our stockholders.

Our ability to obtain the necessary additional financing to carry out our business plans or to refinance, if necessary, any outstanding

debt when due is subject to a number of factors, including general market conditions and investor acceptance of our business model. These

factors may make the timing, amount, terms and conditions of such financing unattractive or unavailable to us. If we are unable to raise

sufficient funds on favorable terms, we may have to significantly reduce our spending, delay or cancel our planned activities or substantially

change our corporate structure. We might not be able to obtain any such funding or we might not have sufficient resources to conduct

our business as projected, both of which could mean that we would be forced to curtail or discontinue our operations and our prospects,

financial consolidated results of operations could be materially adversely affected, in which case our investors could lose some or all

of their investment.

Management will have broad discretion as

to the use of the proceeds from the Supplemental Agreement, and uses may not improve our financial condition or market value.

Because we have designated

the amount of net proceeds from the SEPA, as amended by the Supplemental Agreement, to be used for working capital purposes, our management

will have broad discretion as to the application of such proceeds. Our management may use the proceeds for working capital that may not

improve our financial condition or advance our business objectives.

PLAN OF DISTRIBUTION

On May 16, 2022, the Company

entered into the SEPA with Yorkville. Pursuant to the SEPA, the Company shall have the right, but not the obligation, to sell to Yorkville

up to $50,000,000 of its shares of common stock upon the Company’s written request during the twenty-four months following execution

of the SEPA (the “Commitment Period”). At any time during the Commitment Period, the Company may require Yorkville to purchase

shares of its common stock by delivering an Advance Notice that the Company desires to issue and sell to Yorkville a number of shares

of common stock with an aggregate value of up to $5,000,000. The shares would be purchased pursuant to the SEPA at 98.0% of the Market

Price and would be subject to certain limitations, including that Yorkville could not purchase any shares that would result in it beneficially

owning more than 4.99% of our common stock. Moreover, under applicable NYSE American rules, in no event will we issue to Yorkville shares

that, in the aggregate, would exceed 19.9% of the Company’s outstanding common stock as of the date of the Purchase Agreement unless

we receive stockholder approval for such issuance or such issuance is otherwise permitted by applicable NYSE American rules.

On September 23, 2022, we entered

into the Supplemental Agreement with Yorkville, which Supplemental Agreement is intended to amend and supplement the SEPA. Pursuant to

the Supplemental Agreement, Yorkville committed to advance up to $50,000,000 against future purchases of shares of our common stock under

the SEPA. Pursuant to the Supplemental Agreement, we may request from time to time Pre-Paid Advances of up to $15,000,000 from Yorkville

(or such greater amount that the parties may mutually agree), with a limitation on aggregate Pre-Paid Advances of $50,000,000. Concurrently

with the entry into the Supplemental Agreement, Yorkville advanced, as an Initial Advance in the amount of $15,000,000.

On March 10, 2023, the Company

and Yorkville agreed and closed on a $2,000,000 Second Advance for the purchase of our Common Stock from time to time under the SEPA Offering.

Pursuant to the Supplemental

Agreement, Yorkville may submit to us an Investor Notice (the “Investor Notice”) of up to $3,000,000 per 30-day period, or

such greater amount as the parties may mutually agree, and any outstanding Pre-Paid Advances, and accrued interest, will be offset upon

the issuance of our Common Stock to Yorkville at an investor purchase price (“Investor Purchase Price”) equal to the lower

of (a) 135% of the VWAP on the Trading Day immediately prior to the Pre-Advance Date with respect to such Pre-Paid Advance, or (b) 95%

the lowest VWAP during the 3 consecutive Trading Days immediately prior to the Investor Notice Date; however, in no event shall the Investor

Purchase Price be less than the Floor Price. The number of shares issuable to Yorkville under any individual Investor Notice or aggregate

Investor Notices shall be limited by the same limitations set forth in the SEPA, as amended.

Interest accrues on the outstanding

balance of each of the Pre-Paid Advances at an annual rate of 10%, subject to an increase to 15% upon events of default described in

the Supplemental Agreement. We will be required to pay to the Investor an amount in cash representing any amount of a Pre-Paid Advance

that remains outstanding, plus any accrued and unpaid interest thereon, on the date that is 12 months following the Pre-Advance Date

of each Pre-Paid Advance, unless otherwise agreed by the parties. Furthermore, upon the occurrence of certain events, we may be required

to make monthly repayments of amounts outstanding under a Pre-Paid Advance, each monthly repayment to be in an amount equal to the sum

of (x) $3.0 million, (y) the Payment Premium in respect of such amount, and (z) all outstanding accrued and unpaid interest in respect

of such Pre-Paid Advance as of each payment date.

Delivery of the shares against

payment therefor in respect of each Advance Notice shall be settled promptly following each sale pursuant to the SEPA. In connection with

any Advance Notice, if any portion of an advance would cause Yorkville’s beneficial ownership of our then outstanding common stock

to exceed 4.99%, then such portion shall automatically be deemed to be withdrawn by us (with no further action required by us) and modified

to reduce the amount of the advance requested by an amount equal to such withdrawn portion. We may terminate the SEPA upon five trading

days of prior notice to Yorkville, provided that there are no Advance Notices outstanding and we have paid to Yorkville all amounts then

due.

In addition to the issuance

of our common stock to Yorkville pursuant to the SEPA, the Prospectus Supplement, as amended by this Amendment, also covers the resale

of those shares from time to time by Yorkville to the public. Though we have been advised by Yorkville, and Yorkville represents in the

SEPA, that Yorkville is purchasing the shares for its own account, for investment purposes in which it takes investment risk (including,

without limitation, the risk of loss), and without any view or intention to distribute such shares in violation of the Securities Act

or any other applicable securities laws, the SEC may take the position that Yorkville may be deemed an “underwriter” within

the meaning of Section 2(a)(11) of the Securities Act. We have agreed in the SEPA to provide customary indemnification to Yorkville. It

is possible that our shares may be sold by Yorkville in one or more of the following manners:

| |

● |

ordinary brokerage transactions and transactions in which the broker solicits purchasers; |

| |

● |

a block trade in which the broker or dealer so engaged will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

● |

to a broker-dealer as principal and resale by the broker-dealer for its account; or |

| |

● |

a combination of any such methods of sale. |

Yorkville has agreed that,

during the term of the SEPA, neither Yorkville nor its affiliates will engage in any short sales or hedging transactions with respect

to our common stock, provided that upon receipt of an Advance Notice Yorkville may sell shares that it is obligated to purchase under

such Advance Notice prior to taking possession of such shares.

Yorkville may be subject

to liability under the federal securities laws and must comply with the requirements of the Exchange Act, including without limitation,

Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of our common

stock by Yorkville. Under these rules and regulations, Yorkville:

| |

● |

may not engage in any stabilization activity in connection with our securities; |

| |

● |

must furnish each broker which offers shares of our common stock covered by the prospectus supplement and accompanying prospectus that are a part of our registration statement with the number of copies of such prospectus supplement and accompanying prospectus which are required by each broker; and |

| |

● |

may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange Act. |

These restrictions may affect

the marketability of the shares by Yorkville.

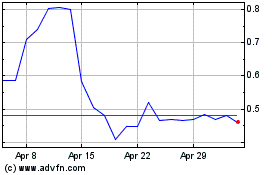

KULR Technology (AMEX:KULR)

Historical Stock Chart

From May 2024 to Jun 2024

KULR Technology (AMEX:KULR)

Historical Stock Chart

From Jun 2023 to Jun 2024