U.S. Futures Dip Ahead of PPI and Unemployment Claims, Oil Prices Slide

April 11 2024 - 7:23AM

IH Market News

U.S. index futures are down in Thursday’s pre-market trading,

extending the decline seen the previous day. This movement comes

after the release of a Consumer Price Index (CPI) above

expectations, intensifying speculation that the Federal Reserve

(Fed) may keep interest rates at high levels for an extended

period, while the minutes from the last meeting of the Federal

Reserve revealed that some officials still express concerns about

the progress of inflation towards the established target.

At 6:23 AM, Dow Jones futures (DOWI:DJI) fell 111 points, or

0.29%. S&P 500 futures fell 0.31%, and Nasdaq-100 futures lost

0.25%. The yield on 10-year Treasury notes was at 4.548%.

In the commodities market, West Texas Intermediate crude oil for

May fell 0.60% to $85.70 a barrel. Brent crude for June fell 0.46%,

near $90.06 a barrel. Iron ore traded on the Dalian exchange rose

1.29% to $114.14 per metric ton.

Thursday’s economic schedule brings two relevant indicators to

assess the health of the labor market and inflationary pressures in

the economy. At 8:30 AM, data on weekly unemployment insurance

claims will be released, with LSEG consensus anticipating about

215,000 applications. At the same time, producer prices are

expected to be published, with LSEG projections indicating a

monthly increase of 0.3% and an annual rise of 2.2%.

European markets are down, reflecting the analysis of

international investors on the recent inflation indicators from the

United States. Meanwhile, there is widespread anticipation of the

imminent announcement by the European Central Bank (ECB) on its

monetary policy, keeping market participants on alert.

Asian markets showed mixed performance, reflecting a variety of

economic influences. Concerns about the possibility that interest

rates in the United States will remain stable for an extended

period put pressure on some markets in the region. However, in

China, economic indicators showed a different trend. The country’s

CPI showed a significant slowdown, with the annual rate dropping to

just 0.1% in March, a sharp reduction compared to 0.7% in February

and well below the market expectation of 0.4%. In addition, China’s

PPI recorded a drop of 2.8%, aligning with forecasts.

In terms of market performance, China’s Shanghai SE saw a slight

increase of 0.23%, while Japan’s Nikkei and Hong Kong’s Hang Seng

Index retreated by 0.35% and 0.26%, respectively. South Korea’s

Kospi advanced modestly with a 0.07% gain, while Australia’s ASX

200 fell 0.44%.

U.S. stocks fell sharply on Wednesday, influenced by a 0.4%

increase in consumer prices in March, matching the increase

observed in February. Economists had expected consumer prices to

rise by 0.3%. The report also stated that the annual consumer price

growth rate accelerated to 3.5% in March, up from 3.2% in February.

Economists had anticipated a more modest acceleration to 3.4%. The

Dow Jones, S&P 500, and Nasdaq recorded declines of 1.09%,

0.95%, and 0.84%, respectively. This scenario reinforced concerns

about the continuation of high interest rates by the Federal

Reserve, in a context of persistent inflation and reduced rate cut

expectations for June to just 16.5%, according to the CME Group’s

FedWatch tool.

For the quarterly earnings front, scheduled to present financial

reports are Constellation Brands (NYSE:STZ),

Carmax (NYSE:KMX), Fastenal

(NASDAQ:FAST), Lovesac (NASDAQ:LOVE),

Conn’s Inc (NASDAQ:CONN), Hooker

Furnishings (NASDAQ:HOFT), Northern Technologies

International Corporation (NASDAQ:NTIC), among others.

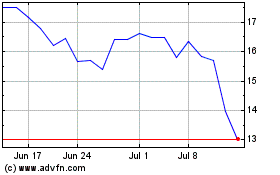

Northern Technologies (NASDAQ:NTIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Northern Technologies (NASDAQ:NTIC)

Historical Stock Chart

From Apr 2023 to Apr 2024