Red Violet, Inc. (NASDAQ: RDVT), a leading analytics and

information solutions provider, today announced financial results

for the quarter and full year ended December 31, 2023.

“We delivered a solid quarter, capping off another

record year for red violet that produced records in revenue, gross

profit, net income, adjusted EBITDA, cash flow from operations, and

free cash flow,” stated Derek Dubner, red violet’s CEO. “Our

industry-leading AI/ML-powered platform, proprietary linking

algorithms, and core identity graph continue to drive our

excellence in entity resolution that is pivotal to identity

verification, fraud prevention, and risk mitigation. With 2024

revenue to date off to a record start, we are highly focused on

accelerating our business and continuing to deliver exceptional

customer and shareholder value in 2024 and beyond.”

Fourth Quarter Financial

Results

For the three months ended December 31, 2023, as

compared to the three months ended December 31, 2022:

- Total revenue increased 15% to $15.1 million.

- Gross profit increased 16% to $9.6 million. Gross margin

increased to 64% from 63%.

- Adjusted gross profit increased 17% to $11.7 million. Adjusted

gross margin increased to 78% from 77%.

- Net loss narrowed 31% to $1.1 million, which resulted in a loss

of $0.08 per basic and diluted share. Net loss margin improved to

7% from 12%.

- Adjusted EBITDA increased 76% to $2.7 million. Adjusted EBITDA

margin increased to 18% from 12%.

- Adjusted net income increased 157% to $0.3 million, which

resulted in adjusted earnings of $0.02 per basic and diluted

share.

- Cash from operating activities decreased 4% to $4.2

million.

- Cash and cash equivalents were $32.0 million as of December 31,

2023.

Full Year Financial Results

For the year ended December 31, 2023, as compared

to the year ended December 31, 2022:

- Total revenue increased 13% to $60.2 million.

- Gross profit increased 13% to $39.0 million. Gross margin

remained consistent at 65%.

- Adjusted gross profit increased 15% to $47.1 million. Adjusted

gross margin increased to 78% from 77%.

- Net income increased to $13.5 million from $0.6 million, which

resulted in earnings of $0.97 and $0.96 per basic and diluted

share, respectively. Net income margin increased to 22% from

1%.

- Adjusted EBITDA increased 27% to $16.4 million. Adjusted EBITDA

margin increased to 27% from 24%.

- Adjusted net income increased 17% to $8.1 million, which

resulted in adjusted earnings of $0.58 and $0.57 per basic and

diluted share, respectively.

- Cash from operating activities increased 21% to $15.1

million.

Fourth Quarter and Recent Business

Highlights

- Added over 100 customers to IDI™ during the fourth quarter,

ending the year with 7,875 customers.

- Added over 17,000 users to FOREWARN® during the fourth quarter,

ending the year with 185,380 users. Over 400 REALTOR® Associations

are now contracted to use FOREWARN.

- Continued growth in the onboarding of higher-tier customers,

with 72 customers contributing over $100,000 of revenue in 2023

compared to 67 customers in 2022.

- Appointed Bill Livek as an independent director of the Board of

Directors, bringing his knowledge and expertise in platform-driven

consumer insights to the red violet Board of Directors.

- Appointed Jonathan McDonald as Executive Vice President of

Public Sector division, leveraging his extensive experience and

proven leadership in the public sector to strengthen our ability to

deliver our impactful solutions and drive sustainable growth in

this key market segment.

- The Board of Directors authorized the repurchase of an

additional $5.0 million of the Company’s common stock on December

19, 2023. During the fourth quarter, the Company purchased 125,703

shares at an average price of $19.89 per share pursuant to the

Stock Repurchase Program. Since inception in May of 2022, through

February 29, 2024, the Company purchased a total of 289,340 shares

at an average price of $18.73 per share. As of March 1, 2024, the

Company had approximately $4.6 million remaining under the Stock

Repurchase Program.

Conference Call

In conjunction with this release, red violet will

host a conference call and webcast today at 4:30pm ET to discuss

its quarterly and full year results and provide a business update.

Please click here to pre-register for the conference call and

obtain your dial in number and passcode. To access the live audio

webcast, visit the Investors section of the red violet website at

www.redviolet.com. Please login at least 15 minutes prior to the

start of the call to ensure adequate time for any downloads that

may be required. Following the completion of the conference call,

an archived webcast of the conference call will be available on the

Investors section of the red violet website

at www.redviolet.com.

