0001063259false--12-31FY2021falsetruefalse00010632592021-01-012021-12-3100010632592021-12-31iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 40-F

(Check One)

☐ | Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934 |

☒ | Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended: December 31, 2021 | | Commission file number: 001-33414 |

DENISON MINES CORP. |

(Exact name of registrant as specified in its charter) |

Ontario, Canada

(Province or other jurisdiction of incorporation or organization)

1090

(Primary standard industrial classification code number)

98-0622284

(I.R.S. employer identification number)

1100 – 40 University Avenue, Toronto, Ontario M5J 1T1 Canada; Phone number: 416-979-1991

(Address and telephone number of registrant’s principal executive offices)

C T Corporation System

28 Liberty Street

New York, NY 10005

Phone number: 212-894-8940

(Name, address and telephone number of agent for service in the United States)

Securities registered pursuant to Section 12(b) of the Act: Not applicable.

Securities registered pursuant to Section 12(g) of the Act: Common shares without par value.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: Not applicable.

For annual reports, indicate by check mark the information filed with this form:

☒ Annual Information Form | ☒ Audited Annual Financial Statements |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 812,429,995 Common Shares as of December 31, 2021.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13(d) or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant has been required to file such reports); and (2) has been subject to such filing requirements in the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

EXPLANATORY NOTE

Denison Mines Corp. (the “Company” or the “Registrant”) is an Ontario corporation eligible to file its Annual Report pursuant to Section 13(a) of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), on Form 40-F. The Registrant is a “foreign private issuer” as defined in Rule 3b-4 under the Exchange Act. Equity securities of the Registrant are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3 thereunder.

DOCUMENTS FILED PURSUANT TO GENERAL INSTRUCTIONS

In accordance with General Instruction B.(3) of Form 40-F, the Registrant hereby incorporates by reference Exhibits 99.1 through 99.3 as set forth in the Exhibit Index attached hereto, which are deemed filed herewith.

In accordance with General Instruction D.(9) of Form 40-F, the Company has filed written consents of certain experts named in the foregoing Exhibits as Exhibits 99.4 and 99.7 through 99.15, as set forth in the Exhibit Index attached hereto.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain of the information contained in this Annual Report on Form 40-F, including the documents incorporated herein by reference, may contain “forward-looking information”. Forward-looking information and statements may include, among others, statements regarding the future plans, costs, objectives or performance of the Company, or the assumptions underlying any of the foregoing. In this Annual Report on Form 40-F, words such as “may”, “would”, “could”, “will”, “likely”, “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate” and similar words and the negative form thereof are used to identify forward-looking statements. Forward-looking statements should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether, or the times at or by which, such future performance will be achieved. Forward-looking statements and information are based on information available at the time and/or management’s good-faith belief with respect to future events and are subject to known or unknown risks, uncertainties and other unpredictable factors, many of which are beyond the Company’s control. These risks, uncertainties and assumptions include, but are not limited to, those described under the section “Risk Factors” in the Company’s Annual Information Form for the fiscal year ended December 31, 2021 (the “AIF”), which is filed as Exhibit 99.1 to this Annual Report on Form 40-F, and could cause actual events or results to differ materially from those projected in any forward-looking statements.

The Company’s forward-looking statements contained in the exhibits incorporated by reference into this Annual Report on Form 40-F are made as of the respective dates set forth in such exhibits. In preparing this Annual Report on Form 40-F, the Company has not updated such forward-looking statements to reflect any subsequent information, events or circumstances or otherwise, or any change in management’s beliefs, expectations or opinions that may have occurred prior to the date hereof, nor does the Company assume any obligation to update such forward-looking statements in the future, except as required by applicable laws.

NOTE TO UNITED STATES READERS – DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

The Registrant is permitted, under a multijurisdictional disclosure system adopted by the United States, to prepare this Annual Report on Form 40-F in accordance with Canadian disclosure requirements, which are different from those of the United States.

The Registrant prepares its consolidated financial statements, which are filed with this Annual Report on Form 40-F, in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board (“IFRS”). IFRS differs in some significant respects from United States generally accepted accounting principles (“U.S. GAAP”), and thus the Registrant’s financial statements may not be comparable to the financial statements of United States companies. These differences between IFRS and U.S. GAAP might be material to the financial information presented in this Annual Report on Form 40-F. In addition, differences may arise in subsequent periods related to changes in IFRS or U.S. GAAP or due to new transactions that the Registrant enters into. The Registrant is not required to prepare a reconciliation of its consolidated financial statements and related footnote disclosures between IFRS and U.S. GAAP and has not quantified such differences.

