false0001826889Beachbody Company, Inc.00018268892024-04-102024-04-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): April 10, 2024 |

The Beachbody Company, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39735 |

85-3222090 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

400 Continental Blvd Suite 400 |

|

El Segundo, California |

|

90245 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (310) 883-9000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common Stock, par value $0.0001 per share |

|

BODI |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

President Compensation Letter Agreement

On April 10, 2024, Beachbody, LLC (“BODi”), a subsidiary of The Beachbody Company, Inc. (the “Company”), entered into a severance letter agreement with Michael Neiman, who serves as the Company’s President, Beachbody (the “Letter Agreement”). The material terms of the Letter Agreement are described below.

Under the Letter Agreement, if Mr. Neimand’s employment is terminated by BODi without “cause” or due to his resignation for “good reason” (each, as defined in the Letter Agreement), then he will be eligible to receive the following severance payments and benefits:

(i)an amount equal to one-half times (or, if such termination occurs on or within 12 months following a “change in control”, one times) his annual base salary as in effect on the termination date, payable in substantially equal installments over the six-month period following the termination date;

(ii)subsidized healthcare coverage for 12 months following the termination date, at the same levels as in effect on the termination date; and

(iii)an additional 12 months of vesting for each outstanding and unvested time-vesting equity award then-held by Mr. Neimand in The Beachbody Company, Inc. (or, if such termination occurs on or within 12 months following a change in control, full accelerated vesting of all outstanding and unvested time-vesting equity awards then-held by Mr. Neimand).

The severance payments and benefits described above are subject to Mr. Neimand’s timely execution and non-revocation of a general release of claims in favor of the Company.

The foregoing description of the Letter Agreement does not purport to be complete and is subject to and qualified in its entirety by reference to the full text of such agreement, a copy of which will be filed as an exhibit to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

The Beachbody Company, Inc. |

|

|

|

|

Date: |

April 16, 2024 |

By: |

/s/ Jonathan Gelfand |

|

|

|

Jonathan Gelfand

Executive Vice President, Business & Legal Affairs Corporate Secretary |

Exhibit 10.1

Via Email

April 10, 2024

Re: Severance Agreement

Michael:

Following our conversations, this document modifies your severance benefits in the case of separation from the Beachbody, LLC (“BODi” or the “Company”). While each party expressly understands and agrees that the severance and separation terms expressly provided in this letter will replace and govern over and prior severance and separation terms provided to you (either orally or in writing), for the avoidance of doubt, this document does not modify any other terms of your employment, including, without limitation, your salary, benefits, bonus opportunities, or at-will status.

If your employment is terminated (a) by BODi without Cause, or (b) by you for Good Reason, then BODi will 1) pay you an amount equal to 0.5 times your annual Base Salary at the date of termination, (the “Severance”); and 2) make its normal portion of your monthly health insurance payments at your then-current coverage levels (including reimbursement for any required COBRA payments) for a period of twelve (12) months. The Severance shall be fixed and paid to you in substantially equal installments in accordance with the Company’s normal payroll practices over the 6‑month period following your termination date, but shall commence on the first normal payroll date following the date the Release (as defined below) becomes irrevocable (the “Release Effective Date”) and amounts otherwise payable prior to such first payroll date shall be paid on such date without interest thereon. Notwithstanding the foregoing, in the event that the qualifying termination occurs on or within twelve (12) months following a Change in Control (as such term is defined in BODi's 2021 Incentive Award Plan (the “Plan”)), then the Severance will be an amount equal to 1.0 times your annual Base Salary at the date of termination.

Notwithstanding the foregoing, any severance payments and benefits (including, for clarity, any acceleration of vesting for Time Vesting Awards (described below)) will be expressly conditioned upon your (or your estate’s) timely execution and non-revocation of BODi’s standard general release of all claims against BODi and related entities and persons (the “Release”). For the avoidance of doubt, all equity awards eligible for accelerated vesting pursuant to this letter shall remain outstanding and eligible to vest following the date of termination and shall actually vest and become exercisable (if applicable) and non-forfeitable upon the Release Effective Date.

In the event of a qualified termination leading to Severance, all outstanding Company equity awards that vest solely on the passage of time that are held by you on the date of such termination (the “Time Vesting Awards”) within twelve (12) months of your termination date shall vest and, to the extent applicable, become exercisable, on an accelerated basis as of the date of termination with respect to the number of shares underlying such Time-Vesting Award that would have vested (and become exercisable, if applicable) had you remained in continuous employment with the Company beyond the date of termination for twelve (12) additional months. Notwithstanding the foregoing, in the event that the qualifying termination occurs on or within twelve (12) months following a Change in Control (as such term is defined in the Plan), then all Time Vesting Awards shall become fully vested and, to the extent applicable, exercisable.