About red

violet®

At red violet, we build proprietary technologies

and apply analytical capabilities to deliver identity intelligence.

Our technology powers critical solutions, which empower

organizations to operate with confidence. Our solutions enable the

real-time identification and location of people, businesses, assets

and their interrelationships. These solutions are used for purposes

including identity verification, risk mitigation, due diligence,

fraud detection and prevention, regulatory compliance, and customer

acquisition. Our intelligent platform, CORE™, is purpose-built for

the enterprise, yet flexible enough for organizations of all sizes,

bringing clarity to massive datasets by transforming data into

intelligence. Our solutions are used today to enable frictionless

commerce, to ensure safety, and to reduce fraud and the concomitant

expense borne by society. For more information, please

visit www.redviolet.com.

Company Contact:Camilo RamirezRed

Violet, Inc.561-757-4500ir@redviolet.com

Investor Relations Contact:Steven

Hooser Three Part Advisors214-872-2710ir@redviolet.com

Use of Non-GAAP Financial

Measures

Management evaluates the financial performance of

our business on a variety of key indicators, including non-GAAP

metrics of adjusted EBITDA, adjusted EBITDA margin, adjusted net

income, adjusted earnings per share, adjusted gross profit,

adjusted gross margin, and free cash flow ("FCF"). Adjusted EBITDA

is a non-GAAP financial measure equal to net income (loss), the

most directly comparable financial measure based on US GAAP,

excluding interest income, net, income tax expense (benefit),

depreciation and amortization, share-based compensation expense,

litigation costs, and write-off of long-lived assets and others. We

define adjusted EBITDA margin as adjusted EBITDA as a percentage of

revenue. Adjusted net income is a non-GAAP financial measure equal

to net income (loss), the most directly comparable financial

measure based on US GAAP, excluding share-based compensation

expense, amortization of share-based compensation capitalized in

intangible assets, and discrete tax items, and including the tax

effect of adjustments. We define adjusted earnings per share as

adjusted net income divided by the weighted average shares

outstanding. We define adjusted gross profit as revenue less cost

of revenue (exclusive of depreciation and amortization), and

adjusted gross margin as adjusted gross profit as a percentage of

revenue. We define FCF as net cash provided by operating activities

reduced by purchase of property and equipment and capitalized costs

included in intangible assets.

FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking

statements," as that term is defined under the Private Securities

Litigation Reform Act of 1995 (PSLRA), which statements may be

identified by words such as "expects," "plans," "projects," "will,"

"may," "anticipate," "believes," "should," "intends," "estimates,"

and other words of similar meaning. Such forward looking statements

are subject to risks and uncertainties that are often difficult to

predict, are beyond our control and which may cause results to

differ materially from expectations, including whether the 2024

revenue to date resulting in a record start will help in

accelerating our business and continuing to deliver exceptional

customer and shareholder value in 2024 and beyond. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which are based on our expectations as of the date of

this press release and speak only as of the date of this press

release and are advised to consider the factors listed above

together with the additional factors under the heading

"Forward-Looking Statements" and "Risk Factors" in red violet's

Form 10-K for the year ended December 31, 2022 filed on March 8,

2023, as may be supplemented or amended by the Company's other SEC

filings, including the Form 10-K for year ended December 31, 2023

expected to be filed today. We undertake no obligation to publicly

update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise, except as required

by law.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RED VIOLET, INC.CONSOLIDATED BALANCE

