BM Technologies Receives Notice from NYSE American

May 27 2022 - 4:01PM

BM Technologies, Inc. (NYSE American: BMTX) (the “Company”), one of

the largest digital banking platforms and Banking-as-a-Service

(BaaS) providers, received notice on May 24, 2022 from NYSE

Regulation stating that the Company was not in compliance with the

continued listing standards of the NYSE American LLC (the

“Exchange”) under the timely filing criteria set forth in Section

1007 of the NYSE American Company Guide (the “Company Guide”). The

non-compliance resulted from the Company’s failure to timely file

its Quarterly Report on Form 10-Q for the quarter ended March 31,

2022 (the “Form 10-Q”) (the “Filing Deficiency”).

Although the NYSE notice gives the Company a grace period of six

months to file the Form 10-Q and cure the filing delinquency, the

Company expects to file the Form 10-Q within the next 60 days.

The Form 10-Q was originally due to be filed with the Securities

and Exchange Commission (“SEC”) on May 16, 2022. The Form

12b-25 stated that it was unable to file the Form 10-Q by the

original due date without unreasonable effort or expense due to the

nature of and time constraints inherent in the process for the

Company to diligently search for and engage a new independent

registered public accounting firm.

As disclosed by the Company in its Current Report on Form 8-K

filed with the Securities and Exchange Commission on May 16, 2022,

by mutual agreement, BDO USA LLP (“BDO”) resigned as the

independent registered public accounting firm for the Company

effective May 10, 2022. The Company’s Audit Committee has commenced

the process of selecting an independent registered public

accounting firm to replace BDO with targeted engagement in June

2022.

Until the Company is again able to file its periodic reports, it

intends to furnish preliminary quarterly operating results under

cover of a Form 8-K beginning with the results for the quarterly

period ended March 31, 2022, which was filed on May 16, 2022.

About BM Technologies, Inc.

BM Technologies, Inc. (NYSE American: BMTX)—formerly known as

BankMobile—is among the largest digital banking platforms and

Banking-as-a-Service (BaaS) providers in the country, providing

access to checking and savings accounts, personal loans, credit

cards, and financial wellness. It is focused on technology,

innovation, easy-to-use products, and education with the mission to

financially empower millions of Americans by providing a more

affordable, transparent, and consumer-friendly banking experience.

The BM Technologies digital banking platform employs a

multi-partner distribution model, known as "Banking-as-a-Service"

(BaaS), that enables the acquisition of customers at higher volumes

and substantially lower expense than traditional banks, while

providing significant benefits to its customers, partners, and

business. BM Technologies, Inc. currently has approximately two

million accounts and provides disbursement services at

approximately 750 college and university campuses (covering one out

of every three college students in the U.S.). BM Technologies, Inc.

is a technology company and is not a bank, which means it provides

banking services through its partner bank. More information can

also be found at www.bmtx.com.

BM Technologies, Inc. recently announced the signing of a

definitive agreement to merge with First Sound Bank,

a Seattle, Washington-based business bank. The combined

company, to be named BMTX Bank, will be a fintech-based bank

focused on serving customers digitally nationwide. The transaction

is subject to regulatory approvals and other customary closing

conditions and is expected to close in the second half of 2022.

Investors: Bob Ramsey, CFA

BM Technologies, Inc.

571-236-8851

rramsey@bmtx.com

Media Inquiries: Brigit Hennaman

Rubenstein Public Relations, Inc.

212-805-3005

bhennaman@rubensteinpr.com

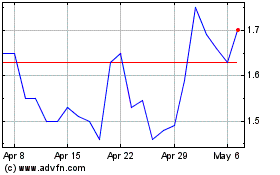

BM Technologies (AMEX:BMTX)

Historical Stock Chart

From Oct 2024 to Nov 2024

BM Technologies (AMEX:BMTX)

Historical Stock Chart

From Nov 2023 to Nov 2024