false

0001011509

0001011509

2024-07-29

2024-07-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

Current Report

Pursuant to

Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 29, 2024

GOLDEN MINERALS COMPANY

(Exact name of registrant as specified in its

charter)

| delaware |

1-13627 |

26-4413382 |

(State or other jurisdiction of

incorporation or

organization) |

(Commission

File Number) |

(I.R.S. Employer

Identification Number) |

350 Indiana Street, Suite 650

Golden,

Colorado 80401

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including

area code: (303) 839-5060

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to

Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

|

AUMN |

|

NYSE American |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. | Results of Operations and Financial Condition. |

On August 1, 2024, Golden

Minerals Company (the “Company”) issued a press release announcing certain financial results for the quarter ended June 30,

2024 and provided a corporate update. The full text of the press release issued in connection with the announcement is attached as Exhibit 99.1

to this Current Report on Form 8-K and is incorporated herein by reference.

The information in Item 2.02, including the information set forth in Exhibit 99.1, is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall such information

be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be

expressly set forth by specific reference in such a filing.

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

Departure of Senior Vice President and Chief

Financial Officer

On July 29, 2024, Julie

Weedman notified the Company that she would be retiring and resigning from her roles as Senior Vice President and Chief Financial Officer

of the Company, effective on August 15, 2024. In connection with her retirement, Ms. Weedman and the Company expect to enter

into a consulting agreement (the “Consulting Agreement”), pursuant to which Ms. Weedman would provide consulting services

for a limited period of time following her retirement. Ms. Weedman will be entitled to receive 18,000 shares of Company stock following

her retirement in accordance with applicable Company plans and programs. Ms. Weedman will remain subject to the confidentiality obligations

set forth in the applicable existing agreements and other policies, and any similar obligations as may be set forth in the Consulting

Agreement.

Appointment of Chief Financial Officer

On July 31, 2024, the Board of Directors of the Company appointed Joe Dwyer, the current Corporate Controller of the Company, as the Chief

Financial Officer of the Company, effective as of August 15, 2024.

Mr. Dwyer, 55, has a

diverse work experience spanning over two decades. Mr. Dwyer has served as the Company’s Corporate Controller since 2022. Prior

to that, Mr. Dwyer worked as a Consultant at Bridgepoint Consulting in 2022. From 2020 to 2022, he held the role of Controller at

Kärcher North America Inc. From 2016 to 2019, he served as the Director of Business Operations at Westmoreland Coal Company. From

2014 to 2016, he was a Senior Manager of Financial Process & Controls at Cloud Peak Energy. From 2012 to 2014, he worked as a

Senior Manager of Internal Audit & SOX Compliance at Dish Network. From 2009 to 2011, he worked as a Senior Project Manager at

ACME Business Consulting. From 2005 to 2009, he worked as the SVP/Manager of Internal Audit & SOX Compliance at Umpqua Bank.

From 2003 to 2005, he worked as a Consultant at Resources Global Professionals. From 2000 to 2003, he served as a Manager at Deloitte.

Mr. Dwyer earned his Bachelor’s degree from the University of Nevada, Las Vegas.

The Company has not yet entered

into an employment agreement or determined adjustments to Mr. Dwyer’s compensation in connection with his appointment at this

time. The Company intends to promptly begin negotiations with Mr. Dwyer with respect to his employment as Chief Financial Officer

and will file an amendment to this Current Report on Form 8-K disclosing any material compensation adjustments made in connection

with this appointment when determined.

There are no arrangements

or understandings between Mr. Dwyer and any other persons pursuant to which Mr. Dwyer is to be appointed the Company’s

Chief Financial Officer. Mr. Dwyer does not have any family relationship with any of the Company’s directors or executive officers

or any persons nominated or chosen by the Company to be a director or executive officer. Mr. Dwyer has no direct or indirect material

interest in any transaction or proposed transaction required to be reported under Section 404(a) of Regulation S-K.

The information in this Form 8-K

contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended, and applicable Canadian securities legislation, including the expectation to enter

in the Consulting Agreement and negotiations regarding the employment agreement and adjustments to compensation in connection with the

new officer appointment. These statements are subject to a number of known and unknown risks and uncertainties that could cause actual

results, conditions and events to differ materially from those anticipated. The Company assumes no obligation to update this information.