SHEETS(Amounts in thousands, except share

data) |

|

|

|

|

|

|

|

|

|

|

December 31, 2023 |

|

|

December 31, 2022 |

|

|

ASSETS: |

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

32,032 |

|

|

$ |

31,810 |

|

| Accounts receivable, net of

allowance for doubtful accounts of $159 and $60 as of December 31,

2023 and 2022, respectively |

|

7,135 |

|

|

|

5,535 |

|

| Prepaid expenses and other

current assets |

|

1,113 |

|

|

|

771 |

|

| Total current assets |

|

40,280 |

|

|

|

38,116 |

|

| Property and equipment, net |

|

592 |

|

|

|

709 |

|

| Intangible assets, net |

|

34,403 |

|

|

|

31,647 |

|

| Goodwill |

|

5,227 |

|

|

|

5,227 |

|

| Right-of-use assets |

|

2,457 |

|

|

|

1,114 |

|

| Deferred tax assets |

|

9,514 |

|

|

|

- |

|

| Other noncurrent assets |

|

517 |

|

|

|

601 |

|

| Total

assets |

$ |

92,990 |

|

|

$ |

77,414 |

|

| LIABILITIES AND

SHAREHOLDERS' EQUITY: |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

| Accounts payable |

$ |

1,631 |

|

|

$ |

2,229 |

|

| Accrued expenses and other

current liabilities |

|

1,989 |

|

|

|

1,845 |

|

| Current portion of operating

lease liabilities |

|

569 |

|

|

|

692 |

|

| Deferred revenue |

|

690 |

|

|

|

670 |

|

| Total current liabilities |

|

4,879 |

|

|

|

5,436 |

|

| Noncurrent operating lease

liabilities |

|

1,999 |

|

|

|

598 |

|

| Deferred tax liabilities |

|

- |

|

|

|

287 |

|

| Total

liabilities |

|

6,878 |

|

|

|

6,321 |

|

| Shareholders' equity: |

|

|

|

|

|

|

|

| Preferred stock—$0.001 par value,

10,000,000 shares authorized, and 0 shares issued and outstanding,

as of December 31, 2023 and 2022 |

|

- |

|

|

|

- |

|

| Common stock—$0.001 par value,

200,000,000 shares authorized, 13,980,274 and 13,956,404 shares

issued, and 13,970,846 and 13,956,404 shares outstanding, as of

December 31, 2023 and 2022 |

|

14 |

|

|

|

14 |

|

| Treasury stock, at cost, 9,428

and 0 shares as of December 31, 2023 and 2022 |

|

(188 |

) |

|

|

- |

|

| Additional paid-in capital |

|

94,159 |

|

|

|

92,481 |

|

| Accumulated deficit |

|

(7,873 |

) |

|

|

(21,402 |

) |

| Total shareholders'

equity |

|

86,112 |

|

|

|

71,093 |

|

| Total liabilities and

shareholders' equity |

$ |

92,990 |

|

|

$ |

77,414 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

RED VIOLET, INC.CONSOLIDATED STATEMENTS OF

OPERATIONS(Amounts in thousands, except share

data) |

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

Revenue |

|

$ |

60,204 |

|

|

$ |

53,318 |

|

| Costs and

expenses(1): |

|

|

|

|

|

|

|

|

| Cost of revenue (exclusive of

depreciation and amortization) |

|

|

13,069 |

|

|

|

12,211 |

|

| Sales and marketing expenses |

|

|

13,833 |

|

|

|

10,834 |

|

| General and administrative

expenses |

|

|

22,446 |

|

|

|

23,237 |

|

| Depreciation and

amortization |

|

|

8,352 |

|

|

|

6,675 |

|

| Total costs and

expenses |

|

|

57,700 |

|

|

|

52,957 |

|

| Income from

operations |

|

|

2,504 |

|

|

|

361 |

|

| Interest income, net |

|

|

1,334 |

|

|

|

351 |

|

| Income before income

taxes |

|

|

3,838 |

|

|

|

712 |

|

| Income tax (benefit) expense |

|

|

(9,691 |

) |

|

|

96 |

|

| Net income |

|

$ |

13,529 |

|

|

$ |

616 |

|

| Earnings per

share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.97 |

|

|

$ |

0.04 |

|

| Diluted |

|

$ |

0.96 |

|

|

$ |

0.04 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

| Basic |

|

|

13,974,125 |

|

|

|

13,759,296 |

|

| Diluted |

|

|

14,134,021 |

|

|

|

14,107,144 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Share-based compensation

expense in each category: |

|

|

|

|

|

|

|

|

| Sales and marketing

expenses |

|

$ |

462 |

|

|

$ |

290 |

|

| General and administrative

expenses |

|

|

4,924 |

|

|

|

5,215 |

|

| Total |

|

$ |

5,386 |

|

|

$ |

5,505 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

RED VIOLET, INC.CONSOLIDATED STATEMENTS OF

CASH FLOWS(Amounts in thousands) |

| |

|

|

| |

Year Ended December 31, |

|

| |

2023 |

|

|

2022 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

| Net income |

$ |

13,529 |

|

|

$ |

616 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

8,352 |

|

|

|

6,675 |

|

| Share-based compensation

expense |

|

5,386 |

|

|

|

5,505 |

|

| Write-off of long-lived

assets |

|

6 |

|

|

|

177 |

|

| Provision for bad debts |

|

1,088 |

|

|

|

174 |

|

| Noncash lease expenses |

|

576 |

|

|

|

547 |

|

| Deferred income tax (benefit)