RESOURCE AND RESERVE ESTIMATES

The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves (“CIM Standards”), adopted by the CIM Council, as amended.

Until recently, the CIM Standards differed significantly from standards in the United States. The U.S. Securities and Exchange Commission (the “SEC” or the “Commission”) adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the Exchange Act. These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical disclosure requirements for mining registrants that were included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the corresponding definitions under the CIM Standards, as required under NI 43-101.

United States investors are cautioned that while the above terms are “substantially similar” to the corresponding CIM Definition Standards, there are differences in the definitions under the SEC Modernization Rules and the CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules.

United States investors are also cautioned that while the SEC now recognizes “indicated mineral resources” and “inferred mineral resources”, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any “indicated mineral resources” or “inferred mineral resources” that the Company reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are also cautioned not to assume that all or any part of the “inferred mineral resources” exist. In accordance with Canadian securities laws, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

Accordingly, information contained in this Annual Report on Form 40-F and the documents incorporated by reference herein containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

CURRENCY

Unless otherwise indicated, all dollar amounts in this Annual Report on Form 40-F are in Canadian dollars. The daily exchange rate published by the Bank of Canada for the exchange of Canadian dollars into United States dollars on December 31, 2021, the last business day of calendar 2021, was CDN$1.00 = U.S.$0.7888.

TAX MATTERS

Purchasing, holding, or disposing of securities of the Registrant may have tax consequences under the laws of the United States and Canada that are not described in this Annual Report on Form 40-F.

CONTROLS AND PROCEDURES

A. Certifications

The required certifications are included in Exhibits 99.5 and 99.6 of this Annual Report on Form 40-F.

B. Disclosure Controls and Procedures

The Company maintains disclosure controls and procedures to ensure that information required to be disclosed in the Company’s filings under the Exchange Act, is recorded, processed, summarized and reported in accordance with the requirements specified in the rules and forms of the SEC. The Company carried out an evaluation, under the supervision and with the participation of its management, including the Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of the Company’s “disclosure controls and procedures” (as defined in Rule 13a-15(e) or Rule 15d-15(e) under the Exchange Act) as of the end of the period covered by this Annual Report on Form 40-F. Based upon that evaluation, the Chief Executive Officer and Chief Financial Officer concluded that the Company’s disclosure controls and procedures as of December 31, 2021 are effective to ensure that information required to be disclosed by the Registrant in reports it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms and is accumulated and communicated to the Registrant’s management, including its Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

The Company’s disclosure controls and procedures are designed to provide reasonable assurance of achieving their objectives and, as indicated in the preceding paragraph, the Chief Executive Officer and Chief Financial Officer believe that the Company’s disclosure controls and procedures are effective at that reasonable assurance level, although the Chief Executive Officer and Chief Financial Officer do not expect that the disclosure controls and procedures will prevent or detect all errors and all fraud.

It should be noted that a control system, no matter how well conceived or operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. The Company will continue to periodically review its disclosure controls and procedures and may make such modifications from time to time as it considers necessary.

C. Management’s Annual Report on Internal Control Over Financial Reporting

The Company’s management is responsible for establishing and maintaining adequate internal control over the Company’s financial reporting (as defined in Rules 13a-15(f) or 15d-15(f) under the Exchange Act). Internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of the Company’s financial reporting and the preparation of financial statements for external purposes in accordance with IFRS.

A company’s internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Management conducted an assessment of the Company’s internal control over financial reporting based on the framework established by the Committee of Sponsoring Organizations of the Treadway Commission on Internal Control — Integrated Framework (2013). Based on this assessment, management concluded that, as of December 31, 2021, the Company’s internal control over financial reporting is effective.

It should be noted that a control system, no matter how well conceived or operated, can only provide reasonable, not absolute, assurance that the objectives of the control system are met. The Company will continue to periodically review its internal control over financial reporting and may make such modifications from time to time as it considers necessary.

D. Attestation Report of the Independent Registered Public Accounting Firm

The effectiveness of the Registrant’s internal control over financial reporting as of December 31, 2021 has been audited by KPMG LLP, an Independent Registered Public Accounting Firm, as stated in their report included with the Registrant’s Audited Financial Statements, which are an exhibit to this Annual Report on Form 40-F.

