Franklin Street Properties Corp. Appoints Bruce J. Schanzer to Board of Directors and Enters into Cooperation Agreement with Converium Capital Inc. and Erez Asset Management LLC

November 27 2024 - 4:29PM

Business Wire

Franklin Street Properties Corp. (the “Company” or “FSP”) (NYSE

American: FSP), a real estate investment trust (REIT), announced

today that Bruce J. Schanzer will join the Company’s Board of

Directors (the “Board”), effective November 27, 2024. In addition,

effective November 27, 2024, the Board will appoint Mr. Schanzer to

serve as a member of the Audit Committee. With the addition of Mr.

Schanzer to the Board, effective November 27, 2024, the Board will

be comprised of eight directors, seven of whom are independent.

George J. Carter, Chairman and Chief Executive Officer,

commented, “We welcome Bruce to the Board and appreciate the

collaborative engagement we have had with Converium Capital and

Erez Asset Management, both of which are significant FSP

shareholders. Bruce has a long REIT and investment banking

pedigree. This appointment is another step in refreshing our Board

to ensure that we have diverse perspectives and skills to guide

FSP’s future success for the benefit of all stakeholders.”

“We appreciate our constructive engagement with the FSP Board

and its management team,” said Michael Rapps, Managing Partner,

Converium Capital. “With the addition of Bruce, we believe that the

Board is well positioned to help FSP maximize value for all

stakeholders.”

In connection with these changes to the Board, the Company has

entered into a Cooperation Agreement with Converium Capital and

Erez Asset Management, pursuant to which Converium Capital and Erez

Asset Management will vote their shares in favor of all of the

Board’s director nominees at the 2025 Annual Meeting of

Stockholders. Under the Cooperation Agreement, Converium Capital

and Erez Asset Management have agreed to customary standstill,

voting and other provisions. The full agreement among FSP,

Converium Capital and Erez Asset Management will be filed on Form

8-K with the U.S. Securities and Exchange Commission (the

“SEC”).

About Bruce J. Schanzer

Mr. Schanzer is Chairman and Chief Investment Officer of Erez

Asset Management, a fund manager focused on investment

opportunities in small market cap REITs. Prior to forming Erez

Asset Management in August 2022, Mr. Schanzer was President, Chief

Executive Officer and a director of Cedar Realty Trust (NYSE: CDR),

a real estate investment trust focused on the ownership, operation

and redevelopment of shopping centers in the Washington, D.C. to

Boston corridor, from June 2011 to August 2022. Before joining

Cedar in 2011, he was a managing director in the real estate

investment banking group at Goldman Sachs & Co and prior

thereto a vice president at Merrill Lynch. Before working on Wall

Street, Bruce worked as a real estate attorney in New York. He

received an M.B.A. in finance and accounting from the University of

Chicago (now known as the Booth School of Business); a J.D. from

Benjamin N. Cardozo School of Law, where he served as a member of

the Law Review; and a B.A. from Yeshiva College, where he is

currently a member of the board of trustees of Sym Schools of

Business. He is also presently a member of the board of trustees of

SAR Academy in Riverdale, NY and the board of advisors of New York

Medical College. Mr. Schanzer previously served as a member of the

board of governors of the National Association of Real Estate

Investment Trusts.

This press release, along with other news about FSP, is

available on the Internet at www.fspreit.com. We routinely post

information that may be important to investors in the Investor

Relations section of our website. We encourage investors to consult

that section of our website regularly for important information

about us and, if they are interested in automatically receiving

news and information as soon as it is posted, to sign up for E-mail

Alerts.

About Franklin Street Properties Corp.

Franklin Street Properties Corp., based in Wakefield,

Massachusetts, is focused on infill and central business district

(CBD) office properties in the U.S. Sunbelt and Mountain West, as

well as select opportunistic markets. FSP seeks value-oriented

investments with an eye towards long-term growth and appreciation,

as well as current income. FSP is a Maryland corporation that

operates in a manner intended to qualify as a real estate

investment trust (REIT) for federal income tax purposes. To learn

more about FSP please visit our website at www.fspreit.com.

Forward Looking Statements

Statements made in this press release that state FSP’s or

management’s intentions, beliefs, expectations, or predictions for

the future may be forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. This press

release may also contain forward-looking statements, such as those

relating to the potential or intended benefits of FSP’s board

structure and related contributions by its directors and FSP’s

future success, which are subject to certain risks, trends and

uncertainties that could cause actual results to differ materially

from those indicated in such forward-looking statements.

Accordingly, readers are cautioned not to place undue reliance on

forward-looking statements. Investors are cautioned that our

forward-looking statements involve risks and uncertainty, including

without limitation, adverse changes in general economic or local

market conditions, including as a result of the long-term effects

of the COVID-19 pandemic, wars, terrorist attacks or other acts of

violence, which may negatively affect the markets in which we and

our tenants operate, inflation rates, interest rates, disruptions

in the debt markets, economic conditions in the markets in which we

own properties, risks of a lessening of demand for the types of

real estate owned by us, adverse changes in energy prices, which if

sustained, could negatively impact occupancy and rental rates in

the markets in which we own properties, including energy-influenced

markets such as Dallas, Denver and Houston, changes in government

regulations and regulatory uncertainty, uncertainty about

governmental fiscal policy, geopolitical events and expenditures

that cannot be anticipated, such as utility rate and usage

increases, delays in construction schedules, unanticipated

increases in construction costs, increases in the level of general

and administrative costs as a percentage of revenues as revenues

decrease as a result of property dispositions, unanticipated

repairs, additional staffing, insurance increases and real estate

tax valuation reassessments. See the “Risk Factors” set forth in

Part I, Item 1A of our Annual Report on Form 10-K for the year

ended December 31, 2023, which may be updated from time to time in

subsequent filings with the United States Securities and Exchange

Commission. Although we believe the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, acquisitions, dispositions,

performance or achievements. We will not update any of the

forward-looking statements after the date of this press release to

conform them to actual results or to changes in our expectations

that occur after such date, other than as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241127366308/en/

For Franklin Street Properties Corp. Georgia Touma,

877-686-9496

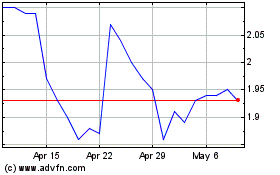

Franklin Street Properties (AMEX:FSP)

Historical Stock Chart

From Nov 2024 to Dec 2024

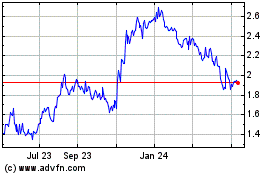

Franklin Street Properties (AMEX:FSP)

Historical Stock Chart

From Dec 2023 to Dec 2024