expense |

|

(9,801 |

) |

|

|

89 |

|

| Changes in assets and

liabilities: |

|

|

|

|

|

|

|

| Accounts receivable |

|

(2,688 |

) |

|

|

(1,973 |

) |

| Prepaid expenses and other

current assets |

|

(342 |

) |

|

|

(172 |

) |

| Other noncurrent assets |

|

84 |

|

|

|

(464 |

) |

| Accounts payable |

|

(598 |

) |

|

|

624 |

|

| Accrued expenses and other

current liabilities |

|

100 |

|

|

|

1,450 |

|

| Deferred revenue |

|

20 |

|

|

|

(171 |

) |

| Operating lease liabilities |

|

(641 |

) |

|

|

(618 |

) |

| Net cash provided by operating

activities |

|

15,071 |

|

|

|

12,459 |

|

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

|

|

|

|

|

| Purchase of property and

equipment |

|

(122 |

) |

|

|

(373 |

) |

| Capitalized costs included in

intangible assets |

|

(9,024 |

) |

|

|

(8,456 |

) |

| Net cash used in investing

activities |

|

(9,146 |

) |

|

|

(8,829 |

) |

| CASH FLOWS FROM FINANCING

ACTIVITIES: |

|

|

|

|

|

|

|

| Taxes paid related to net share

settlement of vesting of restricted stock units |

|

(1,992 |

) |

|

|

(5,200 |

) |

| Repurchases of common stock |

|

(3,711 |

) |

|

|

(878 |

) |

| Net cash used in financing

activities |

|

(5,703 |

) |

|

|

(6,078 |

) |

| Net increase (decrease)

in cash and cash equivalents |

$ |

222 |

|

|

$ |

(2,448 |

) |

| Cash and cash equivalents at

beginning of period |

|

31,810 |

|

|

|

34,258 |

|

| Cash and cash equivalents

at end of period |

$ |

32,032 |

|

|

$ |

31,810 |

|

| SUPPLEMENTAL DISCLOSURE

INFORMATION: |

|

|

|

|

|

|

|

| Cash paid for interest |

$ |

- |

|

|

$ |

- |

|

| Cash paid for income taxes |

$ |

82 |

|

|

$ |

39 |

|

| Share-based compensation

capitalized in intangible assets |

$ |

1,851 |

|

|

$ |

1,621 |

|

| Retirement of treasury stock |

$ |

5,559 |

|

|

$ |

6,078 |

|

| Right-of -use assets obtained in

exchange of operating lease liabilities |

$ |

1,919 |

|

|

$ |

- |

|

| Operating lease liabilities

arising from obtaining right-of-use assets |

$ |

1,919 |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Use and Reconciliation of Non-GAAP

Financial Measures

Management evaluates the financial performance of

our business on a variety of key indicators, including non-GAAP

metrics of adjusted EBITDA, adjusted EBITDA margin, adjusted net

income, adjusted earnings per share, adjusted gross profit,

adjusted gross margin, and FCF. Adjusted EBITDA is a non-GAAP

financial measure equal to net income (loss), the most directly

comparable financial measure based on US GAAP, excluding interest

income, net, income tax expense (benefit), depreciation and

amortization, share-based compensation expense, litigation costs,

and write-off of long-lived assets and others. We define adjusted

EBITDA margin as adjusted EBITDA as a percentage of revenue.

Adjusted net income is a non-GAAP financial measure equal to net

income (loss), the most directly comparable financial measure based

on US GAAP, excluding share-based compensation expense,

amortization of share-based compensation capitalized in intangible

assets, and discrete tax items, and including the tax effect of

adjustments. We define adjusted earnings per share as adjusted net

income divided by the weighted average shares outstanding. We

define adjusted gross profit as revenue less cost of revenue

(exclusive of depreciation and amortization), and adjusted gross

margin as adjusted gross profit as a percentage of revenue. We

define FCF as net cash provided by operating activities reduced by

purchase of property and equipment and capitalized costs included

in intangible assets.