Additional risks relating to the Company may be found in the periodic and current reports filed with the SEC by the Company, including

the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Date: August 2, 2024

| |

Golden Minerals Company |

| |

|

| |

By: |

/s/ Julie Z. Weedman |

| |

|

Name: Julie Z. Weedman |

| |

|

Title: Senior Vice President and Chief Financial Officer |

Exhibit 99.1

Golden Minerals Provides Corporate Update

GOLDEN, CO - /BUSINESS WIRE/ - August 1,

2024 – Golden Minerals Company (“Golden Minerals,” “Golden” or the “Company”) (NYSE-A: AUMN

and TSX: AUMN) today provided a corporate update.

As previously disclosed, the Company does not

have sufficient resources to meet its expected cash needs over the next twelve months. As of June 30, 2024, the Company had cash

and cash equivalents of approximately $1.4 million. On the same date, it had accounts payable and other current liabilities of approximately

$4.8 million. Because the Company has ceased mining at the Velardeña mine, its only near-term opportunity to generate cash flow

is from the sale of assets or from new sources of debt or equity capital. The Company is evaluating alternatives to obtain sufficient

funds to continue as a going concern, including finalizing the sale of its Velardeña assets, seeking buyers or partners for the

Company’s other assets (including El Quevar) or obtaining equity or other financing. In the absence of additional cash inflows,

the Company anticipates that its cash resources will be exhausted by September 2024. If the Company is unable to obtain additional

resources, it may be forced to cease operations and liquidate.

The Company is taking actions to address its liquidity

and financial stability through the sale of assets or raising new capital. As part of this effort, the Company is considering the sale

of the Company or its assets, including the El Quevar project in Argentina and the Yoquivo project in Mexico. The proceeds from these

sales would be directed toward addressing the Company’s ongoing operating expenses and satisfying its liabilities, while seeking

to maximize any remaining value for its shareholders.

The Company announced in May 2024 that it

had entered into a series of purchase and sale agreements whereby the Company would sell certain assets at its Velardeña Properties

(located in Durango State, Mexico) to a privately held Mexican company (“the Buyer”) for US$5.5 million plus Value Added Tax

(“VAT”). To date, the Company has received $2.5 million plus VAT in conjunction with the sale of the Velardeña Mine,

the sulfide processing plant, and associated facilities, and title has been transferred to the buyer. There continues to be a delay in

closing the agreement related to the sale of Velardeña’s oxide processing plant and water wells. The Buyer has operational

access to the plant. To date, the Company has received partial payments in the amount of $373,000 for these assets. The remaining $2,627,000,

plus VAT, was due on July 1. The Company is uncertain as to when or if the payment will be received. The Company is working to sign

an extension of the sale agreement with the Buyer.

Forward-Looking Statements

This press release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, and applicable Canadian securities legislation, including statements regarding the Buyer’s scheduled payments

to the Company pursuant to the Agreements. These statements are subject to risks and uncertainties including the Buyer’s ability

to make the payments under the sale agreements; the ability of the Company to sell or realize value from its other assets, increases in

costs and declines in general economic conditions; changes in political conditions, in tax, royalty, environmental and other laws in the

United States, Mexico or Argentina and other market conditions; and fluctuations in silver and gold prices. Golden Minerals assumes no

obligation to update this information. Additional risks relating to Golden Minerals may be found in the periodic and current reports filed

with the Securities & Exchange Commission by Golden Minerals, including the Company’s Annual Report on Form 10-K for

the year ended December 31, 2023.

For additional information, please visit http://www.goldenminerals.com/

or contact:

Golden Minerals Company

(303) 839-5060

SOURCE: Golden Minerals Company

Page 1 of 1

GOLDEN MINERALS COMPANY

350 Indiana Street – Suite 650 –

Golden, Colorado 80401 – Telephone (303) 839-5060

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

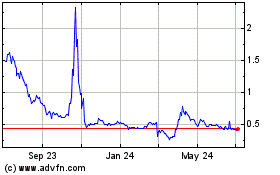

Golden Minerals (AMEX:AUMN)

Historical Stock Chart

From Jul 2024 to Aug 2024

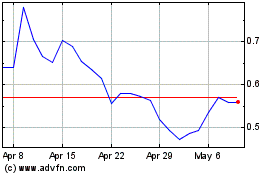

Golden Minerals (AMEX:AUMN)

Historical Stock Chart

From Aug 2023 to Aug 2024