400 Continental Blvd., Suite 400, El Segundo, California 90245 (310) 883-9000

Michael Neimand

Severance Agreement

April 10, 2024

Page 2 of 4

“Cause” means: (i) your misconduct or intentional actions that adversely affects or threatens to adversely affect the Company or its reputation in any material respect as determined in good faith by the Board; (ii) acts or threats of violence by you in any manner affecting the Company’s reputation or otherwise connected to your employment in any way; (iii) alcohol or substance abuse by you; (iv) your wrongful destruction of Company property; (v) any crime involving fraud, embezzlement, theft, conversion or dishonesty against the Company; or any conviction, or plea of guilty or nolo contendere, in a valid court of law for any other financial crime or felony; (vi) any act of fraud or personal dishonesty by you which relates to or involves the Company in any material way, including misrepresentation on your employment application or other materials provided in the course of seeking employment (or continued employment) at the Company; (vii) unauthorized disclosure by you of confidential information of the Company; (viii) material violation by you of any written policy of the Company; or (ix) gross negligence of, or gross incompetence in, the performance of the your duties for the Company as determined in good faith by the Board.

“Good Reason” means, without your written consent: (i) a material breach of this offer letter by the Company (including the Company’s withholding or failure to pay compensation when due to you); (ii) a relocation of the Company’s principal headquarters from the greater Los Angeles metropolitan area to a location more than 50 miles from such location; (ii) a material diminution in your titles, duties, authority, or responsibilities or a change in reporting relationship that requires you to report to someone other than the CEO or the Board; or (iii) a material reduction in your Base Salary or Target Bonus, unless either such reduction is applied proportionately to other members of the Company’s executive team, and is made in the good faith belief by the Board that it is in the best interests of the Company. Notwithstanding the foregoing, you will not be deemed to have resigned for Good Reason unless (1) you provide the Company with written notice setting forth in reasonable detail the facts and circumstances claimed by you to constitute Good Reason within 45 days after the date of the occurrence of any event that you know or should reasonably have known to constitute Good Reason, (2) the Company fails to cure such acts or omissions within 30 days following its receipt of such notice, and (3) the effective date of your termination for Good Reason occurs no later than 90 days after the expiration of the Company’s cure period. For clarity, Good Reason shall not have occurred if the Company’s primary El Segundo, California office is moved or relocated within the greater Westside and/or South Bay Los Angeles metropolitan areas and/or the Company permits you to work from home or another physical or remote location that you may designate in writing.

All payments to you under this letter will be subject to any required withholding of federal, state and local taxes pursuant to any applicable law or regulation and the Company and its affiliates are entitled to withholding any and all such taxes from amounts payable under this offer letter.

For purposes of this letter, your termination of employment shall mean your “separation from service” as defined under Section 409A of the Internal Revenue Code of 1986 (as amended, the “Code”). Each payment under this letter that is determined to be subject to Section 409A shall be treated as a separate payment. In no event may you, directly or indirectly, designate the calendar year of any payment to be made under this offer letter. Notwithstanding any provision of this letter to the contrary, if you are a “specified employee” (as defined in Section 409A of the Code) as of your ”separation from service” (as defined in Section 409A of the Code), then the payment of any amounts payable hereunder that are subject to Section 409A of the Code shall be postponed in compliance with Section 409A (without any reduction in such payments ultimately paid or provided to you) until the first payroll date that occurs after the date that is six (6) months following your “separation from service.” Any such postponed payment shall be paid in a lump sum to you on the first payroll date that occurs after the date that is six (6) months following your “separation from service.” If you die during the postponement period prior to the payment of the postponed amount, the amounts withheld on account of Section 409A shall be paid to your estate within sixty (60) days after the date of your death. Any payments subject to Section 409A that are subject to execution of a waiver and

Michael Neimand

Severance Agreement

April 10, 2024

Page 3 of 4

release which may be executed and/or revoked in a calendar year following the calendar year in which the payment event (such as termination of employment) occurs shall commence payment only in the calendar year in which the consideration period or, if applicable, release revocation period ends, as necessary to comply with Section 409A.

This letter will be governed by and interpreted in accordance with the laws of the State of California, without regard to the conflict of law rules thereof.

[Signature Page Follows]

Michael Neimand

Severance Agreement

April 10, 2024

Page 4 of 4

I greatly value your contribution, partnership, and your importance to our efforts, and it is my sincere desire to keep working together on this business turnaround.

Please acknowledge this modification by signing this letter and returning it to Kathy Vrabeck, Chief Operating Officer, via email at kvrabeck@bodi.com on or before April 12, 2024.

Very truly yours,

__________________________

Carl Daikeler

Chief Executive Officer

I hereby accept the BODi severance agreement as described in this letter and understand that it does not constitute an employment contract.

Acknowledged and accepted this _____ day of April, 2024

__________________________

Michael Neimand

[Signature Page to Severance Agreement]

v3.24.1.u1

Document And Entity Information

|

Apr. 10, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Apr. 10, 2024

|

| Entity Registrant Name |

Beachbody Company, Inc.

|

| Entity Central Index Key |

0001826889

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-39735

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

85-3222090

|

| Entity Address, Address Line One |

400 Continental Blvd

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

El Segundo

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90245

|

| City Area Code |

(310)

|

| Local Phone Number |

883-9000

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

BODI

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Beachbody (NYSE:BODY)

Historical Stock Chart

From Mar 2024 to Apr 2024

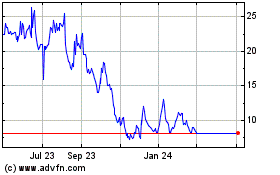

Beachbody (NYSE:BODY)

Historical Stock Chart

From Apr 2023 to Apr 2024