The following is a reconciliation of net income

(loss), the most directly comparable US GAAP financial measure, to

adjusted EBITDA:

|

|

Three Months EndedDecember 31, |

|

|

Year EndedDecember 31, |

|

| (Dollars in

thousands) |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net income (loss) |

$ |

(1,070 |

) |

|

$ |

(1,544 |

) |

|

$ |

13,529 |

|

|

$ |

616 |

|

| Interest income, net |

|

(387 |

) |

|

|

(225 |

) |

|

|

(1,334 |

) |

|

|

(351 |

) |

| Income tax expense (benefit) |

|

562 |

|

|

|

(148 |

) |

|

|

(9,691 |

) |

|

|

96 |

|

| Depreciation and

amortization |

|

2,211 |

|

|

|

1,815 |

|

|

|

8,352 |

|

|

|

6,675 |

|

| Share-based compensation

expense |

|

1,328 |

|

|

|

1,439 |

|

|

|

5,386 |

|

|

|

5,505 |

|

| Litigation costs |

|

- |

|

|

|

4 |

|

|

|

49 |

|

|

|

132 |

|

| Write-off of long-lived assets

and others |

|

19 |

|

|

|

171 |

|

|

|

77 |

|

|

|

178 |

|

| Adjusted

EBITDA |

$ |

2,663 |

|

|

$ |

1,512 |

|

|

$ |

16,368 |

|

|

$ |

12,851 |

|

| Revenue |

$ |

15,061 |

|

|

$ |

13,069 |

|

|

$ |

60,204 |

|

|

$ |

53,318 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss)

margin |

|

(7 |

%) |

|

|

(12 |

%) |

|

|

22 |

% |

|

|

1 |

% |

| Adjusted EBITDA

margin |

|

18 |

% |

|

|

12 |

% |

|

|

27 |

% |

|

|

24 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following is a reconciliation of net income

(loss), the most directly comparable US GAAP financial measure, to

adjusted net income:

|

|

Three Months EndedDecember 31, |

|

|

Year EndedDecember 31, |

|

| (Dollars in thousands,

except share data) |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net income (loss) |

$ |

(1,070 |

) |

|

$ |

(1,544 |

) |

|

$ |

13,529 |

|

|

$ |

616 |

|

| Share-based compensation

expense |

|

1,328 |

|

|

|

1,439 |

|

|

|

5,386 |

|

|

|

5,505 |

|

| Amortization of share-based

compensation capitalized in intangible assets |

|

263 |

|

|

|

210 |

|

|

|

969 |

|

|

|

766 |

|

| Discrete tax items(1) |

|

- |

|

|

|

- |

|

|

|

(10,272 |

) |

|

|

- |

|

| Tax effect of adjustments(2) |

|

(251 |

) |

|

|

- |

|

|

|

(1,526 |

) |

|

|

- |

|

| Adjusted net

income |

$ |

270 |

|

|

$ |

105 |

|

|

$ |

8,086 |

|

|

$ |

6,887 |

|

| Earnings (loss) per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

(0.08 |

) |

|

$ |

(0.11 |

) |

|

$ |

0.97 |

|

|

$ |

0.04 |

|

| Diluted |

$ |

(0.08 |

) |

|

$ |

(0.11 |

) |

|

$ |

0.96 |

|

|

$ |

0.04 |

|

| Adjusted earnings per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.02 |

|

|

$ |

0.01 |

|

|

$ |

0.58 |

|

|

$ |

0.50 |

|

| Diluted |

$ |

0.02 |

|

|

$ |

0.01 |

|

|

$ |

0.57 |

|

|

$ |

0.49 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

13,985,426 |

|

|

|

13,964,010 |

|

|

|

13,974,125 |

|

|

|

13,759,296 |

|

| Diluted(3) |

|

14,307,797 |

|

|

|

14,205,633 |

|

|

|

14,134,021 |

|

|

|

14,107,144 |

|

|

(1) |

During the three months ended September 30, 2023, $10.3 million of

income tax benefit was recognized as a result of the release of the

valuation allowance previously recorded on our deferred tax asset

and cumulative research and development tax credit, which were

excluded to calculate the adjusted net income. |

| (2) |

The tax effect of adjustments is

calculated using the expected federal and state statutory tax rate.