E. Changes in Internal Control Over Financial Reporting

There was no change in the Company’s internal control over financial reporting that occurred during the twelve month period covered by this Annual Report on Form 40-F that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting.

NOTICES PURSUANT TO REGULATION BTR

There were no notices required by Rule 104 of Regulation BTR during the fiscal year ended December 31, 2021, concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

CORPORATE GOVERNANCE

The Company is listed on the Toronto Stock Exchange (the “TSX”) and is required to describe its practices and policies with regard to corporate governance with specific reference to the corporate governance guidelines of the Canadian Securities Administrators on an annual basis by way of a corporate governance statement contained in the Company’s Annual Information Form or Information Circular. The Company is also listed on the NYSE American LLC (the “NYSE American”) and additionally complies as necessary with the rules and guidelines of the NYSE American as well as the SEC. The Company reviews its governance practices on an ongoing basis to ensure it is in compliance with the applicable laws, rules and guidelines both in Canada and in the United States.

The Company’s Board of Directors (the “Board”) is responsible for the Company’s corporate governance policies and has separately designated a standing Corporate Governance and Nominating Committee. The Board has determined that the members of the Corporate Governance and Nominating Committee are independent, based on the criteria for independence and unrelatedness prescribed by the Sarbanes-Oxley Act of 2002, Section 10A(m)(3), and the NYSE American. Corporate governance relates to the activities of the Board, the members of which are elected by and are accountable to the shareholders, and takes into account the role of the senior officers who are appointed by the Board and who are charged with the day to day administration of the Company. The Board is committed to sound corporate governance practices that are both in the interest of its shareholders and contribute to effective and efficient decision making.

BENEFIT PLAN BLACKOUT PERIODS

Not applicable.

AUDIT COMMITTEE FINANCIAL EXPERT

The Company’s Board of Directors has determined that Ms. Patricia Volker, Chair of the Audit Committee, is an audit committee financial expert within the meaning of paragraph 8(b) of General Instruction B of Form 40-F, and that all three members of the Audit Committee (Ms. Patricia Volker, Mr. Brian Edgar and Mr. David Neuburger) are independent within the meaning of United States and Canadian securities regulations and applicable stock exchange requirements. A description of the education and experience of these persons is set forth in the table below:

Member Name | | Education & experience relevant to performance of audit committee duties |

Patricia Volker, Chair of the Audit Committee | | ● | | Chartered Professional Accountant, Chartered Accountant, Certified Management Accountant |

| ● | | Over 17 years of service at the Chartered Professional Accountants of Ontario, the self-regulating body for Ontario’s CPAs |

| ● | | Has served and chaired audit committees of a number of companies |

| | | | |

Brian Edgar | | ● | | Law degree, with extensive corporate finance experience |

| | |

| | ● | | Held positions in a public company of Chairman since 2011 and President and Chief Executive Officer from 2005 to 2011. |

| | |

| | ● | | Has served on audit committees of a number of public companies |

| | |

David Neuburger | | ● | | Completed Financial Accounting and Managerial Accounting courses as part of a Masters of Business Administration (MBA) Program |

| | |

| | ● | | Disclosure Committee experience with Cameco Corporation, including review of quarterly and annual financial statements and management’s discussion & analysis |

| | |

| | ● | | Has served on another public company audit committee |

Through such education and experience, each of these three members has experience overseeing and assessing the performance of companies and public accountants with respect to the preparation, auditing and evaluation of financial statements, and has: (1) an understanding of generally accepted accounting principles and financial statements; (2) the ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves; (3) experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the Company’s financial statements; (4) an understanding of internal control over financial reporting; and (5) an understanding of audit committee functions.

The SEC has provided that the designation of an audit committee financial expert does not make him or her an “expert” for any purpose, impose on him or her any duties, obligations or liability that are greater than the duties, obligations or liability imposed on him or her as a member of the Audit Committee and the Board in the absence of such designation, or affect the duties, obligations or liability of any other member of the Audit Committee or Board.