The expected federal and state income tax rate was approximately

25.75% for the three and twelve months ended December 31, 2023.

There was no tax effect of such adjustments for the three and

twelve months ended December 31, 2022, as a full valuation

allowance was provided for the net deferred tax assets. |

| (3) |

For the three months ended

December 31, 2023 and 2022, diluted weighted average shares

outstanding for adjusted diluted earnings per share are calculated

by the inclusion of unvested RSUs, which were not included in US

GAAP diluted weighted average shares outstanding due to the

Company's net loss position for such periods. |

| |

|

The following is a reconciliation of gross profit,

the most directly comparable US GAAP financial measure, to adjusted

gross profit:

|

|

Three Months EndedDecember 31, |

|

|

Year EndedDecember 31, |

|

| (Dollars in

thousands) |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Revenue |

$ |

15,061 |

|

|

$ |

13,069 |

|

|

$ |

60,204 |

|

|

$ |

53,318 |

|

| Cost of revenue (exclusive of

depreciation and amortization) |

|

(3,337 |

) |

|

|

(3,054 |

) |

|

|

(13,069 |

) |

|

|

(12,211 |

) |

| Depreciation and amortization

of intangible assets |

|

(2,154 |

) |

|

|

(1,758 |

) |

|

|

(8,119 |

) |

|

|

(6,440 |

) |

| Gross

profit |

|

9,570 |

|

|

|

8,257 |

|

|

|

39,016 |

|

|

|

34,667 |

|

| Depreciation and amortization

of intangible assets |

|

2,154 |

|

|

|

1,758 |

|

|

|

8,119 |

|

|

|

6,440 |

|

| Adjusted gross

profit |

$ |

11,724 |

|

|

$ |

10,015 |

|

|

$ |

47,135 |

|

|

$ |

41,107 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

margin |

|

64 |

% |

|

|

63 |

% |

|

|

65 |

% |

|

|

65 |

% |

| Adjusted gross

margin |

|

78 |

% |

|

|

77 |

% |

|

|

78 |

% |

|

|

77 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following is a reconciliation of net cash

provided by operating activities, the most directly comparable US

GAAP measure, to FCF:

| |

Three Months EndedDecember 31, |

|

|

Year EndedDecember 31, |

|

| (Dollars in

thousands) |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net cash provided by operating activities |

$ |

4,204 |

|

|

$ |

4,359 |

|

|

$ |

15,071 |

|

|

$ |

12,459 |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase of property and

equipment |

|

(24 |

) |

|

|

(102 |

) |

|

|

(122 |

) |

|

|

(373 |

) |

| Capitalized costs included in

intangible assets |

|

(2,103 |

) |

|

|

(2,317 |

) |

|

|

(9,024 |

) |

|

|

(8,456 |

) |

| Free cash

flow |

$ |

2,077 |

|

|

$ |

1,940 |

|

|

$ |

5,925 |

|

|

$ |

3,630 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In order to assist readers of our consolidated

financial statements in understanding the operating results that

management uses to evaluate the business and for financial planning

purposes, we present non-GAAP measures of adjusted EBITDA, adjusted

EBITDA margin, adjusted net income, adjusted earnings per share,

adjusted gross profit, adjusted gross margin, and FCF as

supplemental measures of our operating performance. We believe they

provide useful information to our investors as they eliminate the

impact of certain items that we do not consider indicative of our

cash operations and ongoing operating performance. In addition, we

use them as an integral part of our internal reporting to measure

the performance and operating strength of our business.

We believe adjusted EBITDA, adjusted EBITDA margin,

adjusted net income, adjusted earnings per share, adjusted gross

profit, adjusted gross margin, and FCF are relevant and provide

useful information frequently used by securities analysts,

investors and other interested parties in their evaluation of the

operating performance of companies similar to ours and are

indicators of the operational strength of our business. We believe

adjusted EBITDA eliminates the uneven effect of considerable

amounts of non-cash depreciation and amortization, share-based

compensation expense and the impact of other non-recurring items,

providing useful comparisons versus prior periods or forecasts.

Adjusted EBITDA margin is calculated as adjusted EBITDA as a

percentage of revenue. We believe adjusted net income provides

additional means of evaluating period-over-period operating

performance by eliminating certain non-cash expenses and other

items that might otherwise make comparisons of our ongoing business

with prior periods more difficult and obscure trends in ongoing

operations. Adjusted net income is a non-GAAP financial measure

equal to net income (loss), excluding share-based compensation

expense, amortization of share-based compensation capitalized in

intangible assets, and discrete tax items, and including the tax

effect of adjustments. We define adjusted earnings per share as

adjusted net income divided by the weighted average shares

outstanding. Our adjusted gross profit is a measure used by

management in evaluating the business’s current operating

performance by excluding the impact of prior historical costs of

assets that are expensed systematically and allocated over the

estimated useful lives of the assets, which may not be indicative

of the current operating activity. Our adjusted gross profit is

calculated by using revenue, less cost of revenue (exclusive of

depreciation and amortization). We believe adjusted gross profit

provides useful information to our investors by eliminating the

impact of non-cash depreciation and amortization, and specifically

the amortization of software developed for internal use, providing

a baseline of our core operating results that allow for analyzing

trends in our underlying business consistently over multiple

periods. Adjusted gross margin is calculated as adjusted gross

profit as a percentage of revenue. We believe FCF is an important

liquidity measure of the cash that is available, after capital

expenditures, for operational expenses and investment in our

business. FCF is a measure used by management to understand and

evaluate the business’s operating performance and trends over time.

FCF is calculated by using net cash provided by operating

activities, less purchase of property and equipment and capitalized

costs included in intangible assets.

Adjusted EBITDA, adjusted EBITDA margin, adjusted

net income, adjusted earnings per share, adjusted gross profit,

adjusted gross margin, and FCF are not intended to be performance

measures that should be regarded as an alternative to, or more

meaningful than, financial measures presented in accordance with US

GAAP. In addition, FCF is not intended to represent our residual

cash flow available for discretionary expenses and is not

necessarily a measure of our ability to fund our cash needs. The

way we measure adjusted EBITDA, adjusted EBITDA margin, adjusted

net income, adjusted earnings per share, adjusted gross profit,

adjusted gross margin, and FCF may not be comparable to similarly

titled measures presented by other companies, and may not be

identical to corresponding measures used in our various

agreements.

SUPPLEMENTAL METRICS

The following metrics are intended as a supplement

to the financial statements found in this release and other

information furnished or filed with the SEC. These supplemental

metrics are not necessarily derived from any underlying financial

statement amounts. We believe these supplemental metrics help

investors understand trends within our business and evaluate the

performance of such trends quickly and effectively. In the event of

discrepancies between amounts in these tables and the Company's

historical disclosures or financial statements, readers should rely

on the Company's filings with the SEC and financial statements in

the Company's most recent earnings release.

We intend to periodically review and refine the

definition, methodology and appropriateness of each of these

supplemental metrics. As a result, metrics are subject to removal

and/or changes, and such changes could be material.

| |

(Unaudited) |

|

| (Dollars in

thousands) |

Q1'22 |

|

|

Q2'22 |

|

|

Q3'22 |

|

|

Q4'22 |

|

|

Q1'23 |

|

|

Q2'23 |

|

|

Q3'23 |

|

|

Q4'23 |

|

|

Customer metrics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IDI - billable customers(1) |

|

6,592 |

|

|

|

6,817 |

|

|

|

6,873 |

|

|

|

7,021 |

|

|

|

7,256 |

|

|

|

7,497 |

|

|

|

7,769 |

|

|

|

7,875 |

|

|

FOREWARN - users(2) |

|

91,490 |

|

|

|

101,261 |

|

|

|

110,051 |

|

|

|

116,960 |

|

|

|

131,348 |

|

|

|

146,537 |

|

|

|

168,356 |

|

|

|

185,380 |

|

| Revenue

metrics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contractual revenue %(3) |