CODE OF ETHICS

The Company has adopted a code of ethics that applies to the Company’s directors, officers and employees, including the Chief Executive Officer, the Chief Financial Officer, the principal accounting officer or controller, persons performing similar functions and other officers, directors and employees of the Company. A current copy of the code of ethics is on the Company’s website at www.denisonmines.com. In the fiscal year ended December 31, 2021, the Company has not made any amendment to a provision of its code of ethics that applies to any of its Chief Executive Officer, Chief Financial Officer, principal accounting officer or controller or persons performing similar functions that relates to one or more of the items set forth in paragraph (9)(b) of General Instruction B to Form 40-F. In the fiscal year ended December 31, 2021, the Company has not granted a waiver (including an implicit waiver) from a provision of its code of ethics to any of its Chief Executive Officer, Chief Financial Officer, principal accounting officer or controller or persons performing similar functions that relates to one or more of the items set forth in paragraph (9)(b) of General Instruction B to Form 40-F.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

Our independent registered public accounting firm is KPMG LLP, Toronto, ON, Canada, Auditor Firm ID: 85.

The following table discloses the fees billed to the Company by its external auditor during the last two financial years ended December 31, 2021 and 2020. Services were billed and paid in Canadian dollars and the table below reflects amounts in Canadian dollars.

Periods Ending (1) | | Audit Fees(2) | | | Audit Related Fees(3) | | | Tax Fees(4) | | | All Other Fees(5) | |

December 31, 2021 | | $ | 475,700 | | | $ | 27,820 | | | $ | 28,747 | | | $ | 0 | |

December 31, 2020(6) | | $ | 416,654 | | | $ | 27,300 | | | $ | 24,015 | | | $ | 0 | |

Notes:

(1) | These amounts include accruals for fees billed outside the period to which the services related. |

(2) | The aggregate fees billed for audit services of the Company’s consolidated financial statements, including services normally provided by an auditor for statutory or regulatory filings or engagements and other services only the auditor can reasonably provide. The Audit Fees in 2020 and 2021 include fees related to reviews of interim consolidated financial statements (2021: $80,250; 2020: $83,817) and the extensive work required of the auditors to support, and conduct consent procedures in connection with, the Company’s various equity issuances (2021: $181,900; 2020: $160,000). |

(3) | The aggregate fees billed for specified audit procedures, assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not disclosed in the Audit Fees column. Audit-related fees in 2020 and 2021 were billed for certain specified procedures engagements and the audit of certain subsidiary financial statements. |

(4) | The aggregate fees billed for tax compliance, tax advice, and tax planning services, such as transfer pricing and tax return preparation. |

(5) | The aggregate fees billed for professional services other than those listed in the other three columns. |

(6) | Fees in 2020 have been re-classified from prior years, to present consistently as described in Notes 1, 2 and 3, above. Fees in 2020 include $167,904 of audit fees and $27,300 of audit-related fees for professional services billed by the Company’s former auditor, PricewaterhouseCoopers LLP. |

The Company’s Audit Committee mandate and charter provides that the Audit Committee shall (i) approve, prior to the auditor’s audit, the auditor’s audit plan (including, without limitation, staffing), the scope of the auditor’s review and all related fees, and (ii) pre-approve any non-audit services (including, without limitation, fees therefor) provided to the Company or its subsidiaries by the auditor or any auditor of any such subsidiary and shall consider whether these services are compatible with the auditor’s independence, including, without limitation, the nature and scope of the specific non-audit services to be performed and whether the audit process would require the auditor to review any advice rendered by the auditor in connection with the provision of non-audit services.

The following sets forth the percentage of services described above that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X:

| | 2021 | | | 2020 | |

Audit Related Fees: | | | 100 | % | | | 100 | % |

Tax Fees: | | | 100 | % | | | 100 | % |

All Other Fees: | | | 100 | % | | | 100 | % |

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

At December 31, 2021, the Company had an estimated aggregate reclamation liability of $37,532,000, which is the present value amount that is expected to be sufficient to cover the projected future costs for reclamation of the Company’s mill and mine operations. This estimated aggregate reclamation liability consists of $20,877,000 for Elliot Lake obligations, $15,405,000 for the McClean Lake and Midwest joint venture obligations and $1,245,000 for other obligations. The Company maintains a trust fund equal to the estimated reclamation spending for the succeeding six calendar years, less interest expected to accrue on the funds, in respect of its liability for Elliot Lake. At December 31, 2021, the balance in the trust fund was $2,886,000. In addition, as at December 31, 2021, the Company has pledged as collateral $9,135,000 of cash to support its standby letters of credit from the Bank of Nova Scotia for the McClean and Midwest reclamation obligations.

See other information in the section entitled “Contractual Obligations and Contingencies” in the Company’s Management’s Discussion and Analysis of Results of Operations and Financial Condition for the Year ended December 31, 2021, incorporated by reference as Exhibit 99.2 hereof.

IDENTIFICATION OF THE AUDIT COMMITTEE

The Company has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The committee members are Ms. Patricia Volker (Chair), Mr. Brian Edgar and Mr. David Neuburger. For further information on these members, see “Audit Committee Financial Expert” above.

INTERACTIVE DATA FILE

An interactive data file has been filed herewith, with the Consolidated Audited Financial Statements for the Years Ended December 31, 2021 and 2020.

NYSE AMERICAN CORPORATE GOVERNANCE

The Company’s common shares are listed on the NYSE American. Section 110 of the NYSE American Company Guide permits the NYSE American to consider the laws, customs and practices of foreign issuers in relaxing certain NYSE American listing criteria, and to grant exemptions from the NYSE American listing criteria based on these considerations. An issuer seeking relief under these provisions is required to provide written certification from independent local counsel that the non-complying practice is not prohibited by home country law. A description of the significant ways in which the Company’s governance practices differ from those followed by domestic companies pursuant to the NYSE American standards is as follows:

Board Composition: The NYSE American requires that a listed company have a Board of Directors consisting of at least a majority of members who satisfy applicable independence standards under Section 803 of the NYSE American Company Guide (the “NYSE American Independence Standard”). The Company’s Board is currently composed of nine members, seven of whom qualify as independent under the NYSE American Company Guide and who meet the NYSE American Independence Standard, namely Messrs. Dengler, Edgar, Hochstein and Neuburger and Mses. Sterritt, Traub and Volker. The Company’s remaining two directors do not satisfy the NYSE American Independence Standard, being Messrs. Cates and Jeong.

Shareholder Meeting Quorum Requirement: The NYSE American minimum quorum requirement for a shareholder meeting is one-third of the shares issued and outstanding and entitled to vote for a meeting of a listed company’s shareholders. The TSX does not specify a quorum requirement for a meeting of a listed company’s shareholders. The Company’s current required quorum at any meeting of shareholders as set forth in the Company’s by-laws is two persons present, each being a shareholder entitled to vote at the meeting or a duly appointed proxyholder for an absent shareholder so entitled, holding or representing in aggregate not less than 10% of the shares of the Company entitled to be voted at the meeting. The Company’s current quorum requirement is not prohibited by, and does not constitute a breach of, the Business Corporations Act (Ontario) (the “OBCA”), applicable Canadian securities laws or the rules and policies of the TSX.

Proxy Solicitation Requirement: The NYSE American requires the solicitation of proxies and delivery of proxy statements for all shareholder meetings of a listed company, and requires that these proxies be solicited pursuant to a proxy statement that conforms to the proxy rules of the U.S. Securities and Exchange Commission. The Company is a foreign private issuer as defined in Rule 3b-4 under the Exchange Act, and the equity securities of the Company are accordingly exempt from the proxy rules set forth in Sections 14(a), 14(b), 14(c) and 14(f) of the Exchange Act. The Company solicits proxies in accordance with the OBCA, applicable Canadian securities laws and the rules and policies of the TSX.

Shareholder Approval Requirements: The NYSE American requires a listed company to obtain the approval of its shareholders for certain types of securities issuances. One is the sale of common shares (or securities convertible into common shares) at a discount to officers or directors. The TSX rules require shareholder approval for the issuance of shares to insiders in private placements where insiders are being issued more than 10% of the presently issued and outstanding shares. The NYSE American also requires shareholder approval of private placements that may result in the issuance of common shares (or securities convertible into common shares) equal to 20% or more of presently outstanding shares for less than the greater of book or market value of the shares. There is no such requirement under Ontario law. The TSX rules require shareholder approval for private placements that materially affect control, or where more than 25% of presently issued and outstanding shares will be issued at a discount to market. The Company will seek a waiver from the NYSE American shareholder approval requirement should a dilutive securities issuance trigger such NYSE American shareholder approval requirement in circumstances where such securities issuance does not trigger a shareholder approval requirement under the rules of the TSX.