|

77 |

% |

|

|

80 |

% |

|

|

68 |

% |

|

|

77 |

% |

|

|

75 |

% |

|

|

79 |

% |

|

|

79 |

% |

|

|

82 |

% |

|

Gross revenue retention %(4) |

|

97 |

% |

|

|

95 |

% |

|

|

94 |

% |

|

|

95 |

% |

|

|

94 |

% |

|

|

94 |

% |

|

|

94 |

% |

|

|

92 |

% |

|

Revenue from new customers(5) |

$ |

1,014 |

|

|

$ |

805 |

|

|

$ |

2,016 |

|

|

$ |

1,216 |

|

|

$ |

1,869 |

|

|

$ |

1,147 |

|

|

$ |

1,326 |

|

|

$ |

1,258 |

|

|

Base revenue from existing customers(6) |

$ |

9,721 |

|

|

$ |

10,164 |

|

|

$ |

10,839 |

|

|

$ |

10,574 |

|

|

$ |

11,121 |

|

|

$ |

11,707 |

|

|

$ |

12,432 |

|

|

$ |

12,111 |

|

|

Growth revenue from existing customers(7) |

$ |

1,994 |

|

|

$ |

1,525 |

|

|

$ |

2,171 |

|

|

$ |

1,279 |

|

|

$ |

1,636 |

|

|

$ |

1,826 |

|

|

$ |

2,079 |

|

|

$ |

1,692 |

|

| Other

metrics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employees - sales and marketing |

59 |

|

|

57 |

|

|

64 |

|

|

68 |

|

|

61 |

|

|

63 |

|

|

65 |

|

|

71 |

|

|

Employees - support |

10 |

|

|

9 |

|

|

10 |

|

|

10 |

|

|

10 |

|

|

9 |

|

|

9 |

|

|

9 |

|

|

Employees - infrastructure |

23 |

|

|

25 |

|

|

25 |

|

|

28 |

|

|

27 |

|

|

26 |

|

|

27 |

|

|

27 |

|

|

Employees - engineering |

50 |

|

|

52 |

|

|

52 |

|

|

54 |

|

|

47 |

|

|

47 |

|

|

47 |

|

|

51 |

|

|

Employees - administration |

26 |

|

|

27 |

|

|

26 |

|

|

27 |

|

|

25 |

|

|

25 |

|

|

25 |

|

|

25 |

|

|

(1) |

We

define a billable customer of IDI as a single entity that generated

revenue in the last three months of the period. Billable customers

are typically corporate organizations. In most cases, corporate

organizations will have multiple users and/or departments

purchasing our solutions, however, we count the entire organization

as a discrete customer. |

| (2) |

We define a user of FOREWARN as a

unique person that has a subscription to use the FOREWARN service

as of the last day of the period. A unique person can only have one

user account. |

| (3) |

Contractual revenue % represents

revenue generated from customers pursuant to pricing contracts

containing a monthly fee and any additional overage divided by

total revenue. Pricing contracts are generally annual contracts or

longer, with auto renewal. |

| (4) |

Gross revenue retention is

defined as the revenue retained from existing customers, net of

reinstated revenue, and excluding expansion revenue. Revenue is

measured once a customer has generated revenue for six consecutive

months. Revenue is considered lost when all revenue from a customer

ceases for three consecutive months; revenue generated by a

customer after the three-month loss period is defined as reinstated

revenue. Gross revenue retention percentage is calculated on a

trailing twelve-month basis. The numerator of which is revenue lost

during the period due to attrition, net of reinstated revenue, and

the denominator of which is total revenue based on an average of

total revenue at the beginning of each month during the period,

with the quotient subtracted from one. Prior to Q1’22, FOREWARN

revenue was excluded from our gross revenue retention calculation.

Beginning Q4’22, our gross revenue retention calculation excludes

revenue from idiVERIFIED, which is purely transactional and

currently represents less than 3% of total revenue. |

| (5) |

Revenue from new customers

represents the total monthly revenue generated from new customers

in a given period. A customer is defined as a new customer during

the first six months of revenue generation. |

| (6) |

Base revenue from existing

customers represents the total monthly revenue generated from

existing customers in a given period that does not exceed the

customers' trailing six-month average revenue. A customer is

defined as an existing customer six months after their initial

month of revenue. |

| (7) |

Growth revenue from existing

customers represents the total monthly revenue generated from

existing customers in a given period in excess of the customers'

trailing six-month average revenue. |

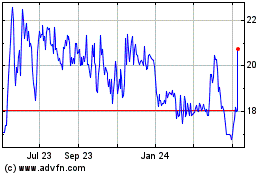

Red Violet (NASDAQ:RDVT)

Historical Stock Chart

From Mar 2024 to Apr 2024

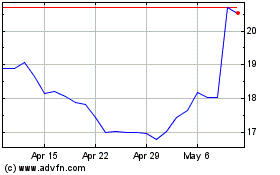

Red Violet (NASDAQ:RDVT)

Historical Stock Chart

From Apr 2023 to Apr 2024