Compensation Committee Requirements: The NYSE American Company Guide requires that additional independence criteria be applied to each member of the Compensation Committee. The NYSE American Company Guide also mandates that the Compensation Committee must have the authority to hire compensation consultants, independent legal counsel and other compensation advisors and exercise the sole responsibility to oversee the work of any compensation advisors retained to advise the Compensation Committee. In addition, before engaging a compensation advisor, the Compensation Committee must consider at least six factors that could potentially impact compensation advisor independence. The Company follows Canadian Securities Administrators and TSX requirements for Compensation Committee charters, independence and authority. The Compensation Committee’s Charter includes a requirement that each member of the Compensation Committee be independent and that the Compensation Committee have the authority to retain outside advisors and determine the extent of funding necessary for payment of consultants.

The foregoing are consistent with the laws, customs and practices in Canada.

In addition, the Company may from time-to-time seek relief from the NYSE American corporate governance requirements on specific transactions under Section 110 of the NYSE American Company Guide by providing written certification from independent local counsel that the non-complying practice is not prohibited by its home country law, in which case, the Company shall make the disclosure of such transactions available on its website at www.denisonmines.com. Information contained on, or accessible through, our website is not part of this Annual Report on Form 40-F.

MINE SAFETY DISCLOSURE

Not applicable.

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS

Not applicable.

UNDERTAKING AND CONSENT TO SERVICE OF PROCESS

A. Undertaking

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an Annual Report on Form 40-F arises; or transactions in said securities.

B. Consent to Service of Process

The Company has previously filed with the SEC a Form F-X in connection with its common shares. Any change to the name or address of the Company’s agent for service shall be communicated promptly to the SEC by amendment to the Form F-X referencing the file number of the Company.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Company certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual Report on Form 40-F to be signed on its behalf by the undersigned, thereto duly authorized.

Registrant: DENISON MINES CORP. | |

| | |

By: | /s/ David D. Cates | |

| | |

Title: | President and Chief Executive Officer | |

| | |

Date: | March 25, 2022 | |

EXHIBIT INDEX

99.1 | | Annual Information Form for the Year Ended December 31, 2021 |

| | |

99.2 | | Management’s Discussion and Analysis of Results of Operations and Financial Condition for the Year ended December 31, 2021 (incorporated by reference to Exhibit 99.2 of the Registration’s Form 6-K furnished to the Commission on March 4, 2022) |

| | |

99.3 | | Consolidated Audited Financial Statements for the Years Ended December 31, 2021 and 2020 together with Management’s Report on Internal Control over Financial Reporting and the report of our Independent Registered Public Accounting Firm thereon (incorporated by reference to Exhibit 99.1 of the Registration’s Form 6-K furnished to the Commission on March 4, 2022) |

| | |

99.4 | | Consent of KPMG LLP |

| | |

99.5 | | Officers’ Certifications Required by Rule 13a-14(a) or Rule 15d-14(a) of the Securities Exchange Act of 1934 |

| | |

99.6 | | Officers’ Certifications Required by Rule 13a-14(b) or Rule 15d-14(b) and Section 1350 of Chapter 63 of Title 18 of the United States Code |

| | |

99.7 | | Consent of SRK Consulting (Canada) Inc. |

| | |

99.8 | | Consent of Mark Liskowich, P.Geo. |

| | |

99.9 | | Consent of Oy Leaungthong, P.Eng. |

| | |

99.10 | | Engcomp Engineering and Computing Professionals Inc. |

| | |

99.11 | | Consent of Gordon Graham, P.Eng. |

| | |

99.12 | | Consent of SLR Consulting (Canada) Ltd. |

| | |

99.13 | | Consent of Richard E. Routledge, M.Sc., P.Geo. |

| | |

99.14 | | Consent of Dale Verran, MSc., P.Geo., Pr.Sci.Nat. |

| | |

99.15 | | Consent of Chad Sorba, P.Geo |

| | |

101 | | Interactive Data File (formatted as Inline XBRL) |

| | |

104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

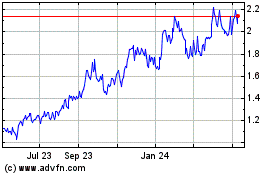

Denison Mines (AMEX:DNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

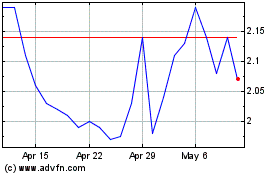

Denison Mines (AMEX:DNN)

Historical Stock Chart

From Apr 2023 to Apr 2024